Slight movement below 1,220.65 has just invalidated the alternate wave count. The main wave count is confirmed.

Yesterday’s main wave count expected more downwards movement. A correction completed first, and now price is moving lower.

Click on the charts below to enlarge.

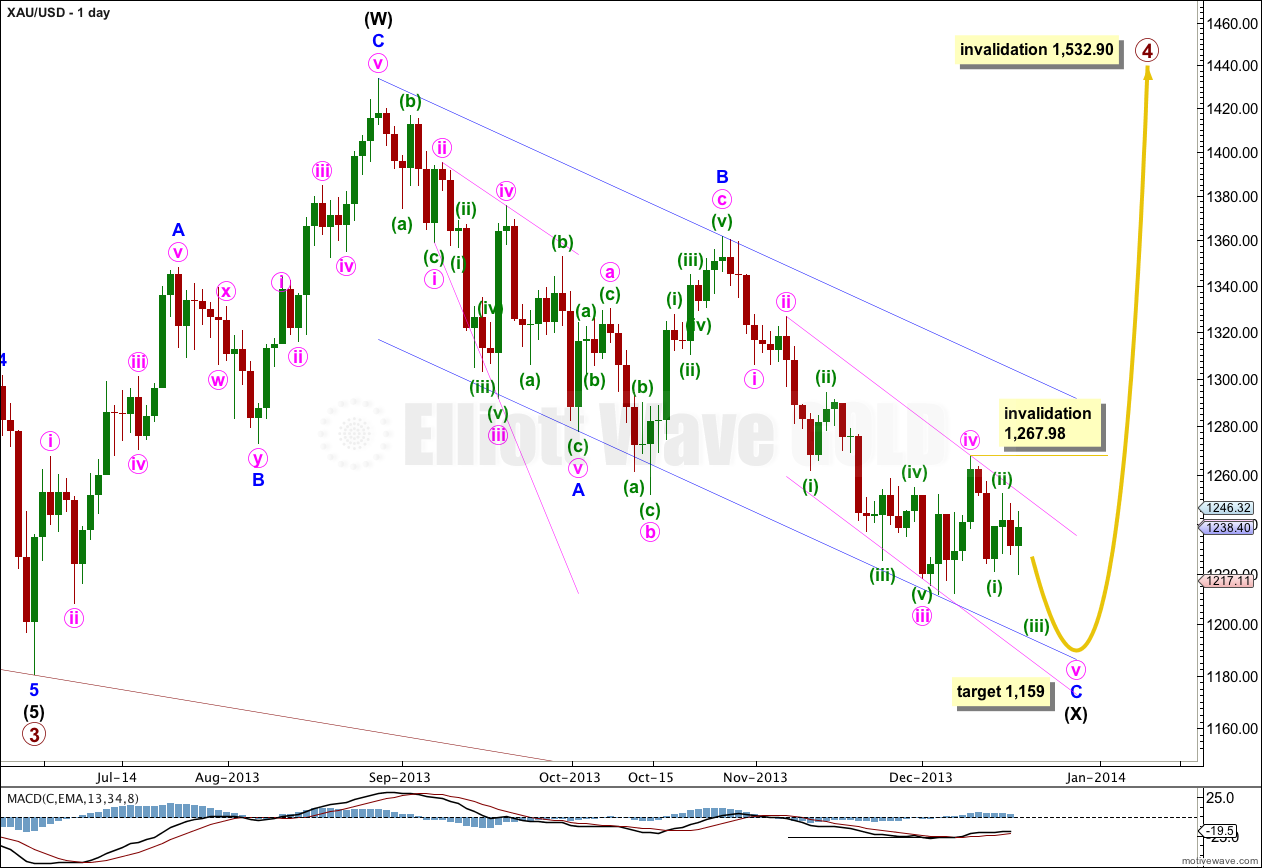

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. To see a full explanation of my reasoning for expecting that primary wave 4 is not over and is continuing see this.

Primary wave 2 was a rare running flat correction, and was a deep 68% correction of primary wave 1. In order to show alternation in structure primary wave 4 may be a zigzag, double zigzag, combination, triangle or even an expanded or regular flat. We can rule out a zigzag because the first wave subdivides as a three. This still leaves several structural possibilities.

If primary wave 4 is a combination, expanded flat or running triangle then we may see a new low below 1,180.40 within it. This is why there is no lower invalidation point for intermediate wave (X).

If price reaches 1,205.74 then downwards movement labeled intermediate wave (X) would be 90% of upwards movement labeled intermediate wave (W). I would relabel primary wave 4 as an A-B-C flat correction. If price does not reach 1,205.74 then primary wave 4 is most likely a double combination.

Minor wave C must subdivide either as an ending diagonal or an impulse. It is clearly not an ending diagonal so it can only be an impulse. This impulsive structure is now almost complete; the final fifth wave downwards just needs to finish.

There was no Fibonacci ratio between minute waves iii and i within minor wave C. This makes it more likely we shall see a Fibonacci ratio exhibited between minute wave v and either of i or iii. At 1,159 minute wave v would reach equality in length with minute wave iii. This lower target allows enough room for minute wave v to complete.

Draw a parallel channel about minor wave C downwards with the first trend line from the highs labeled minute waves ii to iv, then place a parallel copy upon the low labeled minute wave iii. If it gets that low downwards movement should find support at the lower edge of this channel.

I would expect downwards movement to also find support at the lower edge of the parallel channel drawn here about intermediate wave (X).

Draw a parallel channel about the zigzag of intermediate wave (X): draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy upon the end of minor wave A. When this channel is finally breached by upwards movement then I would consider that final confirmation that intermediate wave (Y) is underway.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

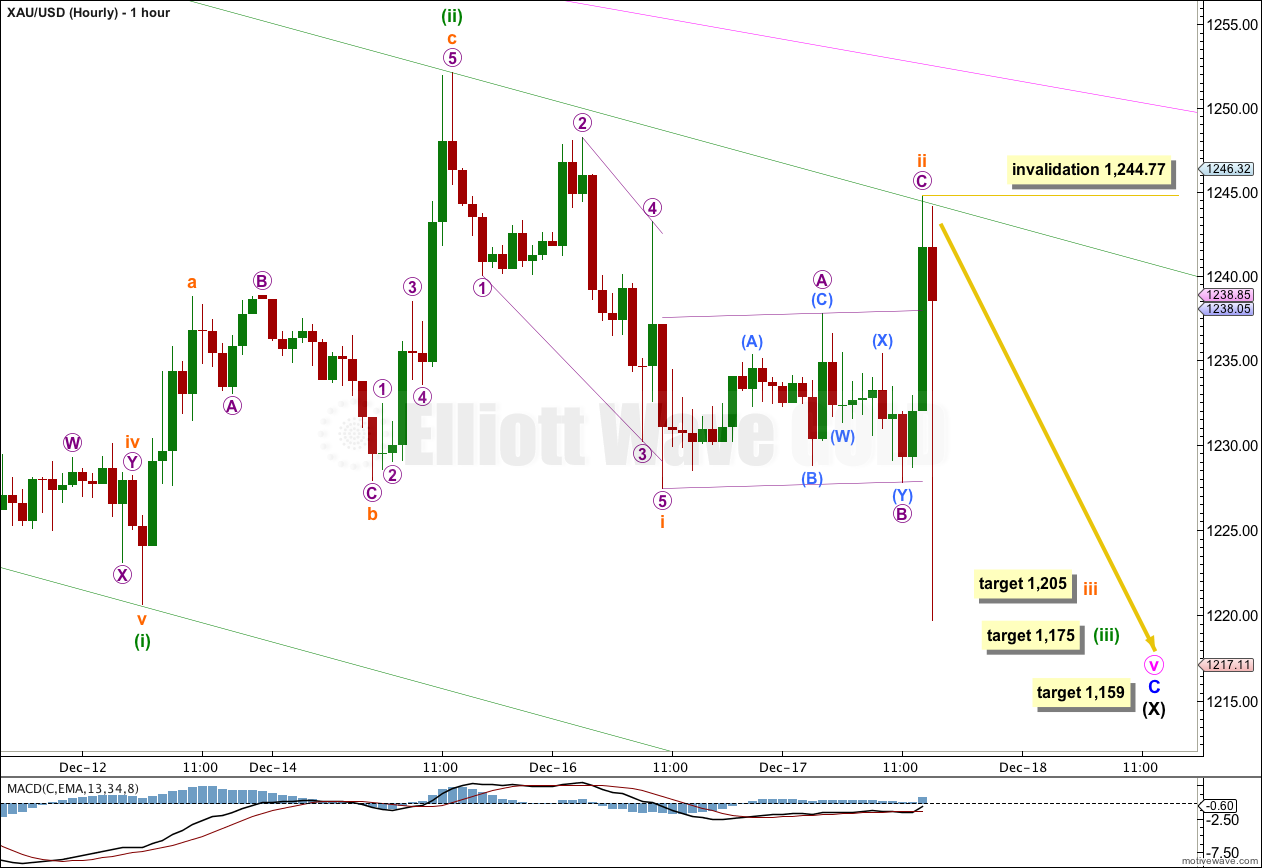

I have analysed the recent downwards movement again on the five minute chart. It may subdivide into a diagonal for a completed first wave. The following second wave is complete. A third wave down has begun.

Subminuette wave ii subdivides as a regular flat, with an uncommonly deep C wave. Micro wave C is just 0.26 longer than 1.618 the length of micro wave A.

I have drawn an acceleration channel about minuette waves (i) and (ii): draw this channel from the start of minuette wave (i) to the end of minuette wave (ii), place a parallel copy upon the end of minuette wave (i). The upper edge of this channel is providing resistance for subminuette wave ii and this is where it ended. The lower edge of this channel should be breached by strong downwards movement as subminuette wave iii unfolds.

At 1,205 subminuette wave iii would reach 1.618 the length of subminuette wave i. This target may be about one or two days away.

At 1,175 minuette wave (iii) would reach 1.618 the length of minuette wave (i). This target may be about six days away.

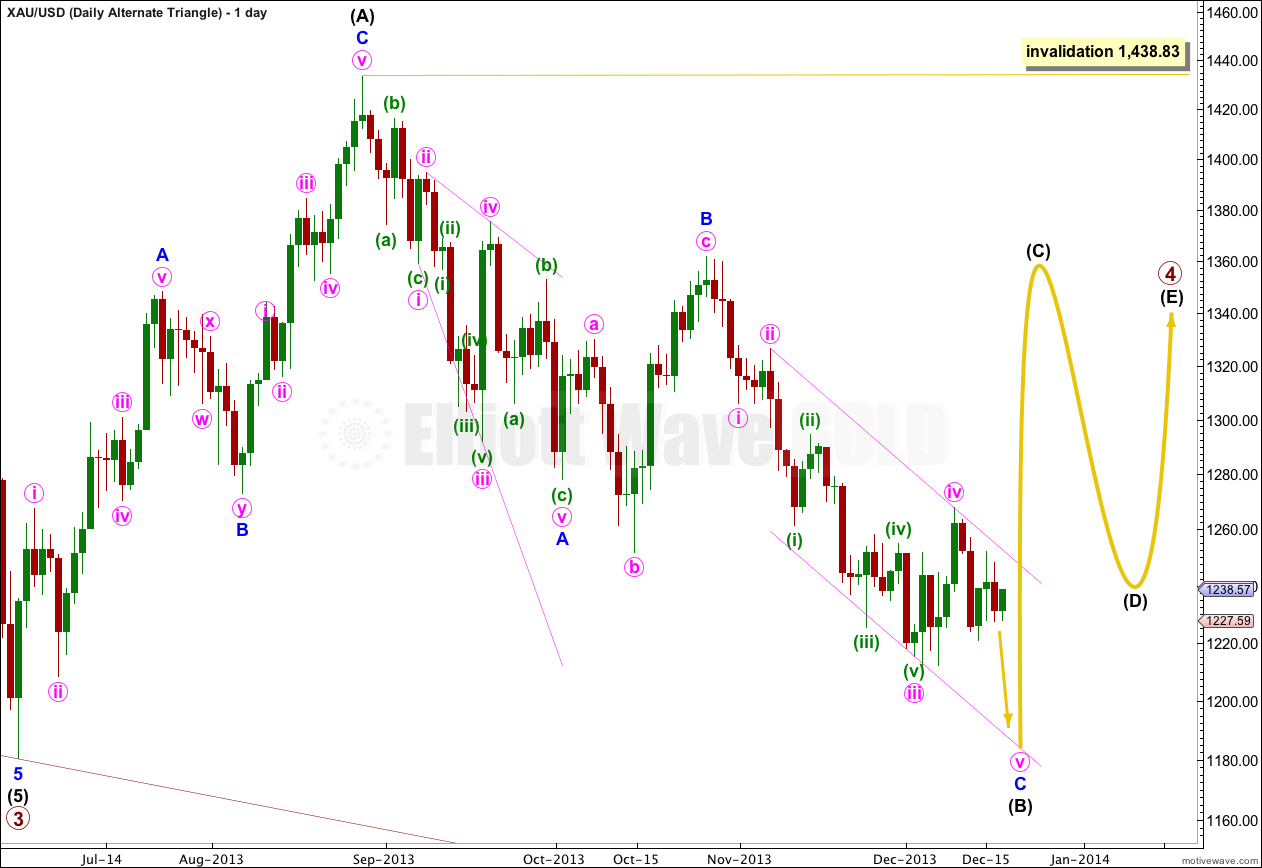

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction and structure of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

That’s brilliant. Nice one you managed to profit from a third wave.

Broke the 1205. So I take it we are looking at an A B C Flat? Target for V is 1159, correct?

Yes.

Very nice call!

Thanks!

Thanks for the quick update Lara. I was wondering what was going on with Gold when i saw the chart. Doing really nicely with my short now. Much appreciated update that.