GOLD: Elliott Wave and Technical Analysis | Charts – May 15, 2020

A new high invalidates the first two Elliott wave counts and provides confidence in the second. Only two Elliott wave counts now remain valid.

Summary: The target is at 1,795 (bull) or 1,980 (bear). The invalidation point is at 1,693.39.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

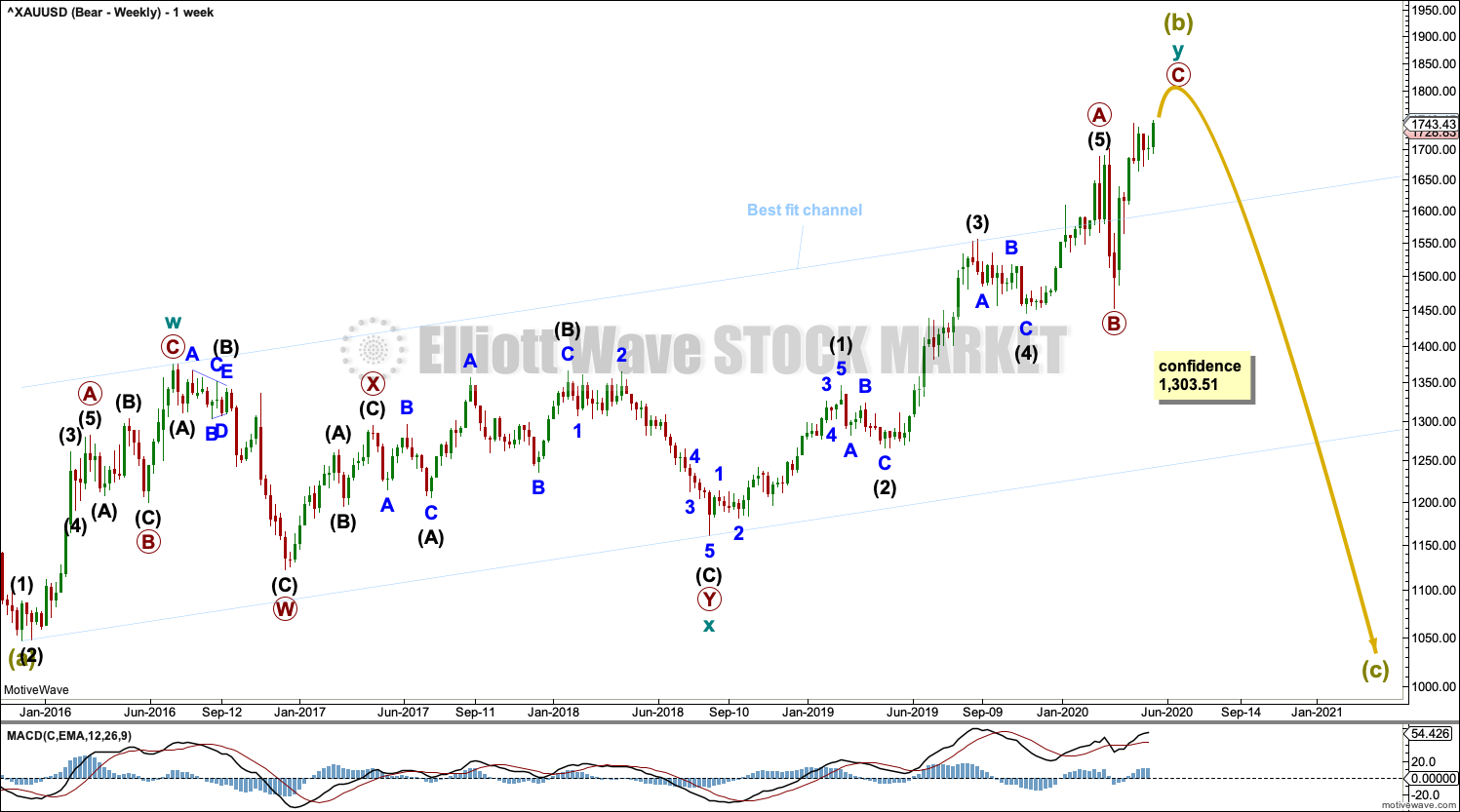

MAIN BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may be an incomplete double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a combination labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

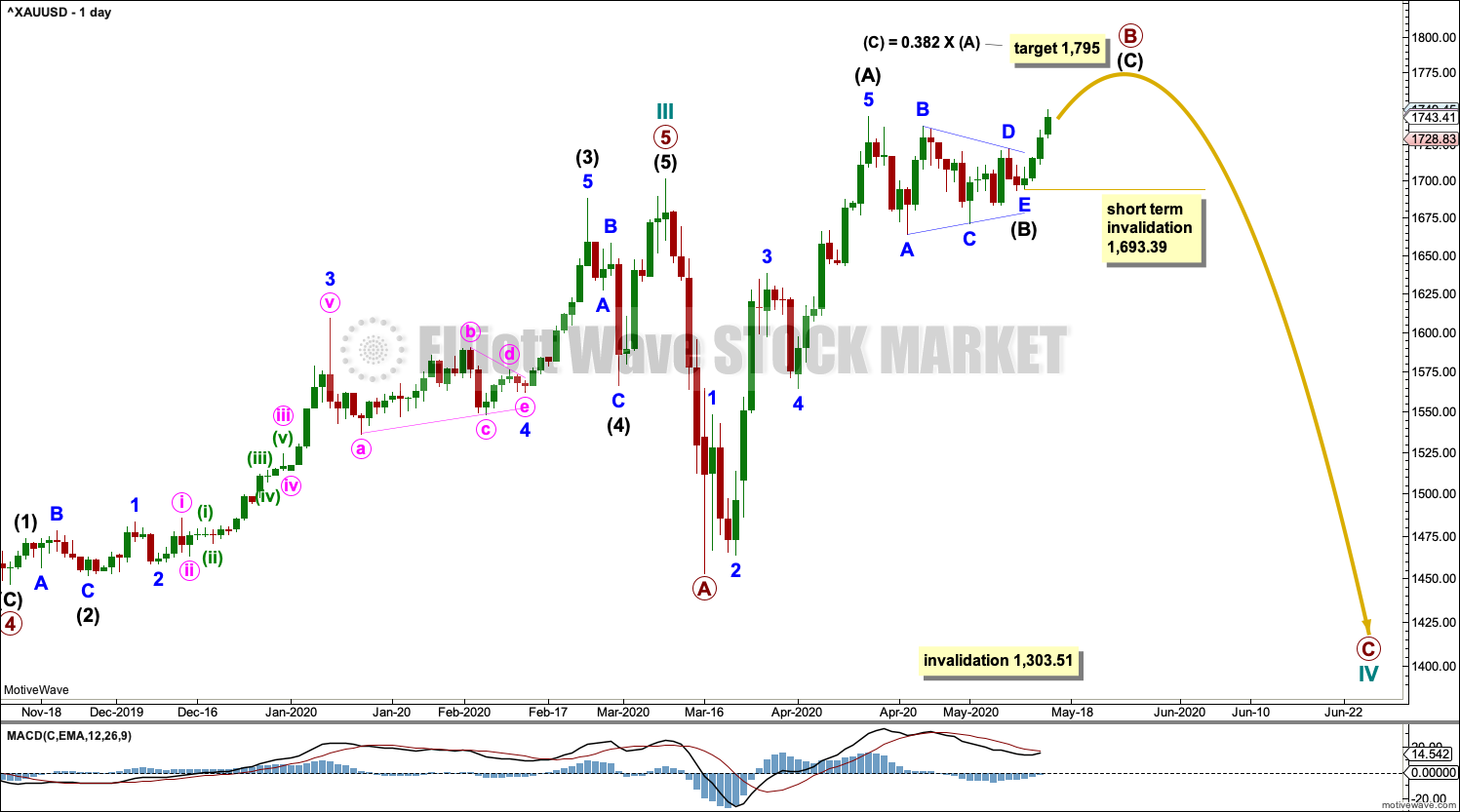

DAILY CHART

Primary wave C may be an incomplete five wave impulse. Intermediate waves (1) through to (3) within primary wave C may be complete. Intermediate wave (4) may be a regular contracting triangle. Minor wave E within the triangle may now be complete. No second wave correction within intermediate wave (5) may move beyond the start of its first wave below 1,693.39.

The point in time at which an Elliott wave triangles trend lines cross over is sometimes when a trend change occurs. Extend the triangle trend lines from intermediate wave (4) outwards. They may cross over on the 29th of May. A trend change may occur on this date to either down or sideways.

HOURLY CHART

Intermediate wave (5) must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more likely, so that shall be what is expected until and unless overlapping suggests a diagonal.

Minor wave 1 within intermediate wave (5) may be incomplete.

Draw a best fit channel as shown about upwards movement. Keep redrawing the channel as price continues higher. Draw the first trend line from the end of minute wave i to the last high, then pull a parallel copy lower to contain all upwards movement. The lower edge of the channel may provide support for pullbacks along the way up. If the channel is breached by downwards movement, then that may provide the earliest indication that minor wave 1 is over and minor wave 2 may have begun.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,693.39.

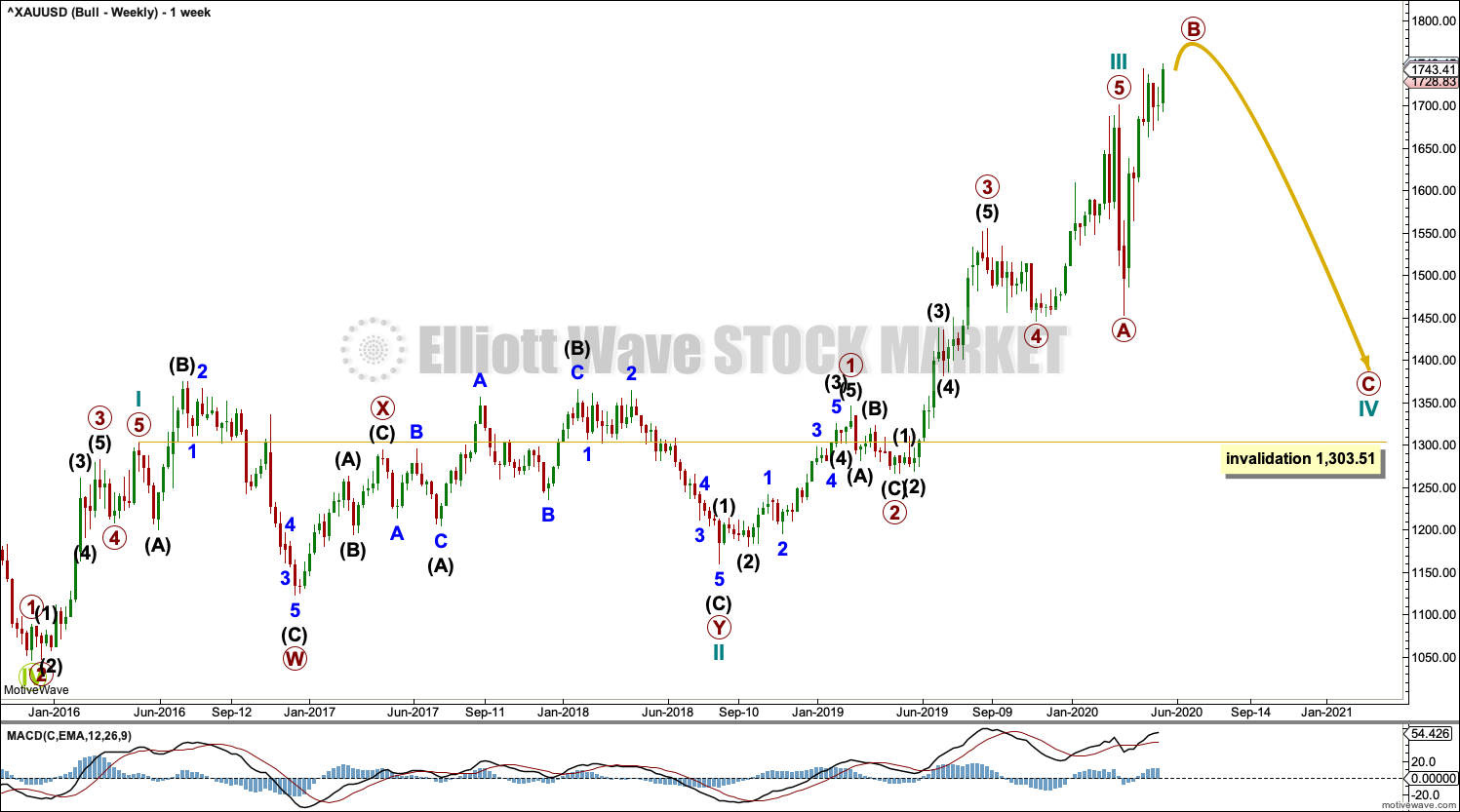

ALTERNATE BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the bear wave count above). This movement must be labelled as a series of overlapping first and second waves.

Within the first flat correction labelled primary wave W of the double flat of cycle wave II, intermediate wave (B) is 1.69 the length of intermediate wave (A). This is longer than the common range of up to 1.38, but within an allowable guideline of up to 2. The length of intermediate wave (B) reduces the probability of this wave count.

Cycle wave III may be complete. Cycle wave IV may not move into cycle wave I price territory below 1,303.51.

DAILY CHART

Cycle wave IV may be an incomplete expanded flat correction. Primary wave A within the flat correction may have subdivided as a zigzag. Primary wave B may now be an incomplete zigzag.

Intermediate waves (A) and (B) may be complete. Intermediate wave (C) may have begun. No second wave correction within intermediate wave (C) may move beyond its start below 1,693.39.

The normal range for primary wave B within a flat would be from 1 to 1.38 times the length of primary wave A, giving a range from 1,701.61 to 1,795.98. The target calculated would see primary wave B end right at the upper edge of this normal range.

HOURLY CHART

Intermediate wave (C) must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more likely, so that shall be what is expected until and unless overlapping suggests a diagonal.

Minor wave 1 within intermediate wave (C) may be incomplete.

Draw a best fit channel as shown about upwards movement. Keep redrawing the channel as price continues higher. Draw the first trend line from the end of minute wave i to the last high, then pull a parallel copy lower to contain all upwards movement. The lower edge of the channel may provide support for pullbacks along the way up. If the channel is breached by downwards movement, then that may provide the earliest indication that minor wave 1 is over and minor wave 2 may have begun.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,693.39.

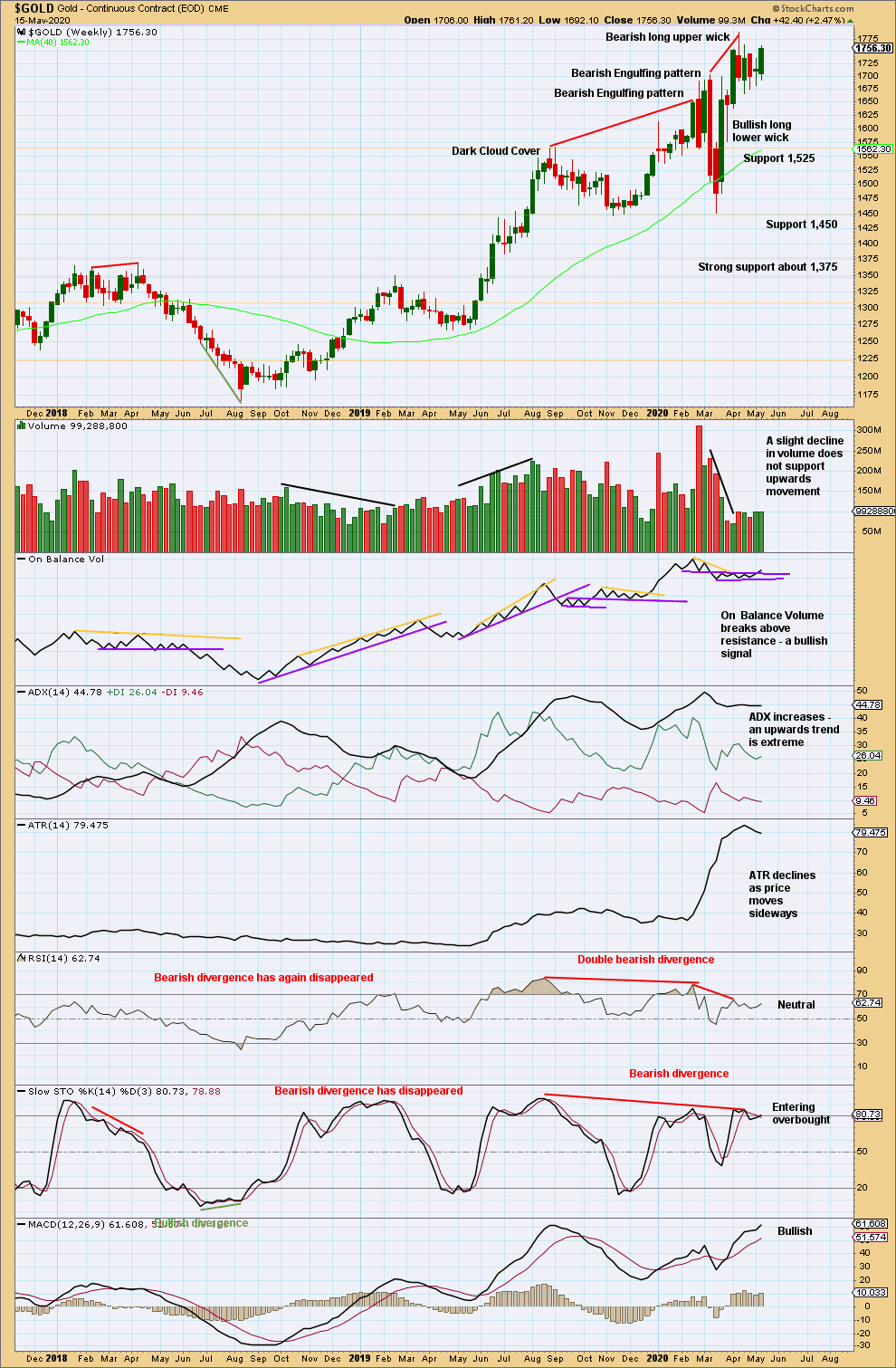

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A bullish signal this week supports the Elliott wave counts. The upwards trend remains extreme.

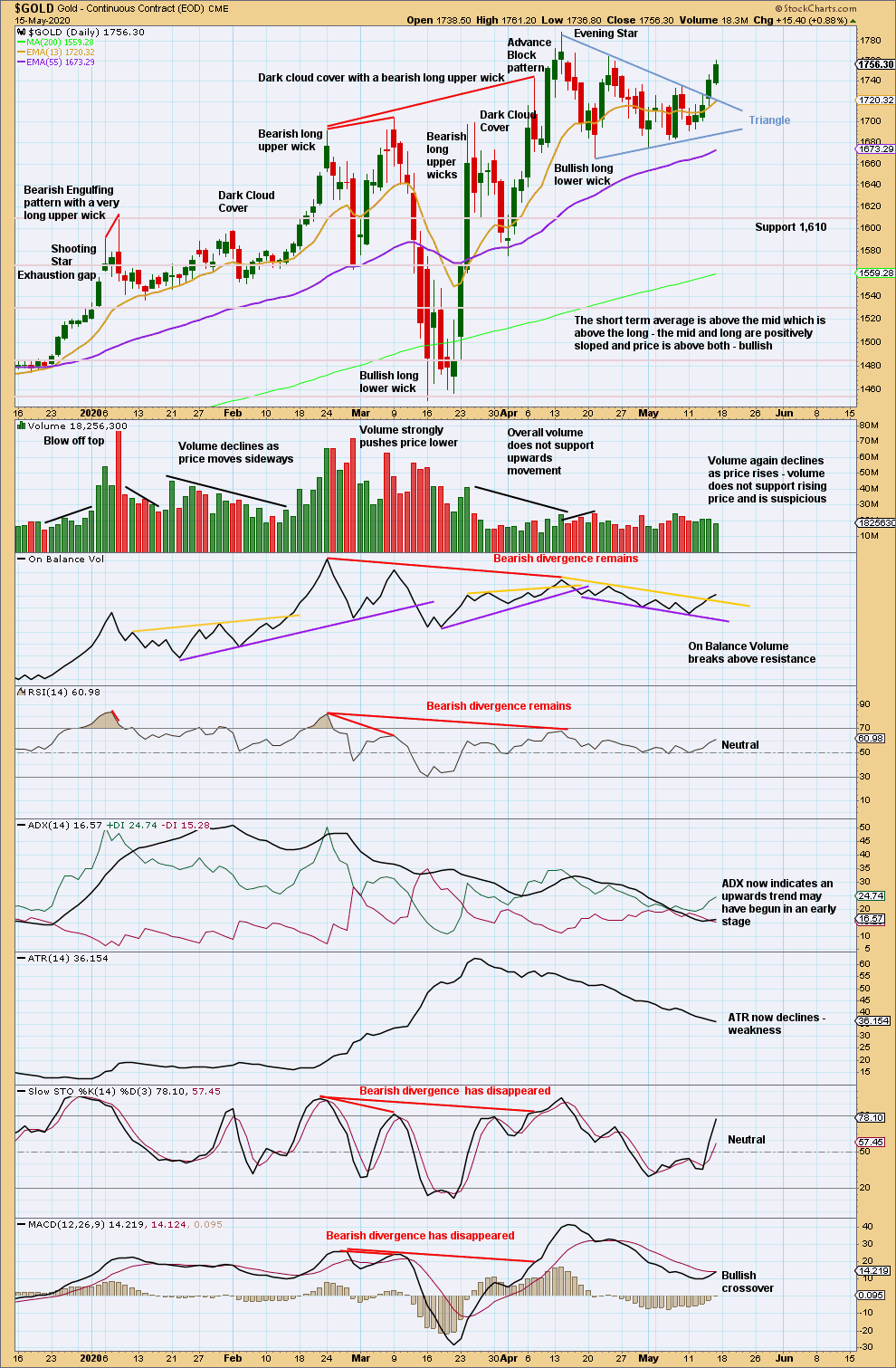

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed above the upper edge of a triangle pattern. A target is at 1,849. However, a lack of support from volume for upwards movement indicates this market may currently be vulnerable to pullbacks. Extra caution regarding risk management is advised at this time.

Overall, this chart is bullish. An upwards trend may be resuming. There is plenty of room for it to continue before conditions again become extreme. The only concern today is volume. This chart supports the Elliott wave counts.

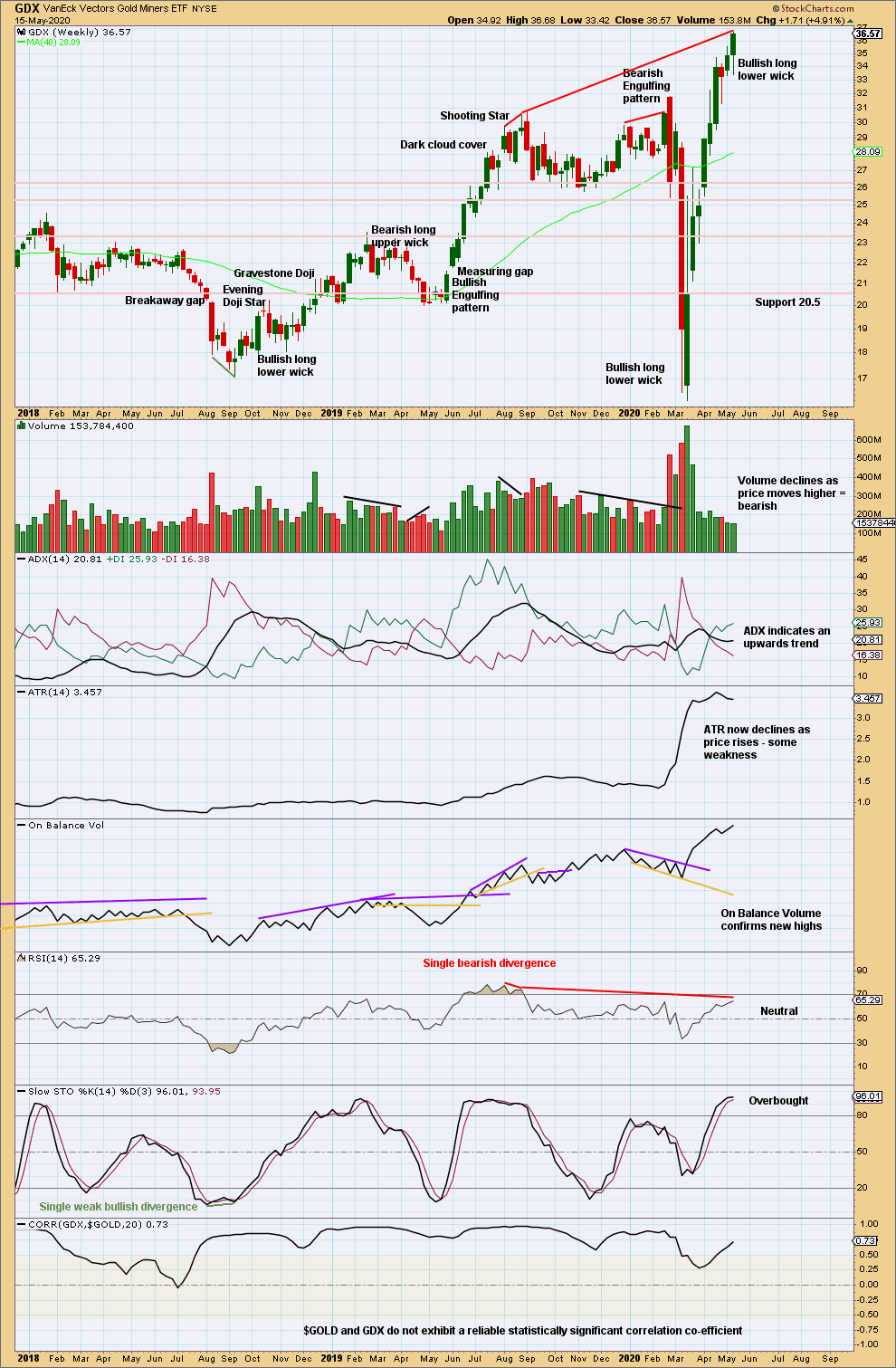

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A bullish long lower wick suggests more upwards movement next week. It may be limited though because volume does not support upwards movement.

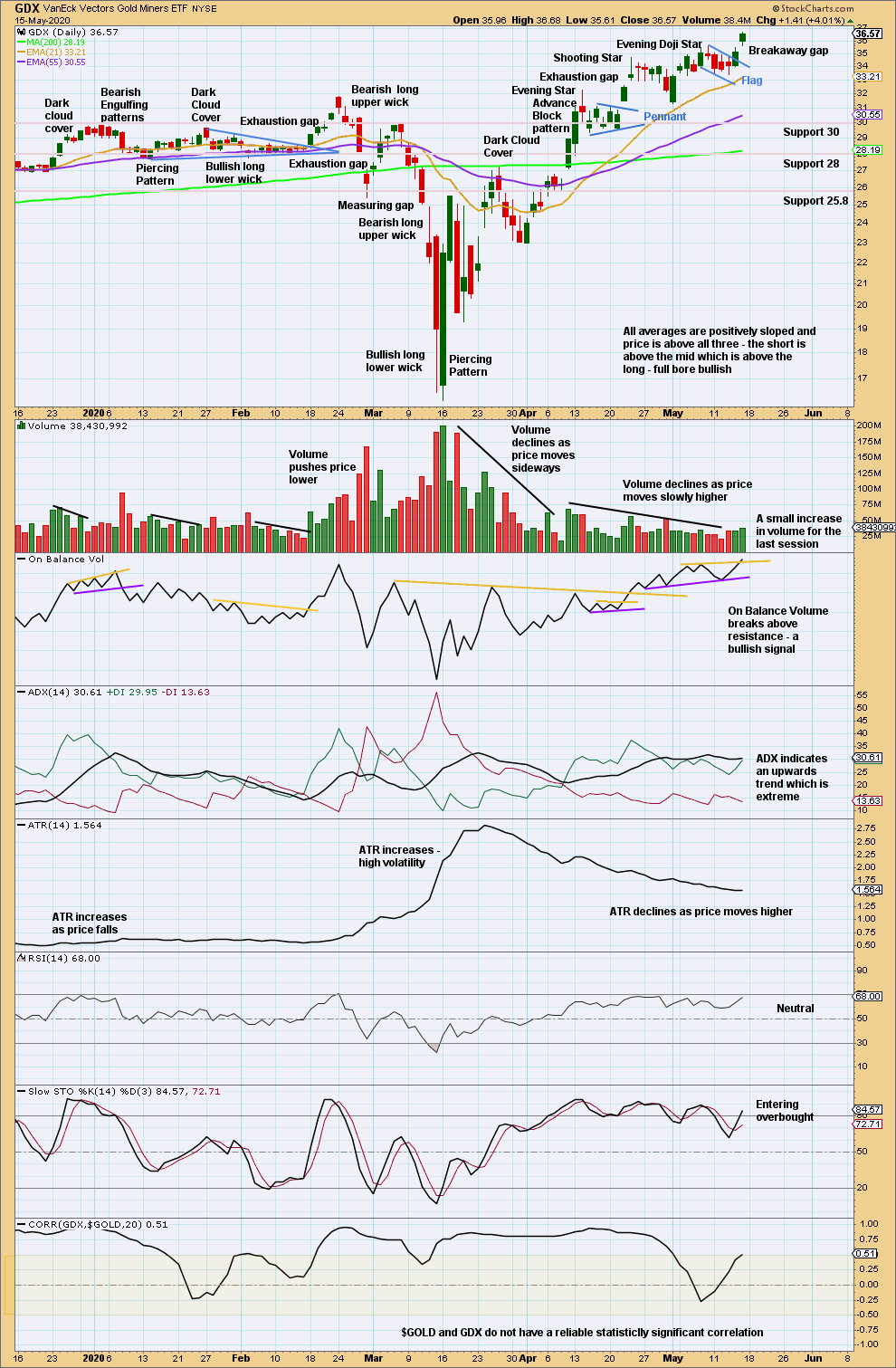

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A flag may have completed. A target calculated from the flag pole is at 38.92. The breakaway gap may offer support at 35.45.

Published @ 08:04 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.