GOLD: Elliott Wave and Technical Analysis | Charts – April 14, 2020

Upwards movement towards targets continues. Both Elliott wave counts at this stage expect more upwards movement.

Summary: A target for upwards movement to end is now at 1,775 or 1,780. If these targets are wrong, they may now be too high. An Advance Block pattern today warns a high may be in place sooner than expected.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

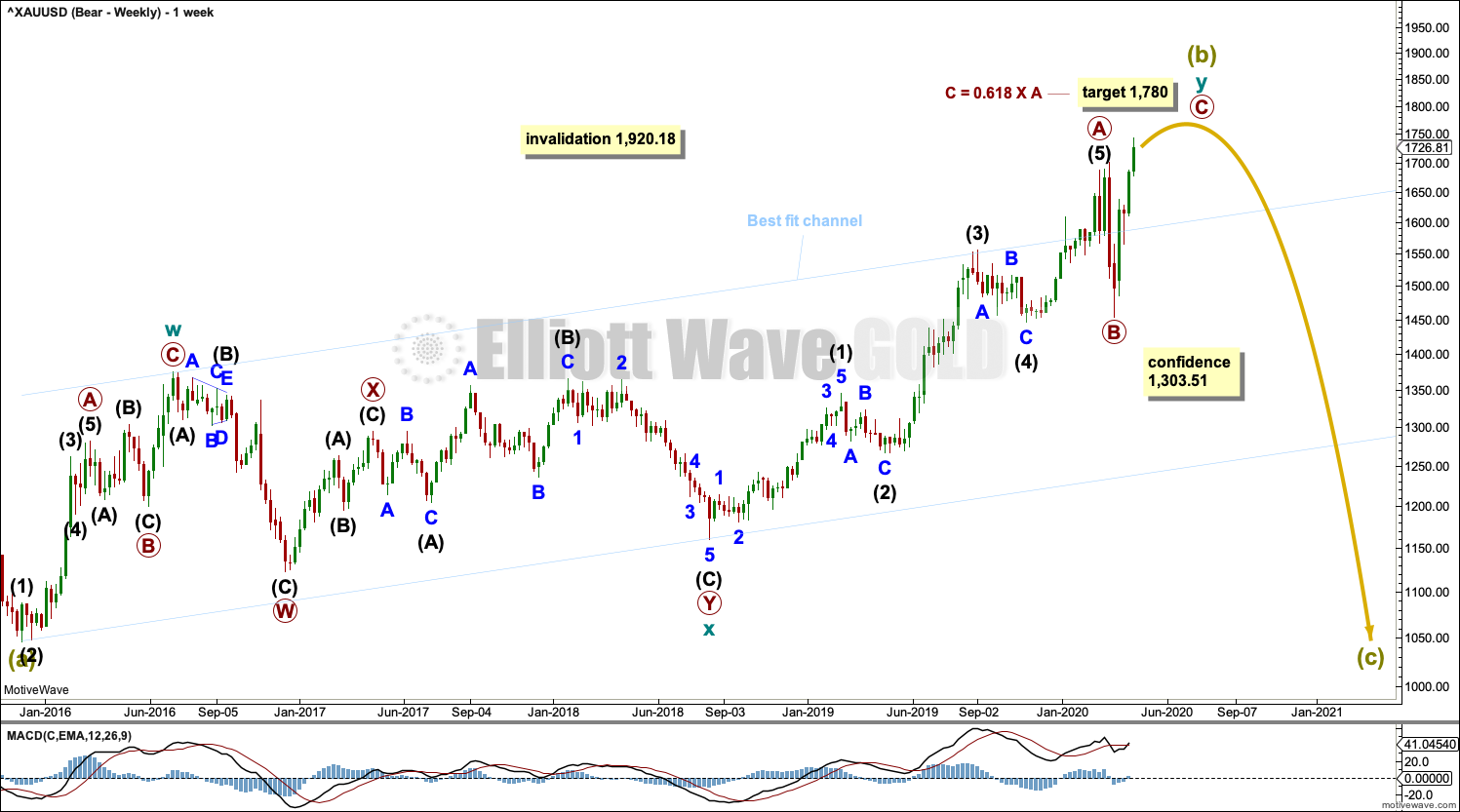

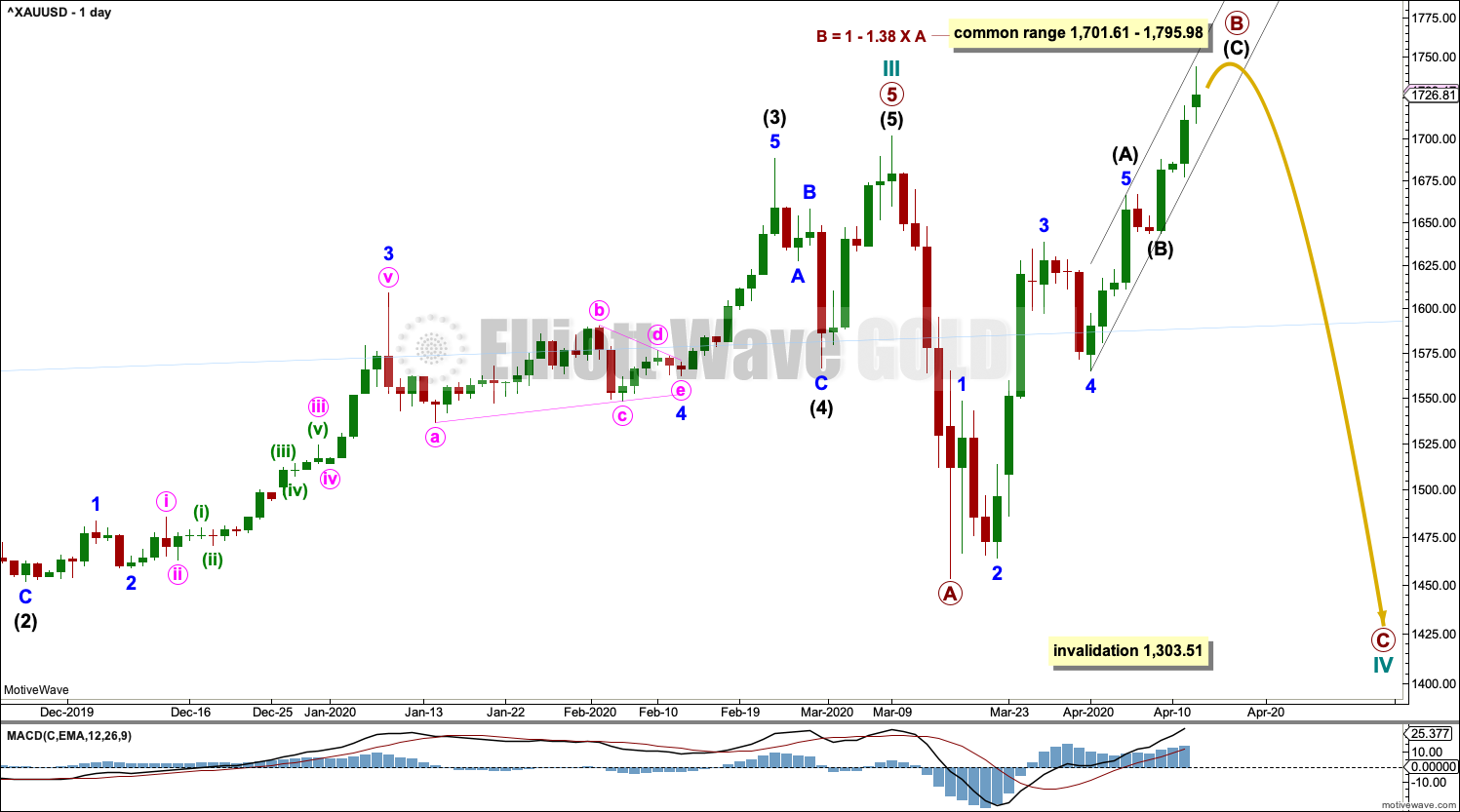

MAIN BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may be an incomplete double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a combination labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

With cycle wave x ending earlier and cycle wave y beginning earlier, primary wave A within cycle wave y now looks like a five wave impulse. Primary wave B may be a complete expanded flat correction. Primary wave C may be an incomplete impulse.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A wide best fit channel is added in light blue. Copy this channel over to daily charts.

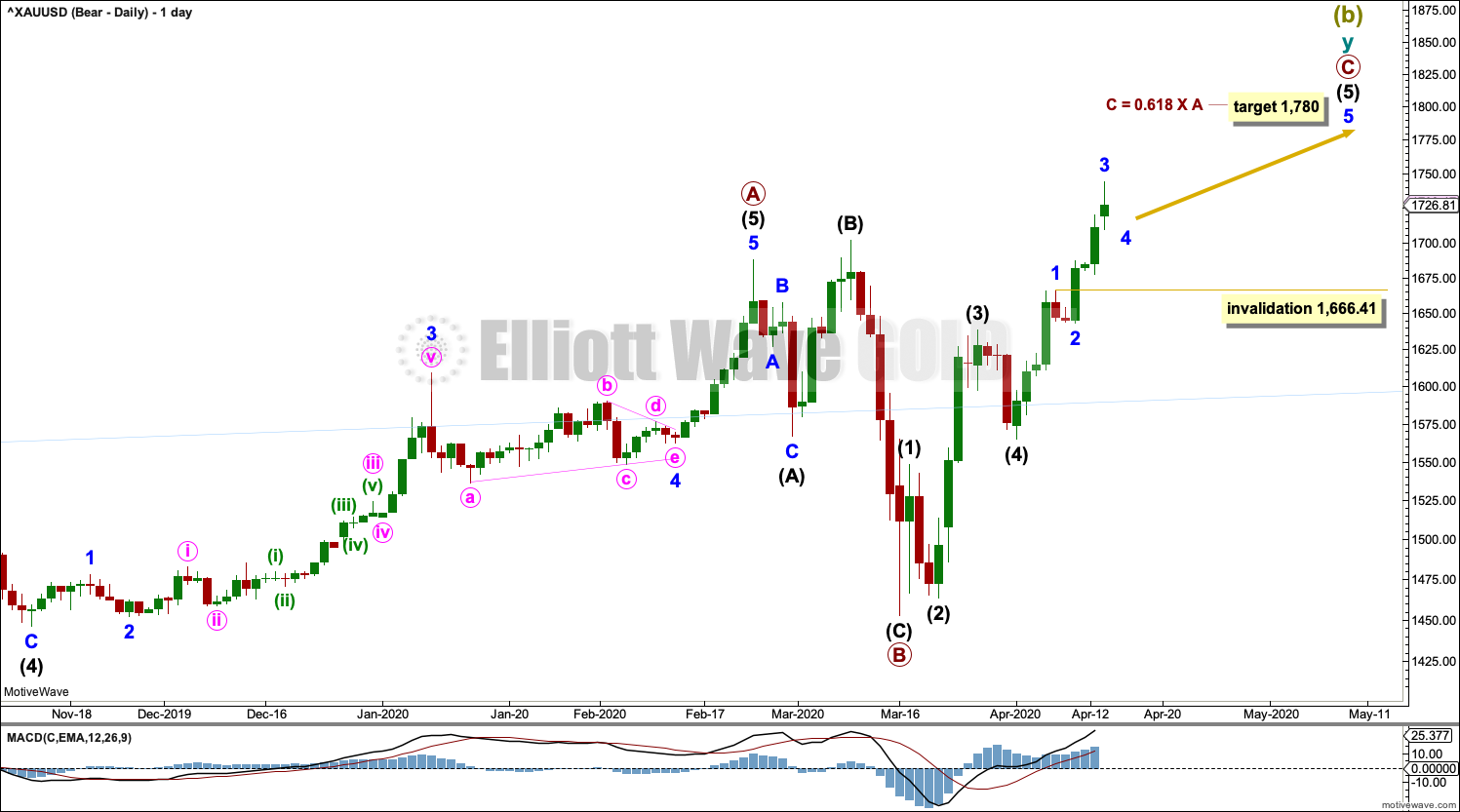

DAILY CHART

The daily chart focusses on the structure of cycle wave y. Today primary wave C is relabelled to have a better fit in terms of proportions of intermediate waves (1) to (3) within primary wave C.

Primary wave C may be an incomplete impulse. Within the impulse: intermediate waves (1) through to (4) may be complete and intermediate wave (5) may be extending.

Within intermediate wave (5): minor waves 1 through to 3 may be complete and minor wave 4 may not move into minor wave 1 price territory below 1,666.41.

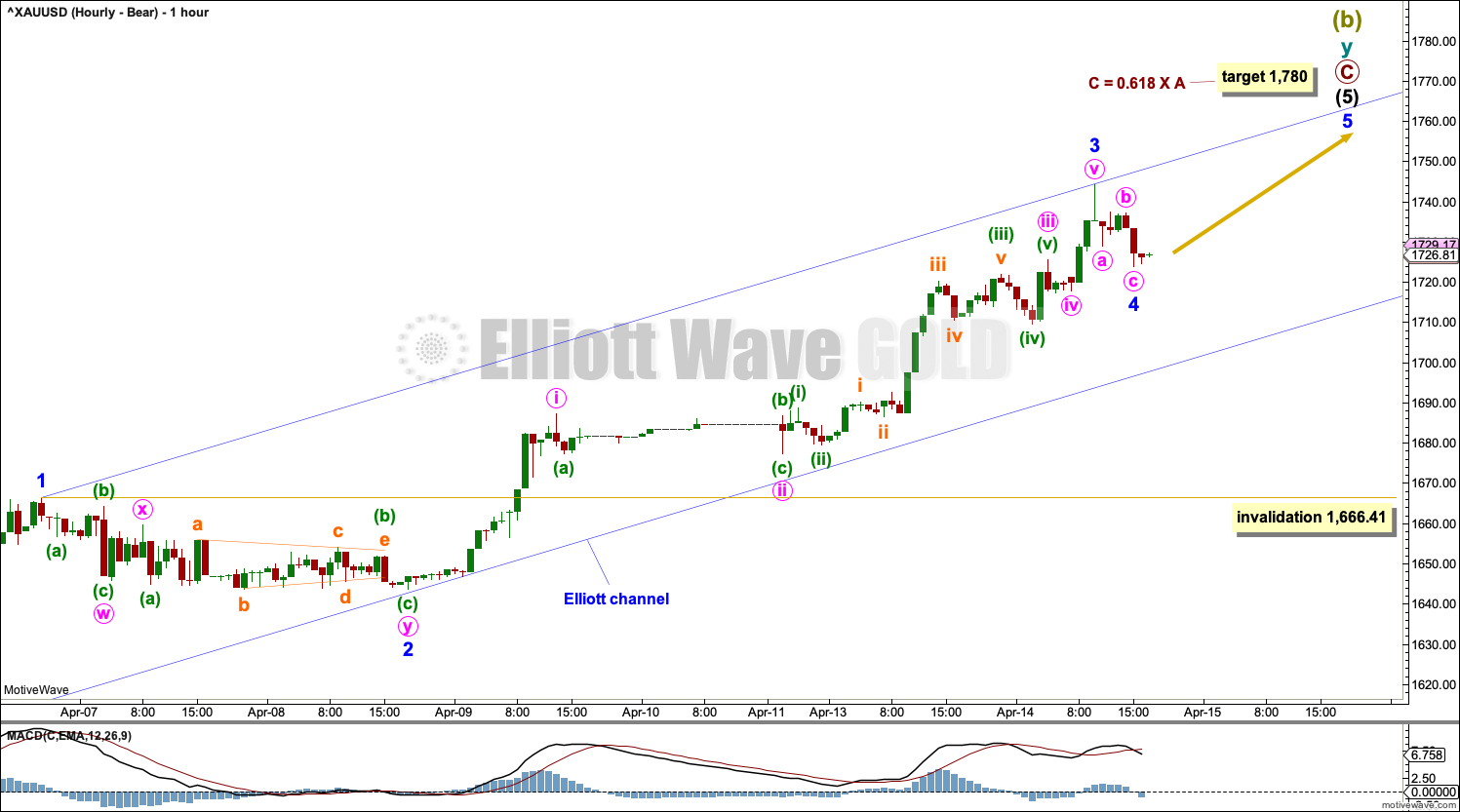

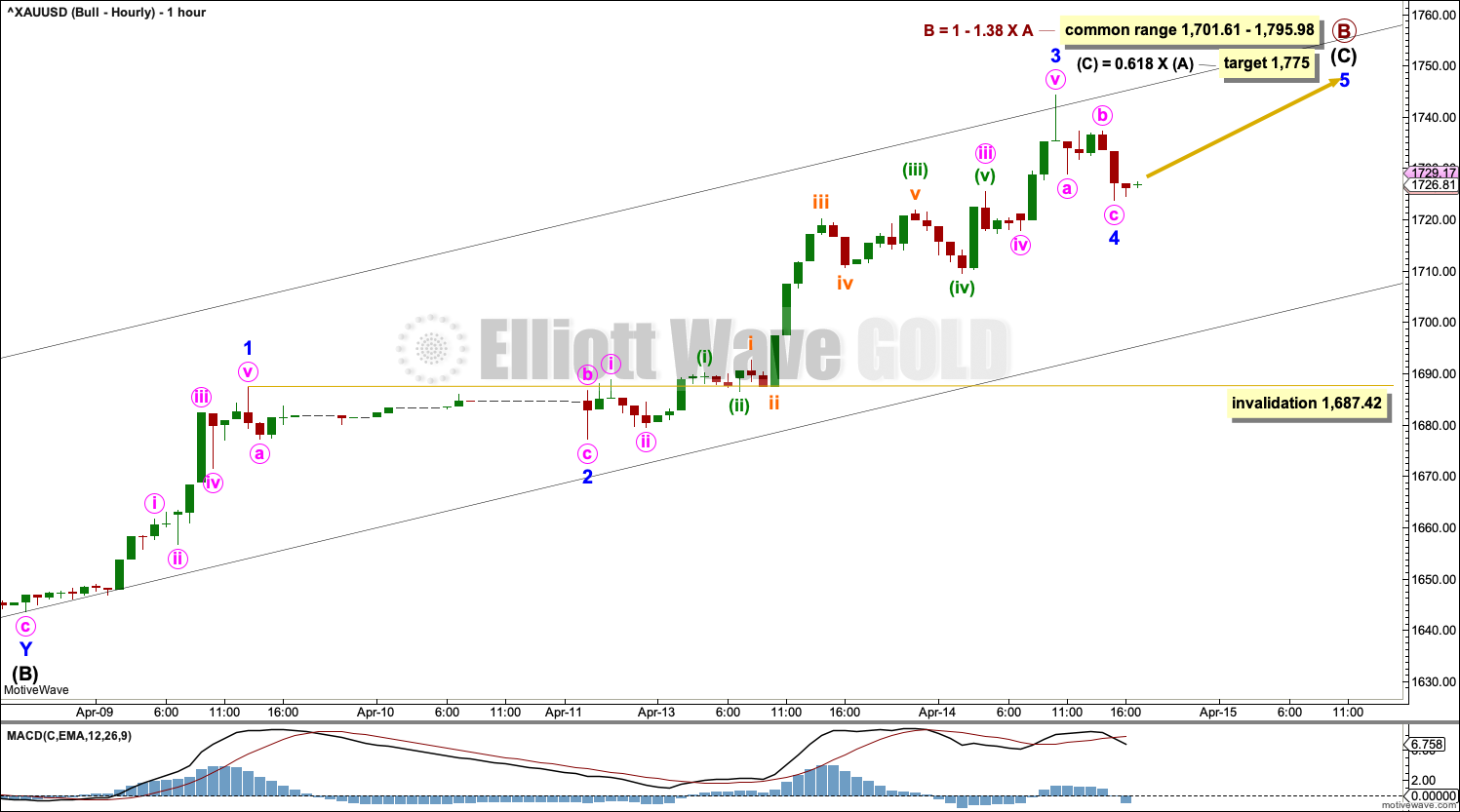

HOURLY CHART

The hourly chart focusses on intermediate wave (5).

Intermediate wave (5) may be an incomplete impulse.

Within intermediate wave (5): minor waves 1 through to 3 may be complete and minor wave 4 may be complete as labelled, or it may continue sideways or lower. Minor wave 4 may not move into minor wave 1 price territory below 1,666.41.

Use Elliott’s first technique to draw a channel about intermediate wave (5). Draw the first trend line from the ends of minor waves 1 to 3, then place a parallel copy on the end of minor wave 2. If minor wave 4 continues further, then it may find support about the lower edge. Minor wave 5 may find resistance about the upper edge.

When the Elliott channel is breached by downwards movement, that may be taken as earliest indication that intermediate wave (5) may be over.

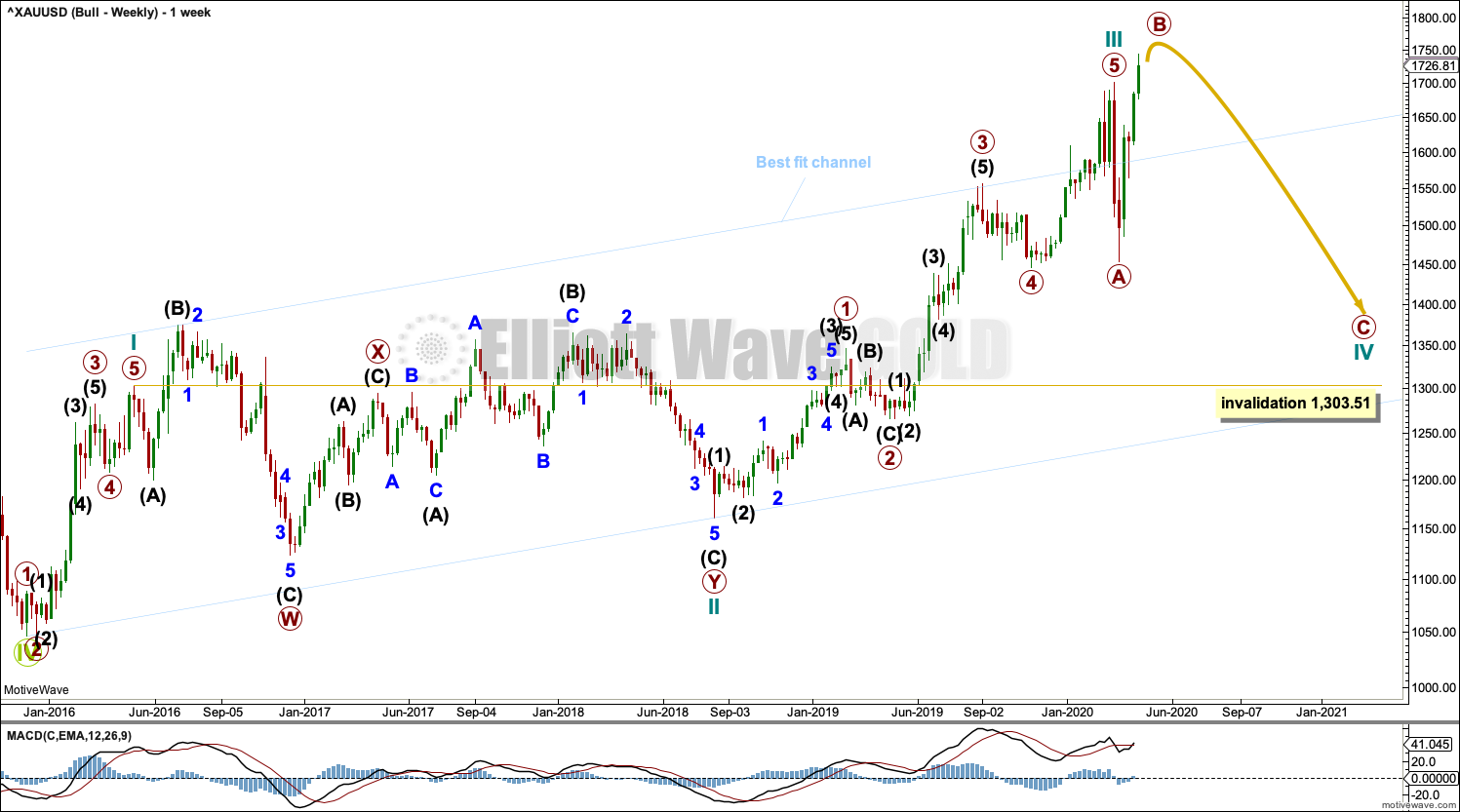

ALTERNATE BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4. This resolves a previous major problem with the bullish wave count.

Cycle wave II now fits as a double flat. However, a problem arises with the relabelling of this structure. Within the first flat correction labelled primary wave W, this wave count now needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the bear wave count above). This movement must now be labelled as a series of overlapping first and second waves.

Within the first flat correction labelled primary wave W of the double flat of cycle wave II, intermediate wave (B) is 1.69 the length of intermediate wave (A). This is longer than the common range of up to 1.38, but within an allowable guideline of up to 2. The length of intermediate wave (B) reduces the probability of this wave count.

Cycle wave III may be complete. Cycle wave IV may not move into cycle wave I price territory below 1,303.51.

DAILY CHART

Cycle wave III may be complete. Cycle wave IV may not move into cycle wave I price territory below 1,303.51.

Cycle wave II was relatively deep at 0.55 of cycle wave I. If cycle wave IV exhibits alternation in depth, it may more likely be shallow; the first target at 0.382 of cycle wave III would be preferred.

Cycle wave IV may subdivide as a flat correction, triangle or combination. Both a flat and triangle would still provide structural alternation with the combination of cycle wave II.

If cycle wave IV subdivides as a flat correction, then within it the common range for primary wave B within a flat would be from 1 to 1.38 times the length of primary wave A.

If cycle wave IV subdivides as a triangle, then within it primary wave B may make a new high above the start of primary wave A as in a running triangle.

Primary wave B may be an incomplete zigzag. Within the zigzag: a narrow channel is drawn about the end of primary wave B.

There is no upper invalidation point for this wave count.

HOURLY CHART

The hourly chart focusses on all of intermediate wave (C). Intermediate wave (C) may be subdividing as an impulse.

Within the impulse of intermediate wave (C): minor waves 1 through to 3 may be complete. If minor wave 4 continues further, then it may not move into minor wave 1 price territory below 1,687.42.

A new target is calculated for primary wave B to end based upon intermediate degree. This target sits within the common range for B waves within flat corrections.

TECHNICAL ANALYSIS

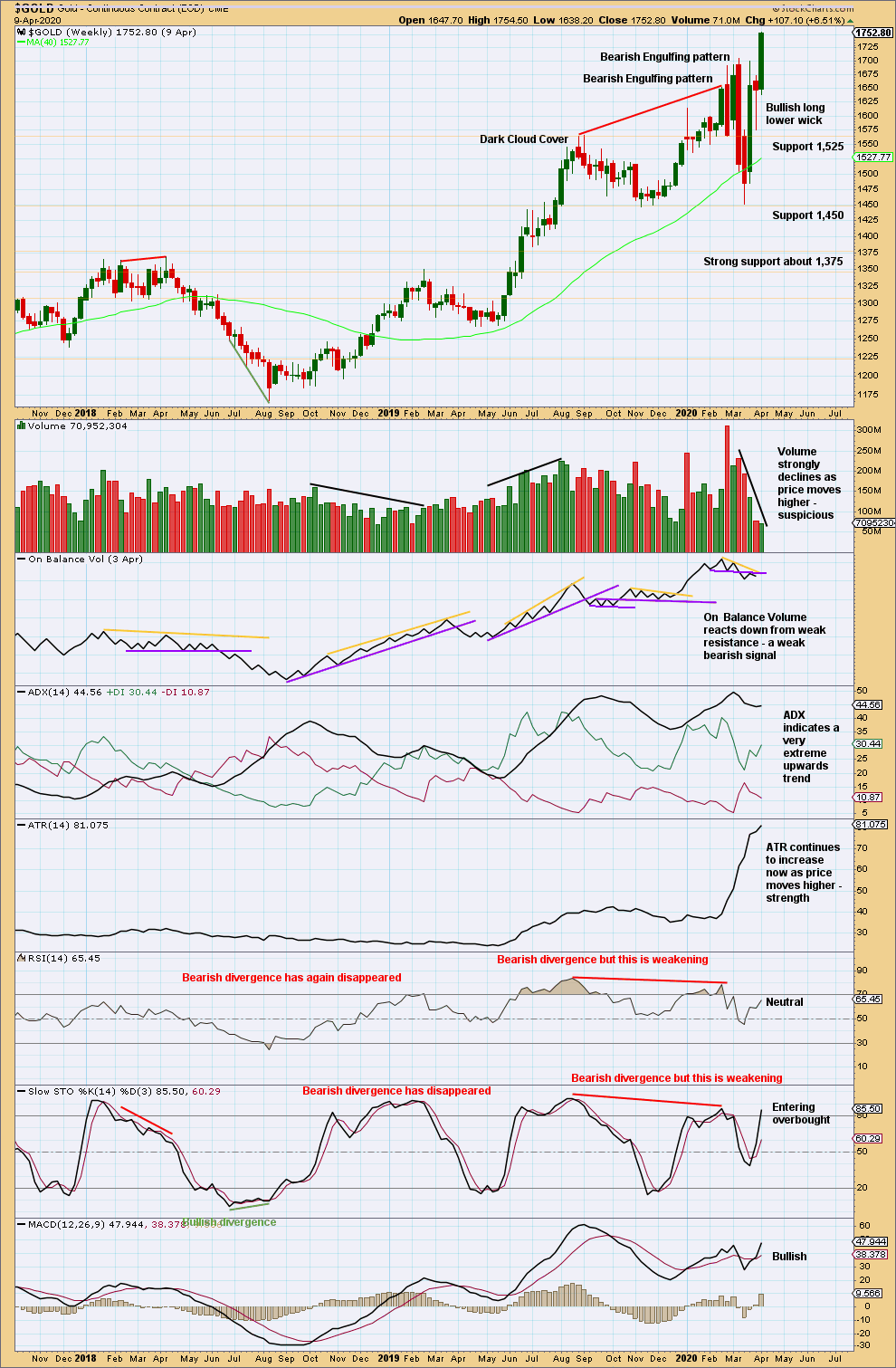

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

New highs last week come while the upwards trend is again very extreme. Volume this week is very weak. This upwards breakout should be treated with reasonable suspicion.

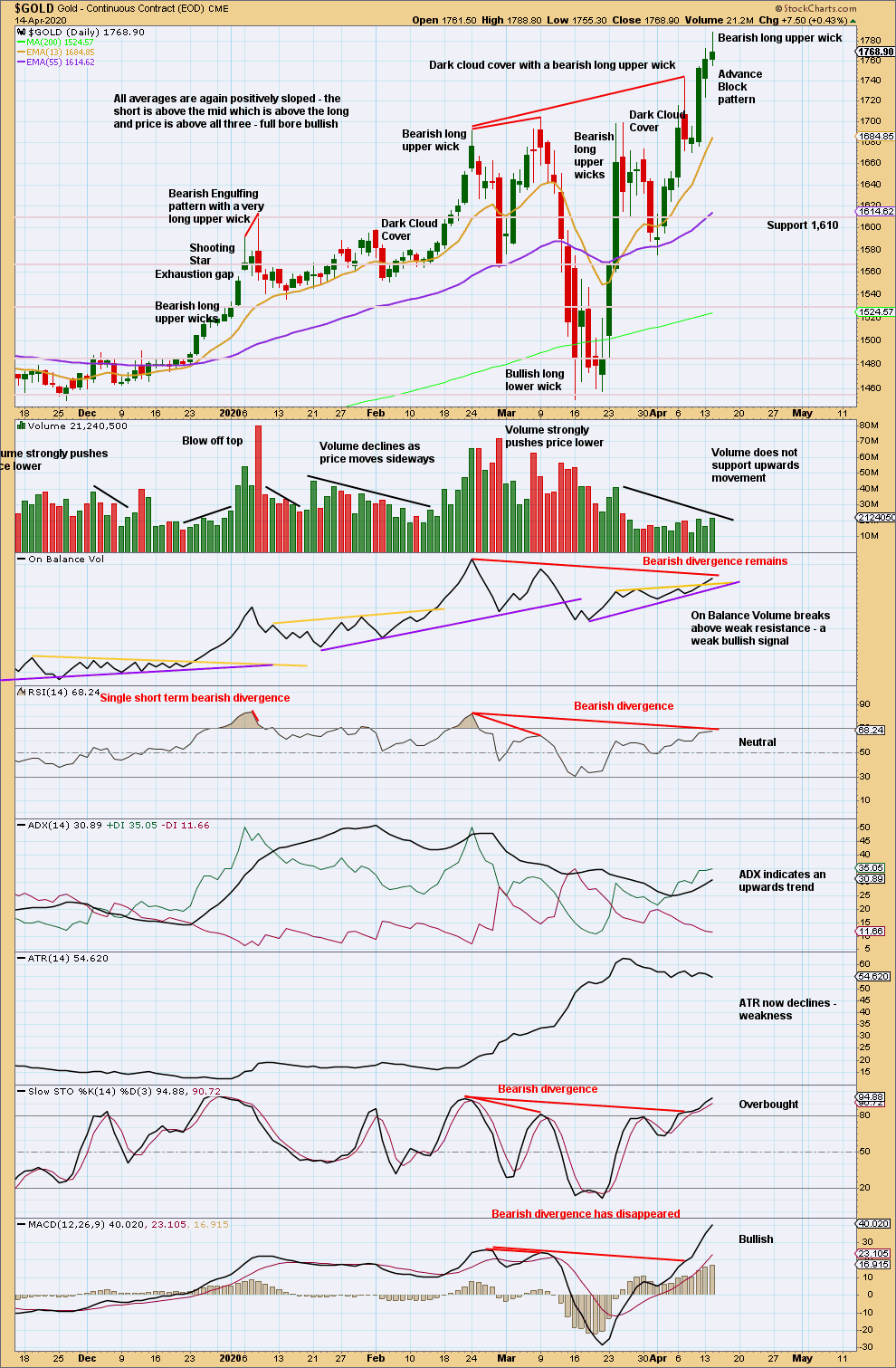

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Overall, volume remains low relative to the last upwards wave, although for the short term there is a little support for upwards movement.

The last two daily candlesticks have declining range, with today’s candlestick having the smallest range of the last three days. This pattern is an Advance Block, which is a bearish reversal pattern:

“If the second and third or just the third candle shows signs of weakening, it is an advance block pattern. This means the rally is running into trouble and longs should protect themselves. Be especially cautious about this pattern during a mature uptrend. Signs of weakening could be progressively smaller white real bodies or relatively long upper shadows.”

Nison, Steve. Japanese Candlestick Charting Techniques (p. 99).

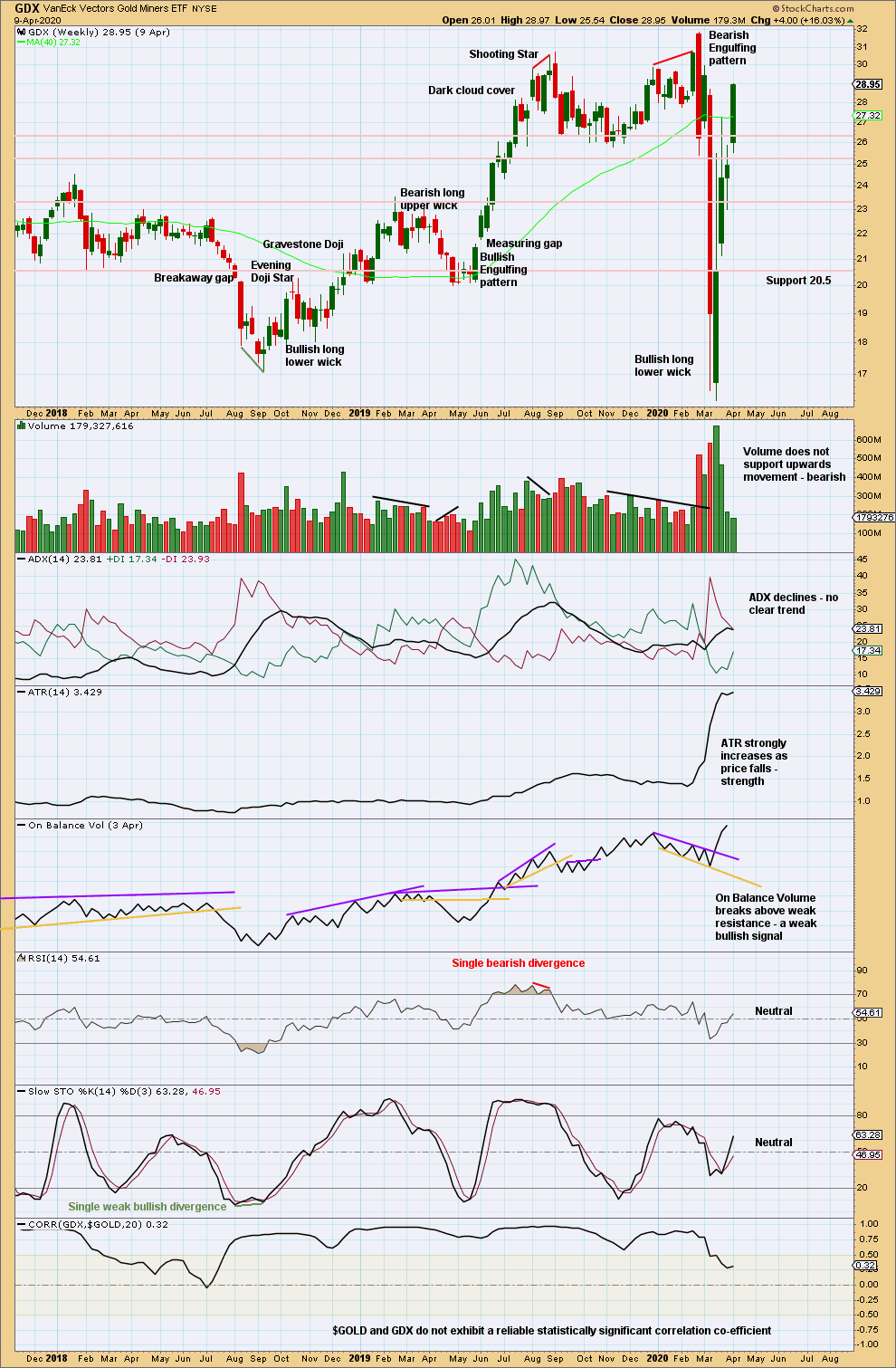

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another wide ranging upwards week does not have support from volume. This upwards movement is suspicious.

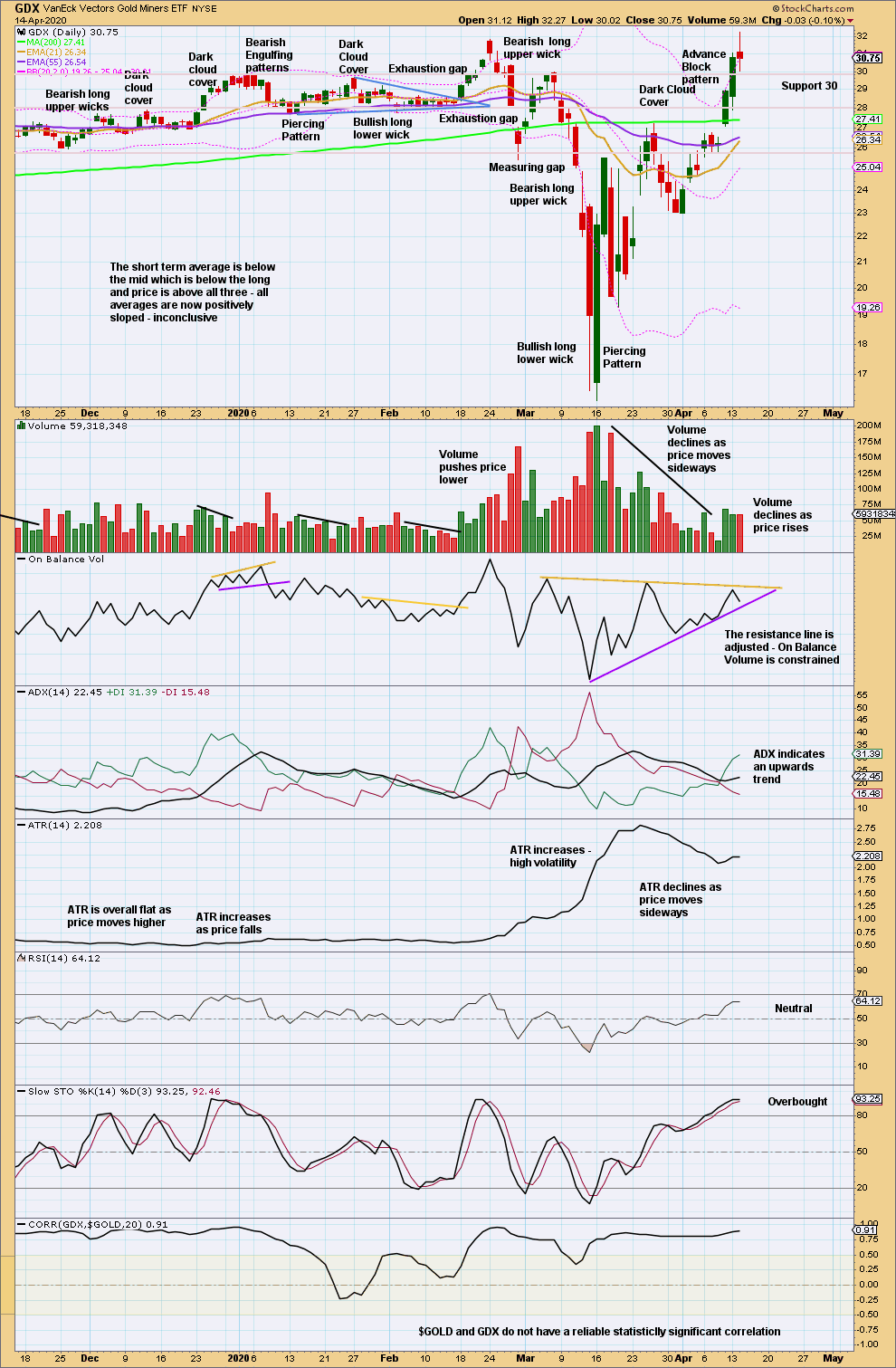

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the width of the last consolidation zone, after an upwards breakout, is at 31.21. This has now been met. A bearish candlestick reversal pattern today warns upwards movement may be over.

Published @ 06:22 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.