“The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact.” [1]

US Consumer Sentiment data release will be at 10 a.m. EST on the 16th of June, 2017. The release will be for preliminary June data.

The sentiment data is very likely to affect equities and indices. It may also affect Gold, but any effect should be short term.

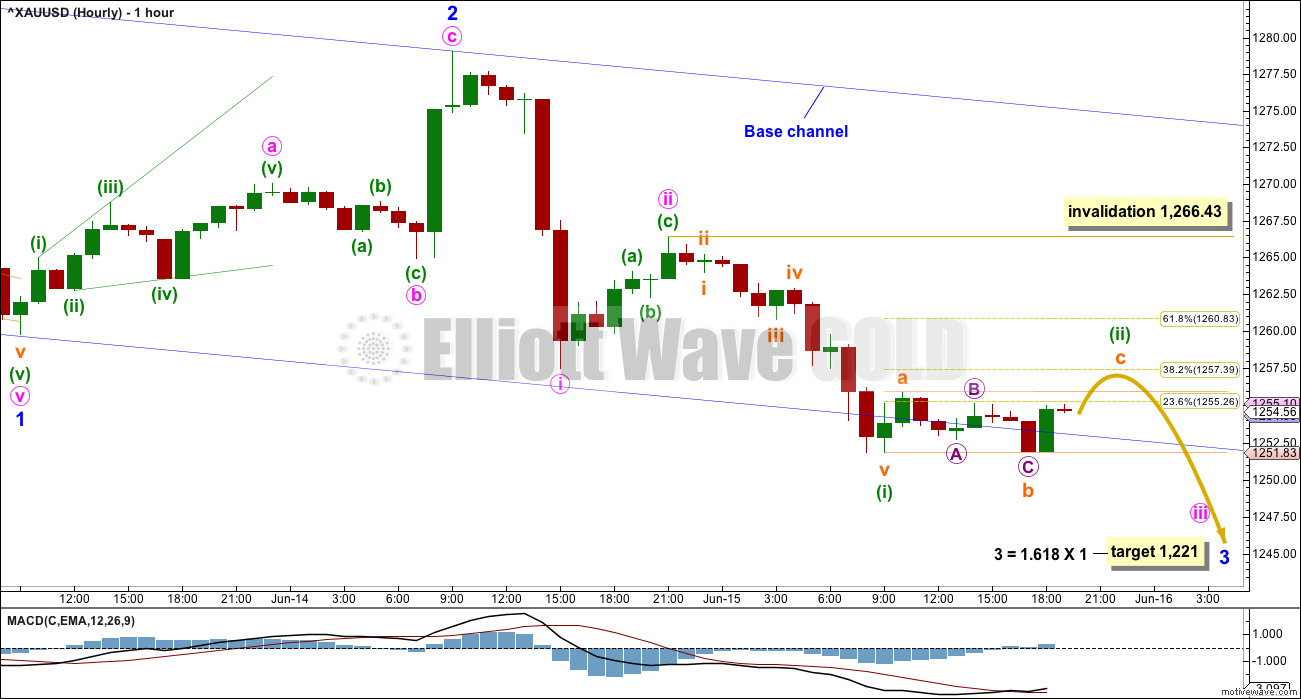

A look at an hourly chart with a simple Elliott wave count and Fibonacci retracement levels may yield clues as to what direction Gold may take after the release:

If US Consumer Sentiment data does have an influence on the Gold price, then Gold may see a short sharp upwards thrust to end about either 1,257 or 1,261 followed by very strong downwards movement to new lows. The target at 1,221 is some days away.

To see how the bigger picture supports this view, see my current Elliott wave count.

This analysis is published @ 09:26 p.m. EST.

Not too much apparently! 🙂

Yeah. I think it’s probably only major political events like elections or Brexit, or FED releases or Non Farm Payrolls.

If you look at the average investor whose collective sentiment equates to buying or selling decisions, it is those events which these folks perceive as having a greater direct and immediate impact on the market that receive attention. I’m sure the majority are people who just pay others to trade for them, such as those who buy into a hedge fund or mutual fund, or unit trusts which are popular here in Singapore. These people have no idea, at least not coherent ones, on what makes the markets tick. They just follow the crowd, so things like consumer sentiment index, GDP figures, manufacturing index, and so on are just that: another number. Tangibles such as employment (which everyone knows because he/she works for others at least at some point in their life) and major political events will impact their thinking. For Americans, sad to say, they are mainly concerned with events happening in Europe and back home. Unless the event is major, such as shooting missiles at each other, they have no concept of what entails. This also holds true for events that they can empathise with, such as the recent Paris climate change issue. For example, how many people really understand the politics behind Saudi Arabia, and why America has gone out of its way to make friends with them, the terrorist issue notwithstanding?

I feel that investor sentiment is very important as a driving force for trades. This constitutes the social mood in EW Analysis. And that is one reason I have often put up events, those which could influence investor mood, in my currently daily gold analyses. Sadly, sentiment analysis is the most underrated part of any trading strategy. This is largely because the analyst has to think like the crowd, and not what he thinks the crowd feels. Crowd psychology becomes paramount. And, humans are very capricious creatures.

It would be interesting to find out how much of US market volume is due to human traders. It was fascinating to watch the instant collapse of a slew of retail grocers on the announcement of Amazon’s acquisition of Whole Foods.

I am stiil uncertain about how a potential black swan event might affect the current market. We all have expectation of an orderly topping process with weeks, if not months of advance warning of impending danger. Considering the nature of the current top, what about black swans?!