GOLD: Elliott Wave and Technical Analysis | Charts – April 28, 2021

Another downwards session was expected by the main Elliott wave count.

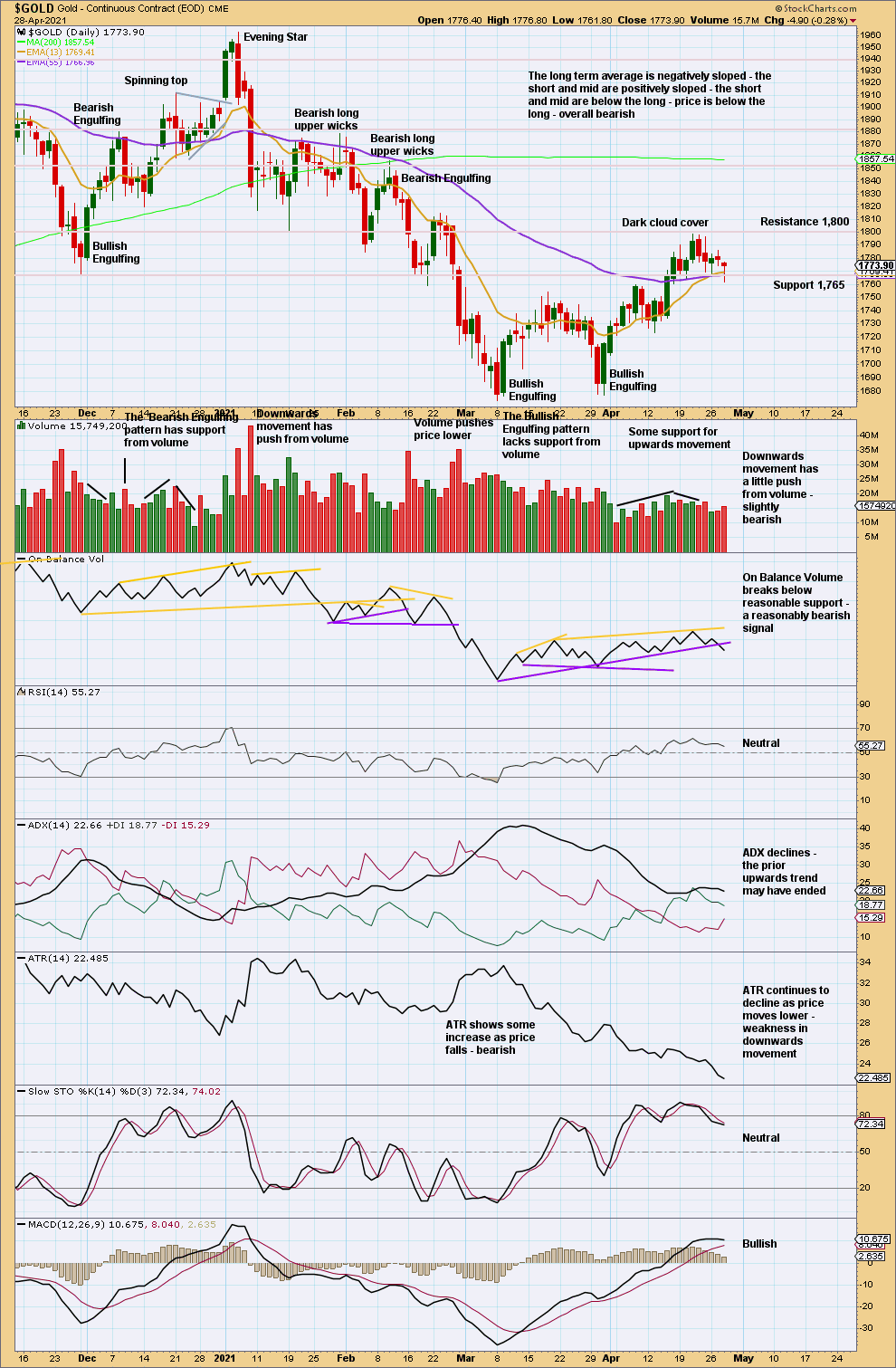

Today On Balance Volume gives a signal.

Summary: The first wave count is bearish for the bigger picture and classic technical analysis supports this view. This wave count expects a multi-year bear market may be in its early stages to end below 1,046.

The bounce may be over. A breach of the channel on the hourly chart would add confidence to this view. A target for the next wave down is now calculated at 1,675.

A long-term target is at 657.

The second wave count is bullish. A new upwards wave may now have begun (although a short-term pullback may continue here to about 1,751). The target is at 2,124.

Grand SuperCycle analysis and last monthly charts are here.

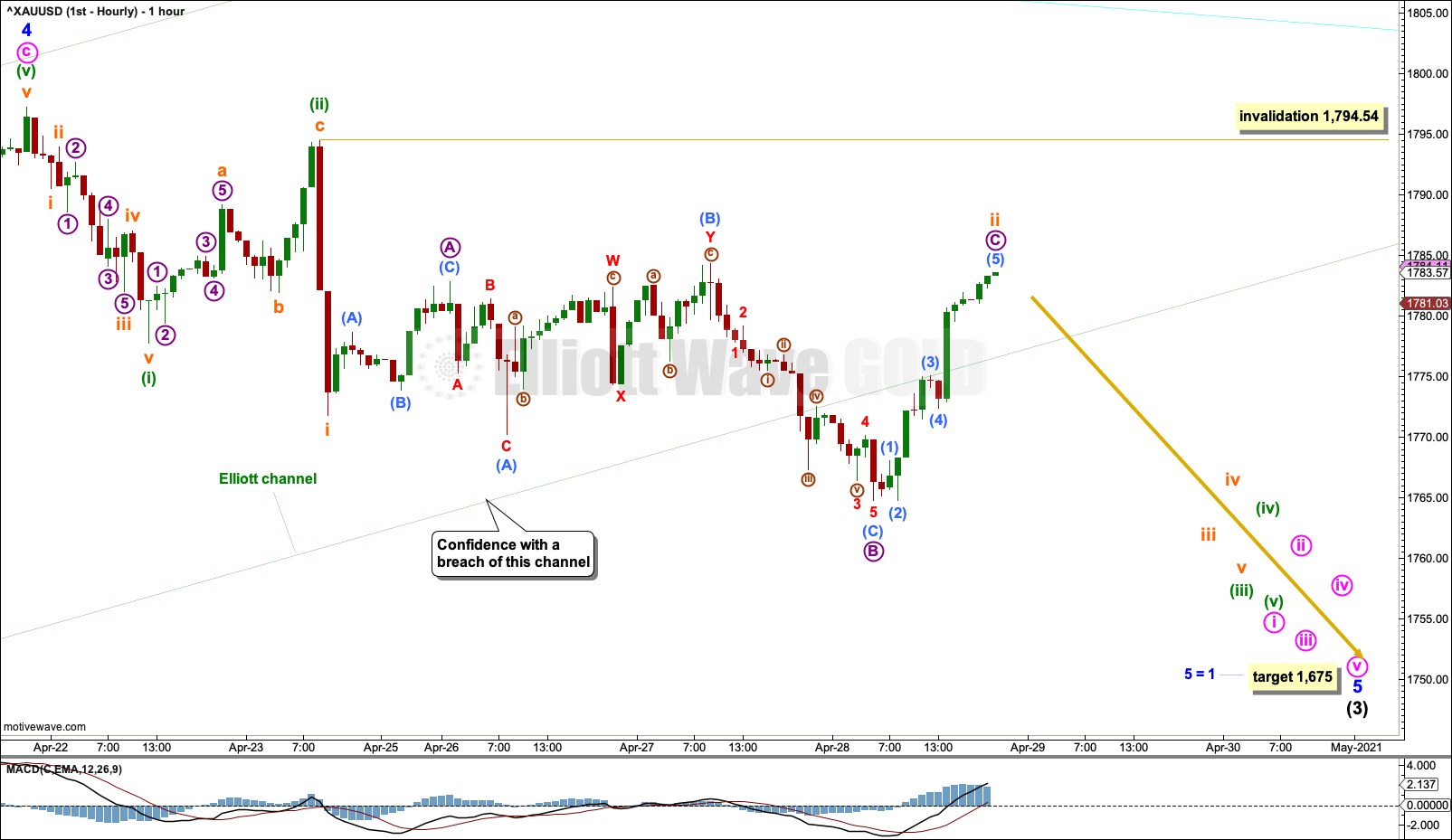

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

The bigger picture for this first Elliott wave count sees Gold as now within a bear market, in a three steps back pattern that is labelled Grand Super Cycle wave IV on monthly charts. Grand Super Cycle wave IV may be subdividing as an expanded flat pattern.

Super Cycle wave (b) within Grand Super Cycle wave IV may be a complete double zigzag. This wave count expects Super Cycle wave (c) to move price below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation and a very rare running flat. The target calculated expects a common Fibonacci ratio for Super Cycle wave (c).

DAILY CHART

Within a new bear market, cycle wave I may be an incomplete five wave impulse.

Cycle wave II within the new downwards trend may not move beyond the start of cycle wave I above 2,070.48.

Gold typically exhibits extended and strong fifth waves; this tendency is especially prevalent for fifth waves to end third wave impulses one degree higher. One or both of minor wave 5 or intermediate wave (5) may exhibit this tendency; there may be one or more selling climaxes along the way down.

Draw an acceleration channel about downwards movement. Draw the first trend line from the end of primary wave 1 to the last low, then place a parallel copy on the end of primary wave 2. Keep redrawing the channel as price continues lower.

Minor wave 4 may be complete as a flat. It may have found resistance close to the upper edge of the cyan Acceleration channel.

If it continues further, then minor wave 4 may not move into minor wave 1 price territory above 1,849.22.

Draw a channel about minute wave c within minor wave 4. Draw the first trend line from the ends of minuette waves (i) to (iii), then place a parallel copy on the end of minuette wave (ii). When this channel is breached by downwards movement, then that may be an indication that minor wave 4 may be over. Today the channel is breached at the hourly chart level, but not yet at the daily chart level.

HOURLY CHART

Copy the channel about minute wave c over from the daily chart.

Minor wave 4 may now be a complete structure, and minute wave c may now be a complete five wave impulse.

Minor wave 5 may have begun. Minor wave 5 may only subdivide as a motive structure. Minute wave i within minor wave 5 may be incomplete.

Minuette waves (i) and (ii) within minute wave i may be complete. Subminuette wave ii may again be a complete expanded flat. If it moves higher, then subminuette wave ii within minuette wave (iii) may not move beyond the start of subminuette wave i above 1,794.54.

A breach of the green Elliott channel adds a little confidence in a trend change, but with price now re-entering the channel this confidence is reduced.

The target for minor wave 5 expects it to exhibit the most common Fibonacci ratio to minor wave 1.

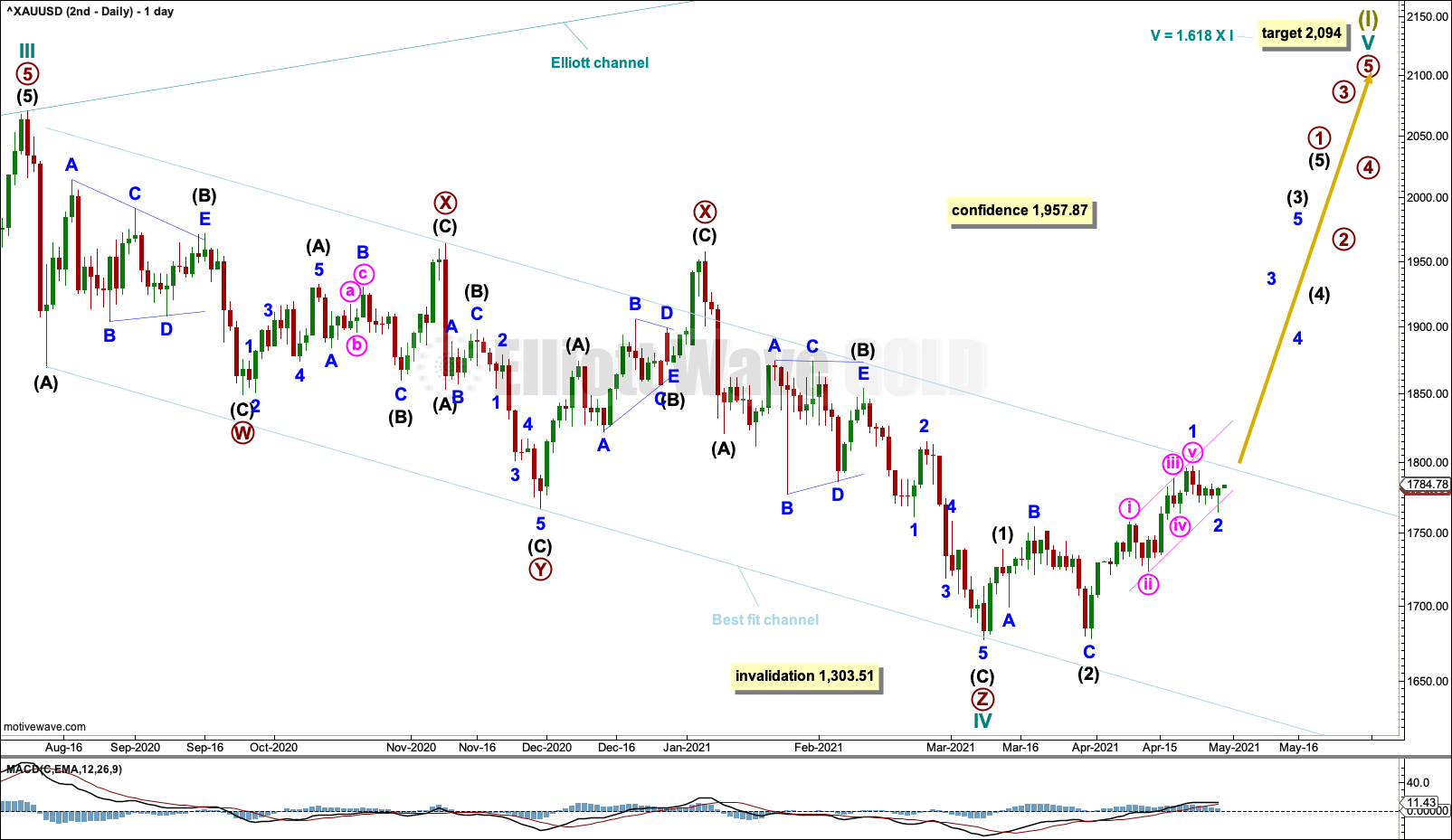

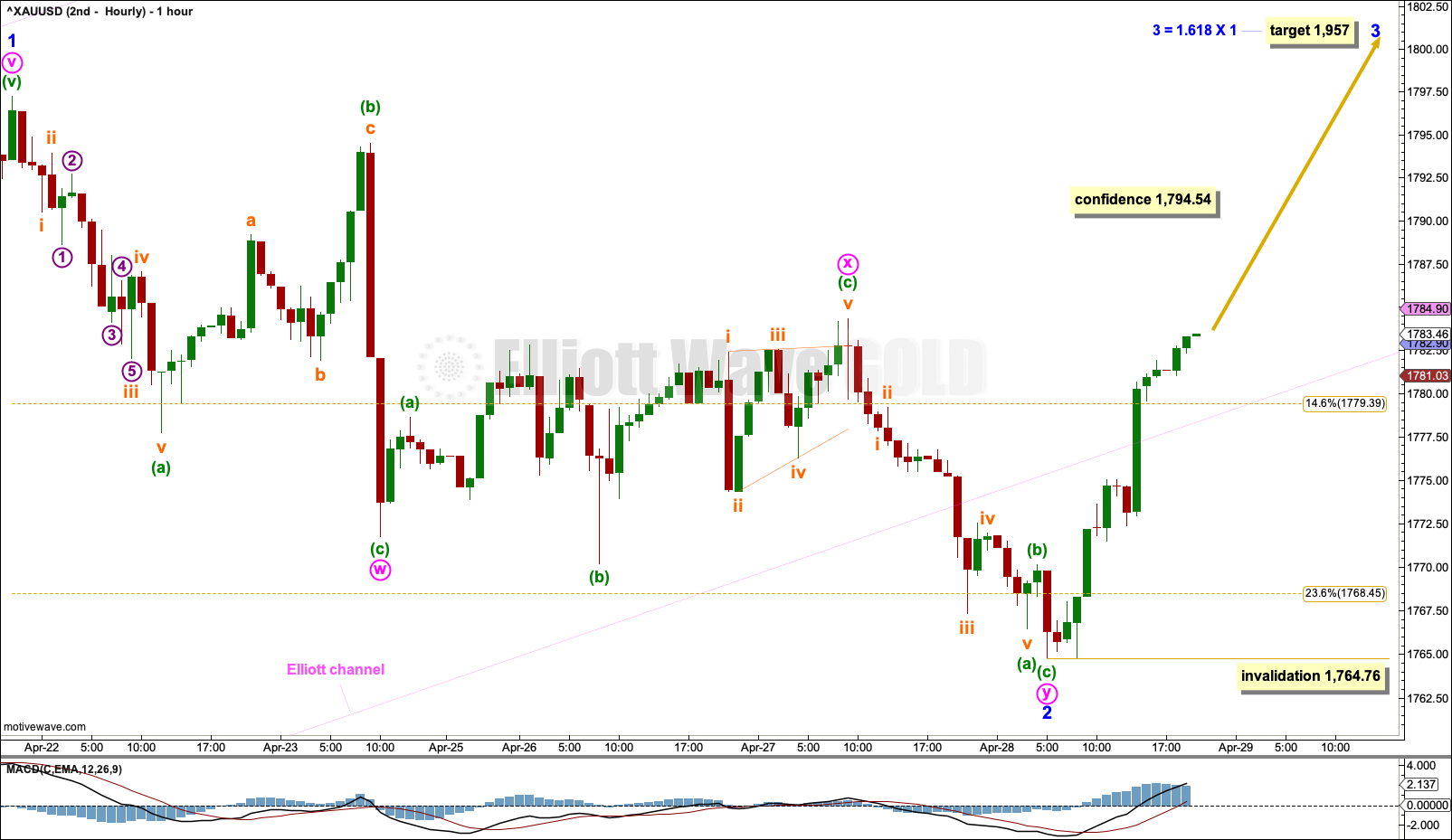

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the second weekly chart on prior analysis here). This movement must be labelled as a series of overlapping first and second waves. Ignoring this triangle reduces the probability of this wave count in Elliott wave terms.

Cycle wave IV may be a complete triple zigzag. The rarity of triple zigzags reduces the probability of this wave count further.

If the third zigzag of primary wave Z continues lower, then cycle wave IV may not move into cycle wave I price territory below 1,303.51.

DAILY CHART

Cycle wave IV may be a complete triple zigzag.

The purpose of multiple zigzags is to deepen a correction when the first zigzag does not move price deep enough. To achieve this purpose multiple zigzags normally have a clear counter trend slope. Cycle wave IV looks normal with a clear downwards slope.

A target is recalculated for cycle wave V. If cycle wave IV continues lower, then this target must again be recalculated.

A best fit channel is drawn about cycle wave IV. If this channel is breached by upwards movement with at least one full daily candlestick above and not touching the upper edge of the channel, then that may provide confidence in this second Elliott wave count. The upper edge of this channel at this stage is not breached and, in the first instance, resistance may be expected if price continues higher to the trend line.

Minor wave 1 may be a complete impulse.

HOURLY CHART

Draw a small Elliott channel about minor wave 1 as shown on the daily chart. Copy this over to the hourly chart.

Minor wave 2 may now also be complete as a double zigzag. A target is calculated for minor wave 3 to exhibit a common Fibonacci ratio to minor wave 1.

No second wave correction within minor wave 3 may move beyond its start below 1,764.76.

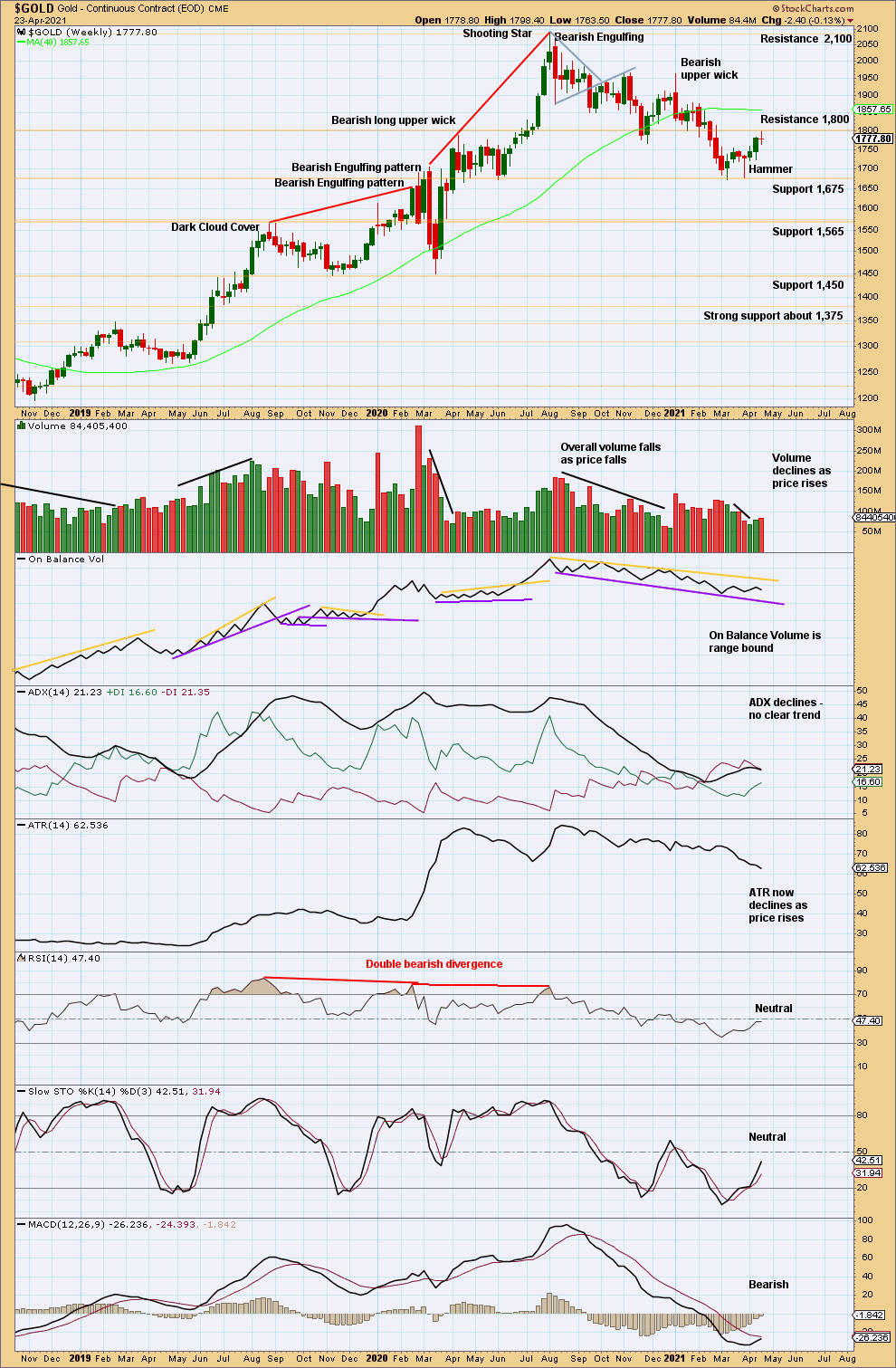

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is a series of lower swing lows and lower swing highs from the last all time high in August 2020.

Neither ADX nor RSI are extreme. There is plenty of room for a downwards trend to continue. Last week ADX slightly declines; no downwards trend is currently indicated.

Following a Hammer candlestick pattern is now three weeks of upwards movement.

Last week closes as a small red doji. This is concerning for a bullish Elliott wav count but fits expectations for a bearish Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a bearish candlestick reversal pattern in a Dark Cloud Cover to indicate the bounce may be over. This is now followed by a downwards session that exhibits a small increase in volume, which supports a bearish Elliott wave count.

Even though the long lower wick on today’s candlestick is bullish, today’s session is slightly more bearish than bullish: Volume slightly increased, On Balance Volume gives a bearish signal, and range is declining as price falls.

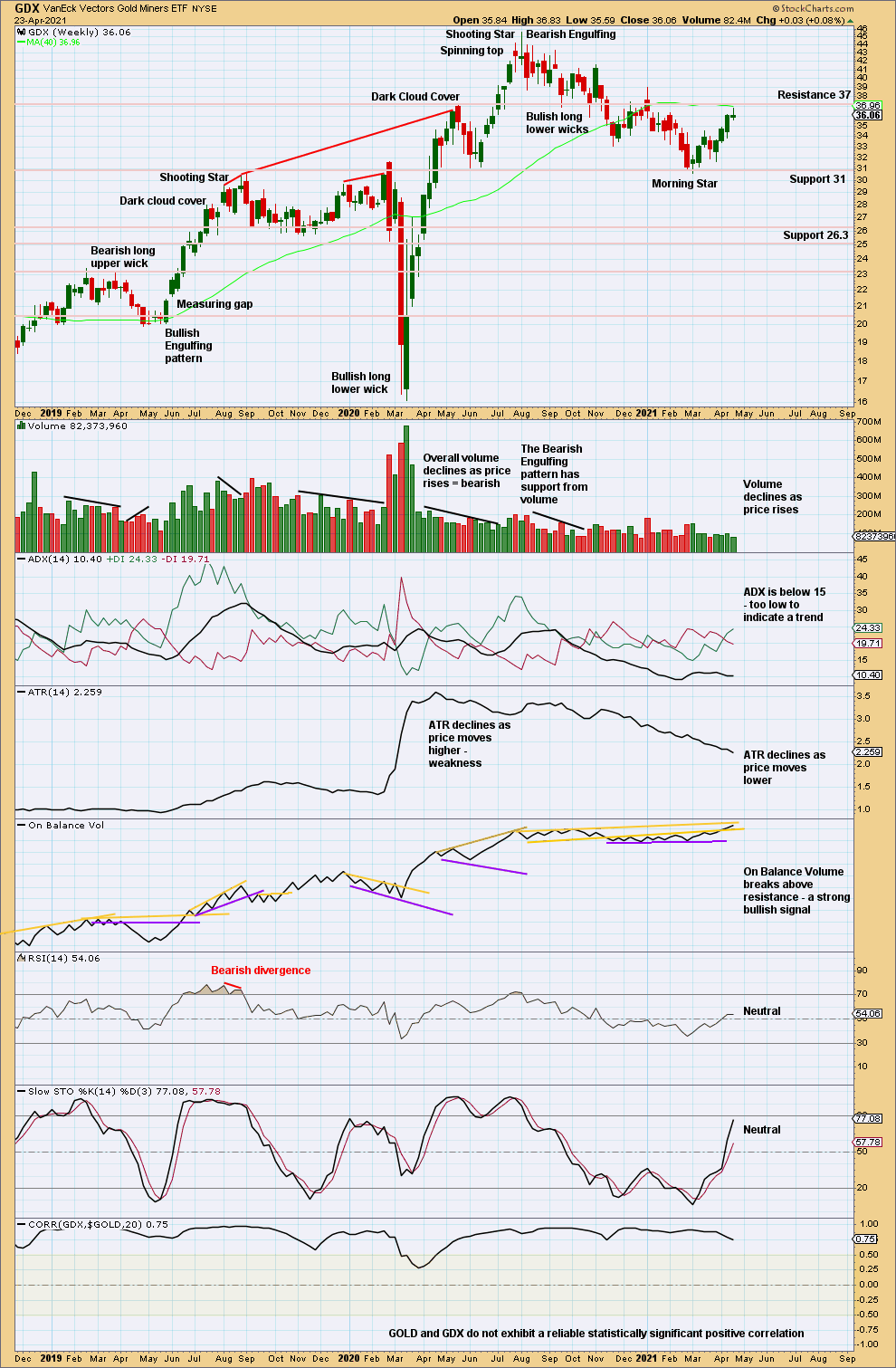

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

For confidence in a Morning Star reversal pattern the third candlestick should have support from volume. This one does not, so confidence may not be had in this pattern.

This may be the start of a new upwards trend, but so far volume does not well support upwards movement (which is concerning for a bullish case).

Resistance about 37 was almost reached last week.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

ADX no longer indicates a new upwards trend.

GDX still looks a little more clearly bearish than Gold.

Published @ 08:50 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.