Yesterday’s analysis expected price to move lower for a small B wave correction against the trend. Price has moved lower, and strongly so.

The wave count remains valid and the same.

Summary: This downwards movement is an incomplete correction against the current short term upwards trend. Downwards movement is incomplete and should be more choppy and overlapping from here. In the very short term I expect a little more upwards movement to 1,313, to be then followed by a slight new low below 1,282.60 but not below 1,277.79.

This analysis is published about 5:10 p.m. EST. Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure: either a flat correction (main hourly wave count) or a double zigzag (alternate hourly wave count). Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

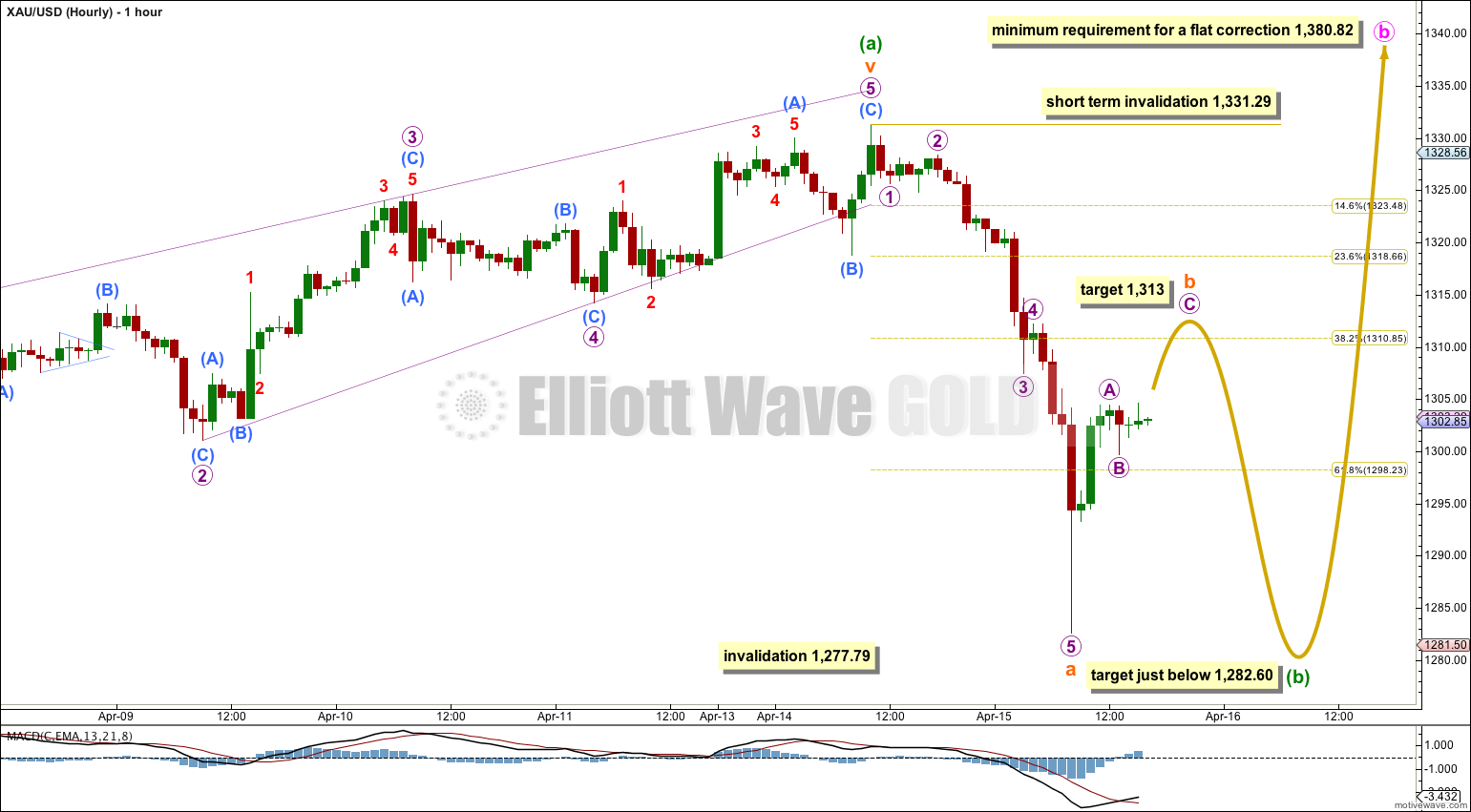

This main wave count follows the idea that minor wave B may be unfolding as a flat correction. Within the flat correction minute wave a subdivides as a single zigzag. Minute wave b within the flat must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b is most likely to subdivide as a single or double zigzag in order to reach 1,380.82.

Within a zigzag minuette wave (a) must subdivide as a five wave structure. It fits best now as a complete impulse.

Minuette wave (a) may have lasted nine days. I would expect minuette wave (b) to last at least three days, and maybe up to eight or nine days.

So far minuette wave (b) looks like it is completing as a zigzag. Within it subminuette wave a subdivides best as an impulse. This means subminuette wave b upwards must be a three wave structure and may not move above the start of subminuette wave a at 1,331.29.

If this upper invalidation point is breached within the next one or two days (before minuette wave (b) downwards is a clearly completed three wave structure) then my analysis of subminuette wave a down as a five wave impulse is incorrect. It could be a completed three which may be minuette wave (b) in its entirety, or may only be subminuette wave a of a flat correction or double combination for minuette wave (b).

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

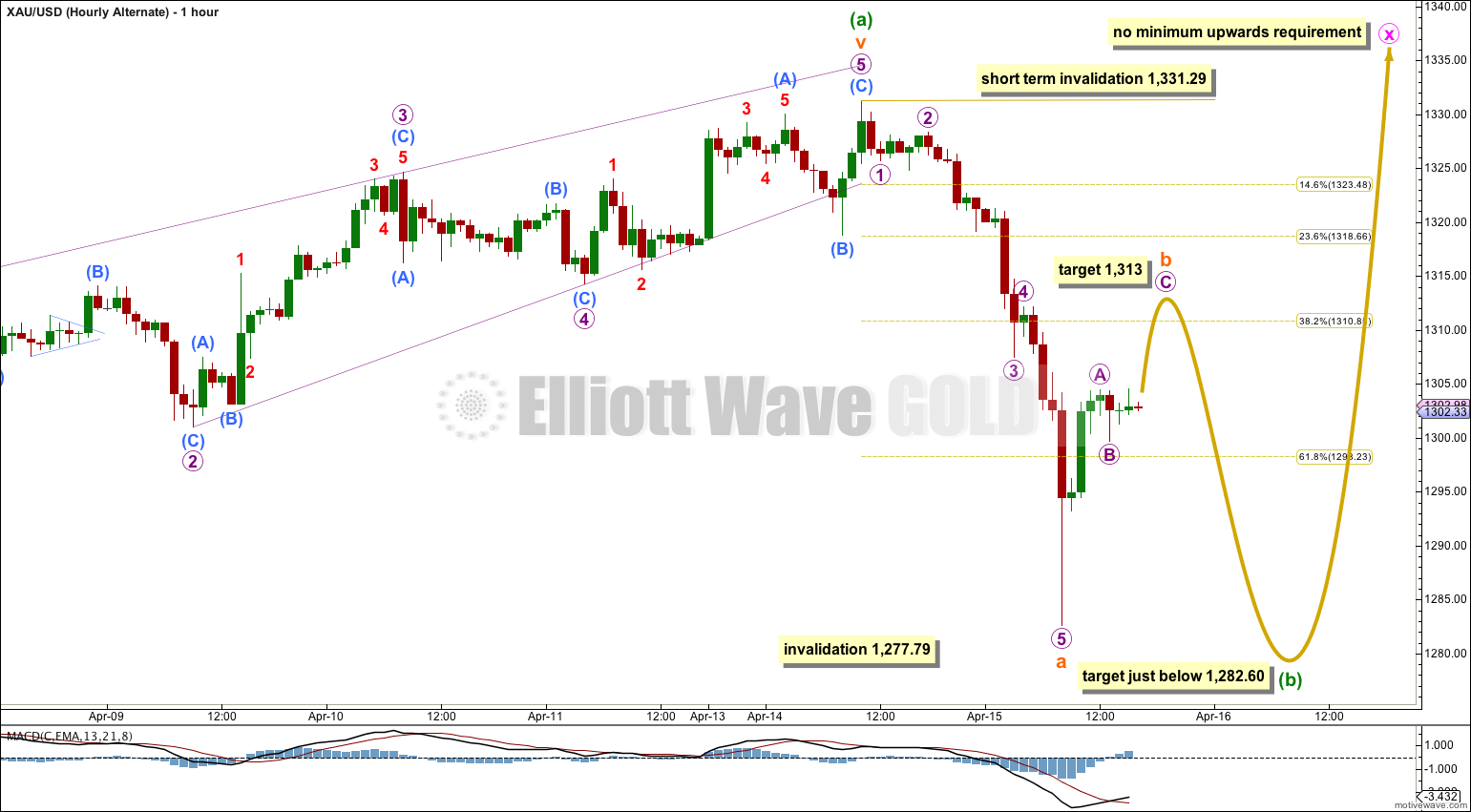

Alternate Hourly Wave Count.

This alternate wave count follows the idea that minor wave B downwards may be unfolding as a double zigzag. The first zigzag downwards is labeled minute wave w. The double should be joined by a “three” in the opposite direction which may subdivide as any corrective structure labeled minute wave x.

At this stage this alternate wave count is again the same as the main wave count with the sole exception of minute wave x not requiring a minimum upwards length.

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

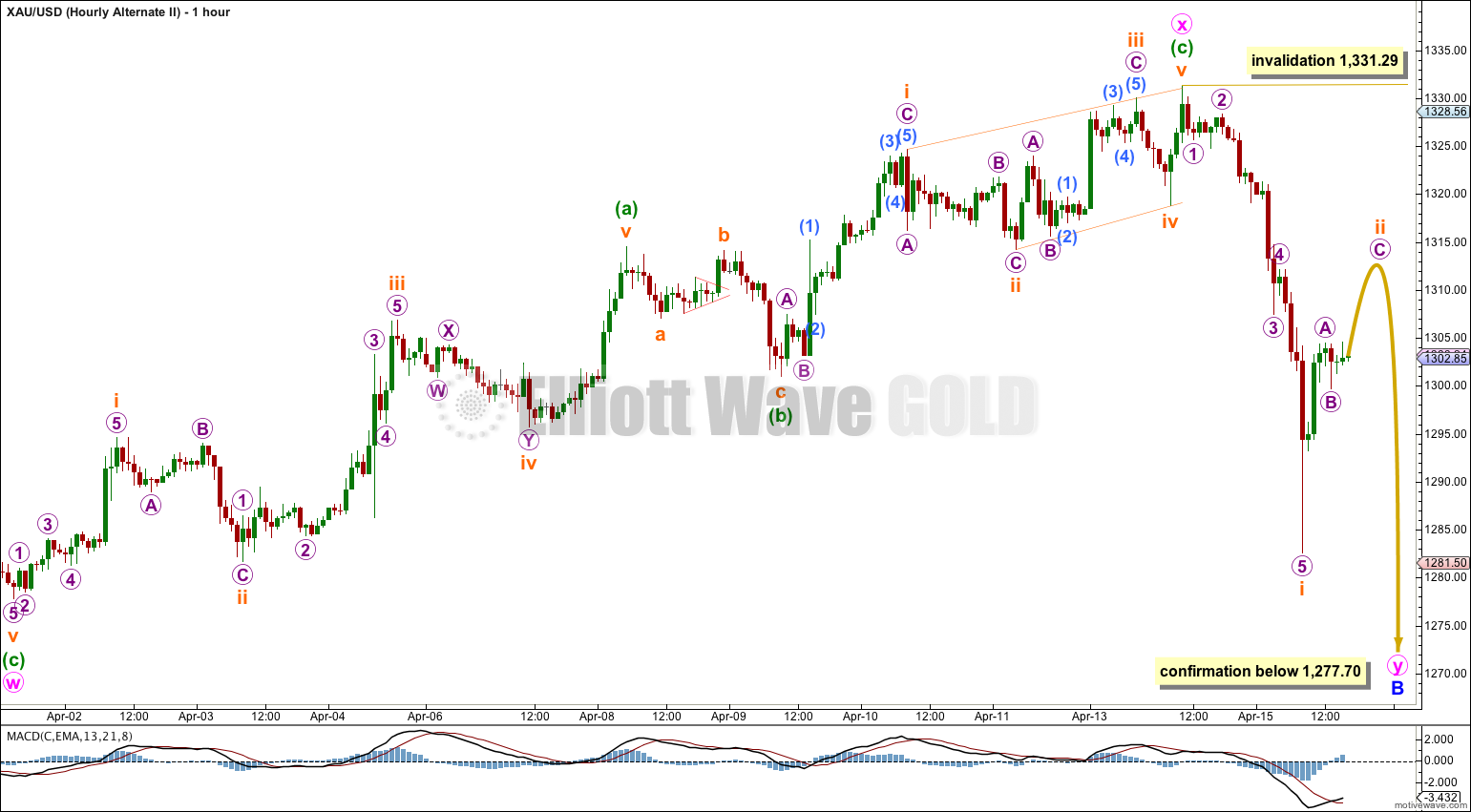

I want to consider the idea that my analysis of minuette wave (a) upwards as a five wave impulse could be wrong. I want to look at the possibility that this upwards wave may be a three wave structure, in which case it may fit best as a single zigzag. If it is a zigzag then it may be a complete minute wave X within a larger double zigzag down for minor wave B.

In trying to see upwards movement as a three wave structure there has to be an ending diagonal for minuette wave (c) which has to begin at 1,301.02 as labeled. This diagonal does not have the “right look”; it is neither expanding nor contracting. Within the diagonal the fourth wave is longer than the second, but the fifth wave is shorter than the third which is shorter than the first. The trend lines are mostly parallel, with only a very slight convergence.

The problem of the wave lengths within this possible ending diagonal reduce the probability of this wave count significantly. It is possible, but it is very unlikely.

If minute wave X is a completed zigzag then minute wave y downwards has begun. Minute wave y must subdivide as a single zigzag. Within it subminuette wave ii may not move beyond the start of subminuette wave i above 1,331.29.

If price moves below 1,277.70 in the next few days this is the wave count I would use.

in which case the second alternate wave count would be correct

or do you have another reason why the main wave count would be invalidated?

for your comment to have benefit an alternate wave count would be a good idea

Hi, Lara,

From your analysis, I have a question to ask, in the last part, you try to find another possibility to view the upward wave as a 3 wave structures and then there has to be viewing minuette wave (c) as a ending diagonal. But I am curious why its subminutte iv and v do not have the ABC structures and still able to view that minuette wave (c) as a diagonal wave.

Is it for a diagonal wave, not necessarily all of the wave has to be divided as ABC structures, I remembered that it seems to be saying that its 1,3,5 could be as impluse in a lower degree, is that true? Please correct my ideas on the rules if I am wrong.

Thanks

The structure of subminuette waves iv and v cannot be seen on the hourly chart, which is why there are no labels for the subdivisions within them on the hourly chart. You have to go to lower time frames to see that. They certainly could be seen as zigzags on the five minute chart.

Within ending diagonals ALL the subwaves must be single zigzags.

It is leading diagonals which may have the actionary waves (1, 3 and 5) subdivide as impulses. It is my experience with leading diagonals that if one of them is to subdivide as an impulse it is usually the third wave. Leading diagonals must have subwaves 2 and 4 as single zigzags.

Thank you Lara clearly explain my ambigious.

“ALL subwaves in ending diagonals are single zigzags”, only leading diagonals may have impulse on waves 1,3,5.

Thank you.

Dear Lara,

About your main and alternate I: in my experience, when a wave retraces more than 78.6% or 1288,55 and that’s the case for minuette wave b (green) unfolding regarding minuette wave a , then more often than not, an invalidation occurs.

Regards,

LOLA

Dear Lara,

About your main and alternate I: in my experience, when a wave retraces more than 78.6% or 1288,55 and that’s the case for minuette wave a (green), then more often than not, an invalidation occurs.

Regards,

Emmanuel

The 3rd alternate looks like it may fit nicely with GDX. It appears that GDX has progressed since your last analysis and may now be in a Minor wave 3 down within Intermediate wave 5 down?

I’ll have to take a look at GDX. Maybe I’ll manage to get that (and Silver) updated today.

I don’t like that alternate though. I’ll spend some more time looking at other ways to see that wave as a three. But that ending diagonal… looks horrible.