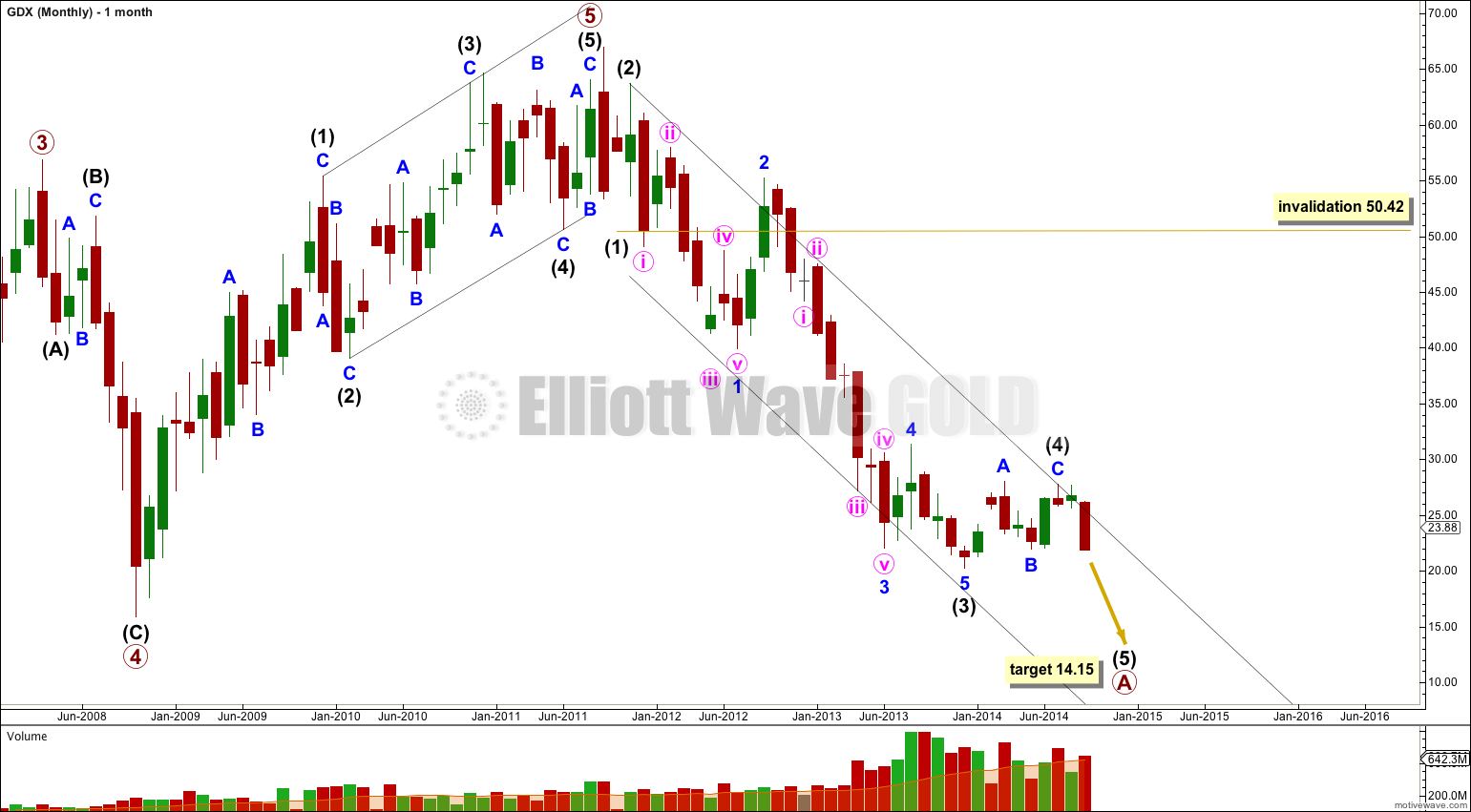

As expected GDX has moved lower. The target for minute wave iii to end was 22.32 and I expected it to be met one to two weeks after last analysis. It looks like it may have ended at 22.02 one and a half weeks after last analysis.

I expect a little sideways movement to end about 22.78, followed by more downwards movement to new lows.

Click charts to enlarge.

The clearest piece of movement is the downwards movement from the high. This looks most like a first, second and third wave. This may be the start of a larger correction.

Intermediate wave (3) is $1.06 longer than 2.618 the length of intermediate wave (1).

Within intermediate wave (3) there are no Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within minor wave 1 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $2.19 longer than 0.618 the length of minute wave i.

Ratios within minor wave 3 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $0.63 longer than 0.382 the length of minute wave iii.

I have played with how to best draw a channel about this downwards movement, which does not fit perfectly into a channel drawn using either of Elliott’s techniques but does fit best if his first technique is used: draw the first trend line from the lows of intermediate waves (1) to (3), then place a parallel copy on the high of intermediate wave (2).

Intermediate wave (5) must subdivide as a five wave structure, either an impulse or an ending diagonal. So far the first five down for minor wave 1 is incomplete. If minor wave 1 completes as a five wave impulse then intermediate wave (5) must be unfolding as an impulse, because an ending diagonal requires all the subwaves to be zigzags.

Minute wave iii is 0.30 longer than 2.618 the length of minute wave i.

Ratios within minute wave iii are: there is no adequate Fibonacci ratio between minuette waves (iii) and (i), and minuette wave (v) is 0.40 longer than 0.618 the length of minuette wave (iii).

Minute wave ii lasted 21 days and was a deep 93% expanded flat correction of minute wave i. So far it looks like minute wave iv may also be an expanded flat, but it is much more shallow. Because there is no alternation in structure between minute waves ii and iv for this wave count, it is possible that my analysis of the end of minute wave iii and the start of minute wave iv is wrong. Minute wave iii may not be over and may yet move lower.

However, because minute wave iii has a close Fibonacci ratio to minute wave i, and because within minute wave iii there is a good ratio with perfect alternation and almost perfect proportion between minuette waves (ii) and (iv) so far this wave count looks correct. It may be that minute wave iv continues sideways as a running triangle to provide alternation with the flat of minute wave ii, or it could be more time consuming as a double combination with the first structure a flat.

Overall the structure for minor wave 1 down is incomplete. When this piece of sideways movement is done I would expect the breakout to be downwards.

At 14.15 intermediate wave (5) would reach equality in length with intermediate wave (1). This target is likely to be several weeks away.

Lara,

First, thanks for doing silver and gdx charts. Seeing gold, silver and gdx daily charts on same day is a big help– all 3 daily charts in synch (as they are now) boosts overall confidence in market direction and helps decision making.

A question. Is it possible to put some boundaries on when target 14.15 might be reached? For example something like 2-4 weeks or 10-12 weeks as “several weeks away” can be really subjective. I realize time-lines are tricky but your best estimate.

“At 14.15 intermediate wave (5) would reach equality in length with intermediate wave (1). This target is likely to be several weeks away”

Yeah, I know “several weeks” is vague… and that’s actually intentional. It’s just way too early to say how long it will last.

Looking at the weekly chart intermediate wave (1) lasted only 4 weeks. So far intermediate wave (5) is already longer in duration at 12 weeks. So that’s no help.

Intermediate wave (3) lasted 108 weeks. I could give you a guess based on a Fibonacci ratio of that, and say intermediate wave (5) could end in a total 41 weeks (0.382 of 108) or 67 weeks (0.618 of 108) but I would have very little confidence in such a prediction.

The best way is to use the trend channel and make a judgement when minor wave 5 begins. But I realise that can’t be done until close to the end.

Thanks.

Thanks Lara!