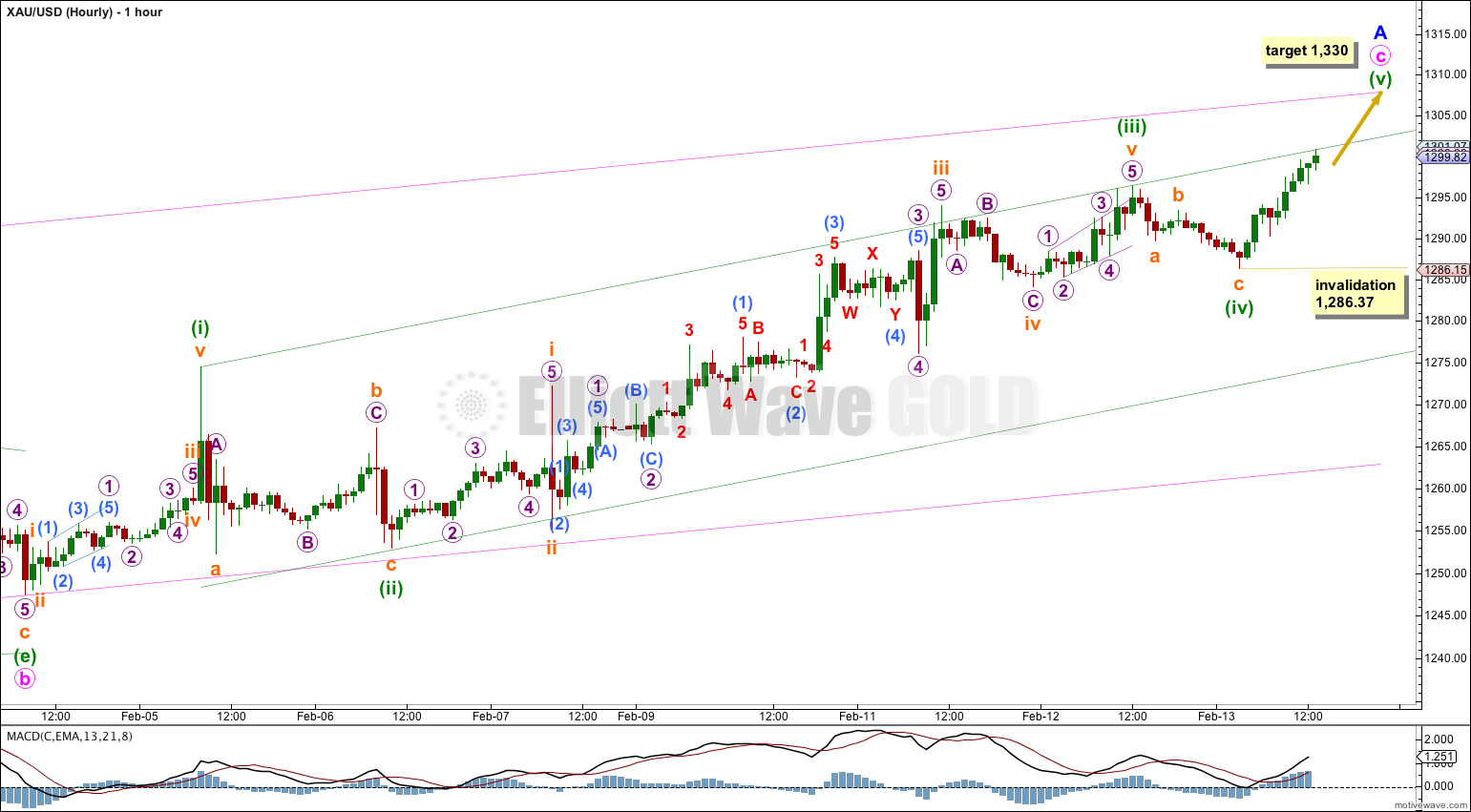

The fourth wave correction which was expected to show after a little more upwards movement had already arrived at the time last analysis was published. The channel on the hourly chart was clearly breached and the correction was over within 24 hours.

The wave count remains the same.

Summary: I expect more upwards movement most likely for another six days towards the target at 1,330. Today the invalidation point can be moved up to 1,286.37.

Click on the charts below to enlarge.

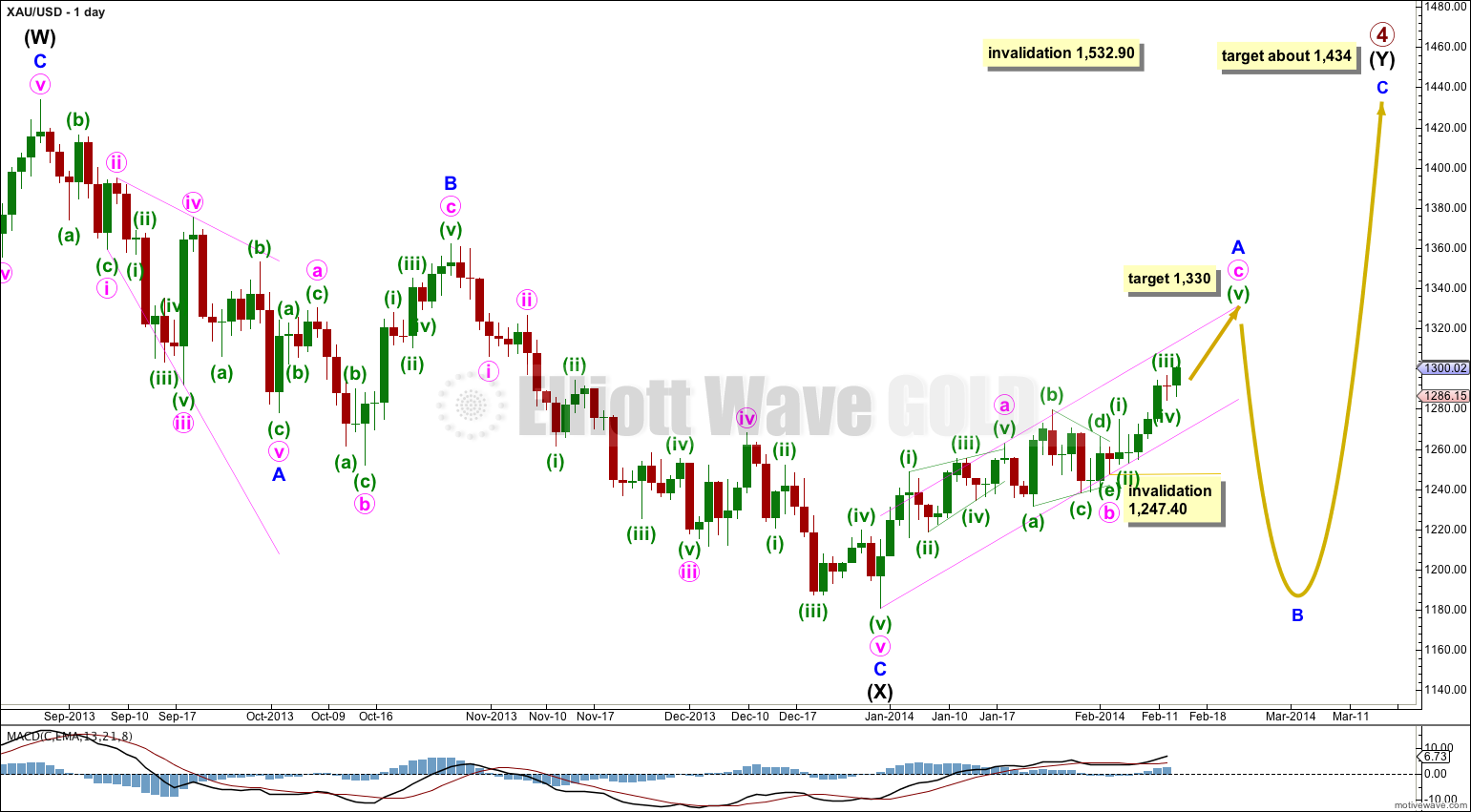

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

To determine what structure the current upwards movement is most likely to take it is necessary to determine what structure primary wave 4 is most likely to take.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled here intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three, and is most likely to be a zigzag.

Minor wave A is unfolding as a zigzag: minute wave a is a five wave structure, minute wave b is a running contracting triangle and minute wave c is a simple impulse. At 1,330 minute wave c would reach equality in length with minute wave a. Minute wave a lasted a Fibonacci 13 days. Minute wave c may end in another one day, totaling a Fibonacci eight, or more likely another six days totaling a Fibonacci 13.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Draw a channel about the zigzag of minor wave A: draw the first trend line from the start of minute wave a to the end of minute wave b, then place a parallel copy upon the end of minute wave a. Downwards corrections along the way up should continue to find support at the lower edge of the channel, and upwards movement may end at the upper edge of the channel.

Minuette wave (iii) was already over and was 0.42 cents short of 1.618 the length of minuette wave (i).

Minuette wave (iv) is over and shows on the daily chart as a small red doji.

At 1,330 minute wave c would reach equality in length with minute wave a, and also at 1,330 minuette wave (v) would reach equality in length with minuette wave (iii). This target has a high probability.

I have redrawn the parallel channel about minute wave c now that the third wave within it is over. Draw the first trend line from the highs labeled minuette waves (i) to (iii), then place a parallel copy upon the low labeled minuette wave (ii). I expect minuette wave (v) may find some resistance at the upper edge of this channel initially, and it may overshoot the channel as fifth waves within Gold tend to do this.

Upwards movement may also find some resistance at the upper edge of the larger pink channel drawn about the zigzag of minor wave A.

Within minuette wave (v) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,286.37.

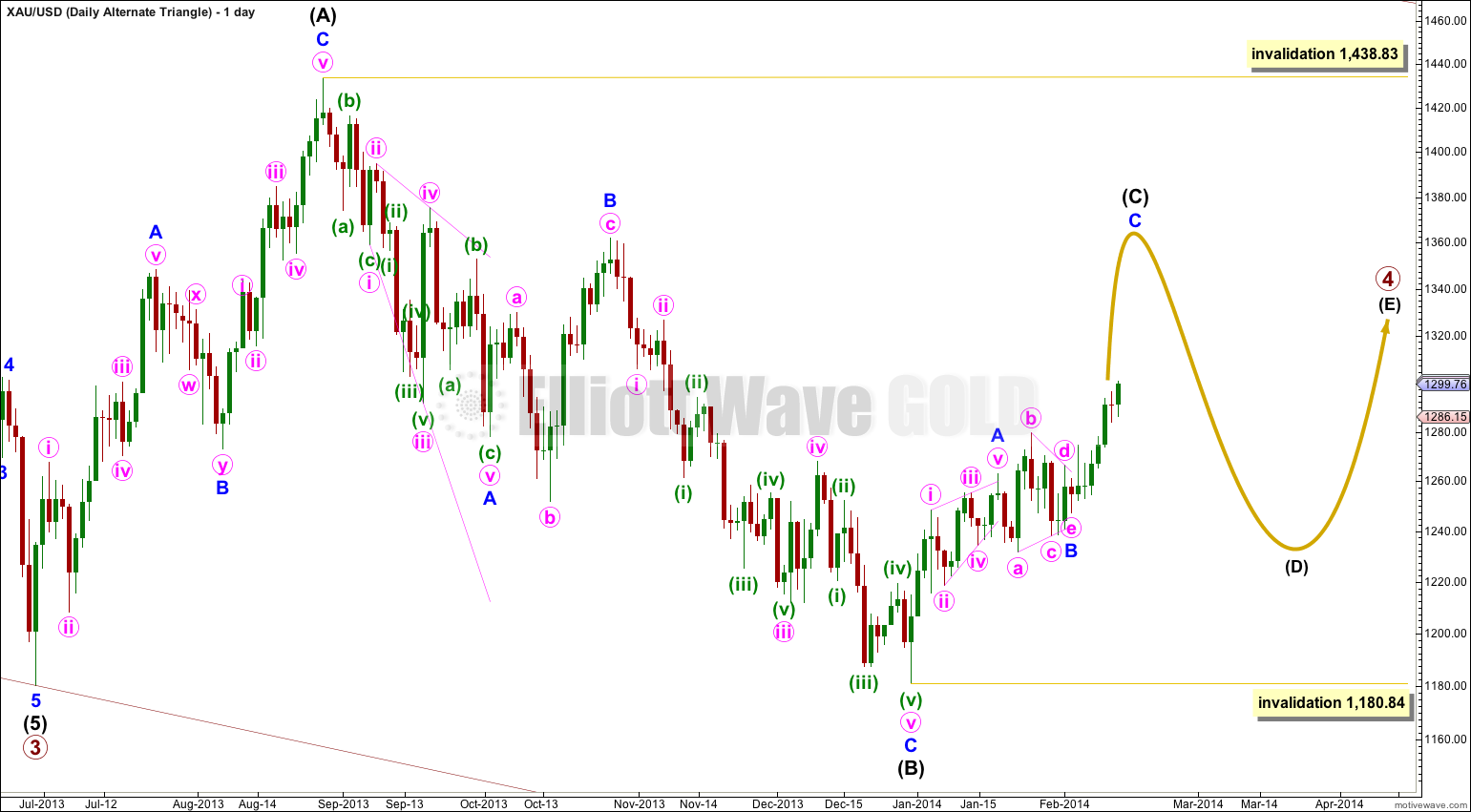

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

Intermediate wave (C) must unfold as either a single or double zigzag. Within it no second wave correction, nor wave B of the zigzag, may move beyond the start of the first wave or A wave. This wave count is invalidated with movement below 1,180.84.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

Lara,

Silver and gold usually move in tandem, yet for Gold you have a target of 1330 for the end of Wave A and a steep drop for Wave B.

For silver, you have a target of $25.49….so how can silver keep going higher if gold is expected to have a steep correction soon?

In the short term they can turn together if silver turns at the first target for iii at 21.872 and gold at 1,330. Thereafter I am expecting both to move lower.

The final upwards leg will most likely see them turn together.

Yes, they (almost always) turn together, but their wave lengths in between turns is often quite different.