A little more upwards movement was expected for Wednesday to end about 1,307 to 1,310. Upwards movement has continued to reach a high at 1,310.17 so far.

Summary: While price remains below the upper edge of the base channel, expect it to find resistance there. This may be the end of the bounce.

If price breaks above the upper edge of the base channel, then the Elliott wave count would be in doubt.

The Elliott wave target is at 1,220.

Three long-term targets are now calculated for cycle wave c to end. Confidence in a new downwards trend may be had with a new low below 1,160.75.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last monthly charts are here. Video is here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

This is the preferred wave count.

Cycle wave b may be a complete regular contracting triangle. If it continues further, then primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

This wave count would expect a cycle degree trend change has recently occurred. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

Primary wave E has exhibited reasonable weakness as it came to an end. Triangles often end with declining ATR, weak momentum and weak volume.

If this weekly wave count is correct, then cycle wave c downwards should develop strength, ATR should show some increase, and MACD should exhibit an increase in downwards momentum.

Three targets are calculated for cycle wave c. Cycle wave a lasted 4.25 years. Cycle wave b may be over in 3.17 years. Cycle wave c may last a minimum of 2 years and possibly up to 5 years.

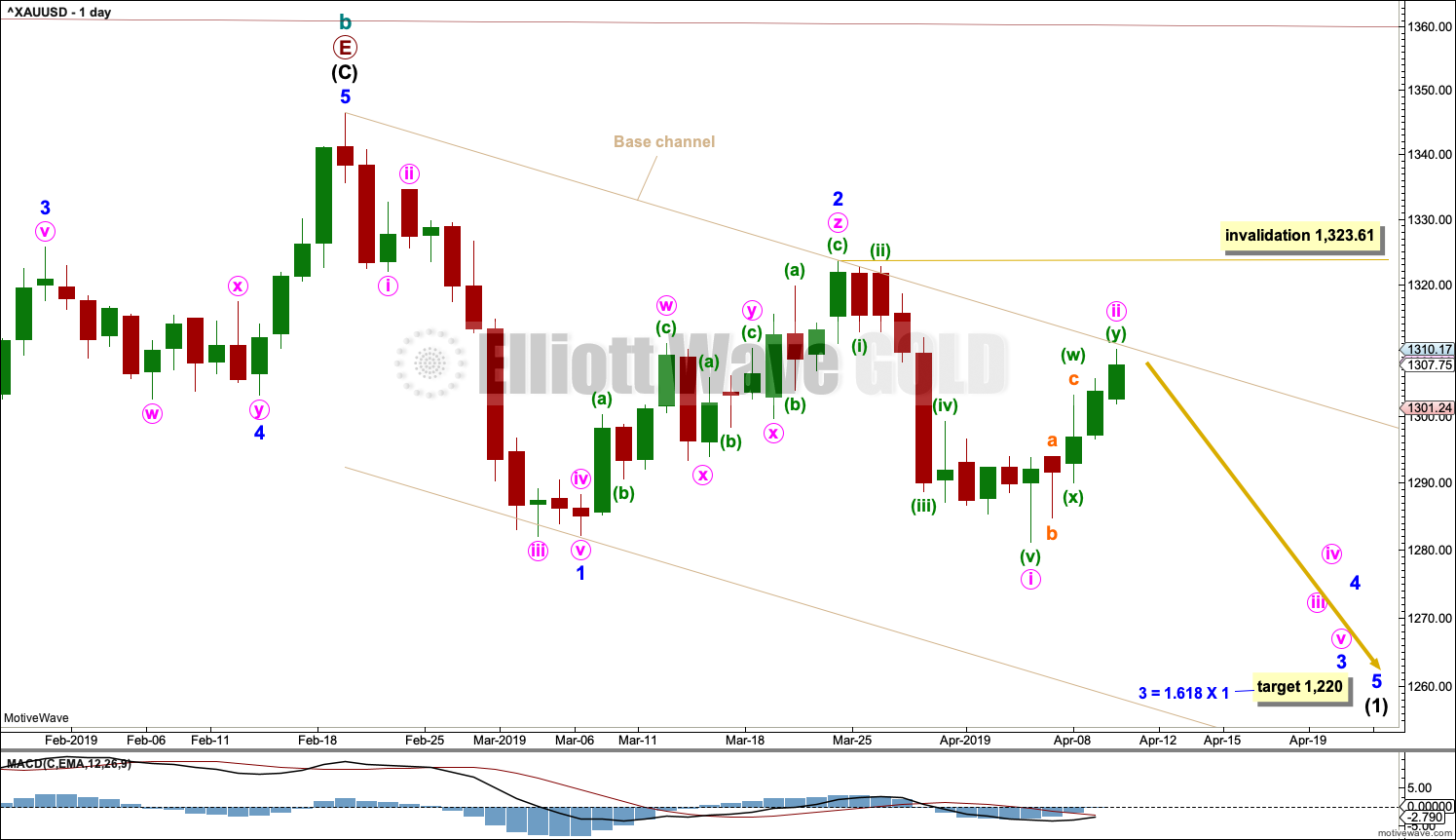

DAILY CHART – TRIANGLE

Cycle wave c must subdivide as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common and that shall be how it is labelled unless overlapping suggests a diagonal should be considered.

A new trend at cycle degree should begin with a five wave structure on the daily chart, which will be labelled minor wave 1.

Minor wave 2 is now labelled as a complete triple zigzag.

A base channel is drawn about minor waves 1 and 2. There will be bounces and consolidations on the way down. This current bounce may find resistance at the upper edge of the base channel. Towards its middle or end the power of a third wave may be able to break below support at the lower edge of the base channel.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave ii may not move above the start of minute wave i at 1,323.61.

It is possible that minor wave 3 may end with a selling climax; it may exhibit a swift and strong fifth wave to end the impulse. This behaviour is typical of commodities, and this tendency is especially prevalent for third wave impulses.

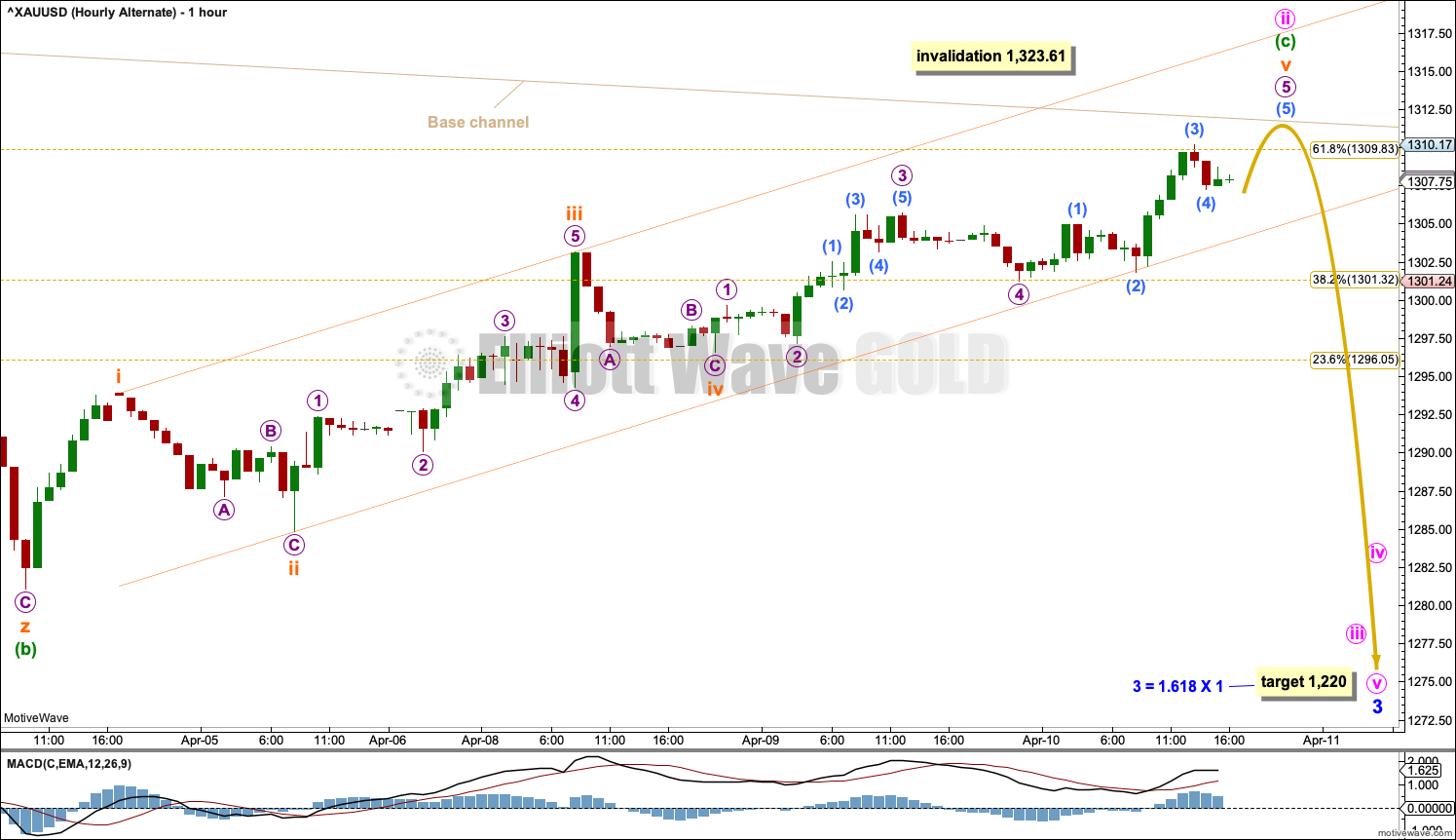

HOURLY CHART

It is possible that minute wave i ended at the last low.

Minute wave ii may be a double zigzag, which is a reasonably common structure.

The base channel is copied over from the daily chart. Minute wave ii may find strong resistance about the upper edge of this channel. Now that price has come up to almost touch this trend line, look for a strong reaction downwards from here.

There is just a little room left for upwards movement before price comes up to touch the base channel. It is possible that labelling of minuette wave (y) is incorrect and a small final fifth wave upwards may be required to complete the structure.

A channel is drawn about the bounce of minute wave ii. While price remains within this channel, the trend at this time frame may be assumed to remain upwards. When this channel is breached by at least one full hourly candlestick below and not touching the lower edge, that may be taken as an indication that the bounce may be over and the larger downwards trend may have resumed.

Minute wave ii may not move beyond the start of minute wave i above 1,323.61.

ALTERNATE HOURLY CHART

Minute wave i within minor wave 3 may have ended on the 29th of March and minute wave ii may have begun there.

Minute wave ii may be unfolding as an expanded flat correction. Within the expanded flat minuette wave (b) may be a complete triple zigzag. Triple zigzags are uncommon structures, but they are not very rare. The probability of this wave count at the hourly chart level is decreased, but it remains valid. Minuette wave (b) is now a little longer than the common range of 1 to 1.38 times the length of minuette wave (a), but it is within allowable limits of up to 2.

Minuette wave (c) has now made a new high above the end of minuette wave (a) at 1,299.45 avoiding a truncation and a very rare running flat, but the structure of minuette wave (c) is incomplete.

Minuette wave (c) must subdivide as a five wave structure. It may now be very close to completion with only the final fifth wave of sub-micro wave (5) required. Minuette wave (c) may end a little above the 0.618 Fibonacci ratio of minute wave i at 1,309.83.

An Elliott channel is drawn about the impulse of minuette wave (c). A breach of the lower edge of this channel would provide confidence that minuette wave (c) may be complete and then minute wave ii may be complete.

Minute wave ii may not move beyond the start of minute wave i above 1,323.61.

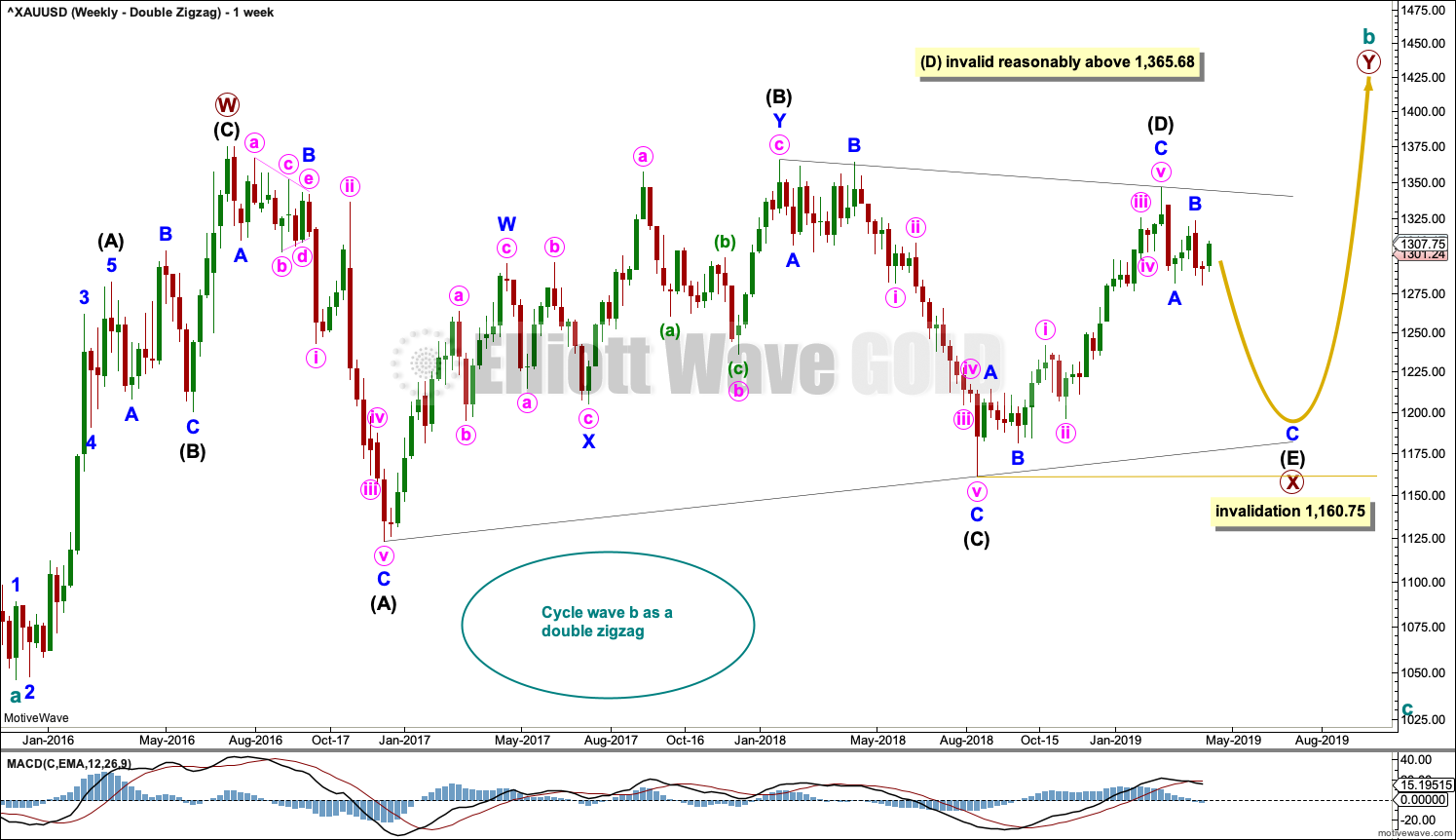

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be an incomplete double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about four fifths complete.

Within multiples, X waves are almost always zigzags and rarely triangles. Within the possible triangle of primary wave X, it is intermediate wave (B) that is a multiple; this is acceptable, but note this is not the most common triangle sub-wave to subdivide as a multiple. These two points reduce the probability of this wave count.

Intermediate wave (D) may be complete. The (B)-(D) trend line is almost perfectly adhered to with the smallest overshoot within intermediate wave (C). This is acceptable.

Intermediate wave (E) should continue to exhibit weakness: ATR should continue to show a steady decline, and MACD may begin to hover about zero.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) below 1,160.75.

This wave count may now expect downwards movement for several weeks.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

Intermediate wave (E) should subdivide as a zigzag labelled minor waves A-B-C. Zigzags subdivide 5-3-5, exactly the same the start of an impulse.

The preferred wave count labels downwards movement minor waves 1-2-3, and this wave count labels downwards movement minor waves A-B-C. At the daily and hourly chart levels, the subdivisions for both wave counts are seen in the same way.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. The probability of this wave count is low due to this problem.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary wave 1 may now be complete. The target for primary wave 2 is the 0.618 Fibonacci ratio of primary wave 1. Primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

A black channel is drawn about primary wave 1. Primary wave 2 may breach the lower edge of this channel.

Cycle wave III so far for this wave count would have been underway now for 34 weeks. It should be beginning to exhibit some support from volume, increase in upwards momentum and increasing ATR. However, ATR continues to decline and is very low, and momentum is weak in comparison to cycle wave I. This wave count lacks support from classic technical analysis.

TECHNICAL ANALYSIS

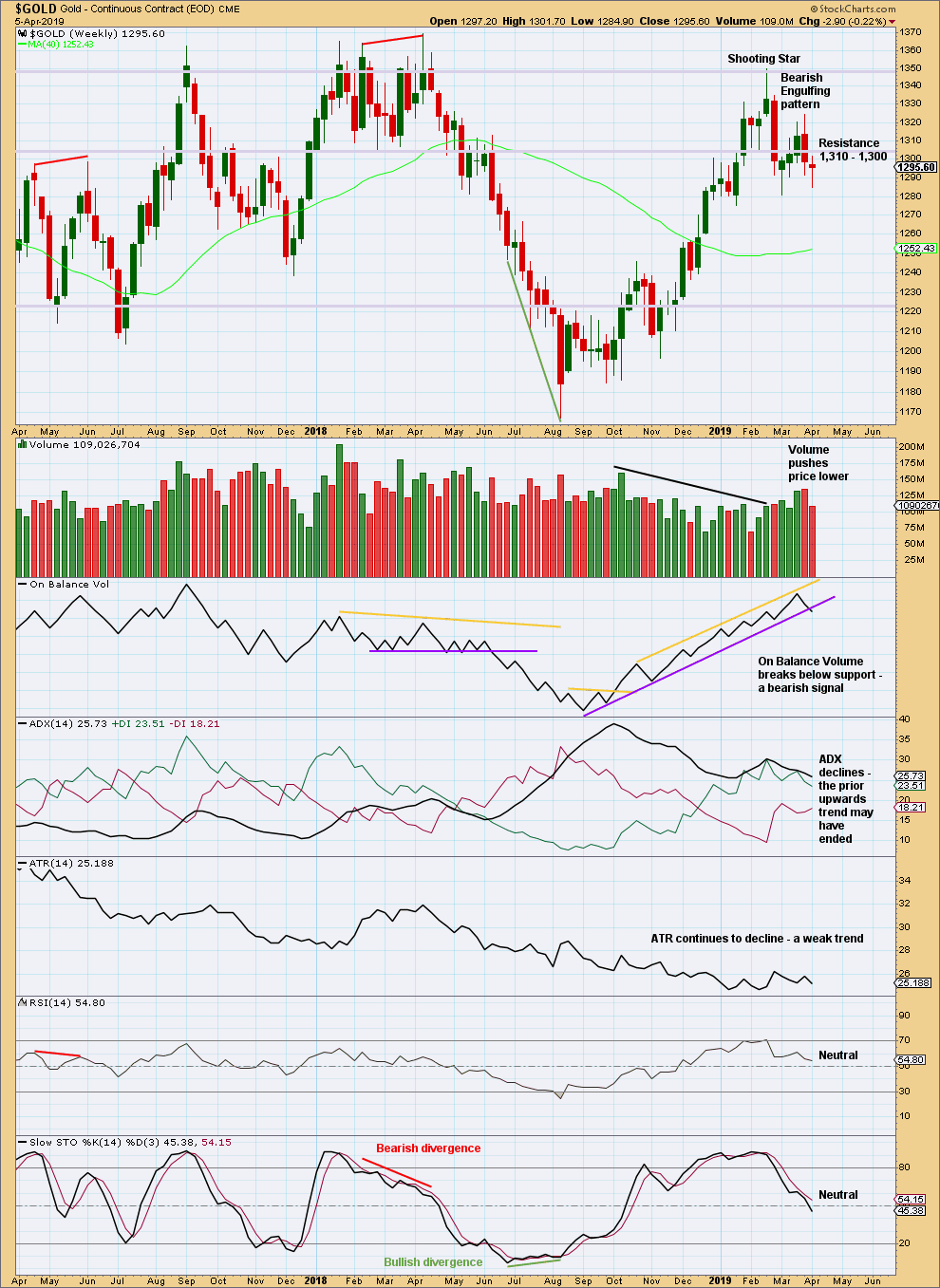

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support and resistance about 1,310 – 1,300 has now been breached in both directions multiple times. This area of prior strong support and resistance has by now been weakened.

The week before last volume pushed price lower. Last week price falls of its own weight. A bearish signal though from On Balance Volume should be given weight, which supports the Elliott wave counts, which all expect more downwards movement this week.

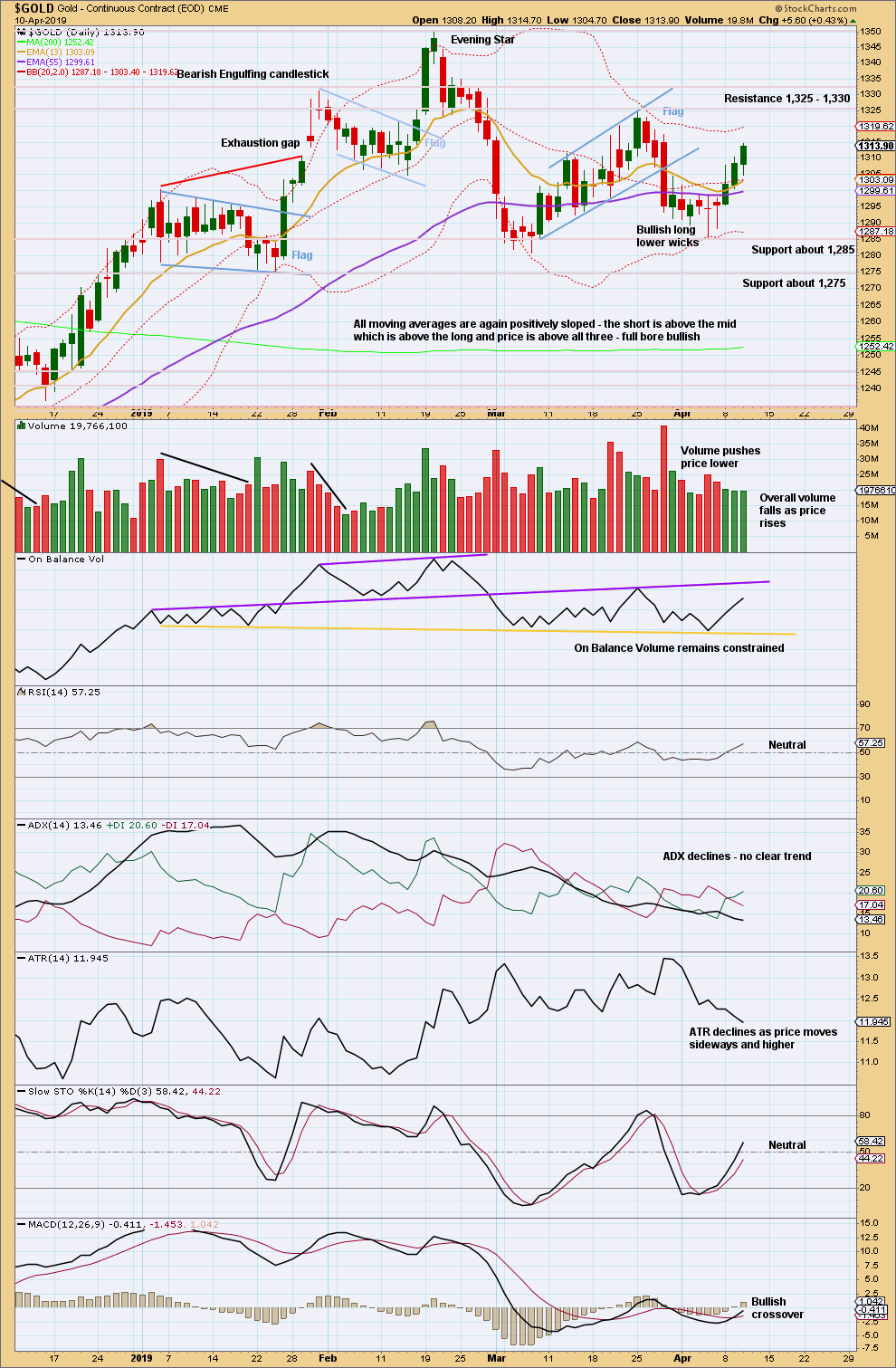

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From August 2018 Gold moved higher with a series of higher highs and higher lows. This series remained intact until the 1st of March 2019 when a lower low was made. At that stage, it was possible that Gold had seen a trend change.

The target using the flag pole is 1,238. This has not been met by downwards movement out of the flag.

Today volume has very slightly increased, but overall it remains low relative to more recent downwards days. The short-term volume profile remains bearish. ATR continues to show upwards movement lacks strength, so far.

The prior zone of resistance and support about 1,300 to 1,310 has now been breached multiple times in both directions and no longer holds any technical significance. The next zone of reasonable resistance above is 1,325 to 1,330.

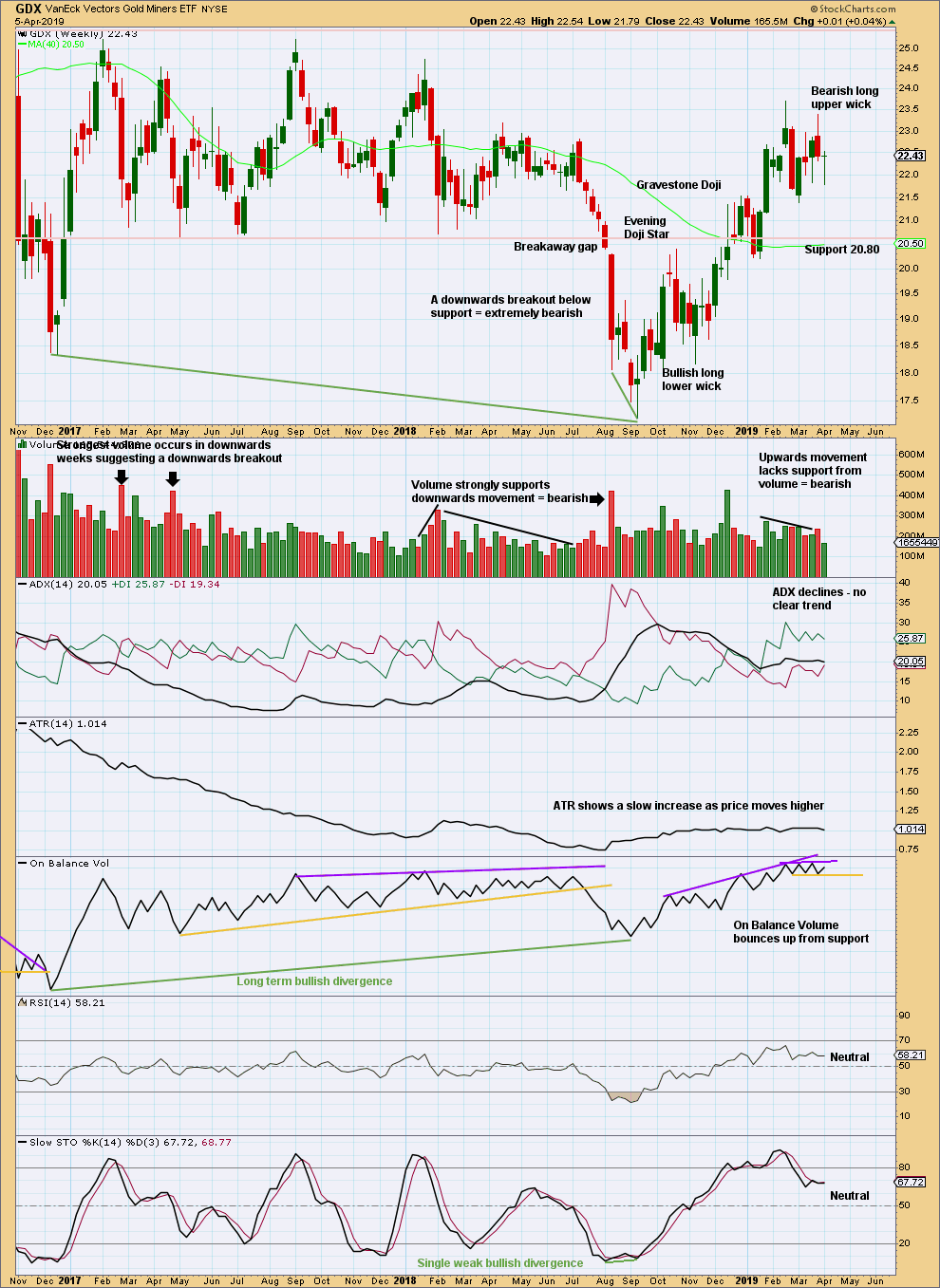

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week moved price lower, but the balance of volume was upwards and the candlestick closed green. Upwards movement within the week lacks support from volume.

On Balance Volume has a new short-term range. A breakout would provide a signal.

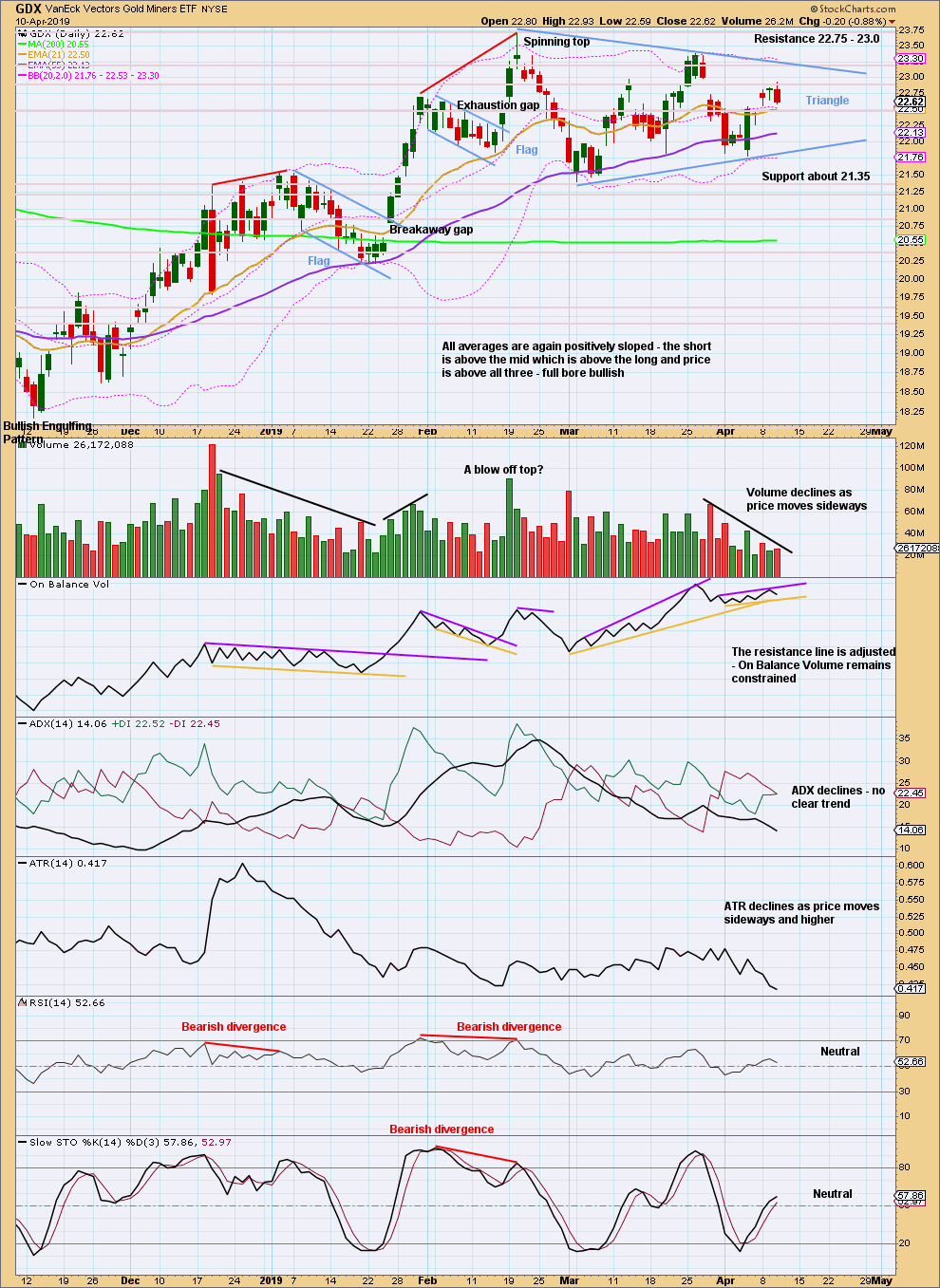

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the daily chart level, the view of an upwards trend may be in doubt with a new swing low on the 1st of March 2019 that moved below the prior swing low of the 14th of February 2019. At that stage, the series of higher highs and higher lows was no longer intact and a trend change was possible.

Since then price has not made another higher high.

Currently, price is range bound with resistance about 22.75 and support about 21.35.

A triangle may be forming; this is now identified on the chart. Classic analysis triangles may be either continuation or reversal patterns. A breakout is required to indicate the next direction. At that stage, a target may be calculated.

The current small upwards swing lacks support from volume. This upwards movement is weak.

Published @ 06:07 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

If members entered short before or after the best fit channel breach, members should now have profits. Some don’t like to hold positions overnight so may not hold on. Those who prefer a longer time frame may hold on to the target. Move stops to breakeven or just above 1,310.17.

Minute (ii) may now be more shallow than second waves usually are due to a strong downwards pull from the middle of a third wave.

That’s minuette (ii)

Thanks Lara, very impressive work again.

Hope others managed to get in short too.

Yeah, sometimes Lara’s analysis is astonishingly accurate. Who would have thought/analyzed this move down today after a big bounce from 1282 to 1310 in a matter of days… And thanks to Lara I added to my short position yesterday around 1308… Wow!

I understand sometimes the count changes, and the analysis needs to change, but overall the work is amazing…

That’s really awesome guys! So glad you’re short and in the green