A trend change was expected for Silver. Instead, it made a new high this week.

Both weekly and daily charts now have candlestick patterns which suggest the next direction.

Summary: A trend change to a large multi week consolidation looks highly likely to have begun. The target for support is 17.588.

Monthly charts were last updated here.

ELLIOTT WAVE COUNTS

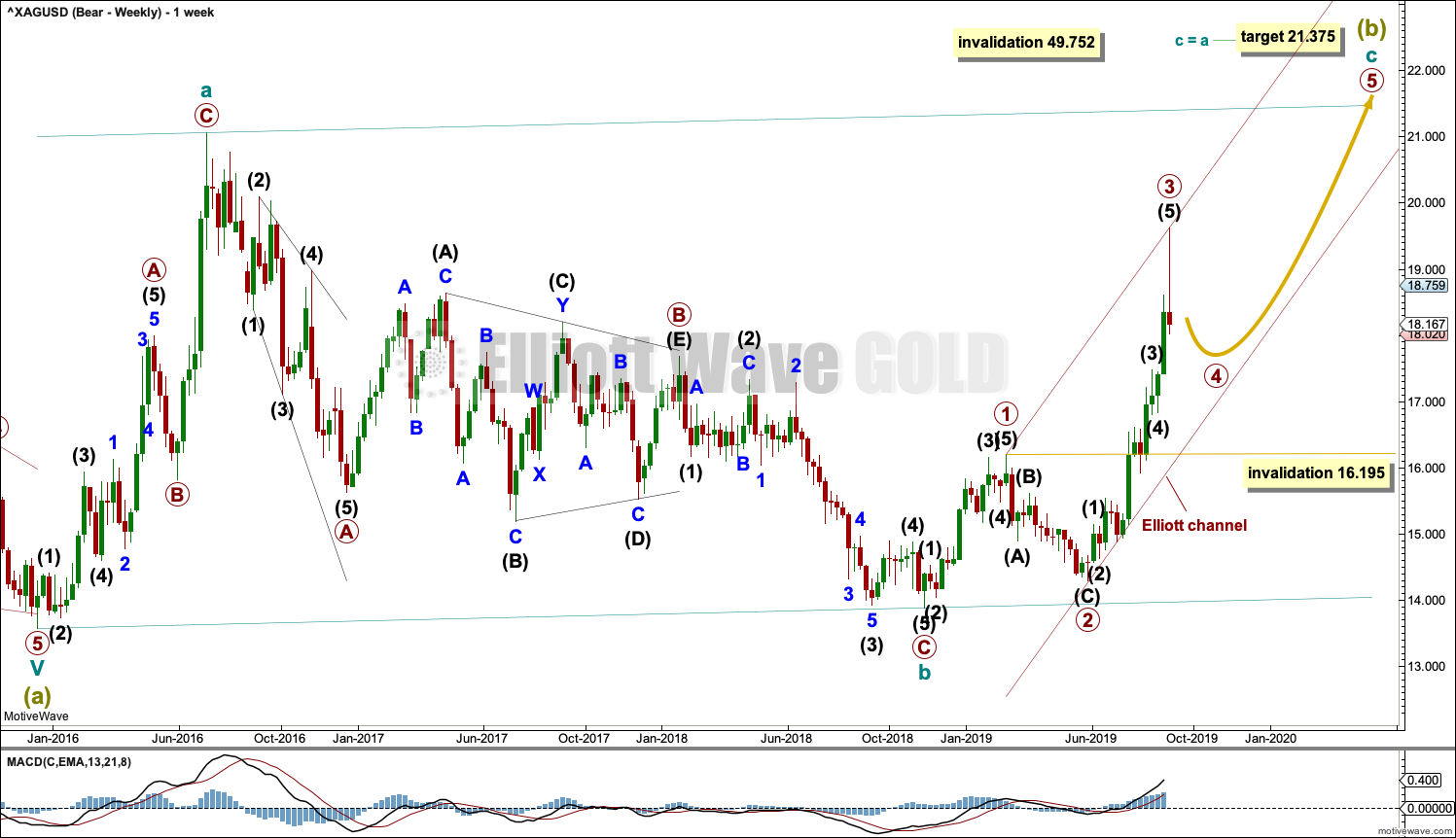

BEARISH WAVE COUNT

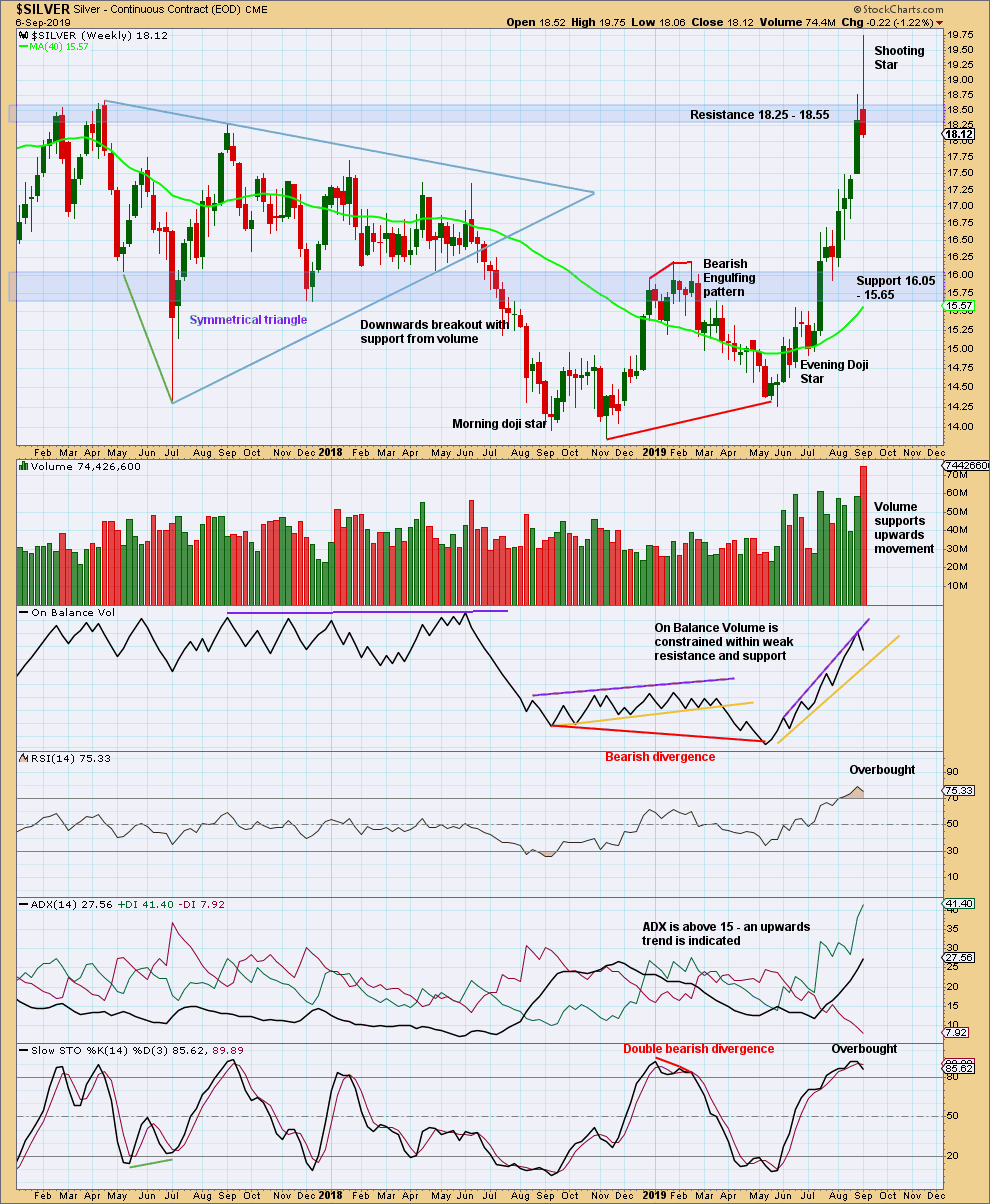

WEEKLY CHART

It is possible that Super Cycle wave (b) is an incomplete regular flat correction.

Within the regular flat correction, cycle wave a subdivides well as a zigzag and cycle wave b subdivides well as a zigzag, which is a 0.96 correction of cycle wave a.

Cycle wave c must complete as a five wave structure. Within cycle wave c, primary waves 1 through to 3 may be complete. Primary wave 4 may not move into primary wave 1 price territory below 16.195.

Regular flat corrections often fit within parallel channels. Cycle wave c may end about resistance at the upper edge of the channel. The most common Fibonacci Ratio for cycle wave c within a regular flat would be equality in length with cycle wave a.

It would be extremely likely, for this wave count, for cycle wave c to move at least slightly above the end of cycle wave a at 21.062 to avoid a truncation.

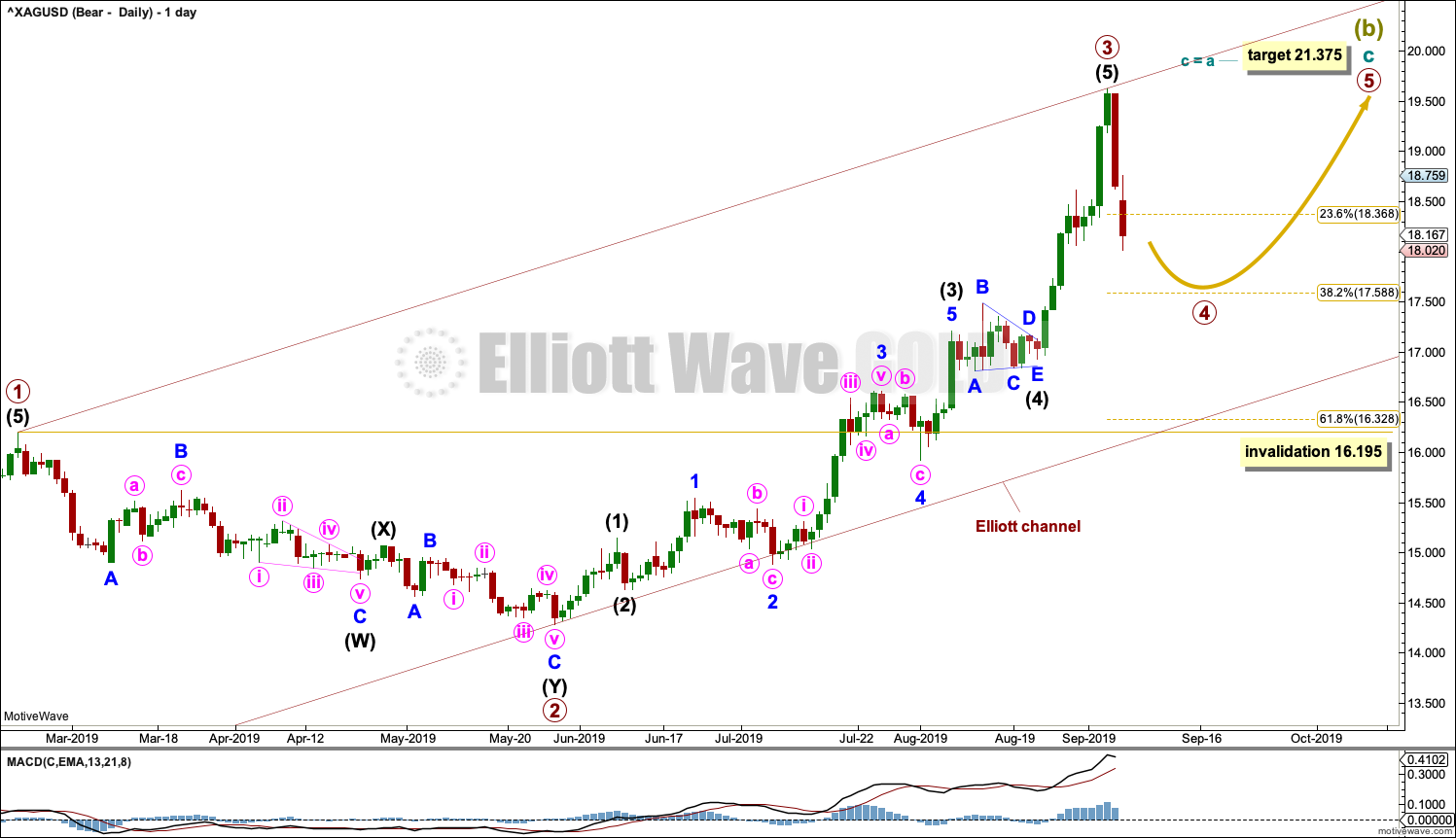

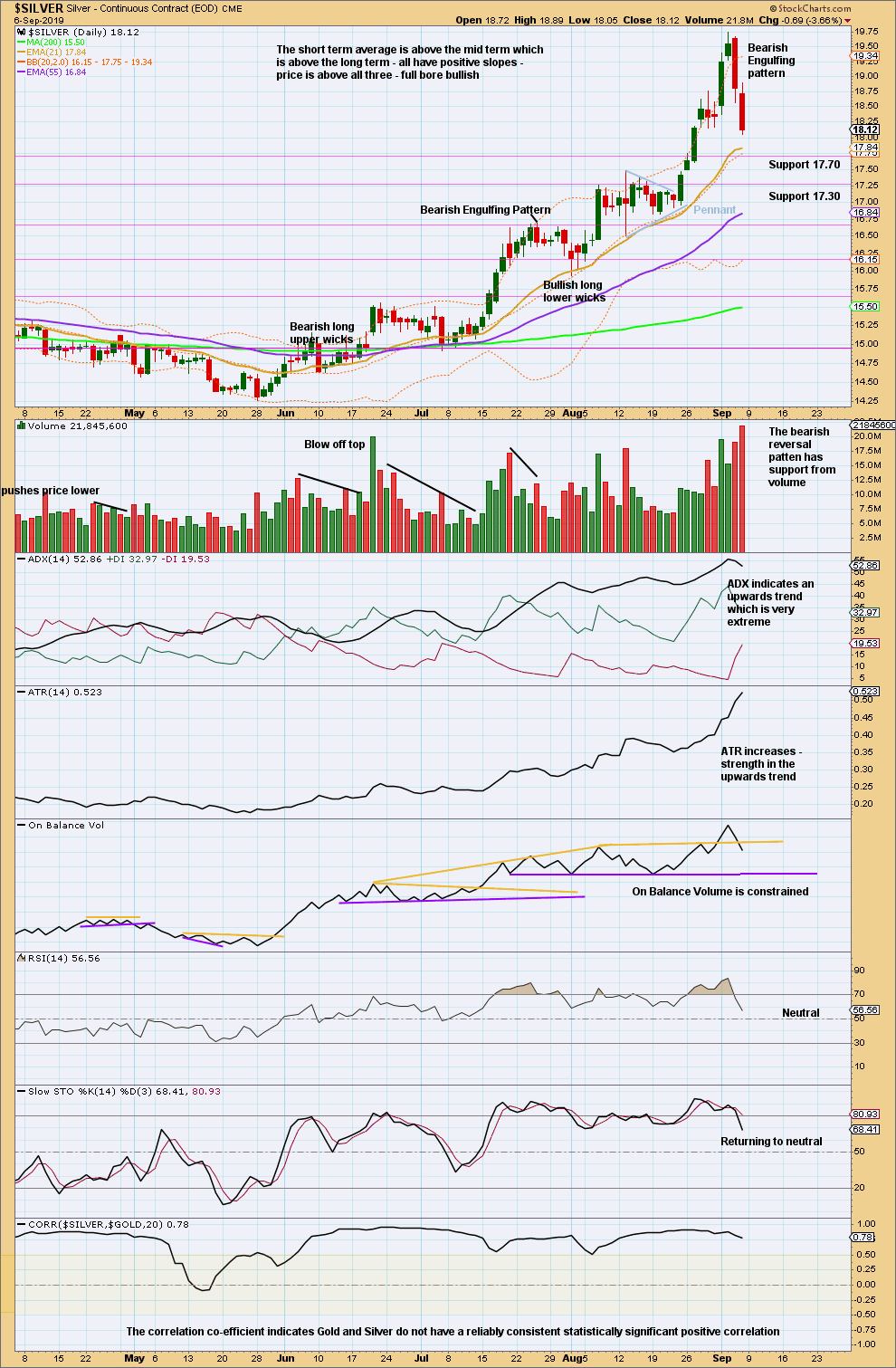

DAILY CHART

Cycle wave C may be subdividing as an impulse. Within the impulse, primary waves 1 to 3 may be complete.

Primary wave 4 may not move into primary wave 1 price territory below 16.195.

Primary wave 2 lasted 69 sessions and subdivided as a deep 0.82 double zigzag. Given the guideline of alternation, primary wave 4 may be expected to be shallow and most likely a sideways type of correction such as a flat, combination or triangle.

Primary wave 4 may be more brief than primary wave 2; fourth waves for Silver tend to be more brief than counterpart second waves.

The preferred target for primary wave 4 is the 0.382 Fibonacci Ratio of primary wave 3 at 17.588.

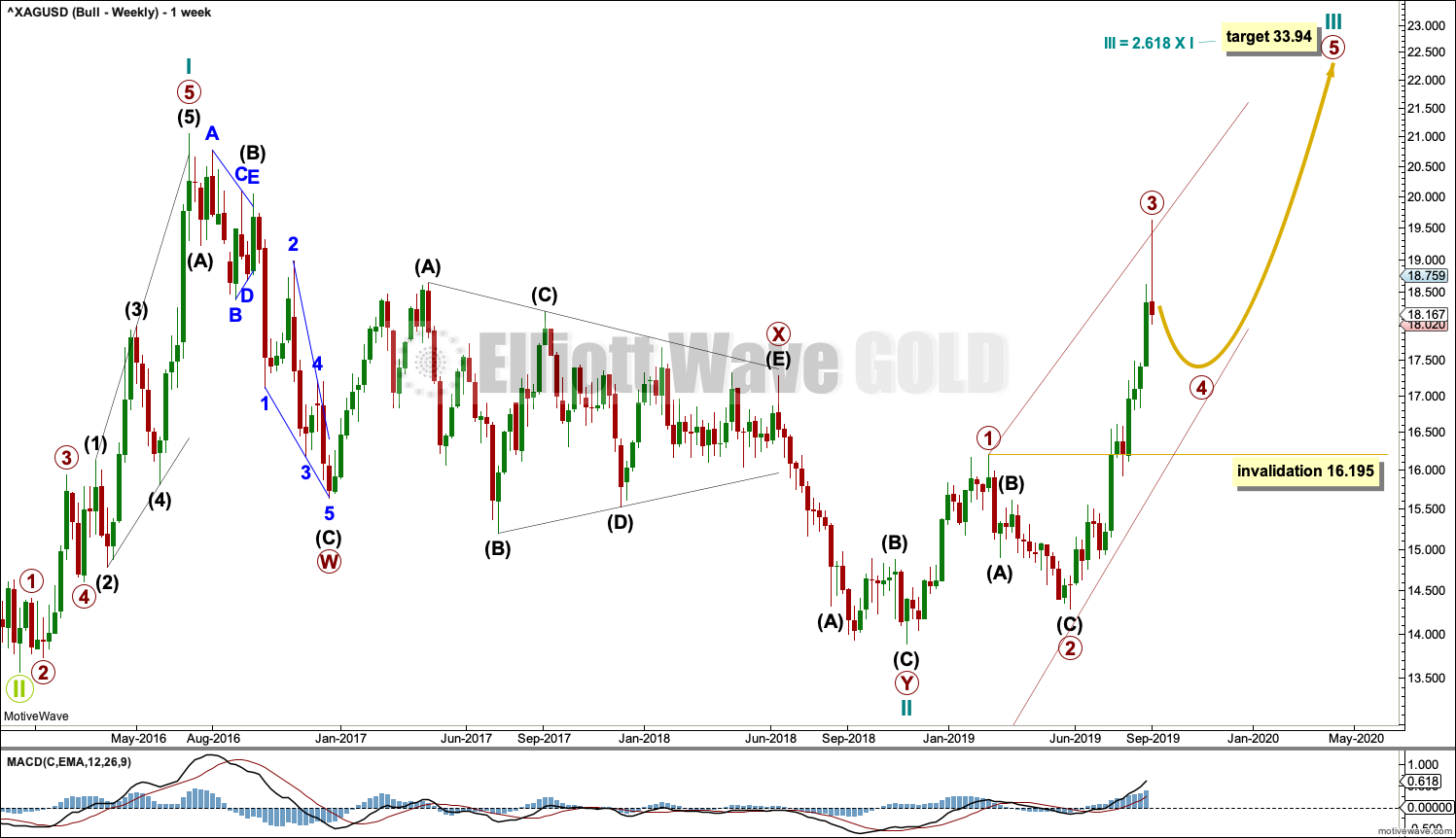

BULLISH WAVE COUNT

WEEKLY CHART

This bullish Elliott wave count sees a new bull market beginning for Silver at the low in December 2015.

A new bull market should begin with a five wave structure upwards. This is labelled cycle wave I.

Following five steps forward should be three steps back. This is labelled cycle wave II. The Elliott wave corrective structure of cycle wave II is labelled as a double zigzag, which is a fairly common structure.

Cycle wave III may only subdivide as an impulse. Within the impulse, primary waves 1 through to 3 may now be complete.

Cycle wave III must move beyond the end of cycle wave I above 21.062. Cycle wave III must move far enough above this point to allow room for cycle wave IV to unfold and remain above cycle wave I price territory.

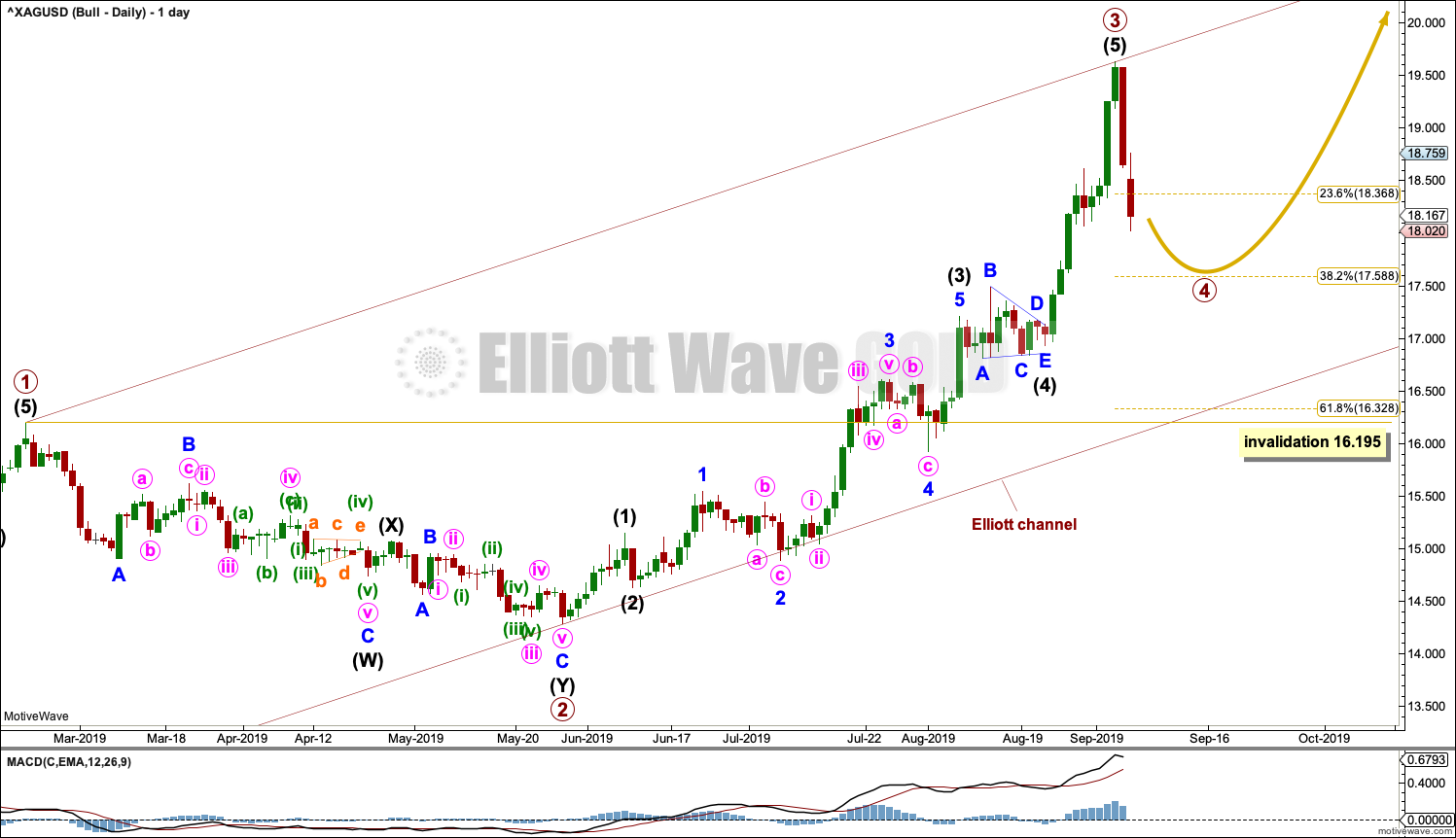

DAILY CHART

Both Elliott wave counts now expect a primary degree fourth wave to unfold. There is currently no divergence between the two wave counts at the daily chart level.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed back below the upper shaded blue zone of resistance.

The Shooting Star reversal pattern has strong support from volume. This is strongly bearish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Bearish Engulfing reversal pattern has strong support from volume. It looks strongly like a high is now in for Silver.

Published @ 12:47 a.m. EST on September 9, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.