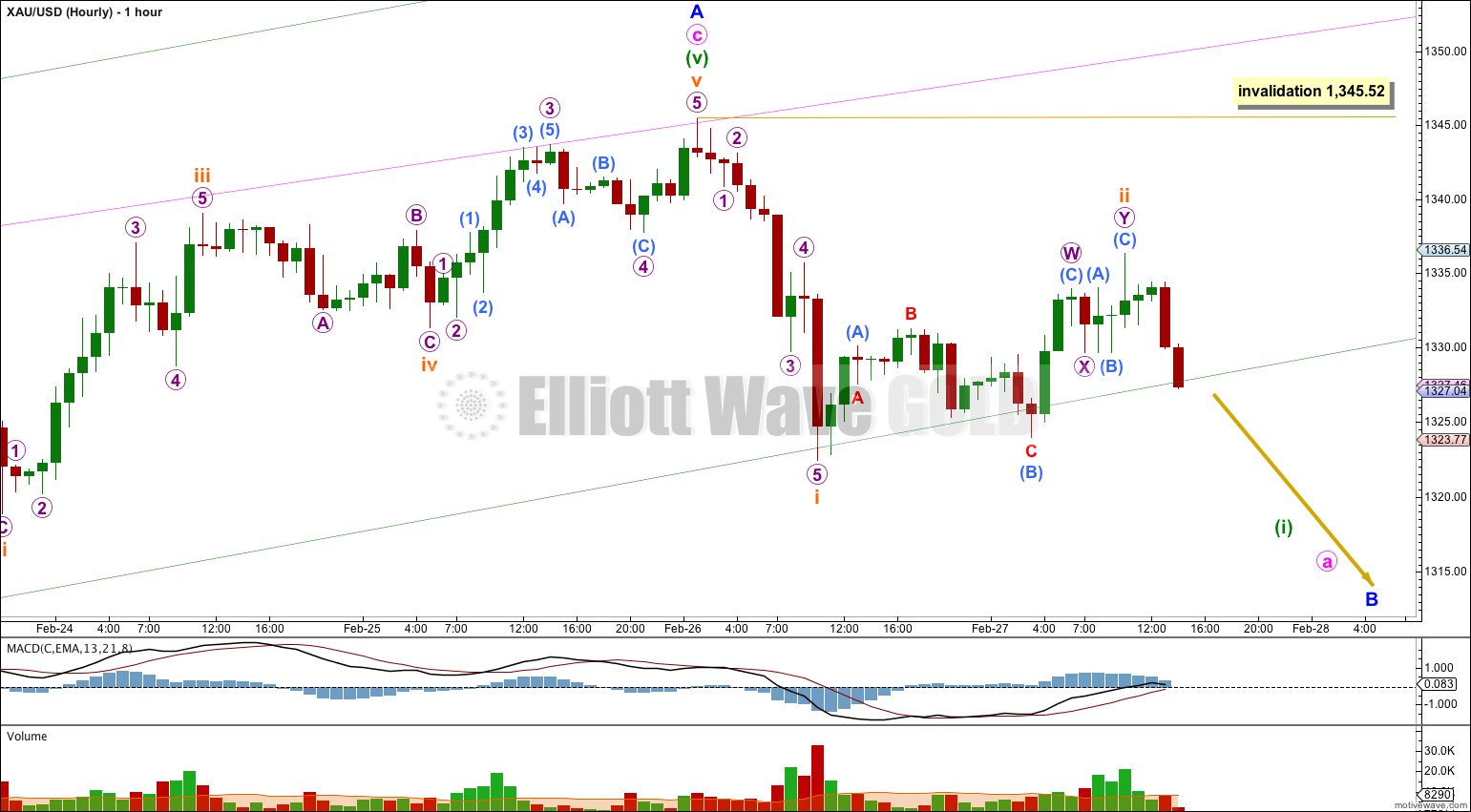

Yesterday’s analysis expected overall downwards movement. A small second wave correction on the main hourly chart was assumed to be incomplete, and price moved higher to complete this. Price thereafter turned lower to create a small red candlestick for the day.

It is vital that the green trend channel on the daily and hourly chart is clearly breached. Only after a channel breach will I have confidence in a trend change at minor degree. We may get that breach within the next few hours.

Summary: Overall I expect downwards movement from here for about 40 days. It may be very choppy and overlapping, or it may be a steep zigzag down. For the short term price should continue lower.

This analysis is published about 02:45 p.m. EST. Click on charts to enlarge.

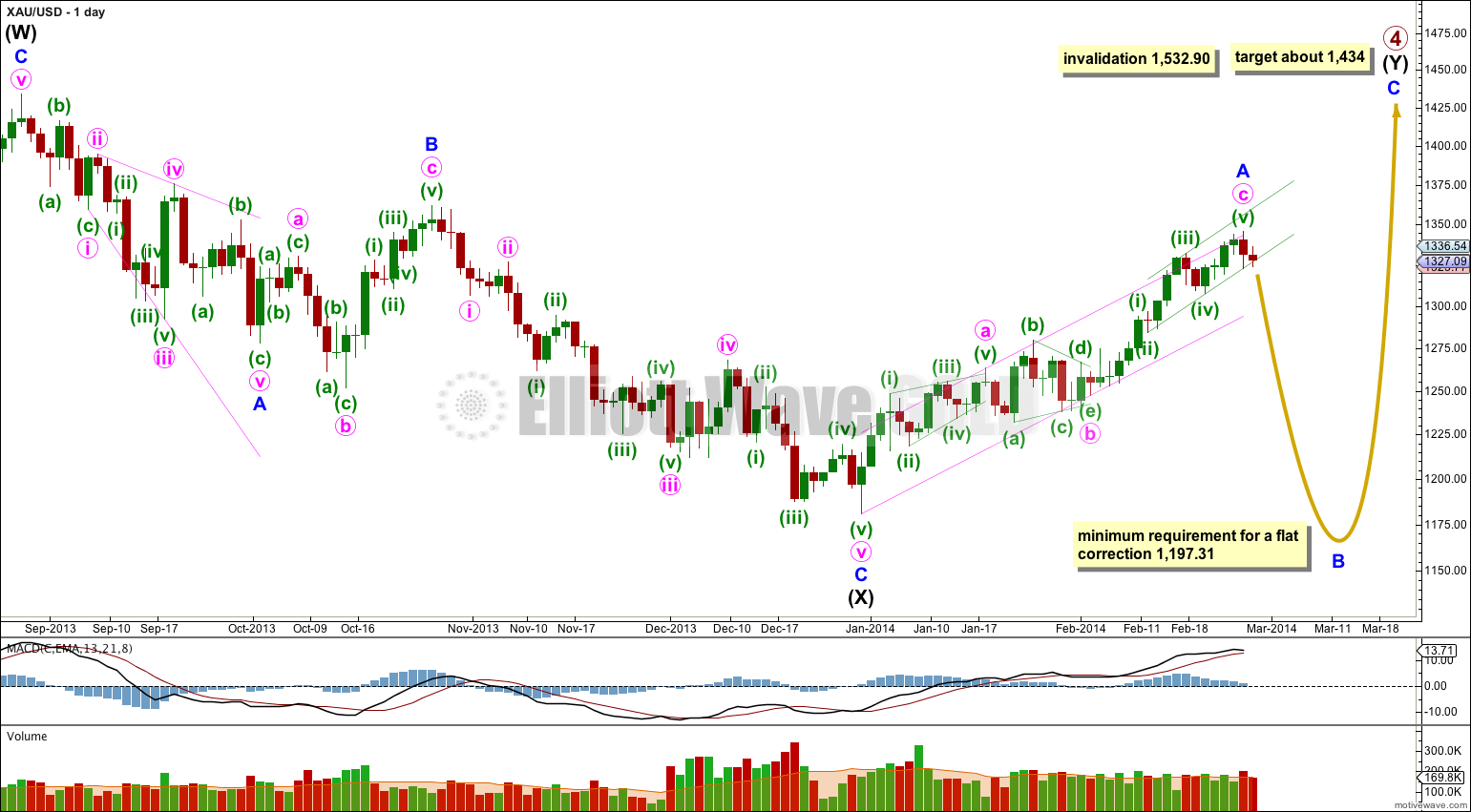

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled here intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three, and is most likely to be a zigzag.

Minor wave A may now again be a complete zigzag. When the pink channel drawn about it is clearly breached by a full daily candlestick below and not touching the lower trend line then we will have final trend channel confirmation of this trend change. While price remains within the channel we must accept the possibility that my analysis is wrong and we could see new highs.

There are more than thirteen possible corrective structures that minor wave B may take. Some of those possibilities, such as expanded flats or running triangles, may see an upwards correction within minor wave B which makes a new high above 1,345.52. Minor wave B may be a steep sharp zigzag downwards, or it may be a very choppy overlapping movement. When the first wave for minute wave a within it is complete then I can narrow down the possibilities for you.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Main Hourly Wave Count.

I have drawn the green channel about minute wave c using Elliott’s second technique. Draw the first trend line from the lows of minuette waves (ii) to (iv) then place a parallel copy higher up on the high of minuette wave (iii). The lower trend line is showing where price is currently finding support. If this wave count is correct then downwards momentum of a third wave should break through support within the next several hours.

The first downwards movement within minor wave B should be a five wave structure.

Depending upon risk appetite these are the things I would want to see (in sequence) to provide confidence in a trend change at 1,345.52:

1. Movement below 1,322.41 providing invalidation of the alternate hourly wave count below.

2. A clear breach of the green trend channel about minute wave c. It is at this stage that I would have confidence in a trend change and I would have only wave counts which expect minor wave B has begun.

3. A clear five wave structure downwards on the hourly chart.

4. A clear breach of the pink channel about minor wave A.

Within minor wave B minute wave a may subdivide as either a three wave corrective structure or a five wave motive structure, and the only structure it cannot take is a triangle. Initially I expect to see a 5-3-5 downwards unfold. Once that is complete I will manage the many possibilities with alternate wave counts for you.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement above 1,345.52.

Alternate Hourly Wave Count.

This wave count sees minuette wave (i) over earlier at 1,274.53. Minuette wave (iii) may have just ended with no Fibonacci ratio to minuette wave (i). Although this is possible it does not have quite as good a look on the daily chart as the main wave count does. This reduces the probability of this alternate.

At 1,349 minuette wave (v) would reach equality in length with minuette wave (i). This target would see upwards movement find resistance again and end at the upper edge of the pink channel.

While price remains within the green channel drawn about minute wave c we must accept the possibility that minute wave c is not over and we may see new highs. I want to see that green channel clearly breached to have confidence in a trend change.

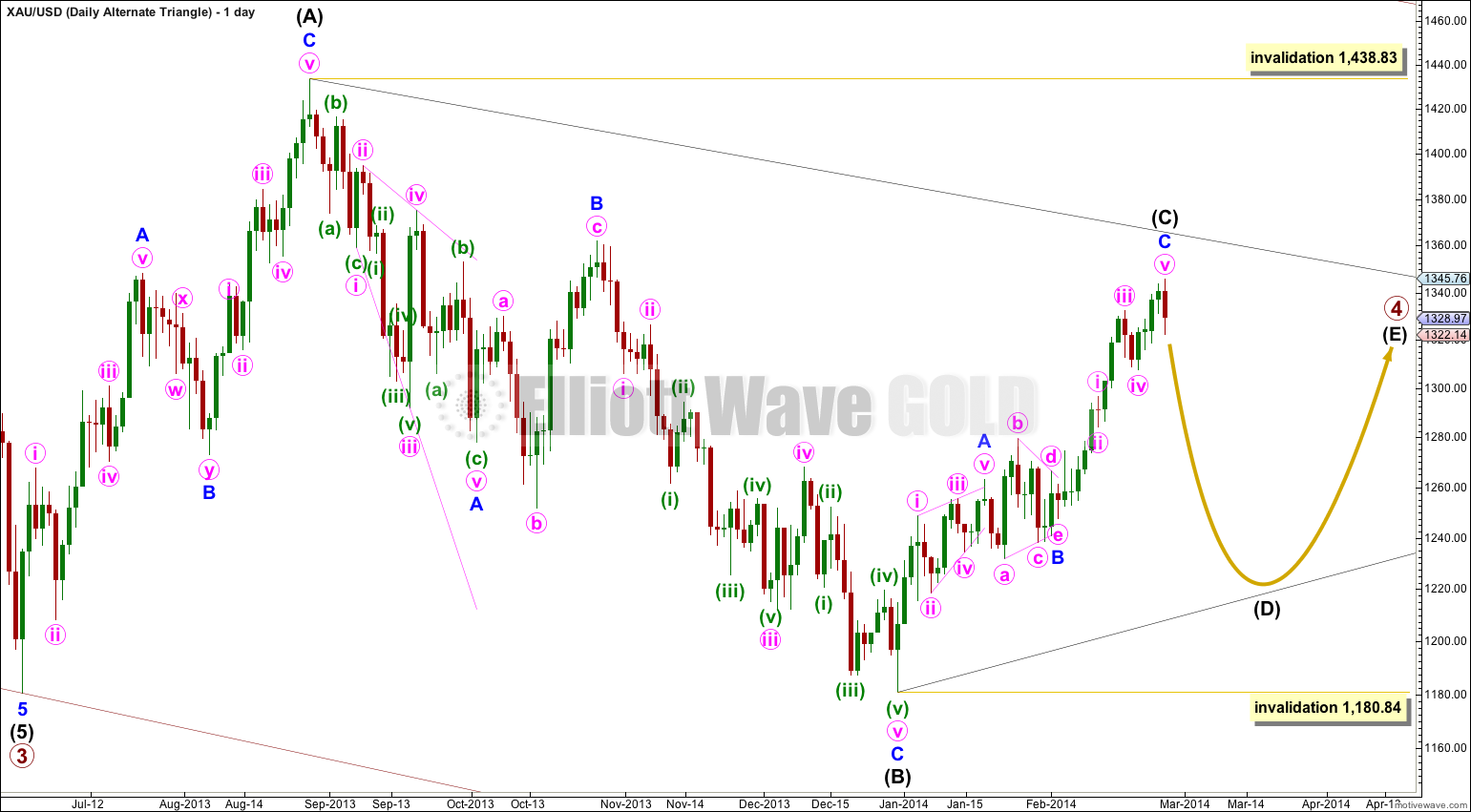

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

Lara, significant market changes often see capitulation selling at the bottom and euphoric buying at the top. I have not seen what seems capitulation selling of gold and gold direction appears ambiguous. Does EW provide a scenario where gold moves significantly lower (capitulates) to maybe the 1000 level before turning back up towards 1400 – 1500?

The wave count expects significantly lower movement to at least 1,197.31 and likely to new lows, thereafter upwards movement to end about 1,434. Which is exactly what you are asking for?

I do notice that volume increased towards the end of the fifth wave down for intermediate wave (X). That looks pretty typical to me.

Isn’t it possible that the capitulation Davey is looking for will occur after Primary 4 is complete and we head down into a wave 5 bottom?

Possibly. But that’s months away still.

Thank you.

“at least 1,197.31 and likely to new lows”

I guess my question is–how low can gold can go below 1197? Yes, there was more volume at end of (X) but I did not get a sense of capitulation, that people were “done” with gold that they had “thrown in the towel” on gold, no panic in the gold market. So I am still looking for more human emotional capitulation on gold and wondering–maybe capitulation comes when gold moves below 1197. Does EW suggest how low gold might or could go below 1197?