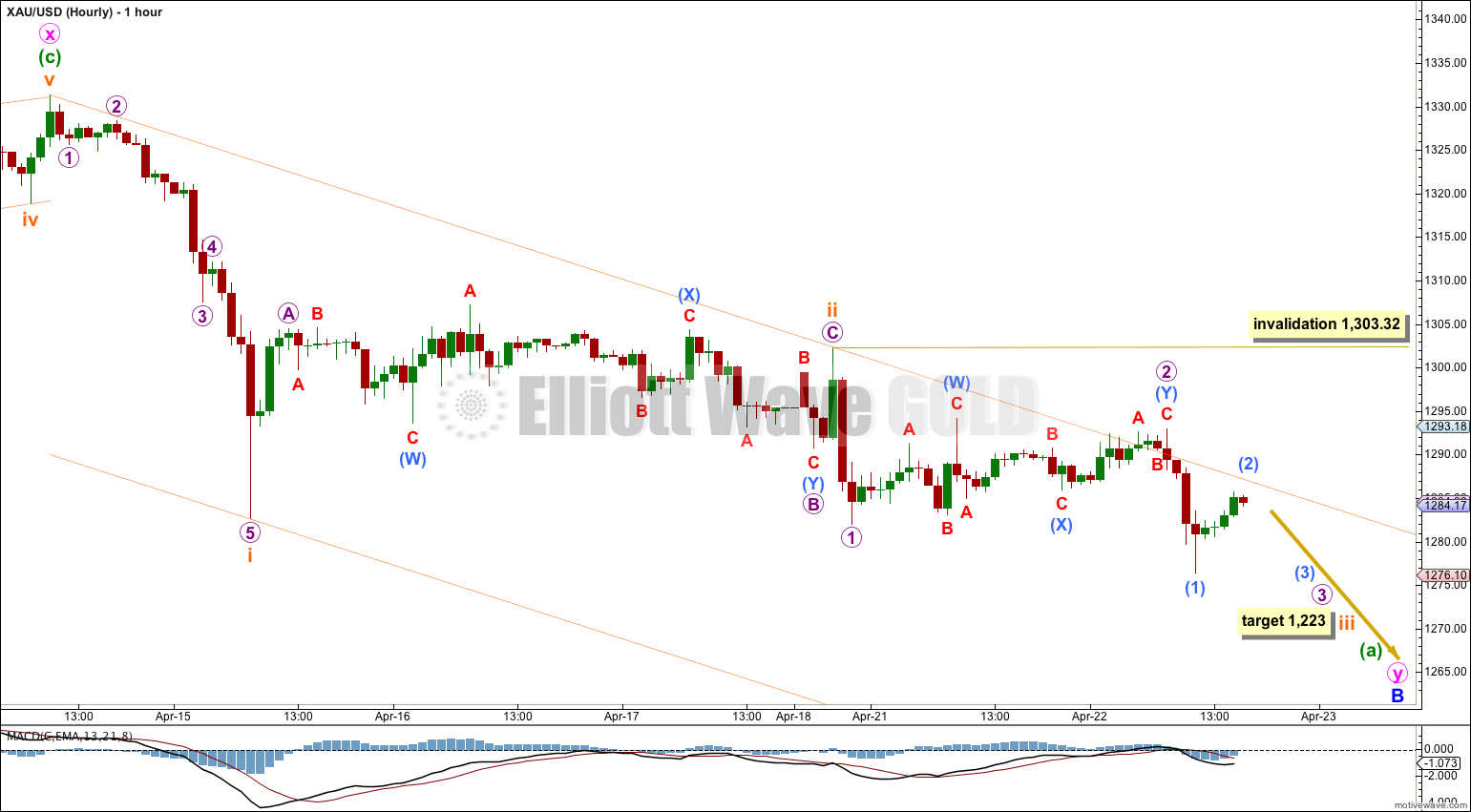

The channel on the hourly chart was not clearly breached, and a new low below 1,277.47 has invalidated the main hourly wave count and confirmed the second alternate. Now we have some clarity I have just the one hourly wave count for you today.

Summary: The minor degree downwards trend has most likely resumed. The short / mid term target is at 1,223.

This analysis is published about 6:15 p.m. EST. Click on charts to enlarge.

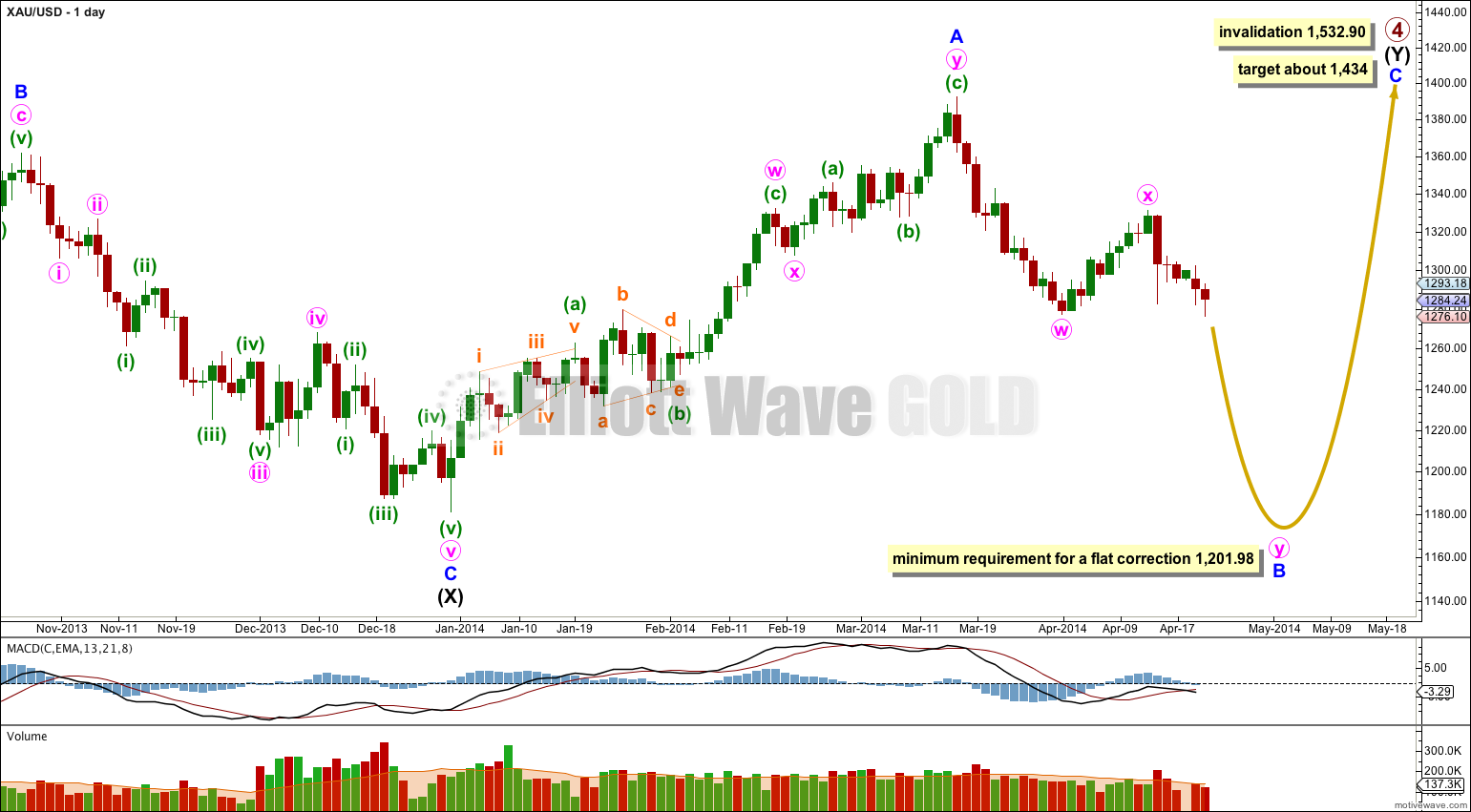

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure fits best as an incomplete double zigzag. Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Within minor wave B minute wave w lasted 11 days and minute wave x lasted 9 days. So far minute wave y has lasted 6 days and it still has a long way down to go. It looks like it will be longer lasting than minute wave w. It may last a total Fibonacci 13 or 21 days.

This wave count sees the upwards wave labeled minute wave x as a completed three wave structure. A new low below its start confirms that this upwards movement must be a completed three.

Minute wave x is complete as a single zigzag and so minute wave y has most likely begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below.

So far within the zigzag of minute wave y it is most likely that minuette wave (a) is incomplete. Within minuette wave (a) subminuette wave iii downwards should show an increase in downwards momentum beyond that seen for subminuette wave i. At 1,223 subminuette wave iii would reach 1.618 the length of subminuette wave i.

Within subminuette wave iii micro wave 2 may not move beyond the start of micro wave 1. This wave count is invalidated with movement above 1,303.32.

Overall this wave count expects to see a continuation of downwards movement for another six to fifteen days to a minimum of 1,201.98, and we may see a new low below 1,180.84.

The orange channel drawn here is a base channel about subminuette waves i and ii. So far the upper edge shows where corrections are finding some resistance, and this should continue.

Subminuette wave iii should be strong enough to breach the lower edge of the base channel. Once it is breached the lower trend line may then provide resistance.

Gdx is looking strong-clear impulse to the upside?

It looks like the channel has been clearly breached to the upside now. This has been some tricky price action. The count has the right look on the daily, but the hourly count is tricky. Crude had similar price action about a month ago where the hourly channel was clearly breached and then reversed $5 to the upside back into the channel. Will we see something similar here?

Hi Lara,

I understand gold price had broken the low price slightly 1277.7 of minute wave (a) of Minor B, but why this would totally turn against your previous main wave count and let the previous wave count set aside?

(No need comment below, just share for fun)

I was waiting for 2 days to cash out my profit orders targeting to the price closing 1277 but it stopped from marching downward and pretending shifted sideway upward. Unwillingly, I closed all my profit orders and open new orders preparing for upward movements while price was trying to breach the channel. Then all of sudden, it dropped and even broke through the invalidation point 1277.7x (I have set the stop loss beyond 1277 at 1276 something). Then, price broke through 1277 once and return back! It really looks like they acted againist our orders 🙂 and actually the invalidation points and channel take effects.

No, that’s correct.

There are two hourly candlesticks just above the upper trend line, but they both touch the upper trend line. It’s not a clear breach.

I categorise a clear breach as candlesticks outside the channel and not touching the trend line at all.

Since the channel is not broken to the downside, is there still a possibility of a flat / extended flat at Minute degree that would see a wave C high around 1331 before we decline into Minute wave C to complete Minor B down?

The video answered my question. Thanks.

Lara,

Possible ‘typo’.

The channel on the hourly chart was not clearly breached

Should be ‘NOW’ instead of ‘NOT’?