GOLD: Elliott Wave and Technical Analysis | Charts – January 10, 2020

Two of the three Elliott wave counts, including the preferred wave count, expected a consolidation had begun. An inside day fits this expectation.

Summary: A consolidation to last either a Fibonacci 5 or 8 sessions and find support about the lower edge of the adjusted Elliott channel on daily charts is expected to have begun. Thereafter, more upwards movement may be a final thrust before a bear market resumes.

A bullish wave count expects a third wave is ending here or very soon. The target is 1,635 or 1,693.

An alternate bearish wave count looks at the possibility that Gold has just seen a Super Cycle degree trend change. Confidence in this idea may be had with a new low below 1,473.36. Full and final confidence would be had if price makes a new low below 1,374.91.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

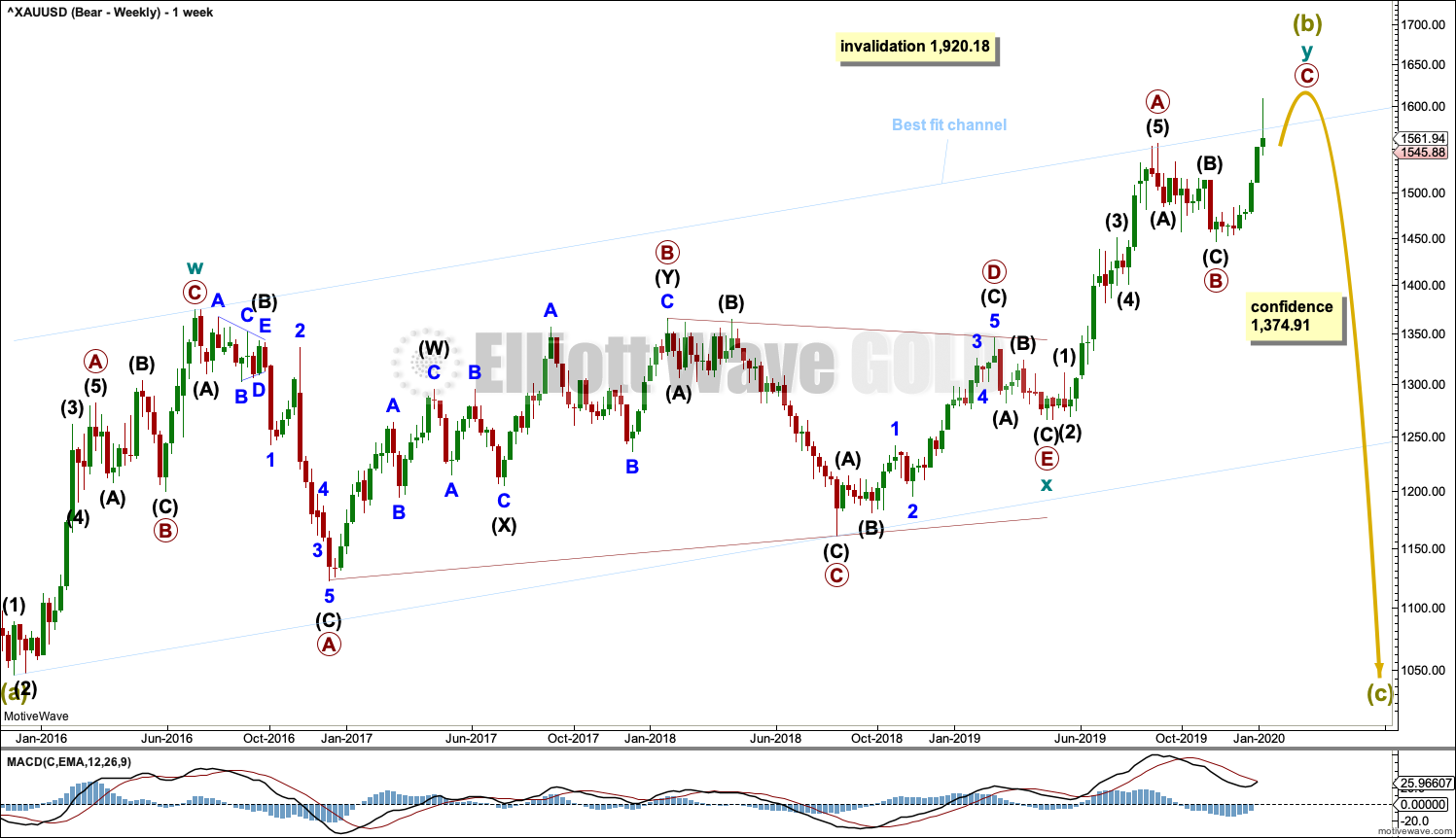

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may still be an incomplete double zigzag, requiring one more high.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

After the structure of cycle wave y may be complete, then a new low below 1,374.91 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated. At that stage, targets for Super Cycle wave (c) would be calculated.

A wide best fit channel is added in light blue. Copy this channel over to daily charts. The upper edge of this channel was breached, but now price has returned strongly to within the channel.

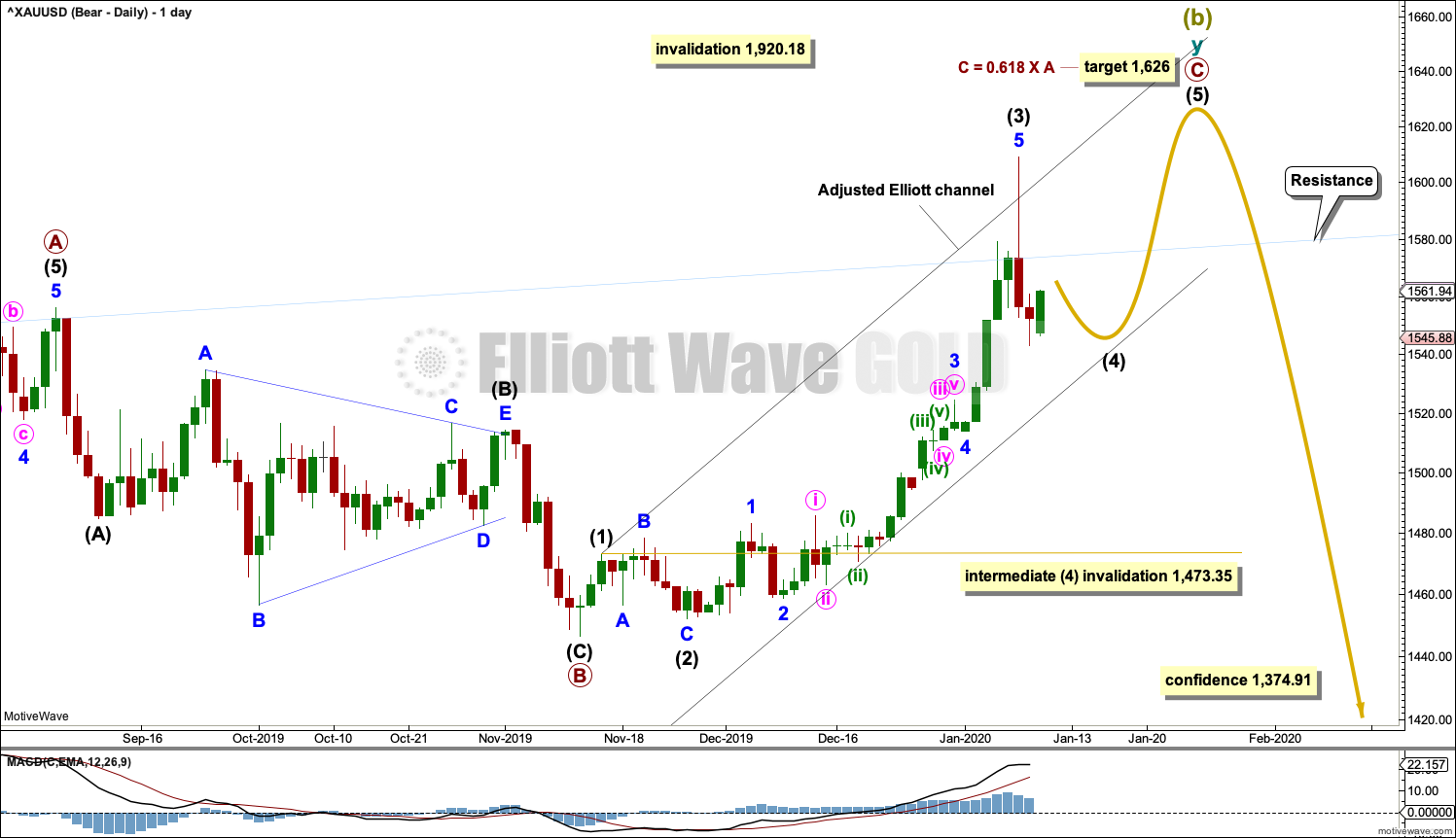

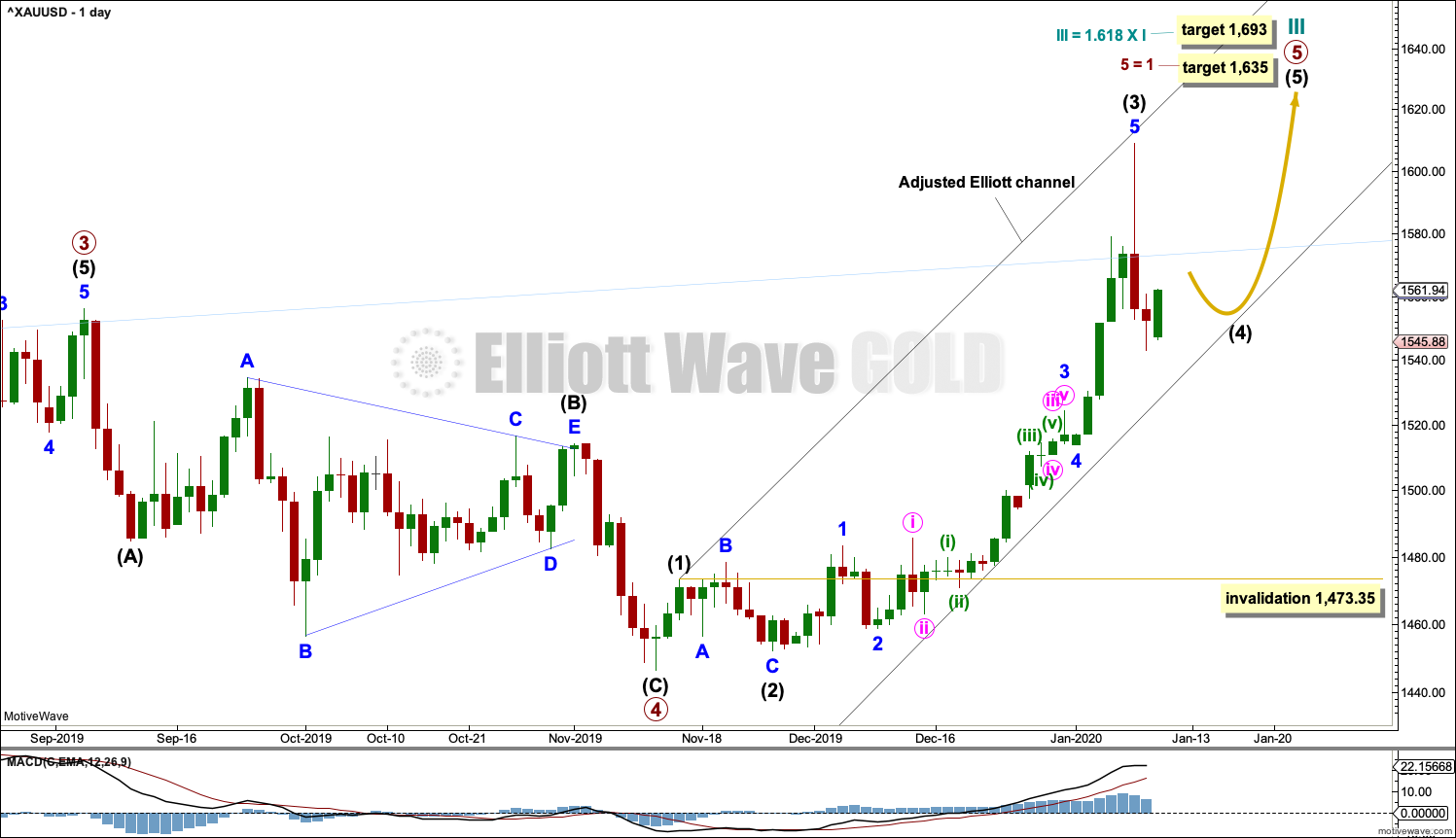

DAILY CHART

The double zigzag for Super Cycle wave (b) may be still incomplete.

Within cycle wave y, primary waves A and B are complete. Primary wave C must complete as a five wave structure. It is unfolding as an impulse. Within the impulse, intermediate waves (1) to (3) may now be complete.

Intermediate wave (2) was a deep 0.79 zigzag, which lasted 8 sessions. Given the guideline of alternation, intermediate wave (4) would least likely unfold as a zigzag and most likely unfold as either a flat, combination or triangle. Intermediate wave (4) would most likely be shallow. It may last about a Fibonacci 5 or 8 sessions. So far it would have lasted 2 sessions.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 1,473.35.

Drawn an Elliott channel about primary wave C and then pull the lower edge down to contain all of primary wave C. The lower edge may provide support to intermediate wave (4). Copy this channel over to hourly charts.

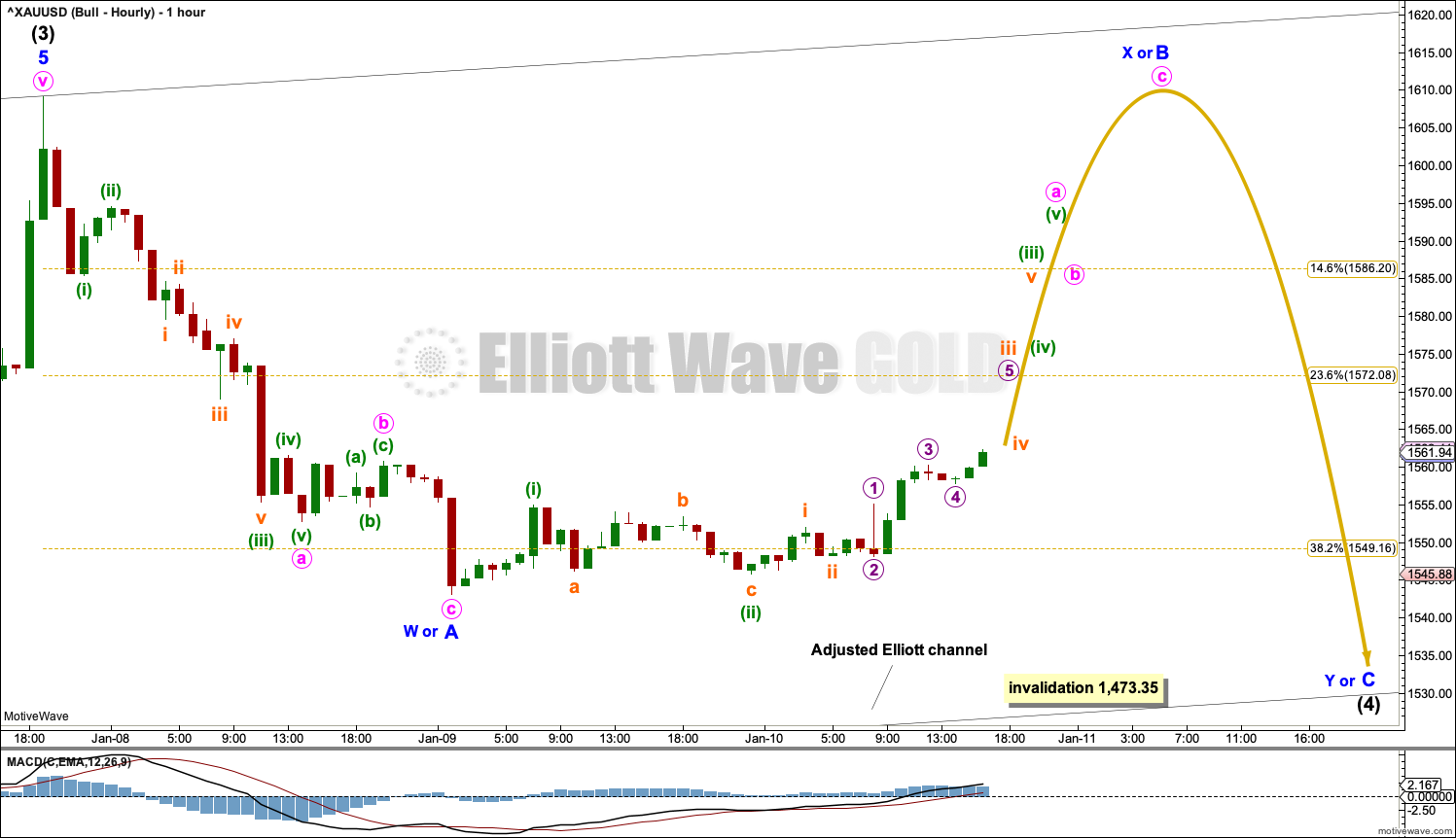

HOURLY CHART

Intermediate wave (4) would most likely unfold as one of either a flat, combination or triangle. Within all these corrective structures, the first wave down would subdivide as a three, most likely a zigzag. This may now be complete and is labelled minor wave A or W.

If intermediate wave (4) unfolds as any one of an expanded flat, running triangle or combination, then within it minor wave B or X may make a new price extreme beyond the start of minor wave A or W.

At this stage, it is impossible to tell which of several structures intermediate wave (4) may be. Focus over the next few sessions will be not on identifying each swing within intermediate wave (4) but on identifying when it may be complete. This main wave count expects it to be followed by an upwards breakout to a new high with a target at 1,626.

If intermediate wave (4) subdivides as a flat correction, then minor wave B within it must retrace a minimum 0.9 length of minor wave A at 1,602.52. The most common length of minor wave B within a flat correction would be from 1 to 1.38 times the length of minor wave A, giving a range from 1,609.12 to 1,634.22.

If intermediate wave (4) subdivides as a triangle or combination, then there is no minimum required length for minor wave B or X.

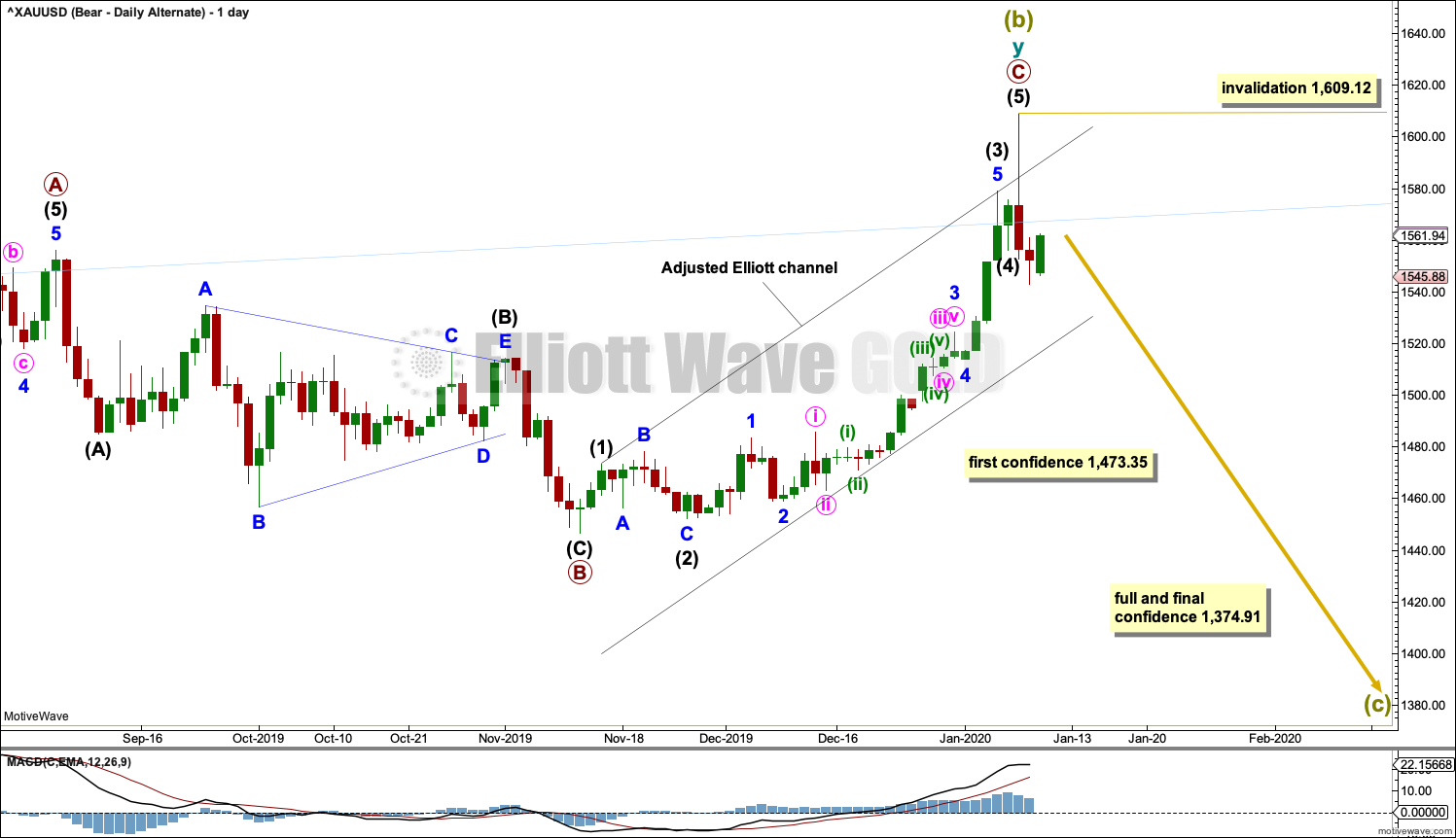

ALTERNATE DAILY CHART

Alternatively, it is possible again that Super Cycle wave (b) may be complete and the bear market for Gold may have resumed.

A new low below 1,473.35 would invalidate the main bearish wave count and add some confidence in this alternate. Thereafter, a new low by any amount at any time frame below 1,374.91 would invalidate the bullish wave count below and add full and final confidence in this wave count. Targets for Super Cycle wave (c) would be calculated at that stage.

If Super Cycle wave (c) has begun, then it should develop a five wave structure downwards at the daily and weekly time frames. Within the first five down, no second wave correction may move beyond the start of its first wave above 1,609.12.

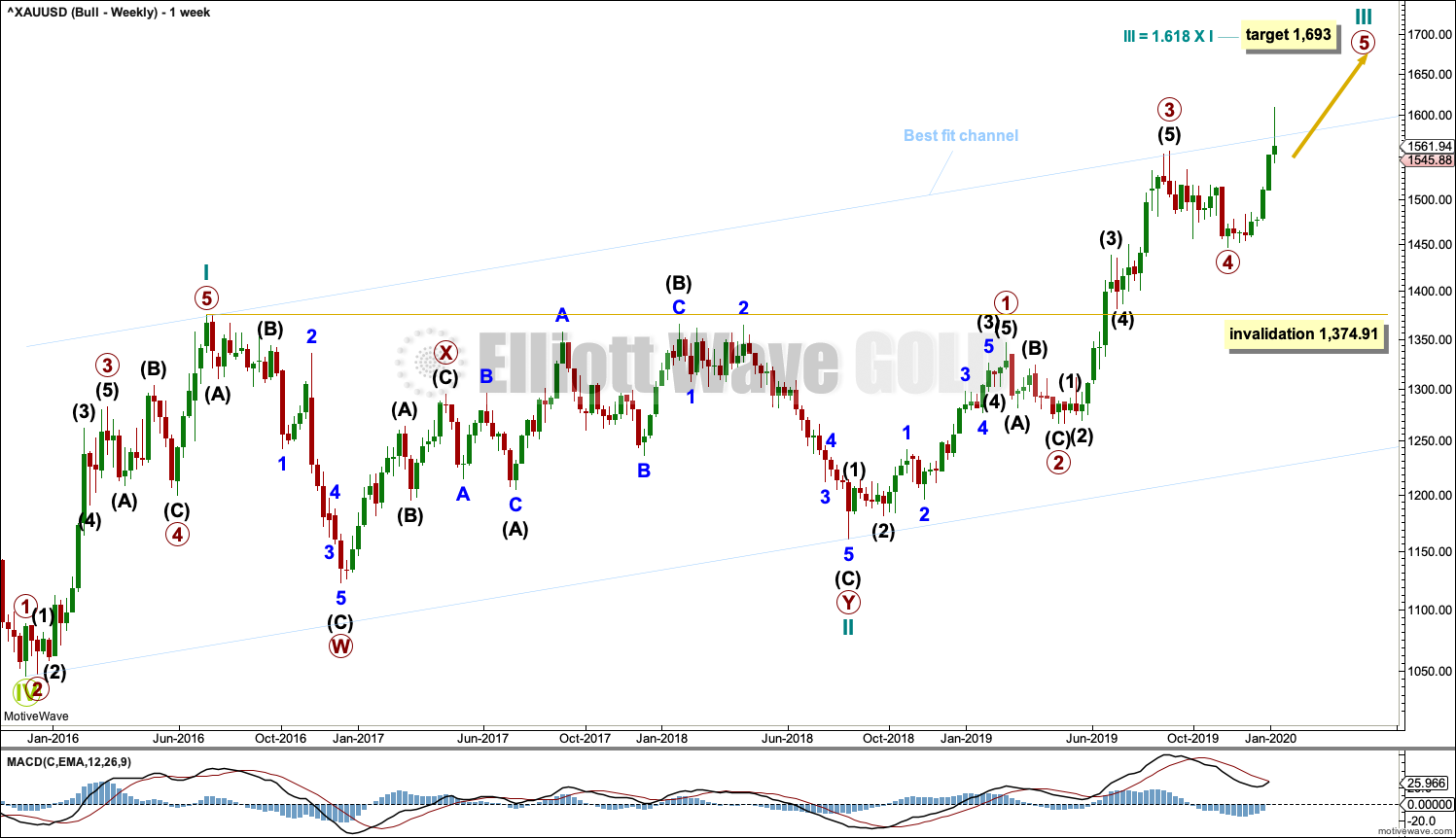

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, which is one reason why the bearish wave count is preferred because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 through to 4 may now be complete. Primary wave 5 may be complete at any stage now; this would complete the whole structure of cycle wave III. Cycle wave IV may not move into cycle wave I price territory below 1,374.91.

Add the wide best fit channel to weekly and daily charts.

DAILY CHART

A target for cycle wave III is calculated also now at primary degree. If price reaches the first target and keeps rising, then the second higher target may be used.

Primary wave 5 may only subdivide as a five wave structure, most likely an impulse. Within primary wave 5, intermediate waves (1) through to (3) may now be complete. Intermediate wave (4) may not move into intermediate wave (1) price territory below 1,473.35.

Draw an adjusted Elliott channel about primary wave 5. Intermediate wave (4) may find support at the lower edge.

This wave count for the next few weeks remains essentially the same as the main bearish wave count. Both wave counts are seeing a fourth wave unfold, to then be followed by a final fifth wave up.

HOURLY CHART

Hourly charts for the main bearish and this bullish wave count are the same.

TECHNICAL ANALYSIS

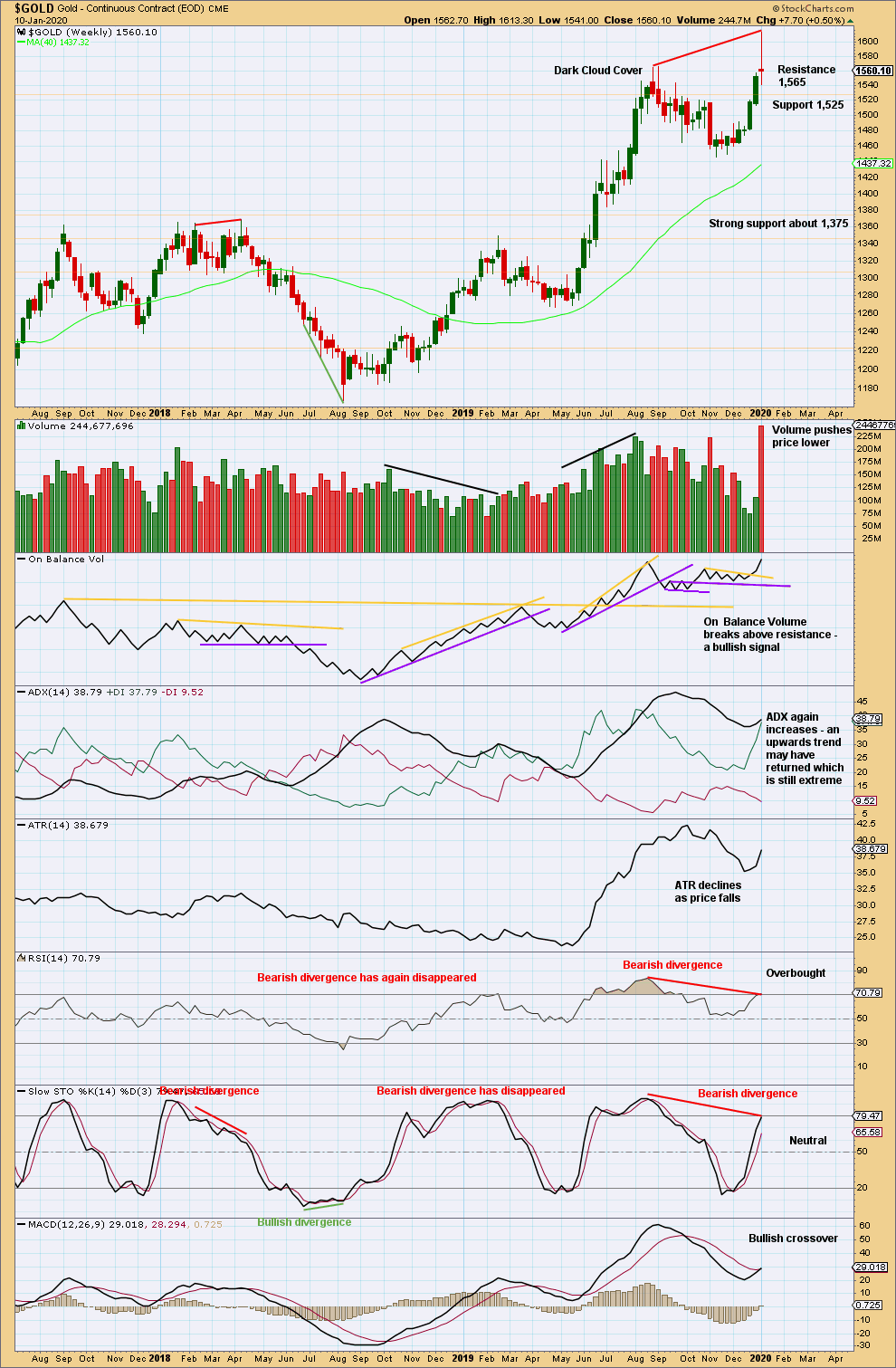

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This last completed weekly candlestick is bearish. With the upwards trend now extreme, a trend change may have occurred this week or will occur very soon.

To judge the volume profile this week daily volume bars are best analysed.

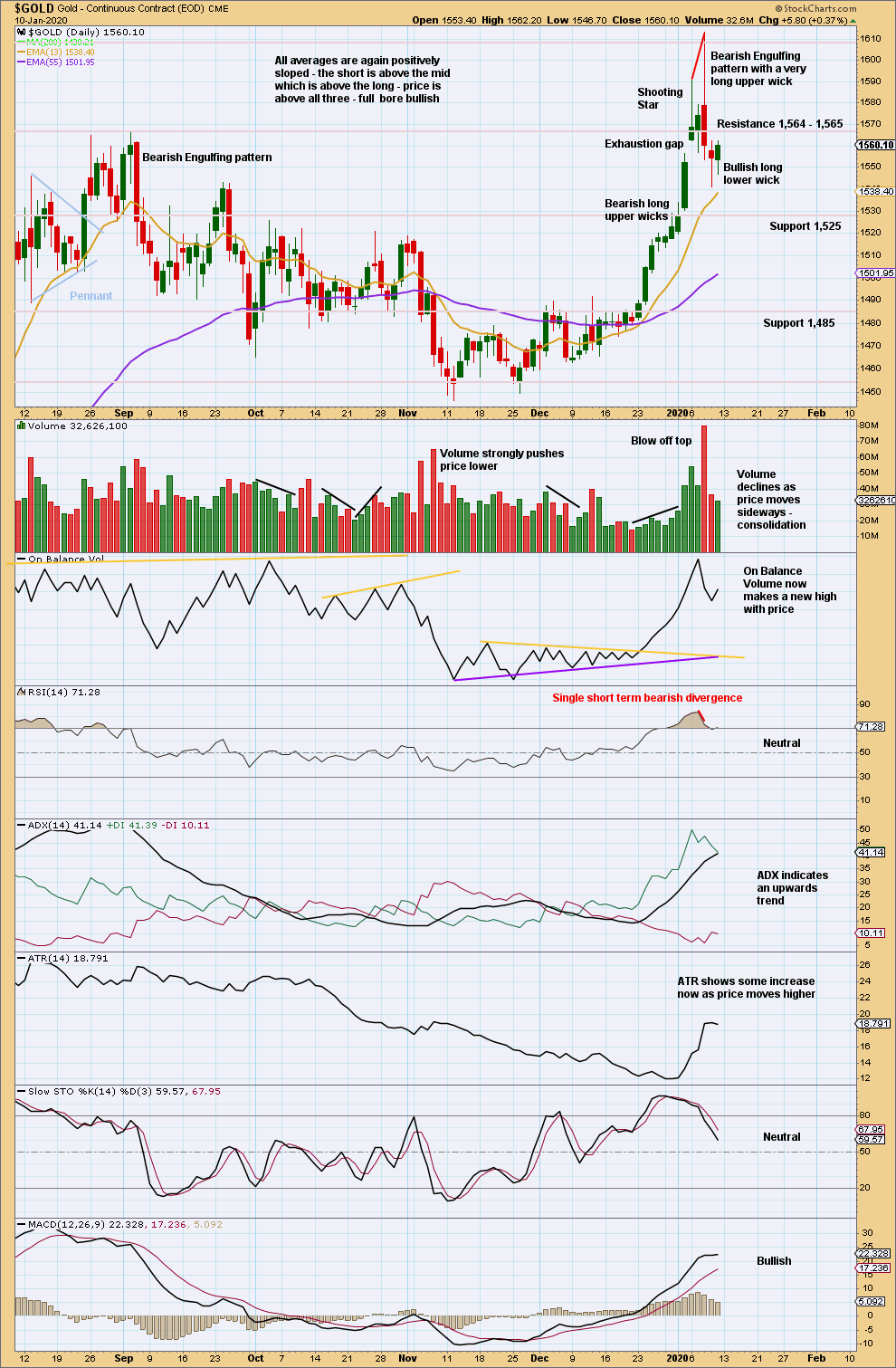

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last Bearish Engulfing pattern has strong support from volume, which increases the bearish implications. Expect a trend change to either down or sideways.

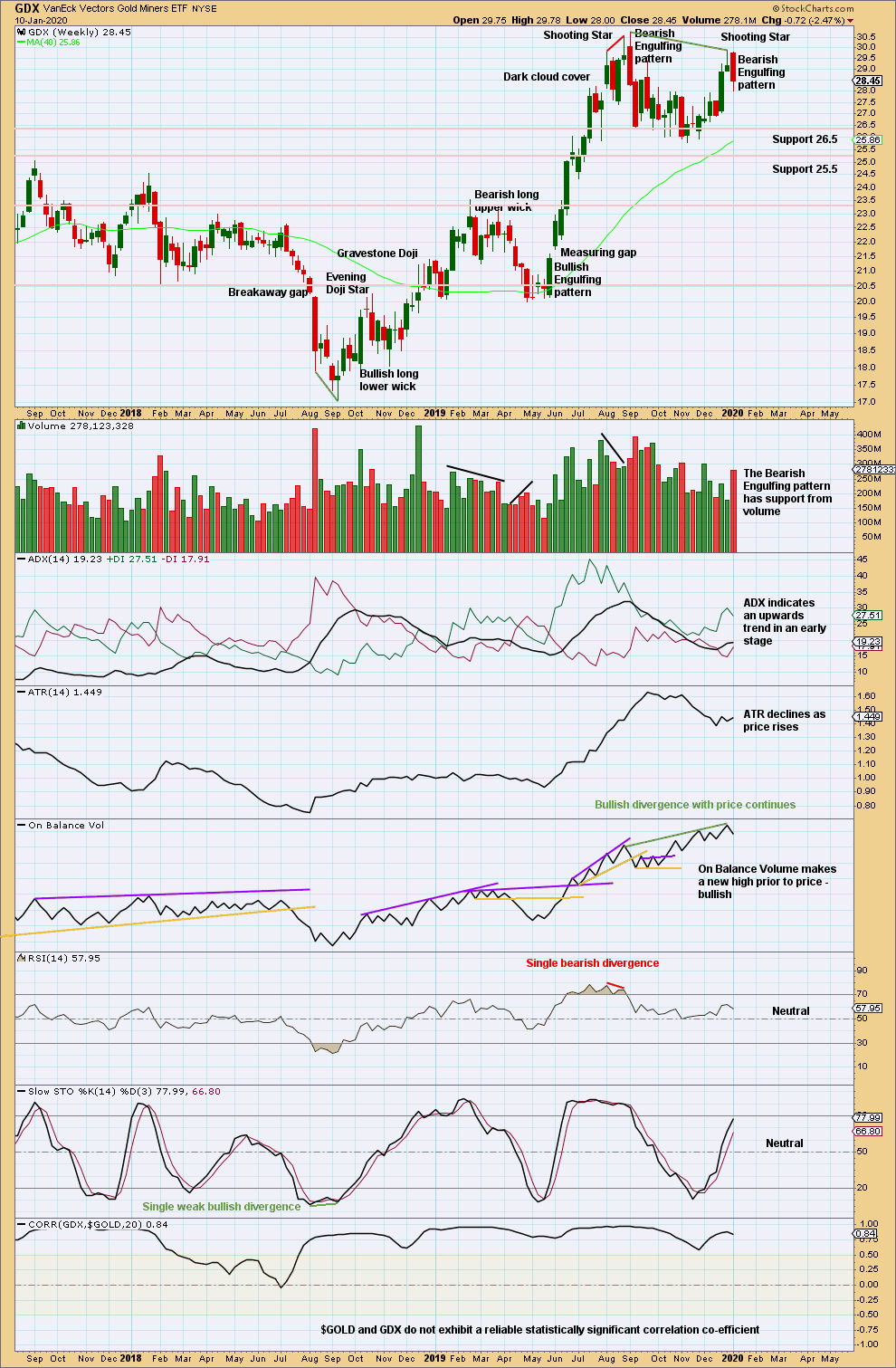

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Now two bearish candlestick patterns in a row, the second with support from volume, strongly suggest a trend change here to either down or sideways.

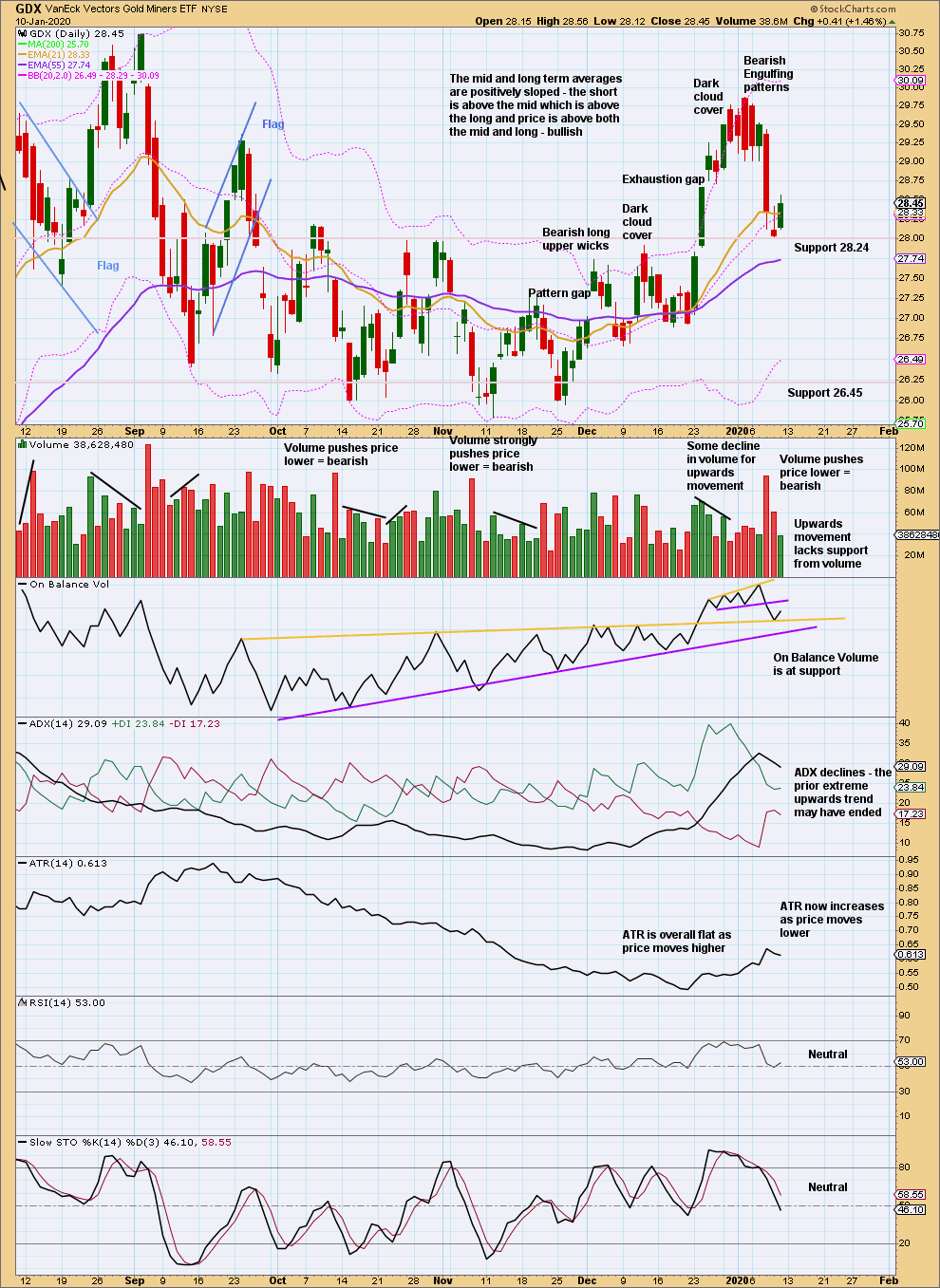

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A very strong bearish candlestick after an extreme upwards trend, along with closure of the last gap (now renamed an exhaustion gap) and now two bearish signals from On Balance Volume and volume supporting downwards movement and not upwards, strongly suggest GDX has found a high.

Published @ 07:35 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Intermediate (4) still may be incomplete and may continue sideways this week.