More downwards movement was expected, which is what has happened.

Summary: Gold and GDX both remain range bound. In the short term, look for a little more downwards movement to end about 1,328 – 1,324; after this is done, look out for an upwards swing within the consolidation.

The Elliott wave count still has Gold in a B wave at three degrees, possibly the worst trading opportunity of all.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

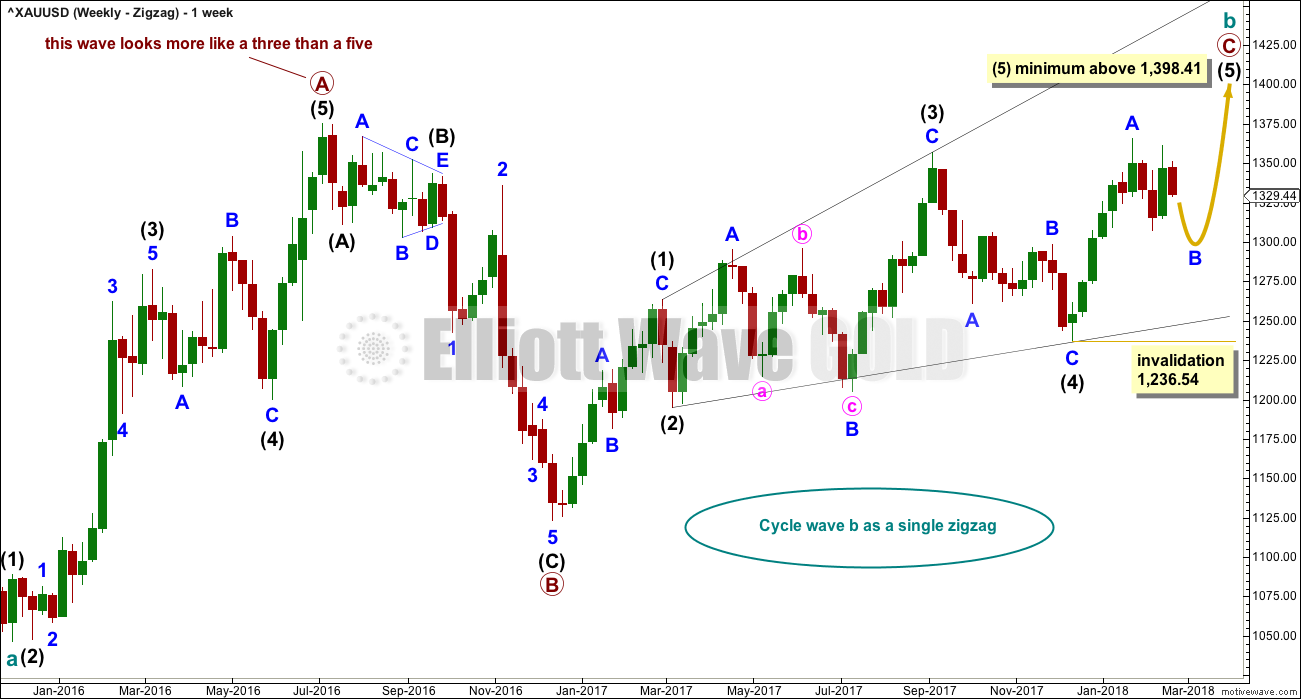

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

FIRST DAILY CHART

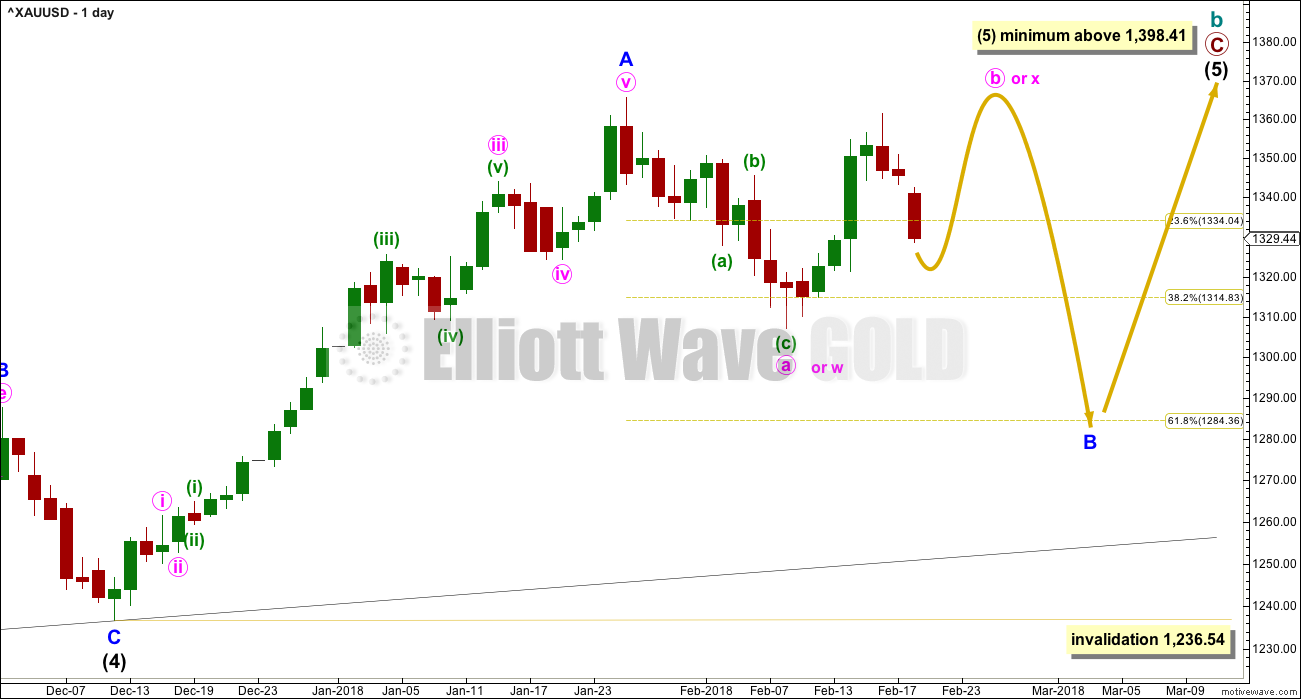

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured). At this stage, it looks more likely that minor wave B may be a more time consuming sideways consolidation. Although it is possible that minor wave B could have been over at the last low as a quick shallow pullback, which is considered in the second alternate hourly chart.

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which structure has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required from time to time.

The yellow arrows outline the possible pathway for an expanded flat for minor wave B. Members are strongly advised that this pathway is only one possible pathway of many. It is chosen to illustrate one of the most common structures for a B wave. This pathway may change as minor wave B continues further. If it does, then the labelling on hourly charts will change.

Minor wave B may still be a triangle or zigzag. All possibilities must still be considered.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

HOURLY CHART

This first hourly chart considers the possibility that minor wave B may be continuing as a flat, triangle or combination.

If minor wave B is a flat correction, then within it minute wave a must be seen as a three wave structure and minute wave b must retrace a minimum 0.9 length of minute wave a and must also subdivide as a three wave structure. This minimum at 1,359.82 is now met; minor wave B may now be a flat correction, which are very common structures. The most common type of flat correction is an expanded flat where minute wave b may be 1.05 times the length of minute wave a at 1,368.61 or above. The most common range for minute wave b within a flat correction is from 1 to 1.38 times the length of minute wave a, giving a common range of 1,365.68 to 1,387.94.

If minor wave B is a triangle, then minute wave b within it must subdivide as a three wave structure and would most likely be a zigzag. There is no minimum requirement for minute wave b within a triangle. The most common type of triangle is a regular contracting triangle where minute wave b would end below the end of minute wave a. A running triangle is less common but not a rare structure, and within it minute wave b would end above the start of minute wave a.

If minor wave B is a combination, then the first structure in a double may be a zigzag labelled minute wave w. The double would be joined by a three in the opposite direction labelled minute wave x, which would most likely be a zigzag but may be any corrective structure. Minute wave x may make a new high above the start of minute wave w.

Minute wave b must subdivide as a corrective structure. At this stage, it looks like it may be unfolding as a single zigzag. A five up may be complete for minuette wave (a). Minuette wave (b) may now continue lower as a corrective structure; if analysis of minuette wave (a) as a five is correct, then minuette wave (b) may not move beyond its start below 1,307.09.

Minuette wave (b) may now complete within the next 24 hours. It may end about either the 0.382 or 0.618 Fibonacci ratios of minuette wave (a) and neither may be favoured. Minuette wave (b) may be any one of more than 23 possible corrective structures. It looks like it may be a simple zigzag at this stage.

The best fit channel neatly contains all this downwards movement so far. Expect new lows while price remains within this channel. If this channel is breached to the upside by upwards movement, then expect a low is temporarily in place an an upwards swing within the consolidation has begun.

It is also possible to see minute wave b as complete at Friday’s high, as per labelling of it on the alternate hourly chart below. If price makes a new low below 1,307.09 this week, then that is how that piece of movement would be labelled.

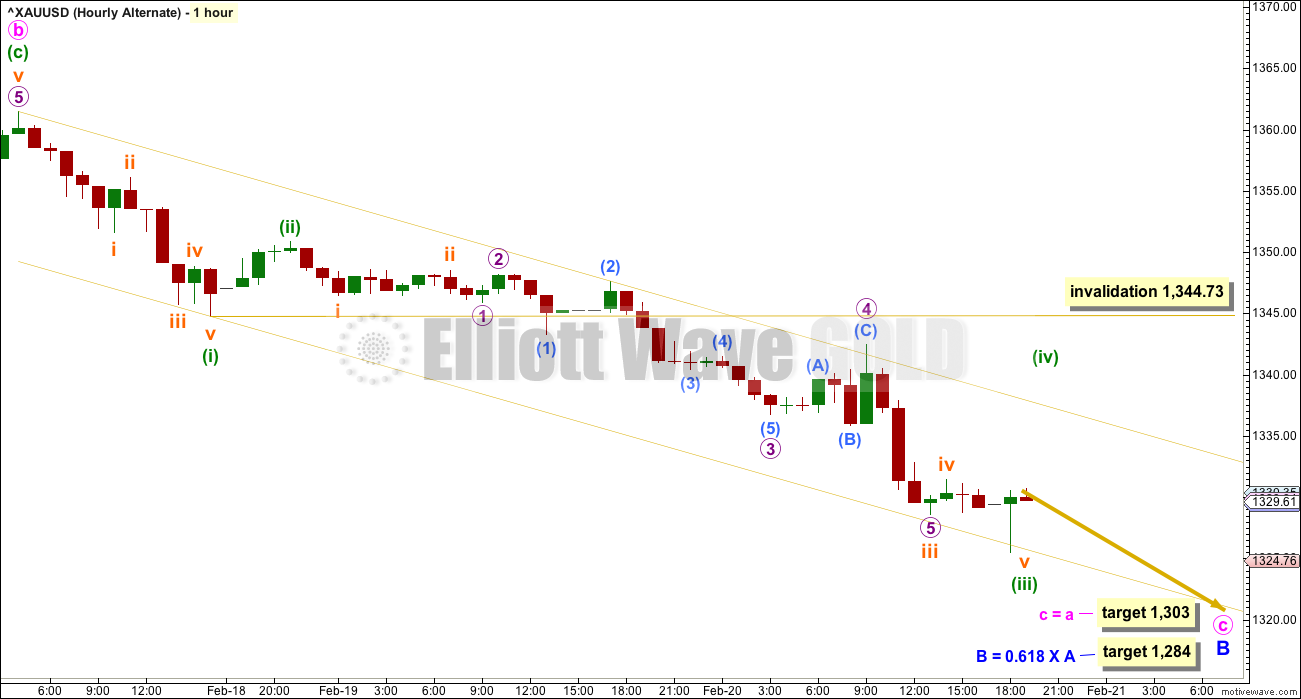

ALTERNATE HOURLY CHART

It is still possible that minor wave B is continuing as a zigzag. It is still possible that the last wave down labelled minute wave a was a five wave impulse.

It is also possible to see the upwards wave to Friday’s high as a complete zigzag. If minute wave b is a complete zigzag, then minute wave c downwards may be underway. Within the impulse of minute wave c, minuette wave (iv) may not move into minuette wave (i) price territory above 1,344.73.

Two targets are given for minor wave B to end.

It is also possible to label minute wave b as incomplete, as per labelling of it on the first hourly chart. Both ideas work in exactly the same way for both of these two hourly charts.

SECOND ALTERNATE HOURLY CHART

Bullishness at the end of last week in classic technical analysis does offer some support for this second alternate hourly chart.

This wave count is the same as the first hourly wave count, with the exception of the degree of labelling. If the degree of labelling within the possible zigzag downwards is moved up one, then minor wave B may be complete already. It would be relatively shallow and brief though, which is the main reason for low probability.

Minor wave C now shows some strength: volume strongly supports upwards movement. However, for reasonable confidence, this wave count would still require a classic upwards breakout above resistance about 1,375 on a day with support from volume. However, reasonable support today from volume for downwards movement now puts a little doubt on this wave count.

Minute wave i may now be a complete five wave impulse. Downwards movement at the end of Friday’s session has broken out of the channel drawn about minute wave i, indicating that the upwards wave is complete and a new downwards wave has begun.

Minute wave ii would most likely correct to about the 0.618 Fibonacci ratio of minute wave i. Minute wave ii may not move beyond the start of minute wave i below 1,307.09. Minute wave ii may be any corrective structure except a triangle. At this stage, it looks like it may be an incomplete zigzag. This is the most common structure for a second wave.

For this wave count, when the correction of minute wave ii is complete, then a strong upwards wave for minute wave iii should then see a classic upwards breakout above 1,375 with support from volume.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

WEEKLY CHART

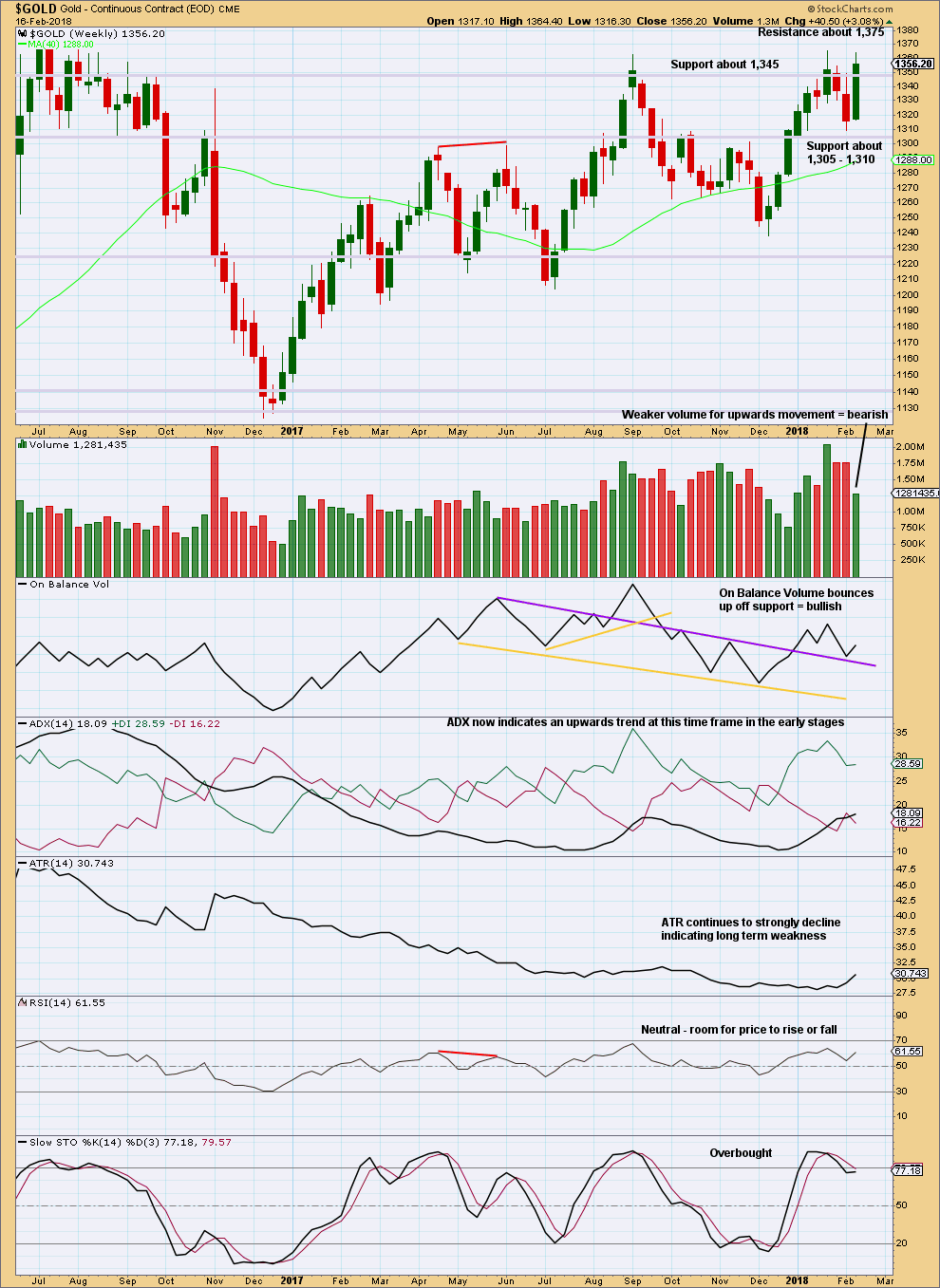

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the weekly time frame, ADX now indicates an upwards trend but price is still range bound with resistance about 1,375 and support finally about 1,225.

Strongest weekly volume of recent weeks is an upwards week, which is bullish. The last signal from On Balance Volume is bullish. This supports the main daily Elliott wave count.

DAILY CHART

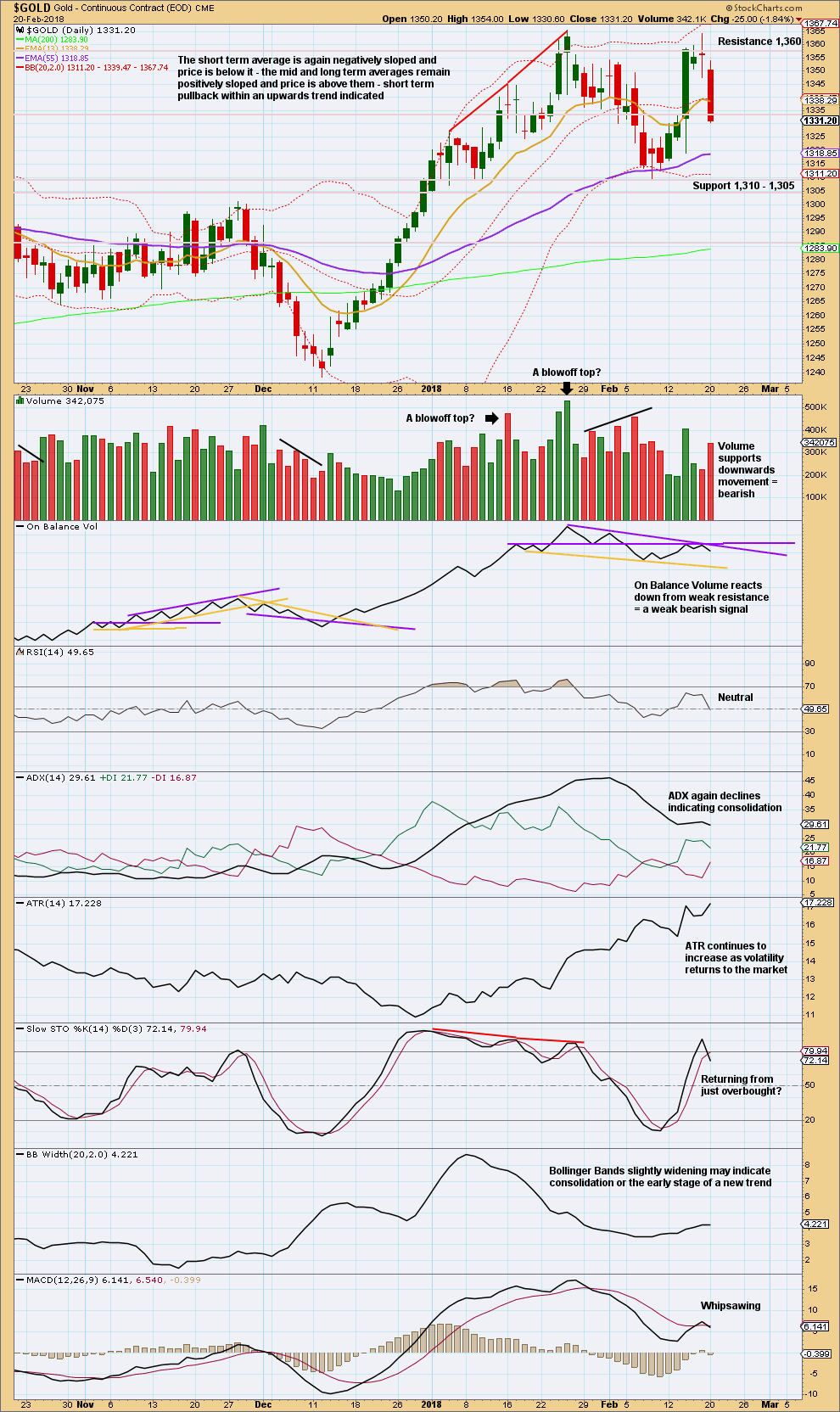

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last three candlesticks do not correctly complete an Evening Doji star because the third candlestick gaps below the first. Neither is this a Bearish Engulfing candlestick as it is below and does not engulf the prior two candlesticks. However, it is very bearish indeed and has support from volume.

Expect another red candlestick. Next support is again about 1,310 – 1,305.

With now steadily increasing ATR, some volatility is finally returning to this market. This may possibly be an indication of a winding up of energy prior to a breakout from the large trading range Gold has been in now for over a year.

GDX WEEKLY CHART

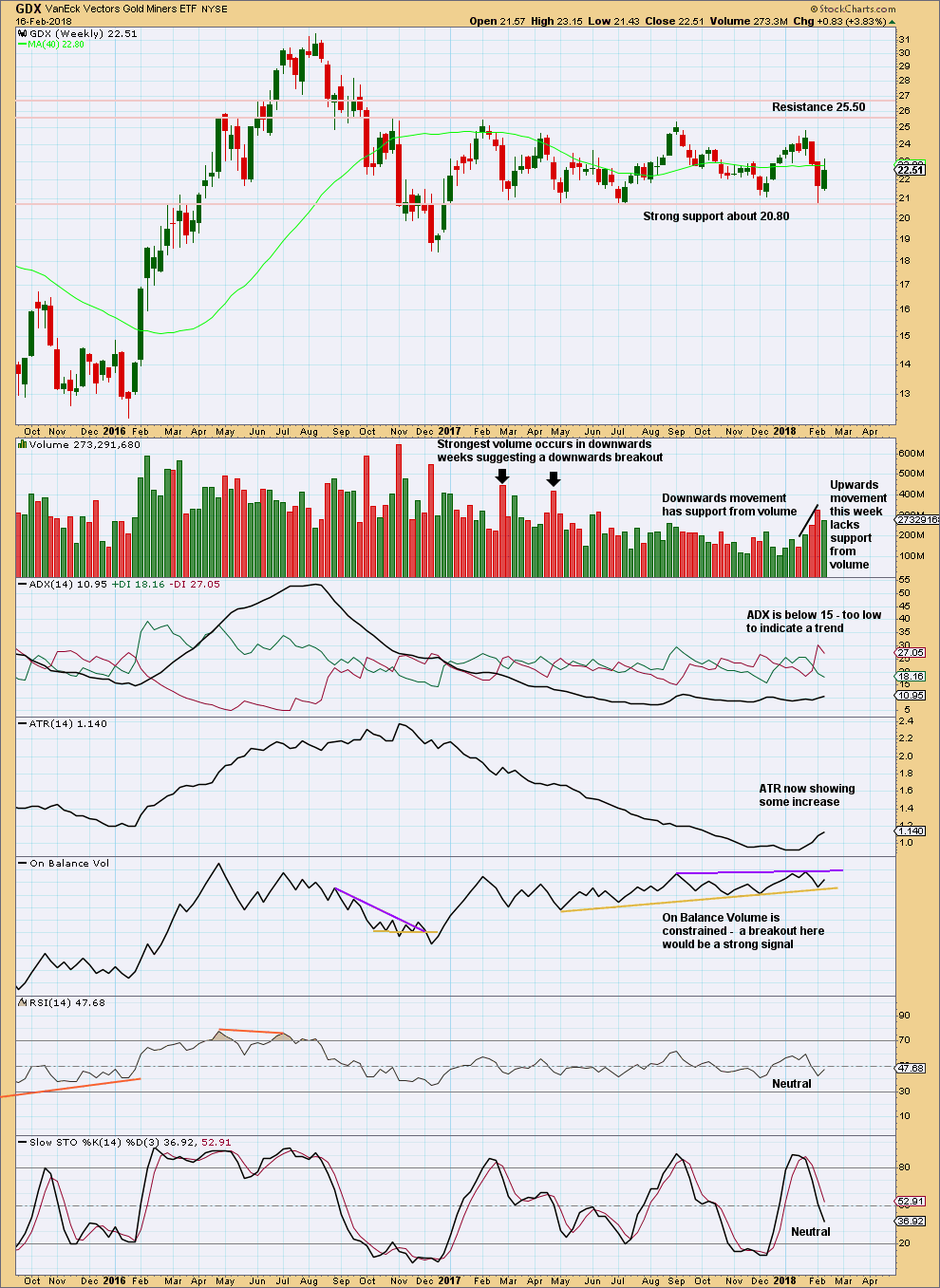

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about seven times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

The longer upper wick on this week and declining volume are both bearish.

On Balance Volume should be watched closely. A breakout there may signal the breakout direction for price.

GDX DAILY CHART

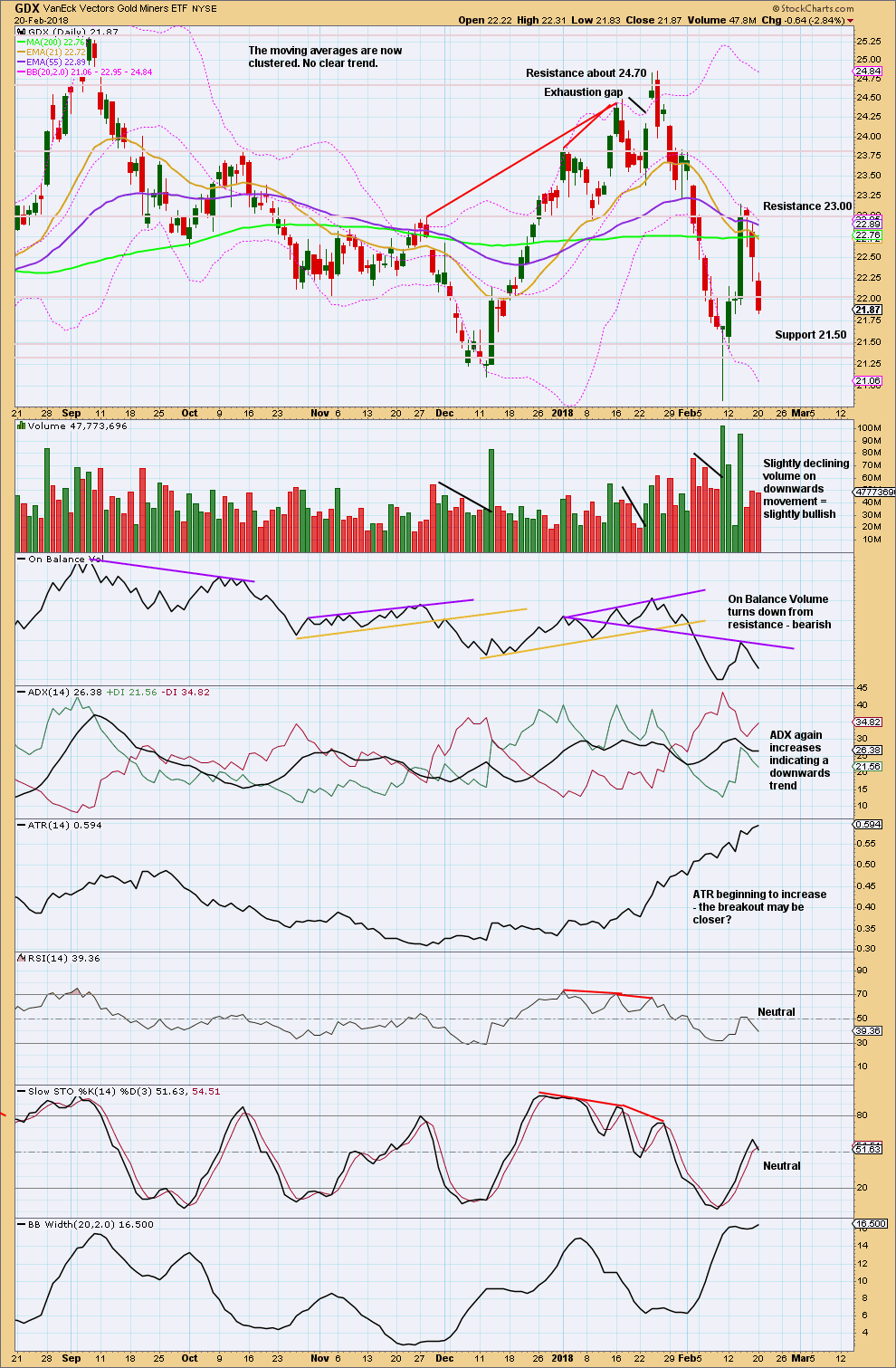

Click chart to enlarge. Chart courtesy of StockCharts.com.

A slightly longer upper wick, or at least the lack of a long lower wick, and only a slight decline in volume looks overall still bearish for the short term.

Published @ 07:40 p.m. EST.

Good morning everybody!

The target is reached and passed. And price is continuing to fall.

Targets on the alternate hourly chart are 1,303 and 1,284. These may now be used.

The channel on the hourly charts was overshot, but not breached. For newer members, my definition of a breach is a full candlestick outside and not touching the channel. It should also be by movement in the opposite direction, not a small candlestick within sideways movement.

In this instance price shot up outside the channel, and quickly returned. The channel is only overshot by a candlestick wick.

I know that may be very annoying. Channels just don’t always work perfectly. They very often work, but not always. So far this one still looks pretty good.

It’s now make or break time for this first hourly chart. If this is the one then price should reverse within the next couple of hours and then the channel should be breached. If that happens then I’ll calculate a target for the next upwards swing for you.

If it doesn’t happen then the next hourly chart is looking more likely.

And remember, we’re still within a B wave. A consolidation. Expect swings from resistance to support, and back again. And don’t expect price to move in straight lines. That’s not how markets behave.