A small range day has not managed to make a new high. Declining ATR and light volume still suggest some consolidation may unfold here.

Summary: There is an upwards trend in place that is very extreme. Conditions are overbought. This can continue while price moves a considerable distance further, or a trend change may occur at any time now. Caution is warranted. Risk management is essential.

The bullish Elliott wave count expects a large interruption to the trend may now have begun. It may last about four to ten weeks and may end about 1,431.

The bearish Elliott wave count expects the upwards trend may now have ended. The first confidence point is at 1,401.30. Thereafter, a new low below 1,346.45 would see the bullish wave count discarded and a bearish wave count the only remaining count.

A new high above 1,533.34 would leave the new bearish alternate and the bullish wave counts valid.

Grand SuperCycle analysis is here.

Monthly charts were last published here with video here.

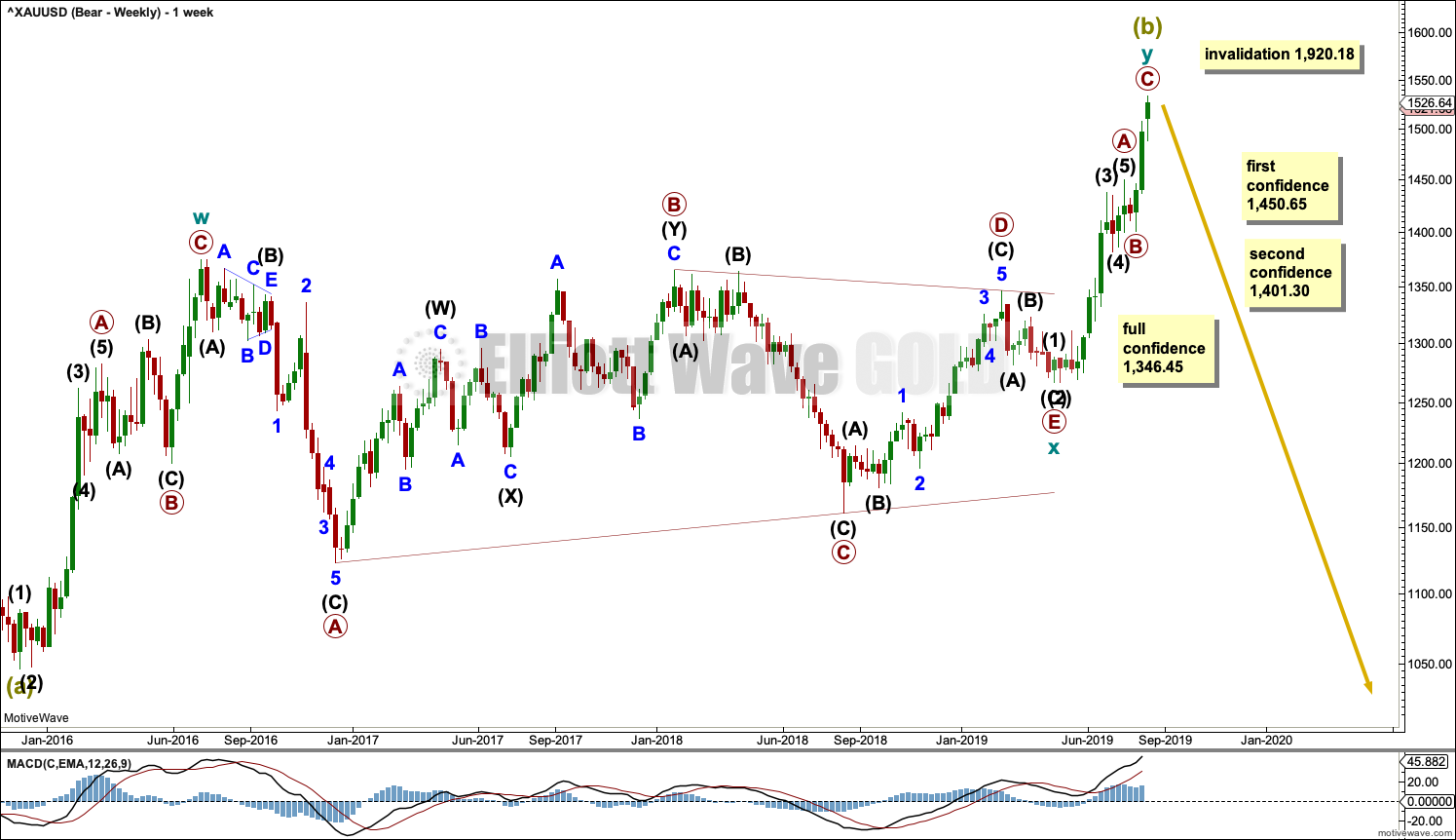

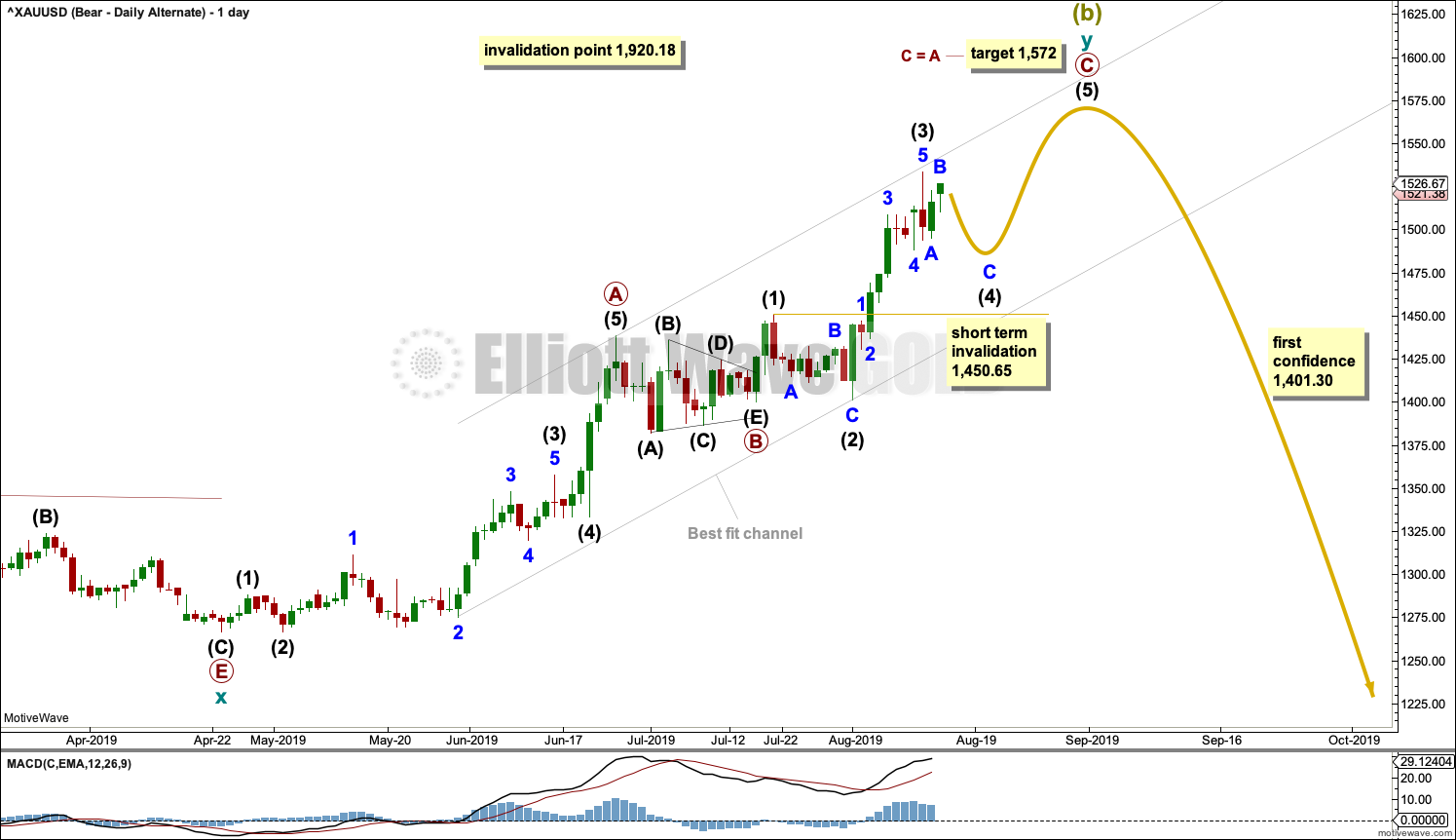

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

It is now possible that Super Cycle wave (b) is a complete double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

Cycle wave y now fits as a complete zigzag.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A new low below 1,450.65 would invalidate the new bearish alternate below and add a little confidence to this wave count.

1,401.30 is the start of primary wave C. A new low below this point could not be a second wave correction within primary wave C, so at that stage primary wave C would be confirmed as over.

A new low below 1,346.45 would invalidate the bullish wave count below and add confidence to a bearish wave count.

Two daily charts below look at the zigzag of cycle wave y in two different ways.

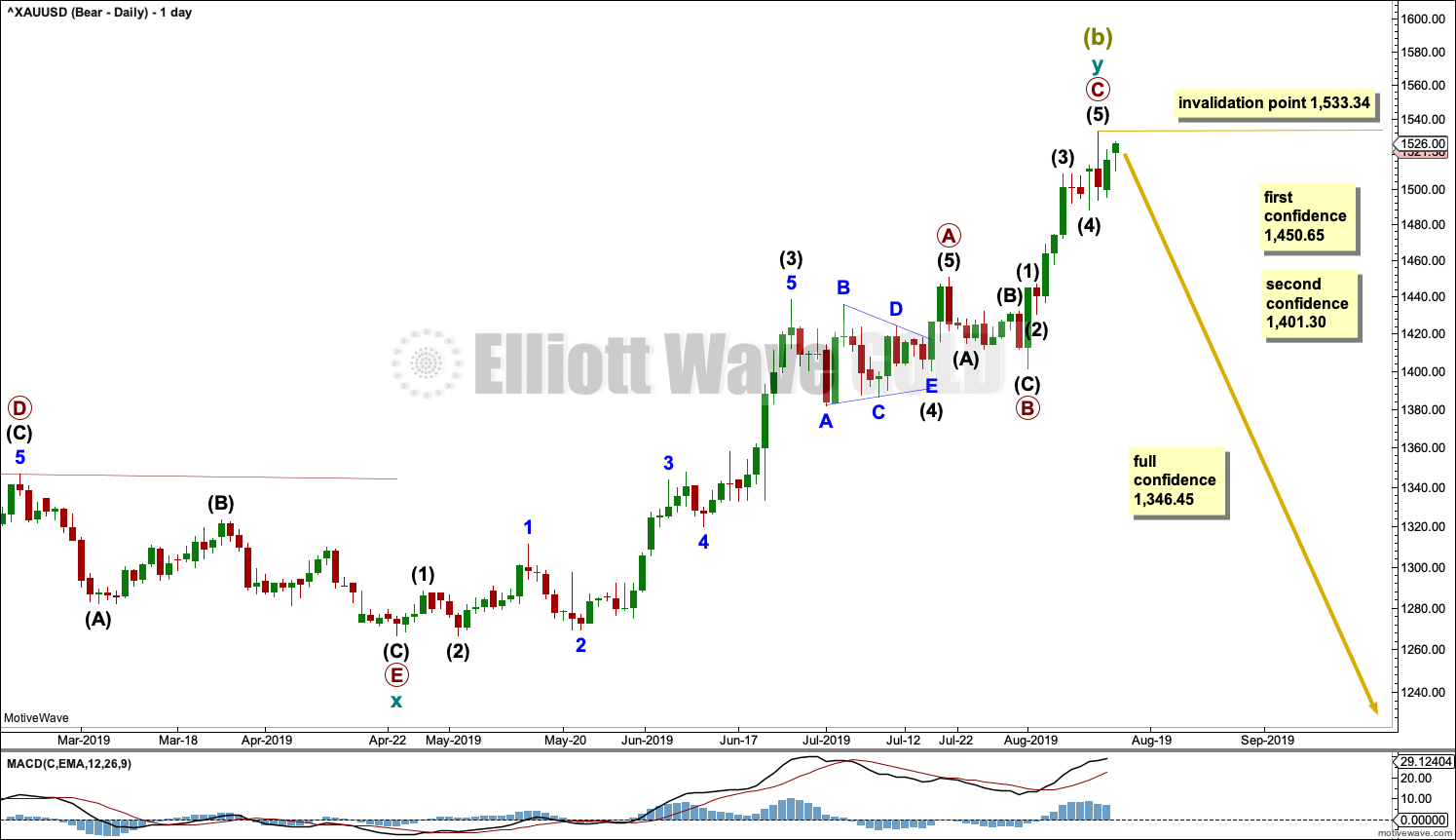

DAILY CHART

Primary wave C may now be a complete five wave structure.

If there has been a trend change, then downwards movement should unfold as a five wave structure from the high. Downwards movement should exhibit strength in either rising ATR or volume.

No second wave correction within a new downwards trend may move beyond the start of its first wave above 1,533.34.

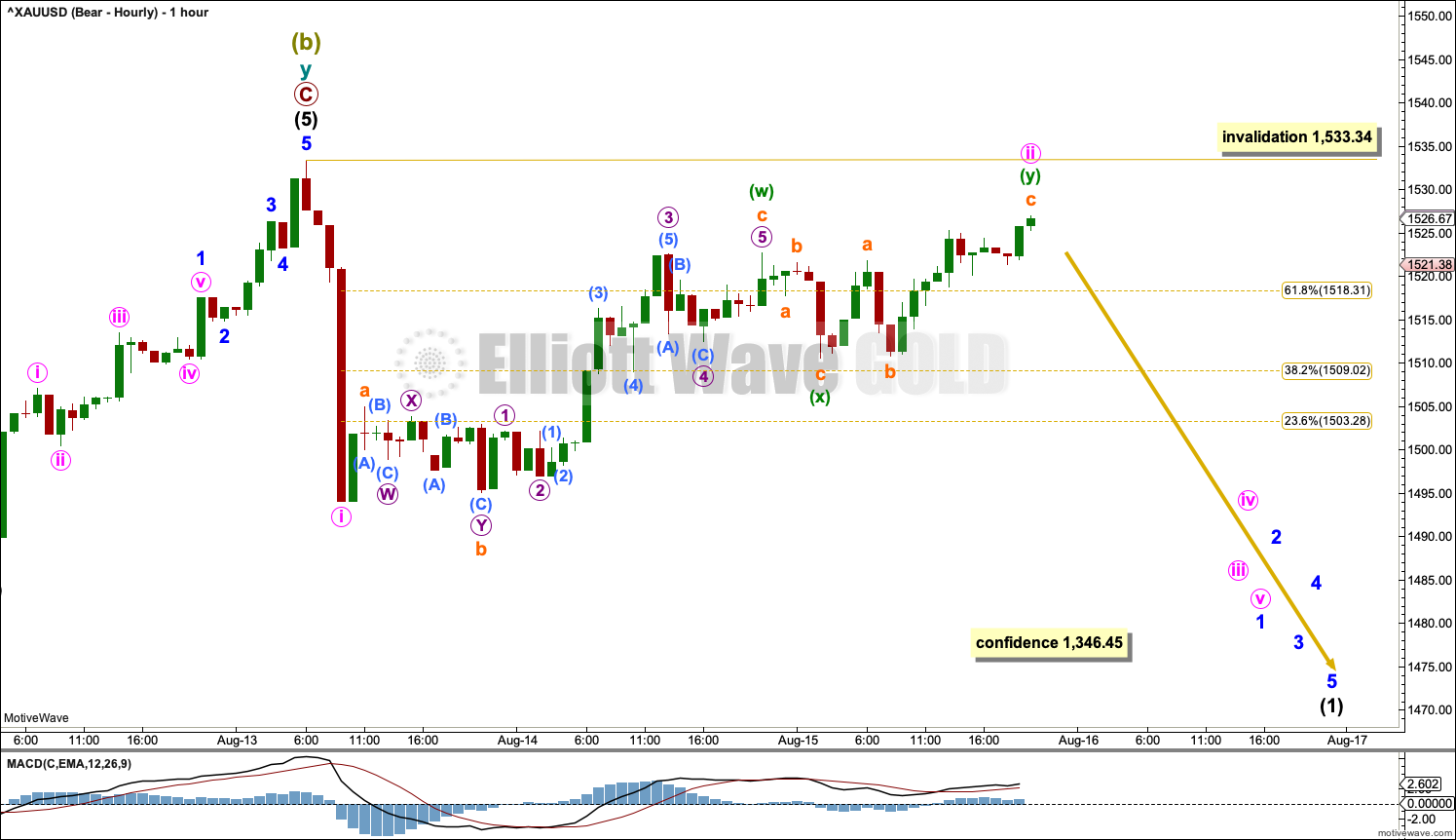

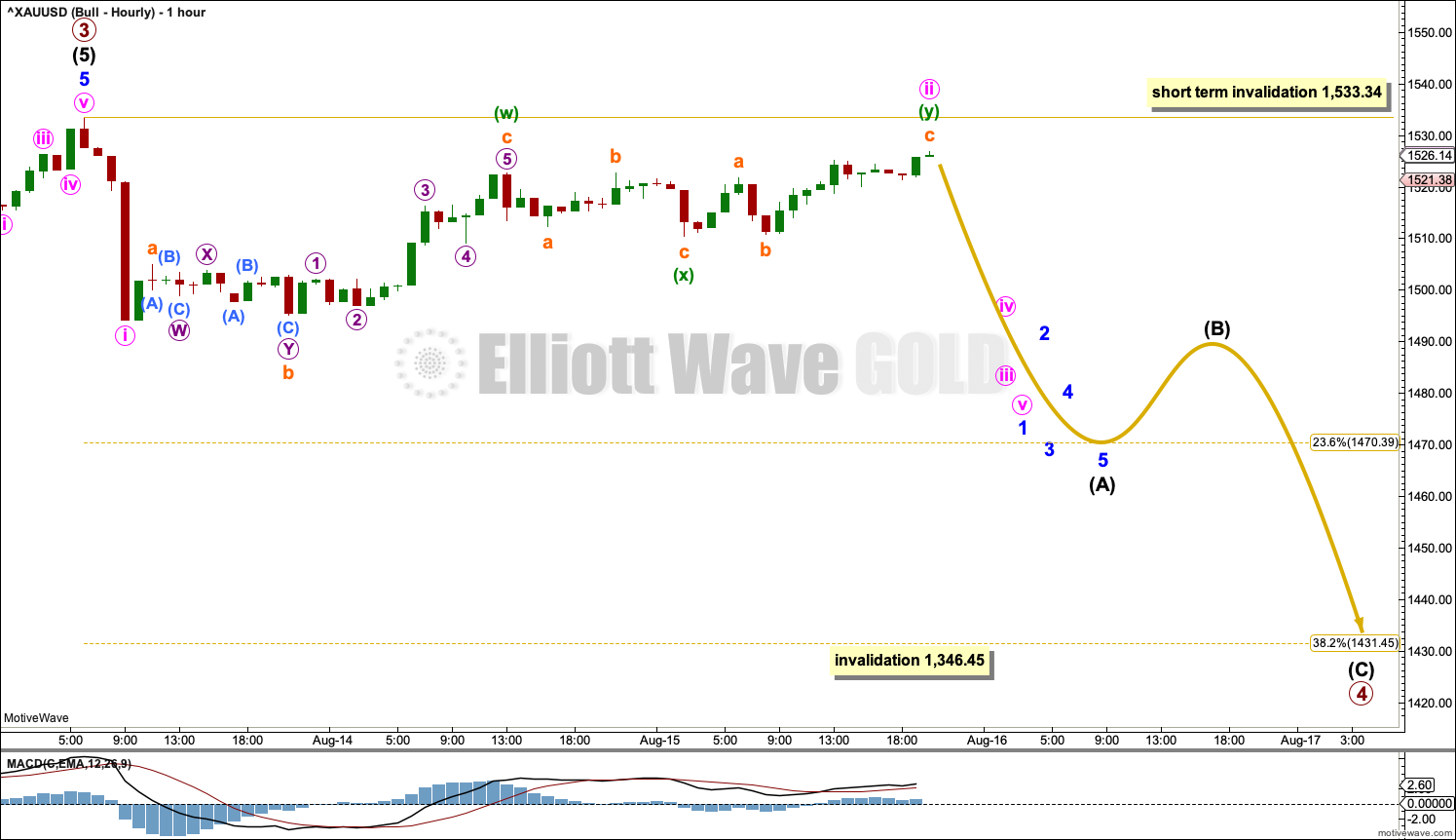

HOURLY CHART

Intermediate wave (5) may now be a complete five wave structure. Downwards movement from the high is swift and strong, typical of the start of a first wave.

Minute wave ii may continuing higher as a double zigzag. Minute wave ii may not move beyond the start of minute wave i above 1,533.34.

If price does make a new high by any amount at any time frame above 1,533.34, then the new bearish alternate wave count below may be used.

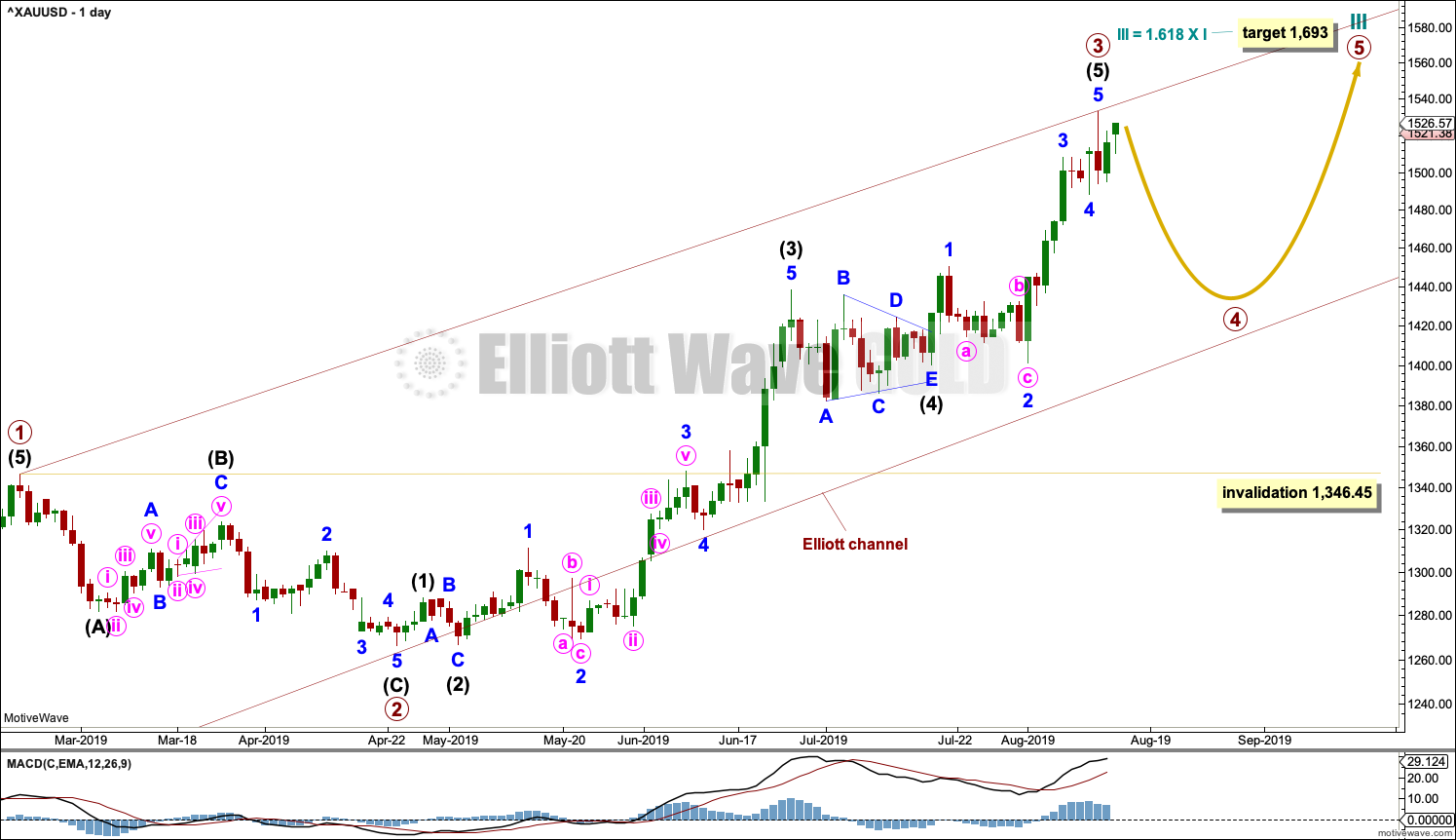

ALTERNATE DAILY CHART

Both bearish wave counts at the daily and weekly chart level today see cycle wave y beginning at the same point at 1,266.61 on the 24rd of April 2019. Thereafter, this alternate wave count looks at the zigzag of cycle wave y differently.

Within cycle wave y, the triangle that ended on the 17th of July may have been primary wave B. Primary wave C may have begun there. Primary wave C must subdivide as a five wave structure; it may be completing as an impulse.

Intermediate waves (1), (2) and (3) within the impulse of primary wave C may be complete. Intermediate wave (3) for this wave count is just 0.33 longer than 2.618 the length of intermediate wave (1).

Intermediate wave (4) may be unfolding sideways as a small consolidation to continue for a few more days. Intermediate wave (2) completed as a deep 0.98 zigzag lasting 9 sessions. Intermediate wave (4) may exhibit alternation as a flat, triangle or combination. Within those structural possibilities, any one of an expanded flat, running triangle or combination may include a new high above 1,533.34. A new high above 1,533.34 would invalidate the first bearish wave count and leave this alternate valid.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 1,450.65.

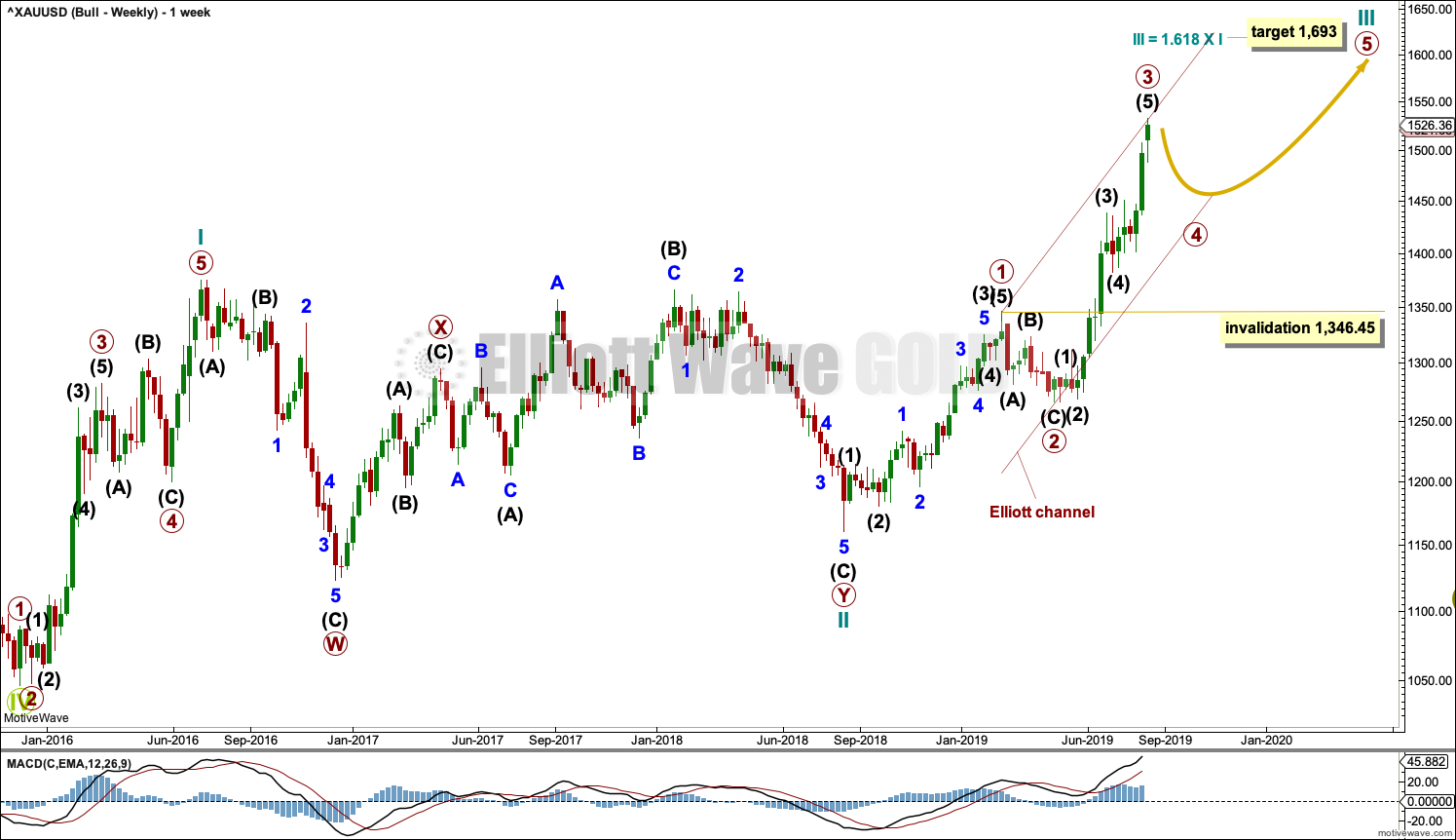

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, and for this reason the bearish wave count is still considered because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. Primary wave 3 has now moved above the end of primary wave 1 meeting a core Elliott wave rule. It has now moved far enough to allow room for primary wave 4 to unfold and remain above primary wave 1 price territory. Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Cycle wave III so far for this wave count would have been underway now for 52 weeks. It is beginning to exhibit some support from volume and increasing ATR. This wave count now has some support from classic technical analysis.

The channel drawn about cycle wave III is an Elliott channel. Primary wave 4 may find support about the lower edge.

DAILY CHART

Primary wave 3 may now be a complete impulse. The structure of intermediate wave (5) is now complete.

Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Primary wave 4 may last about four to ten weeks. It may unfold as any one of more than 23 possible Elliott wave corrective structures. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree; intermediate wave (4) has its range from 1,438.43 to 1,382.10.

HOURLY CHART

Within the price territory of intermediate wave (4), from 1,438.43 to 1,382.10, lies the 0.382 Fibonacci Ratio of primary wave 3 at 1,431.45. This is the preferred target for primary wave 4.

A new trend at primary degree should begin with a five down on the hourly chart. Within this first five down, minute wave ii may not move beyond the start of minute wave i above 1,533.34.

If primary wave 4 unfolds as any one of an expanded flat, running triangle or combination, then it may include a new high above 1,533.34 within wave B or X of the corrective structure. In coming weeks the invalidation point at 1,533.34 may no longer apply (this is a short-term invalidation point only).

If price makes a new high by any amount at any time frame above 1,533.34, then the alternate hourly chart below may be used.

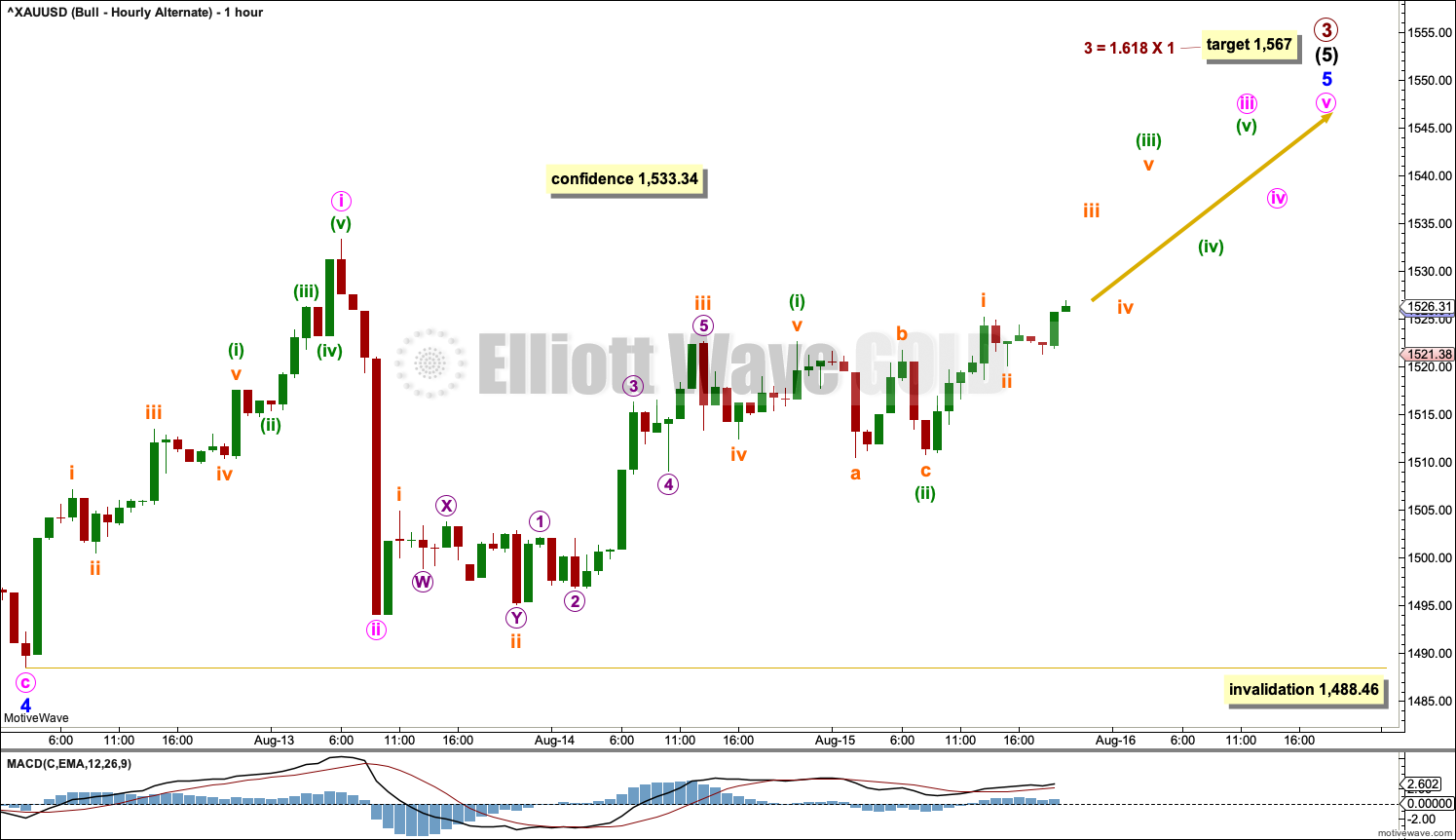

ALTERNATE HOURLY CHART

The degree of labelling within intermediate wave (5) is moved down one degree. Intermediate wave (5) may be an incomplete impulse. Within the impulse, minute waves i and ii may be complete.

If minute wave ii continues lower as a double zigzag, then it may not move beyond the start of minute wave i below 1,488.46.

Invalidation of this alternate wave count with a new low below 1,488.46 by any amount at any time frame would add confidence to the two main hourly wave counts in the short term.

TECHNICAL ANALYSIS

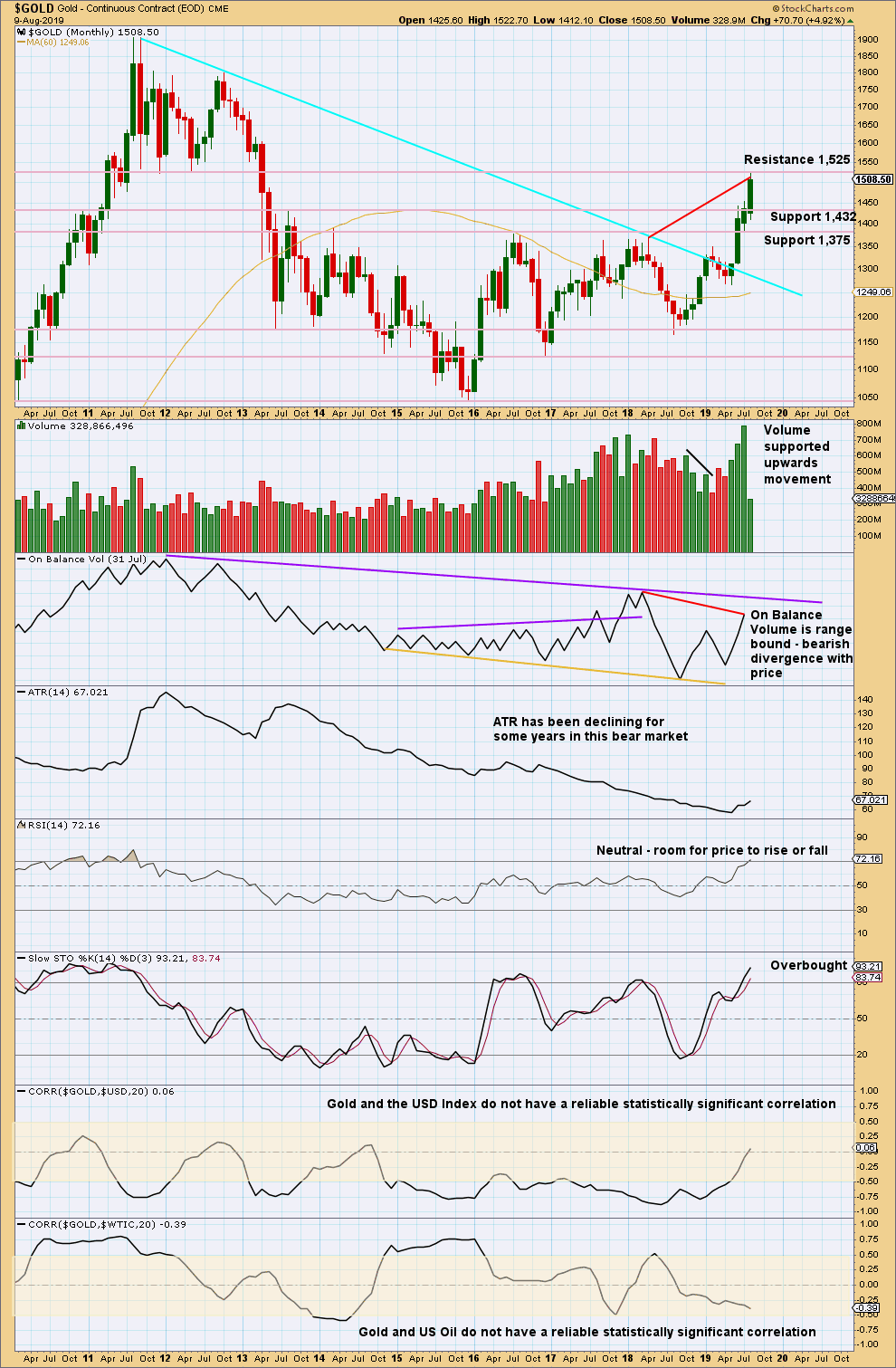

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold has effected an upwards breakout above multi-year resistance and above the cyan bear market trend line. Price is now at strong resistance about 1,525.

The new high in price above prior highs for March / April 2018 have not been matched by new highs for On Balance Volume. This divergence is bearish and supports a bearish Elliott wave count. This divergence may be given a little weight because it is strong and evident on the monthly chart.

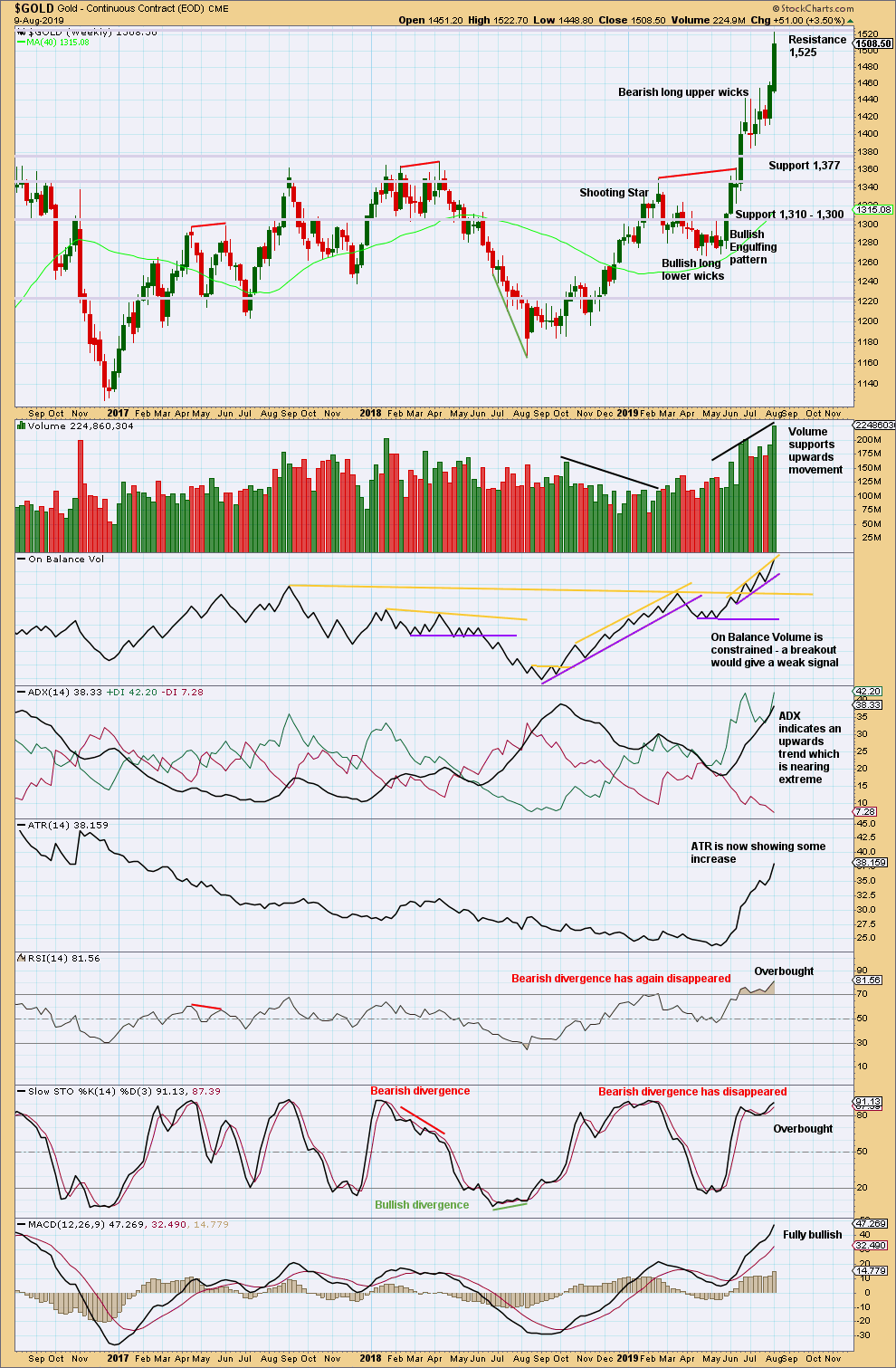

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When trends for Gold reach extreme, they can continue still for a few weeks and price can continue for a considerable distance.

When both ADX and RSI reach extreme together, then that is sometimes where a trend ends.

RSI at overbought on the weekly chart is a warning to be cautious; the trend is overbought, but at this stage there is no evidence of a trend change.

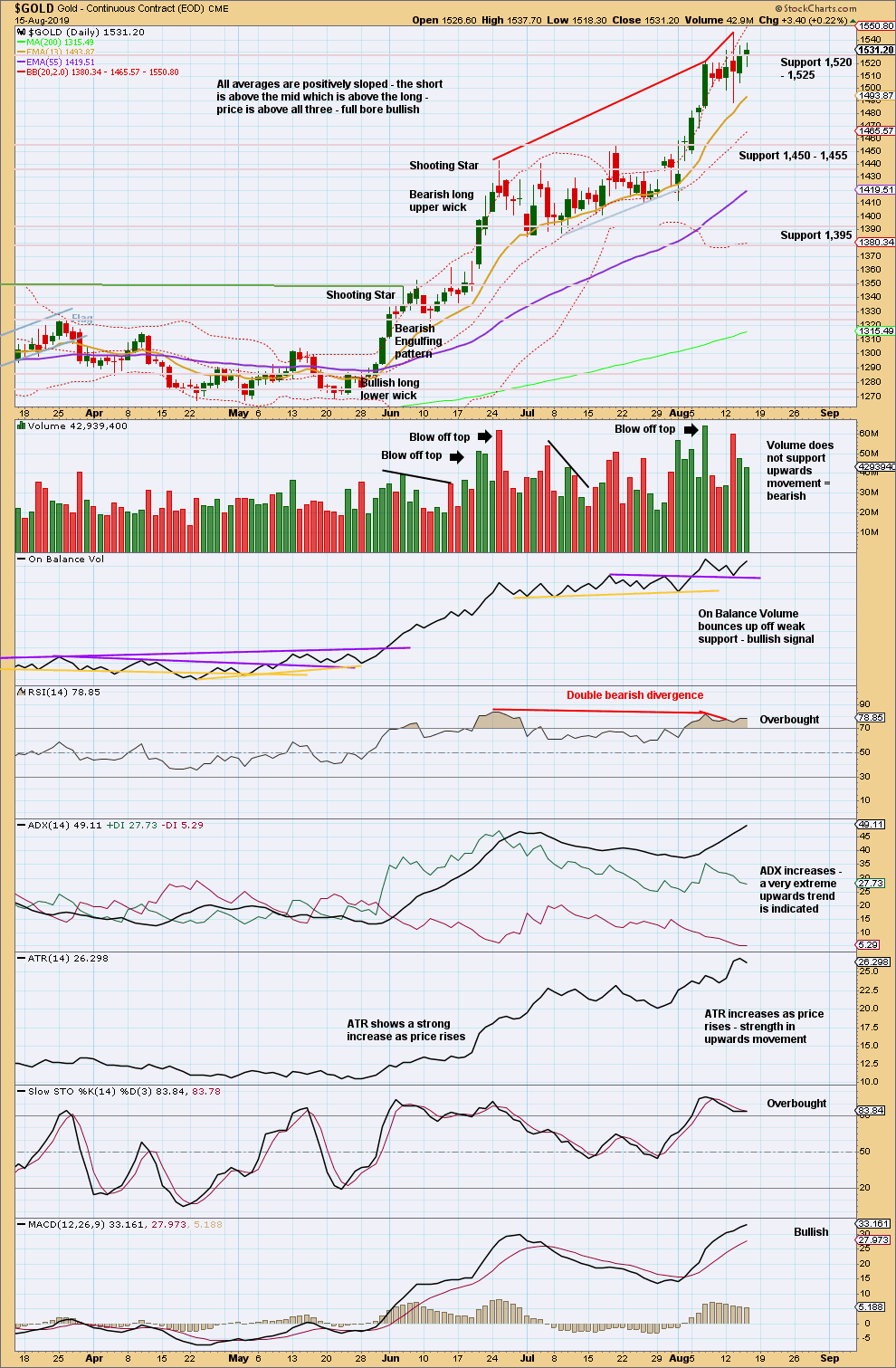

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards trend may continue, but it is now very extreme with RSI in overbought territory and now exhibiting double bearish divergence. While it remains possible that the upwards trend may yet continue for a further few weeks and conditions may remain extreme for a while longer, it is also possible that it may end at any time. Caution is still advised.

While price remains above the last swing low at 1,412.10, there is a series of higher highs and higher lows in place. A new low below 1,412.10 would be a lower low and would confirm a trend change.

Today price has again closed above prior strong resistance at 1,520 to 1,525, but it has not done so with support from volume. This potential upwards breakout is still suspicious. For confidence an upwards breakout, support from volume is required. Both volume and ATR have declined today; this upwards day is weak.

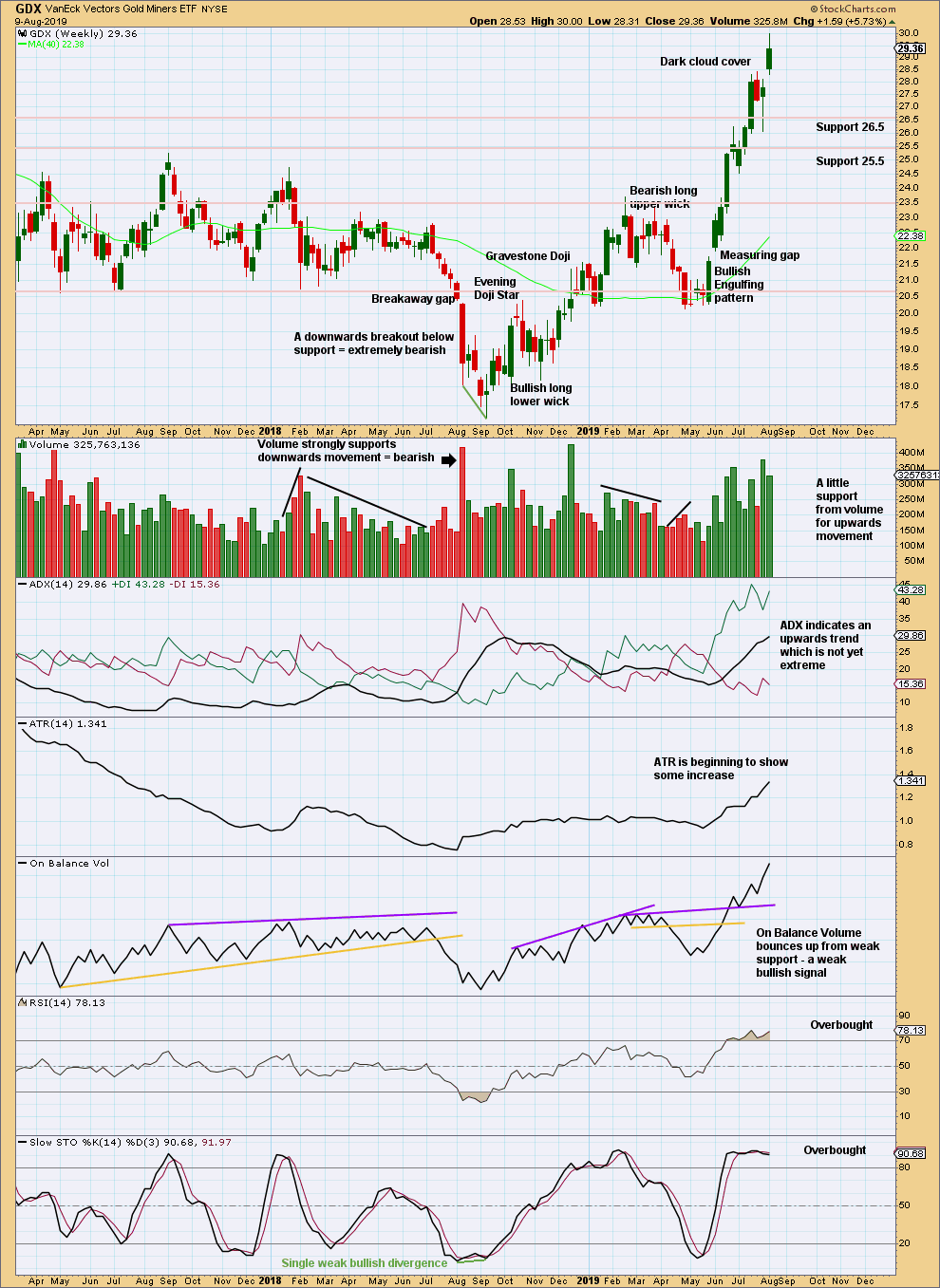

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

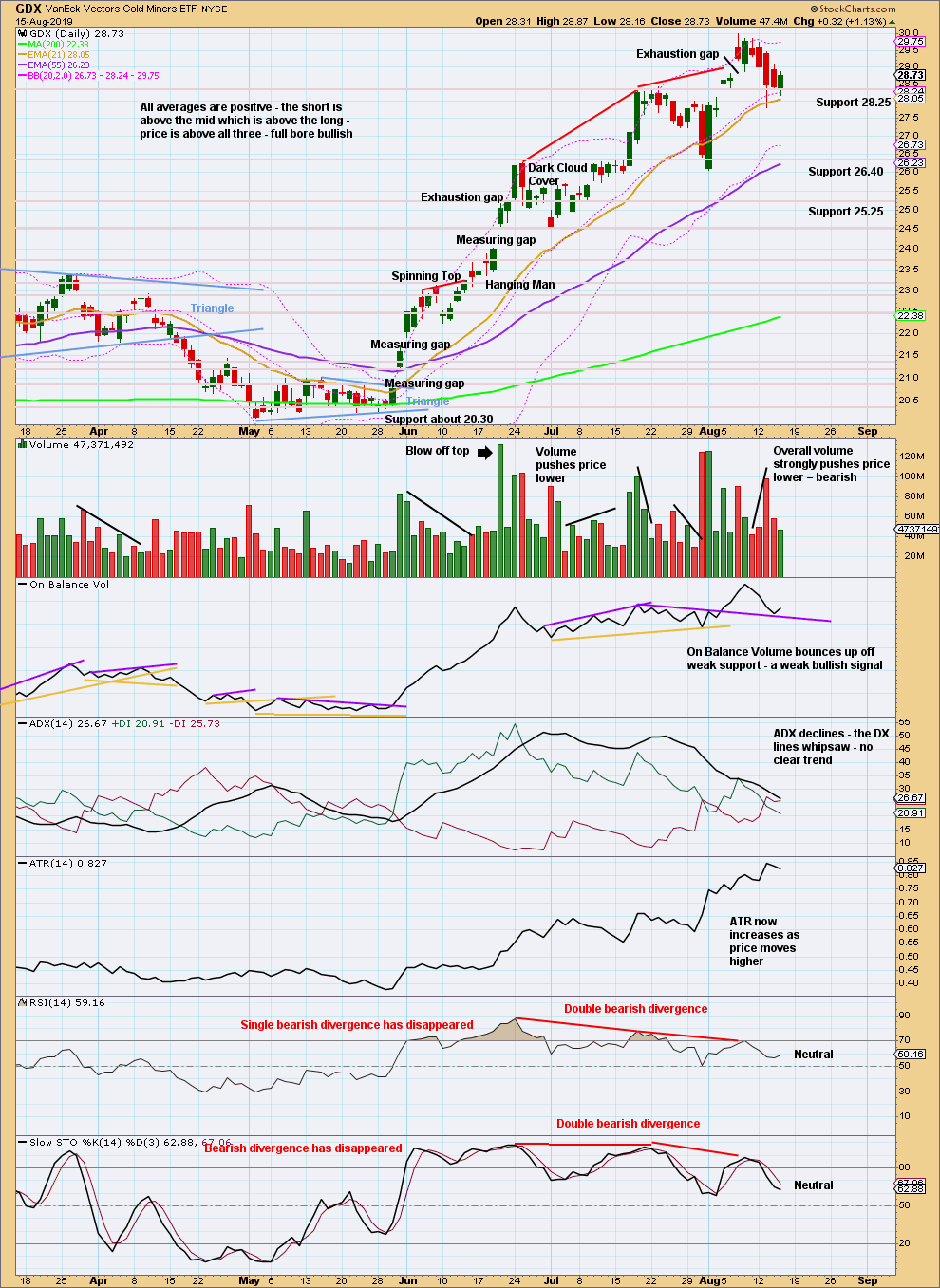

The Dark Cloud Cover reversal pattern was followed by downwards movement in the following week.

Now a new high indicates the last pullback should be over.

Volume last week has slightly declined, but overall volume is rising with price.

The trend has further to go before it reaches extreme at the weekly chart time frame.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A consolidation may have begun. Look for support about 28.4.

The last swing low was at 26.04. A new low below this point would confirm a trend change.

Published @ 09:30 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly bear chart updated:

Hourly bull chart updated:

I like the new Bearish Alternate daily. I think the triangle looks better for Primary B and I think this count allows for a strong wave 5 for a proper blow-off top! 😃👍

I agree.

Sideways movement since the high so far looks like another consolidation. With the data in hand today, anyway.

Although I think gold is in the position to get hammered soon, I tend to agree that there needs to be one more blow off move higher. I also think that somewhat correlates with further stock market weakness over the next week.

But if you look at the price history of Gold, its blow off tops are rarely at the actual eventual top. They come just before, then a small consolidation, and then the final high.

Which fits in EW terms. Blow off tops are the ends of third waves (specifically, a fifth wave to end a third wave one degree higher), followed by a consolidation for a fourth wave, and then the final fifth wave.

Agree and thank you for the clarification. Interesting that gold actually moved $10 off its lows while stocks rebounded all day. Was a perfect day for gold to be pounded. Resilient. At least for now!

Gold commercials today did not cover there short position which is higher now then it was in 2016 top. If gold goes down 50 to 100 bucks from here how quick the commercials sell there short position will be telling whether the bullish or bearish ew will take hold.