Downwards movement was expected.

The wave count remains the same.

Summary: Momentum has not yet shown an increase, but the third wave has not yet reached its middle. I expect strong downwards momentum for the next day or so. The short term target for the next small correction to begin is 1,282. The next target for another correction is at 1,271. The trend is down.

This analysis is published about 04:15 p.m. EST. Click on charts to enlarge.

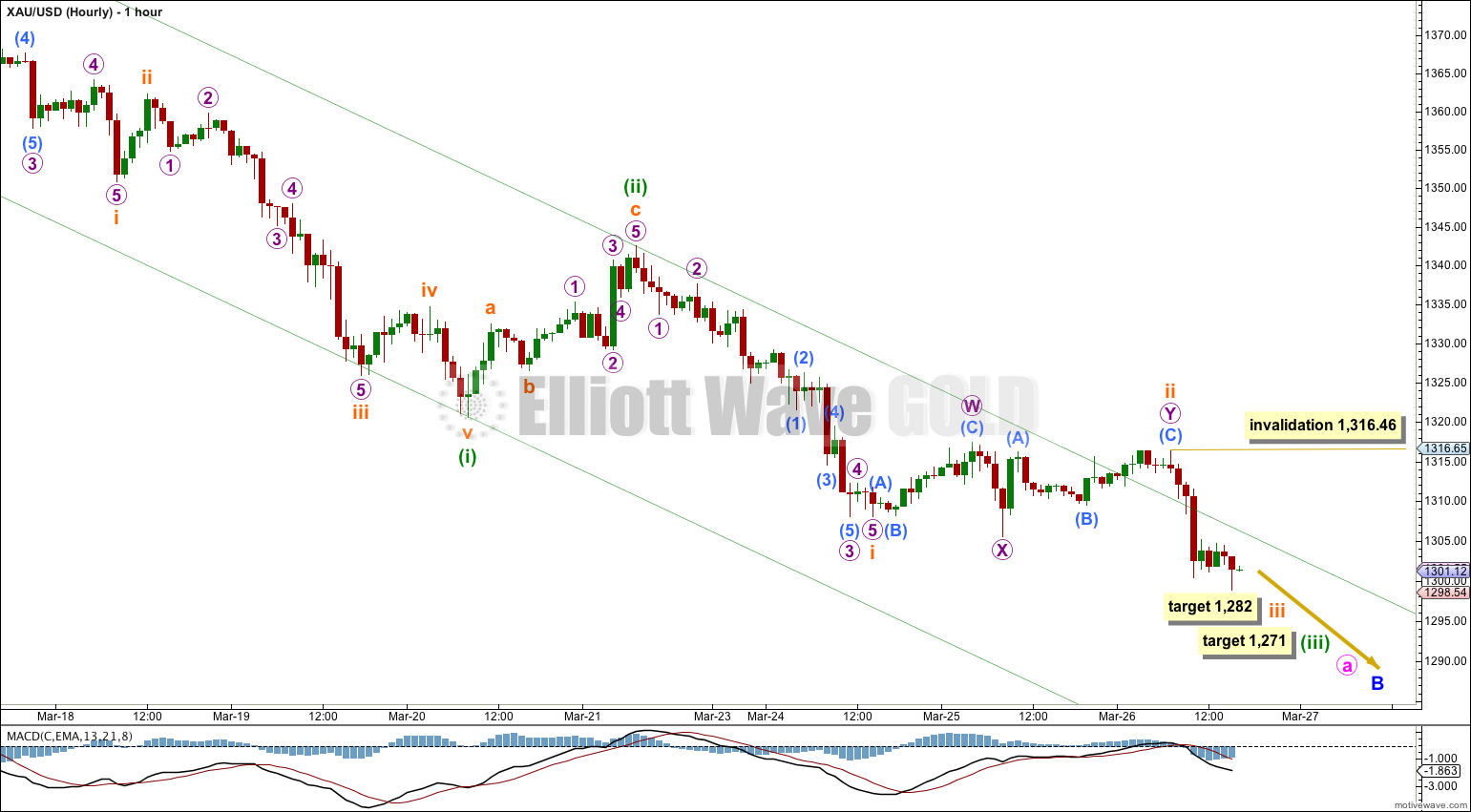

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

There are more than thirteen possible corrective structures that minor wave B may take. It is most likely to be a zigzag. Within a zigzag minute wave a must subdivide as a five wave motive structure, either a leading diagonal or an impulse. This downwards movement so far is clearly not a diagonal and it may be an impulse.

This main hourly wave count follows the most likely structure of a zigzag for minor wave B.

If minuette wave (iii) is extending then within it we may see subminuette waves ii and iv show on the daily chart. It looks like that is what is happening.

At 1,271 minuette wave (iii) would reach equality with minuette wave (i). Within minuette wave (iii) when subminuette waves iii and iv are complete I will add to this target calculation at a second wave degree, so it may change. If it changes I would expect it to be lower. At 1,227 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Subminuette wave ii continued sideways as a double combination before it ended, and has slightly breached the upper edge of the base channel. This is a little unusual, but with price now firmly back in the channel and trending strongly downwards the wave count still has the “right look”. This illustrates how these channels should be used as guides as to what is most likely to happen, not as definitive lines as to what must happen.

I expect that a third wave within a third wave has now begun. I expect to see downwards movement breach the lower edge of the base channel and stay below it. I expect to see a strong increase in downwards momentum beyond that seen for minuette wave (i).

At 1,282 subminuette wave iii would reach equality in length with subminuette wave i. This is the ratio I am using to calculate the target because again the second wave was very shallow.

Within subminuette wave iii no second wave correction may move beyond its start. This wave count is invalidated with movement above 1,316.46.

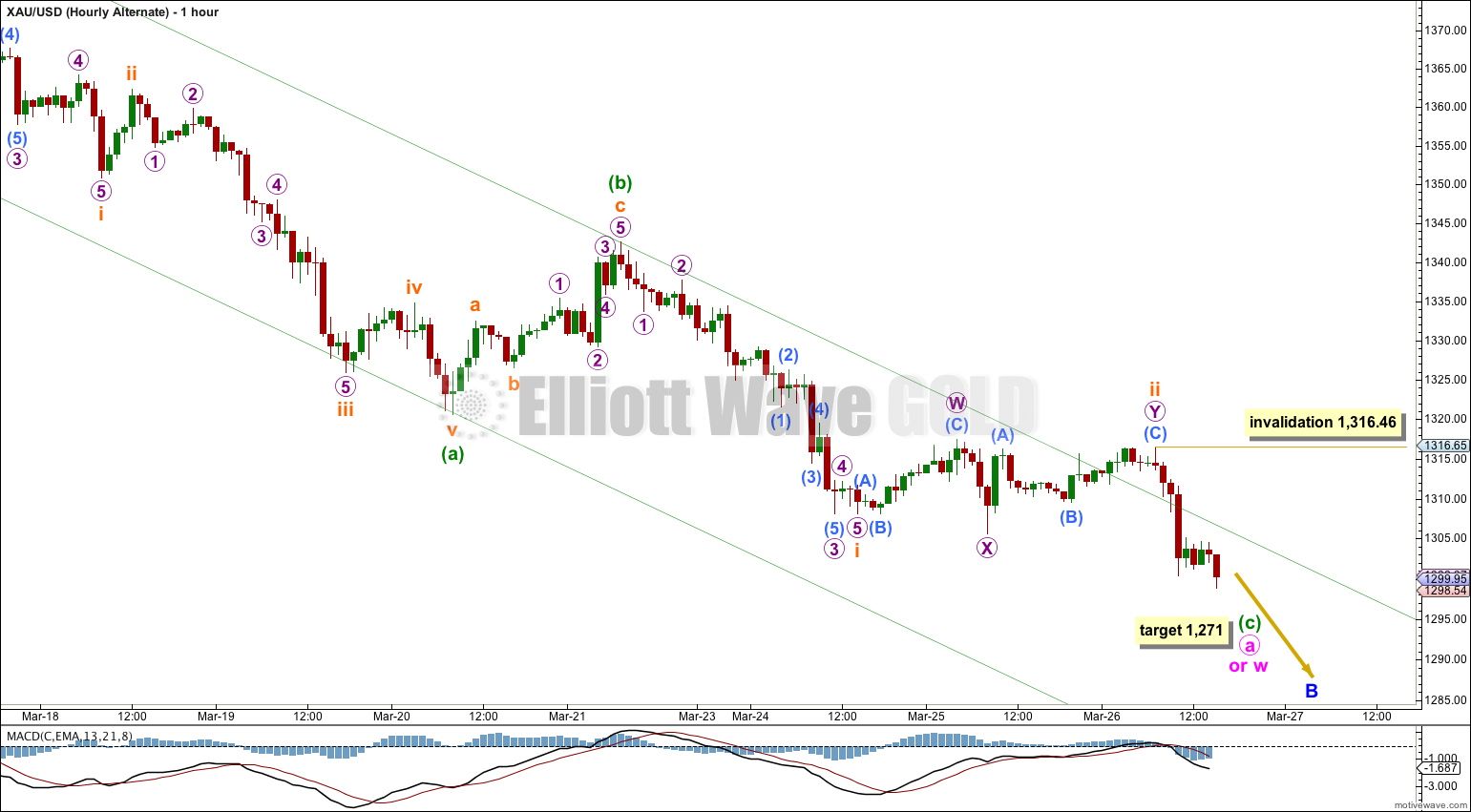

Alternate Hourly Wave Count.

If minor wave B is a flat (or a combination with a flat as the first structure) then minute wave a within it must subdivide as a three. Minute wave a for this alternate is seen as an incomplete zigzag.

This alternate wave count again does not diverge from the main wave count above, because 1-2-3 and A-B-C have exactly the same subdivisions when the correction is a zigzag.

When the currently unfolding impulse downwards labeled here as minuette wave (c) may again be considered complete then this alternate will again diverge from the main wave count.

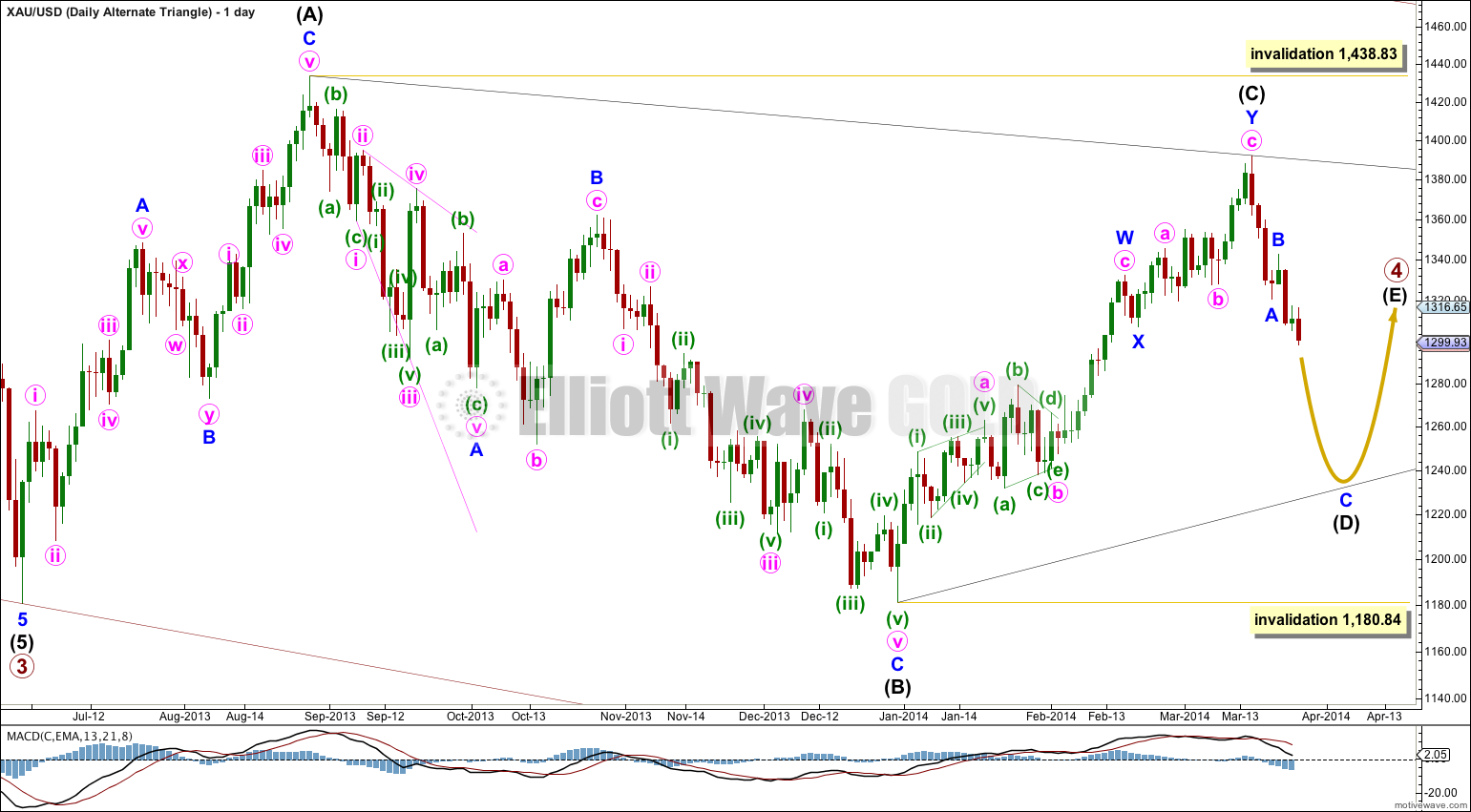

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle. With MACD moving reasonably close to the zero line on the daily chart this triangle looks typical. At this stage the subdivisions within primary wave 4 do not indicate whether it is a triangle or combination, both are possible. A triangle is less likely only because it is not as common a structure as a double combination.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

good job! thanks

Hi Lara,

I noticed in your analysis today that subminuette wave 2 in minuette wave 3 is considerably longer in duration than minuette wave 2. I understand that minuette wave 3 may be extended, but I was wondering if this is any cause for concern to the present wavecount. I currently see minuette wave 2 as 1 day on the daily chart, whereas subminuette wave 2 of minuette wave 3 is showing as two days now. I recall in the past when similar situations arose and it turned out you correctly identified that the lower degree wave wasn’t what was expected for this reason.

Thank you!

Now that that day is over subminuette wave ii shows as only one green candlestick.

I am however looking at an alternate which sees subminuette wave ii over earlier.