Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – November 6, 2020

S&P 500

Upwards movement continues as the main Elliott wave count expected.

Summary: The main wave count expects a low is now in. The target is at 4,606 and an invalidation point at 3,209.45.

If the main wave count is invalidated with a new low below 3,209.45 and then 2,191.86, then an alternate may be used. This wave count is extremely bearish. It expects a bear market to continue for several years and possibly over a decade. It has no lower final target at this stage, but a short-term target is at 2,937.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

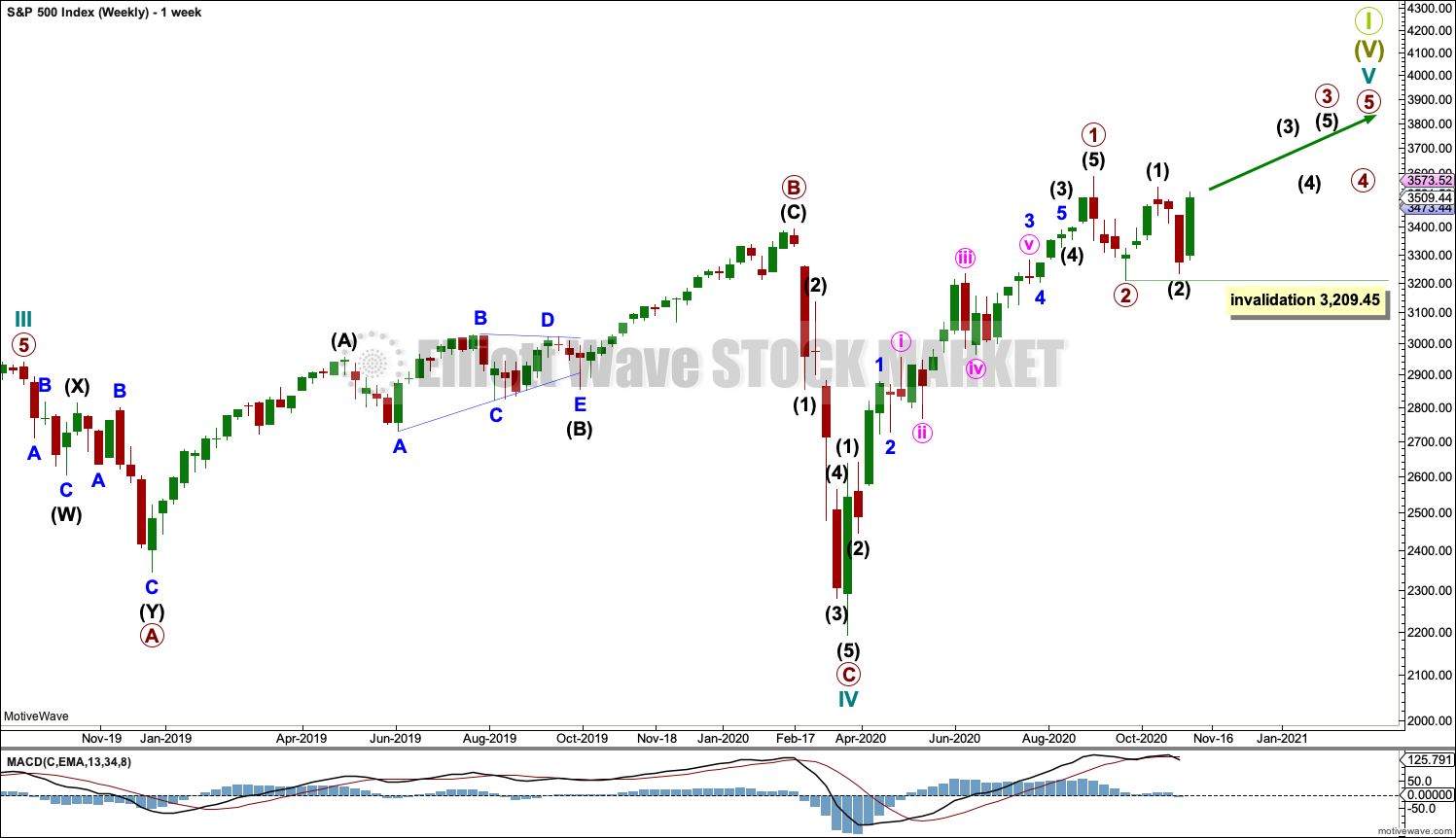

MAIN WAVE COUNT

WEEKLY CHART

Cycle wave V may last from one to several years. So far it is in its eighth month.

Cycle wave V would most likely subdivide as an impulse. But if overlapping develops, then an ending diagonal should be considered. This chart considers the more common impulse.

Primary waves 1 and 2 may be complete.

Primary wave 3 may only subdivide as an impulse. Intermediate wave (2) within primary wave 3 may not move beyond the start of intermediate wave (1) below 3,209.45.

There is already a Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). The S&P500 often exhibits a Fibonacci ratio between two of its actionary waves but rarely between all three; it is less likely that cycle wave V would exhibit a Fibonacci ratio. The target for Super Cycle wave (V) to end would best be calculated at primary degree, but that cannot be done until all of primary waves 1, 2, 3 and 4 are complete.

DAILY CHART

Primary waves 1 and 2 may both be complete. Primary wave 3 may now be underway.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3: Intermediate waves (1) and (2) may both be complete, and intermediate wave (3) may now be underway and may only subdivide as an impulse.

No second wave correction within intermediate wave (3) may move beyond the start of its first wave below 3,233.94.

Primary wave 1 looks extended. The target for primary wave 3 expects it to also be extended.

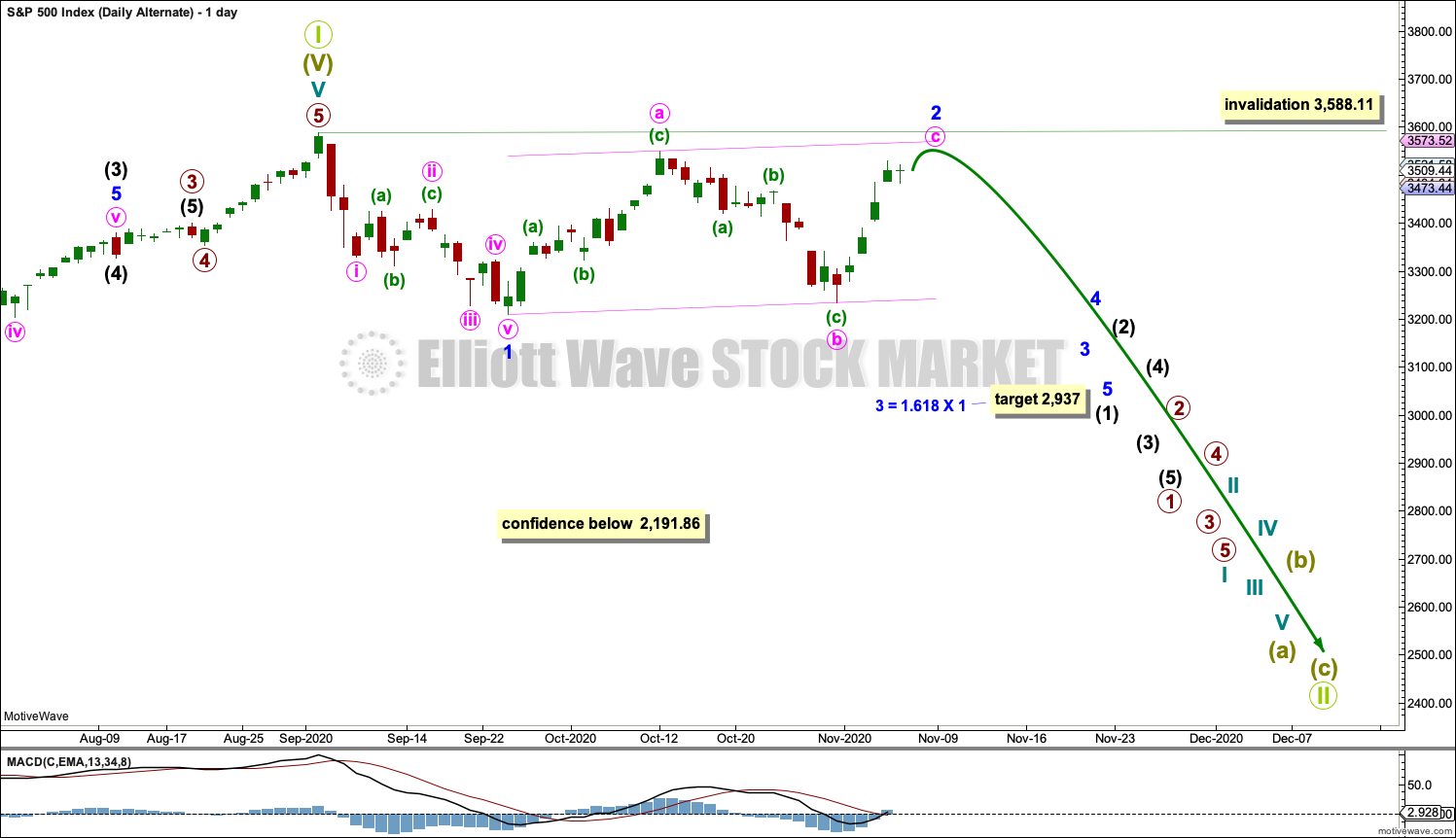

ALTERNATE WAVE COUNT

DAILY CHART

This wave count is the same as the first wave count with the exception of the degree of labelling within cycle wave V. If the degree of labelling is moved up one degree, then it is possible that cycle wave V to end Super cycle wave (V) to end Grand Super Cycle wave I is complete.

A new low below 2,191.86 would add confidence in this wave count. At that stage, the first wave count would be invalidated.

A new bear market at Grand Super Cycle degree may be expected to last over a decade. It may take price below the start of Super Cycle wave (V) at 666.79 in March 2009.

A first five down, labelled minor wave 1, may be complete. Minor wave 2 may be continuing sideways as a regular flat correction. Minor wave 2 may not move beyond the start of minor wave 1 above 3,588.11. Minute wave c within minor wave 2 would be very likely to move at least slightly above the end of minute wave a at 3,549.85 to avoid a truncation.

Major new downwards trends for this market usually begin with strength. The 26th of October is a 90% down day, and the session for the 28th of October completes as an 80% downwards day; this may offer very small support to this wave count. However, recent new all time highs in both NYSE AD line and Lowry’s OCO AD line suggest this wave count has a very low probability.

The last bear market of February to March 2020 (a 35% drop in market value, meeting the technical definition of a bear market as it was over 20%) came after no bearish divergence between price and market breadth. This was the third instance of a bear market formed following zero divergence between price and market breadth; the first was in 1946 and the second was in 1976. Bear markets forming following zero divergence between price and breadth are positively correlated with being more shallow.

This very bearish wave count requires a new low below 2,191.86 for confidence.

TECHNICAL ANALYSIS

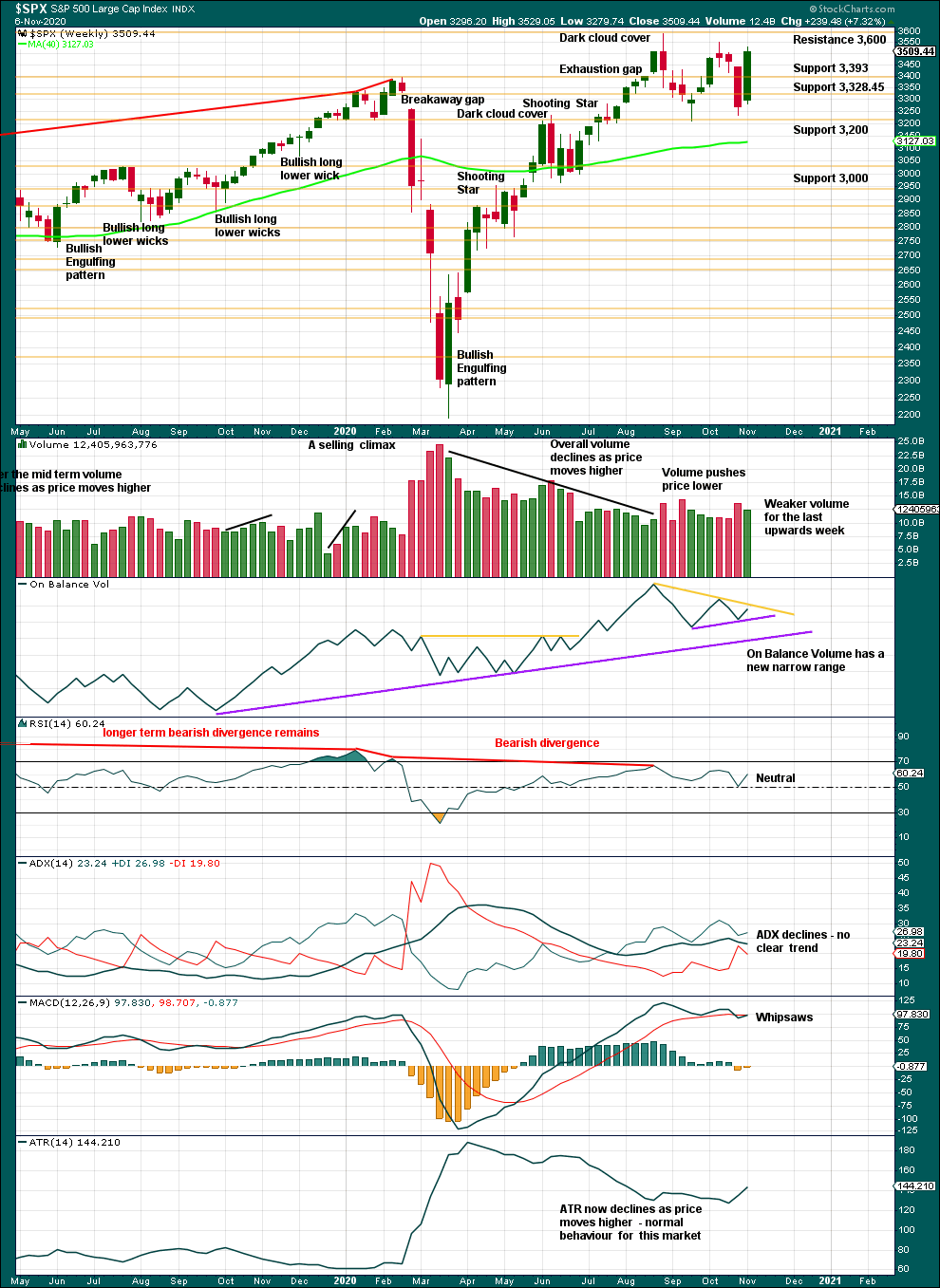

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong upwards week with strong range sees price remain within a consolidation zone. Resistance is about 3,590 to 3,600. Support is about 3,200. A breakout is required for confidence in the next direction.

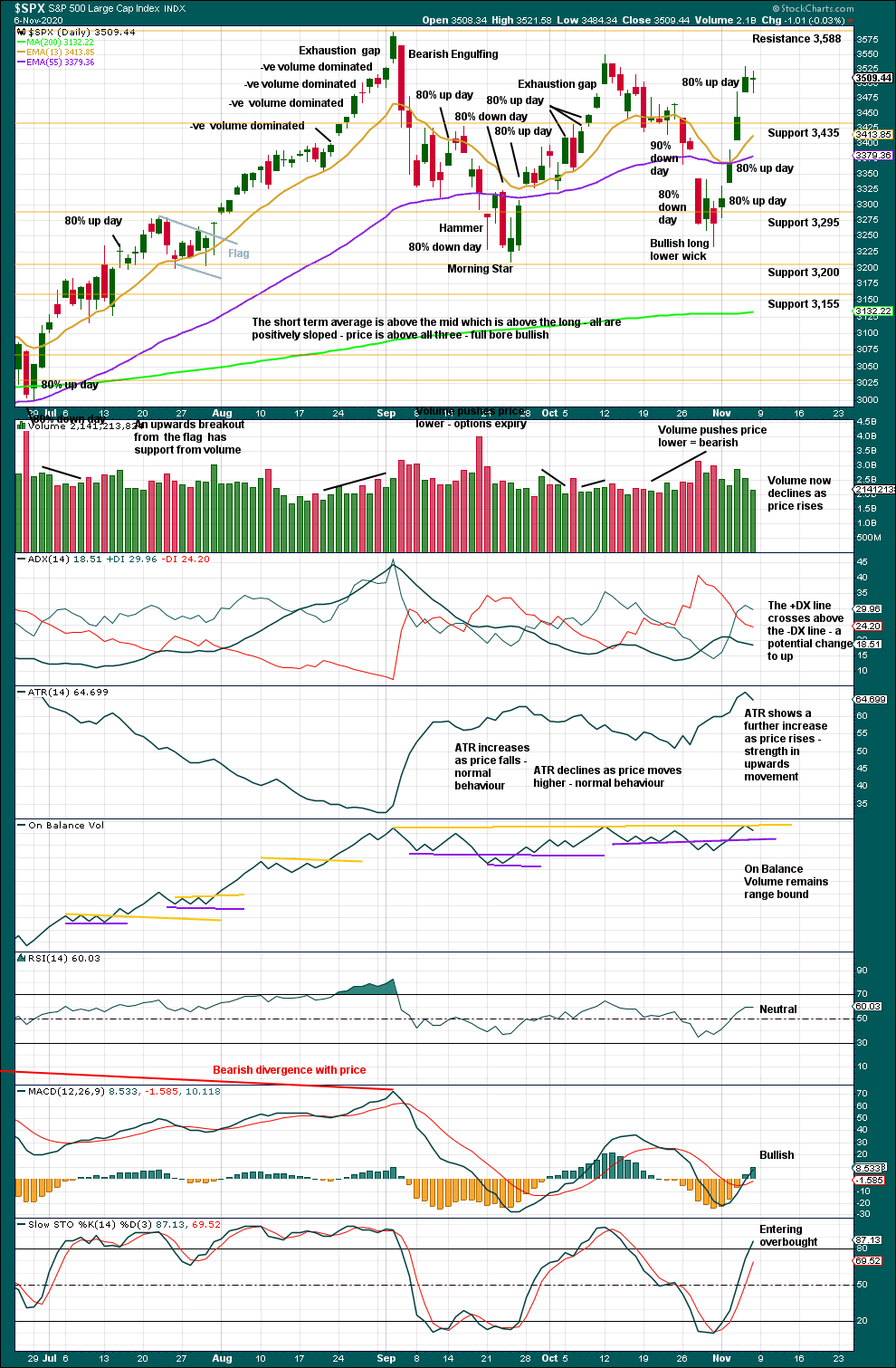

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This particular market commonly forms V bottoms. It will at its lows often exhibit one 90% down day or two back to back 80% down days, followed quickly (within four sessions) by one 90% up day or two back to back 80% up days.

The current set up is not perfect to indicate a V bottom because there was no 90% down day nor two back to back 80% down days within four sessions of the now two 80% up days. However, two back to back 80% up days straight after a low does indicate strength in buying power. This offers some support now to the main Elliott wave count.

Price is range bound. A breakout is needed for confidence in the next trend. ADX suggests it may be up.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

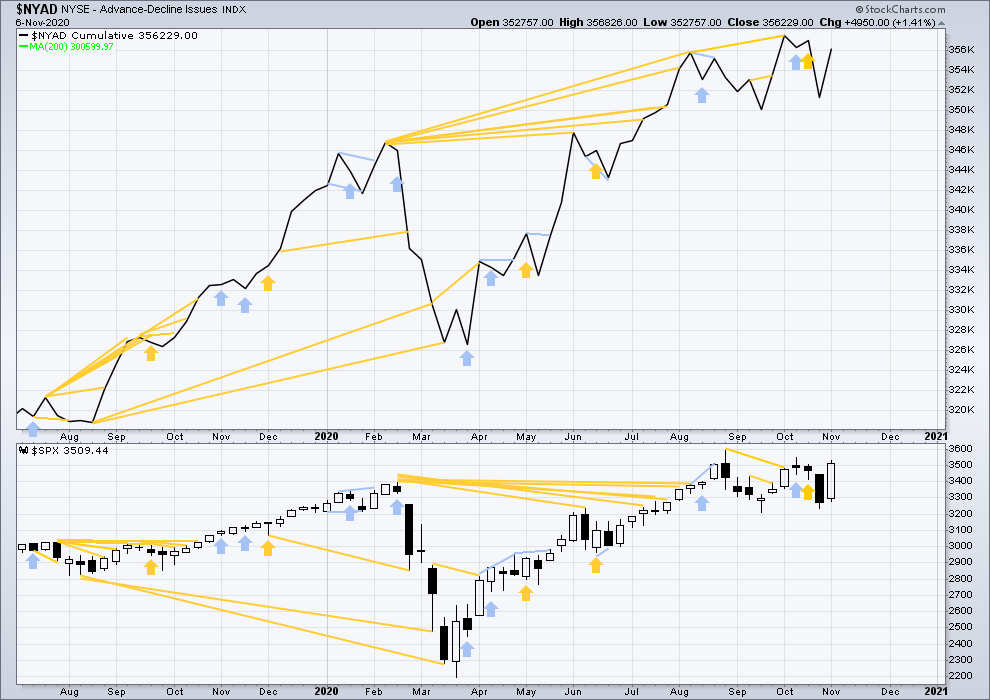

Breadth should be read as a leading indicator.

Lowry’s Operating Companies Only AD line has made a new all time high on the 12th of October. This erases prior bearish divergence with the last all time high in January 2020. With both the NYSE and OCO AD lines making new all time highs, breadth is leading price. This is a strong bullish signal and supports the main Elliott wave count.

Large caps all time high: 3,588.11 on September 2, 2020.

Mid caps all time high: 2,109.43 on February 20, 2020.

Small caps all time high: 1,100.58 on August 27, 2018.

This week both price and the AD line have moved higher. Neither has made new short-term swing highs. There is no new divergence.

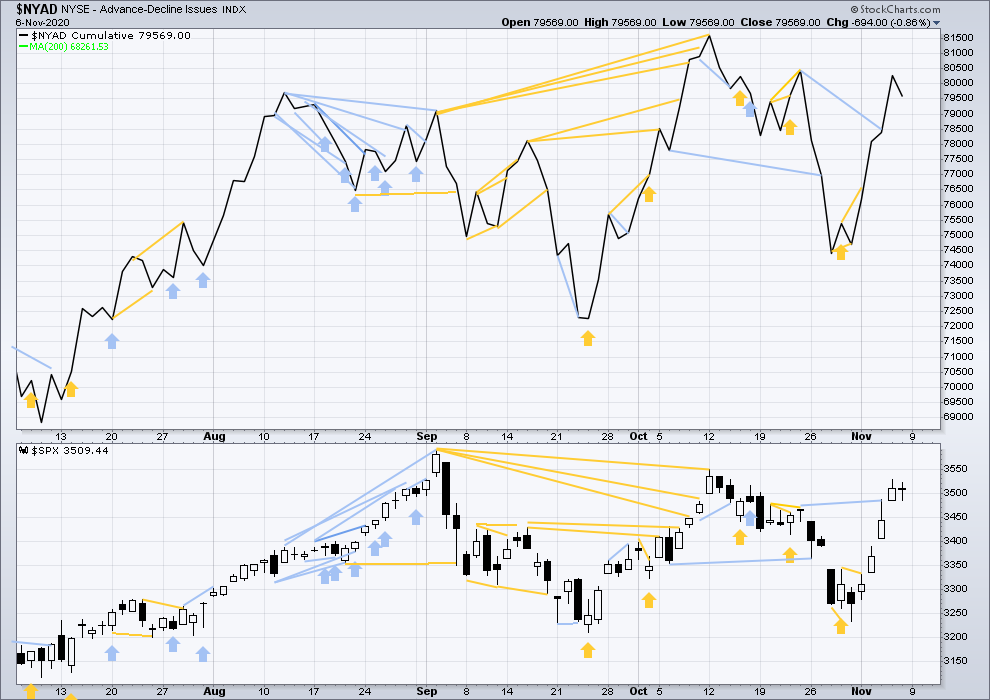

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Friday has completed an inside session. The AD line has declined. There is no new divergence.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Inverted VIX remains well below all time highs. The all time high for inverted VIX was in the week beginning October 30, 2017. There is over 3 years of bearish divergence between price and inverted VIX. There is all of long, mid and short-term bearish divergence. This supports the second alternate Elliott wave count.

This week price and inverted VIX have moved higher. Inverted VIX has made a very slight new high above the prior swing high, but price has not. This divergence is bullish for price, but it is very weak.

Comparing VIX and VVIX: Both VIX and VVIX have moved higher. VIX has made a new high above the prior high of the 8th of June, but VVIX has not. This divergence is bullish for price and may support either the main or first alternate Elliott wave counts.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved higher on Friday. Inverted VIX has made a new swing high by a very small margin above the prior swing high of the 12th of October, but price has not. This divergence is bullish, but it is weak.

Comparing VIX and VVIX at the daily chart level: Today both VIX and VVIX have moved lower. There is no new divergence.

DOW THEORY

Dow Theory still concludes a bear market is in place.

Dow Theory confirmed a bear market with the following lows made on a closing basis:

DJIA: 21,712.53 – a close below this point was been made on the March 12, 2020.

DJT: 8,636.79 – a close below this point was been made on March 9, 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, a bear market was confirmed:

S&P500: 2,346.58 – a close below this point was made on March 20, 2020.

Nasdaq: 7,292.22 – a close below this point was made on the March 12, 2020.

At this time, to shift Dow Theory from viewing a bear market to confirmation of a new bull market would require new highs made on a closing basis:

DJIA: 29,568.57

DJT: 11,623.58 – closed above on 7th October 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, confirmation of a bull market would require new highs made on a closing basis:

S&P500: 3,393.52 – closed above on 21st August 2020.

Nasdaq: 9,838.37 – closed above on June 8, 2020.

GOLD

Upwards movement continues as the main Elliott wave counts expect.

Summary: The first wave count is bearish for the bigger picture, and it has a main and an alternate daily chart. The main daily chart expects upwards movement. The alternate daily chart expects a multi-year bear market may be in its early stages to end below 1,046. The first short-term target is at 1,709. The first confidence point for this alternate remains at 1,849.22.

The second wave count is bullish for the bigger picture, and it has a main and an alternate daily chart. The main daily chart expects upwards movement (short term, both first and second wave counts have main daily charts which have the same expectation). The alternate daily chart expects a multi-month to multi-year bear market that may be in its early stages to possibly end about either 1,722.96 or 1,508.27.

Grand SuperCycle analysis is here.

Last analysis of monthly charts is here with video here.

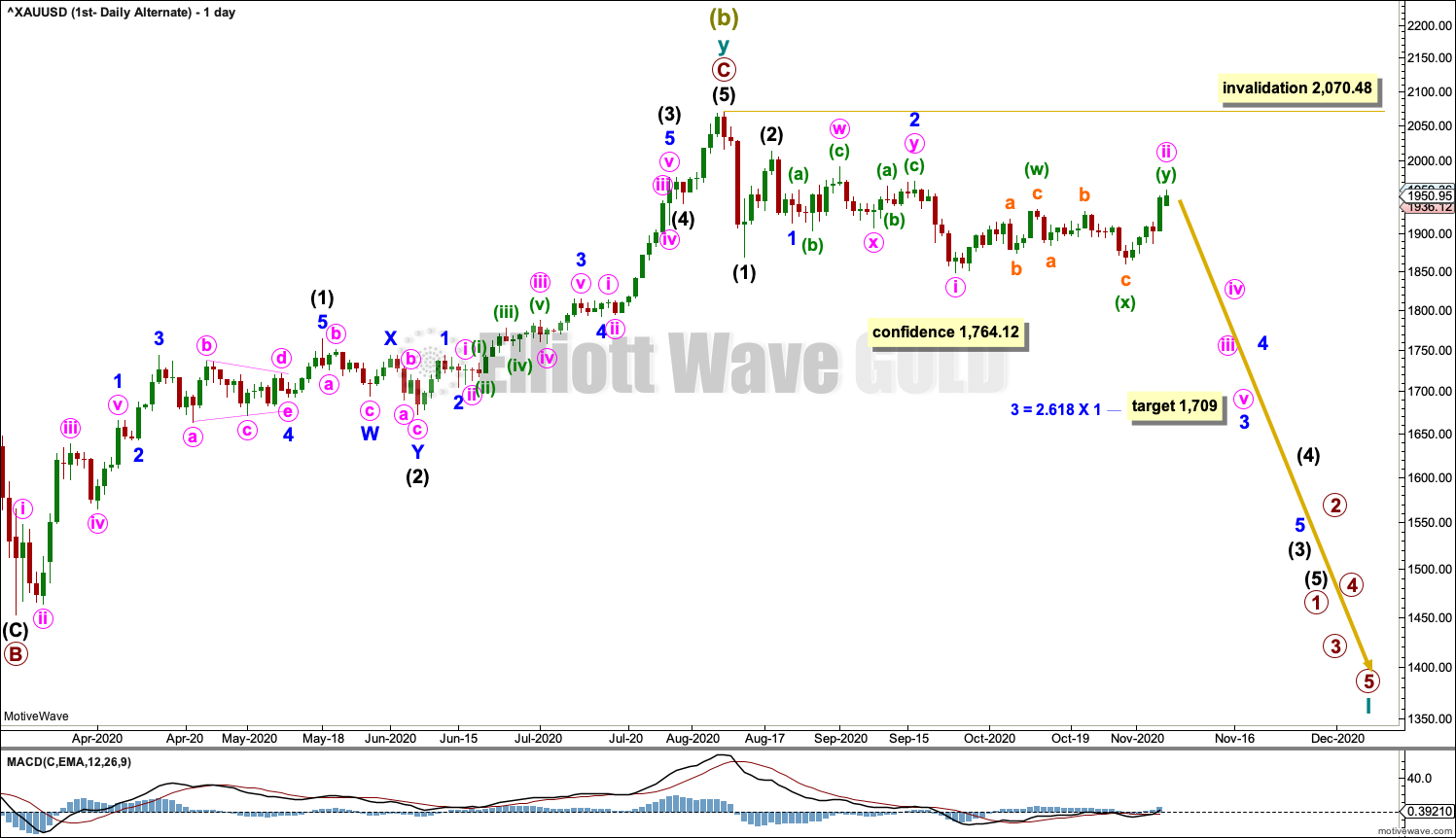

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

The bigger picture for this first Elliott wave count sees Gold as still within a bear market, in a three steps back pattern that is labelled Grand Super Cycle wave IV on monthly charts. Grand Super Cycle wave IV may be subdividing as an expanded flat pattern. The common range for Super Cycle wave (b) within a flat is from 1 to 1.38 times the length of Super cycle wave (a), giving a range from 1,920.18 to 2,252.27. The target would see Super Cycle wave (b) end within this most common range.

Super Cycle wave (b) within Grand Super Cycle wave IV may be an incomplete double zigzag. When Super Cycle wave (b) may be complete, then this wave count expects Super Cycle wave (c) to begin and to move price below the end of Super Cycle wave (a) at 1,046.27.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a combination labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

Primary wave C within cycle wave y may be subdividing as an impulse, which is the most common structure for C waves. Intermediate waves (1) through to (4) within primary wave C may be complete. If it continues any lower, then intermediate wave (4) may not move into intermediate wave (1) price territory below 1,764.12.

A best fit channel is drawn about primary wave C to contain as much of this movement as possible. Copy this channel over to daily charts.

We should always assume the trend remains the same until proven otherwise. At this stage, Gold is in a bull market.

DAILY CHART

The daily chart shows detail of primary wave C as an incomplete impulse.

Intermediate waves (1) through to (4) within primary wave C may be complete. Intermediate wave (4) may be a complete zigzag.

The wide beige channel is copied over from the weekly chart. Price has now breached the channel. For this reason an alternate daily chart is considered below.

If it continues lower, then intermediate wave (4) may not move into intermediate wave (1) price territory below 1,764.12.

If intermediate wave (4) is over as labelled, then within intermediate wave (5) minor wave 2 may not move beyond the start of minor wave1 below 1,849.22. For this reason, 1,849.22 remains an important confidence point for the alternate wave counts.

A target is calculated for intermediate wave (5) that expects it to exhibit the most common Fibonacci ratio to intermediate wave (1).

Intermediate wave (5) must subdivide as a five wave motive structure at minor degree. So far minor wave 1 may be complete, and minor wave 2 may be moving lower as a double combination: zigzag – X – flat.

ALTERNATE DAILY CHART

It is possible for this alternate wave count that a series of three first and second waves may be complete. A third wave down may begin to develop strength.

Primary wave 2 within the new downwards trend may not move beyond the start of primary wave 1 above 2,070.48.

Minute wave ii may be a complete double zigzag. Minute wave ii may not move beyond the start of minute wave i above 1,971.34.

A new low below 1,849.22 would add initial confidence to this wave count. A new low below 1,764.12 would add reasonable confidence.

This wave count expects a further increase in downwards momentum. Either one or both of minuette wave (v) or minute wave v may end with a selling climax. Minuette wave (iv) and minute wave iv may be relatively brief and shallow.

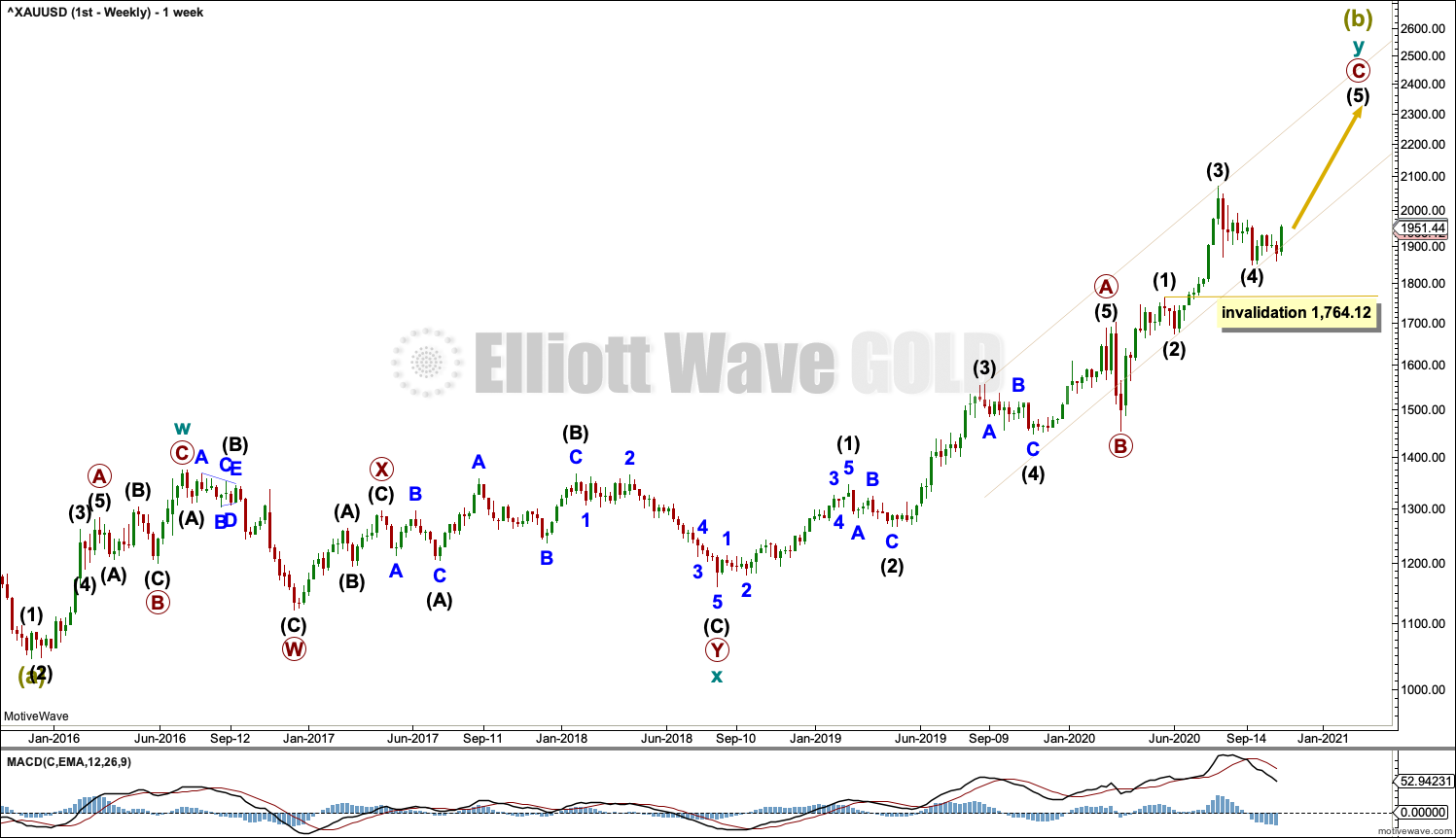

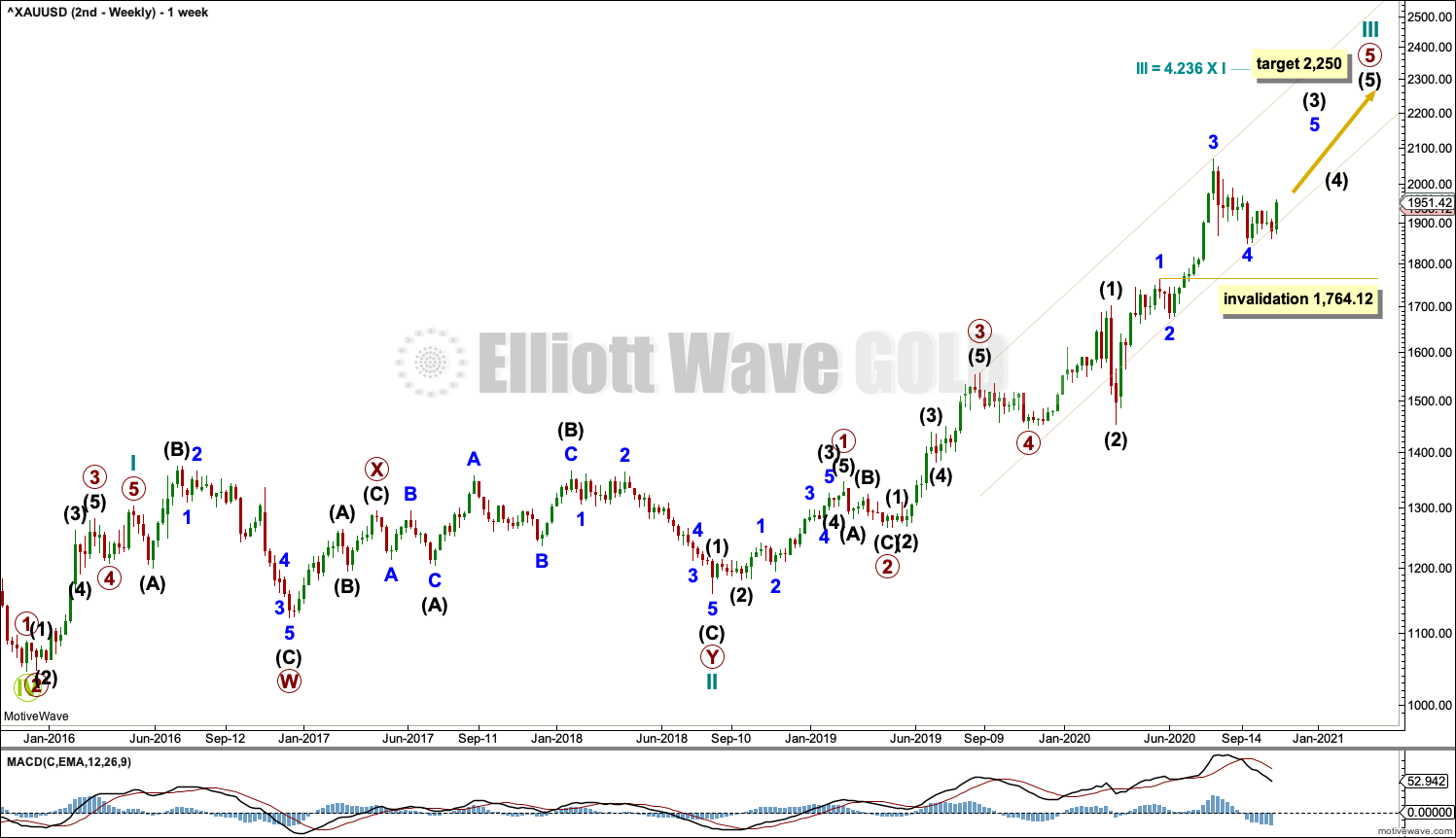

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the first wave count above). This movement must be labelled as a series of overlapping first and second waves. Ignoring this triangle reduces the probability of this wave count in Elliott wave terms.

Cycle wave III may be incomplete. Minor wave 4 within primary wave 5 may not move into minor wave 1 price territory below 1,764.12.

A best fit channel is drawn about cycle wave III in the same way as the channel as on the first wave count.

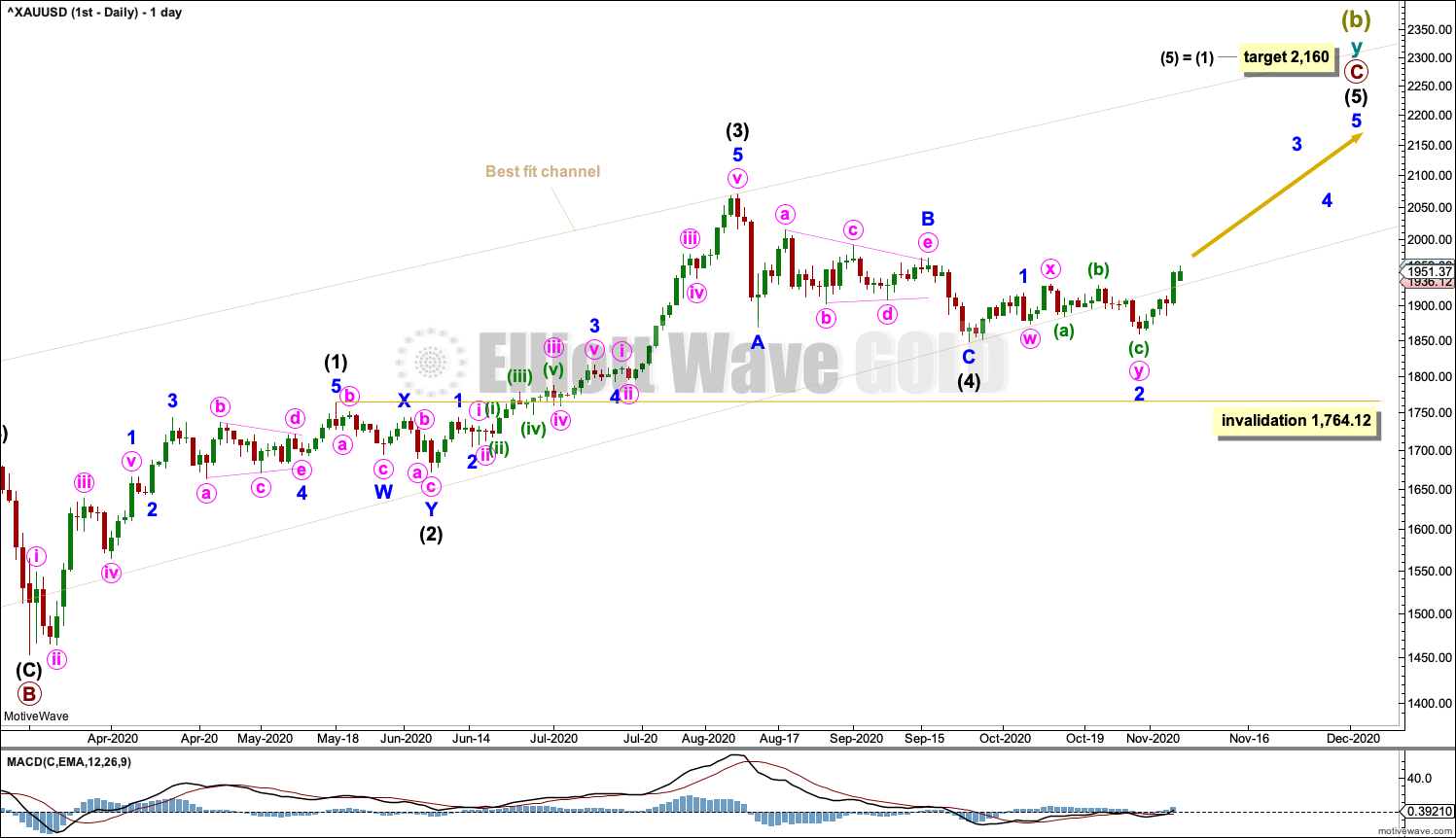

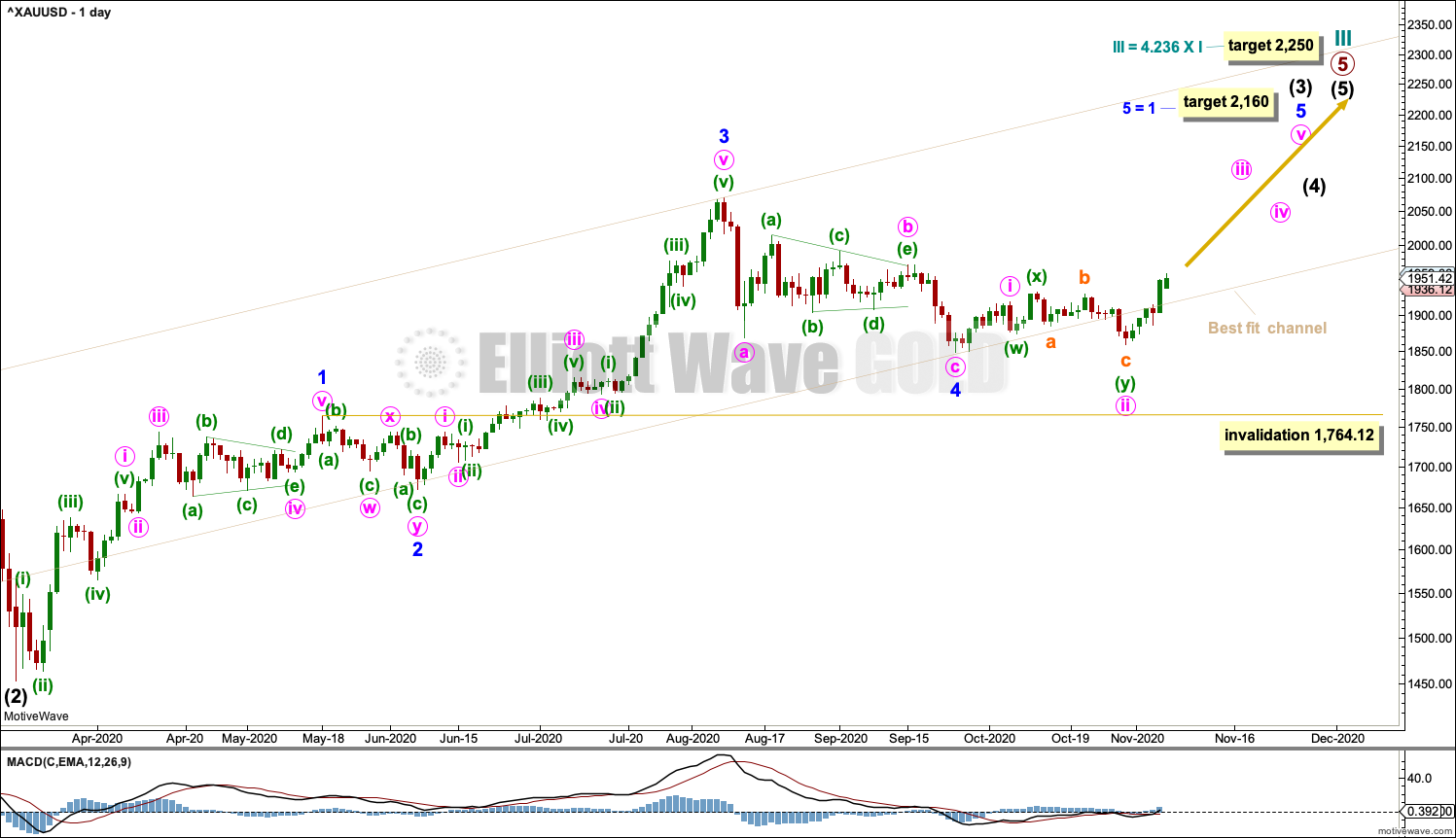

DAILY CHART

Cycle wave III may be incomplete. The daily chart focusses on primary wave 5 within cycle wave III.

Minor wave 4 may be a complete zigzag.

If minor wave 4 continues lower, then it may not move into minor wave 1 price territory below 1,764.12.

Minor wave 5 must subdivide as a five wave motive structure. Within minor wave 5: minute wave i may be complete and minute wave ii may be a complete double combination: zigzag – X – flat. If it continues lower, then minute wave ii may not move beyond the start of minute wave i below 1,849.22.

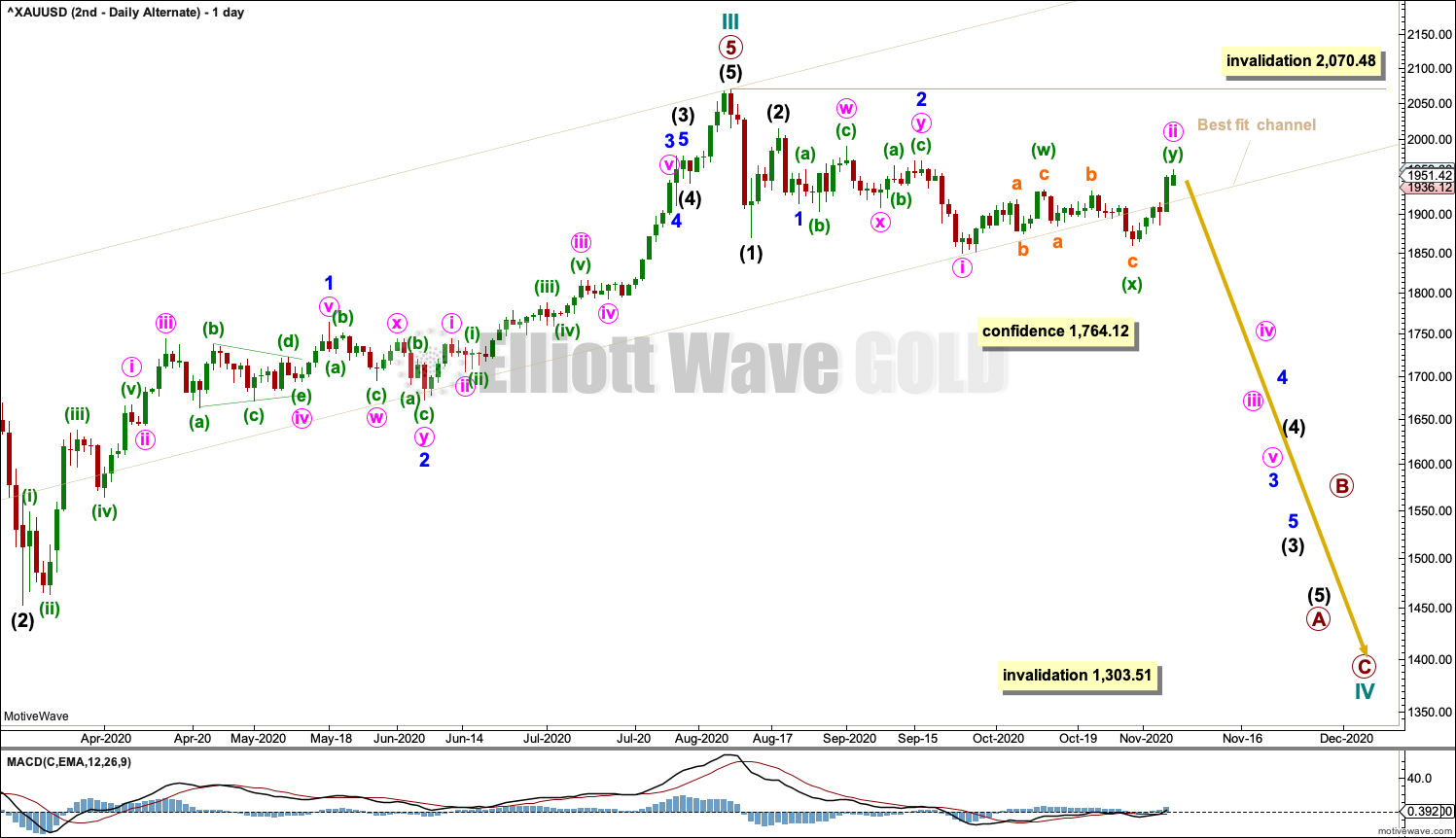

ALTERNATE DAILY CHART

It is possible that cycle wave III is complete and cycle wave IV is in its very early stages. This alternate wave count sees the impulse upwards of primary wave 5 complete.

Cycle wave IV may subdivide as any one of more than 23 Elliott wave corrective structures. It would most likely subdivide as a zigzag. A new bearish trend at cycle degree should begin with a five wave structure downwards at the daily chart level; this would be incomplete. No second wave correction within this first five down may move beyond the start of its first wave above 2,070.48.

Targets for cycle wave IV at this stage may be calculated from Fibonacci ratios of cycle wave III. Cycle wave IV may end at either one of the 0.382 Fibonacci ratio at 1,722.96 or the 0.618 Fibonacci ratio at 1,508.27. Cycle wave IV may not move into cycle wave I price territory below 1,303.51 (this can be seen on the weekly chart).

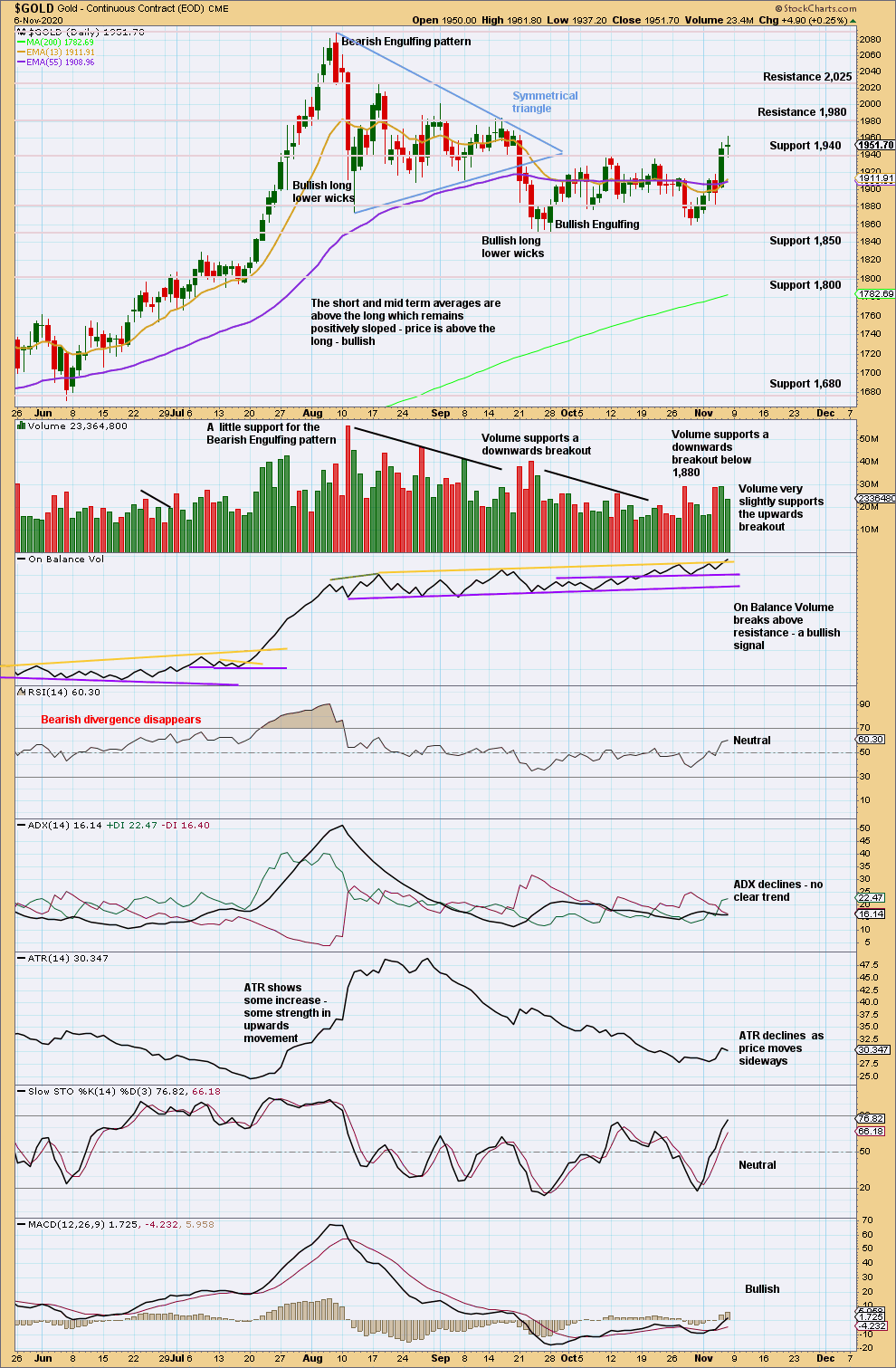

TECHNICAL ANALYSIS

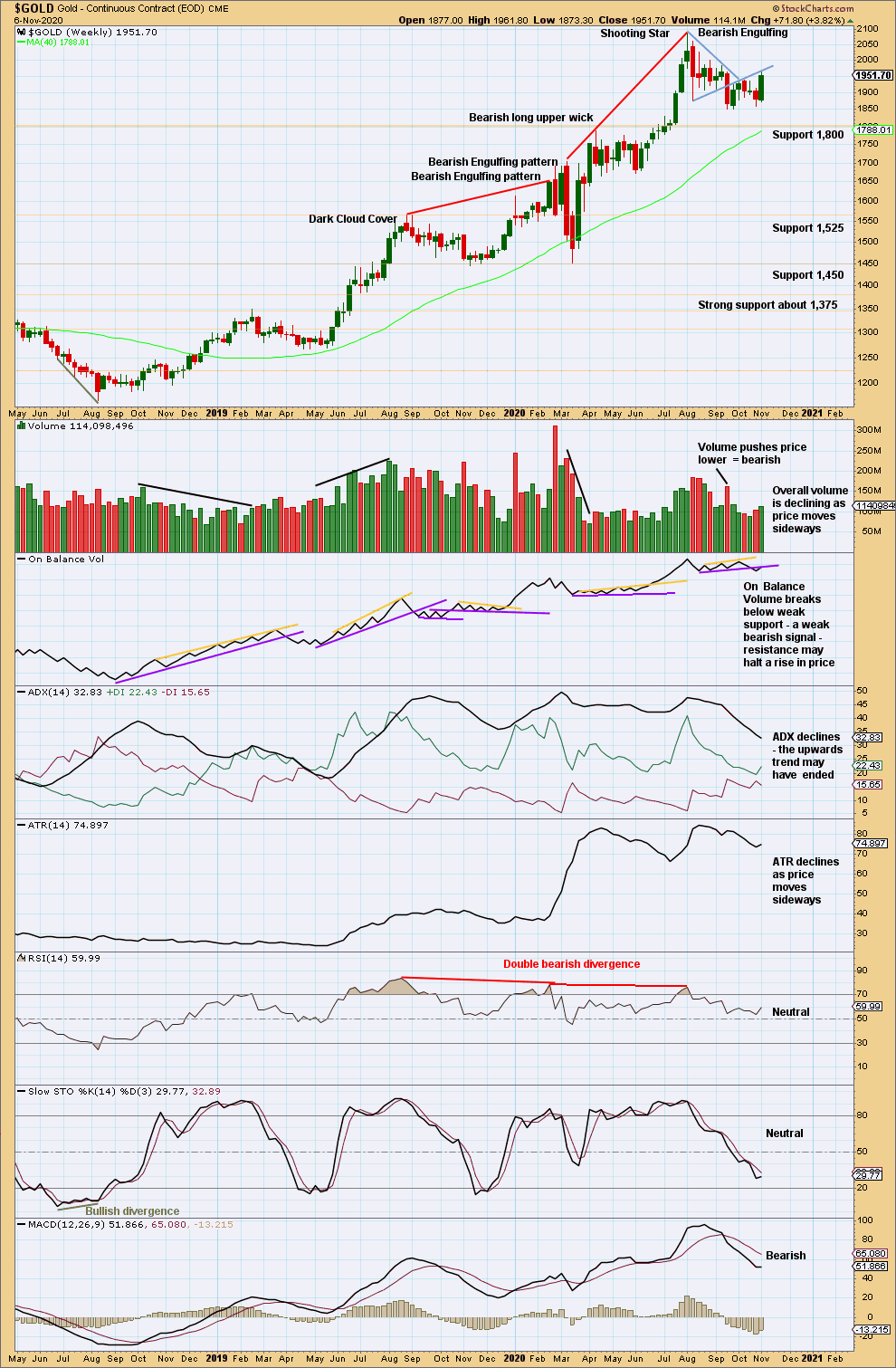

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has broken out downwards from a small triangle. Look for next support about 1,800.

At the last high were two bearish candlestick patterns with overbought RSI exhibiting double bearish divergence. It is possible there may have been a 180° trend change at the high. A new swing low below 1,671.70 would add confidence in that view.

Price and On Balance Volume are both at short-term resistance. This may halt a further rise in price.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards breakout below support, which was at 1,880, has been effected on a strong downwards day that has good support from volume. A target calculated from the width of the consolidation zone would be at 1,843. Price is back within the prior consolidation zone. The target remains valid. Volume still suggests this upwards movement may be a counter trend movement.

Price has closed above prior resistance at 1,940 with a very little support from volume (volume data from Stockcharts has been changed retrospectively). There is a little support for the upwards breakout.

On Balance Volume breaks above resistance. Some confidence in an upwards breakout may be had. Price is still within a larger zone of congestion though, so that may slow it down.

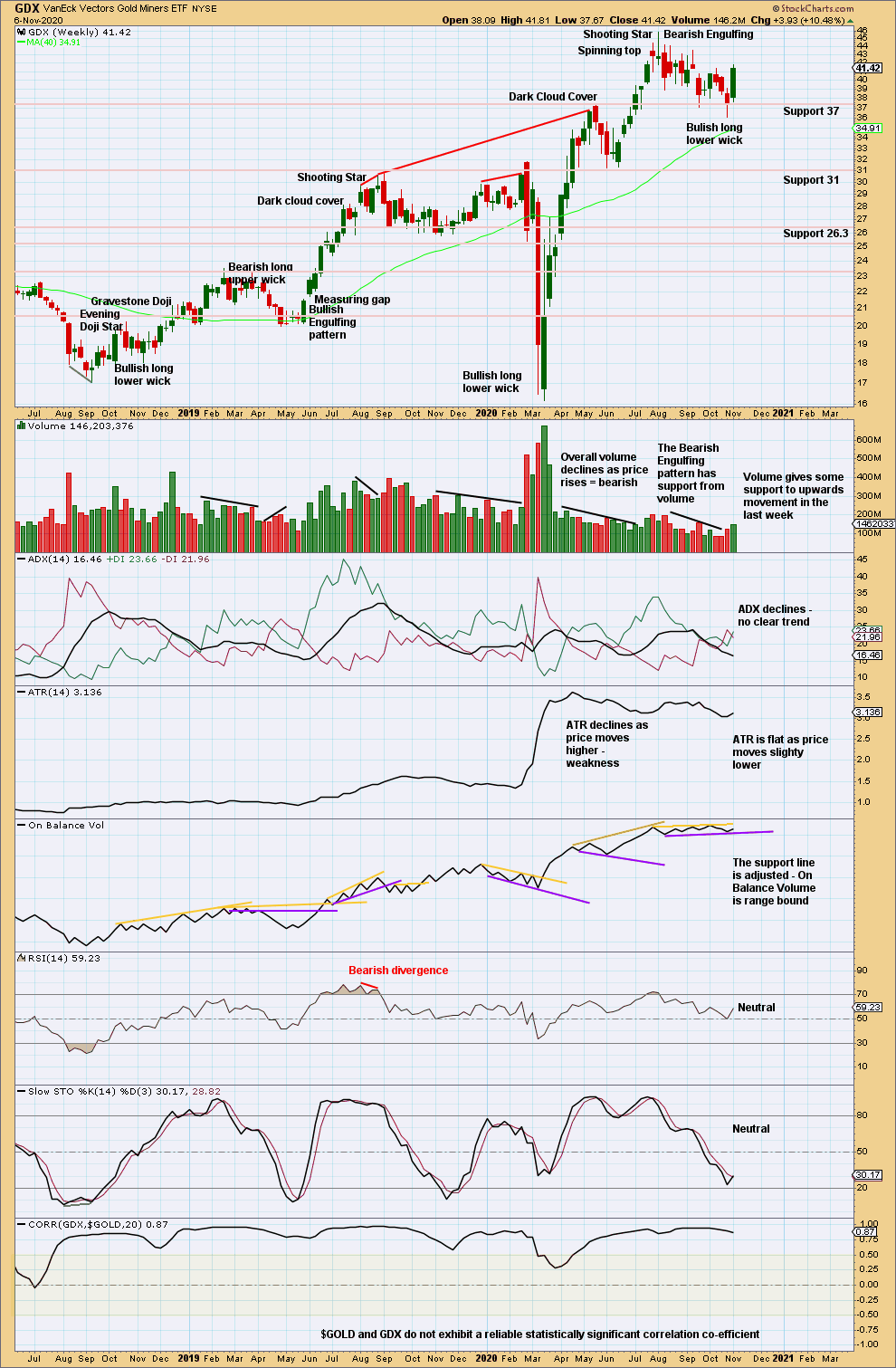

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The pullback may be over. An upwards trend may be ready to resume.

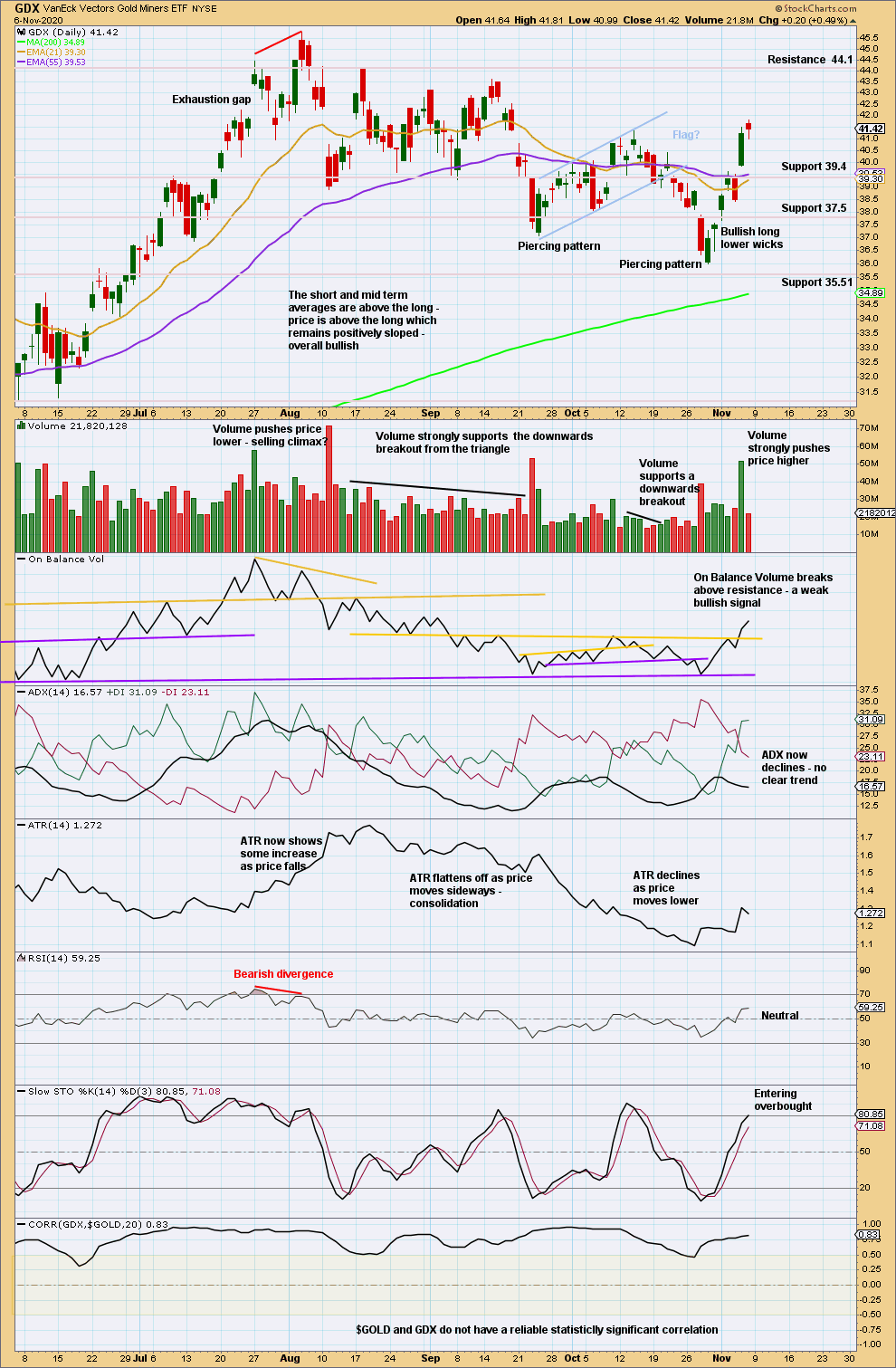

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A new short-term swing high suggests this may not be a bounce within an ongoing lower trend, but that the prior larger upwards trend may have resumed.

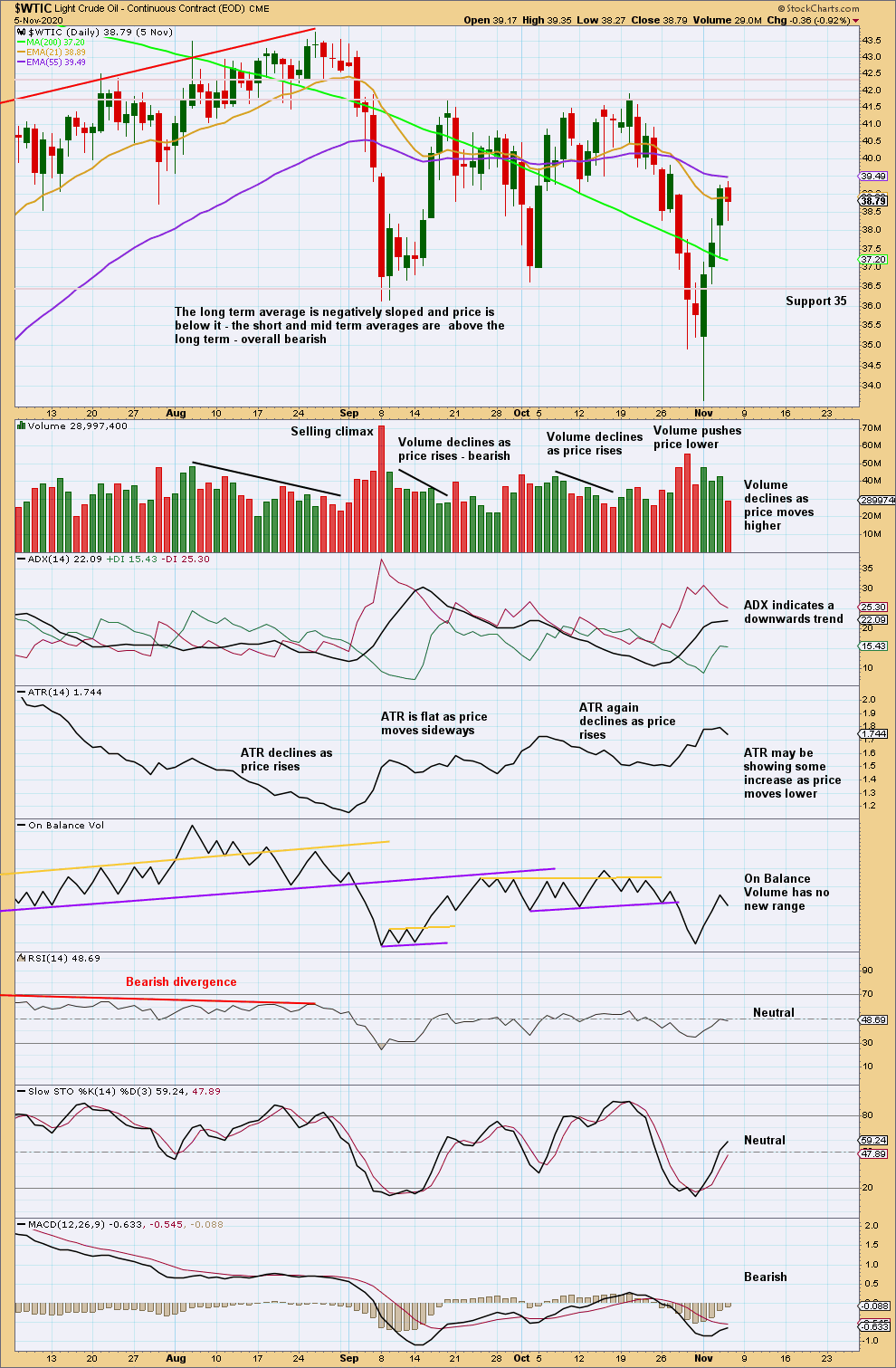

US OIL

Downwards movement has continued as expected this week with a lower low and a lower high, but the week will close green with a strong bounce.

Summary: Downwards movement may overall continue lower. In a downwards trend bounces may be opportunities.

A multi-week pullback is expected to end about 23.05. It is possible the pullback may be deeper than this though; the first major correction within a new trend for Oil tends to be very deep.

When this pullback may be complete, then an upwards trend should resume with increased strength.

Oil may have found a major sustainable low in April 2020.

ELLIOTT WAVE COUNT

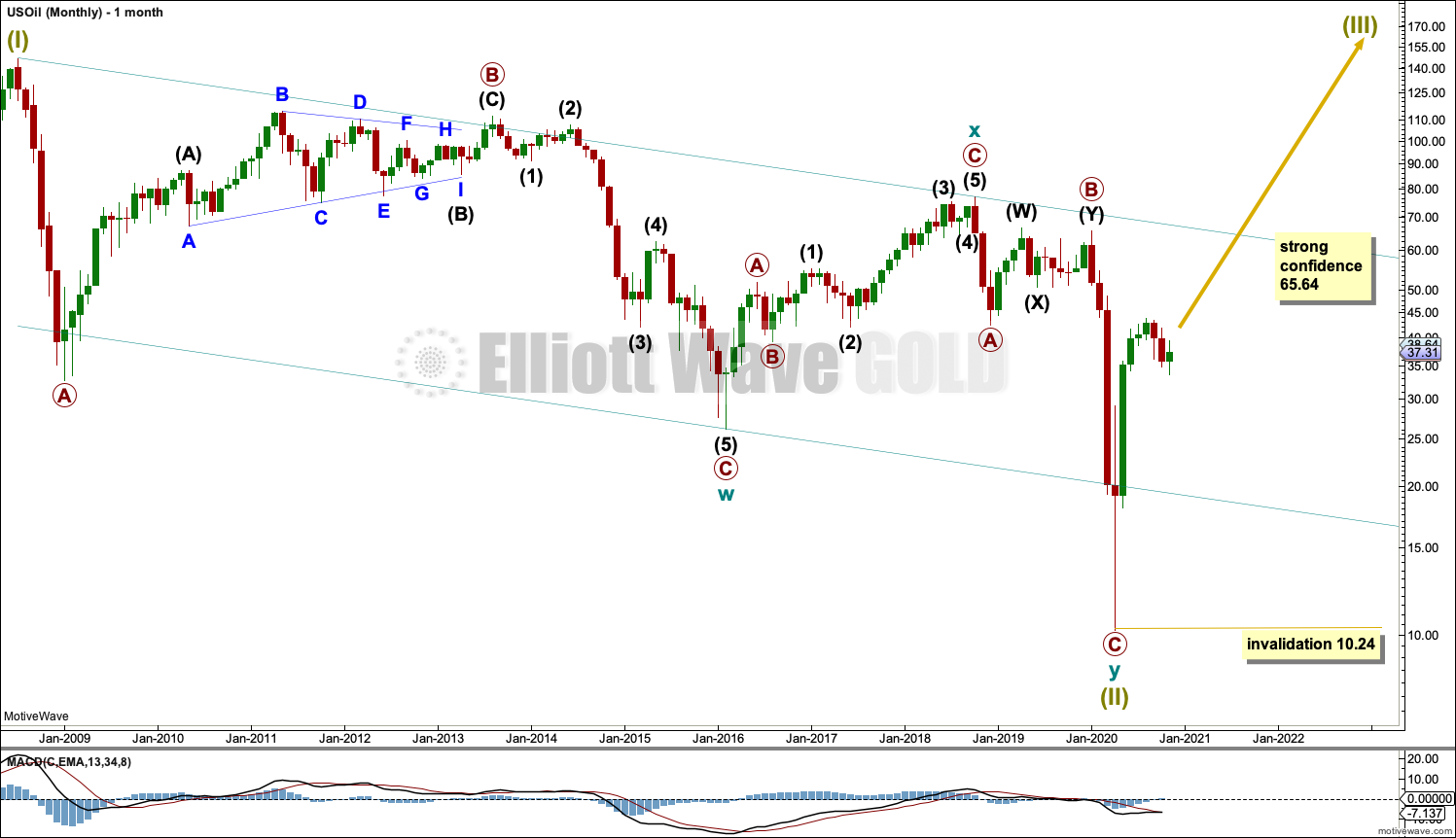

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil may now be over.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w. Price has bounced up off the channel. This trend line is breached, which is a typical look for the end of a movement for a commodity.

The upper edge of the channel may provide resistance.

Following five waves up and three steps back should be another five steps up; this is labelled Super Cycle wave (III), which may only have just begun. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

Super Cycle wave (III) may only subdivide as a five wave impulse. New trends for Oil usually start out very slowly with short first waves and deep time consuming second wave corrections. Basing action over a few years may now have begun.

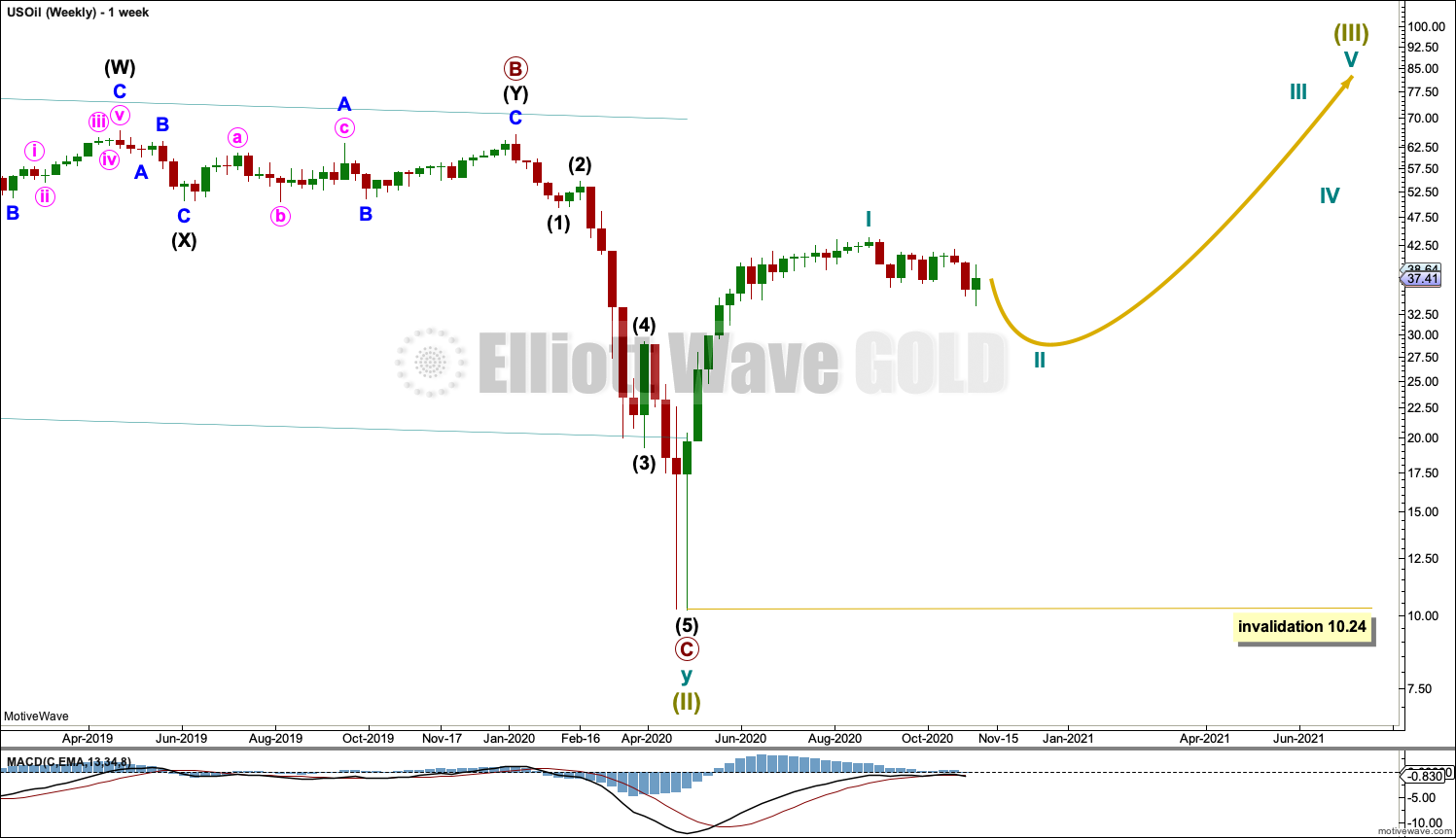

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse. Cycle wave I within the impulse may be complete. Cycle wave II may not move beyond the start of cycle wave I below 10.24.

DAILY CHART

Cycle wave II may subdivide as any corrective Elliott wave structure except a triangle. At this stage, cycle wave II may be an incomplete zigzag that may end close to the 0.618 Fibonaccci ratio.

Primary wave B may be a completed double zigzag.

Primary wave C downwards may have begun. Primary wave C must subdivide as a five wave motive structure. Intermediate wave (2) within primary wave C may not move beyond the start of intermediate wave (1) above 41.89.

Draw a channel about cycle wave II using Elliott’s technique for a correction: draw the first trend line from the start of primary wave A to the end of primary wave B, then place a parallel copy on the end of primary wave A. The upper edge may provide resistance if intermediate wave (2) moves higher. If price breaches the lower edge of this channel, then the first alternate wave count below may be preferred, although C waves may sometimes behave like third waves and breach channels.

Cycle wave II may not move beyond the start of cycle wave I below 10.24.

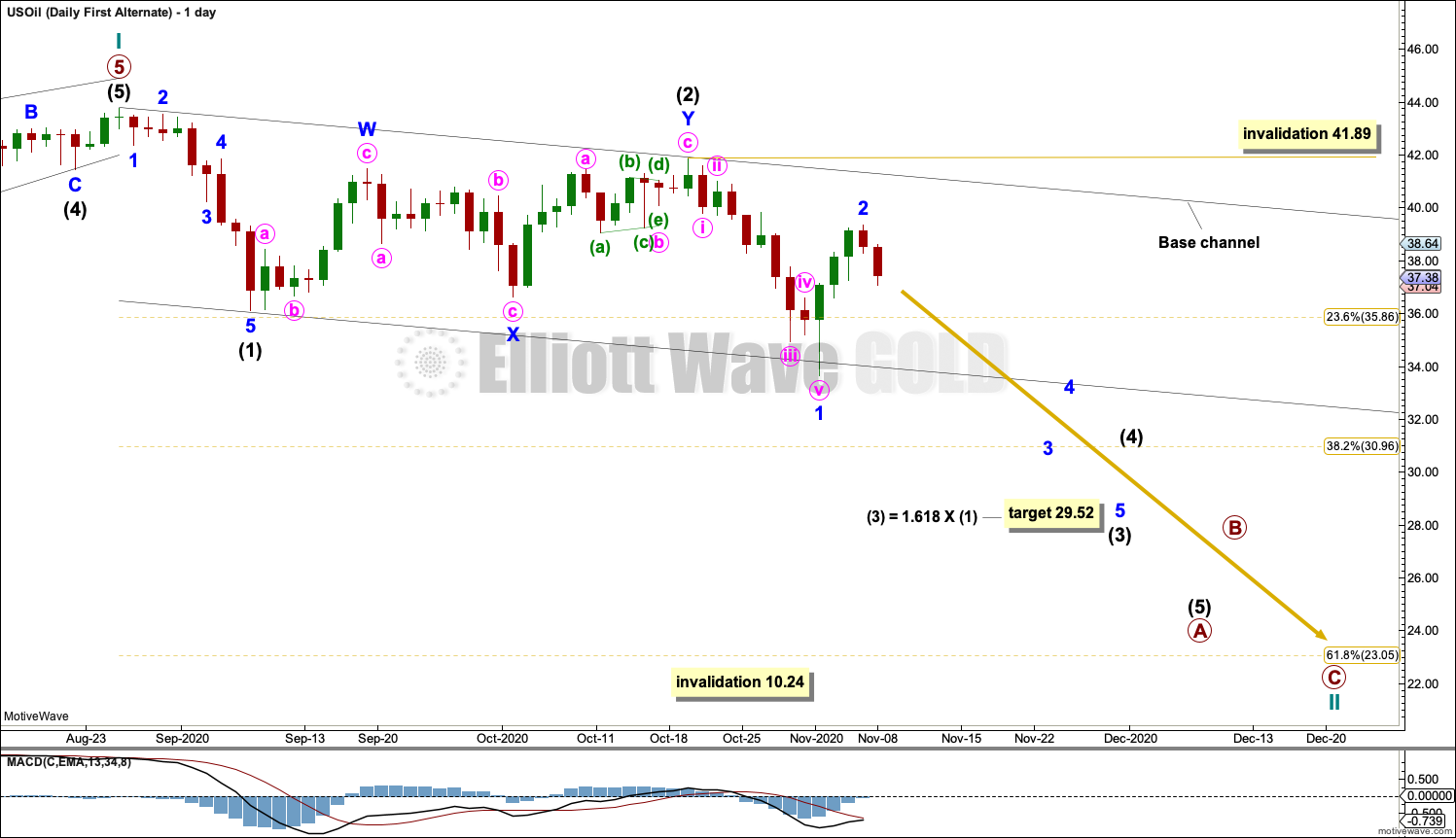

FIRST ALTERNATE DAILY CHART

This first alternate wave count moves the degree of labelling within cycle wave II down one degree.

Cycle wave II may be subdividing as a zigzag. Primary wave A within cycle wave II may be an incomplete impulse.

Intermediate wave (2) may be a complete double zigzag.

Intermediate wave (3) within primary wave A may have begun. Intermediate wave (3) may only subdivide as an impulse. If it continues higher, then minor wave 2 within intermediate wave (3) may not move beyond the start of minor wave 1 above 41.89.

A target is calculated for intermediate wave (3) that expects a common Fibonacci ratio to intermediate wave (1).

Draw a base channel about intermediate waves (1) and (2): draw the first trend line from the start of intermediate wave (1) to the end of intermediate wave (2), then place a parallel copy on the end of intermediate wave (1). The upper edge of the base channel may provide resistance for bounces along the way down. The lower edge of the base channel should be breached by the momentum of intermediate wave (3), and then it may provide resistance.

The 0.618 Fibonacci ratio of cycle wave I at 23.05 is a preferred target, but it is possible that cycle wave II may be deeper than this.

Although this wave count is named an alternate, it has about an even probability with the main wave count above.

SECOND ALTERNATE DAILY CHART

It is also possible that the degree of labelling at the daily chart level may need to be changed back down one degree. It may be that only primary wave 1 is complete within cycle wave I and the current pullback may be primary wave 2.

Primary wave 2 may last several weeks to a few months.

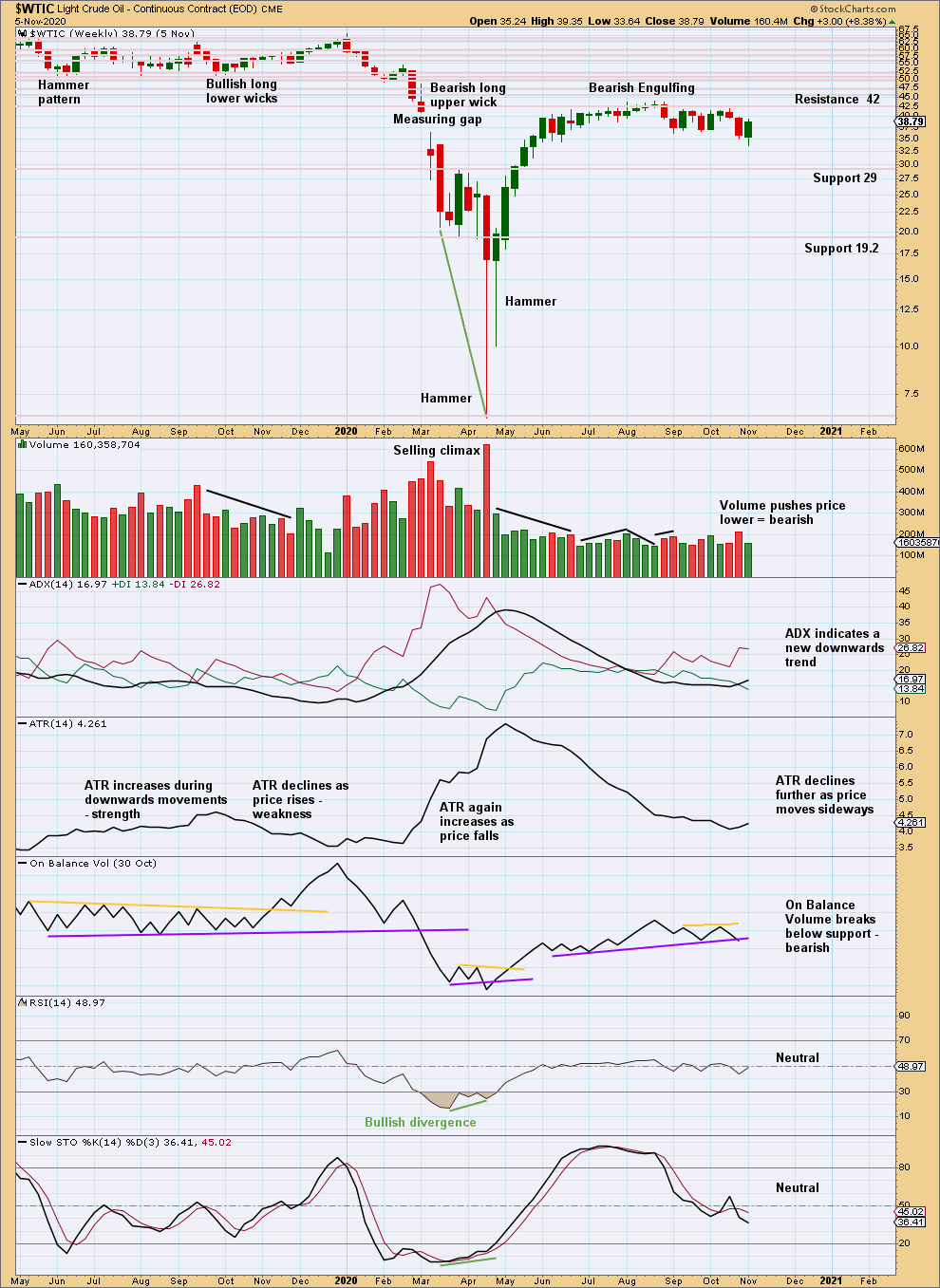

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is back to within the prior consolidation zone. The short-term volume profile is bearish.

On Balance Volume may turn up this week when Friday’s data is finalised. That would negate the bearish signal from last week.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The short-term volume profile is bearish. This bounce looks like a counter trend movement.

—

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.