by Lara | Aug 19, 2021 | Gold

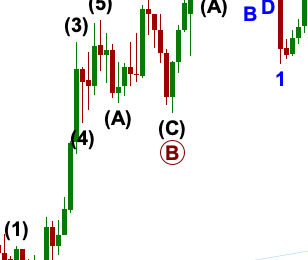

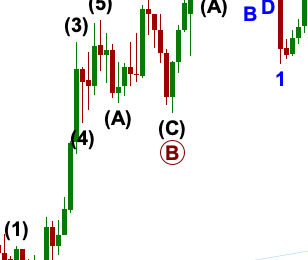

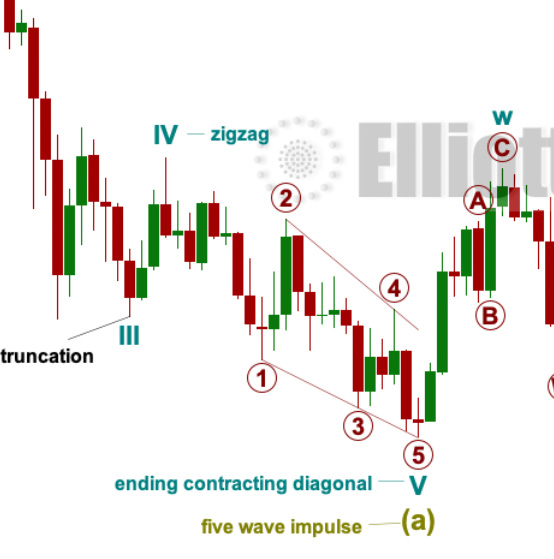

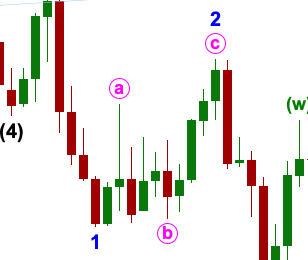

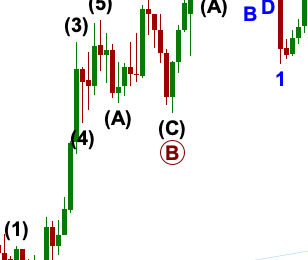

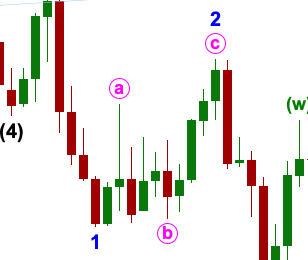

GOLD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Another small range day moves price slowly lower. Both Elliott wave counts remain valid. Today a new alternate bullish Elliott wave count is considered. Summary: Both Elliott wave counts remain...

by Lara | Aug 18, 2021 | Cryptocurrencies

BinanceCoin: Elliott Wave Analysis and Technical Analysis | Video – August 18, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 18, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 18, 2021 A small range day fits expectations for the preferred Elliott wave count, but a lack of range suggests a short-term alternate Elliott wave count should be considered. Summary: Both Elliott wave...

by Lara | Aug 18, 2021 | Cryptocurrencies

TRON: Elliott Wave Analysis and Technical Analysis | Video – August 16, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 17, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 17, 2021 Upwards movement today found resistance at the next identified resistance area and has then breached the short-term channel for the preferred Elliott wave count. Summary: Both Elliott wave...

by Lara | Aug 16, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 16, 2021 Price remains within the channel on the hourly charts and below the invalidation point for the bearish Elliott wave count. Both Elliott wave counts remain valid. Summary: Both Elliott wave...

by Lara | Aug 14, 2021 | Gold, Lara's Weekly, S&P500, US Oil

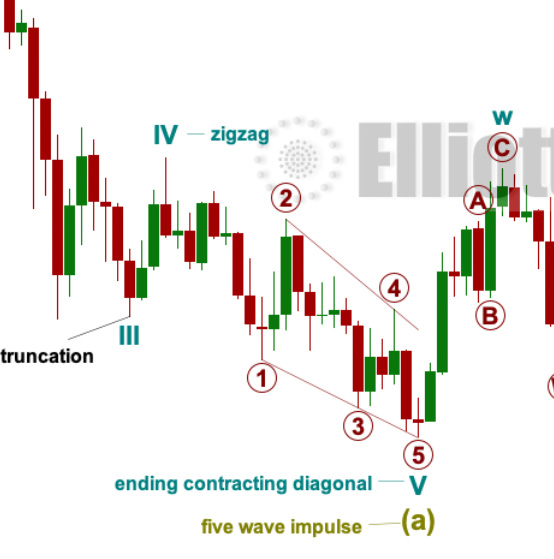

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 13, 2021 S&P 500 Four Elliott wave counts are considered at the end of this week. The main Elliott wave count remains the same because of technical...

by Lara | Aug 13, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 13, 2021 The target for the preferred Elliott wave count for more upwards movement was at 1,777 to 1,779. Price has reached 1,781.30 at the close of the week. Summary: Both Elliott wave counts remain...

by Lara | Aug 13, 2021 | Silver, Silver Historical

SILVER: Elliott Wave and Technical Analysis | Charts – August 13, 2021 Last week’s analysis of Silver expected more downwards movement for both bullish and bearish Elliott wave counts, which is what has happened over the week. Summary: The first wave count...