A bounce was expected to be over at the last high and downwards movement was expected. This is exactly what has happened.

Summary: The downwards trend may resume. The Elliott wave target is at 1,348.

A target calculated from the triangle is about 1,431.

For the very short term, a new swing high above 1,514.29 would add some confidence in a more bullish outlook. The target would then be at 1,567, 1,635 or 1,693.

For the bigger picture, the bearish Elliott wave count expects a new downwards trend to last one to several years has begun. The alternate bearish wave count looks at the possibility that one final high to 1,559 is required first.

The bullish Elliott wave count expects a primary degree fourth wave has completed and the upwards trend has resumed.

Grand SuperCycle analysis is here.

Monthly charts were last published here.

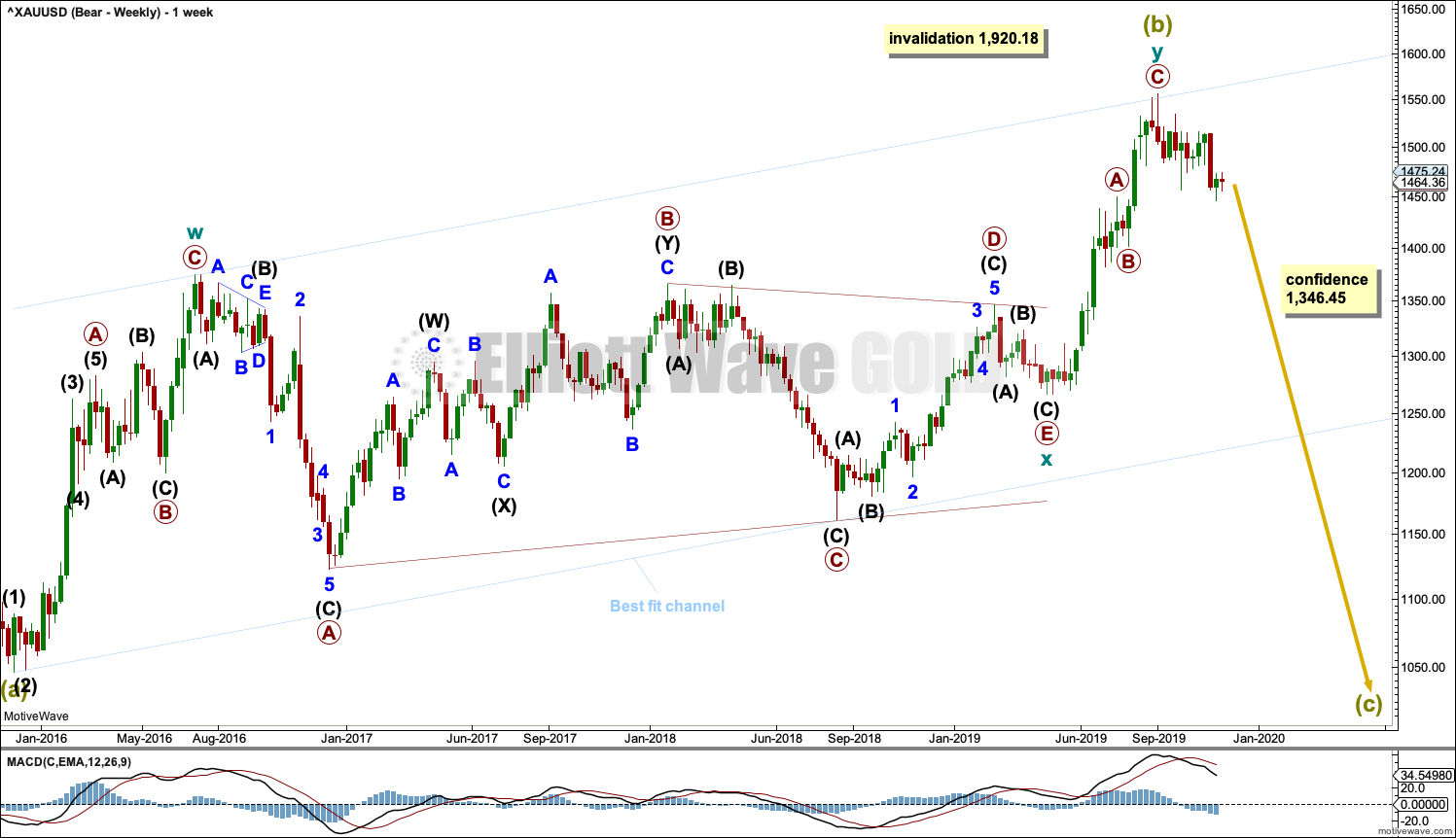

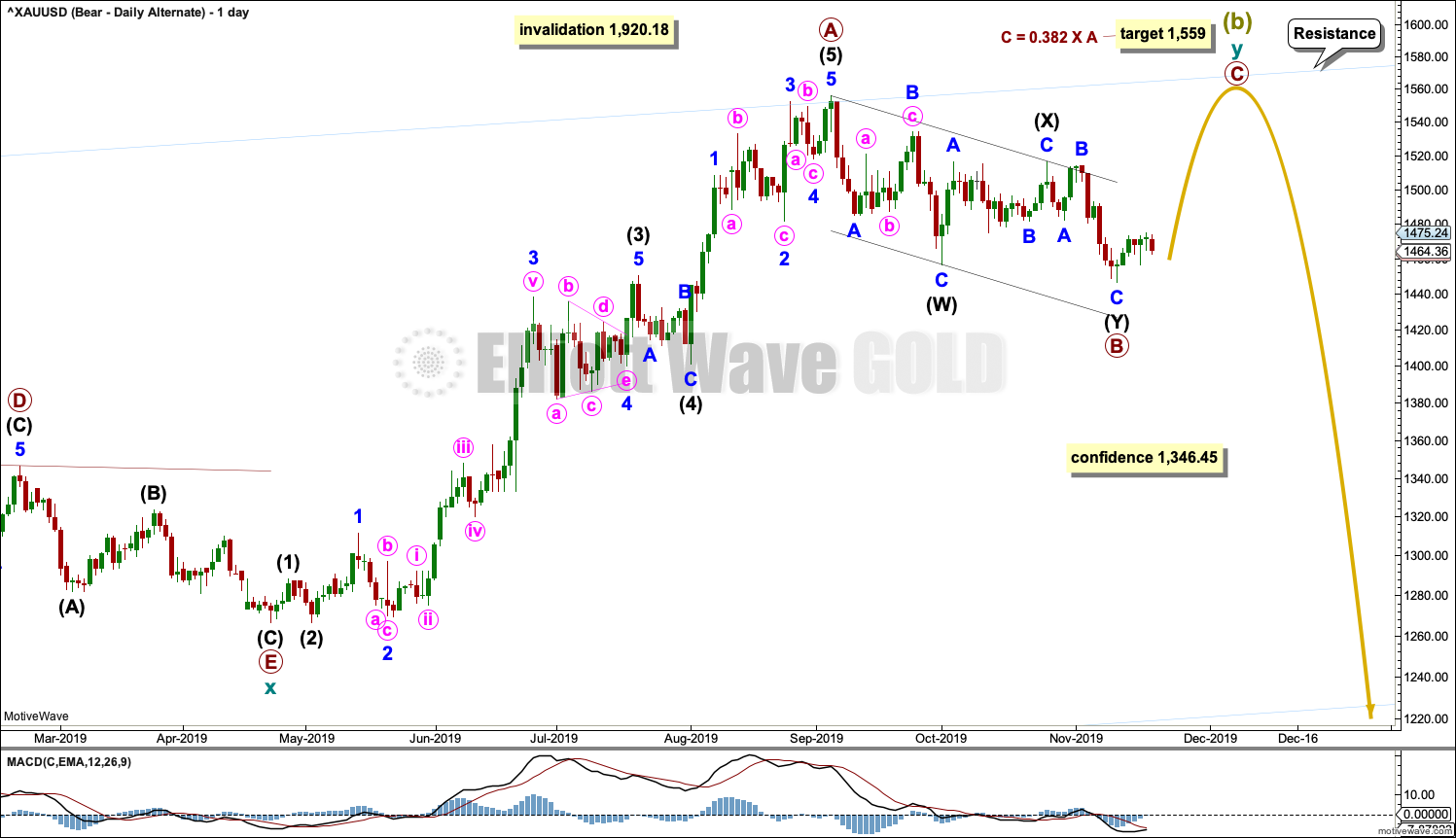

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible that Super Cycle wave (b) is nearly complete as a double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A new low below 1,346.45 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated.

A wide best fit channel is added in light blue. This channel contains all of Super Cycle wave (b) and may provide resistance and support. Copy this channel over to daily charts.

Super Cycle wave (c) must subdivide as a five wave structure, most likely an impulse. It may last several years. It would be very likely to make new lows below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation.

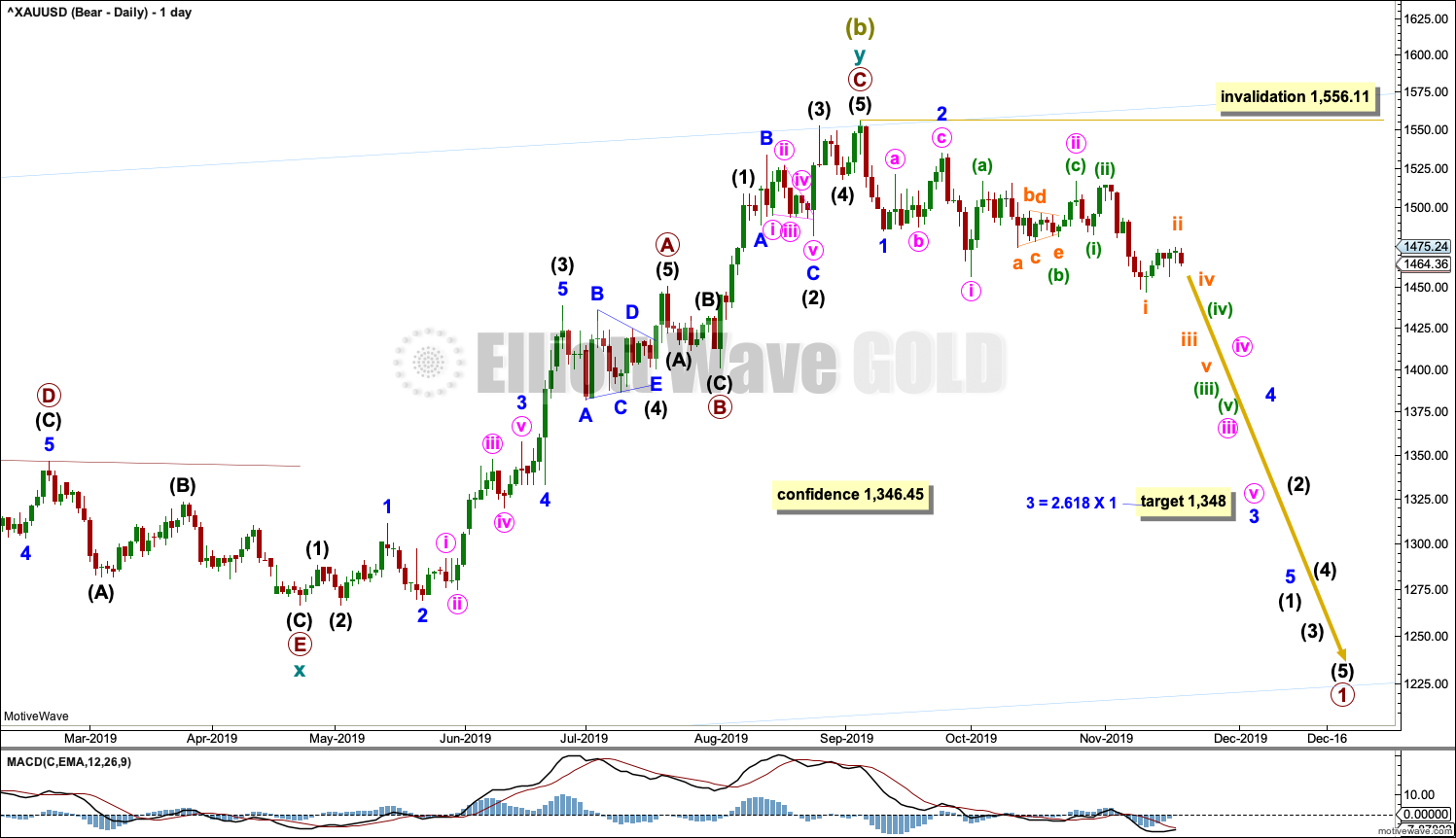

DAILY CHART

Classic analysis now reasonably supports this wave count.

Cycle wave y may be a complete zigzag. Within both of primary waves A and C, there is good proportion between intermediate waves (2) and (4). Within both of primary waves A and C, there is good alternation in structure of intermediate waves (2) and (4).

Within cycle wave y, there is no Fibonacci Ratio between primary waves A and C.

If there has been a trend change at Super Cycle degree, then a five down needs to develop on the daily and weekly charts. So far that is incomplete. It will be labelled intermediate wave (1).

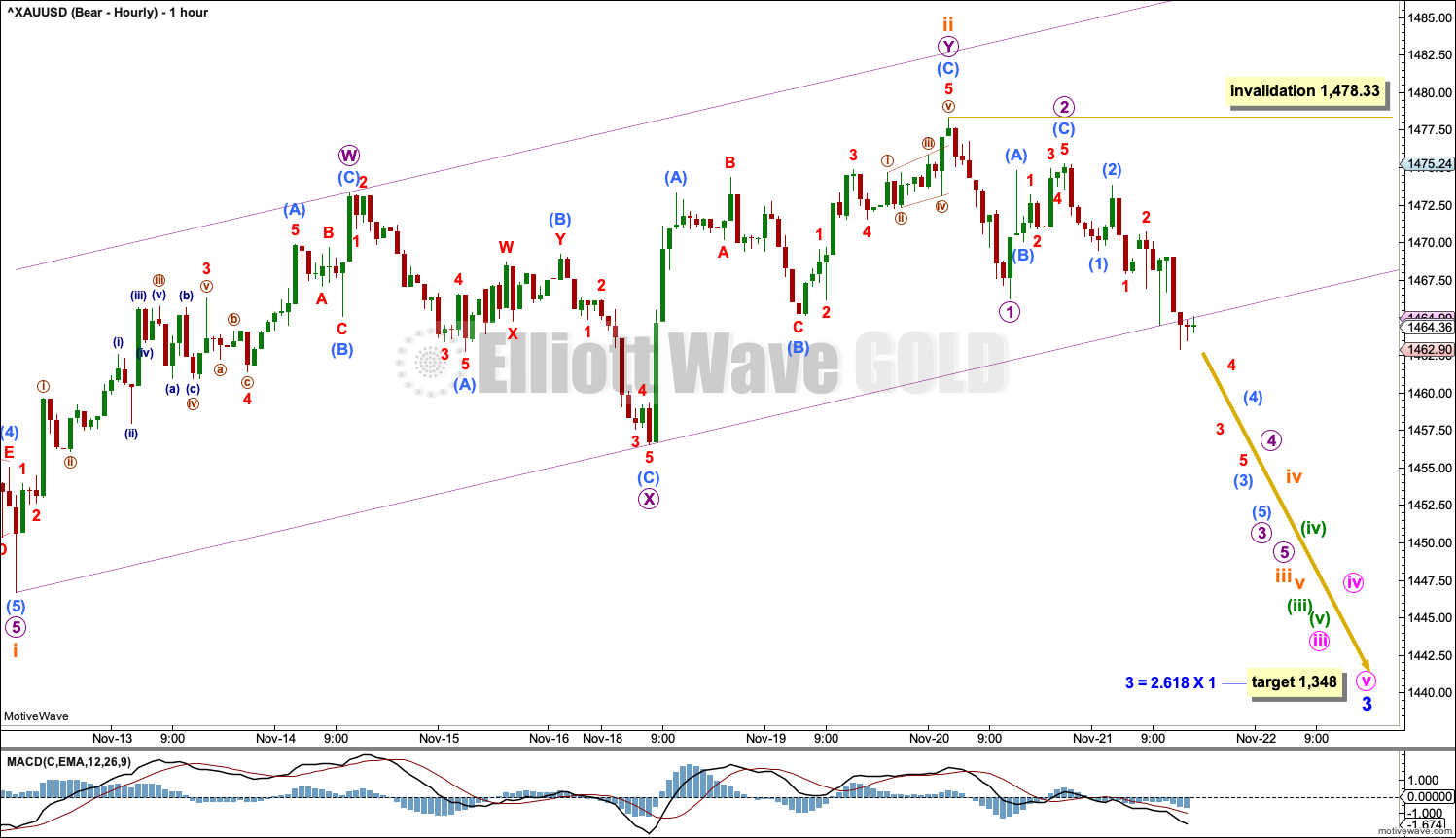

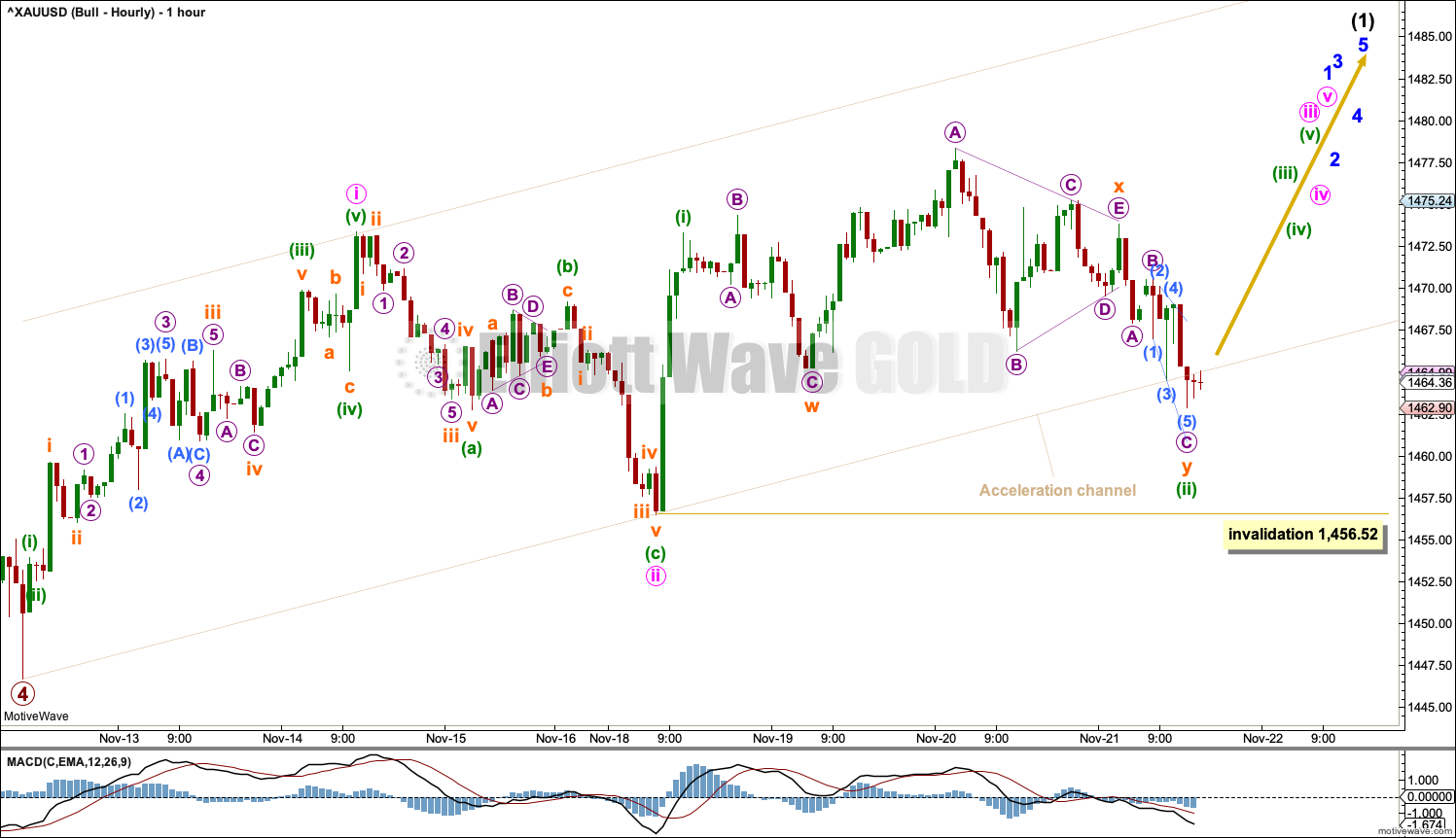

HOURLY CHART

Subminuette wave ii may be complete as a double zigzag.

Draw a channel about subminuette wave ii. When this channel is more clearly breached by downwards movement, that may be taken as indication that subminuette wave ii should be over and subminuette wave iii should have begun. The next wave down may be a third wave at seven degrees; it may exhibit a strong increase in downwards momentum.

Within subminuette wave iii, no second wave correction may move beyond the start of its first wave above 1,478.33.

ALTERNATE DAILY CHART

It is possible that the double zigzag for Super Cycle wave (b) may be incomplete and may yet require one more high.

Within cycle wave y, primary wave A may have been over at the last high. Primary wave B may now be complete as a double zigzag. Primary wave B may not move beyond the start of primary wave A below 1,266.61.

Primary wave C would be expected to find strong resistance and end at the upper edge of the blue best fit channel copied over from the weekly chart.

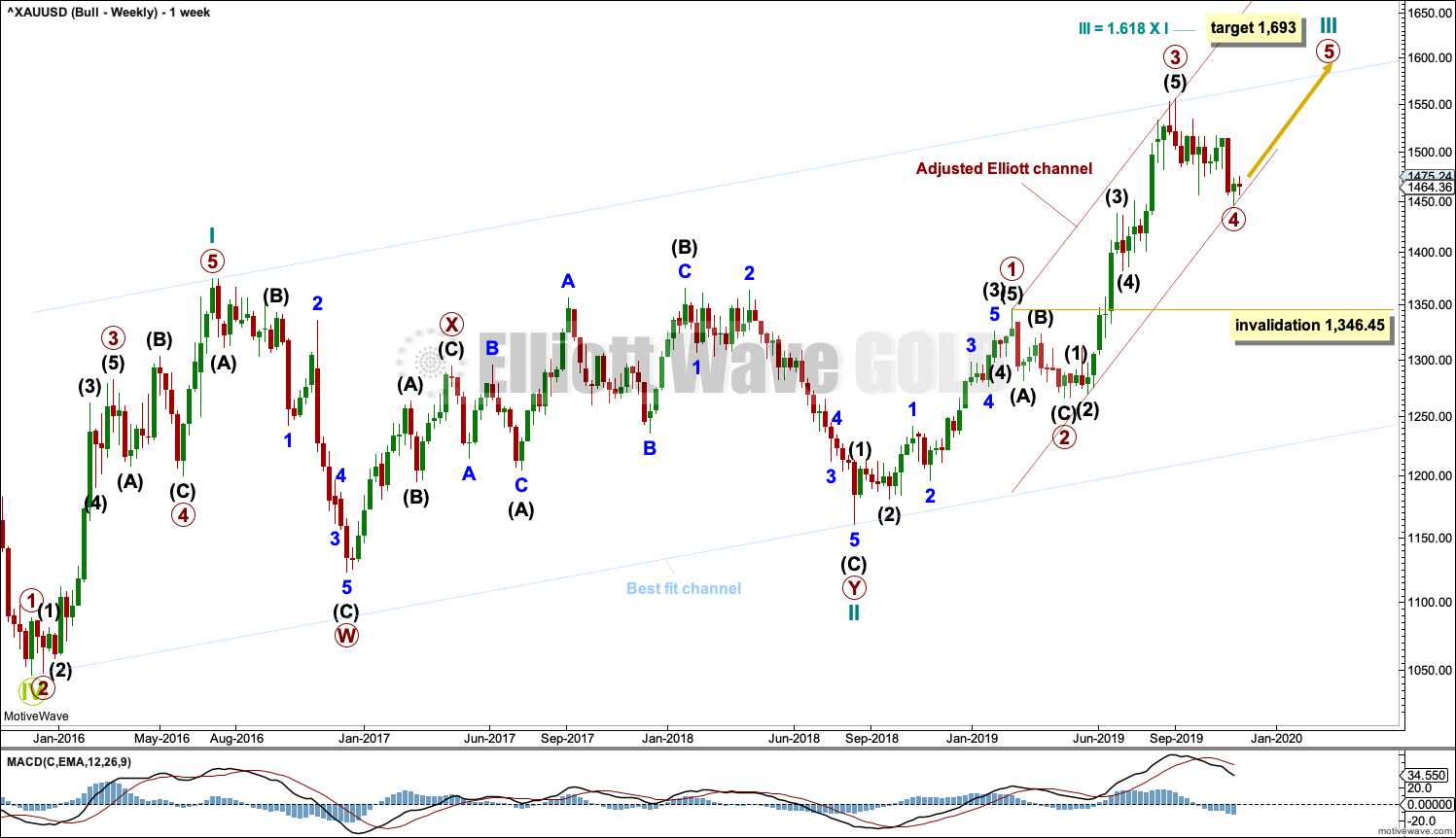

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, and for this reason the bearish wave count is still considered because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. Primary wave 3 has now moved above the end of primary wave 1 meeting a core Elliott wave rule. It has now moved far enough to allow room for primary wave 4 to unfold and remain above primary wave 1 price territory. Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Cycle wave III so far for this wave count would have been underway now for 66 weeks. It exhibits some support from volume and increasing ATR. This wave count has some support from classic technical analysis.

The channel drawn about cycle wave III is an adjusted Elliott channel. The lower edge is pulled lower.

Add the wide best fit channel to weekly and daily charts.

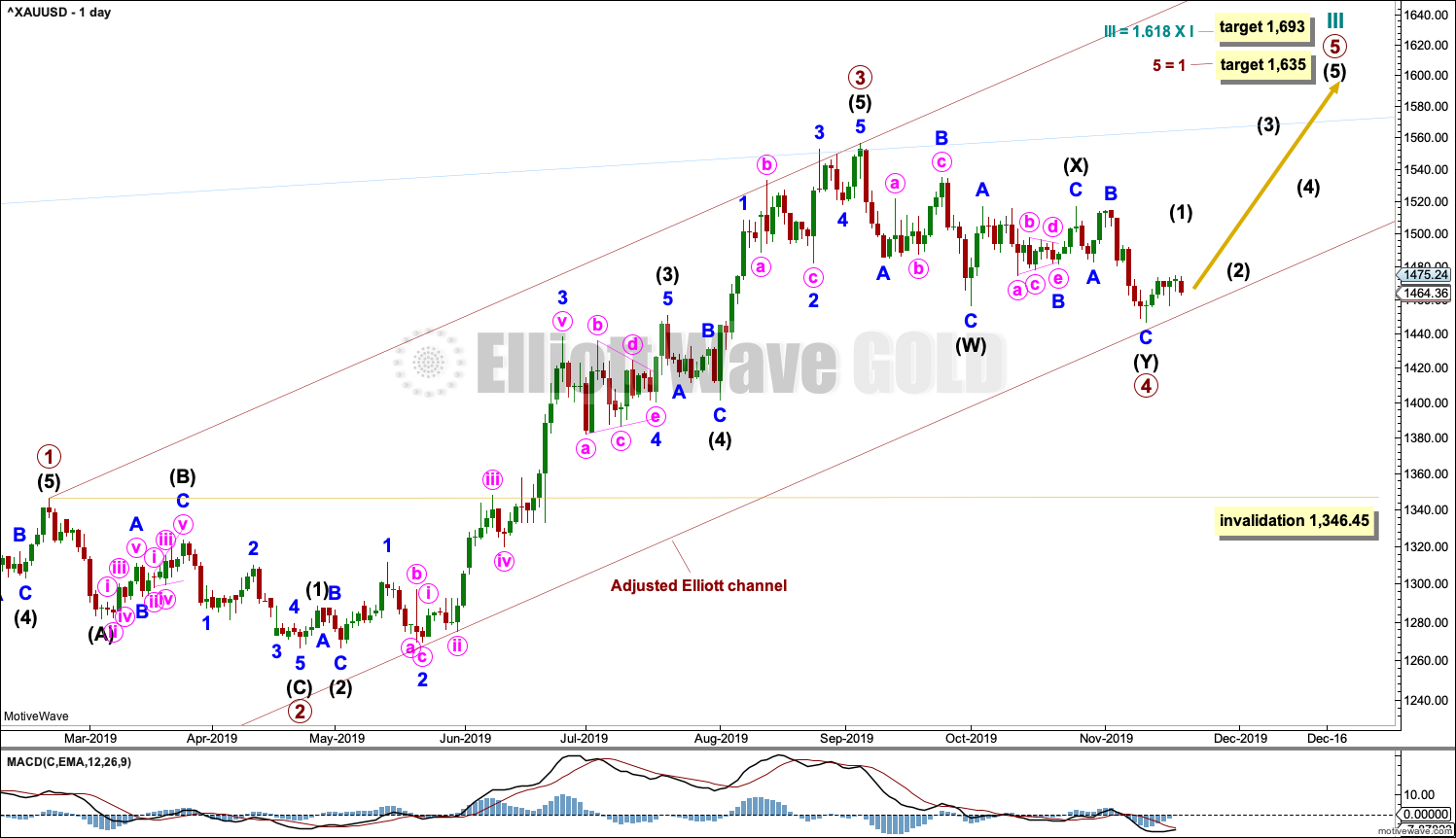

DAILY CHART

Primary wave 4 may be complete as a double zigzag. Primary wave 4 may have lasted 49 sessions, just six more than primary wave 2, which lasted 43 sessions. The proportion remains very good for this part of the wave count.

A target for cycle wave III is calculated also now at primary degree. If price reaches the first target and keeps rising, then the second higher target may be used.

If it continues any further, then primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

HOURLY CHART

Primary wave 5 may have begun. Within primary wave 5, minor wave 1 of intermediate wave (1) may be unfolding higher as an impulse.

Within minor wave 1, minute waves i and ii may be complete, and minute wave iii may only subdivide as an impulse.

Within minute wave iii, minuette waves (i) and (ii) may be complete. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,456.52.

Draw an acceleration channel about minute waves i and ii. Minuette wave (ii) has slightly breached the lower edge of this base channel. While base channels often work for Gold, they do not always work. The probability of this wave count is slightly decreased at this stage.

TECHNICAL ANALYSIS

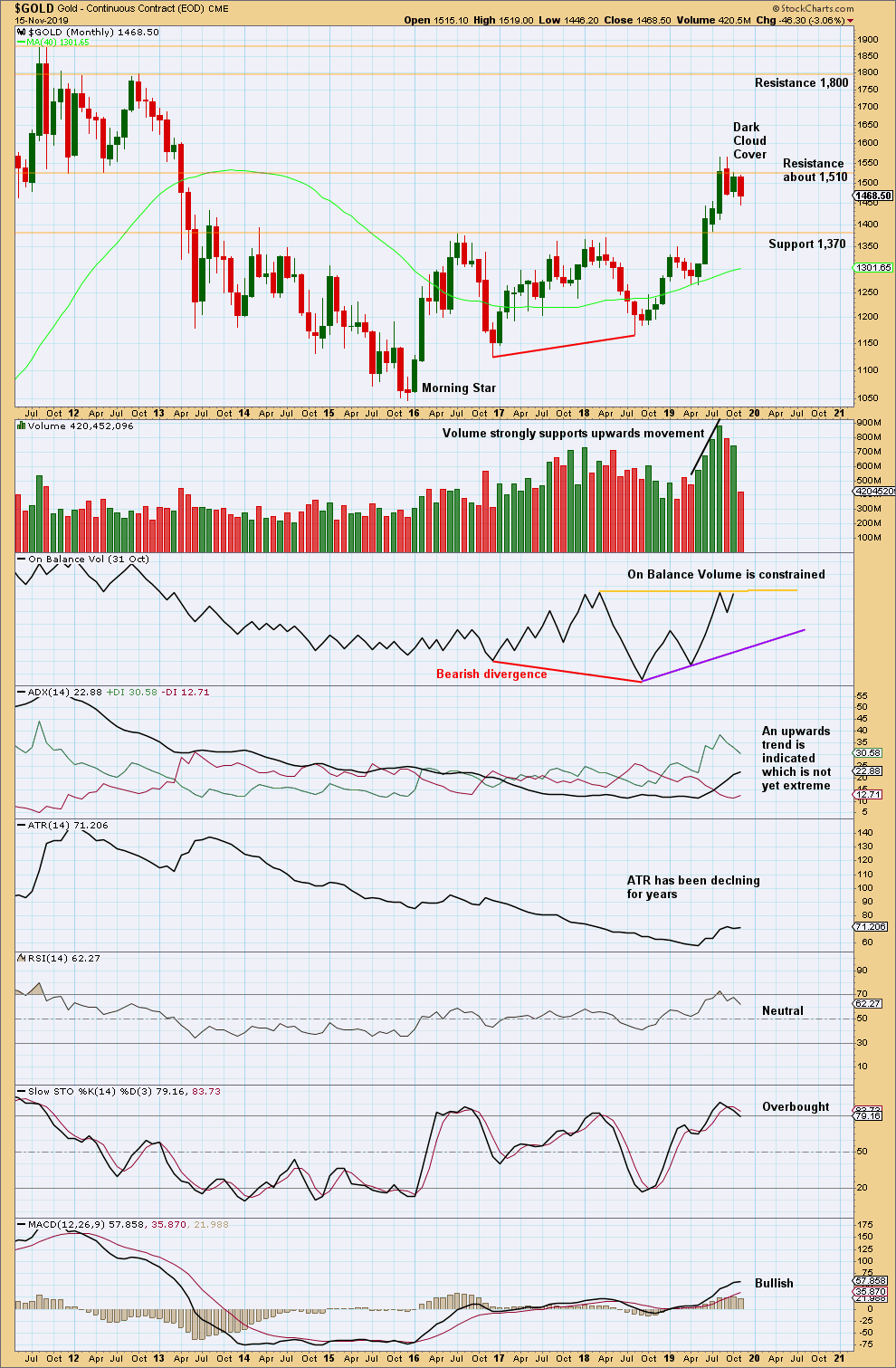

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Overall, this chart is bullish. However, with RSI reaching overbought at the last high, upwards movement may be limited.

The last two months of sideways movement look like a consolidation within an ongoing upwards trend.

Some suspicion regarding the current upwards trend may be warranted by bearish divergence between price and On Balance Volume at the last lows. Also, at the last high price has made a substantial new high above April 2018, but On Balance Volume is flat.

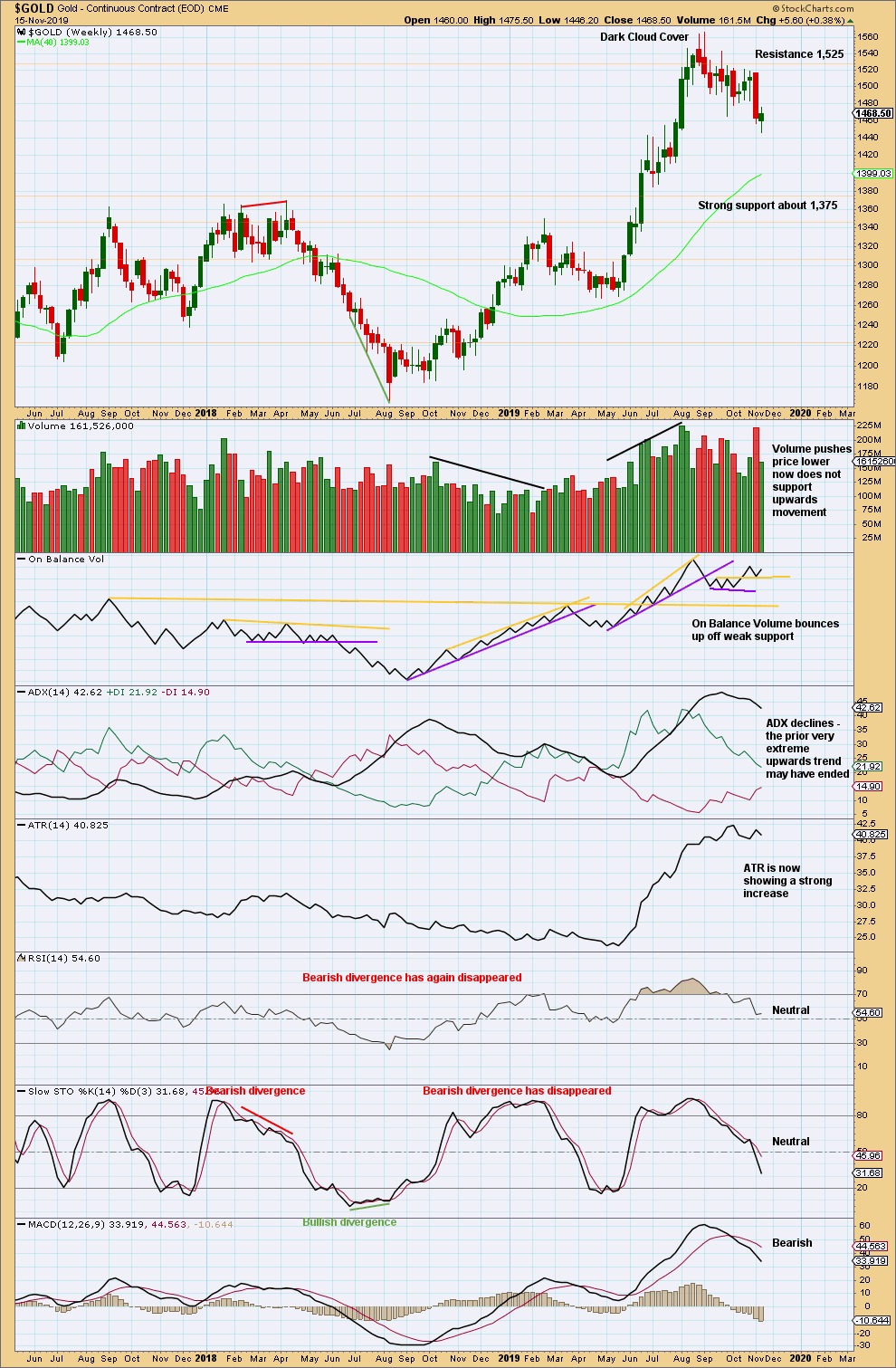

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When trends reach very extreme, candlestick reversal patterns should be given weight. The Dark Cloud Cover bearish reversal pattern is given more bearish weight from the long upper wick.

A very strong downwards week with strong support from volume three weeks ago supports a bearish view. Now a small range downwards week closes green with the balance of volume upwards. Upwards movement last week does not have support from volume and lacks range; this looks like a small pause within a developing downwards trend.

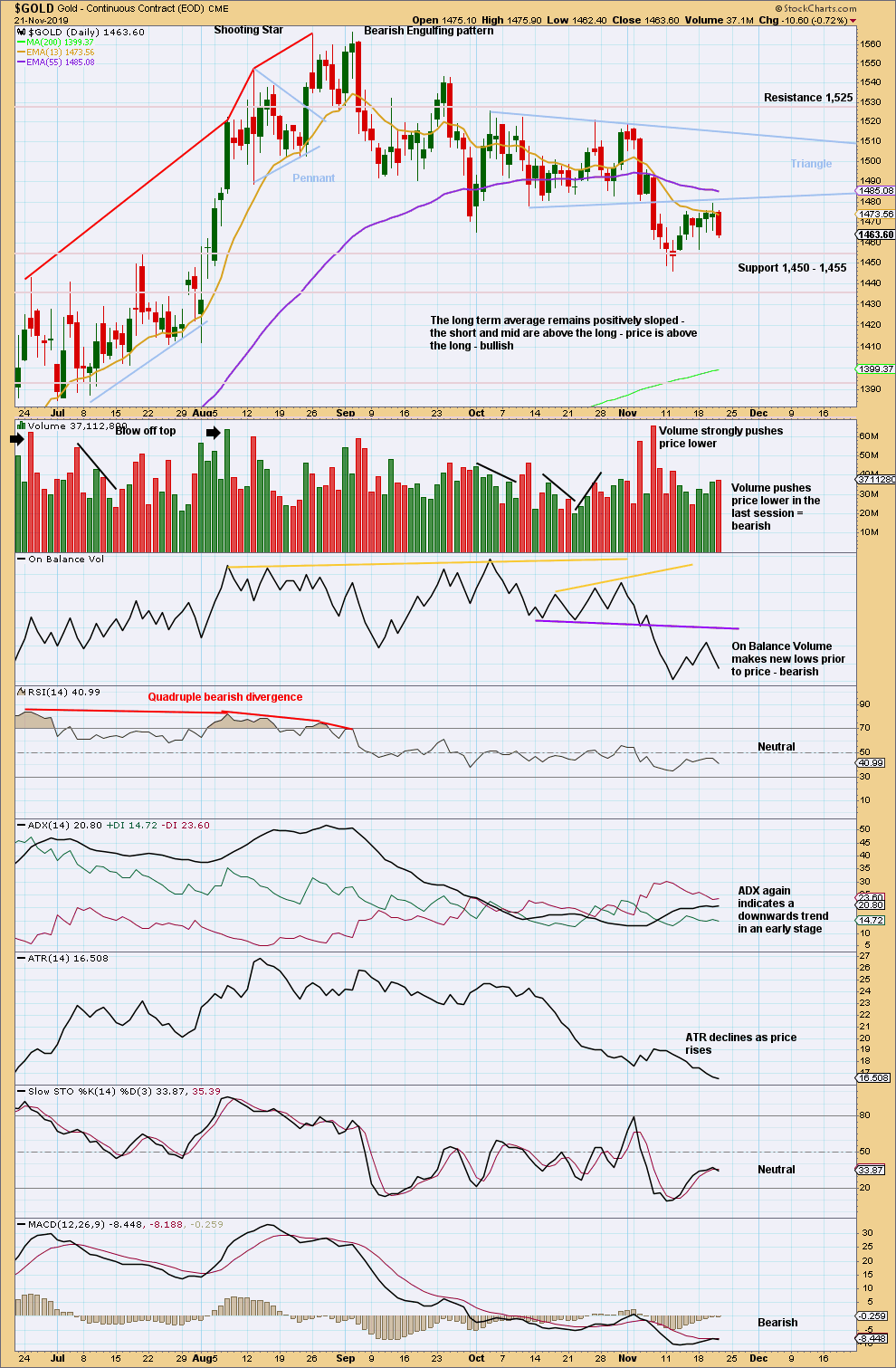

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the last high on the 4th of September, there is now a series of swing lows and swing highs.

After a breakout from the triangle, the target is to be about 1,431.

The downwards breakout from the triangle had strong support from volume pushing price lower, so confidence may be had in the breakout. A back test of resistance at the lower triangle trend line has now completed; resistance has successfully held there. A push today from volume to move price lower supports this view. It looks reasonable to now expect new lows from Gold in coming days. This chart strongly supports the bearish Elliott wave count.

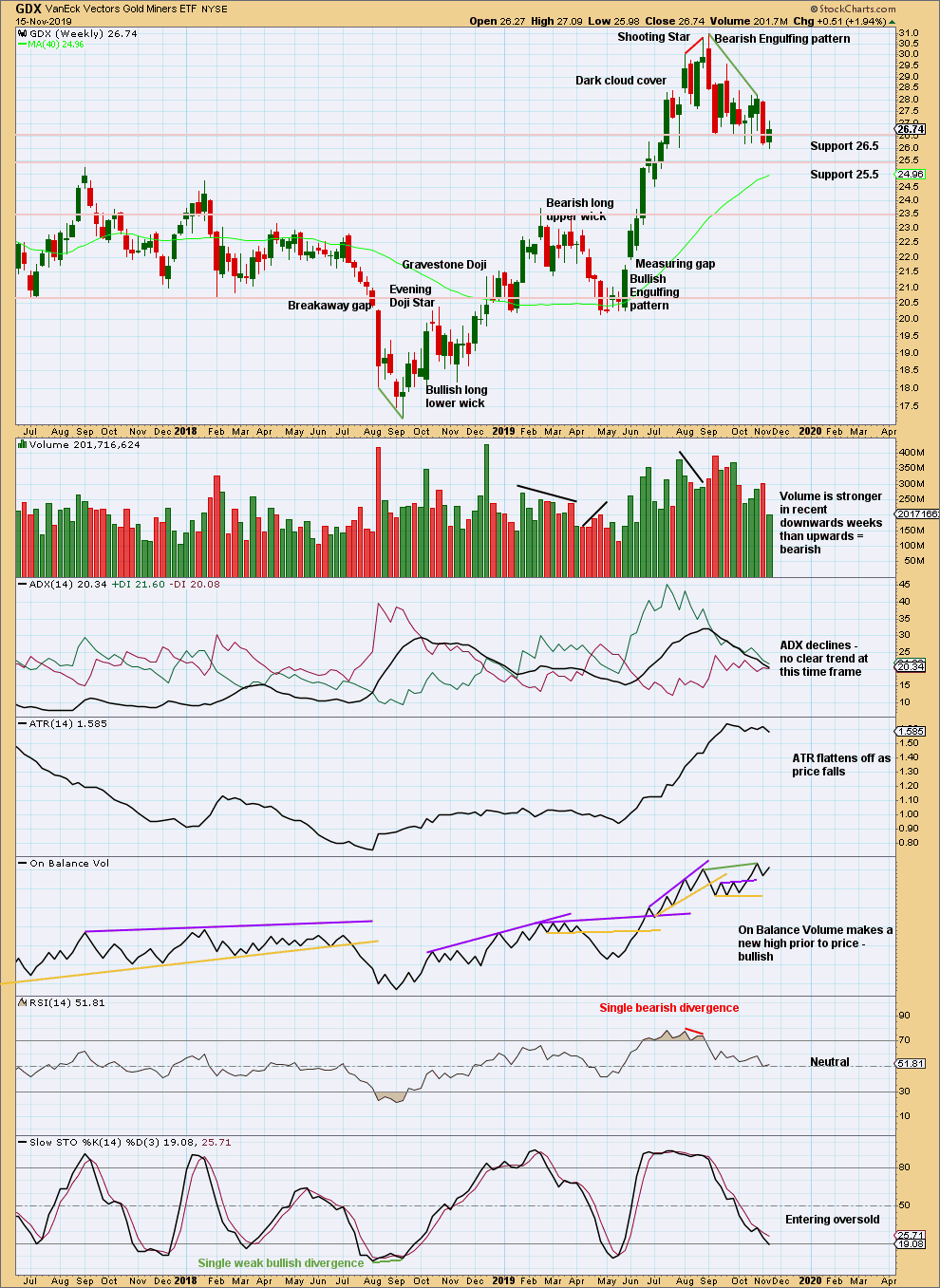

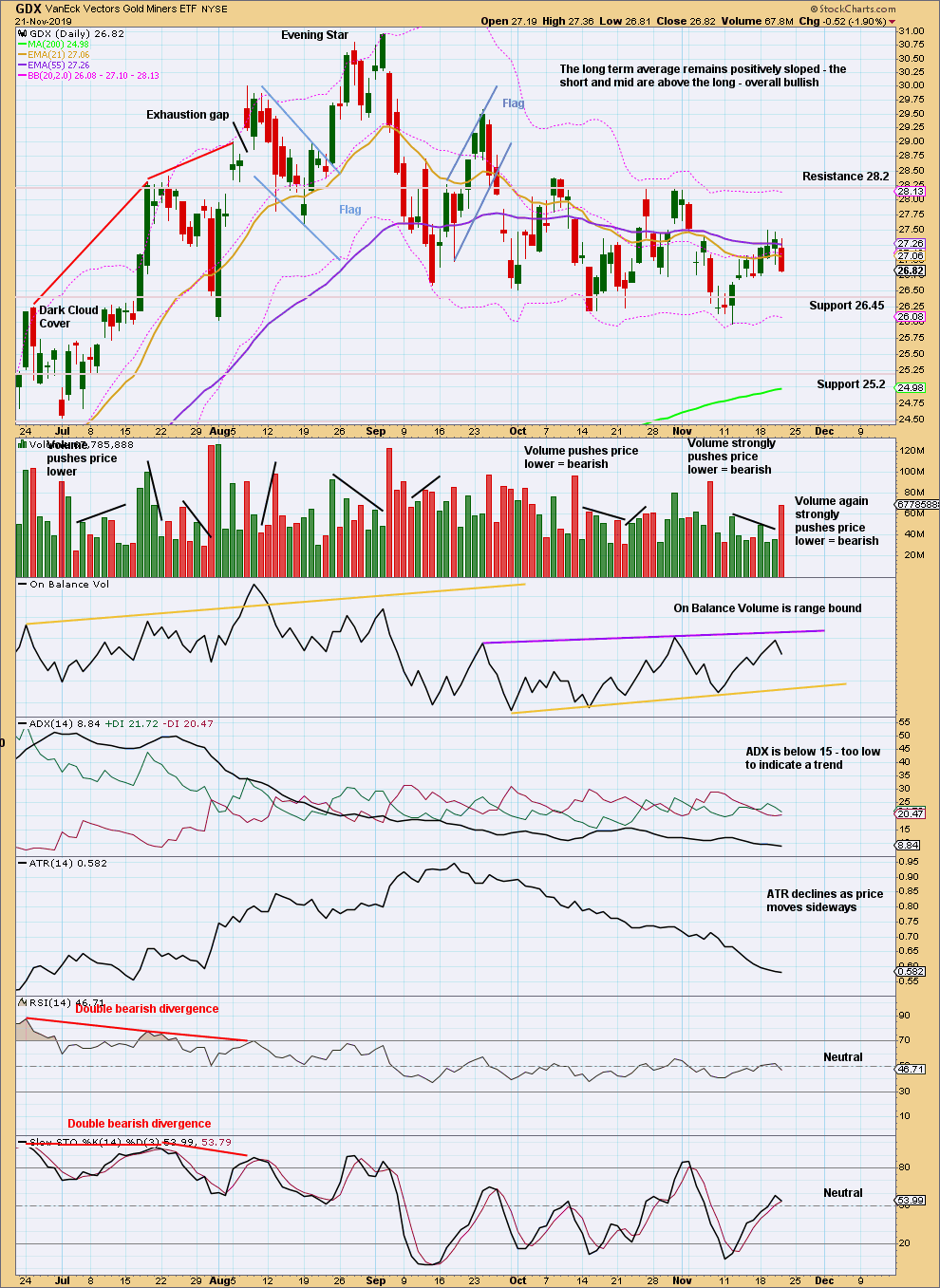

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX, like Gold, often begins a new trend slowly with overlapping and flat or declining ATR. From the last major high at 30.96 a few weeks ago, there has been a strong Bearish Engulfing pattern and strong downwards weeks with greater range and volume than upwards weeks. GDX may have had a trend change.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has made a new swing low. There is now a series of three lower highs and four lower lows from the high on the 4th of September. It still looks like GDX may have had a trend change. This view should remain dominant while the last swing high at 28.18 on the 31st of October remains intact.

Today it looks like the bounce is over and the downwards trend may now resume. With RSI and Stochastics back well within neutral territory, there is again room for price to fall.

Published @ 06:26 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

A message to all members:

I am unwell today. I won’t be able to prepare and publish your analysis. I will do it tomorrow. It will be published late Saturday night / early Sunday morning EST.

Thank you for your understanding and patience.

Sorry to hear you are not feeling well, Lara. Hope you recover soon. Regards.

Get well soon!

hourly chart updated

Please provide BTC update!

If you search the last BTC update, I think we’re looking on track with Lara’s analysis, just a bit further down the road.

Lara, I looked at a 5 and 10 year chart of GDXJ, SLV, GDX. The volume profile at the moment shows volume at nearly a 10 year lows as price has gone down. This strongly supports the alternative wave counts. Can you explain to me how we could be starting a C wave here with volume almost completely drying up as price is moving down? I actually started a JNUG position today. While I know many on the board are playing with Jdst. I’m now on the other-side of that.

I’m not quite sure exactly how to answer this question. I think you have made your mind up already, so I’m not sure that any analysis I could offer may change that view.

But I shall give you an answer, based upon what I see in the charts.

Of course, I could be wrong. It’s happened many times before, and it shall certainly happen again. I’m dealing with the balance of probabilities and sometimes lower probability outcomes occur. And sometimes I just get stuff wrong.

If the hypothesis is that GDX and $GOLD are in bear markets, then it follows that volume may well be low and declining.

For the short term to look and see if a high is currently in place on 4th September, then we need to look at price and volume behaviour at that high, not prior years. Right at that high.

There are strong bearish candlestick patterns with support from volume. That indicates a trend change, to either down or sideways.

The rest of the answer is in my analysis above.

I haven’t made up my mind yet. I hope you are not taking the question the wrong way as I really do value your analysis. It’s just when you look at a five year chart of gold, silver, Gdx or gdxj. It looks like a zig zag move down(3 wave) and where we are now in every chart volume is going down. We are now at a nearly 5 year low in volume. The volume has really slowed to near what could be the bottom of a zig zag. Is it common for volume to keep dropping as a trend continue? The pace of volume slowing down since the peak price has increased? I thought volume normally increases in the direction of the trend? Is my thinking incorrect?

Volume Might increase if we break down through previous recent low. But you may be on to something. The commercials added to their net short position with gold at tuesdays price so they are pretty heavy net short. That kinda leans to Lara’s bearish analysis. I suspect there will be some heavy short covering the next major move down past previous lows. It may be short lived. I’m kinda bullish silver six months out or so. I’ll nibble on pullbacks especially if I see heavy short covering by the commercials.

Any updates on btcusd charts it crushing 🙁

I honestly think the bullish count has more chance.

Clearly Gold does not want to fall anytime fast.

Absolutely everyone is bullish at this point … And that (plus the fact I trust Lara) makes me think we could well be bearish.

Not to mention the miners have still been consolidating, and don’t seem to be acting with the general optimism.

Hopefully it’s not just me that blows the chance for good profits, by being bearish – lol.

Not a whole lot of bullish people out at the moment. Most people think there is more down to go. I would certainly not consider that a contrarian view. selling appears to be drying up. That could change. I have a stop at the prior low which is not far below.

Sorry, I meant bullish long term – feels like everyone is seeing this pullback as a corrective 4th rather than the start of a new trend