by Lara | Dec 7, 2020 | Gold

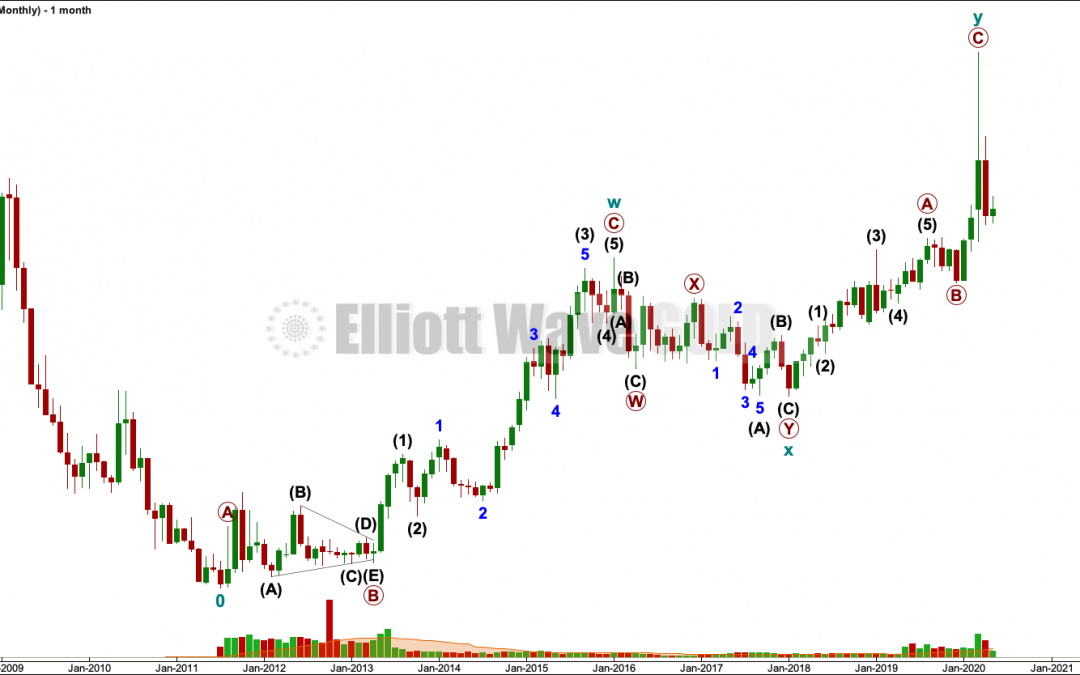

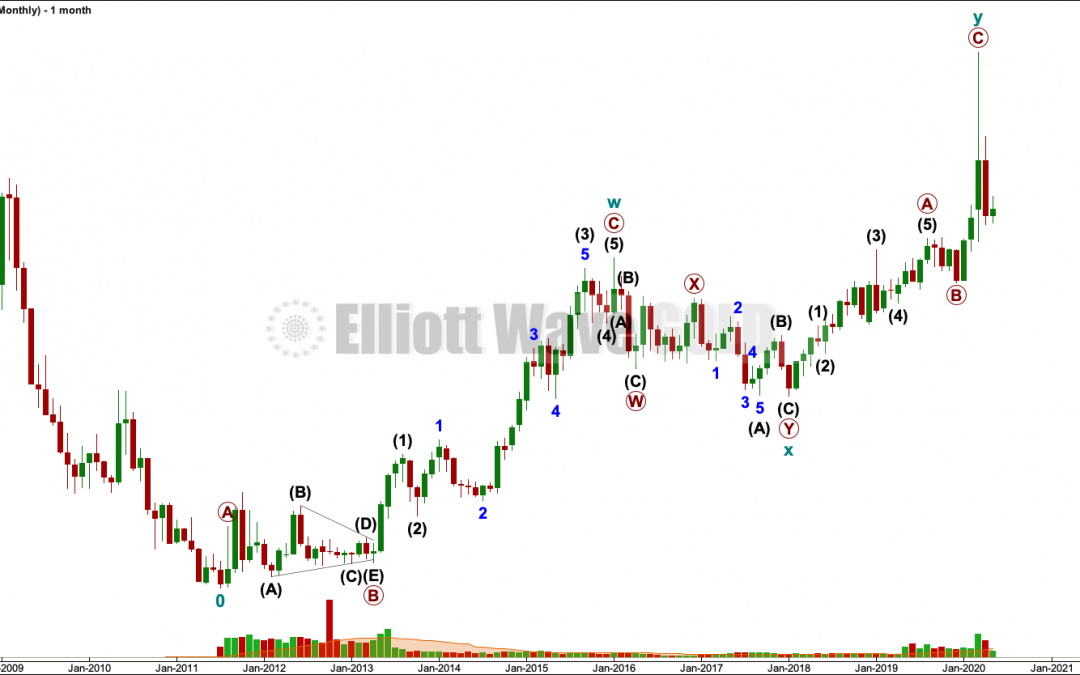

GOLD: Elliott Wave and Technical Analysis | Charts – December 7, 2020 Upwards movement has continued. It remains below the short-term invalidation point and within the channel. Summary: The first wave count is bearish for the bigger picture, and it has a main...

by Lara | Nov 12, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – November 12, 2020 Price remains within a very small range after the strong downwards session of the 9th of November. Some consolidation after a strong movement may be expected. All Elliott wave counts remains...

by Lara | Oct 21, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – October 21, 2020 Price remains within parallel trend lines. Upwards movement has been expected from the main and second Elliott wave counts. Summary: The first and second Elliott wave counts expect upwards...

by Lara | Sep 24, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – September 24, 2020 The first Elliott wave count had a target at 1,849 for downwards movement. Today price reached 1,849.22 and then bounced. Summary: The first Elliott wave count now expects upwards movement...

by Lara | Aug 11, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 11, 2020 A consolidation or pullback was expected to have begun. Support was expected to be about either 1,977 or 1,919. A low today at 1,907.78 is 11.22 below identified support. Summary: The pullback...

by Lara | Jul 20, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – July 20, 2020 Upwards movement continues towards targets as the main Elliott wave count expects. Summary: The upwards trend may still remain intact. The next target is at 1,820 or 1,980. For the short term, a...

by Lara | Jun 26, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – June 26, 2020 A correction found support exactly at the lower edge of a short-term trend channel. This week three Elliott wave counts are considered. Summary: The next target is at 1,820. The final target is...

by Lara | Jun 4, 2020 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – June 4, 2020 An inside day leaves the Elliott wave counts the same. Volume analysis still supports the main Elliott wave count. Summary: Expect continuing downwards movement to at least 1,362. Further...

by Lara | May 15, 2020 | Public Analysis, USDAUD

USDAUD: Elliott Wave and Technical Analysis | Charts – May 14, 2020 This market does not lend itself very well to Elliott wave analysis. Movement is very choppy and overlapping. Summary: The best Elliott wave count I can find sees the big upwards wave from July...