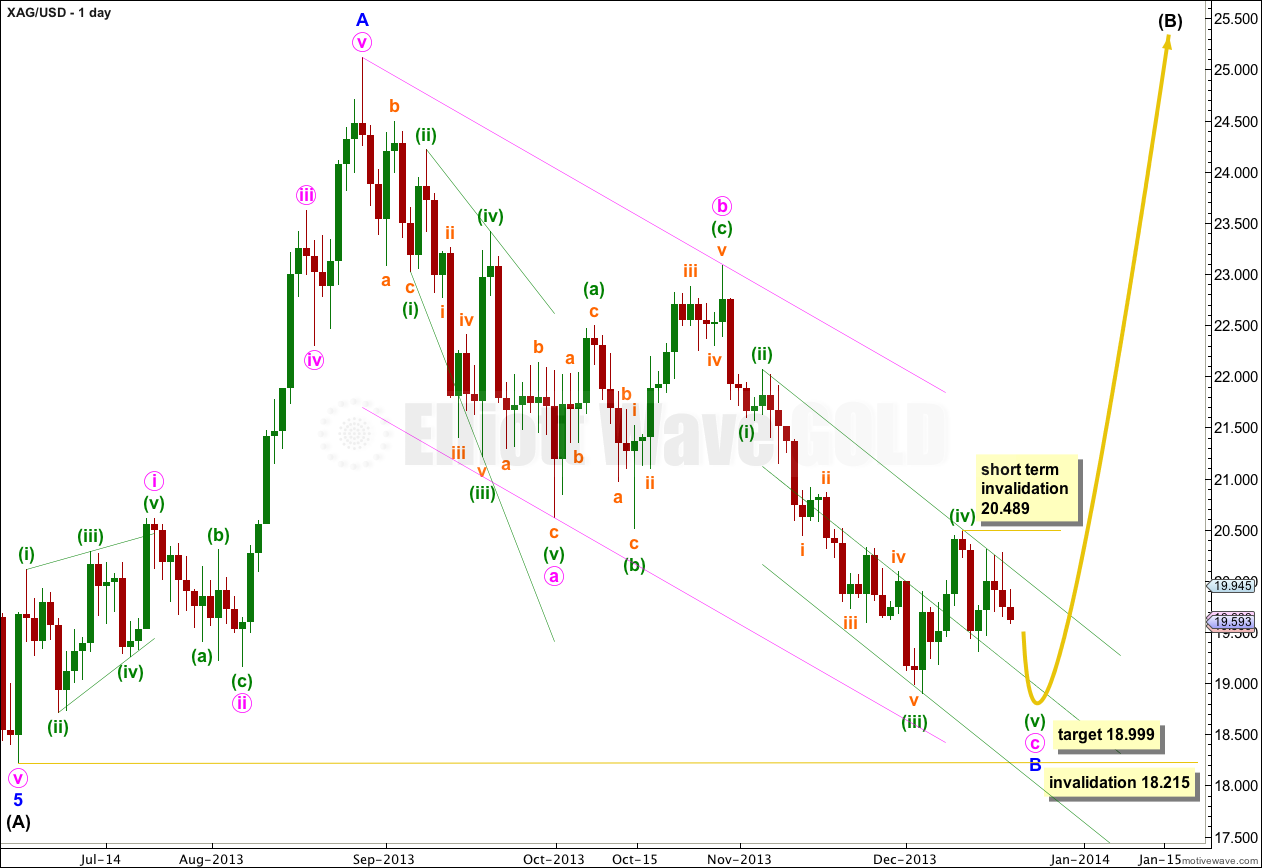

Last analysis of Silver expected downwards movement towards a mid term target at 18.999. Price has moved lower. The target has not yet been reached, and the structure is incomplete. The target remains the same.

Click on the charts below to enlarge.

Minor wave B is an almost complete zigzag, which is within a bigger zigzag trending upwards one degree higher for intermediate wave (B). Because within intermediate wave (B) minor wave A subdivides as a five wave structure, minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 18.215.

Within minor wave B minute wave a subdivides nicely as a leading expanding diagonal. Within the leading diagonal all the subwaves are zigzags except the third wave which is an impulse. For this piece of movement this structure has the best fit.

Minute wave b is labeled as an expanded flat correction. Within it minuette waves (a) and (b) both subdivide as three wave zigzags, and minuette wave (b) is a 106% correction of minuette wave (a). There is no Fibonacci ratio between minuette waves (a) and (c).

Minute wave c is an incomplete impulse. At 18.591 minute wave c would reach equality in length with minute wave a.

The narrow channel drawn about minute wave c is drawn using Elliott’s second technique. Draw the first trend line from the ends of minuette waves (ii) to (iv), then place a parallel copy upon the end of minuette wave (iii). Downwards movement may end close to the mid line of this channel.

At 18.999 minuette wave (v) would reach equality with minuette wave (i). This would see the fifth wave truncated, which is possible after a strong extended third wave. Equality with the first wave is the most common ratio for a fifth wave, so that is what I am using for this target calculation.

Within minuette wave (v) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 20.489.

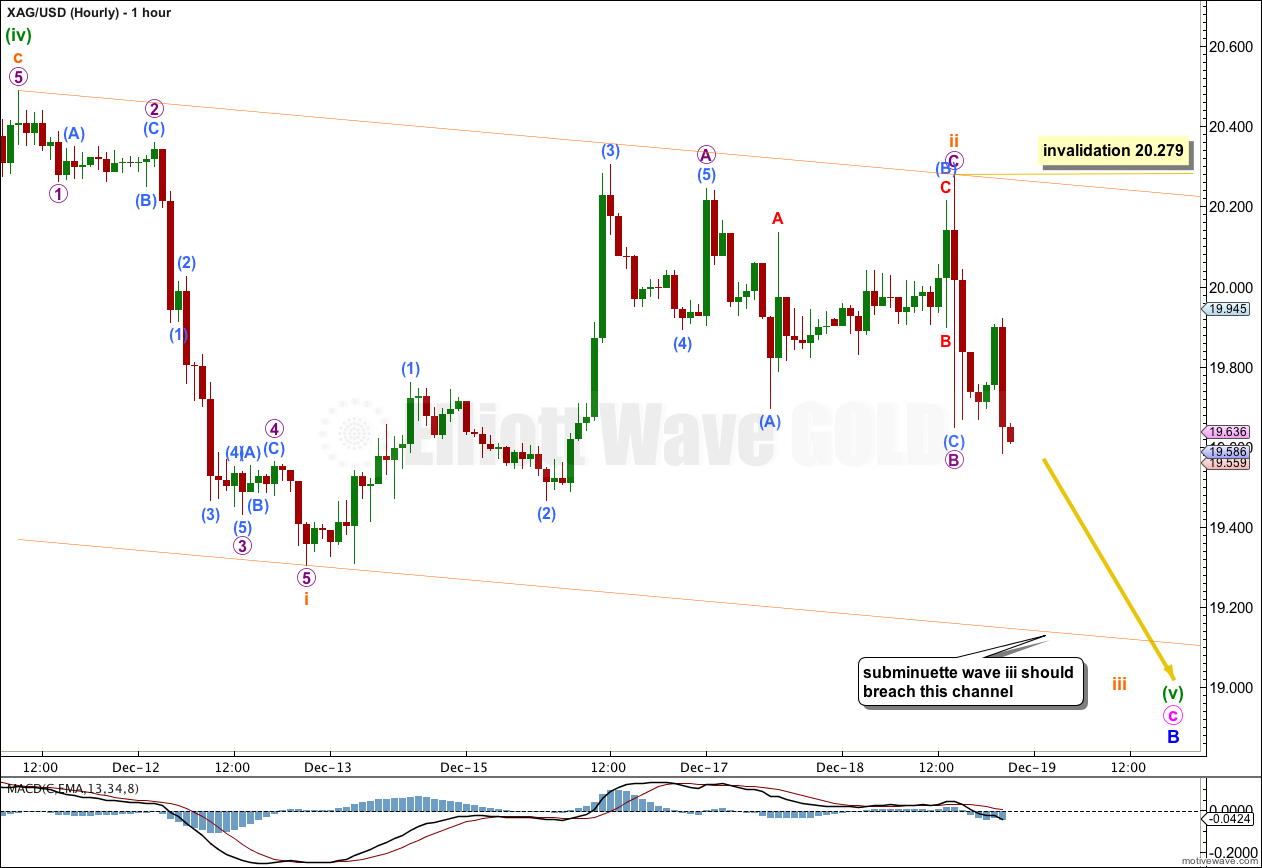

Within minute wave v there is now a completed five wave structure downwards, and a three wave structure upwards. This is most likely subminuette waves i and ii now complete.

Ratios within subminuette wave i are: micro wave 3 is just 0.029 short of 4.236 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to either micro waves 3 or 1.

Within subminuette wave ii there is no Fibonacci ratio between micro waves A and C.

Subminuette wave iii must make a new low below the end of subminuette wave i at 19.305, and must move far enough below this price point to allow enough room for subminuette wave iv to unfold and not move back into subminuette wave i price territory.

I have drawn an acceleration channel about subminuette waves i and ii. Subminuette wave iii should breach the lower edge of this channel. On the way down any corrections should find resistance at the upper edge of this channel.

Within subminuette wave iii no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 20.279.

I would expect the target at 18.999 to be reached within two weeks.

Excellent analysis…I’ve only just now found your blog and will be following you closely. Especially interested to find a post that updates the above to see the current state of things!

Thank you.

I hope to find time to update Silver and US Oil today.

Lara does not appear much has changed for silver since the last update. Am I correct that we are assuming it should turn down from here early next week and hopefully complete v wave

down.

Yes.

Silver looks like it’s completing an ending diagonal for the fifth wave.

The last wave down still needs to complete.

Hello lara, I want to know how are you asumming that perticular wave marking like i,1or so?i know wave notation but i didnot understand when particular wave is complete or not? Please explain largely wave counting & labelling.

You’re basically asking me to explain Elliott wave to you…

which is what I do every day.

check out the “education” page, watch the videos I have there, read “Elliott Wave Principle” by Frost and Prechter (10th edition)…

how do I know a wave is finished? when the structure is complete.

lastnight, XAG lowest is $18.96, the target you asked in post has been reached. Will it be upleg from here, but the gold’s lower target is not in place, I am confused.

No, both markets need a final fifth wave down.