GOLD: Elliott Wave and Technical Analysis | Charts – March 3, 2020

Upwards movement remains below the invalidation point on the daily chart, but it breached the short-term invalidation point on the hourly chart.

Summary: The bear market may have resumed for Gold to eventually make new lows below 1,046.27. For the short term, a bounce or consolidation may be over here or very soon.

The alternate bullish wave count now expects a cycle degree fourth wave may have just begun.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

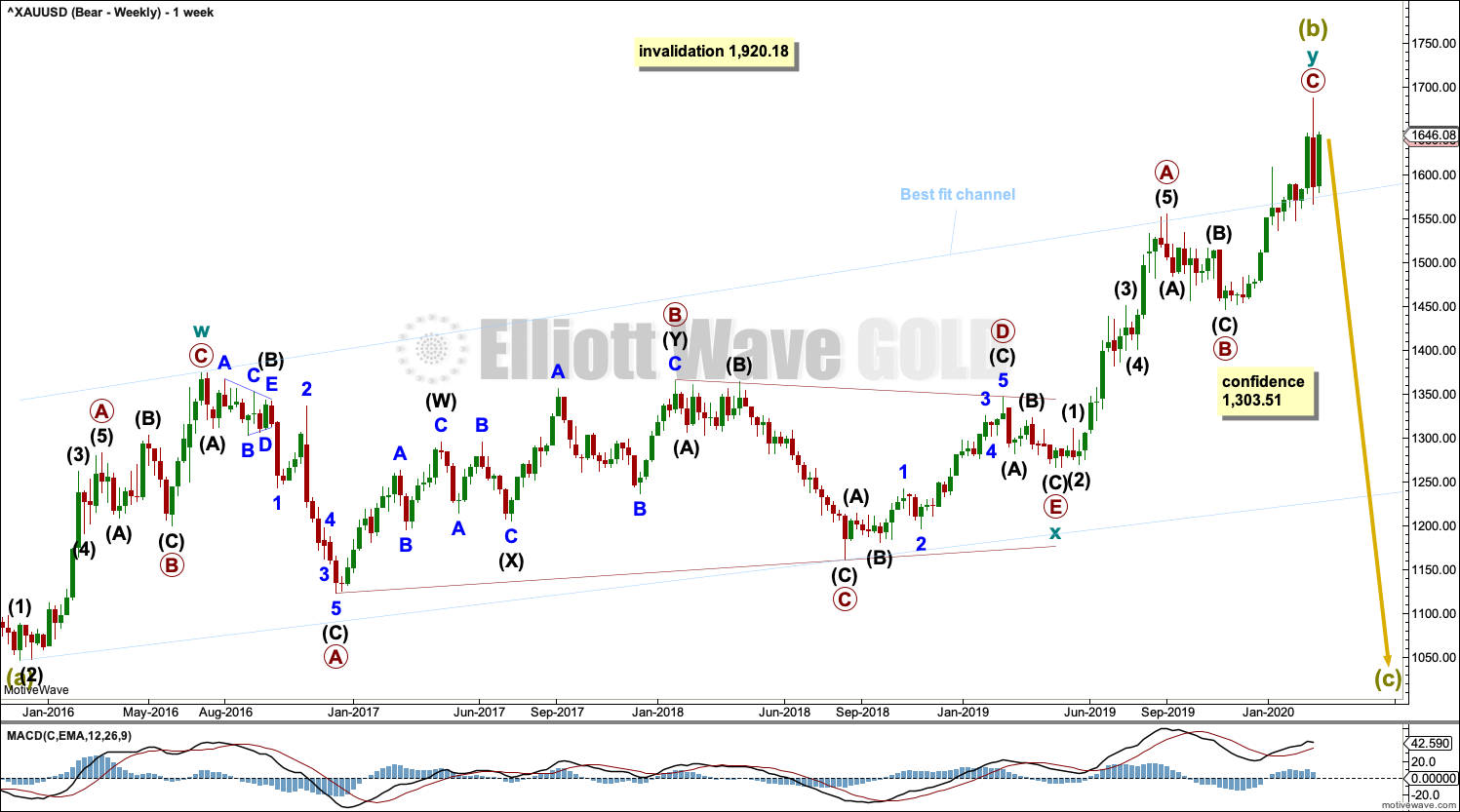

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may be a complete double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A wide best fit channel is added in light blue. Copy this channel over to daily charts. Price is now above the upper edge of this channel, which may now provide some support.

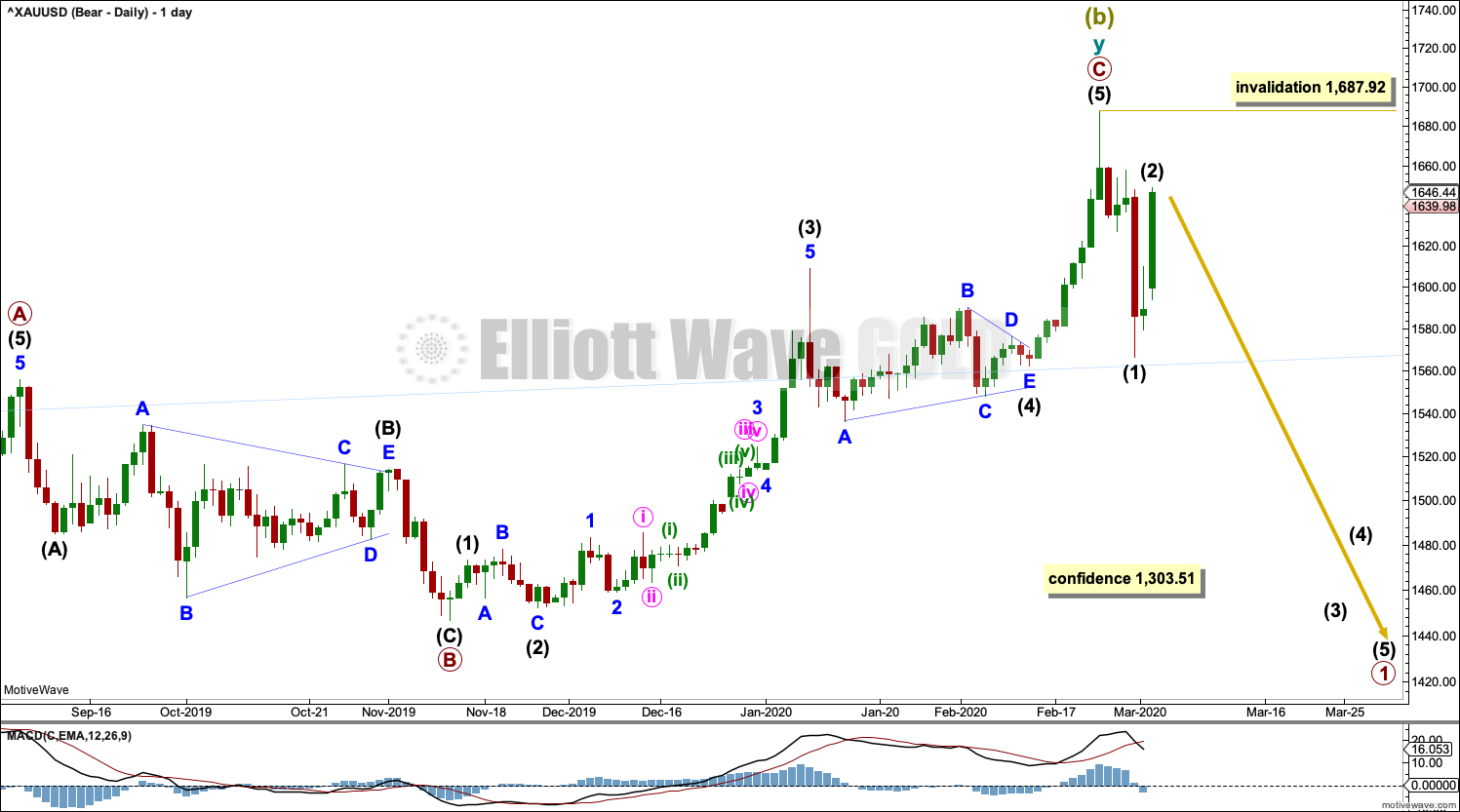

DAILY CHART

Super Cycle wave (b) may be complete.

A new trend at Super Cycle degree should begin with a five down at all time frames. This is labelled intermediate wave (1). Following the completion of intermediate wave (1), intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,687.92.

Intermediate wave (1) may have completed in four days. Intermediate wave (2) may be over here or very soon as a quick sharp bounce.

The first large second wave correction for a new trend in Gold is usually very deep and time consuming. Intermediate wave (2) may be very deep, although so far it is not very time consuming.

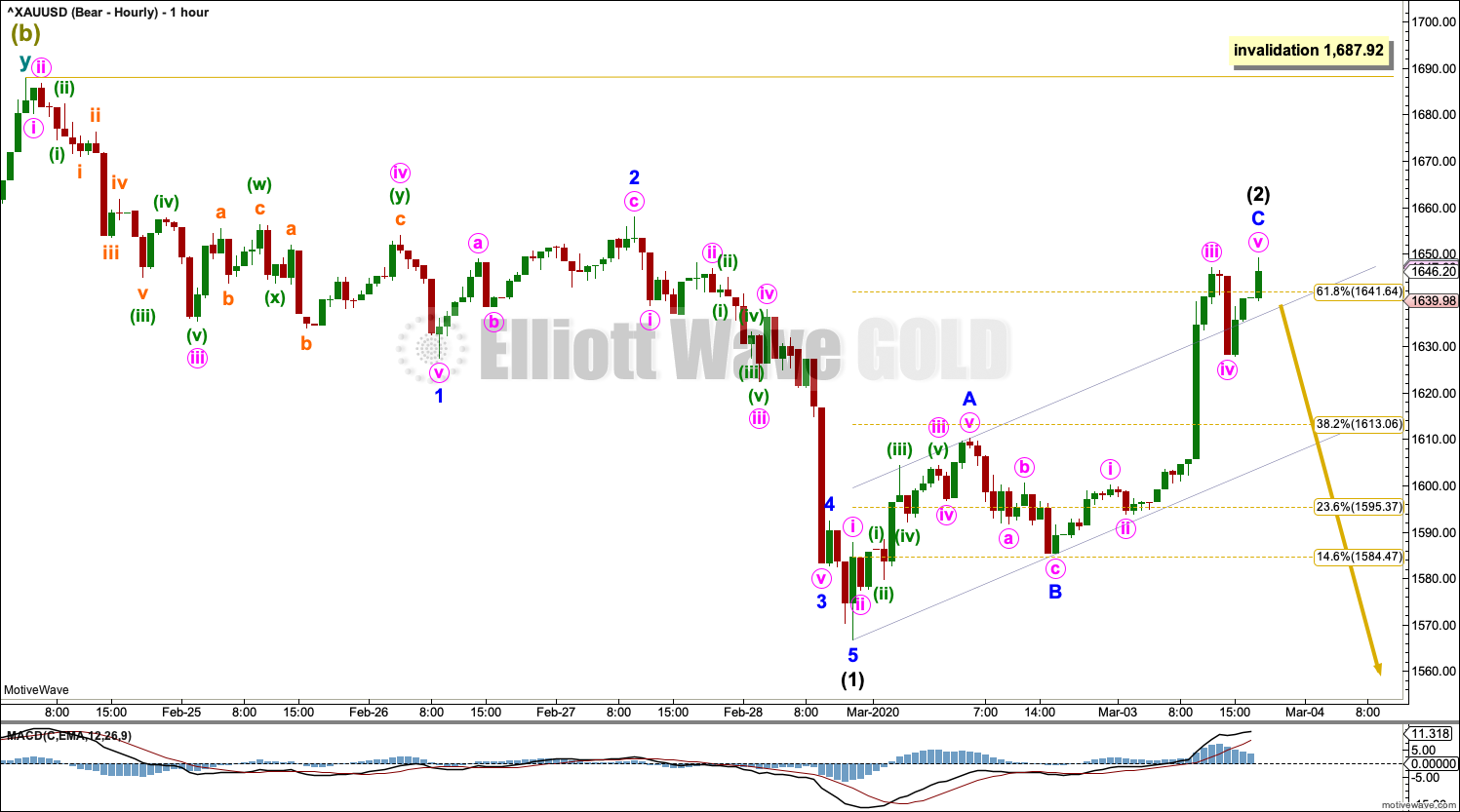

HOURLY CHART

This hourly chart shows detail of intermediate wave (1).

Intermediate wave (1) may have a typical curved look. Intermediate wave (2) may be over here or very soon as a quick sharp bounce.

Intermediate wave (2) may be over here or very soon as a zigzag. A channel is drawn about intermediate wave (2). Minor wave C has breached the upper edge. This is typical of some C waves; they can be strong. If the channel is breached by downwards movement, then that may indicate the bounce of intermediate wave (2) is over and intermediate wave (3) downwards may have begun. At that stage, a target may be calculated for intermediate wave (3).

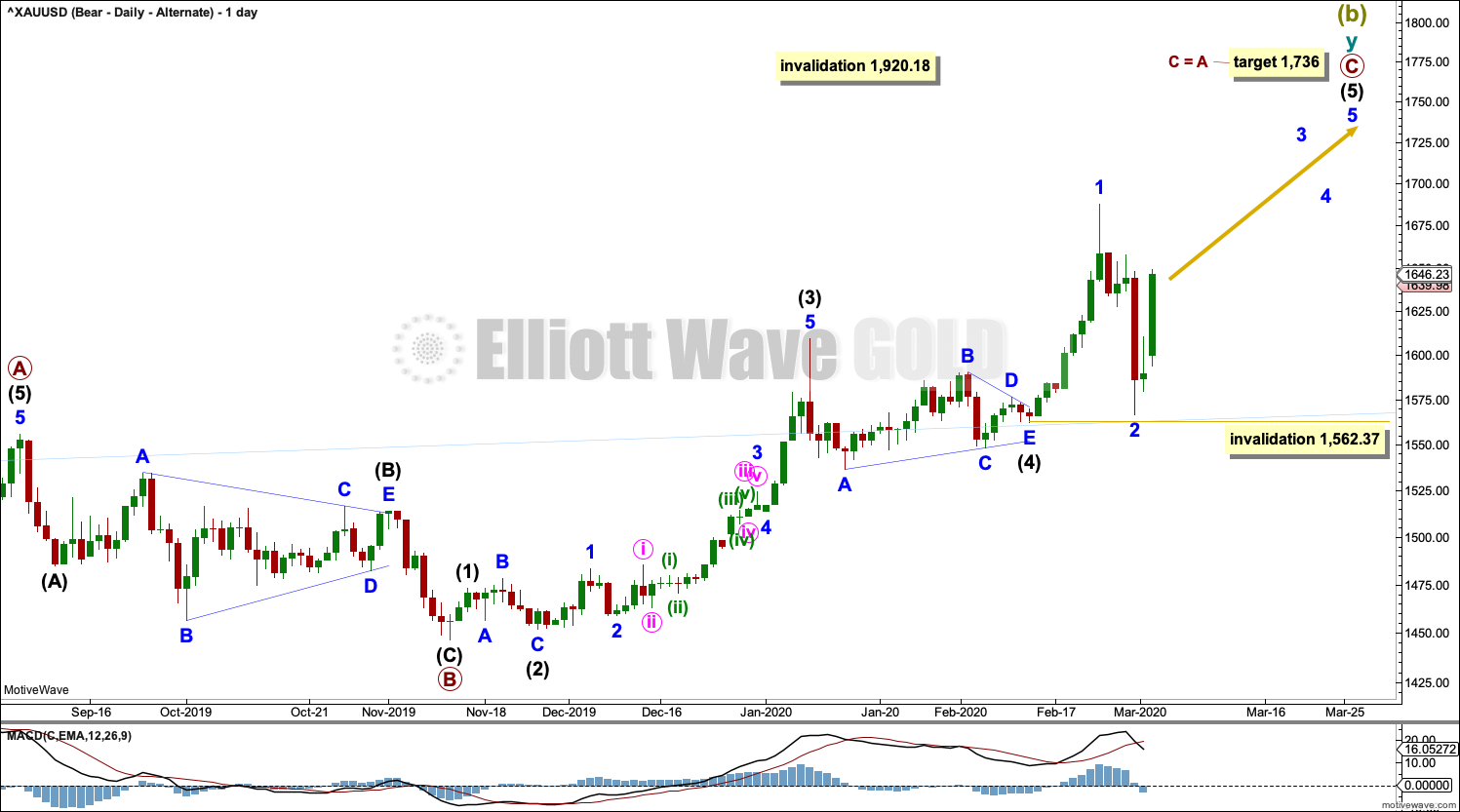

ALTERNATE DAILY CHART

Alternatively, it remains possible that Super Cycle wave (b) may not be over. If the degree of labelling within intermediate wave (5) of primary wave C is moved down one degree, then at the last high only minor wave 1 of intermediate wave (5) may have been complete.

Minor wave 2 may be a complete zigzag. At the daily chart level, this does look best as a three wave structure.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,562.37.

A target is calculated for primary wave C to end. If price makes a new high above 1,687.92 by any amount at any time frame, then this alternate would become the main wave count.

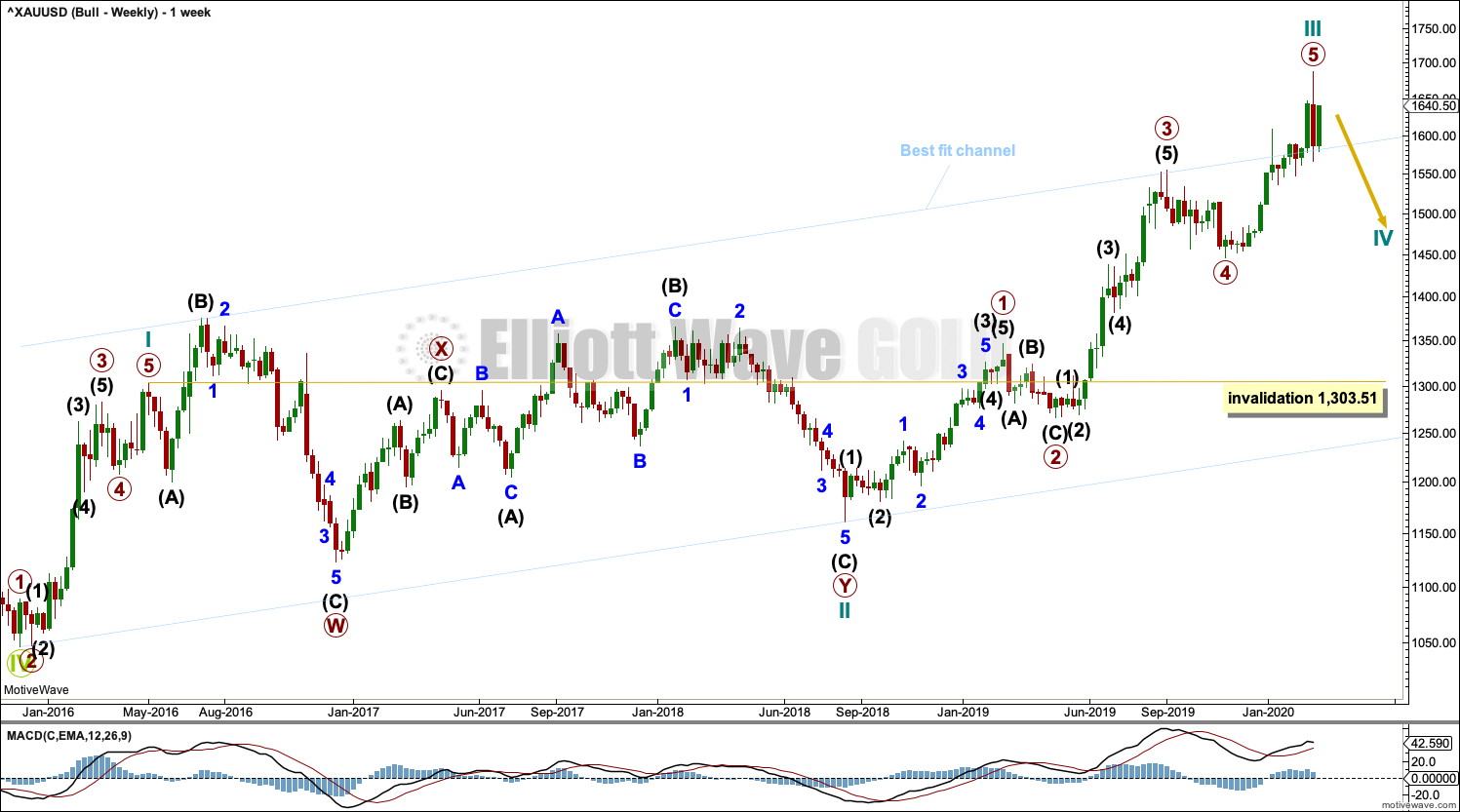

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4. This resolves a previous major problem with the bullish wave count.

Cycle wave II now fits as a double flat. However, a problem arises with the relabelling of this structure. Within the first flat correction labelled primary wave W, this wave count now needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the bear wave count above). This movement must now be labelled as a series of overlapping first and second waves.

Within the first flat correction labelled primary wave W of the double flat of cycle wave II, intermediate wave (B) is 1.69 the length of intermediate wave (A). This is longer than the common range of up to 1.38, but within an allowable guideline of up to 2. The length of intermediate wave (B) reduces the probability of this wave count.

Cycle wave III may now be complete. Cycle wave IV may have just begun, and it may not move into cycle wave I price territory below 1,303.51.

DAILY CHART

Cycle wave IV may end within the price territory of the fourth wave of one lesser degree. Primary wave 4 has its territory from 1,556.11 to 1,446.68. Within this territory is the 0.382 Fibonacci ratio of cycle wave III at 1,486.64.

Cycle wave IV would most likely subdivide as a zigzag. This is the most common Elliott wave corrective structure, and it would provide alternation with the double combination of cycle wave II.

Hourly charts are again essentially the same, so only one will be published today.

TECHNICAL ANALYSIS

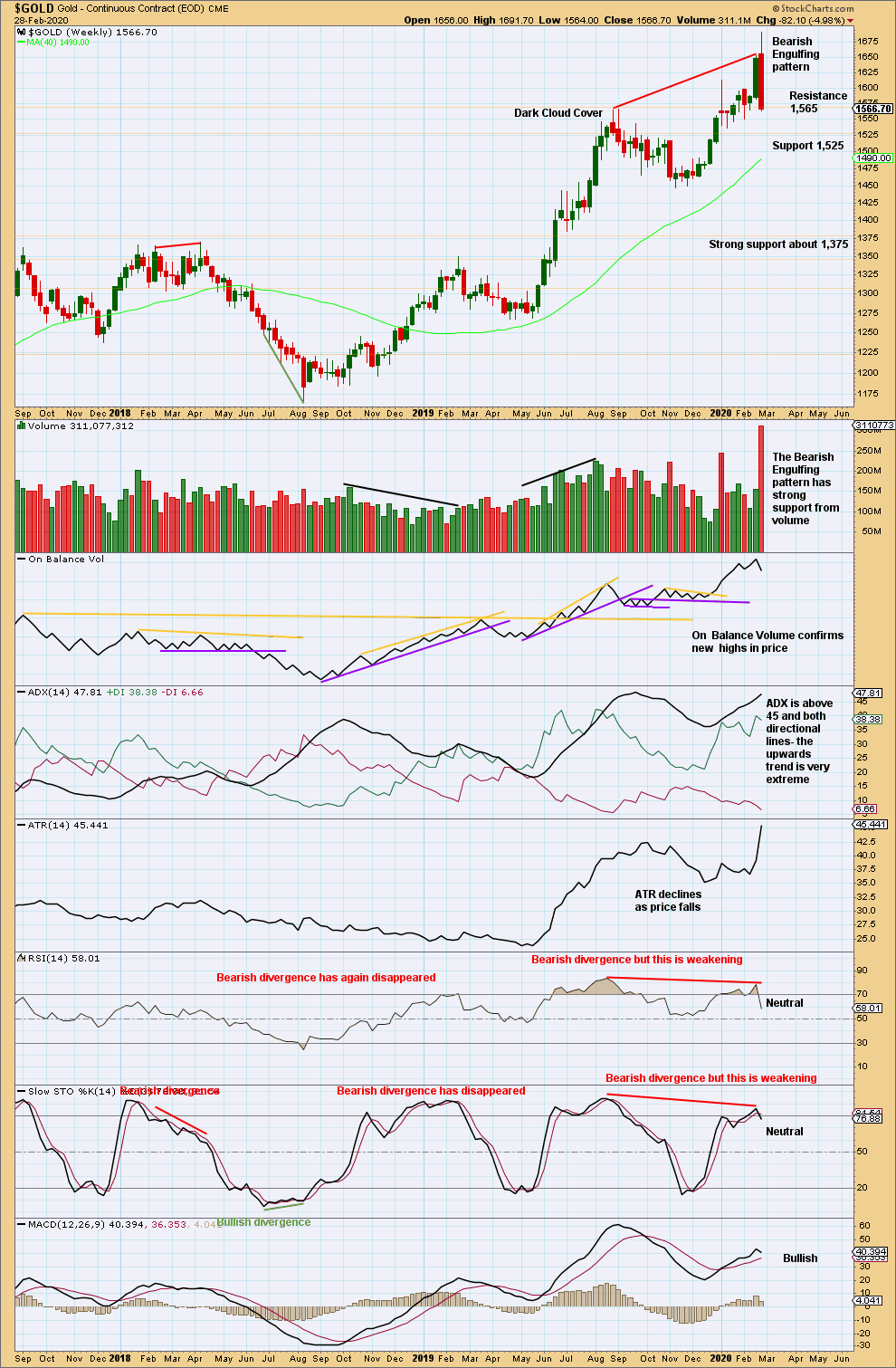

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

After an upwards trend reached very extreme and RSI reached overbought then exhibited bearish divergence, a very strong bearish candlestick reversal pattern should be given weight. A trend change here now looks extremely likely.

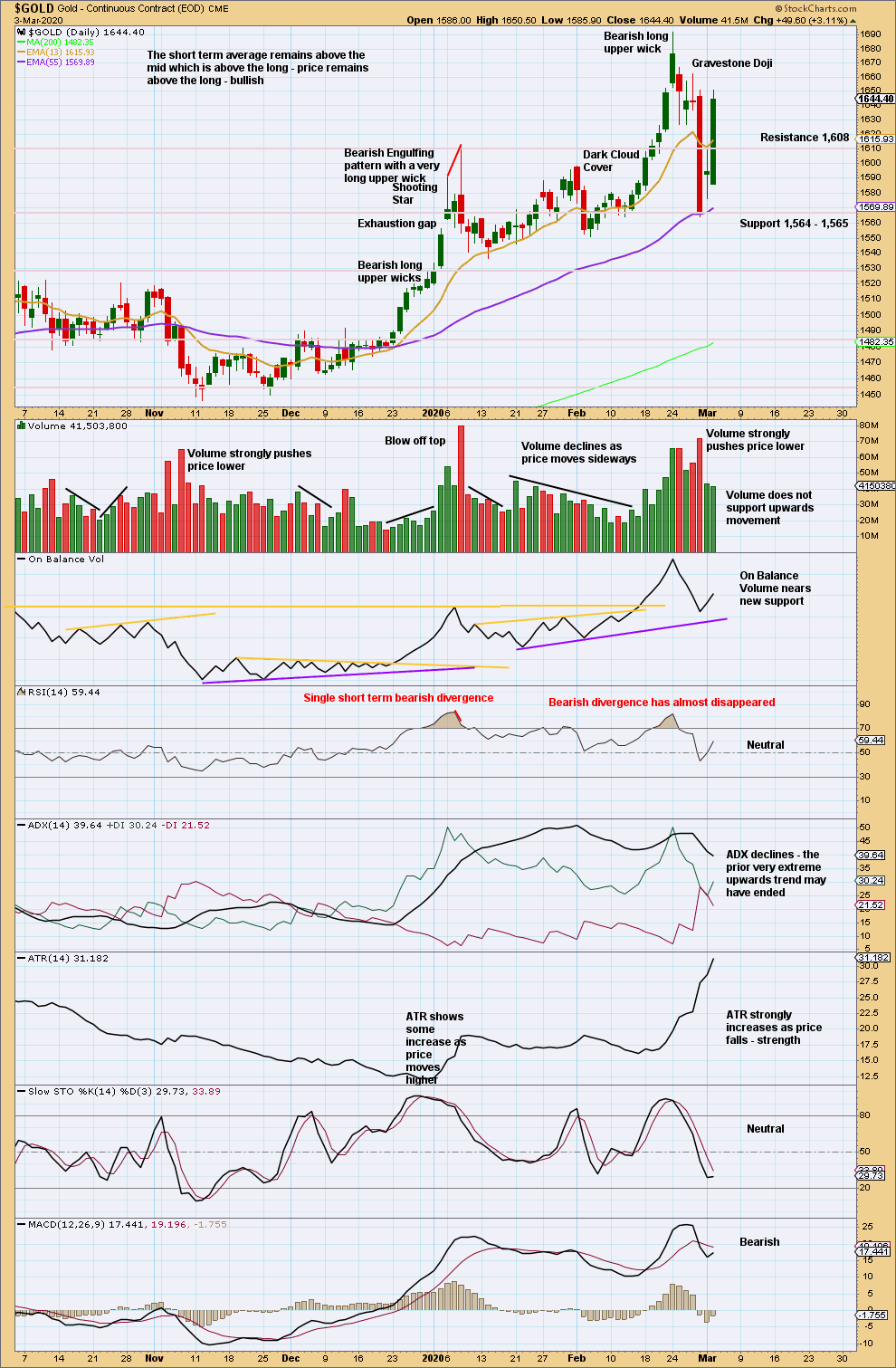

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An extremely strong bearish candlestick for Friday gives confidence that a sustainable high now looks likely to be in place.

Do not expect price to continue to move in a straight line. There will be bounces and consolidations along the way. If price reaches an area of support when Stochastics reaches oversold, then expect a bounce.

Bounces in a downwards trend are opportunities to join the trend.

So far a lack of support from volume for upwards movement suggests this bounce may be a counter trend movement.

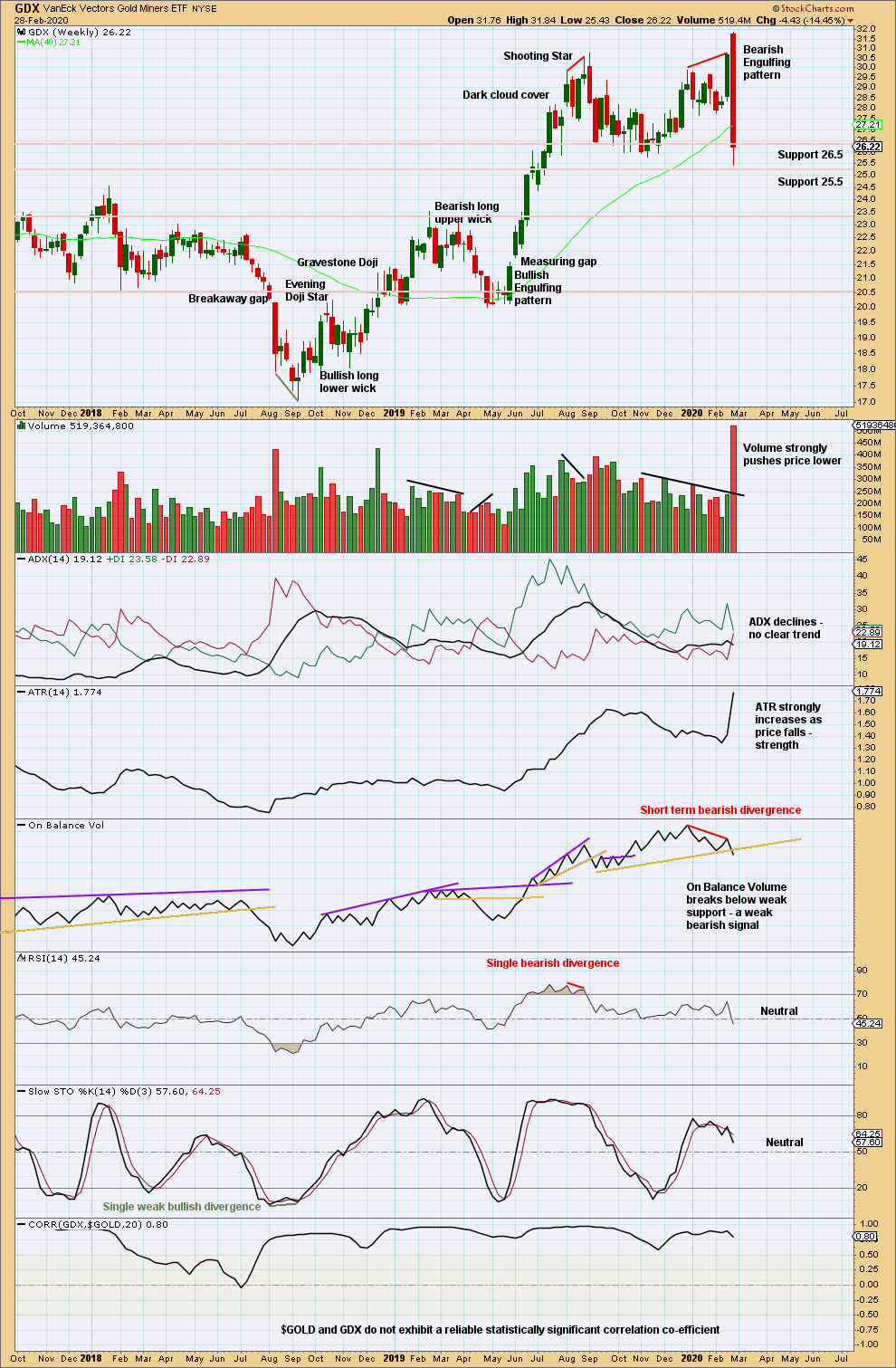

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has had a trend change. Look for bounces and consolidations to possibly arrive about identified support areas.

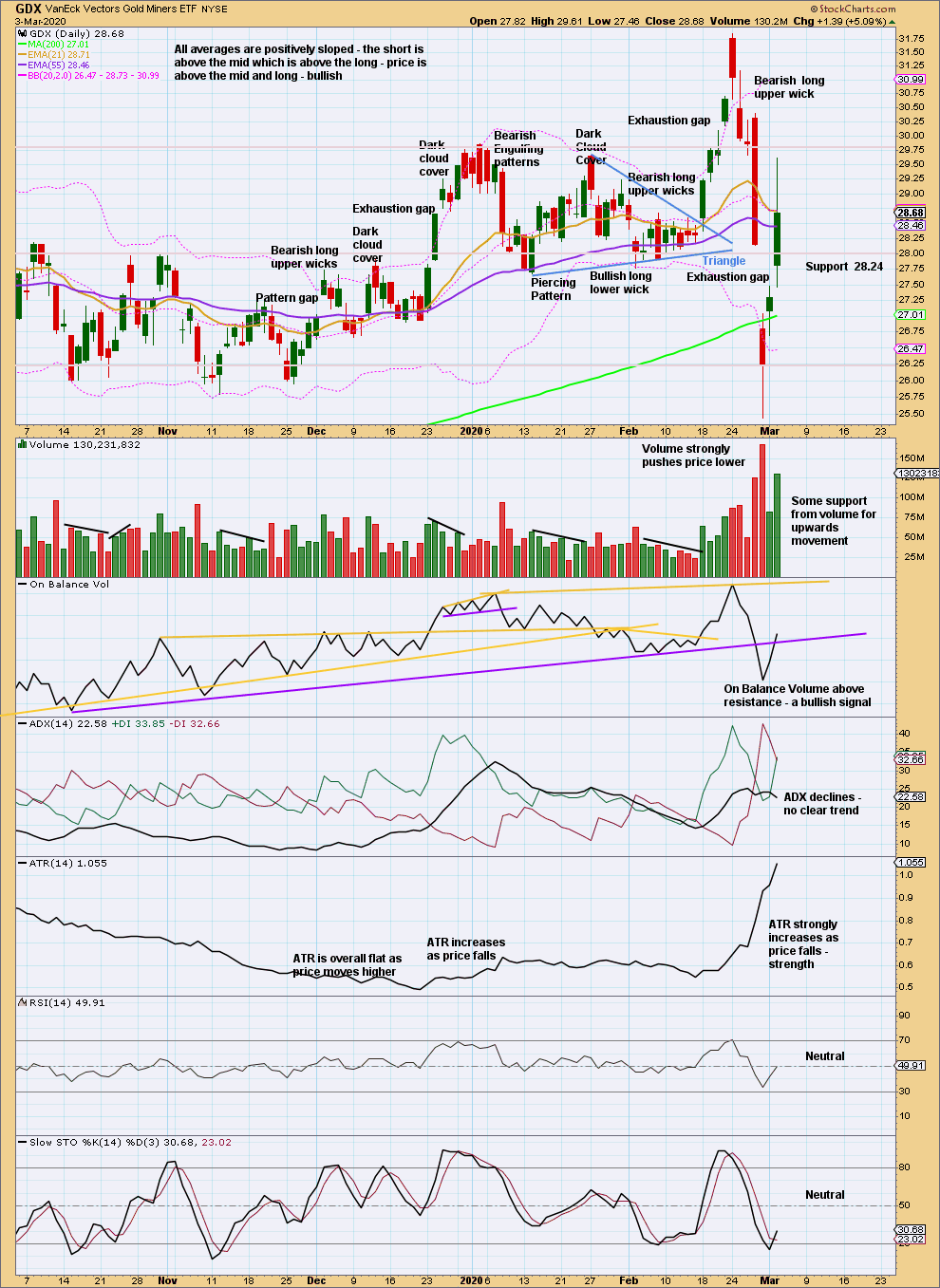

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last gap is closed. It is renamed an exhaustion gap.

A longer upper wick today is bearish, but volume is bullish. This session is inconclusive.

Published @ 07:18 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated

Looks like we are headed up to D. Maybe E tonight or tomorrow. Not getting in until the break out.

looks like a triangle to me. Alternate?

It is looking that way … getting very tight now, we’ll know soon.

I’m only hesitating with that, as it came in to the triangle a bit unusually, so it could reverse.

A small triangle on the hourly chart for a fourth wave would be invalid. Within the triangle wave A would end at 1,647.54 and wave C would end at 1,647.59.

C may not move beyond the end of A, so that would be invalidated.

A-1627.68

B-1647

C-1636

D-?

E?

Larger triangle?

Sorry Andrew, you’ll have to upload a chart of your idea. I find it really hard to follow descriptions with numbers to see a wave count.