GOLD: Elliott Wave and Technical Analysis | Charts – August 9, 2021

Price has stopped just short of the invalidation point for the main Elliott wave count, so both Elliott wave counts remain valid.

Summary: Today the wave counts are renamed simply “bullish” and “bearish”. The bearish wave count is preferred but both remain valid. The bearish wave count expects a short-term target at 1,667 before a bounce. The mid-term target is at 1,568.

The bullish wave count now expects the bull market to resume to a target at 2,078.

The price point which differentiates the two wave counts at this stage is 1,677.64. A new low below this point would add strong confidence in the bearish wave count.

Grand SuperCycle analysis and last monthly charts are here.

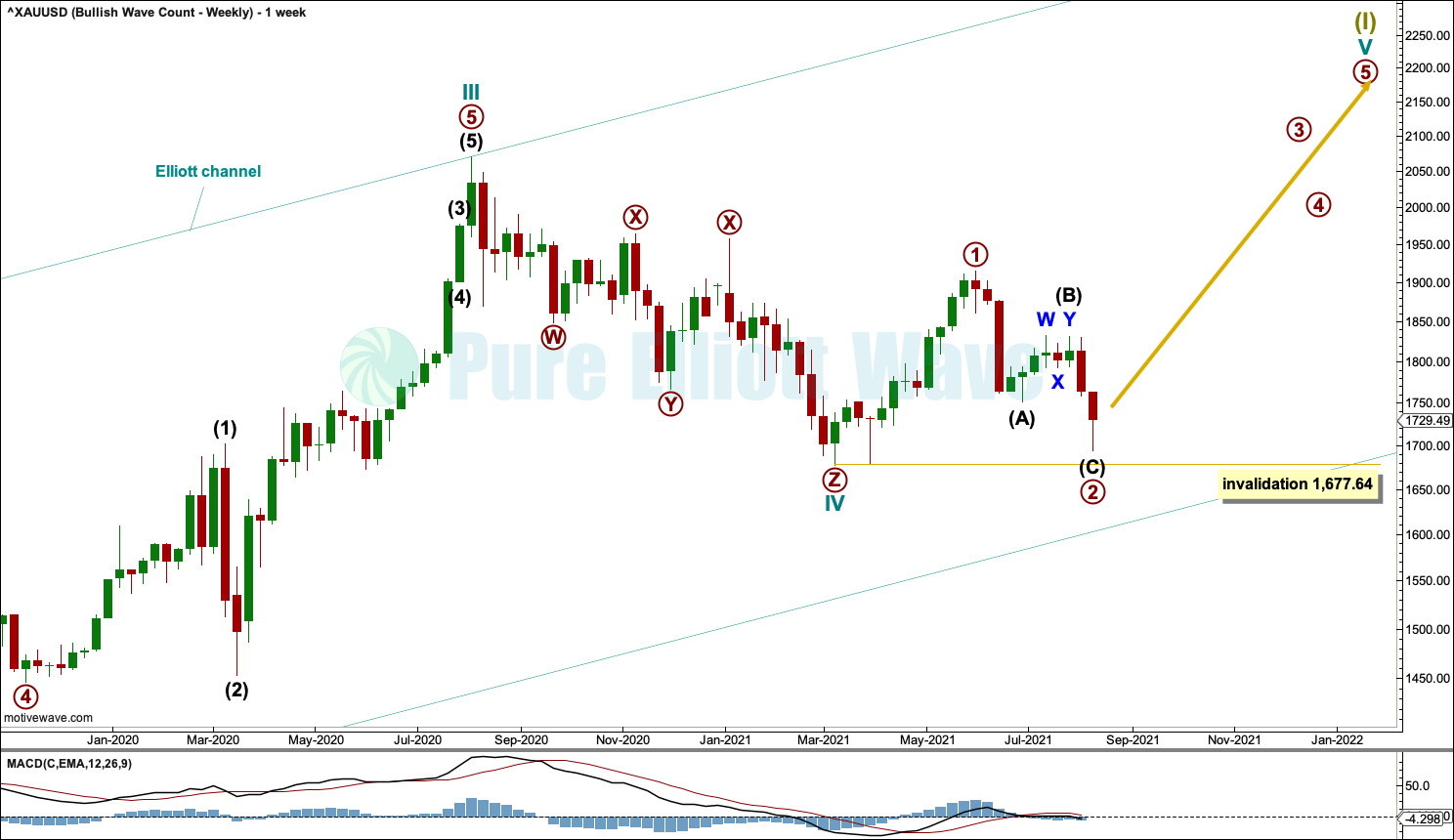

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart.

Cycle wave I fits as a five wave impulse with reasonably proportionate corrections for primary waves 2 and 4.

Cycle wave II fits as a double flat. However, within the first flat correction labelled primary wave W, this wave count needs to ignore what looks like an obvious triangle from July to September 2016 (this can be seen labelled as a triangle on the second weekly chart on prior analysis here). This movement must be labelled as a series of overlapping first and second waves. Ignoring this triangle reduces the probability of this wave count in Elliott wave terms.

Double flats are fairly rare structures. The probability of this wave count is further reduced.

Cycle wave IV may be a complete triple zigzag. Triple zigzags are not rare structures, but they are not common. The probability of this wave count is further reduced in Elliott wave terms. This is one reason why an alternate is still considered.

Cycle wave V may have begun. Within cycle wave V: Primary waves 1 and 2 may now both be over, and primary wave 3 may have just begun. If it continues any lower, then primary wave 2 may not move beyond the start of primary wave 1 below 1,677.64.

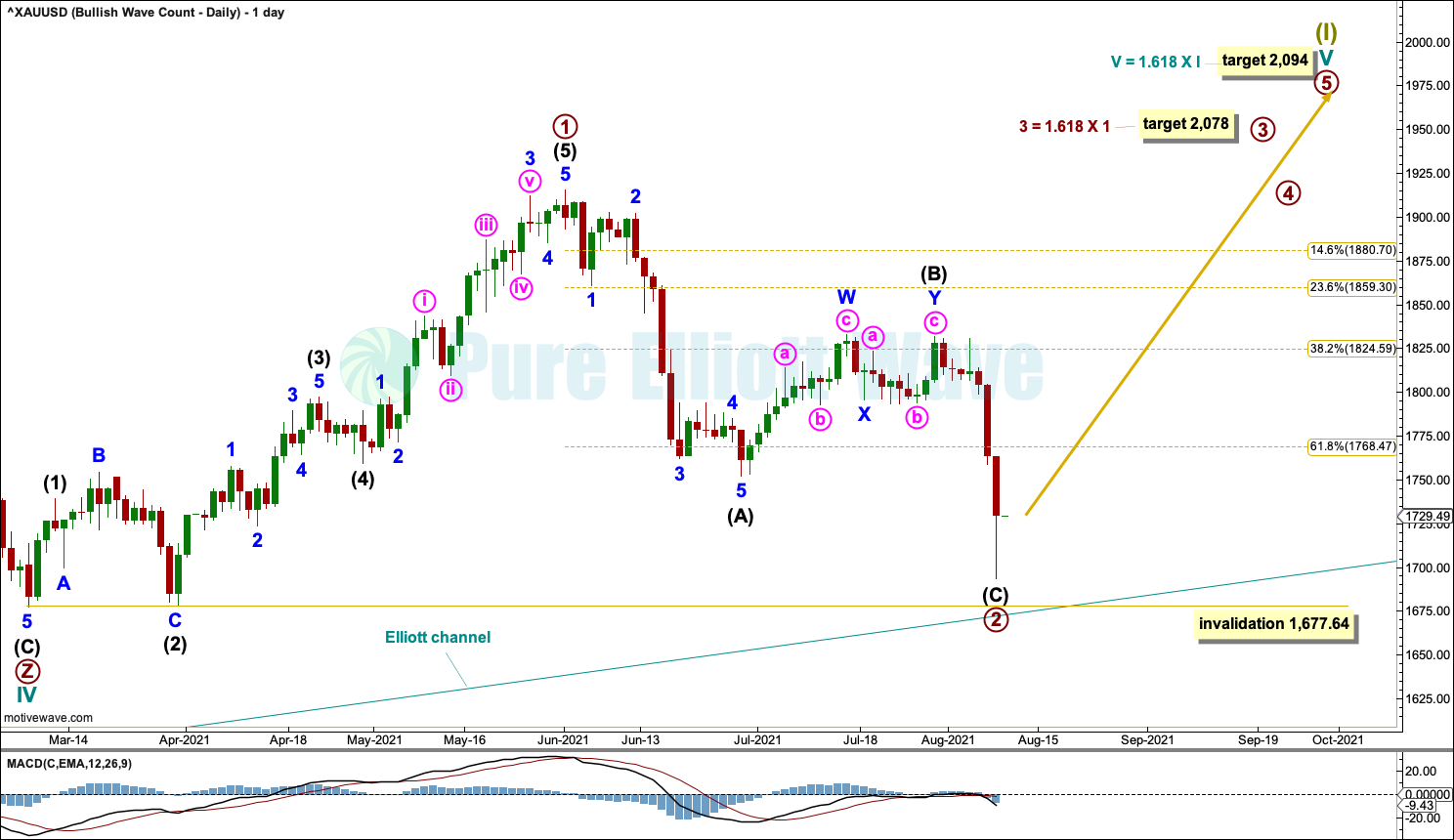

DAILY CHART

A target is calculated for cycle wave V. If this target is wrong for this wave count, then it may be too low. As price approaches the target, if the structure is incomplete, then a higher target may be calculated.

Primary waves 1 and 2 within cycle wave V may be complete.

A target is calculated for primary wave 3. Primary wave 3 should exhibit an increase in upwards momentum and have support from volume.

HOURLY CHART

Primary wave 2 may now be complete. It is possible that primary wave 2 may require one final low though before it is done. The invalidation point is left at the start of primary wave 1 to acknowledge this risk.

A new high above 1,806.56 would provide short-term invalidation of the hourly bearish wave count below and provide some confidence in this bullish wave count.

Primary wave 3 may only subdivide as an impulse.

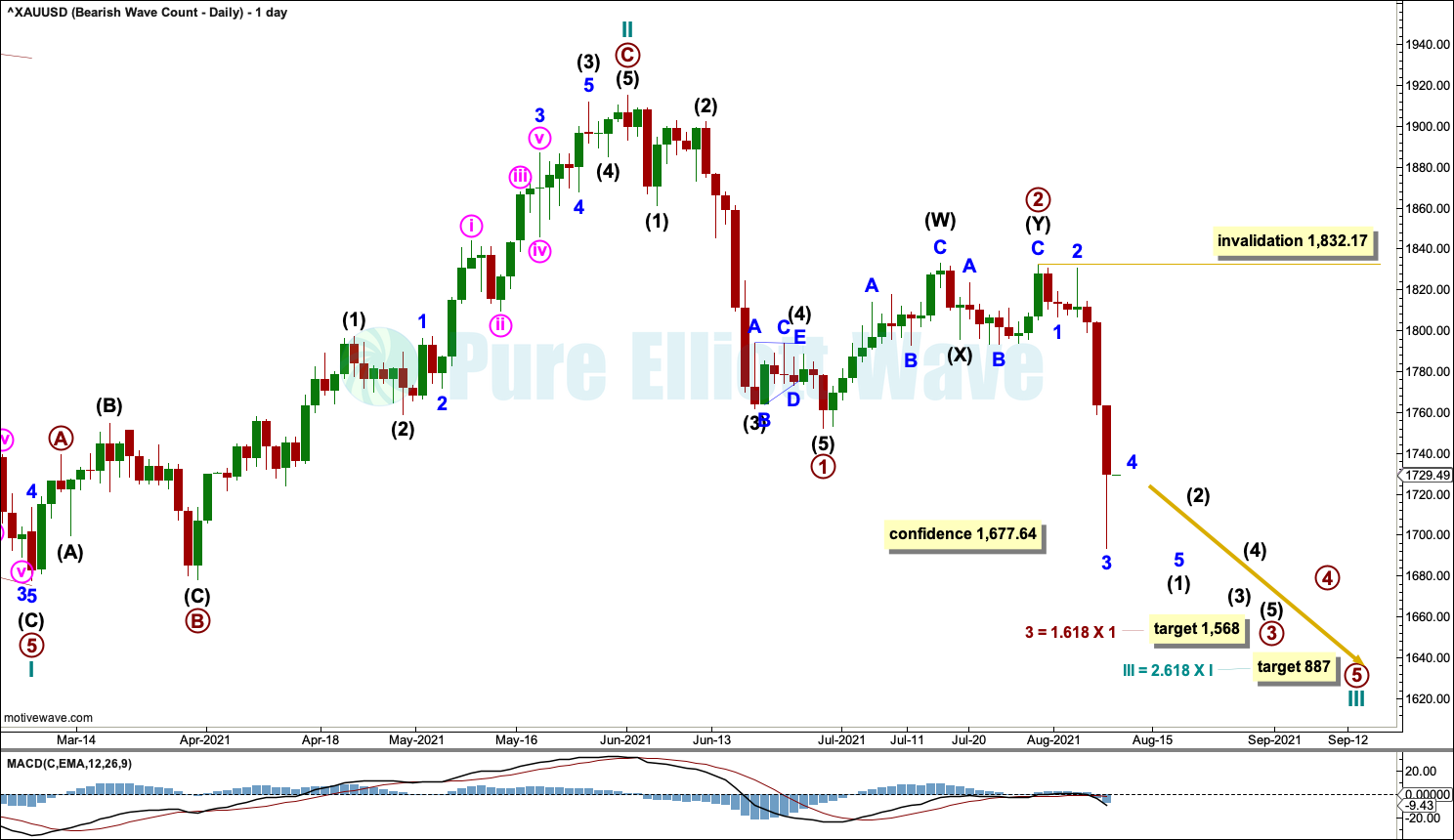

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

The bigger picture for this alternate Elliott wave count sees Gold as within a bear market, in a three steps back pattern that is labelled Grand Super Cycle wave IV on monthly charts. Grand Super Cycle wave IV may be subdividing as an expanded flat pattern.

Super Cycle wave (b) within Grand Super Cycle wave IV may be a complete double zigzag. This wave count expects Super Cycle wave (c) to move price below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation and a very rare running flat. The target calculated expects a common Fibonacci ratio for Super Cycle wave (c).

Super Cycle wave (c) may have begun with a leading expanding diagonal for cycle wave I. Leading expanding diagonals in first wave positions are uncommon, so the probability of this wave count is reduced. However, it has a good fit and must be considered.

Second wave corrections to follow leading diagonals in first wave positions are usually very deep. Cycle wave II is deep and the structure may be complete; so far it is following a common pattern. If it continues higher, then cycle wave II may not move beyond the start of cycle wave I above 2,070.78.

DAILY CHART

A target is calculated for cycle wave III.

Primary wave 2 may be a complete double combination. Primary wave 3 downwards may have just begun. Primary wave 3 has now moved beyond the end of primary wave 1 at 1,752.19, meeting this core Elliott wave rule.

No second wave correction within primary wave 3 may move beyond its start above 1,832.17.

At 1,568 primary wave 3 would reach 1.618 the length of primary wave 1.

Gold often exhibits swift strong fifth waves, particularly fifth waves to end third wave impulses one degree higher. Any one or more of minute wave v to end minor wave 3, minor wave 5 to end intermediate wave (3), or intermediate wave (5) to end primary wave 3, may exhibit this tendency and may end with selling climaxes. Primary wave 3 may last a few months.

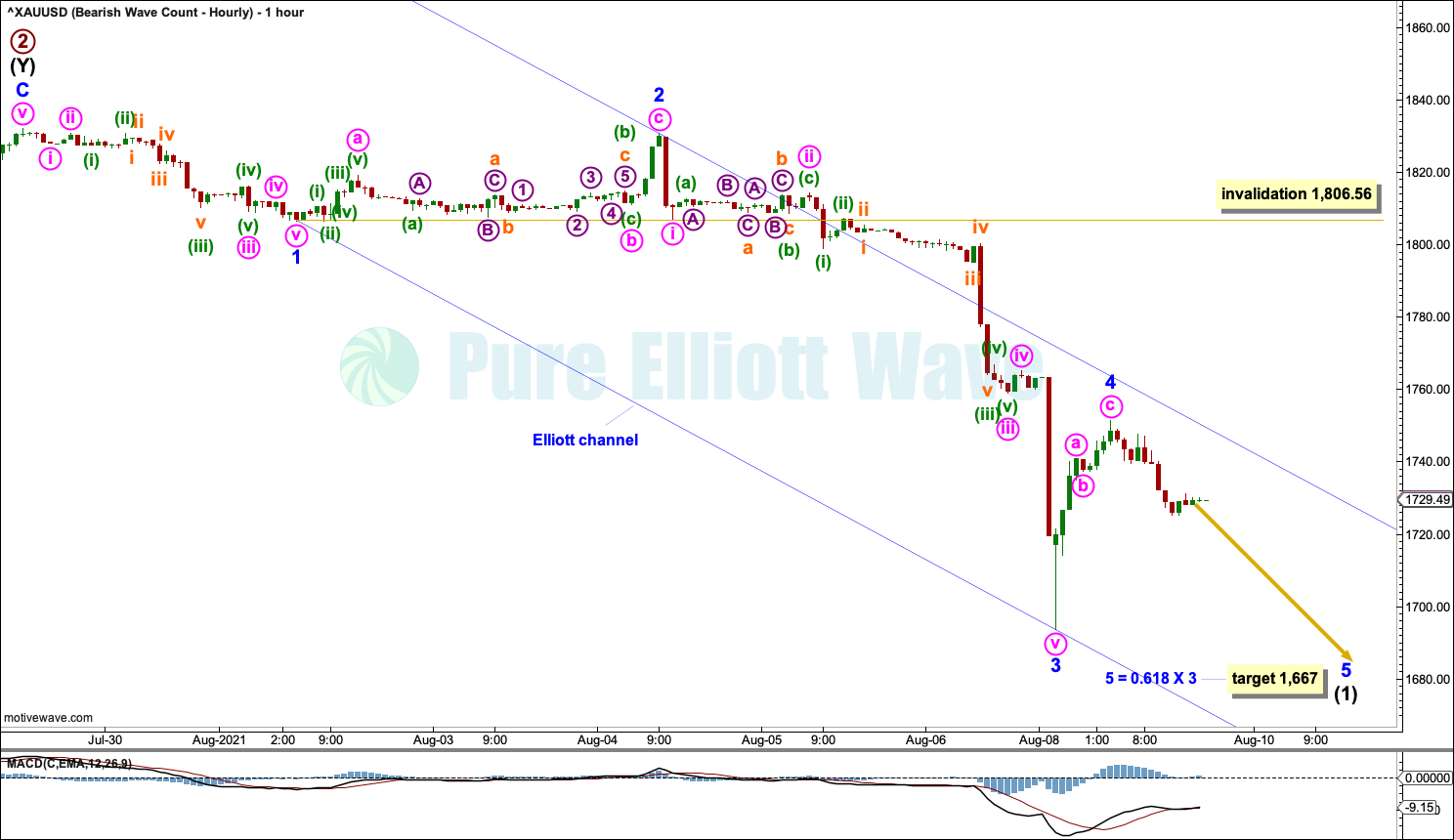

HOURLY CHART

The degree of labelling within primary wave 3 is today moved back down one degree.

Primary wave 3 may only subdivide as an impulse. Intermediate wave (1) within the impulse of primary wave 3 may be incomplete.

Minor waves 1, 2 and 3 within intermediate wave (1) may be complete. Minor wave 4 may not move into minor wave 1 price territory above 1,806.56.

Draw an Elliott channel about intermediate wave (1) using Elliott’s first technique. Draw the first trend line from the ends of minor waves 1 to 3, then place a parallel copy on the end of minor wave 2. Minor wave 4 may have ended near resistance at the upper edge of this channel; if it continues further, then minor wave 4 may end closer to the channel. Minor wave 5 may end either mid way within the channel or about the lower edge. When the channel is breached by subsequent upwards movement, it may then indicate intermediate wave (1) as over and intermediate wave (2) as begun.

TECHNICAL ANALYSIS

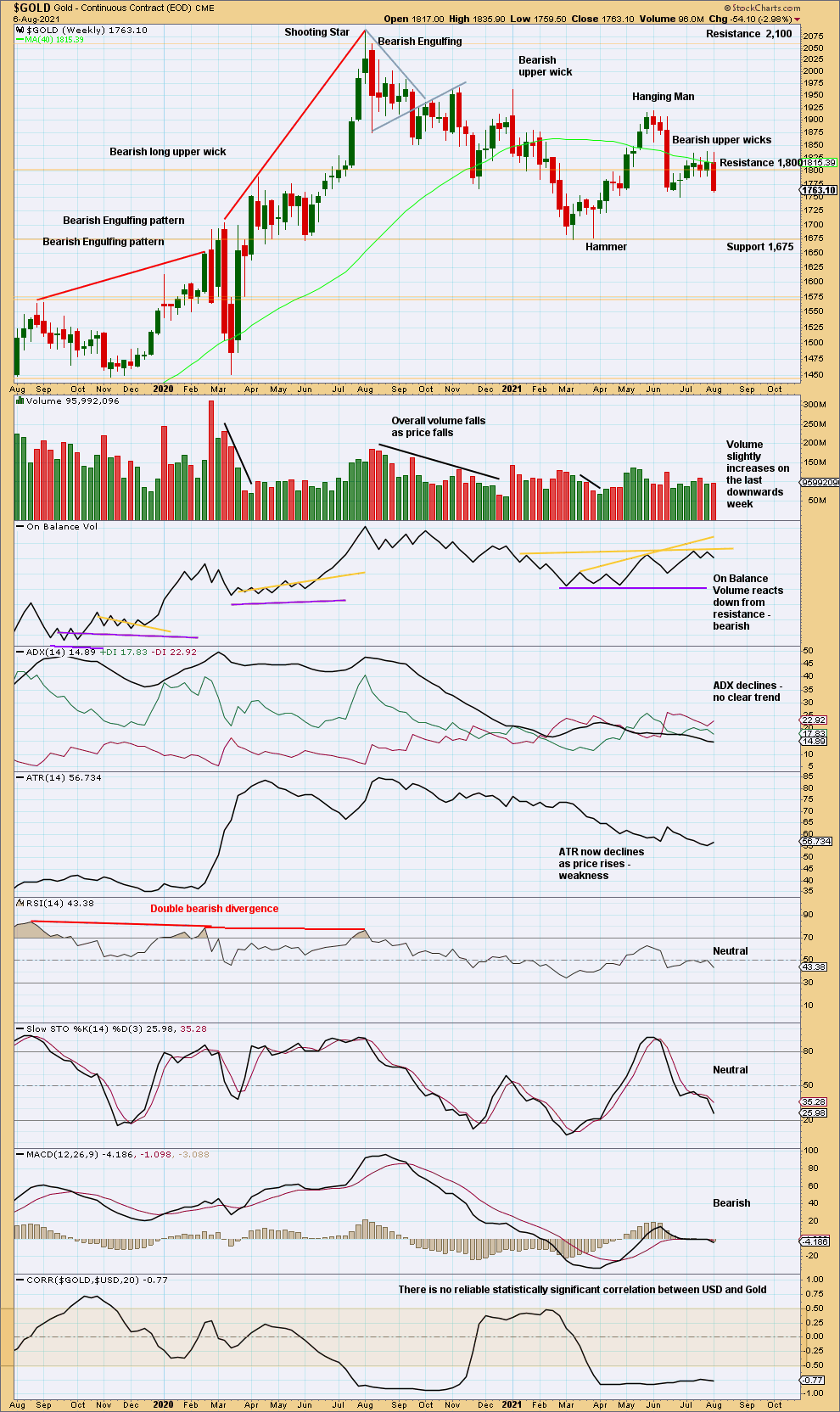

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price last week has convincingly broken below support at 1,800. Stochastics is not yet oversold, so there is room for price to fall further here. Next short-term support is at 1,750 and below that 1,675.

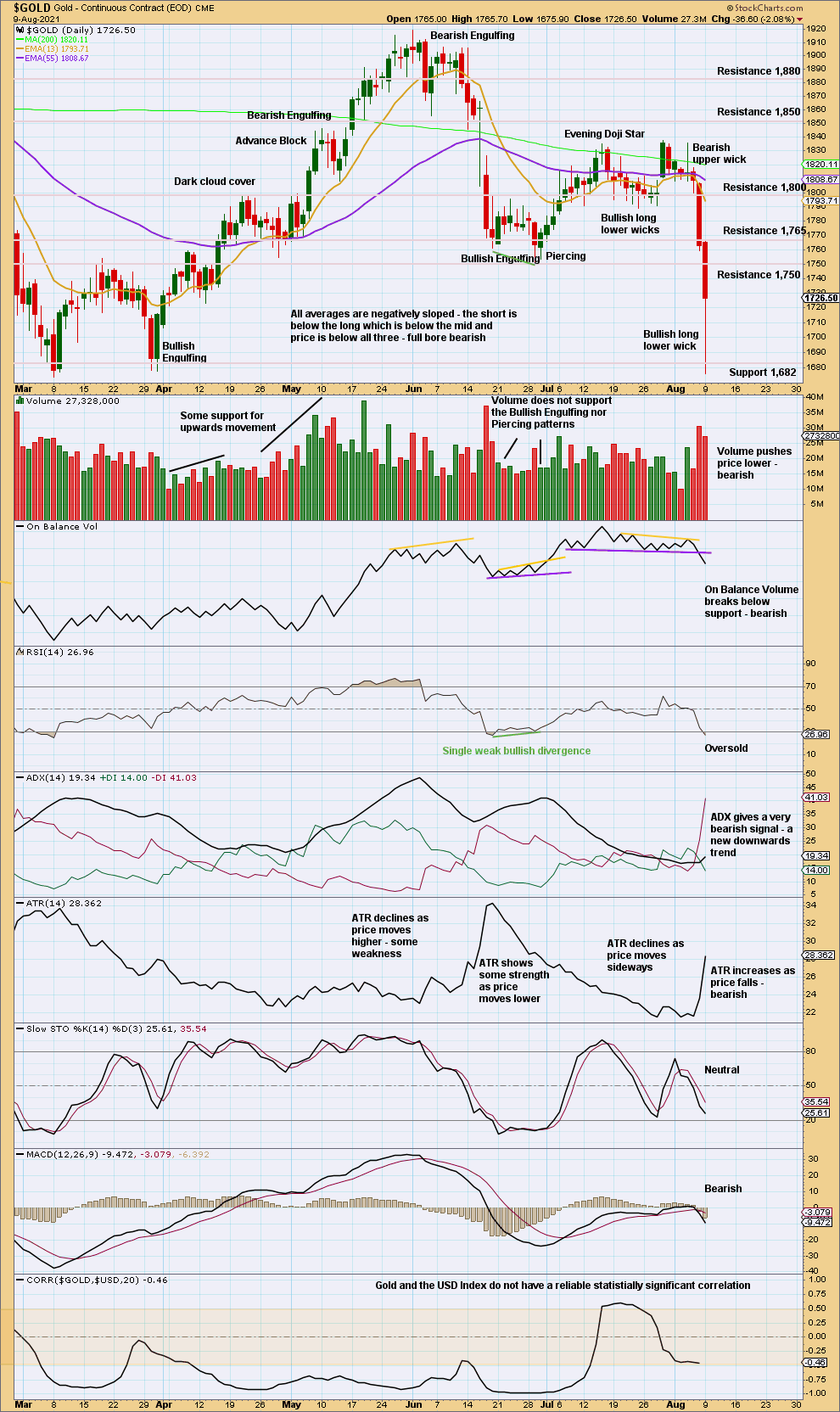

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

RSI has just now reached oversold. RSI can reach more deeply oversold and remain so for several days when this market has a strong trend. There is not yet any bullish divergence to indicate the downwards trend is weakening. ADX is very bearish; there is a long way to go before this new downwards trend may become extreme.

For the short term, a bullish long lower wick suggests a bounce. This looks most likely to be a counter trend bounce within an ongoing downwards trend. This supports the bearish Elliott wave count.

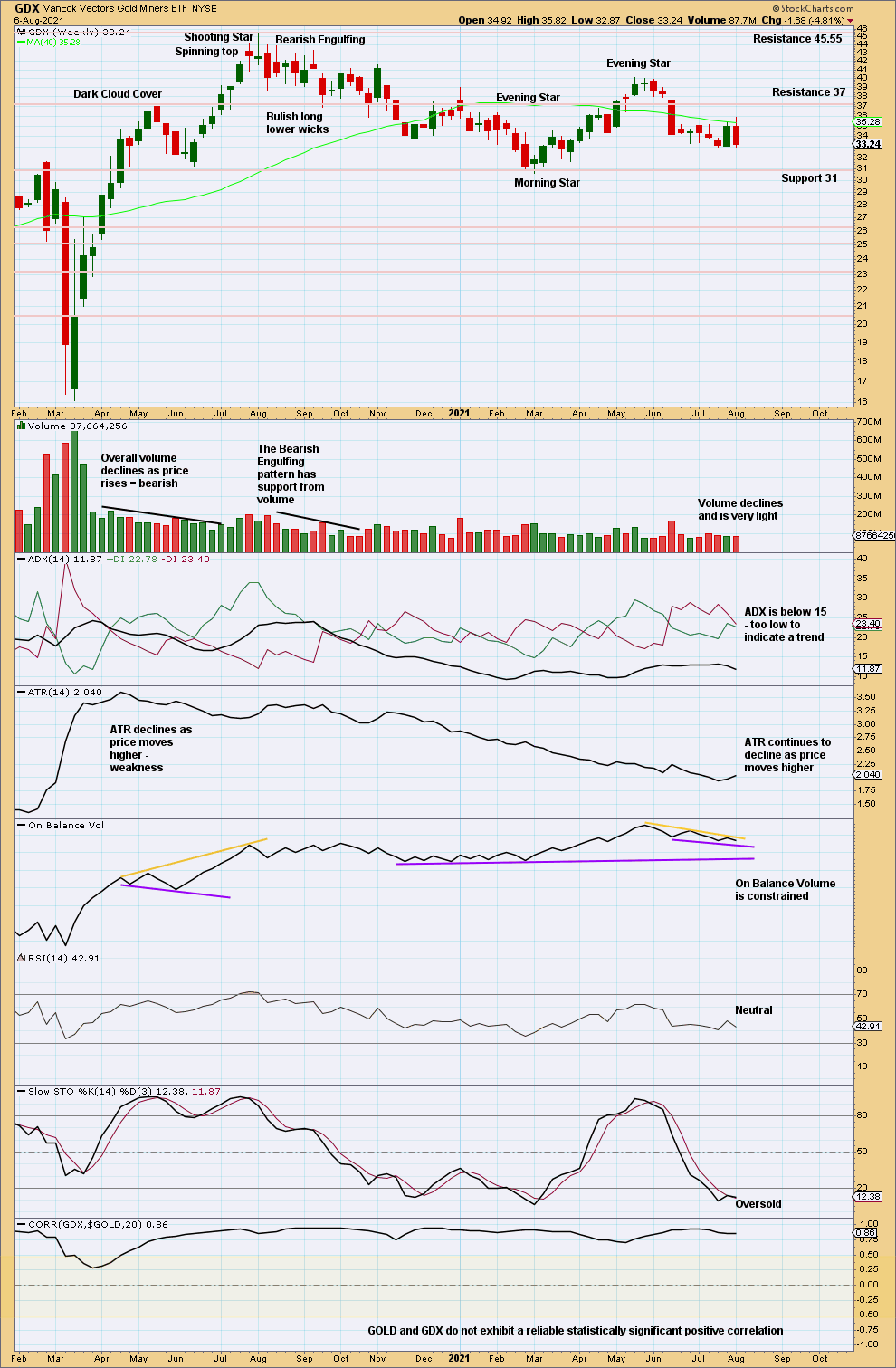

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is still no clear trend at this time frame. Price is range bound.

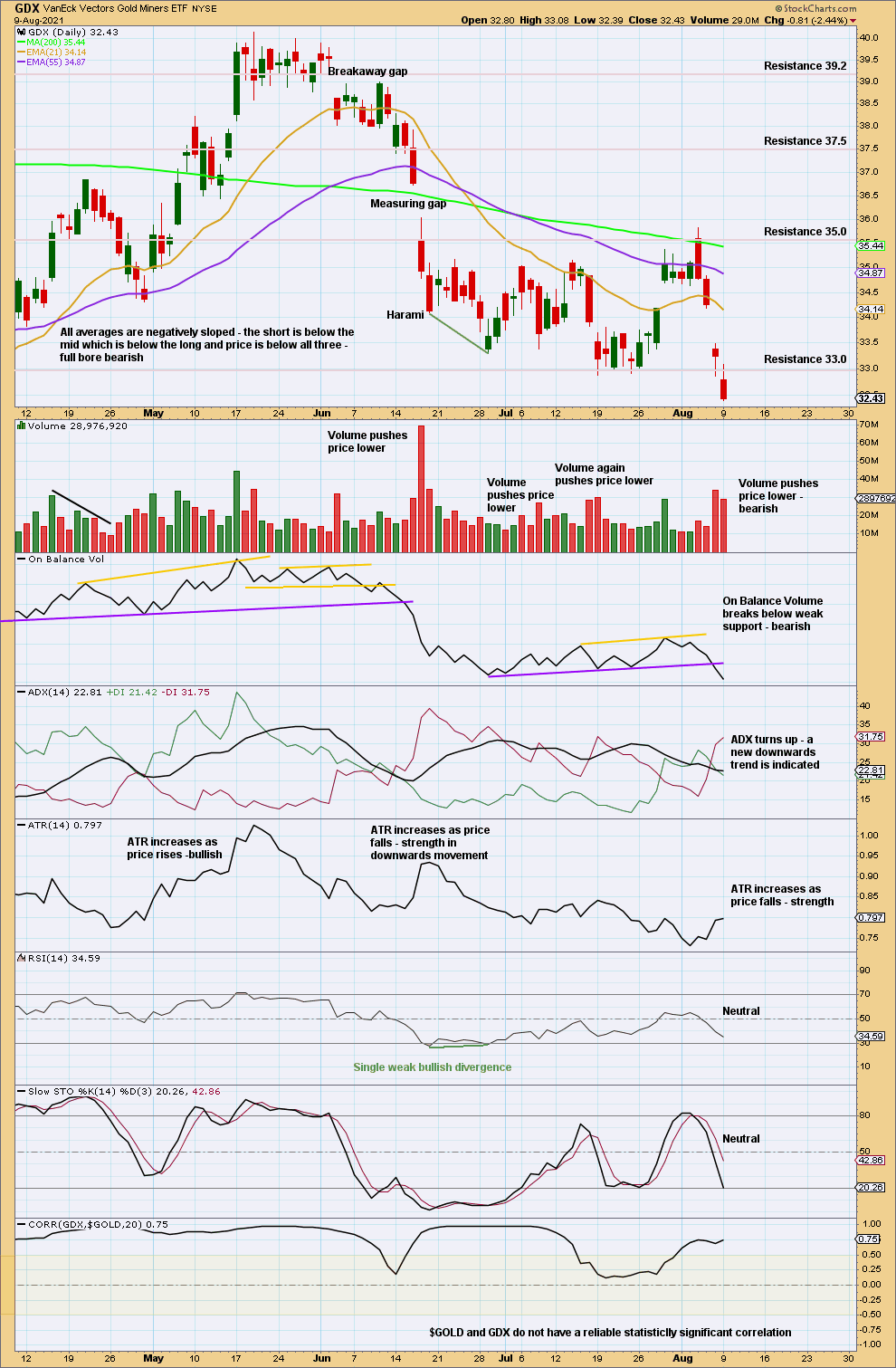

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Today price has closed below support. Volume is still overall pushing price lower. A new downwards trend is indicated. This chart is overall fairly bearish. Next support below is about 31.

Published @ 06:14 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—