At end of week analysis the main Elliott wave count expected a little downwards movement to a target at 1,162 – 1,159, before a third wave up began. Price moved lower, reaching 16.12 below the target but remaining above the invalidation point at 1,131.09. Thereafter, price turned strongly upwards for the expected third wave. Upwards movement has invalidated the alternate wave count and now we have more clarity and confidence.

Summary: A third wave is underway. The target is 1,262.

Click on charts to enlarge

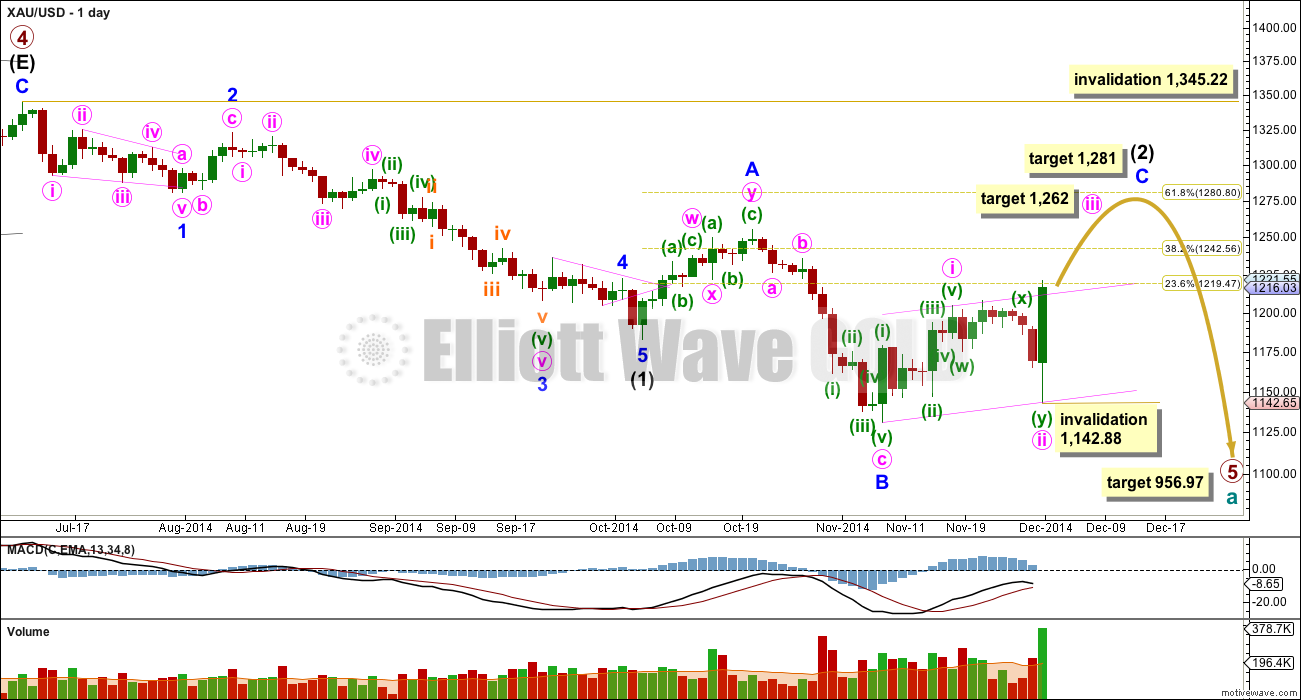

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) has just begun its eighth week.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

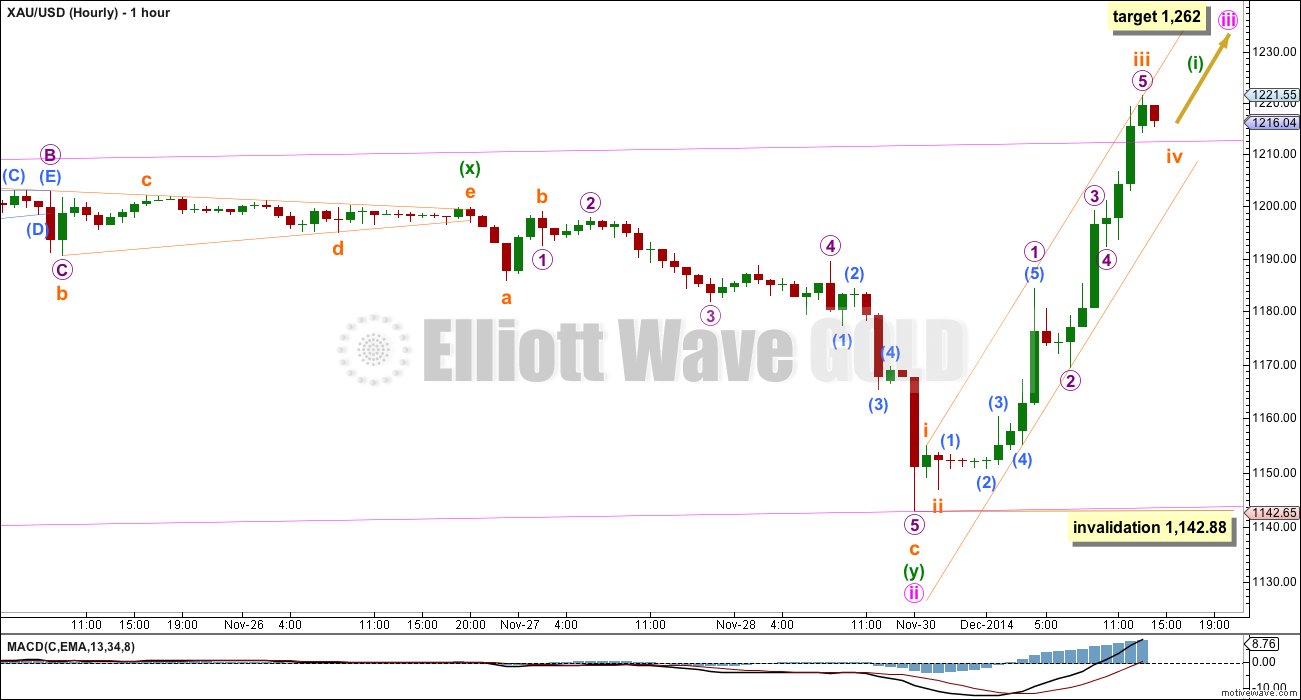

Now that the correction for minute wave ii has ended (finally!) a third wave up has begun. At 1,262 minute wave iii would reach 1.618 the length of minute wave i.

Minute wave iii should show a clear strong increase in upwards momentum beyond that seen for minute wave i. So far momentum is getting close to that seen for minute wave i on the hourly chart (off to the left of this chart now), but it has not increased beyond that. I expect upwards momentum should increase further.

At this stage considering the target and momentum, I do not think that minuette wave (i) within minute wave iii is complete yet. When it is done I would expect another second wave correction downwards for minuette wave (ii). Because this is a second wave within a strong third wave minuette wave (ii) may be more brief and shallow than second waves normally are. It may show up on the daily chart though because Gold normally shows the subdivisions of its third waves clearly on the daily chart.

Draw a base channel (pink channel) on the daily chart about minute waves i and ii. Copy it over to the hourly chart. Price has just broken above the upper edge of the base channel, as a third wave should. This upper pink trend line may now provide support.

Draw a channel about the beginning of this third wave: draw the first trend line from the highs labelled subminuette waves i to iii, then place a parallel copy lower down to contain all this movement. This channel may show where price finds support and resistance as minuette wave (i) continues upwards. When this small orange channel is clearly breached by downwards (not sideways) movement that may indicate that minuette wave (i) is over and minuette wave (ii) has begun. I would look for minuette wave (ii) to find support at the upper pink trend line. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,142.88.

This analysis is published about 02:42 p.m. EST.

Is it possible to identify micro, minute and minuette waves i,ii,iii,iv and v with color does on charts. So I can follow text with chart.

As I understand “At this stage considering the target and momentum, I do not think that minuette wave (i) (green) within minute wave iii (pink) is complete yet.”

Thanks.

No, that would make writing up of the analysis exceptionally time consuming.

Print out the wave degree guide (its on the right hand sidebar of the website) and keep it next to you when you read the analysis. Within a week or two you will be very familiar with what colour and label matches which degree.

Lara- EW won over many TA. Now this wave is confirmed and gold is heading higher.

What is the $ target for orange wave iv ?

Once wave iv correction is over next target is 1260ish. Means gold will be in wave v, green wave iii. Then wave green wave iv a deeper correction. Once green wave iv correction is over the final wave green wave v.

Where the pink wave iii, iv and v comes in to play?

A slow learner here sorry!!!!

Great wave counts my hats off to you!!!!

It may end in the price territory of the fourth wave of one lesser degree, micro wave 4 from 1,199.15 to 1,192.33.

It looks like its breached the channel. Sometimes fourth waves do this, and so the channel has to be redrawn using Elliott’s second technique: from ii to iv with a copy on iii. That may show were v ends.

Lara,

Congrats, your surfer instincts correct, you picked the correct wave. Let’s ride all the way to 1262.