GOLD: Elliott Wave and Technical Analysis | Charts – October 2, 2020

Upwards movement has continued as the first two Elliott wave counts expected.

Summary: The first and second Elliott wave counts now expect upwards movement to 2,160.

A target calculated from the classic symmetrical triangle pattern for downwards movement is at 1,712. However, bullish long lower wicks and a Bullish Engulfing pattern on the daily chart now put this target into some doubt.

The alternate Elliott wave count now expects a bounce to end above 2,014.05 but not above 2,070.48 before the downwards trend begins to exhibit strength.

A new low below 1,764.12 at any time frame would invalidate the first daily chart and add confidence in an alternate daily chart. At that stage, a sustainable high would be in place and a new downwards trend to last months may be underway.

Grand SuperCycle analysis is here.

Last analysis of monthly charts is here with video here.

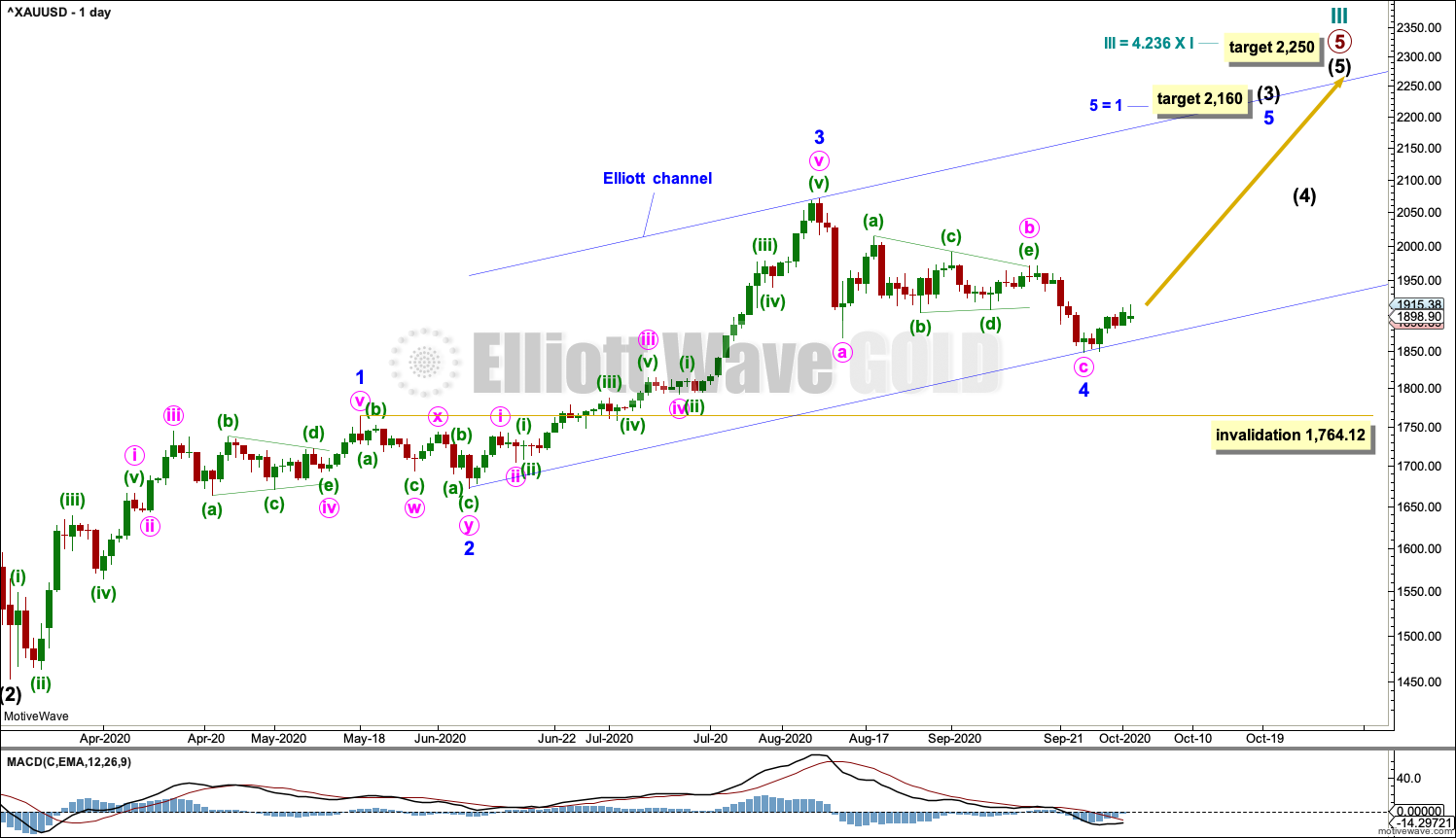

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

The bigger picture for this first Elliott wave count sees Gold as still within a bear market, in a three steps back pattern that is labelled Grand Super Cycle wave IV on monthly charts. Grand Super Cycle wave IV may be subdividing as an expanded flat pattern. The common range for Super Cycle wave (b) within a flat is from 1 to 1.38 times the length of Super cycle wave (a), giving a range from 1,920.18 to 2,252.27. The target would see Super Cycle wave (b) end within this most common range.

Super Cycle wave (b) within Grand Super Cycle wave IV may be an incomplete double zigzag. When Super Cycle wave (b) may be complete, then this wave count expects Super Cycle wave (c) to begin and to move price below the end of Super Cycle wave (a) at 1,046.27.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a combination labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

Primary wave C within cycle wave y may be subdividing as an impulse. Intermediate waves (1) through to (4) within primary wave C may be complete. If it continues any lower, then intermediate wave (4) may not move into intermediate wave (1) price territory below 1,764.12.

We should always assume the trend remains the same until proven otherwise. At this stage, Gold is in a bull market.

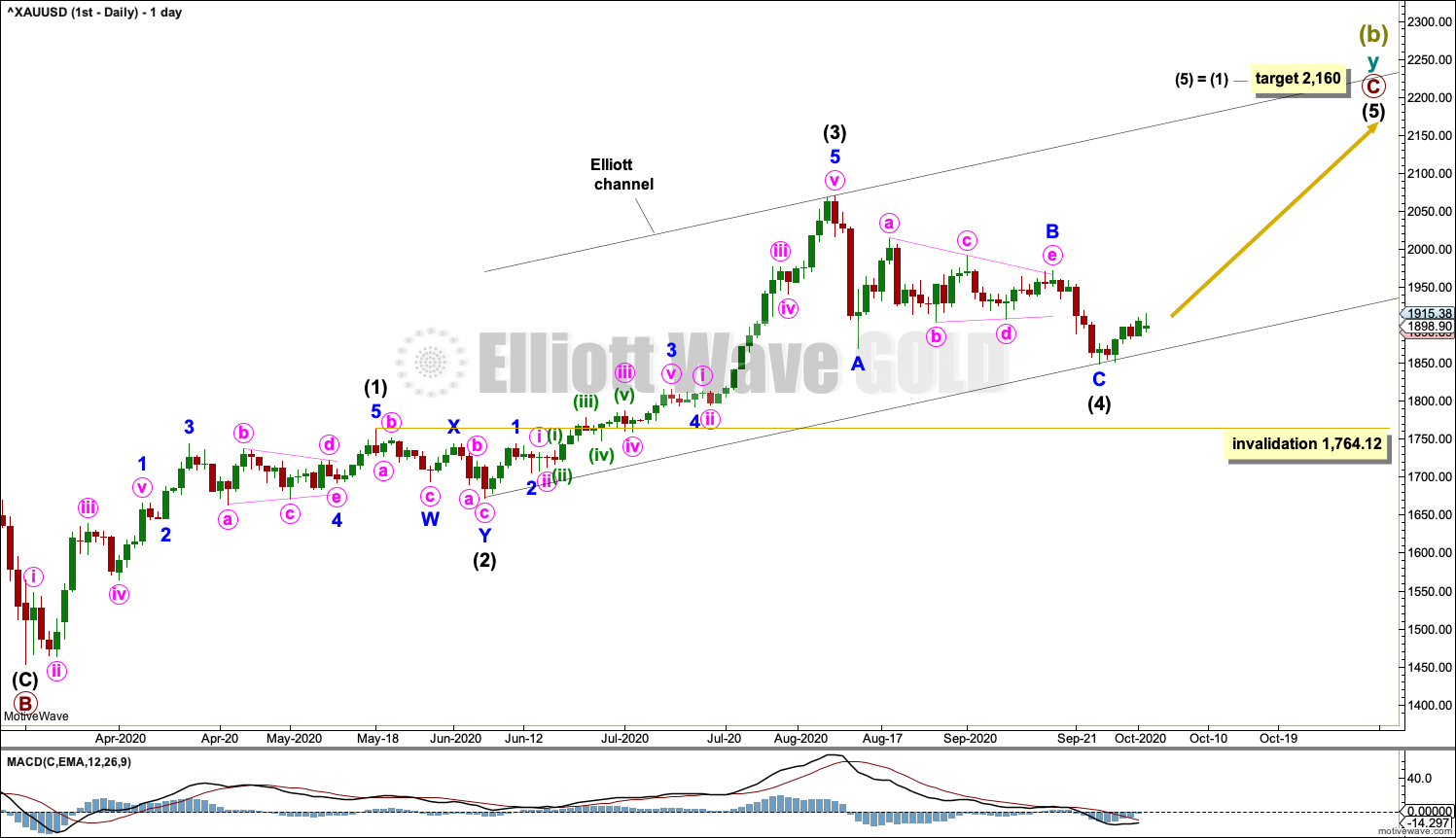

DAILY CHART

The daily chart shows detail of primary wave C as an incomplete impulse.

Intermediate waves (1) through to (4) within primary wave C may be complete. Intermediate wave (4) may be a complete zigzag.

The channel is redrawn using Elliott’s second technique: the first trend line is drawn from the ends of intermediate waves (2) to (4), then a parallel copy is placed upon the end of intermediate wave (3). Intermediate wave (5) may end either mid way within the channel or about the upper edge. Corrections along the way up may find support about the lower edge.

Intermediate wave (2) was a shallow double zigzag, lasting 15 sessions. Intermediate wave (4) may be a complete zigzag. Minor wave B within intermediate wave (4) may have been a triangle. If it continues lower, then intermediate wave (4) may not move into intermediate wave (1) price territory below 1,764.12.

A target is calculated for intermediate wave (5) that expects it to exhibit the most common Fibonacci ratio to intermediate wave (1).

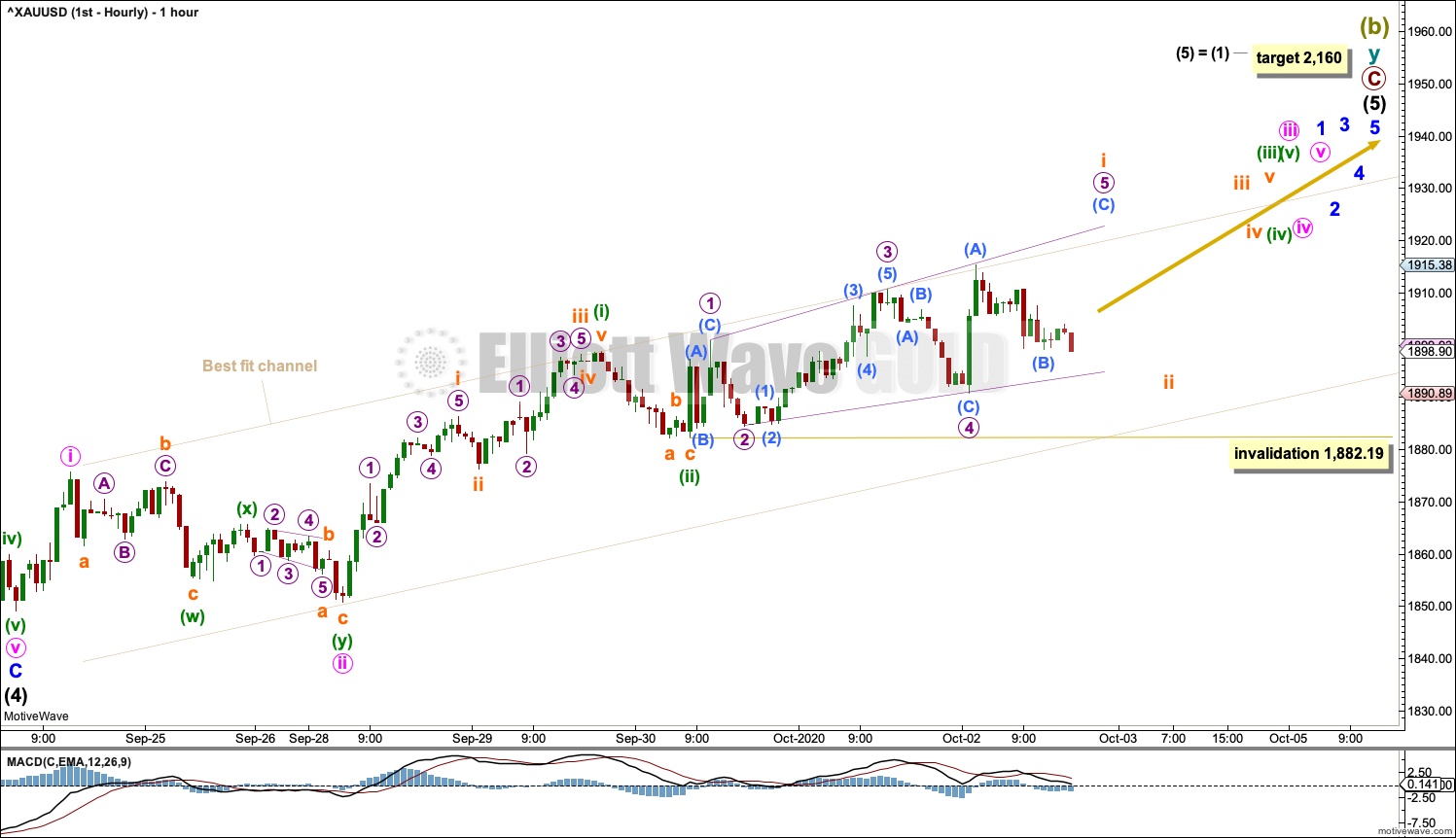

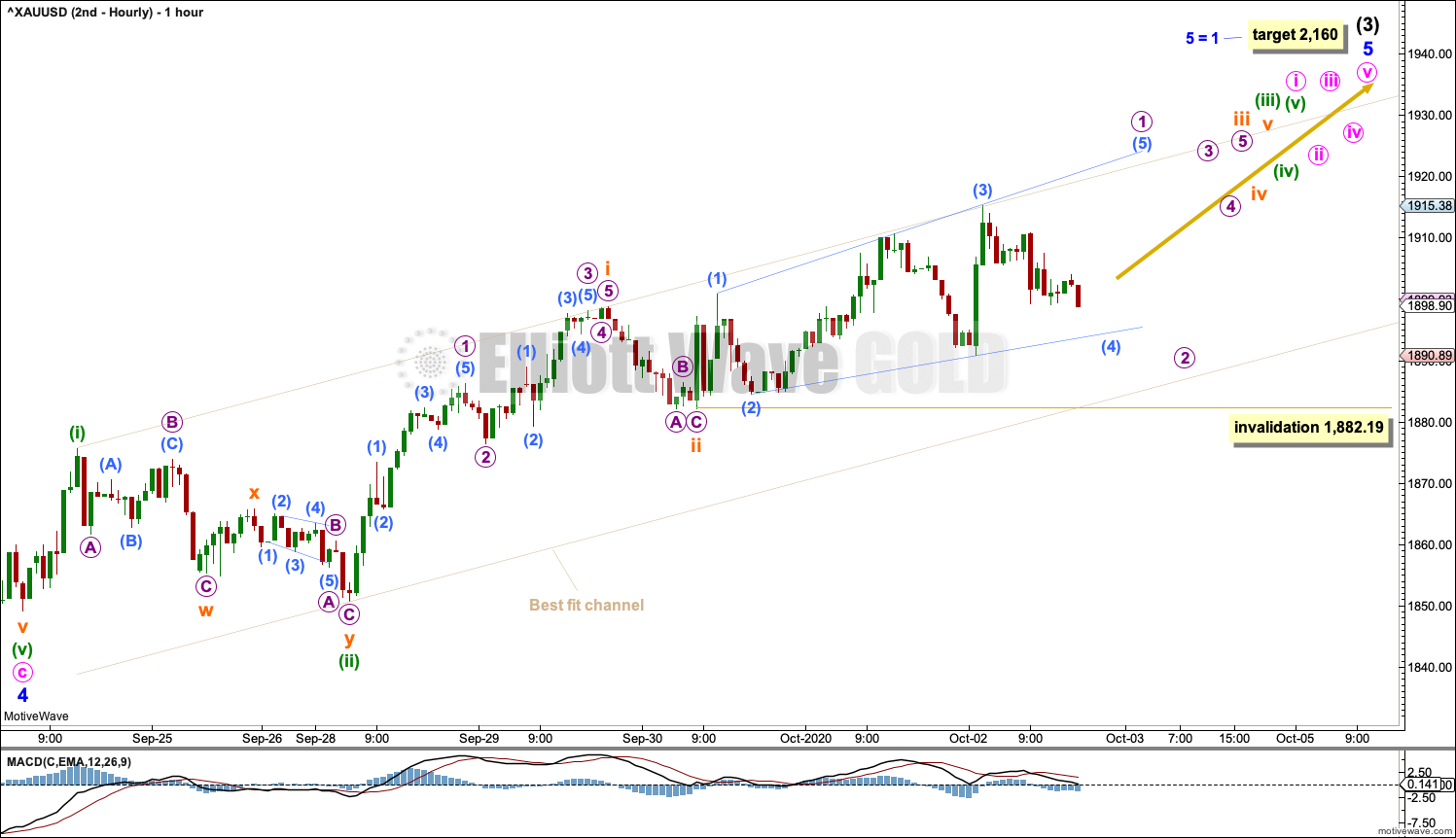

HOURLY CHART

Intermediate wave (4) may be a complete zigzag.

Minor wave 1 within intermediate wave (5) may be an incomplete impulse. Minute waves i and ii within minor wave 1 may be complete.

Minute wave iii may only subdivide as an impulse. Minuette waves (i) and (ii) within minute wave iii may be complete .

Minuette wave (iii) may only subdivide as an impulse. Subminuette wave I within minuette wave (iii) may be an incomplete leading expanding diagonal. Subminuette wave ii may not move beyond the start of subminuette wave I below 1,882.19.

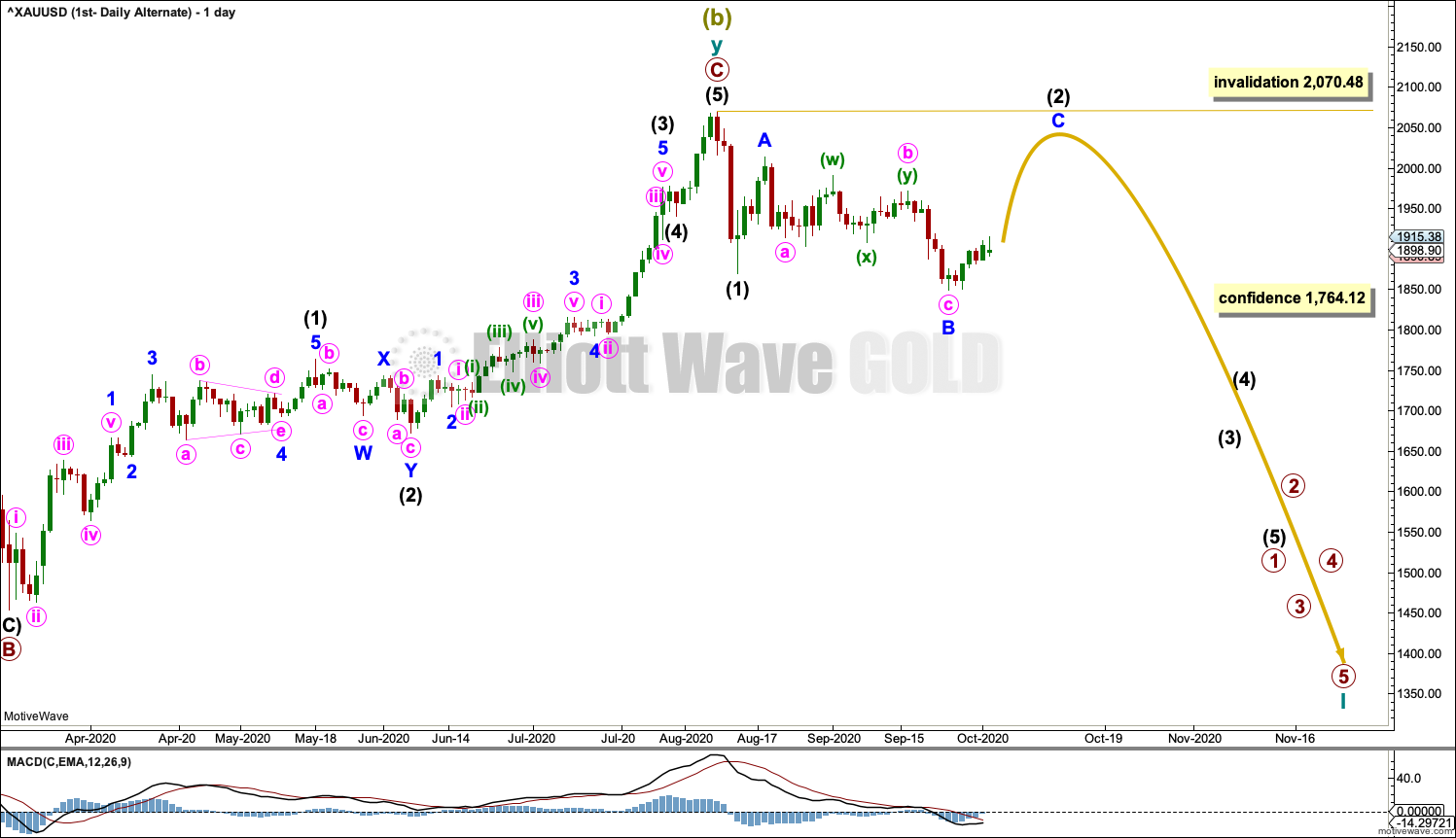

ALTERNATE DAILY CHART

It is also possible that a Super Cycle degree trend change has occurred at the last high. However, we should always assume the trend remains the same until proven otherwise. Assume the upwards trend remains in place and the main wave count is correct until the upwards trend is invalidated with a new low below 1,764.12. At that stage, this would become the main wave count.

Intermediate wave (2) may be an incomplete expanded flat correction. Minor wave B within intermediate wave (2) was a 1.14 length of minor wave A, which is within the most common range of 1 to 1.38 times the length of minor wave A.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 2,070.48.

Super Cycle wave (c) would be likely to make at least a slight new low below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation. If price provides confidence in this wave count with a new low below 1,764.12, then a target would be calculated for Super Cycle wave (c) to end.

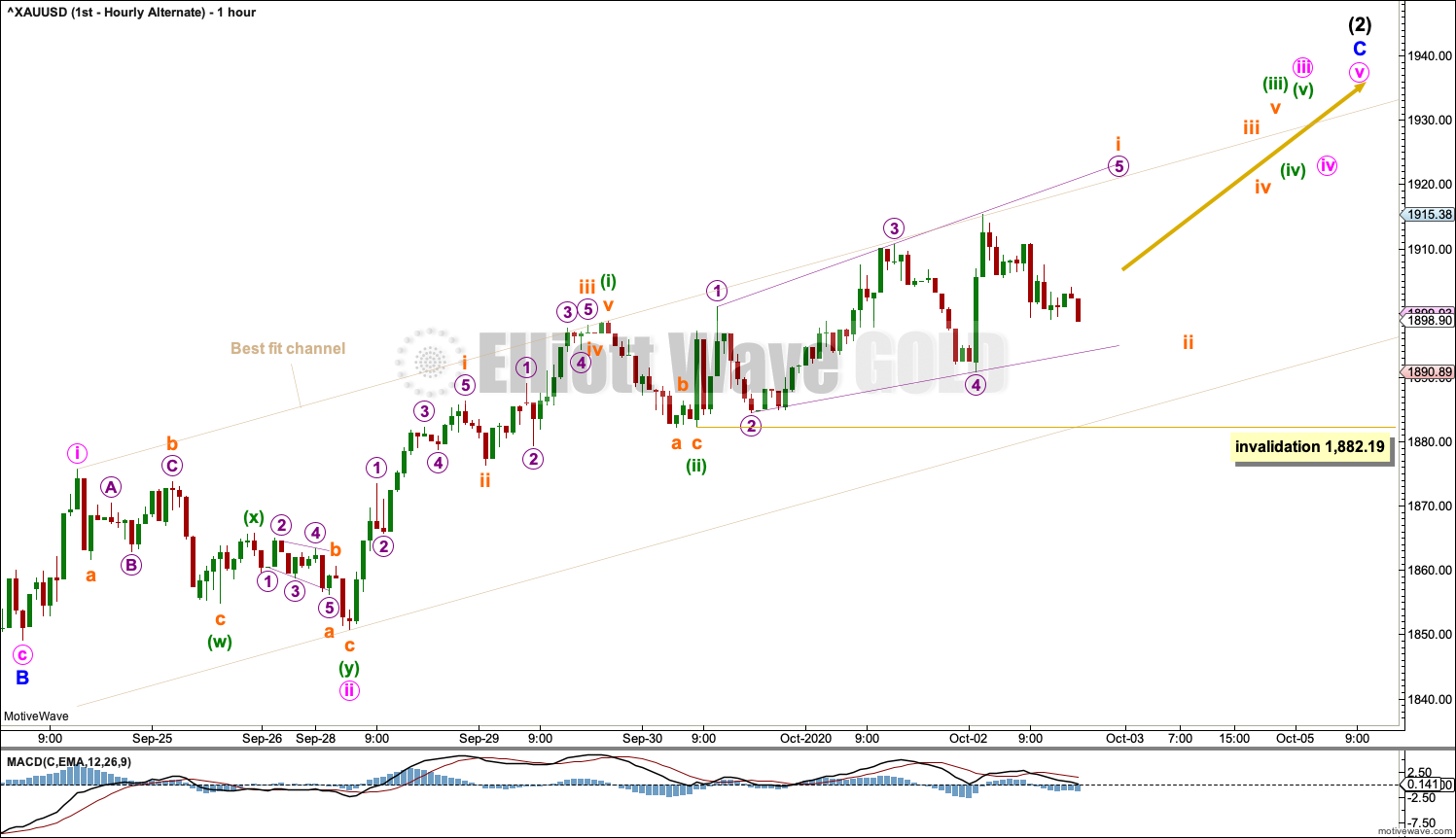

ALTERNATE HOURLY CHART

Minor wave C must subdivide as a five wave motive structure, most likely an impulse.

Minute waves i and ii within minor wave C may be complete.

Minute wave iii may only subdivide as an impulse. Minuette waves (i) and (ii) within minute wave iii may be complete.

Minuette wave (iii) may only subdivide as an impulse. Subminuette wave i within minuette wave (iii) may be an incomplete leading expanding diagonal. Subminuette wave ii may not move beyond the start of subminuette wave i below 1,882.19.

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the first wave count above). This movement must be labelled as a series of overlapping first and second waves. Ignoring this triangle reduces the probability of this wave count in Elliott wave terms.

Cycle wave III may be incomplete. Minor wave 4 within primary wave 5 may not move into minor wave 1 price territory below 1,764.12.

DAILY CHART

Cycle wave III may be incomplete. The daily chart focusses on primary wave 5 within cycle wave III.

Minor wave 4 may be a complete zigzag. Minute wave b within the zigzag may be a complete triangle.

If minor wave 4 continues lower, then it may not move into minor wave 1 price territory below 1,764.12.

The channel about intermediate wave (3) is drawn using Elliott’s second technique.

HOURLY CHART

A target is calculated for minor wave 5 to end intermediate wave (3).

Minor wave 5 must subdivide as a five wave motive structure. Within it minute wave i may be an incomplete impulse.

Minuette waves (i) and (ii) within minute wave i may be complete.

Minuette wave (iii) may only subdivide as an impulse. Subminuette waves i and ii within minuette wave (iii) may be complete.

Subminuette wave iii may only subdivide as an impulse. Micro wave 1 within subminuette wave iii may be an incomplete leading expanding diagonal.

TECHNICAL ANALYSIS

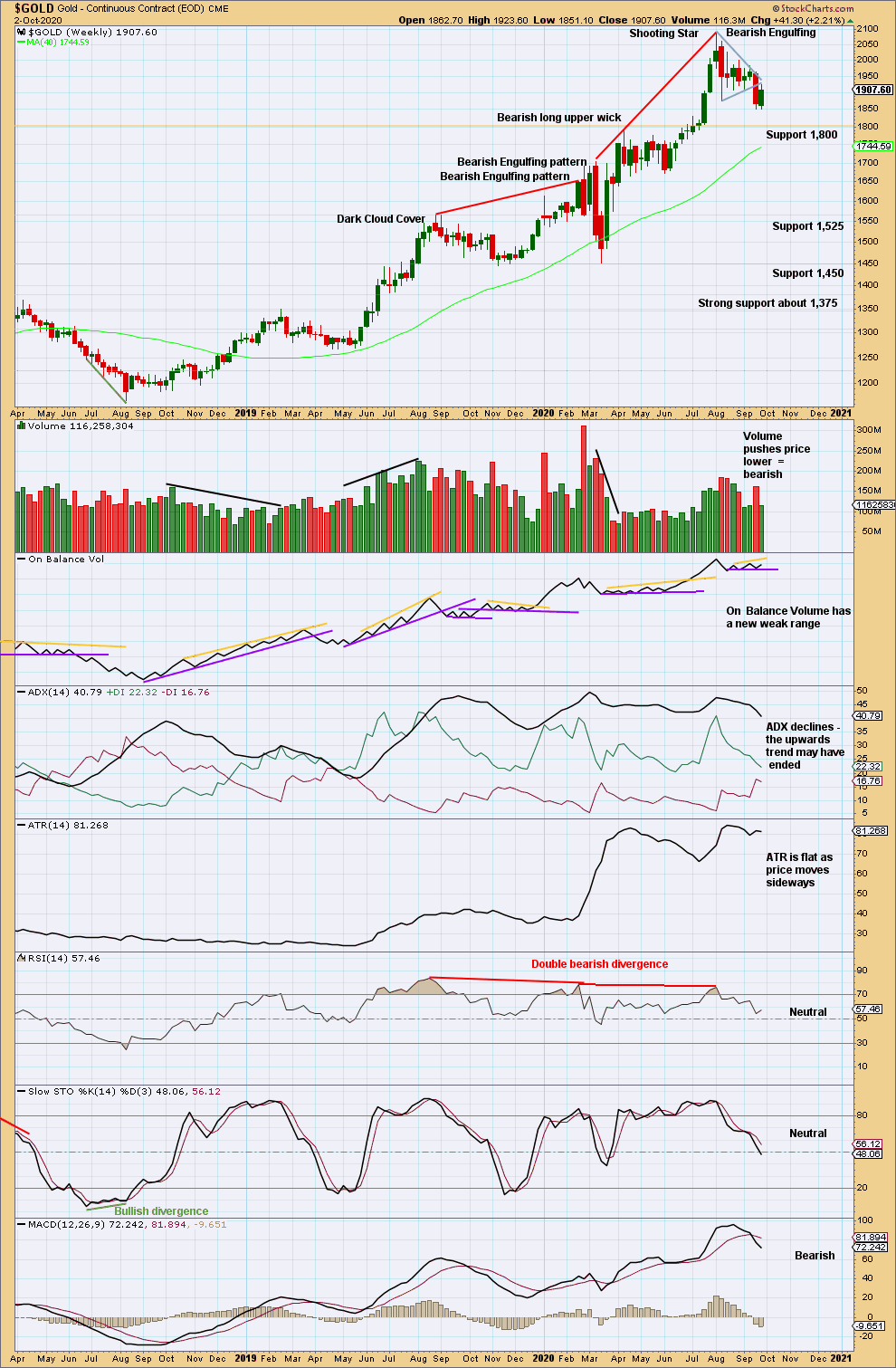

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has broken out downwards from a small triangle. Look for next support about 1,800.

At the last high were two bearish candlestick patterns with overbought RSI exhibiting double bearish divergence. It is possible there may have been a 180° trend change at the high. A new swing low below 1,671.70 would add confidence in that view.

Upwards movement this week lacks support from volume, but that does not mean this may not be the first week of a multi-week rise to new all time highs. Early stages of trends for Gold do not always begin with strength; there are prior examples on this chart.

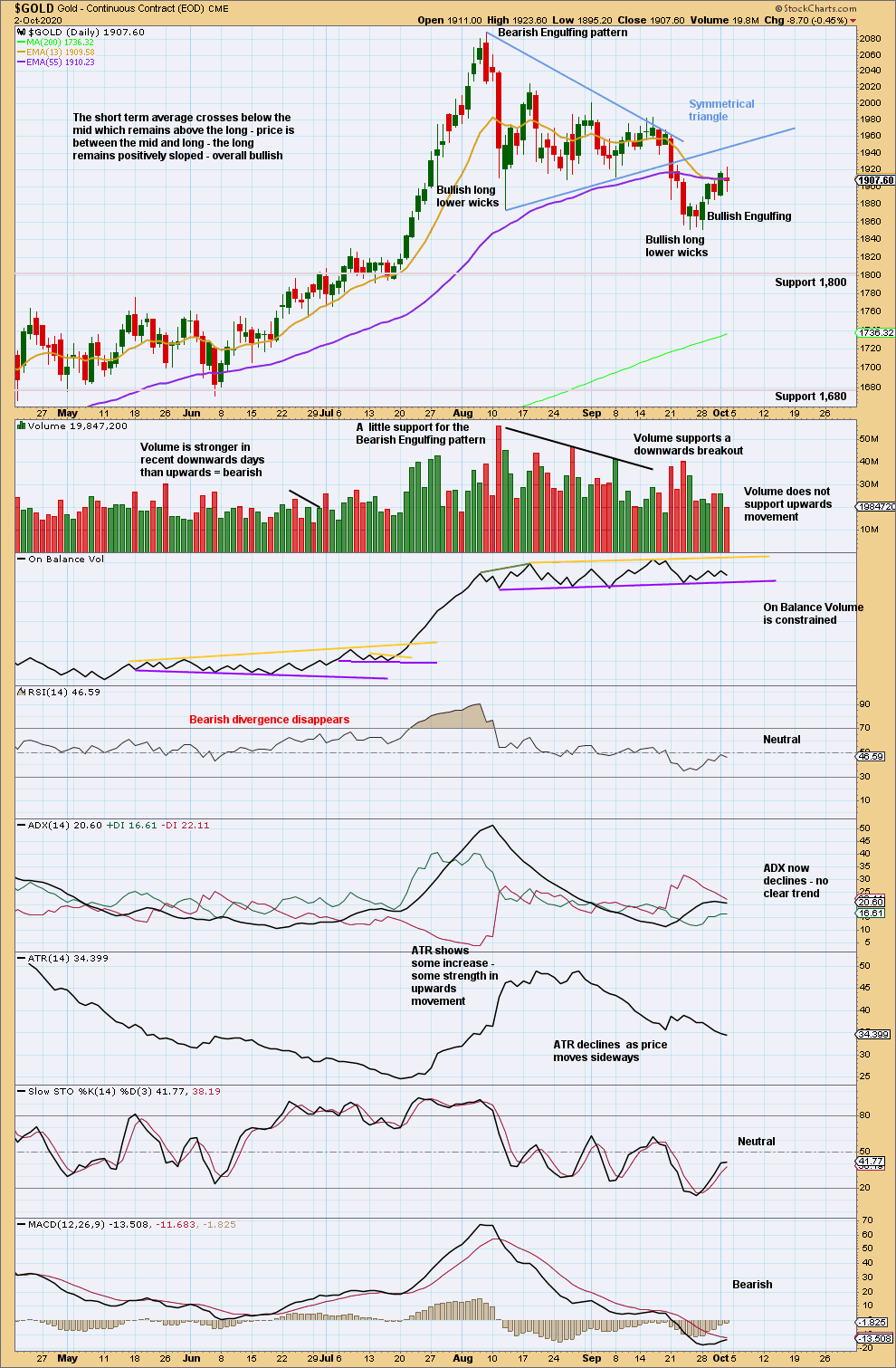

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is a strong downwards breakout from the symmetrical triangle. A target calculated from the width of the base of the triangle is at 1,712.

From Kirkpatrick and Dhalquist regarding symmetrical triangles:

“Symmetrical triangles have many false breakouts and must be watched carefully…

Throwbacks… occur 37%… of the time, and, as in most patterns, when they occur, they detract from eventual performance. This implies that for actual investment or trading, the initial breakout should be acted upon, and if a pullback or throwback occurs, the protective stop should be tightened. It does not imply that a pullback or throwback should be ignored, but that instead, performance expectations should be less than if no pullback or throwback had occurred.

High volume on breakouts, both upward and downward, adds considerably to the performance of the formation and is something to look for. Overall performance is slightly below the mean for classic patterns.”

– Kirkpatrick, Charles D., II. Technical Analysis: The Complete Resource for Financial Market Technicians (p. 350). Pearson Education.

The small quick throwback on 22nd September may detract a little from the performance of this triangle, but this may be outweighed by the strong support from volume on the downwards breakout.

The Bullish Engulfing pattern has now been followed by another upwards day. A more time consuming throwback may be underway. Look for resistance at the lower edge of the triangle trend line. Volume remains light as price moves higher. The short-term volume profile and declining ATR suggest this upwards movement may be a counter trend bounce, which would support the alternate Elliott wave count.

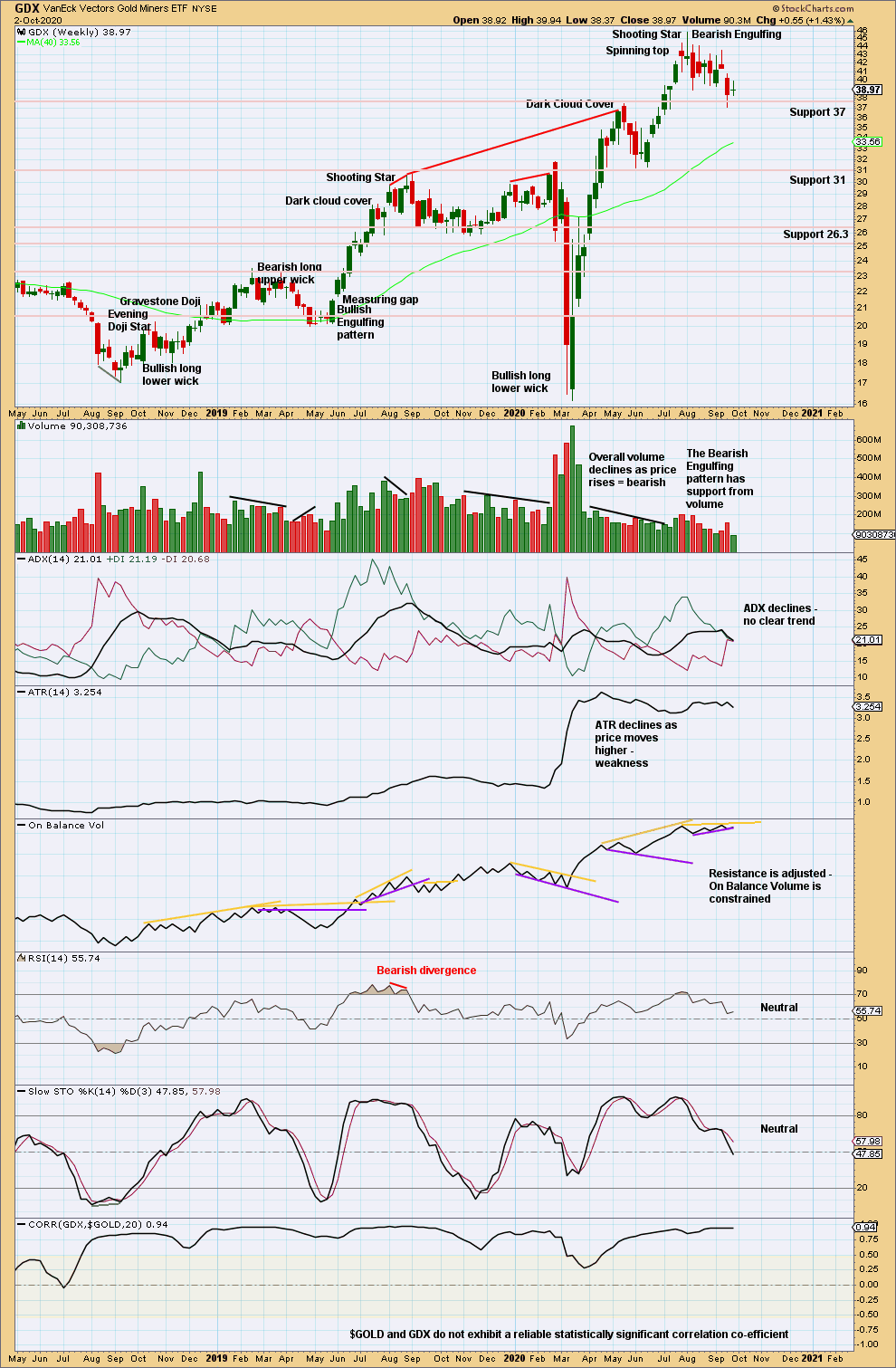

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Now two bearish candlestick reversal patterns in a Shooting Star and a Bearish Engulfing pattern indicate a trend change. With RSI reaching overbought at the high, these signals should be given weight. A trend change may be either a 180° change or a change to a sideways consolidation. With a downwards breakout last week from a small sideways pattern, the probability here of a 180° reversal and a new downwards trend has increased.

However, now eight weeks of slow downwards movement come with declining volume and flat ATR. This downwards movement does not exhibit strength.

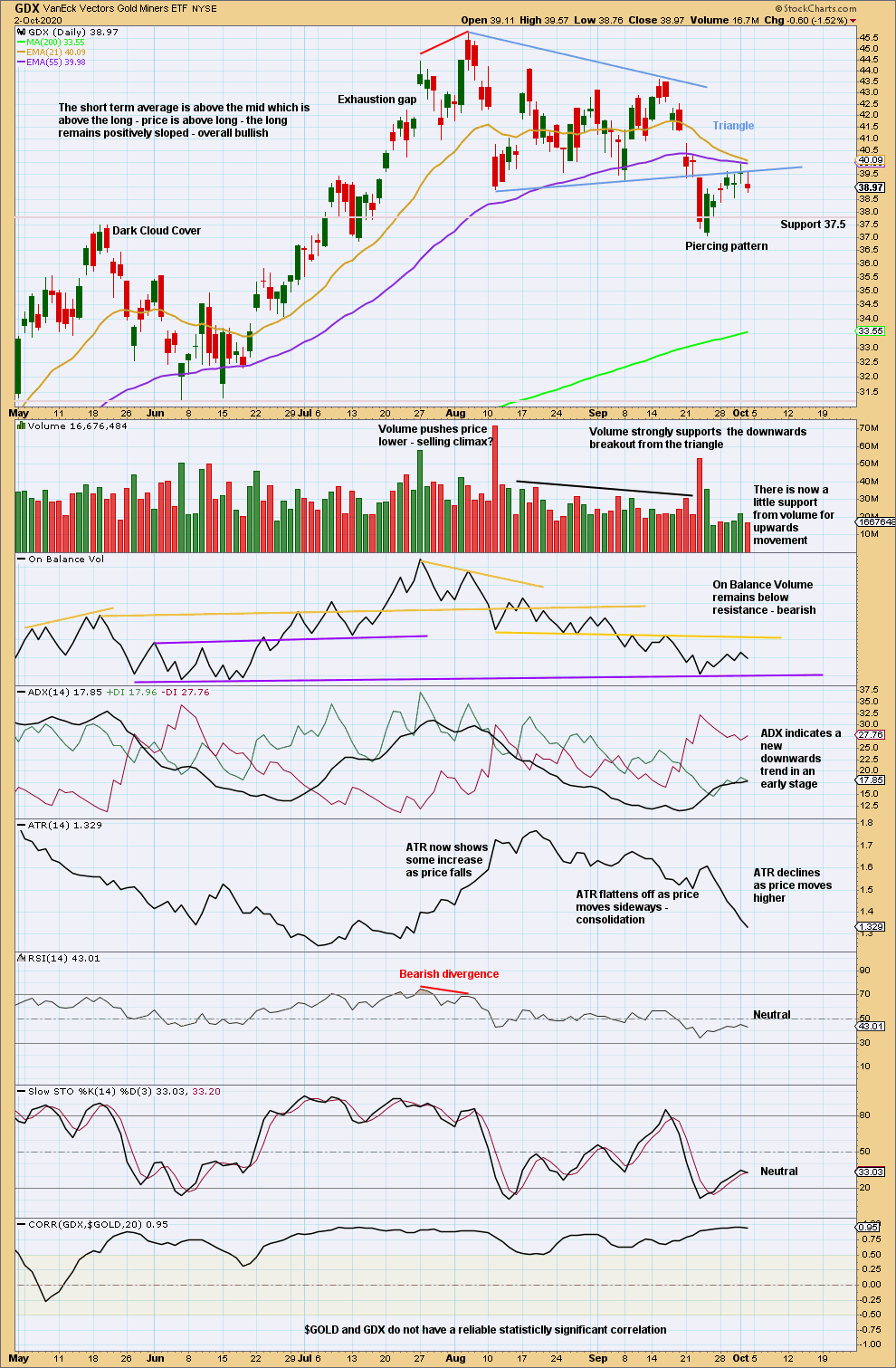

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is a downwards breakout from the triangle. A target is calculated from the width of the triangle at 32.55. An upwards throw back may now be completed. Price is back below the lower edge of the triangle trend line. The brief re-entry back into the price territory of the triangle on Thursday puts a little doubt on the target, but it may be used with caution while price remains below the lower triangle trend line.

Published @ 08:31 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.