Upwards movement continues as expected. I have a new alternate Elliott wave count for you to consider today.

Summary: This third wave up should show a further increase in momentum. The target remains at 1,243.

Click on charts to enlarge.

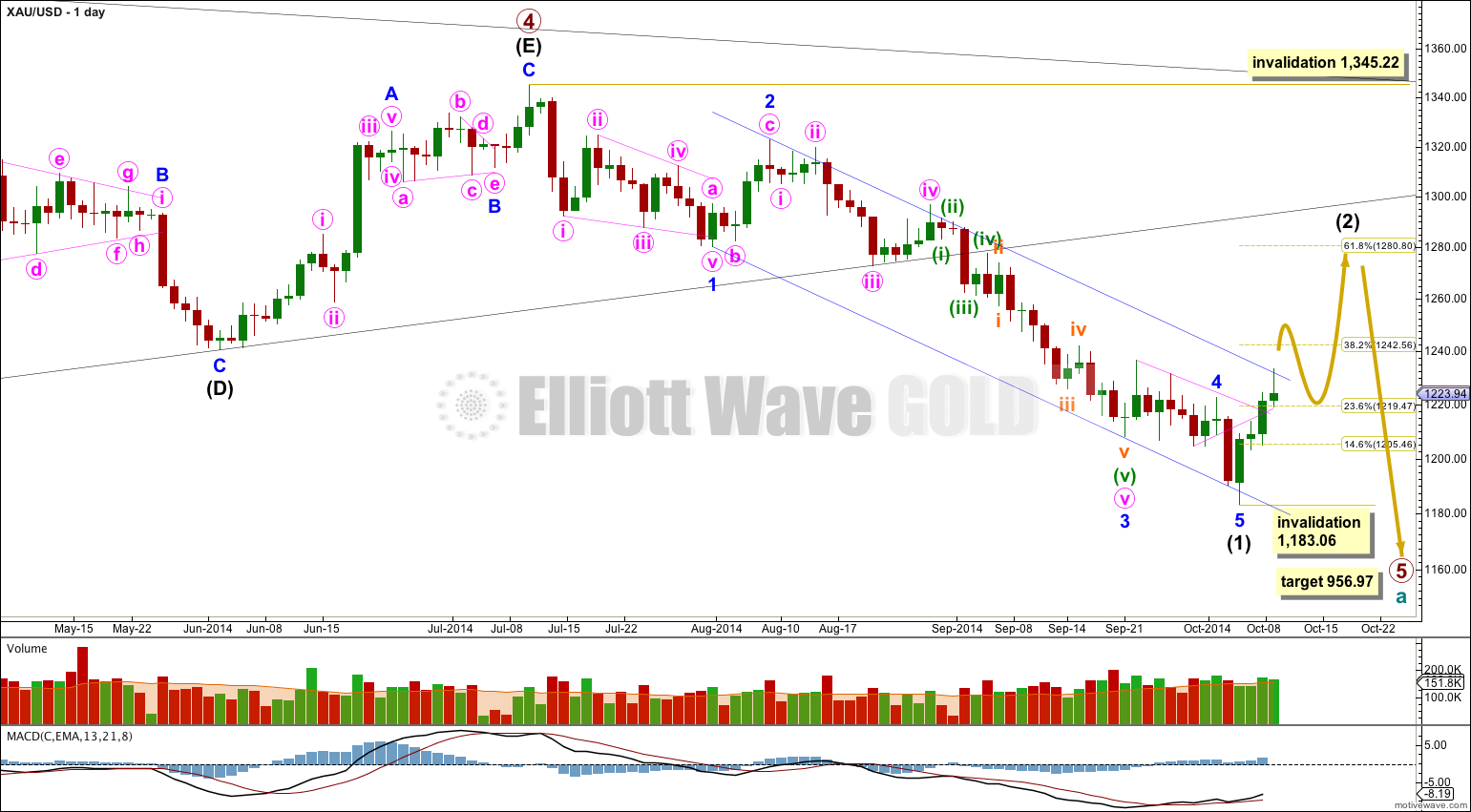

Main Wave Count

On the weekly chart extend the triangle trend lines of primary wave 4 outwards. The point in time at which they cross over may be the point in time at which primary wave 5 ends. This does not always work, but it works often enough to look out for. It is a rough guideline only and not definitive. A trend line placed from the end of primary wave 4 to the target of primary wave 5 at this point in time shows primary wave 5 would take a total 26 weeks to reach that point, and that is what I will expect. Primary wave 5 is ending its 13th week.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1, and equality between primary waves 5 and 1 would give a perfect Elliott relationship for this downwards movement.

However, when triangles take their time and move close to the apex of the triangle, as primary wave 4 has, the movement following the triangle is often shorter and weaker than expected. If the target at 956.97 is wrong it may be too low. In the first instance I expect it is extremely likely that primary wave 5 will move at least below the end of primary wave 3 at 1,180.40 to avoid a truncation. When intermediate waves (1) through to (4) within primary wave 5 are complete I will recalculate the target at intermediate degree because this would have a higher accuracy. I cannot do that yet; I can only calculate it at primary degree.

Movement comfortably below 1,180.84 would provide further confidence in this main wave count as at that stage an alternate idea which sees primary wave 4 as continuing as a barrier triangle would be invalidated.

Draw a channel about intermediate wave (1): draw the first trend line from the lows labeled minor waves 1 to 3, then place a copy on the high labeled minor wave 2. The slight overshoot of the lower edge of this channel indicates minor wave 5 may be over there. Intermediate wave (2) should breach the upper edge of this channel.

Intermediate wave (2) may end close to a Fibonacci ratio of intermediate wave (1). Only because second waves are more commonly deep than shallow is the 0.618 ratio at 1,280.80 slightly favoured. But it does not have to be this deep. When I know where minor waves A and B within this correction have ended then a target should be calculated using the ratio between minor waves A and C.

Intermediate wave (2) is most likely to be a zigzag, but it may also be one of several other possible corrective structures. While the first 5-3-5 up unfolds no second wave correction nor B wave may move beyond its start below 1,183.06.

Minute wave iii is most likely incomplete. So far I expect that only minuette waves (i) and probably (ii) within it are complete. This wave count expects to see a further increase in upwards momentum over the next 24 hours as the middle of this third wave up unfolds.

Although it is possible that minute wave iii could be over at the high labeled minuette wave (i), I am discarding that idea for three reasons:

1. Minute wave iii would be shorter than minute wave i.

2. Minute wave iii would show only a very slight increase in upwards momentum beyond that seen for minute wave i.

3. Minute wave iii would not have broken out of the base channel containing minute waves i and ii.

Keep drawing the base channel about minute waves i and ii. Along the way up downwards corrections should find support at the lower edge. The middle of this third wave should have the power to break through resistance at the upper edge.

Within minute wave iii minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,205.05.

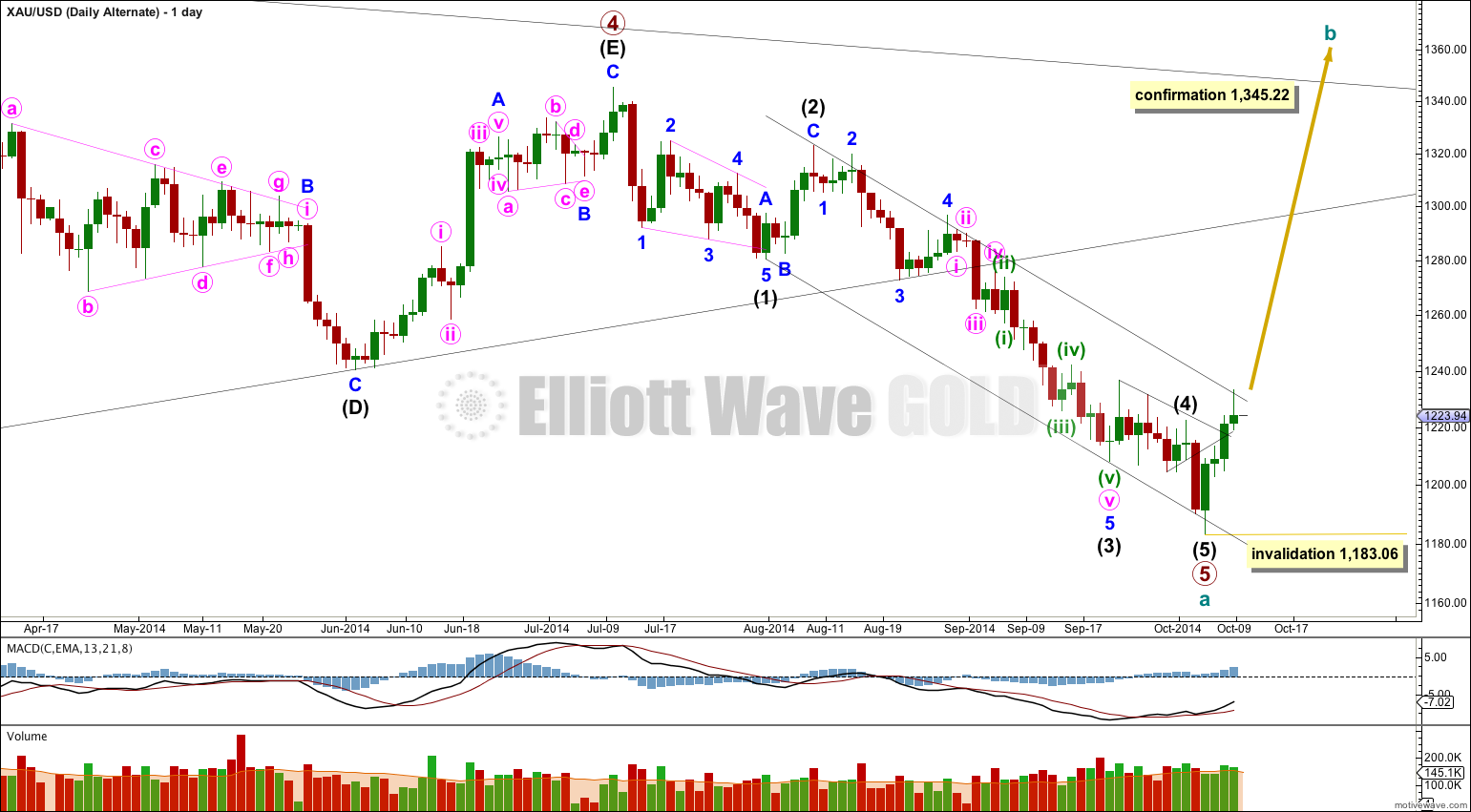

Alternate Wave Count

By simply moving the degree of labeling within primary wave 5 downwards all up one degree it is possible that primary wave 5 and so cycle wave a are over.

This wave count is reduced in probability by a small truncation. Primary wave 5 would be truncated by $2.66. The truncation is small though, so this wave count must be considered.

Movements out of triangles are often more brief and weak than expected, sometimes they are surprisingly brief.

If price breaks out of the upper edge of the parallel channel about cycle wave a this would be first indication that this wave count is correct. This trend channel confirmation would come before price confirmation above 1,345.22.

The first movement upwards for cycle wave b should be a five wave structure. Within it no second wave correction may move beyond the start of its first wave below 1,183.06.

Movement above 1,345.22 would invalidate the main wave count and so confirm this alternate.

*Please note: this idea also works for Silver and GDX, and there it works without any truncation. I will update Silver and GDX with this alternate idea next time I publish analysis of those markets.

This analysis is published about 06:21 p.m. EST.

Lara you outdid yourself tonight. I really enjoyed the charts, the video, the overall quality, details, explanations and insight because they are all AWESOME. Once again your have proved to me that you are the best Elliott Wave forecaster in the world. In my opinion you do the impossible with translating confusing gold movement into an understandable trade able forecast. I don`t think i would trade gold without your forecasts.

Thanks a million for sharing your Elliott Wave brilliance with us daily. When I am day trading and struggling and confused on gold`s next move and what I should do next, I am reassured that you will shine your Elliott Wave light and clarify gold movements that night so I can come up with a trading strategy for the next day.

You’re welcome Richard, and thanks, that made my day.

There are still multiple possibilities technically open to Gold at the weekly chart level right now. I’ll go over these and quickly explain why I’m only presenting two at the end of today’s video.

Lara, isn’t the weekly timeframe a better way to confirm a Primary degree wave to be over? The upper channel sits around $1325 today and the bottom of Primary 4 triangle sits around $1300. I think you are confusing your members again. Last week it was Primary 5 would be confirmed with movement below $1180 and now it’s possible Primary 5 is complete without breaching $1180. Which one is it? EW and channels set aside, I find it very very hard to believe a cycle wave degree ends with no capitulation selling. If gold clearly breaches $1280, it would be at that point I would start looking at other wave counts

Please stop the “you’re confusing your members again”. Its not helpful, it borders on rudeness. If any members are confused they will tell me and ask for clarification.

The wave count is valid. Would you rather I not present it until it is fully confirmed above 1,345.22?

Your comments indicate to me that you are not happy with this analysis. Which makes me wonder why you continue your membership?

I have explained my reasoning very clearly in today’s analysis.