GOLD: Elliott Wave and Technical Analysis | Charts – May 24, 2021

Summary: The main wave count is bullish. For the short term, a consolidation may continue sideways and end tomorrow. The longer-term target is at 2,094.

An alternate Elliott wave count is considered, but it has a low probability. It expects upwards movement to continue here to at least 1,920.42 and likely well above this point. The invalidation point for this alternate wave count is at 2,070.48.

Grand SuperCycle analysis and last monthly charts are here.

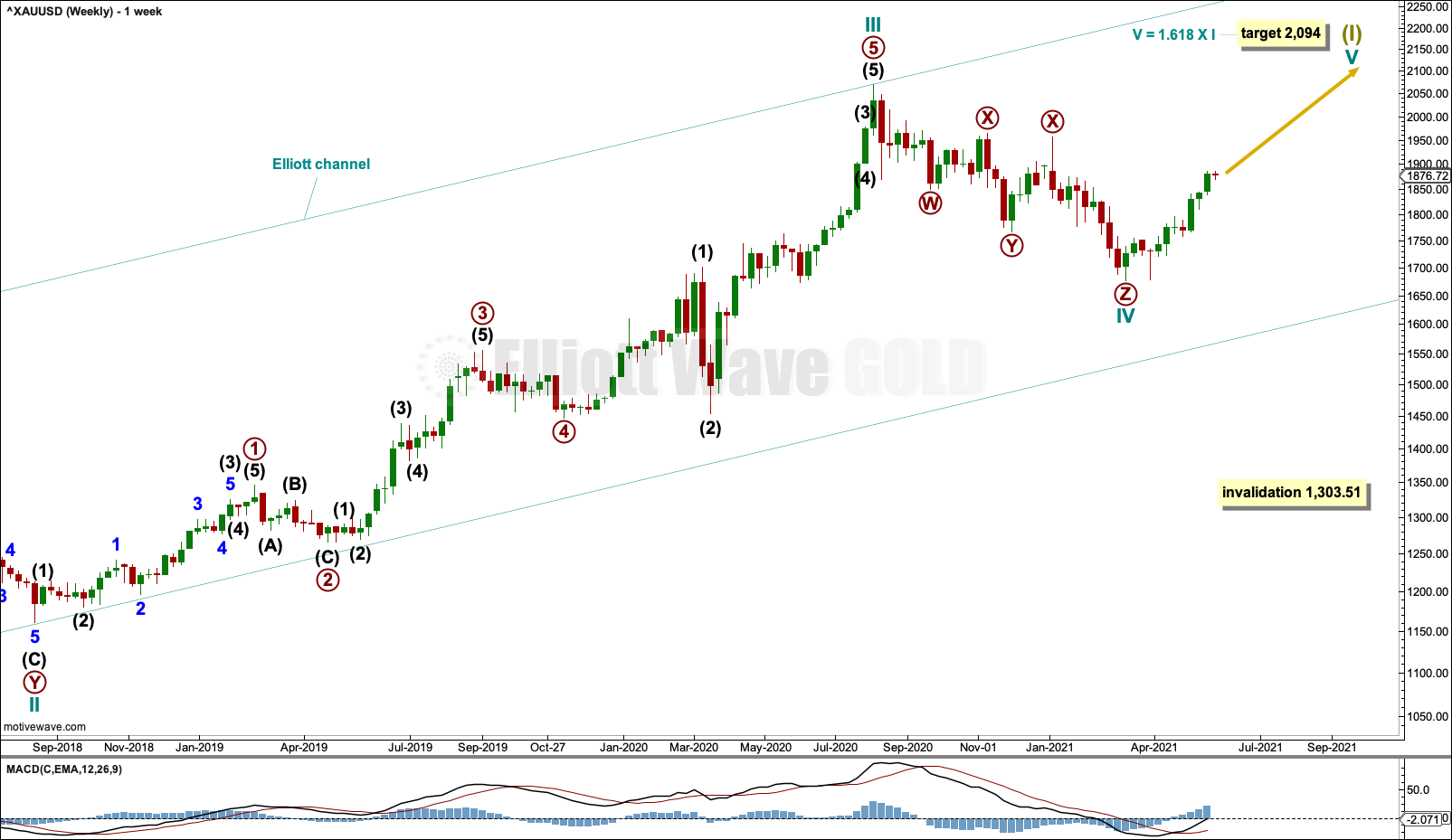

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the second weekly chart on prior analysis here). This movement must be labelled as a series of overlapping first and second waves. Ignoring this triangle reduces the probability of this wave count in Elliott wave terms.

Cycle wave IV may be a complete triple zigzag.

If the third zigzag of primary wave Z continues lower, then cycle wave IV may not move into cycle wave I price territory below 1,303.51.

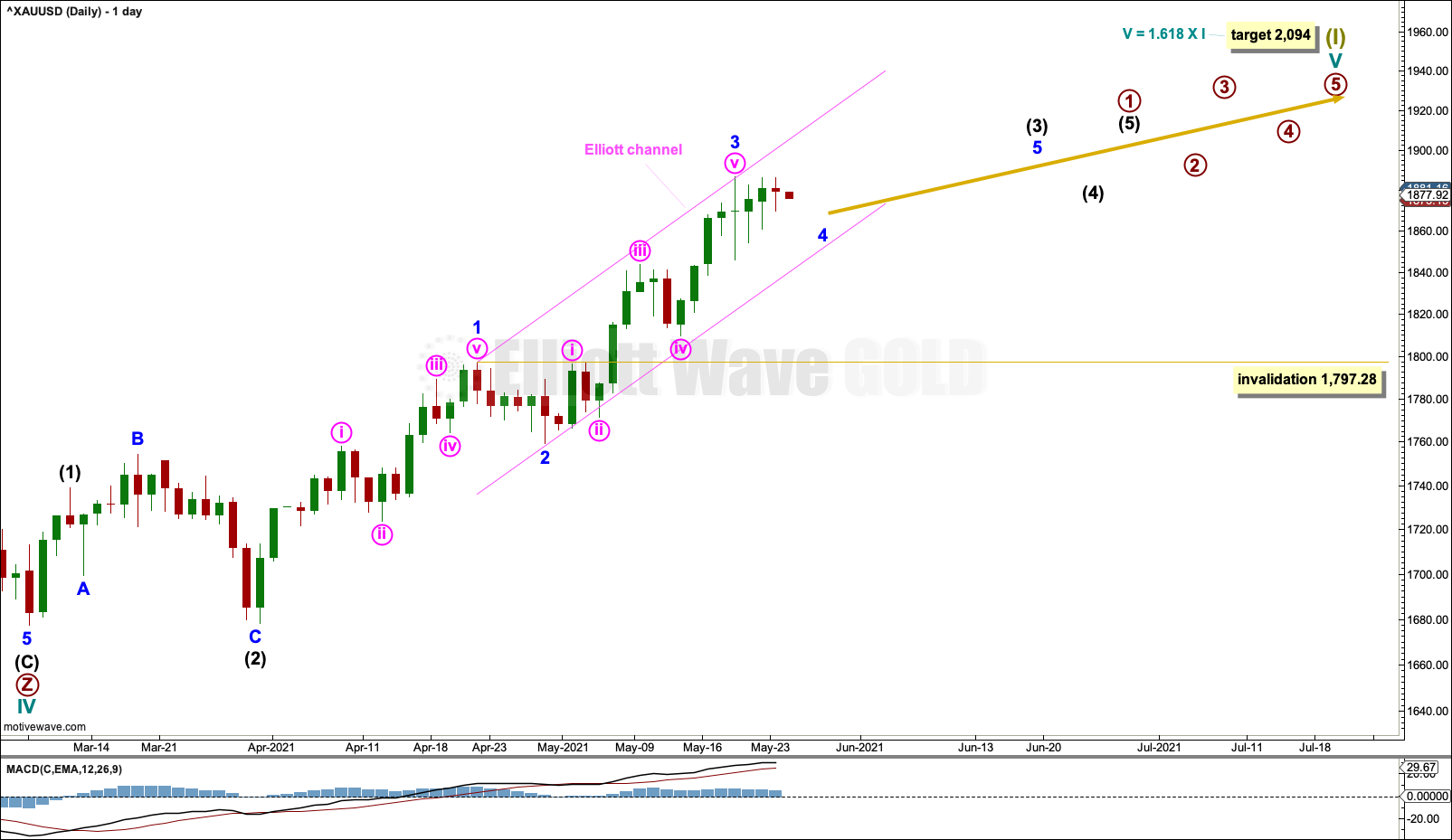

DAILY CHART

Cycle wave IV may be a complete triple zigzag.

A target is calculated for cycle wave V.

Primary wave 1 within cycle wave V may be incomplete.

Within primary wave 1: Intermediate waves (1) and (2) may be complete, and intermediate wave (3) may only subdivide as an impulse.

Today the degree of labelling within intermediate wave (3) is moved up one degree. Within intermediate wave (3): Minor waves 1 to 3 may be complete, and minor wave 4 may not move into minor wave 1 price territory below 1,797.28.

HOURLY CHART

Minor wave 4 may be an almost complete regular barrier triangle. Minute wave d within the triangle ends very close to the same level as minute wave b; the B-D trend line looks essentially flat.

Minute wave e of the triangle may not move beyond the end of minute wave c below 1,861.24. Minute wave e may most likely end a little short of the lower A-C trend line.

Minor wave 4 may still need to be relabelled. It may also still be continuing as a combination or flat.

Minor wave 4 still does not look complete. It may complete now in another one or two sessions. When it is complete, then the breakout is expected to be upwards.

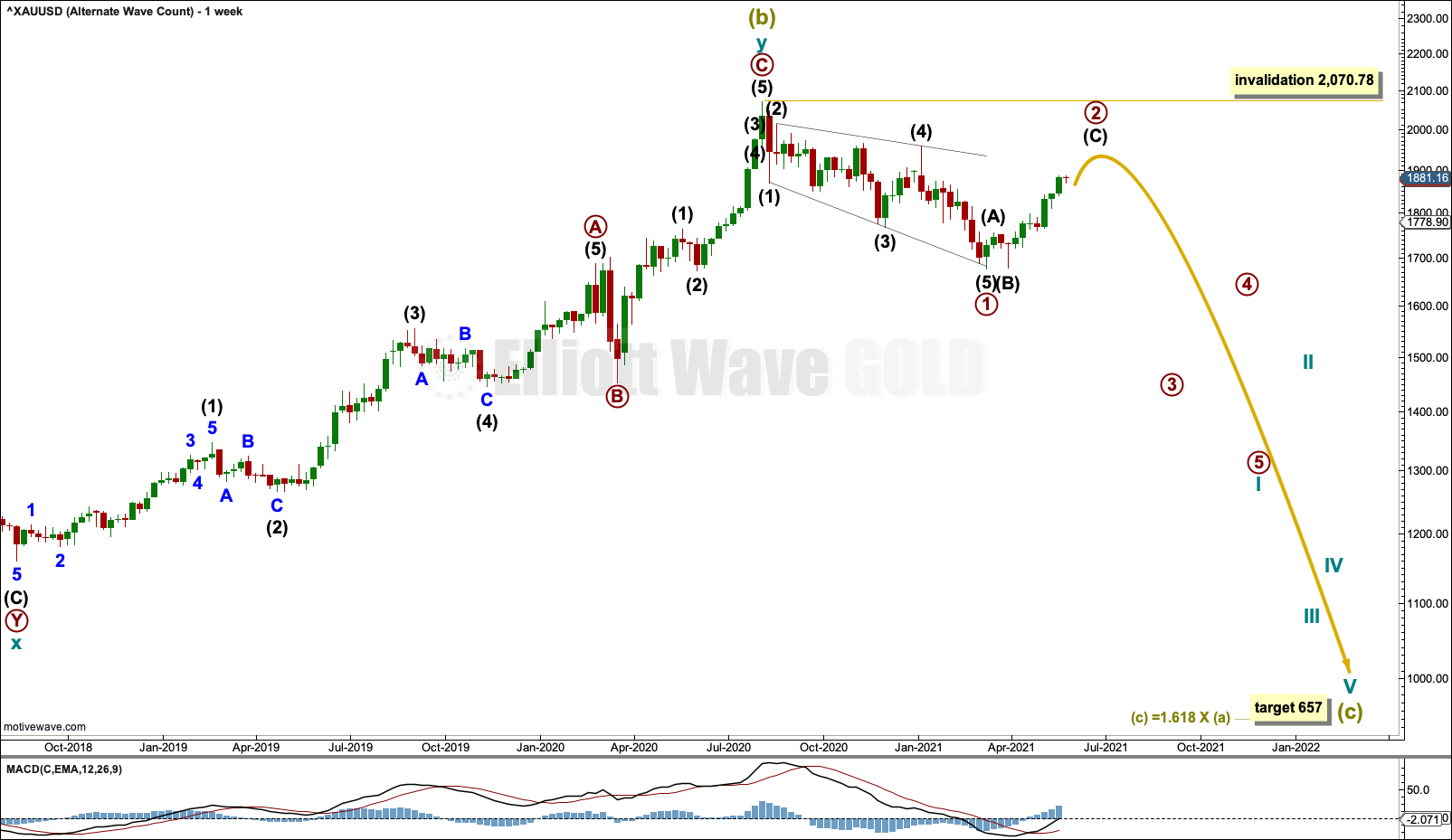

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

The bigger picture for this alternate Elliott wave count sees Gold as still within a bear market, in a three steps back pattern that is labelled Grand Super Cycle wave IV on monthly charts. Grand Super Cycle wave IV may be subdividing as an expanded flat pattern.

Super Cycle wave (b) within Grand Super Cycle wave IV may be a complete double zigzag. This wave count expects Super Cycle wave (c) to move price below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation and a very rare running flat. The target calculated expects a common Fibonacci ratio for Super Cycle wave (c).

Super Cycle wave (c) may have begun with a leading expanding diagonal for primary wave 1. Leading expanding diagonals in first wave positions are uncommon, so the probability of this wave count is low. However, it has a good fit and must be considered.

Second wave corrections to follow leading diagonals in first wave positions are usually very deep. Primary wave 2 may be expected to end at least about the 0.618 Fibonacci ratio at 1,920.42, and more likely a reasonable amount deeper than that. Primary wave 2 may not move beyond the start of primary wave 1 above 2,070.78.

DAILY CHART

Intermediate wave (C) may be subdividing as an impulse. Minor wave 4 within intermediate wave (C) may not move into minor wave 1 price territory below 1,757.92.

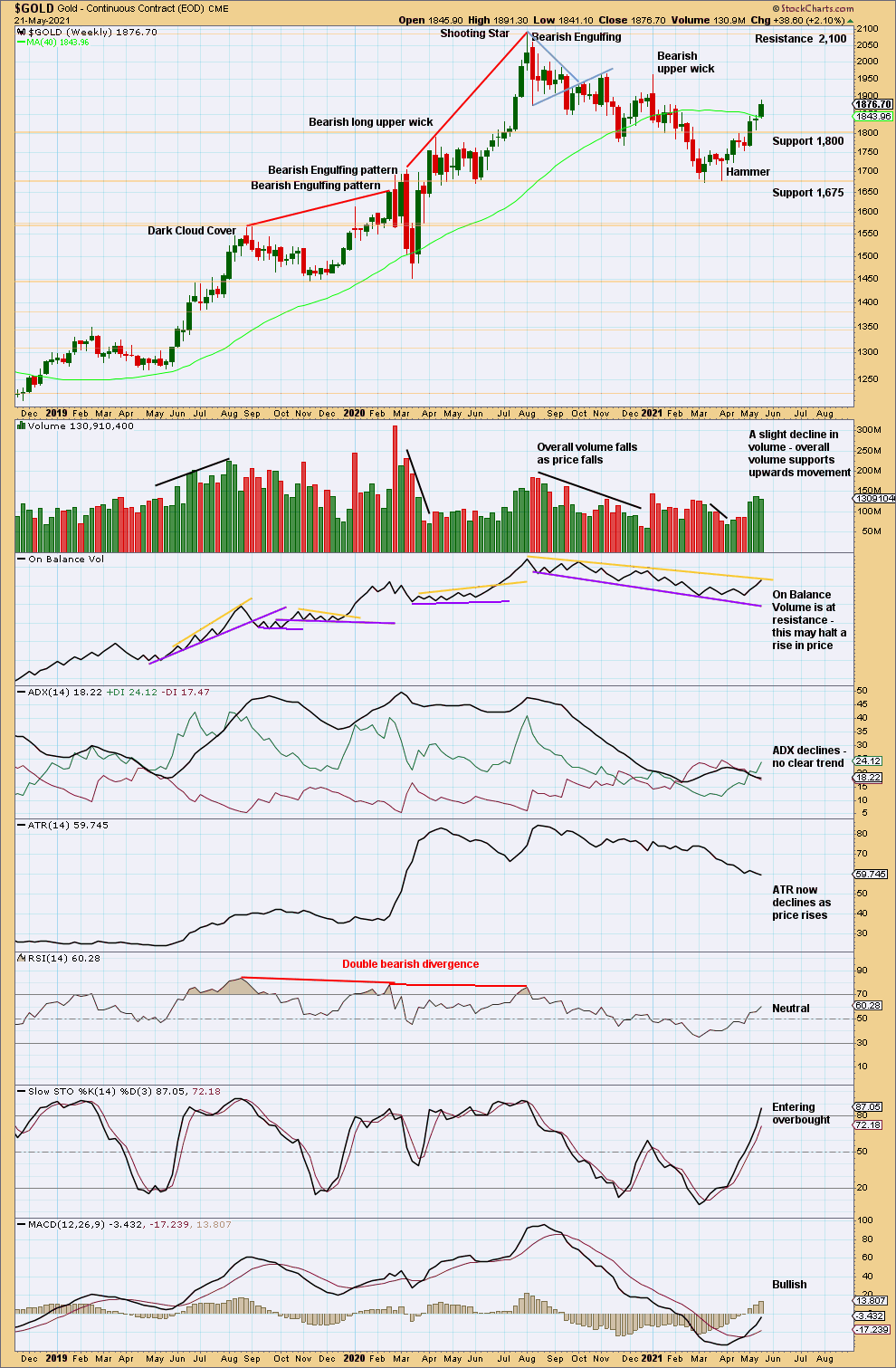

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed above prior resistance at 1,800 with strong support from volume. The +DX line has crossed above the -DX line, indicating a potential trend change to upwards, but with ADX declining no clear trend is indicated.

Volume last week shows a slight decline as price moves higher, but overall remains relatively heavy. There is no bearish reversal pattern.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The upwards trend is now extreme and RSI is oversold. However, when Gold has a strong trend, these indicators may reach very extreme while price travels a considerable distance.

Sideways movement of the last few sessions looks like a small consolidation within an ongoing upwards trend.

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Next resistance is at 45.55.

Upwards movement continues. If there is an upwards trend, then the trend would be in its very early stages; there is plenty of room for it to continue.

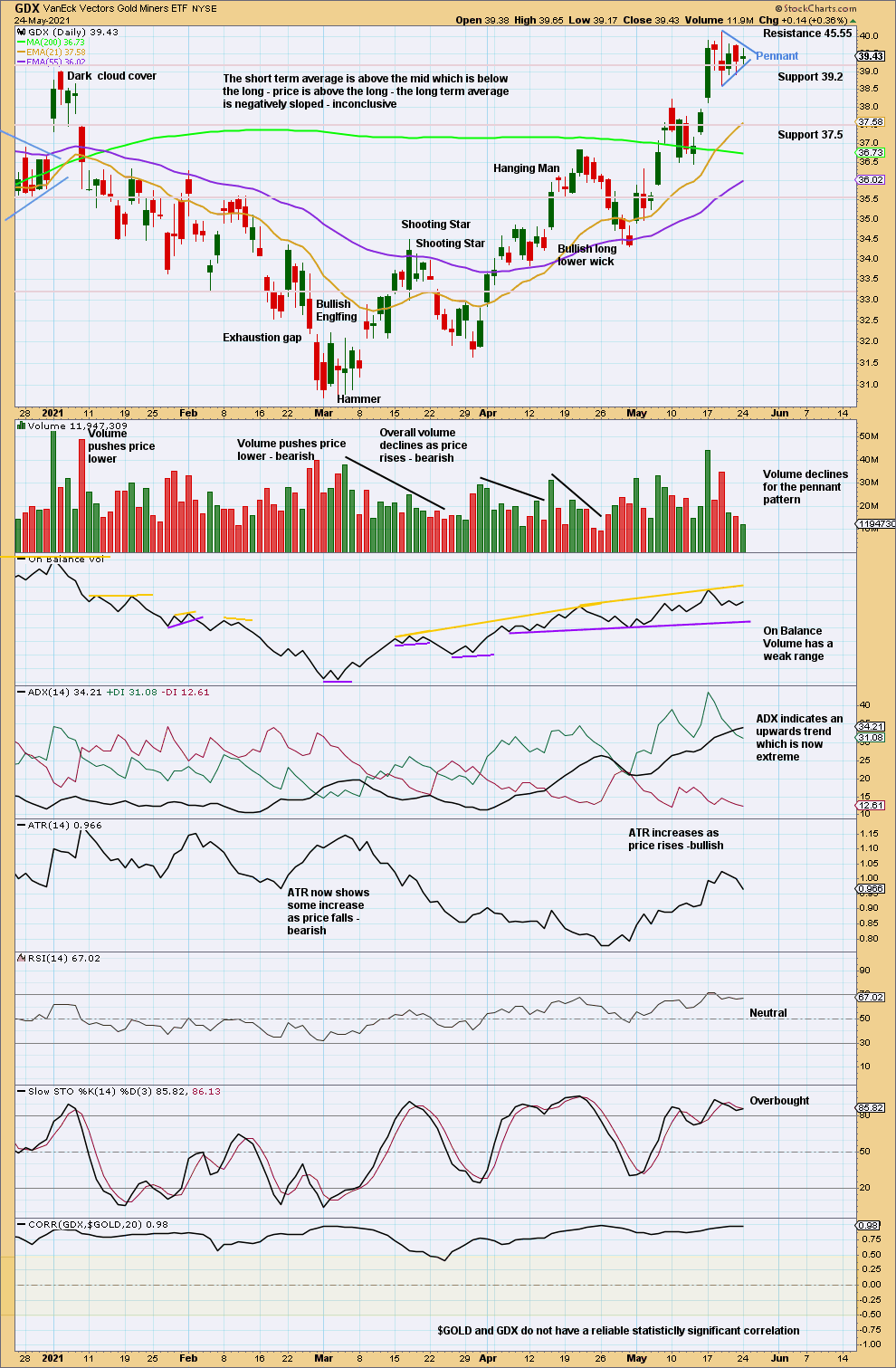

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The trend is up. Next strong resistance is about 45.55.

A small pennant pattern may be forming. If price breaks out upwards on a day with support from volume, the target from the flag pole would be calculated at 43.35.

Published @ 08:21 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.