GOLD: Elliott Wave and Technical Analysis | Charts – January 27, 2020

The main bearish and the bullish Elliott wave counts both expected upwards movement to continue, which is so far what is happening.

Summary: Upwards movement may continue this week. Targets are 1,626 (main bear count) or 1,635 then 1,693 (bull count).

Alternatively, a new low below 1,536.52 would indicate a high was in place on the 8th of January and a downwards trend has begun.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

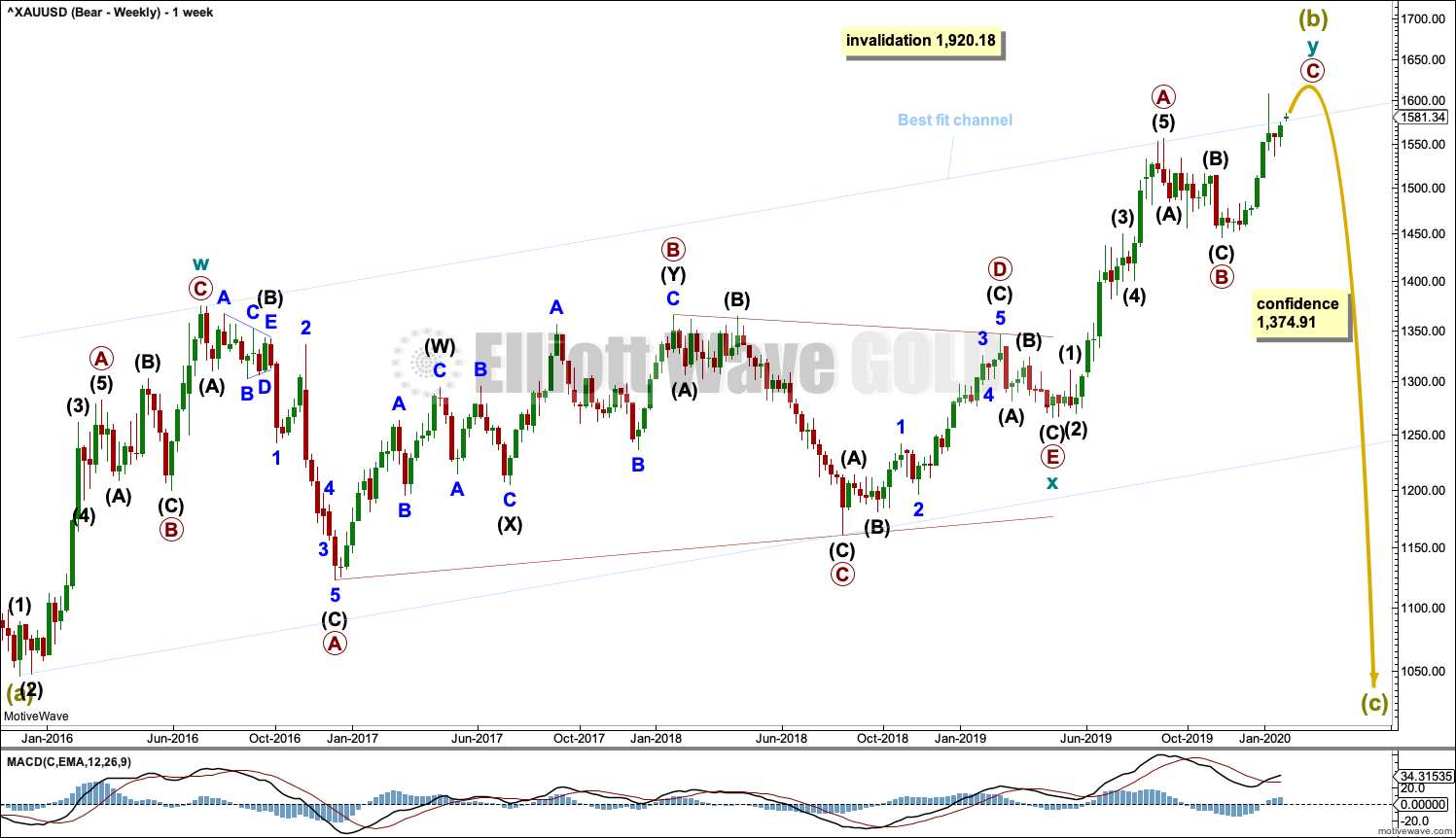

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may still be an incomplete double zigzag, requiring one more high.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

After the structure of cycle wave y may be complete, then a new low below 1,374.91 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated. At that stage, targets for Super Cycle wave (c) would be calculated.

A wide best fit channel is added in light blue. Copy this channel over to daily charts. The upper edge of this channel is again overshot, but this may not last for very long.

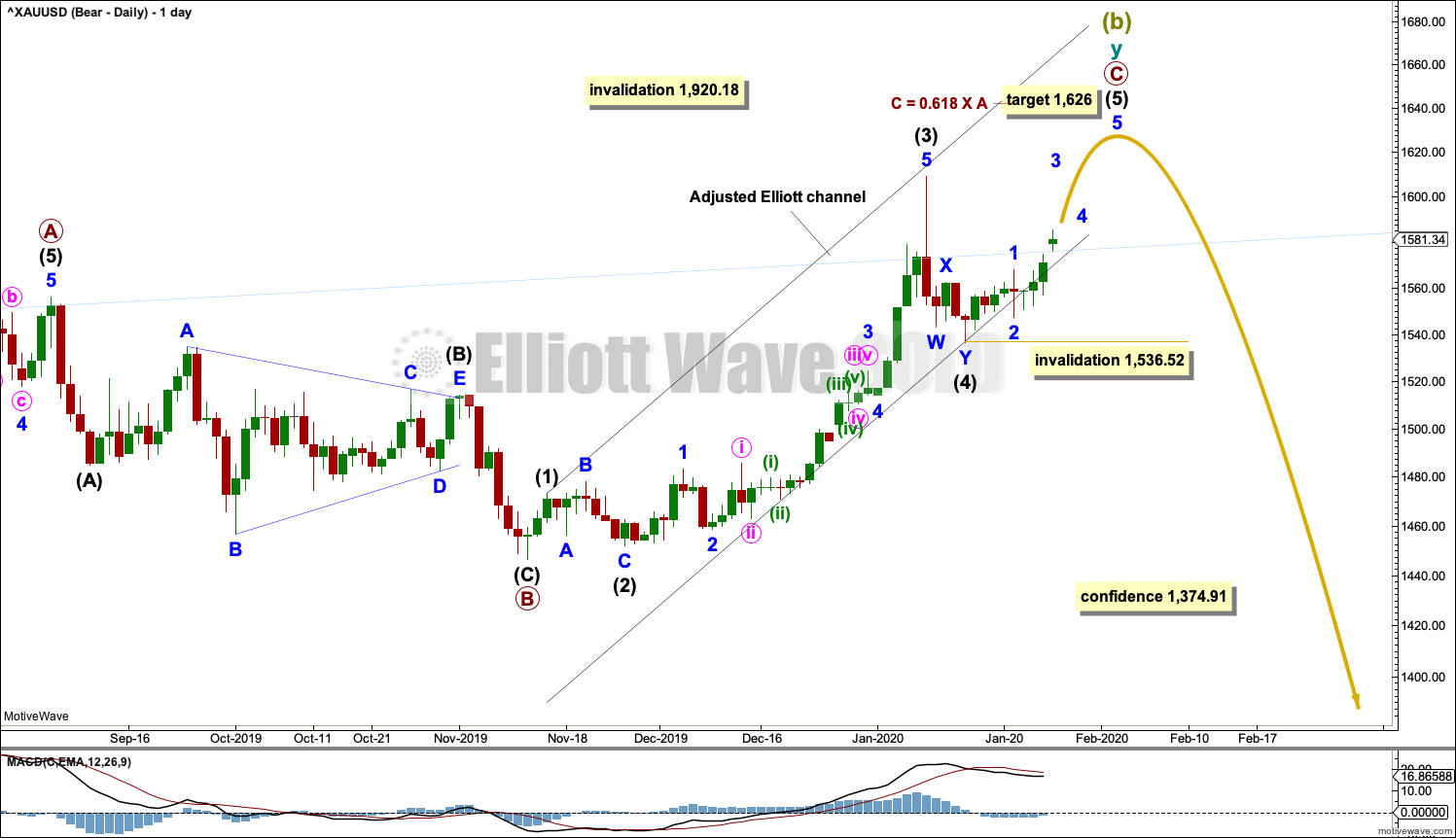

DAILY CHART

The double zigzag for Super Cycle wave (b) may be still incomplete.

Within cycle wave y, primary waves A and B are complete. Primary wave C must complete as a five wave structure. It is unfolding as an impulse. Within the impulse, intermediate waves (1) to (4) may now be complete.

Intermediate wave (2) was a deep 0.79 zigzag, which lasted 8 sessions. Intermediate wave (4) may have been a shallow 0.46 double zigzag lasting 4 sessions. Fourth waves are usually more brief than second waves for Gold.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 1,536.52.

Drawn an Elliott channel about primary wave C and then pull the lower edge down to contain all of primary wave C. The lower edge may provide support to intermediate wave (5) as it continues higher. Copy this channel over to hourly charts.

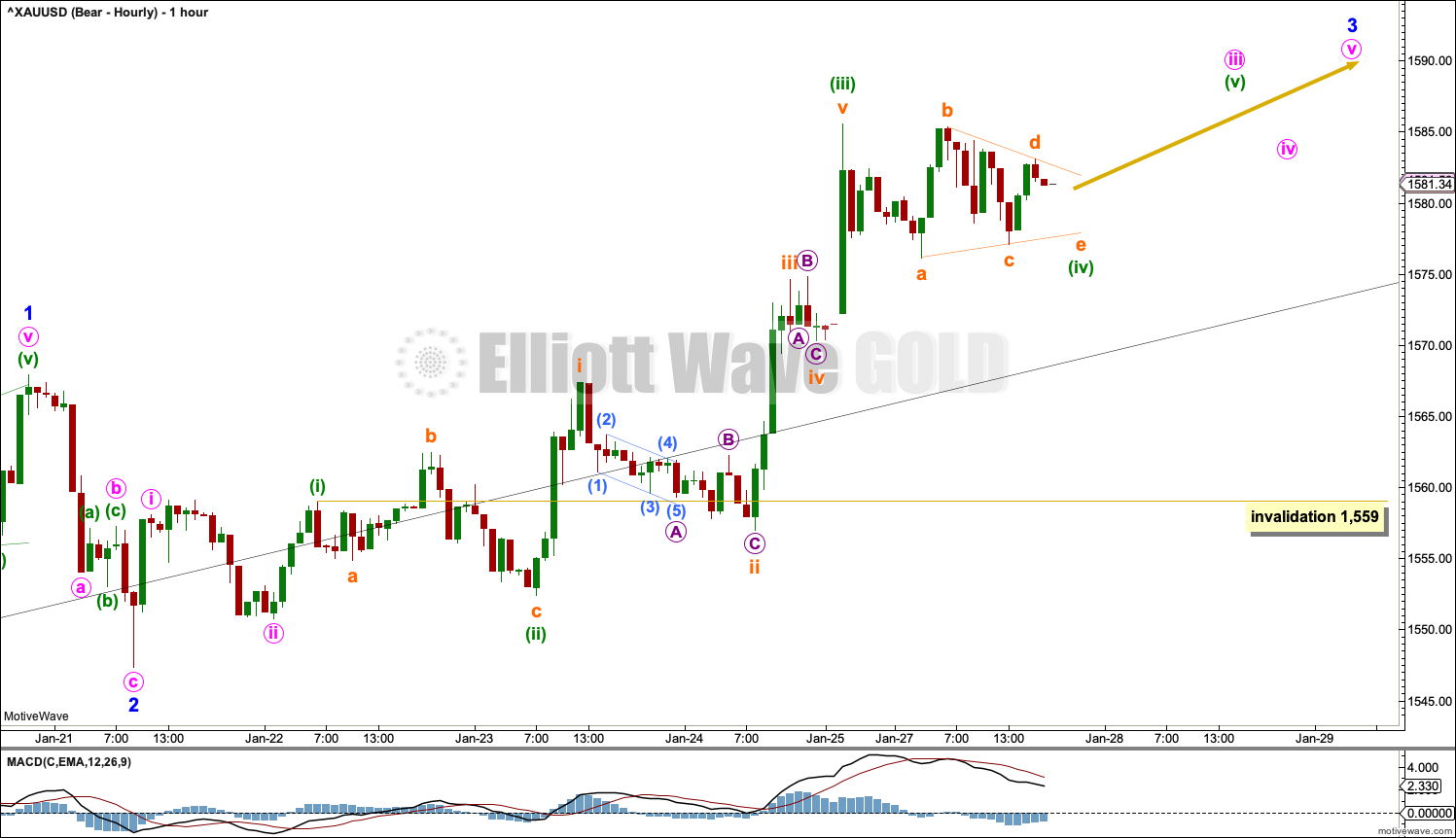

HOURLY CHART

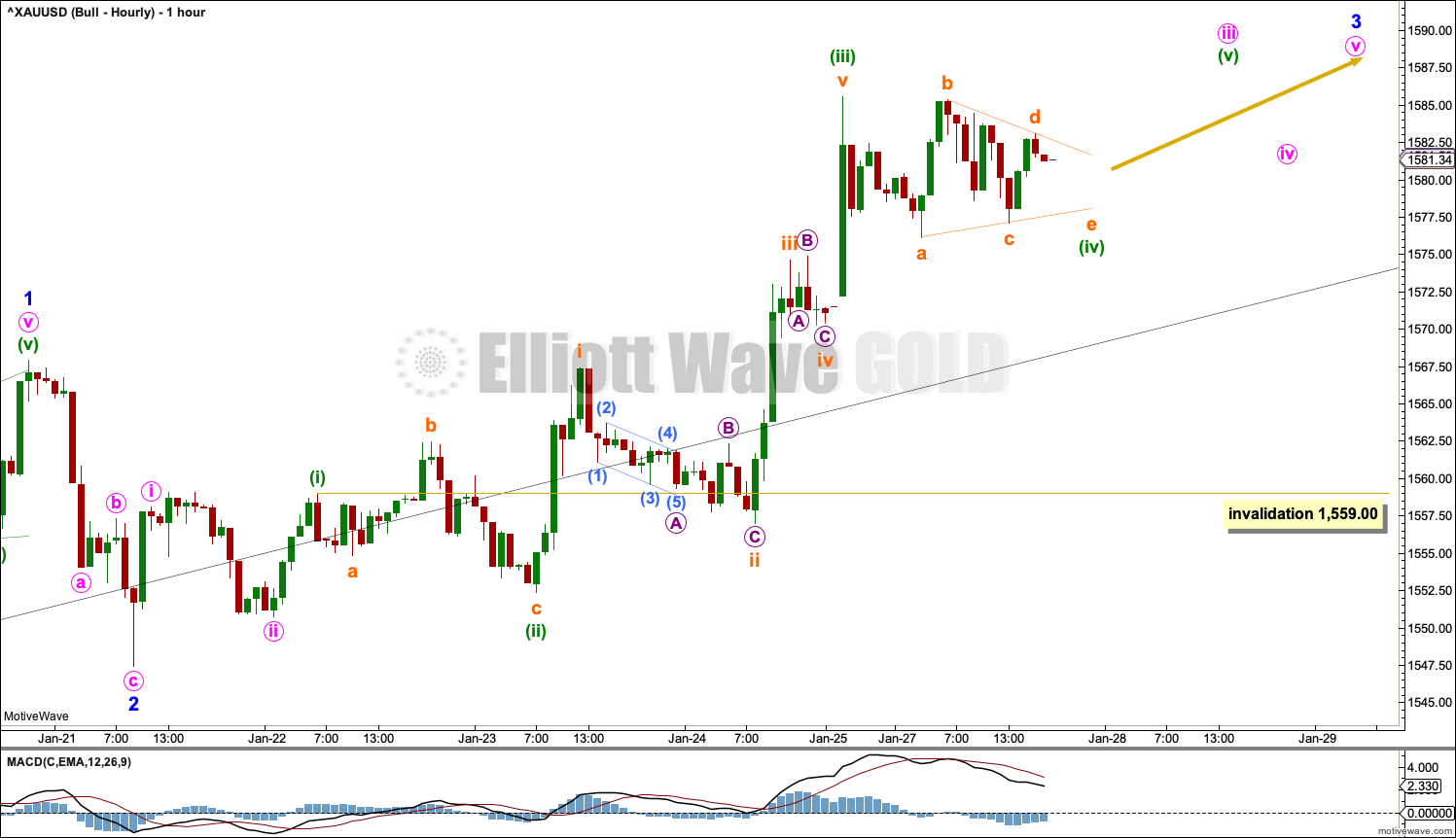

Intermediate wave (5) may only subdivide as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common and so far that has a better fit.

Within intermediate wave (5), so far minor waves 1 and 2 may be complete. Minor wave 3 may only subdivide as an impulse.

Within minor wave 3, minute waves i and ii may be complete. Minute wave iii may only subdivide as an impulse. Within the impulse, minuette wave (iv) may not move into minuette wave (i) price territory below 1,559.00. Minuette wave (iv) may be an almost complete regular contracting triangle.

At its end, intermediate wave (5) would be very likely to make at least a slight new high above the end of intermediate wave (3) at 1,609.12 to avoid a truncation.

ALTERNATE DAILY CHART

Alternatively, it is possible again that Super Cycle wave (b) may be complete and the bear market for Gold may have resumed.

A new low below 1,536.52 would invalidate the main bearish wave count and add some confidence in this alternate. A new low below 1,473.35 would add further confidence. Thereafter, a new low by any amount at any time frame below 1,374.91 would invalidate the bullish wave count below and add full and final confidence in this wave count. Targets for Super Cycle wave (c) would be calculated at that stage.

If Super Cycle wave (c) has begun, then it should develop a five wave structure downwards at all time frames up to and including monthly.

Minor waves 1 and now also 2 may be complete. Minor wave 2 may have continued higher as an expanded flat correction. If it continues further, then minor wave 2 may not move beyond the start of minor wave 1 above 1,609.12.

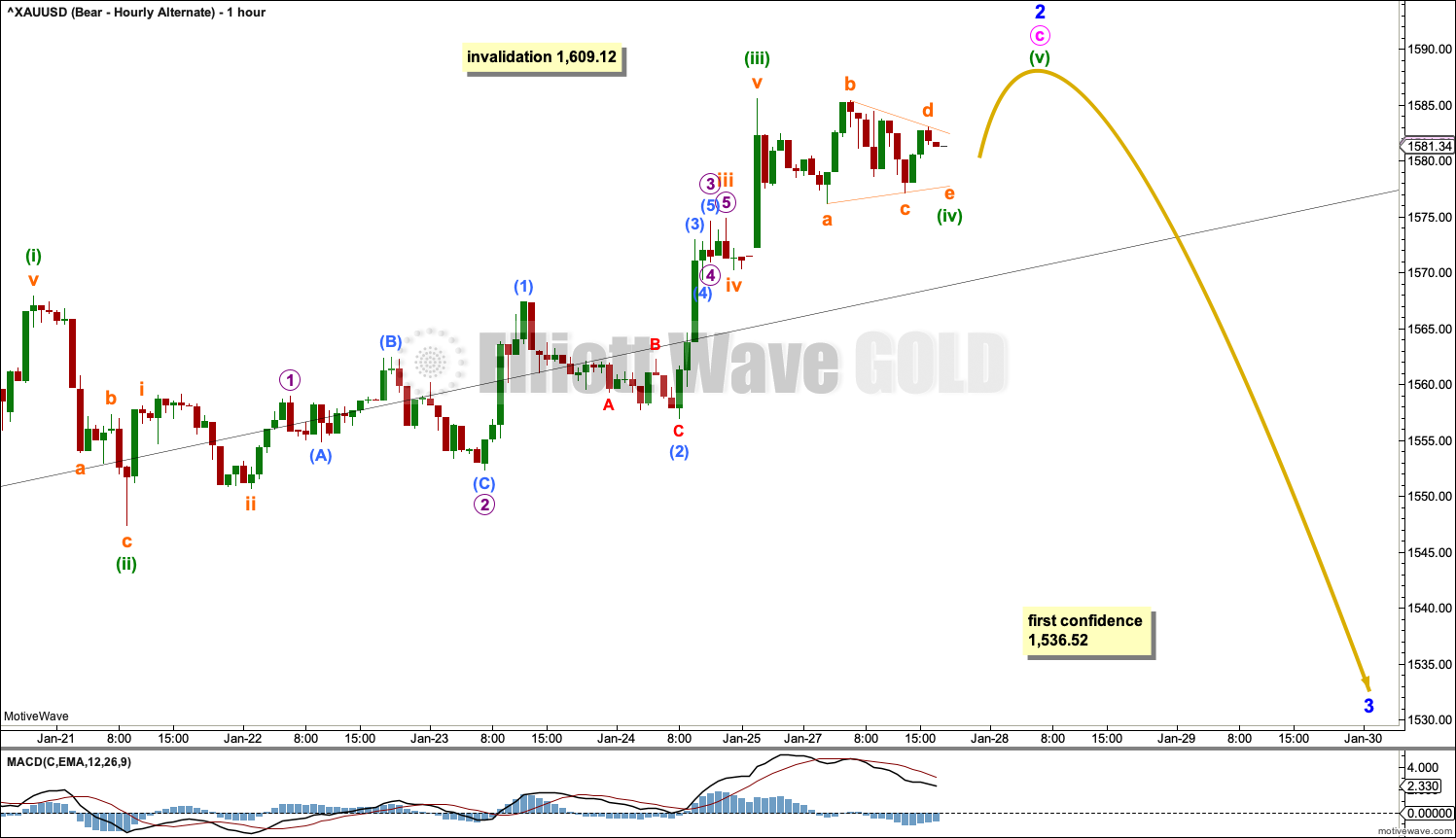

ALTERNATE HOURLY CHART

Minor wave 2 may have continued higher. It may be unfolding as an expanded flat. Within minute wave c, a final fifth wave may be needed to complete the structure.

If minor wave 2 continues higher, then it may not move beyond the start of minor wave 1 above 1,609.12.

BULLISH ELLIOTT WAVE COUNT

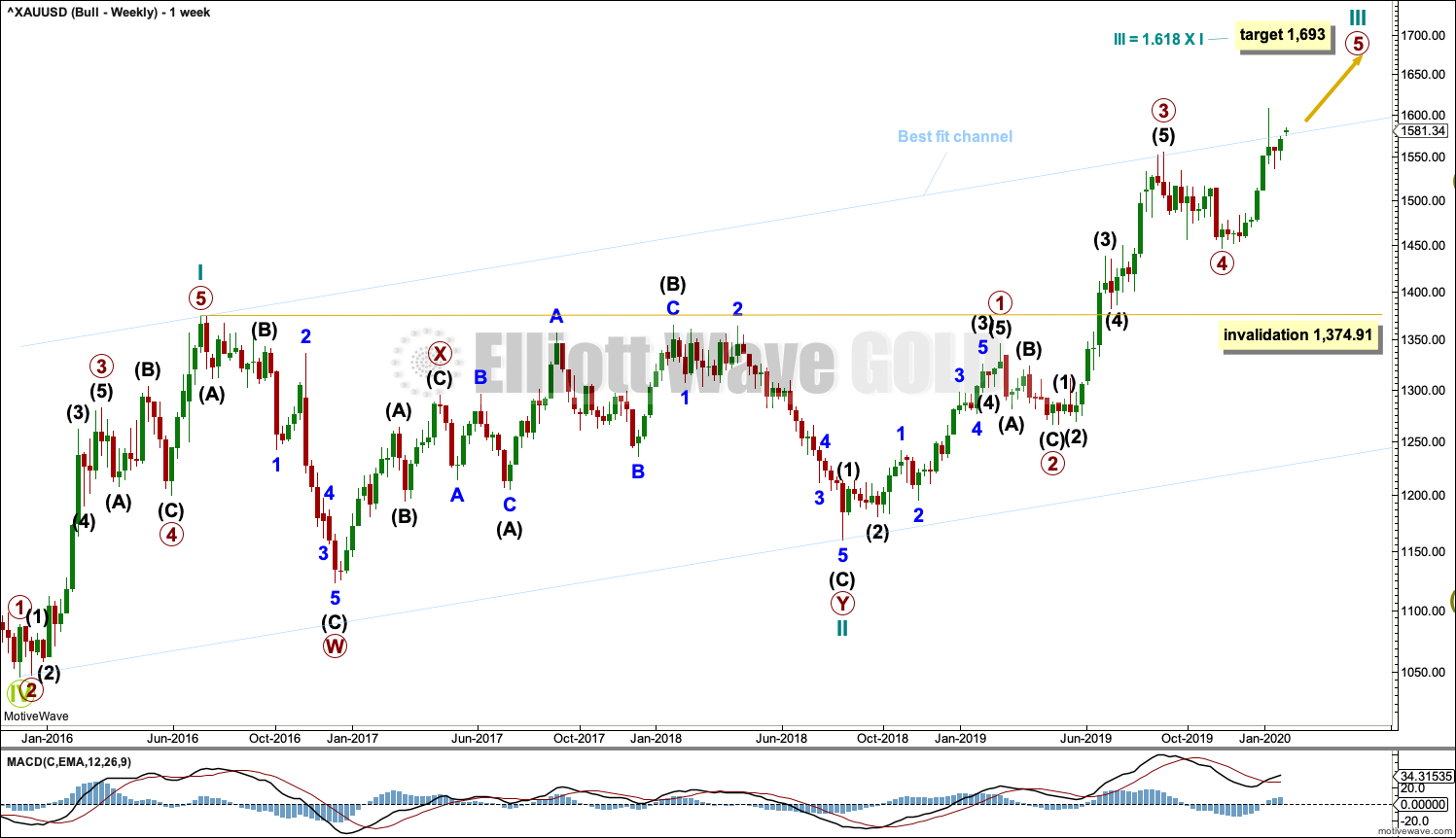

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold on 3 December 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, which is one reason why the bearish wave count is preferred because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 through to 4 may now be complete. Primary wave 5 may be complete at any stage now; this would complete the whole structure of cycle wave III. Cycle wave IV may not move into cycle wave I price territory below 1,374.91.

Add the wide best fit channel to weekly and daily charts.

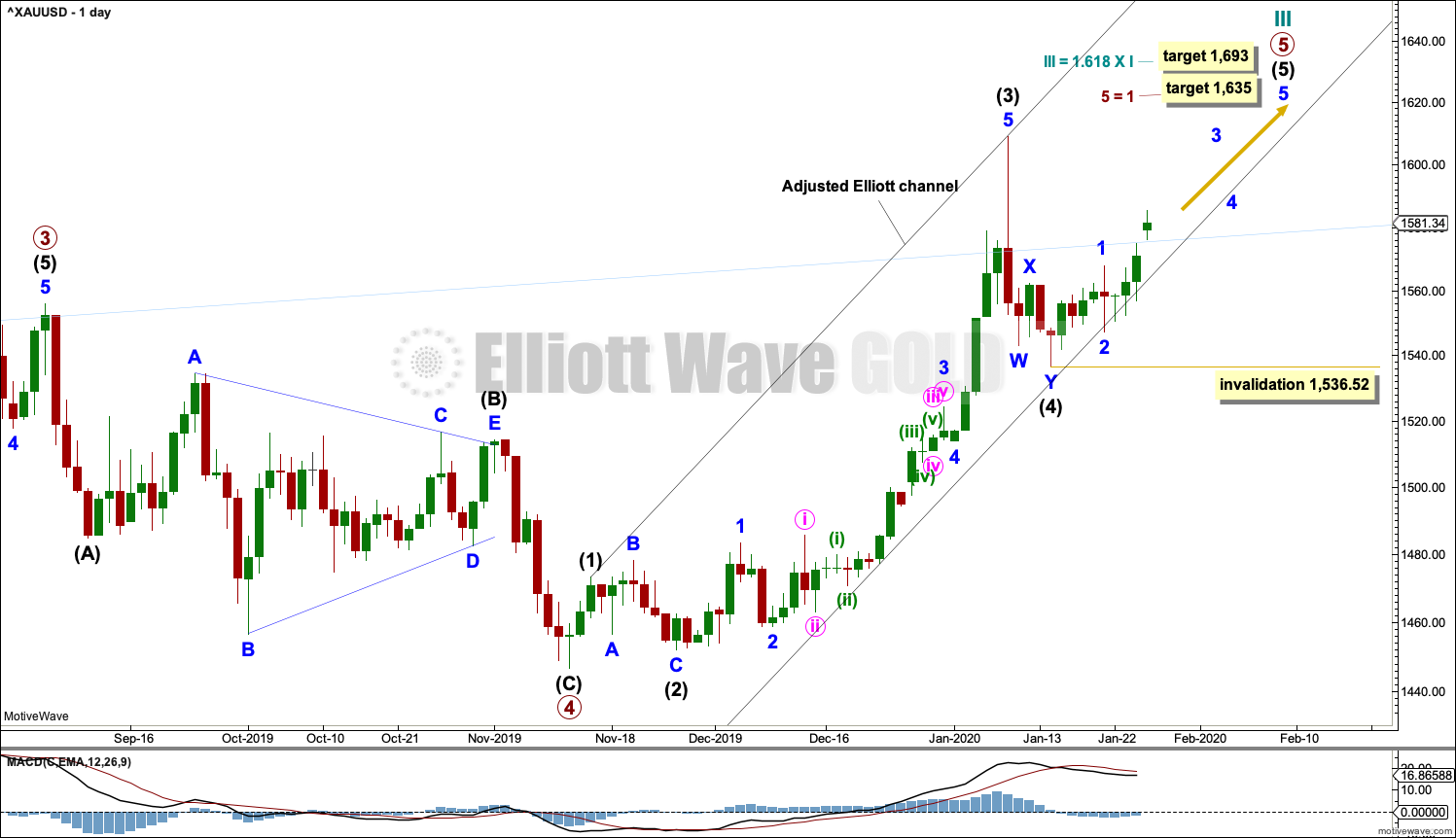

DAILY CHART

A target for cycle wave III is calculated also now at primary degree. If price reaches the first target and keeps rising, then the second higher target may be used.

Primary wave 5 may only subdivide as a five wave structure, most likely an impulse. Within primary wave 5, intermediate waves (1) through to (4) may now be complete.

Draw an adjusted Elliott channel about primary wave 5. Intermediate wave (4) may find support at the lower edge.

This wave count for the next few weeks remains essentially the same as the main bearish wave count. Both wave counts see a fourth wave complete and a fifth wave now beginning and requiring more upwards movement.

HOURLY CHART

Hourly charts are the same.

TECHNICAL ANALYSIS

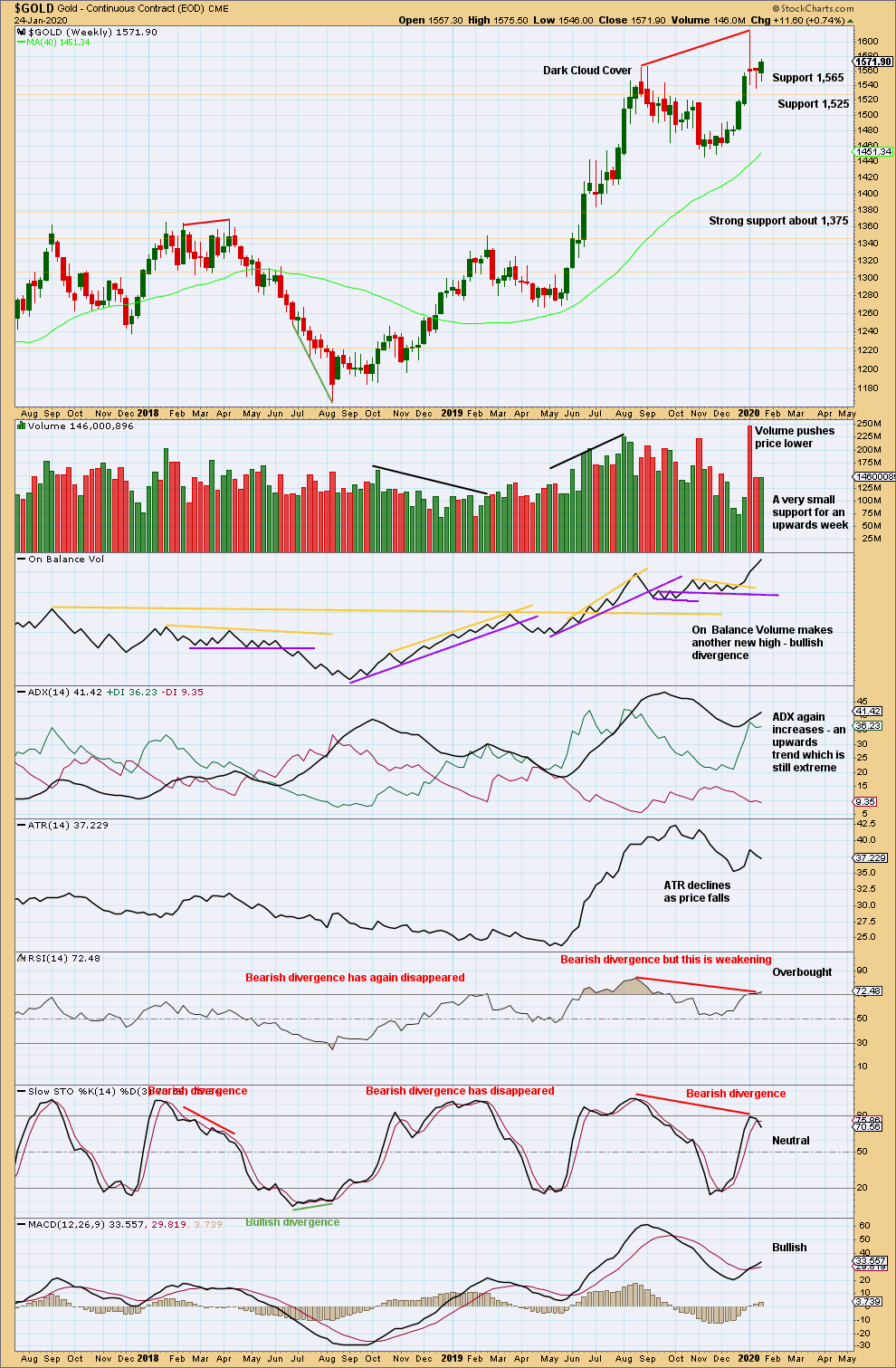

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Bullish divergence between price and On Balance Volume is contradicted by bearish divergence between price and RSI. More weight may be given to RSI as this tends to be slightly more reliable, particularly after it has reached extreme. This would support the alternate bearish wave count.

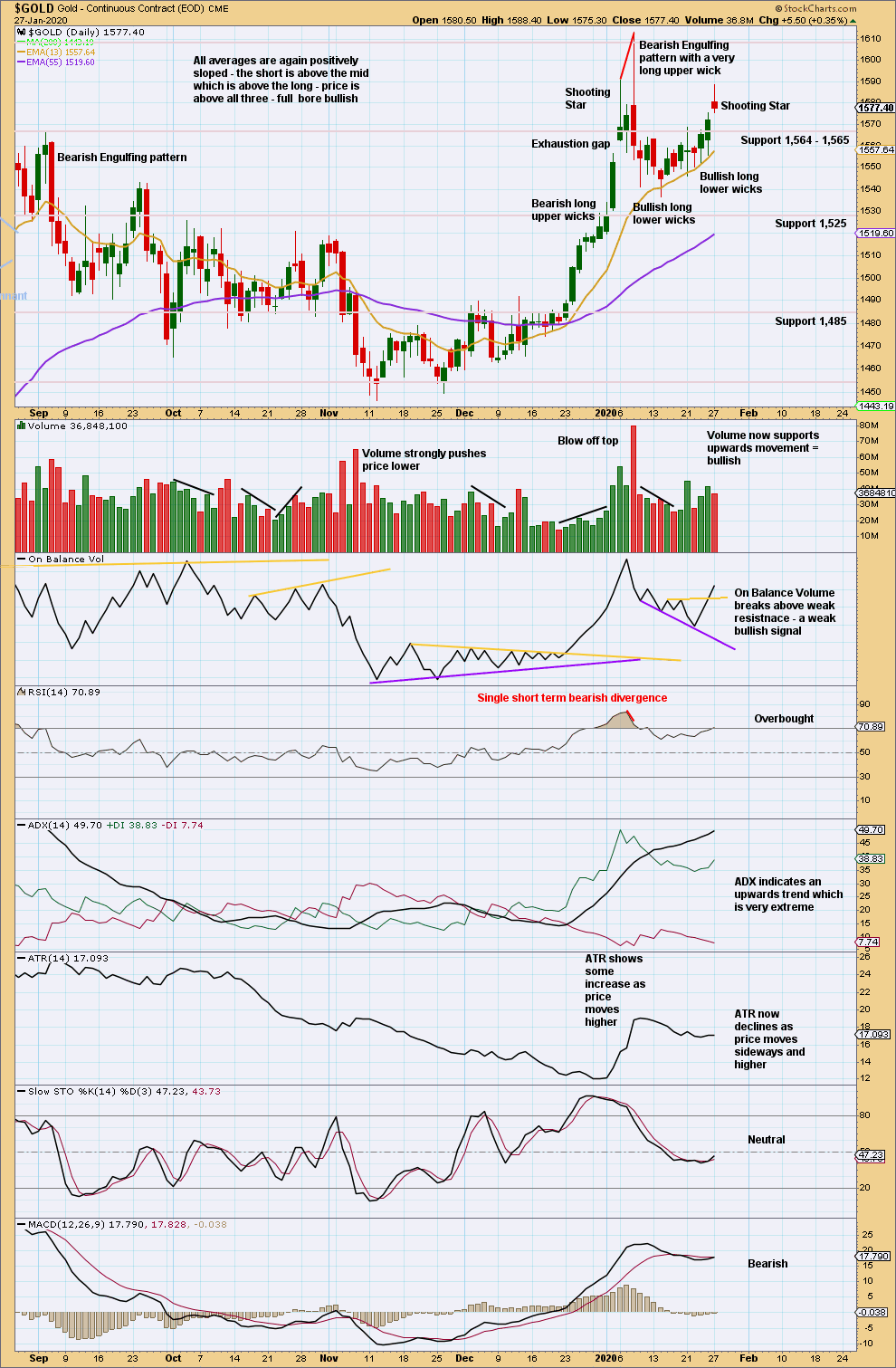

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last Bearish Engulfing pattern has strong support from volume, which increases the bearish implications. Expect a trend change to either down or sideways.

For the short term, some decline in volume for this last upwards session along with a candlestick reversal pattern in the Shooting Star suggest a bounce may be over here.

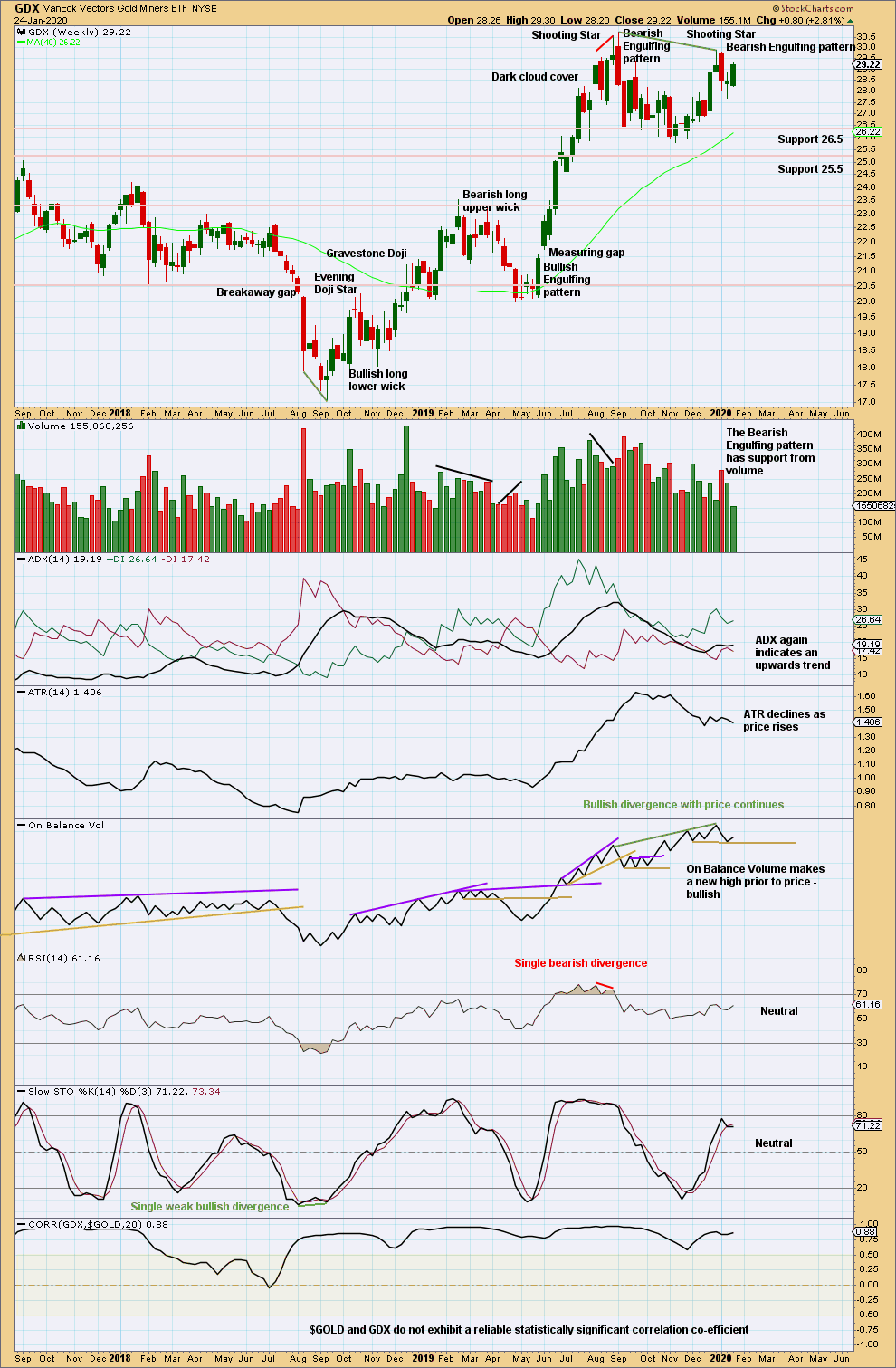

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Now two bearish candlestick patterns in a row, the second with support from volume, strongly suggest a trend change here to either down or sideways.

Last week upwards movement lacks support from volume; with the data in hand at this stage, it looks more likely to be a counter trend bounce.

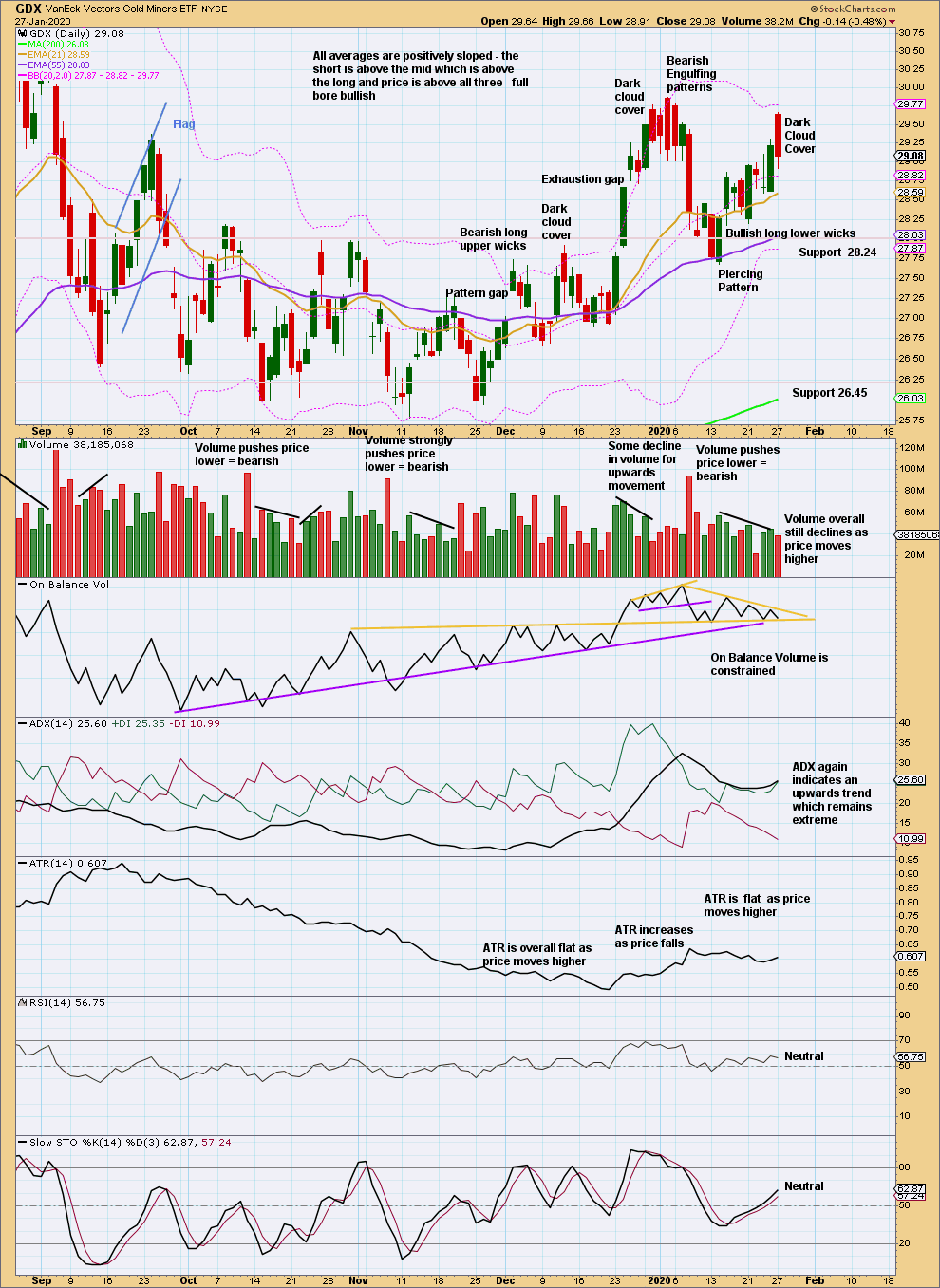

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A very strong bearish candlestick after an extreme upwards trend, along with closure of the last gap (now renamed an exhaustion gap) and now two bearish signals from On Balance Volume and volume supporting downwards movement and not upwards, strongly suggest GDX has found a high.

For the short term, a decline in volume with upwards movement of the last few sessions suggests this looks more likely to be a counter trend bounce. Dark Cloud Cover today suggests the bounce may be over.

Published @ 08:54 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Alternate bear updated today, because this one is easier, it has an okay fit. The only problem, and it’s small, is a truncation at the end of minor 2. The truncation is small but comes after a strong move, so the conditions are acceptable.