Downwards movement was expected for both the main and alternate hourly Elliott wave counts.

Summary: Gold is may be about halfway through this consolidation phase. I expect upwards movement from here to at least just above 1,236.69. This correction may end at 1,251 – 1,253 in another two days time.

Click on charts to enlarge.

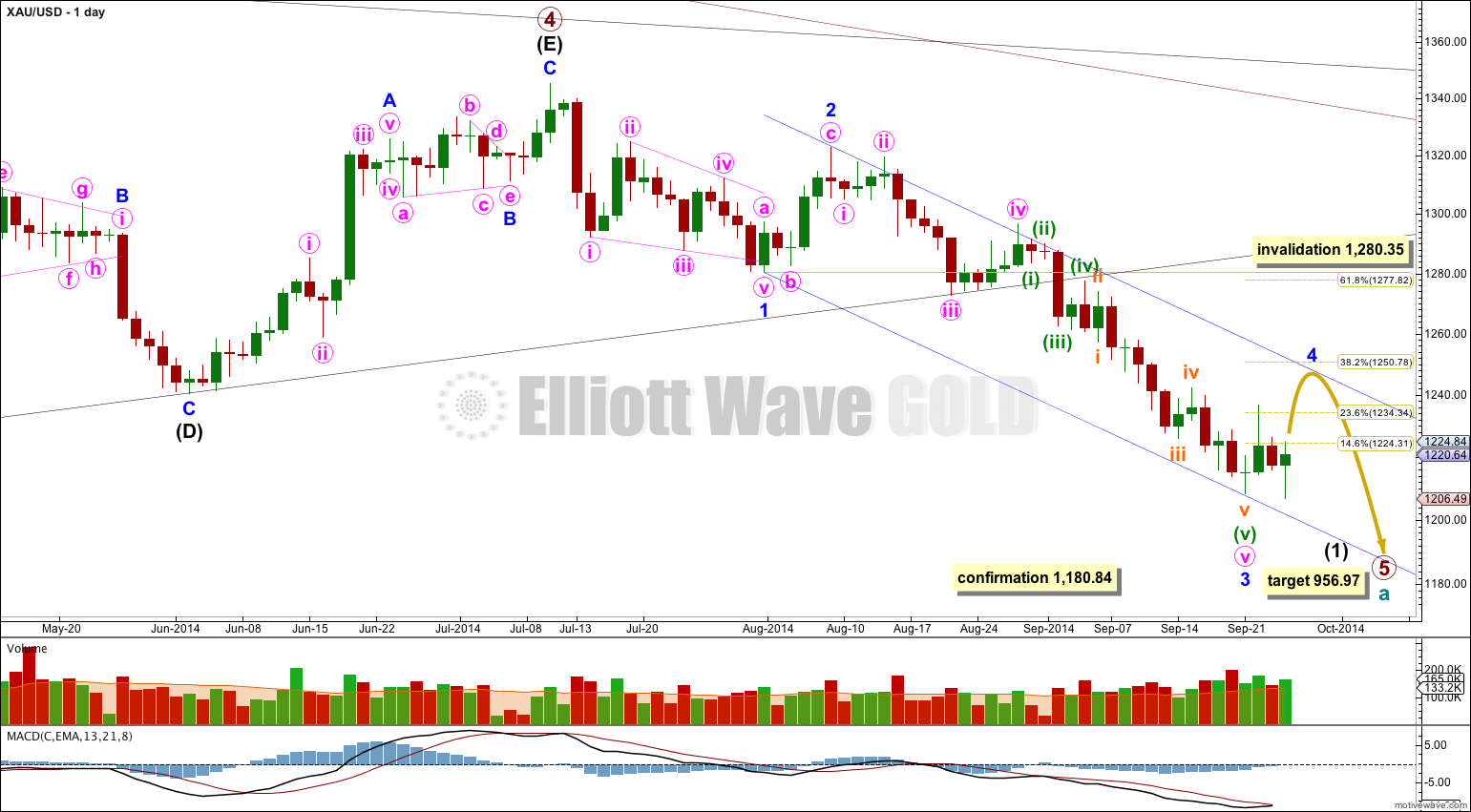

Main Wave Count

On the weekly chart extend the triangle trend lines of primary wave 4 outwards. The point in time at which they cross over may be the point in time at which primary wave 5 ends. This does not always work, but it works often enough to look out for. It is a rough guideline only and not definitive. A trend line placed from the end of primary wave 4 to the target of primary wave 5 at this point in time shows primary wave 5 would take a total 26 weeks to reach that point, and that is what I will expect. Primary wave 5 has begun its 11th week.

The black (B)-(D) trend line is now clearly breached on the daily chart, and also clearly breached on the weekly chart. This is significant.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1, and equality between primary waves 5 and 1 would give a perfect Elliott relationship for this downwards movement.

However, when triangles take their time and move close to the apex of the triangle, as primary wave 4 has (looking at this on a weekly chart is clearer) the movement following the triangle is often shorter and weaker than expected. If the target at 956.97 is wrong it may be too low. In the first instance I expect it is extremely likely that primary wave 5 will move at least below the end of primary wave 3 at 1,180.40 to avoid a truncation. When intermediate waves (1) through to (4) within primary wave 5 are complete I will recalculate the target at intermediate degree because this would have a higher accuracy. I cannot do that yet; I can only calculate it at primary degree.

Minor wave 3 is $9.65 longer than 1.618 the length of minor wave 1. This variation is less than 10% the length of minor wave 3 and so I would consider it an acceptable Fibonacci ratio. Just.

Movement comfortably below 1,180.84 would invalidate the alternate daily wave count below and provide further confidence in this main wave count.

I have drawn a Fibonacci retracement the length of minor wave 3. Minor wave 4 has already reached up to the 0.236 at 1,234.34, and may yet move higher to the 0.382 at 1,250.78 Fibonacci ratio, so that there is alternation with the deep correction of minor wave 2. I expect this tendency to alternation may be stronger than a tendency for corrections following fifth wave extensions to reach up to the end of the second wave within the extended fifth wave.

Draw a channel about intermediate wave (1): draw the first trend line from the lows labeled minor waves 1 to 3, then place a copy on the high labeled minor wave 2. Minor wave 4 may find resistance and may end about the upper edge of this blue channel. This indicates minor wave 4 could last only one week / 5 days. Today, however, it looks like minor wave 4 may be longer lasting than just one week.

Draw a channel on the daily chart and copy it over to the hourly chart about the extended fifth wave of minuette wave (v): draw the first trend line from the highs of subminuette waves ii to iv, then place a parallel copy on the low of subminuette wave iii. The upper orange trend line is showing where price is finding support.

There is a nice morning doji star on this daily chart which supports this wave count. A morning doji star is a bottom reversal pattern, indicating the prior bear trend of minor wave 3 should change to a new trend. This new trend may be either upwards or sideways, and the wave count expects it is sideways.

*Note: I am discarding the alternate daily wave count. With a new low below 1,208.22 minute wave c of intermediate wave (D) no longer fits as a clear five wave structure. Within intermediate wave (E) zigzag there should be no low below its start. This alternate now makes little sense.

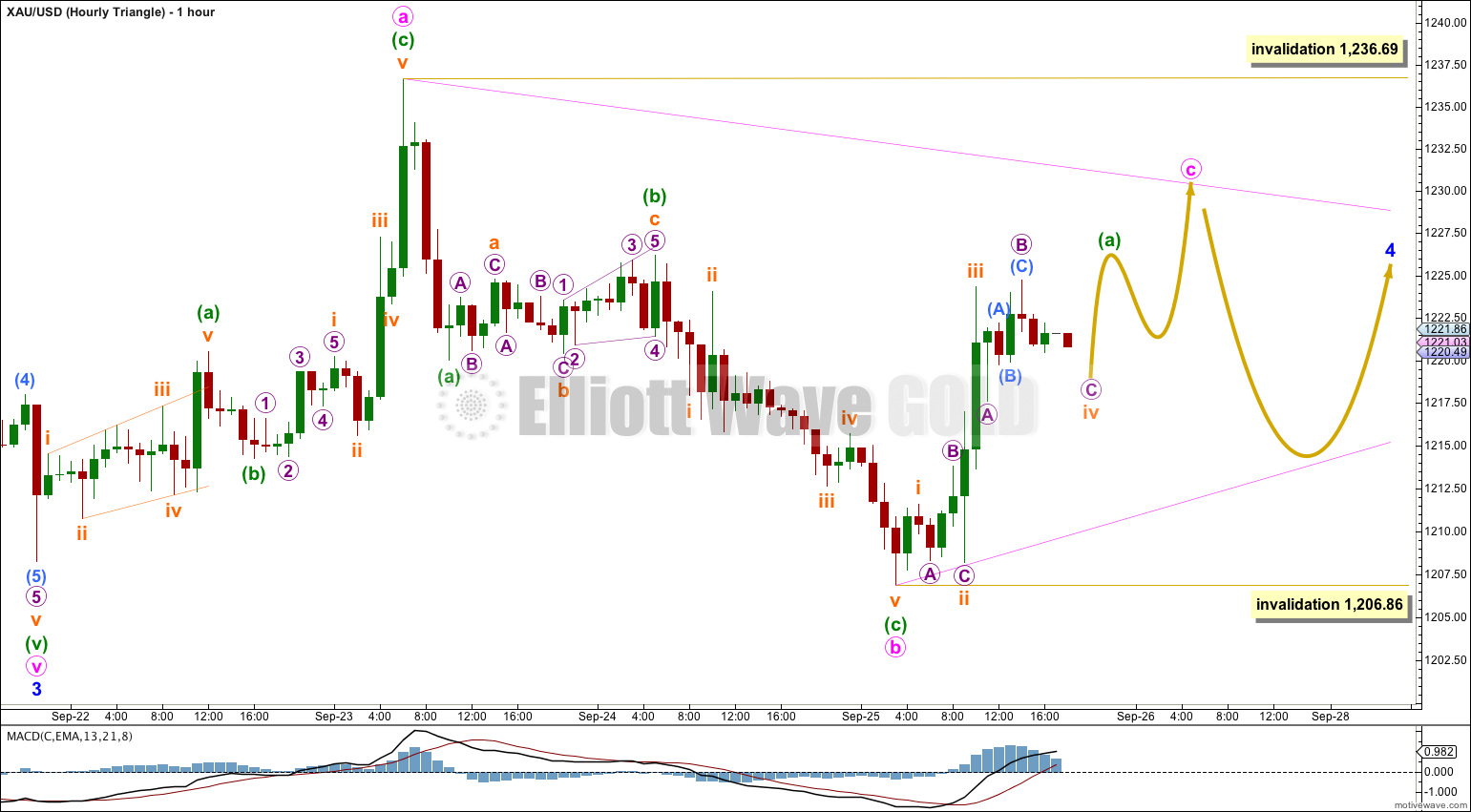

Hourly wave counts below are ranked in order of probability.

Hourly Wave Count – Flat

It looks most likely at this stage that minor wave 4 is unfolding as a flat correction, subdividing 3-3-5.

Minute wave b is a 104.7% correction of minute wave a. This is just slightly below the required length of 105% for an expanded flat correction, and technically this would be a regular flat correction. A regular flat expects minute wave c to move at least slightly above the end of minute wave a at 1,236.69.

It is extremely likely the first target at least will be met to avoid a truncation and avoid a rare running flat.

We may see the most common type of flat, an expanded flat, because minute wave b is so close to 105% the length of minute wave a. This would expect minute wave c to be 1.618 the length of minute wave a at 1,253. This is just $2 above the 0.382 Fibonacci ratio of minor wave 3 at 1,251, and so this second target zone has a reasonable probability.

Within minute wave c minuette wave (ii) may not move beyond the start of minuette wave (i) at 1,206.86.

If price moves above 1,236.69 this hourly wave count would be the only viable hourly wave count for minor wave 4.

If minor wave 4 lasts another two days it might complete in a total Fibonacci five, and have an equal duration with minor wave 3.

Hourly Wave Count – Triangle

It is still possible that minor wave 4 may complete as a running contracting or barrier triangle. All the triangle subwaves must subdivide as threes, and four of the five waves must be single or multiple zigzags. Minute wave c must subdivide as a three (*edit – not a five) and may not move beyond the end of minute wave a at 1,236.69.

Thereafter minute wave d may not move beyond the end of minute wave b at 1,206.86. This lower invalidation point is not black and white though because for a barrier triangle minute wave d may end slightly below 1,206.86 (*edit – not 1,205.86) as long as the b-d trend line is essentially flat.

This triangle structure would expect choppy overlapping movement for a few days yet, and it if lasts another five days it may complete in a total Fibonacci eight, with a 1.618 duration to minor wave 2.

Hourly Wave Count – Combination

The least likely structure at this stage is a combination.

I am moving the degree of labeling for this idea up one degree. Minor wave 4 may be a combination with the first structure in the double combination, labeled minute wave w, a zigzag.

The double is joined by a three in the opposite direction labeled minute wave x which subdivides as a zigzag. X waves are most commonly zigzags. Because minute wave x is very deep in comparison to minute wave w this structure is highly unlikely to be a double zigzag, and more likely to be a combination. Double zigzags and double combinations are very different structures and have different purposes. Within a double zigzag the second zigzag occurs to deepen the correction when the first did not move price deep enough, and so for this purpose a shallow X wave is normal. Double combinations occur to take up time and move price sideways, much like triangles, and so their X waves are normally very deep.

A double zigzag would provide little alternation with the single zigzag of minor wave 2, but a combination would provide perfect alternation.

The second structure for minute wave y may be either a flat or triangle. It is most likely to be a flat. Within a flat minuette wave (b) must reach at least 90% the length of minuette wave (a) at 1,208.61. Minuette wave (b) may make a new low below the start of minuette wave (a) at 1,206.86. There is no lower invalidation point for this wave count.

If price moves below 1,206.86 this hourly wave count would be the only viable wave count for minor wave 4.

A combination is a time consuming structure, and so this idea may also see minor wave 4 last another five days to total a Fibonacci eight.

This analysis is published about 06:50 p.m. EST.

Just thinking ahead a couple steps, how deep could intermediate wave 2 be? It is perhaps too early to make any accurate predictions, in terms of price, but could you provide some typical percentages for an intermediate 2 to end? Do 2nd wave corrections have to retrace 50% or more of 1st waves, or can they also be less than 50% (like 38.2% or 23.6%)? Thanks.

Good morning, Lara!

Please note 2 little writing errors in the analysis for the triangle option:

“Minute wave c must subdivide as a five” should be “Minute wave c must subdivide as a three”, and “minute wave d may end slightly below 1,205.86 as long…” should be “minute wave d may end slightly below 1,206.86 as long…”

Moreover: Why do you discard your alternate completely? I think it is entirely possible that intermediate D finishes around 1188 after current minor 4 and following minor 5. That way it would create a nice barrier triangle. What do you think about this possibility?

Thank you for pointing out those errors, thats fixed now.

It is still technically possible that primary wave 4 could continue as a barrier triangle. But I am judging it to be extremely unlikely.

If it does continue intermediate wave (D) would not end for another three weeks (about) then intermediate wave (E) would take a few weeks as well. By the time it is finished it would be quite a lot longer than primary wave 2.

This is possible, and I’ll keep it in mind, hence the confirmation point at 1,180.84.

But the probability is so low I do not want undue weight given to it by publishing it everyday.

The idea for a barrier triangle is also in alignment with the main wave count anyway. They do not diverge at this stage. If I’m right then minor wave 5 down should end well below 1,180.84.

If it doesn’t then I’ll again publish the continuing triangle idea for primary wave 4.

Does that all make sense?

Yes, perfectly! Thank you.