by Lara | Aug 13, 2021 | Gold

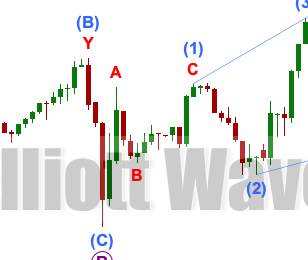

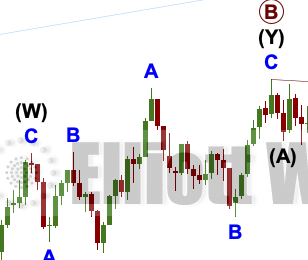

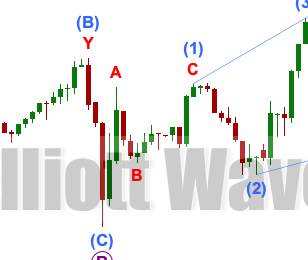

GOLD: Elliott Wave and Technical Analysis | Charts – August 13, 2021 The target for the preferred Elliott wave count for more upwards movement was at 1,777 to 1,779. Price has reached 1,781.30 at the close of the week. Summary: Both Elliott wave counts remain...

by Lara | Aug 12, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 12, 2021 A little more upwards movement over the last 24 hours was expected for both Elliott wave counts, at least for the short term. The target zone for the preferred bearish Elliott wave count...

by Lara | Aug 11, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 11, 2021 A breach of the short-term channel on the hourly chart suggests either a bounce or a trend change has occurred. A small target zone is calculated for the preferred Elliott wave count. Summary:...

by Lara | Aug 10, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 10, 2021 A small range inside day leaves both Elliott wave counts essentially the same today. Classic technical analysis still favours the bearish Elliott wave count. Summary: The wave counts are named...

by Lara | Aug 9, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 9, 2021 Downwards movement has continued as both Elliott wave counts expected. Price has stopped just short of the invalidation point for the main Elliott wave count, so both Elliott wave counts remain...

by Lara | Aug 6, 2021 | Gold, Lara's Weekly, S&P500, US Oil

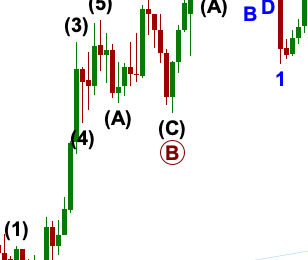

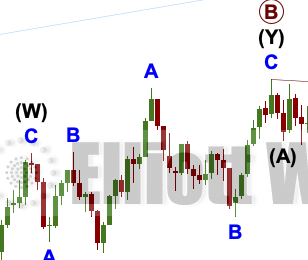

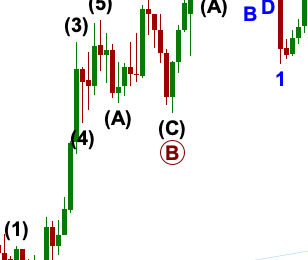

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 6, 2021 S&P 500 For the very short term, a little upwards movement was expected to a short-term target. The short-term Elliott wave target is almost...

by Lara | Aug 6, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 6, 2021 Downwards movement again has unfolded as expected for both the first and second Elliott wave counts. The second (preferred) Elliott wave count has expected an increase in downwards momentum and...

by Lara | Aug 5, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 5, 2021 Downwards movement was expected to continue for both Elliott wave counts, which is exactly what is happening. The short-term invalidation point may be moved lower. Summary: Both the main and...

by Lara | Aug 4, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 4, 2021 A short spike higher was expected for the very short term from the hourly Elliott wave counts. Price has remained below the invalidation point on the short-term hourly Elliott wave charts....