Downwards movement continues as expected. With momentum continuing to slow I will swap over the main and alternate hourly wave counts.

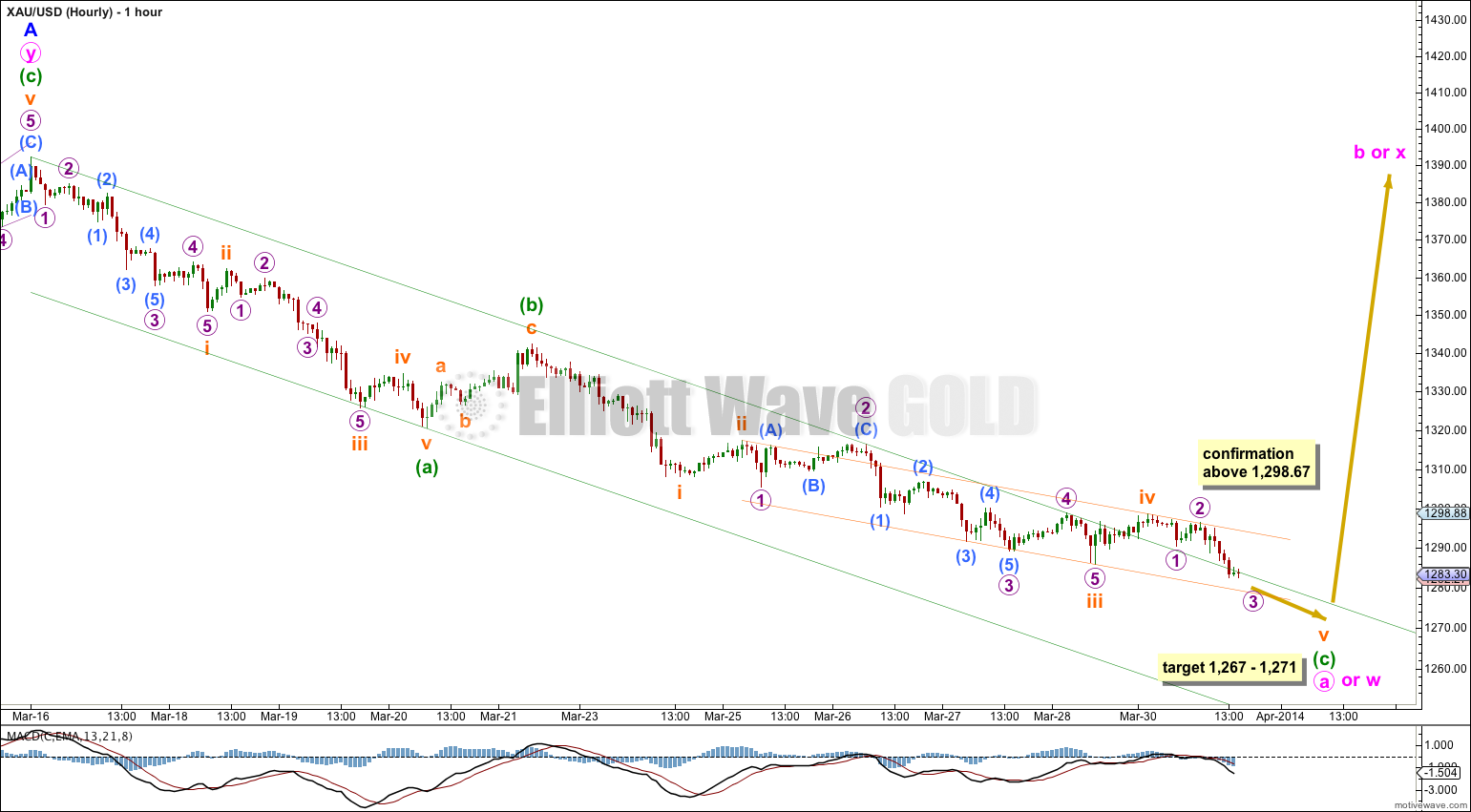

Summary: The trend is still down, but this may end soon. The short term target is 1,271 to 1,267.

This analysis is published about 04:40 p.m. EST. Click on charts to enlarge.

Main Wave Count.

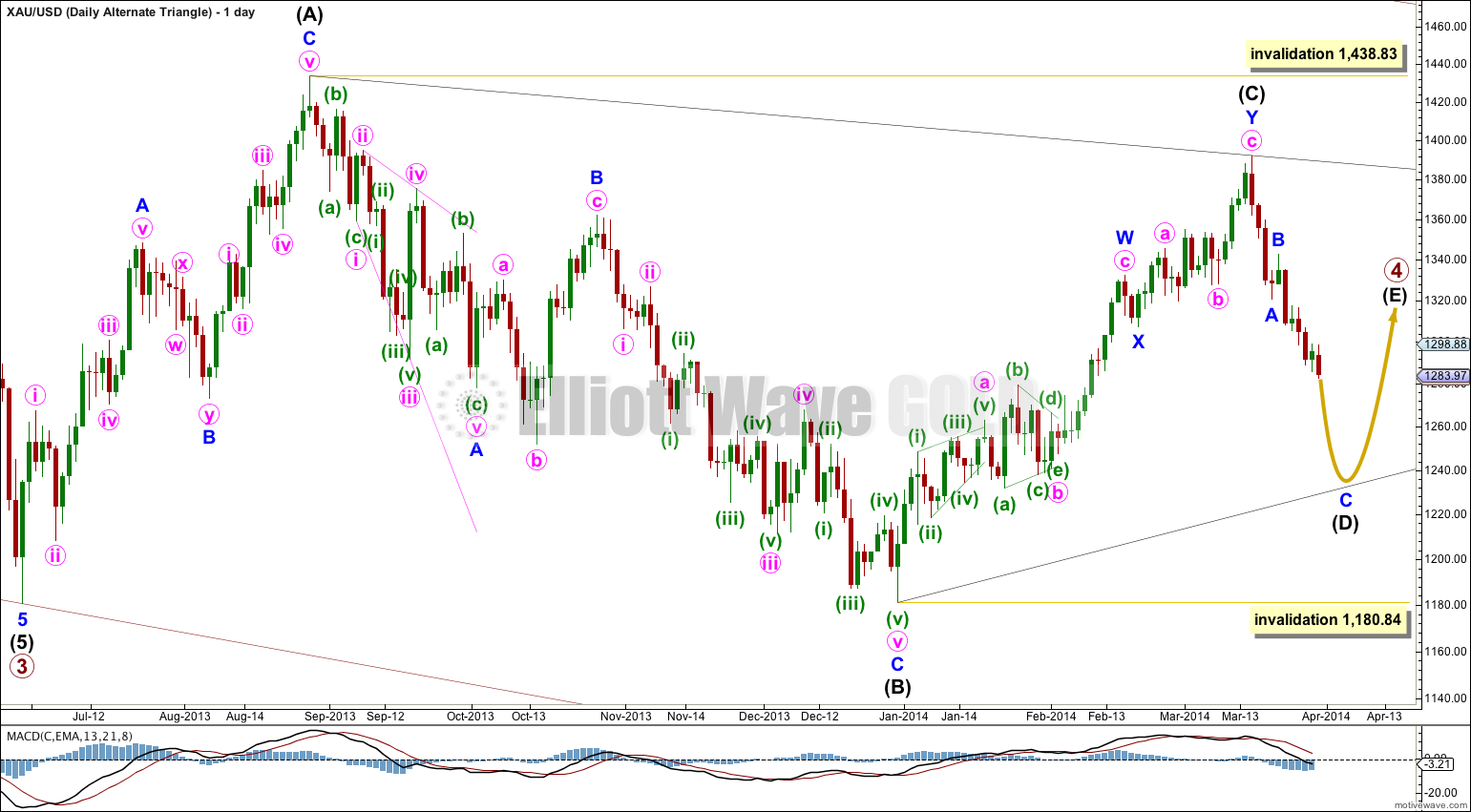

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

If minor wave B is a flat (or a combination with a flat as the first structure) then minute wave a (or w) within it must subdivide as a three. Minute wave a (or w) may be an almost complete zigzag.

Within zigzags C waves do not have to show stronger momentum than A waves. The fact that minuette wave (c) has not shown an increase in momentum beyond that seen for minuette wave (a) fits this wave count. However, within minuette wave (c) subminuette wave iii shows slower momentum than subminuette wave i. This is possible, but unusual. If downwards momentum increases beyond that seen for subminuette wave iii then this wave count must be revised, and the alternate below would be correct. An increase in momentum is not expected for this wave count at this stage, but if seen it would indicate much more downwards movement ahead.

At 1,271 minuette wave (c) would reach equality in length with minuette wave (a).

Within minuette wave (c) subminuette wave iii is shorter than subminuette wave i. This limits subminuette wave v to no longer than equality with subminuette wave iii because a third wave may never be the shortest. This limit is at 1,267. This provides a $4 target zone with the lower edge also providing a limit to downwards movement.

Draw a channel about minuette wave (c) using Elliott’s second technique. I would expect subminuette wave v to find support and end at the lower edge of this channel.

Movement above 1,298.67 would invalidate the alternate below and provide some confirmation for this main wave count.

Minute wave b or x may make a new high beyond the start of minute wave a at 1,392.30. This wave count has no upper invalidation point for this reason.

Alternate Hourly Wave Count.

This alternate hourly wave looks at the possibility that minor wave B downwards may be unfolding as a zigzag which subdivides 5-3-5. Within a zigzag minute wave a must subdivide as a five wave structure, and this may be an incomplete impulse.

Within minute wave a the third wave has not passed the middle, because we have not seen a strong increase in downwards momentum beyond that seen for minuette wave (i). At 1,226 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Also, within minuette wave (iii) the middle has not yet passed because subminuette wave iii has not yet shown an increase in downwards momentum beyond that seen for subminuette wave i. At 1,262 subminuette wave iii would reach 1.618 the length of subminuette wave i.

The continuing divergence between price trending lower and MACD trending higher indicates an upcoming trend change. This wave count should only be used if downwards movement shows an increase in momentum beyond that seen for submicro wave (1) within micro wave 3 within subminuette wave iii.

A breach of the upper edge of the green channel also reduces the probability of this wave count.

Within minuscule wave 3 no second wave correction may move beyond its start. This wave count is invalidated with movement above 1,298.67.

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle. With MACD moving reasonably close to the zero line on the daily chart this triangle looks typical. At this stage the subdivisions within primary wave 4 do not indicate whether it is a triangle or combination, so both are possible. A triangle is less likely only because it is not as common a structure as a double combination.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

You talk about a strong increase in downward momentum pointing to the alternate hourly wave count being correct. However, what about the opposite? If the main wave count is, in fact, correct, do you expect the coming trend change to be an explosion to the upside? We have dropped over 50% from the recent peak in mid-March, with hardly any corrections. That makes me think that we are winding up for a significant bounce. Is it too early to say? Thanks.

No. I would not expect a B or X wave upwards to have strong momentum.

The first wave within it may begin with strong momentum, but overall, no.