The channel on the hourly chart has been clearly breached by upwards movement. I have two wave counts for you today. The situation is unclear.

Summary: We need to see price break above 1,292.99 or below 1,276.36 to have clarity.

This analysis is published about 8:45 p.m. EST. Click on charts to enlarge.

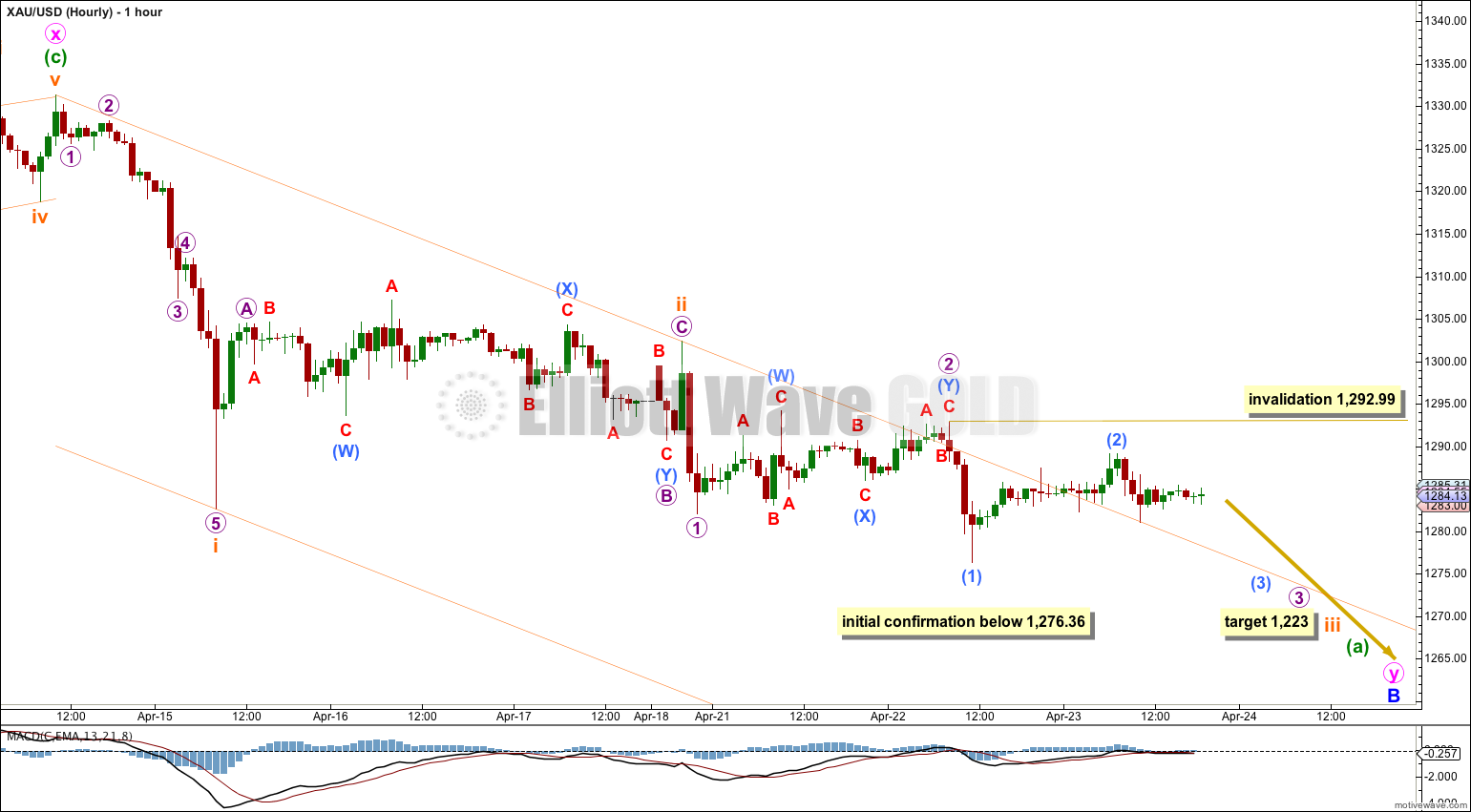

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure fits best as an incomplete double zigzag. Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Within minor wave B minute wave w lasted 11 days and minute wave x lasted 9 days. So far minute wave y has lasted 7 days and it still has a long way down to go. It looks like it will be longer lasting than minute wave w. It may last a total Fibonacci 13 or 21 days.

Minute wave x may be complete as a single zigzag. Minute wave y has most likely begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below.

So far within the zigzag of minute wave y it is most likely that minuette wave (a) is incomplete. Within minuette wave (a) subminuette wave iii downwards should show an increase in downwards momentum beyond that seen for subminuette wave i. At 1,223 subminuette wave iii would reach 1.618 the length of subminuette wave i.

Within subminuette wave iii submicro wave (2) may not move beyond the start of submicro wave (1). This wave count is invalidated with movement above 1,292.99.

Overall this wave count expects to see a continuation of downwards movement for another five to fourteen days to a minimum of 1,201.98, and we may see a new low below 1,180.84.

The orange channel drawn here is a base channel about subminuette waves i and ii. Normally corrections are contained within the base channel, but occasionally they are not. That may be what is happening here. Because the channel is breached by upwards movement I will consider the alternate wave count below.

Subminuette wave iii should be strong enough to breach the lower edge of the base channel. Once it is breached the lower trend line may then provide resistance.

If we see movement to a new low below 1,276.36 within the next day or so the alternate wave count below would be invalidated and I would have confidence in this main wave count and the target.

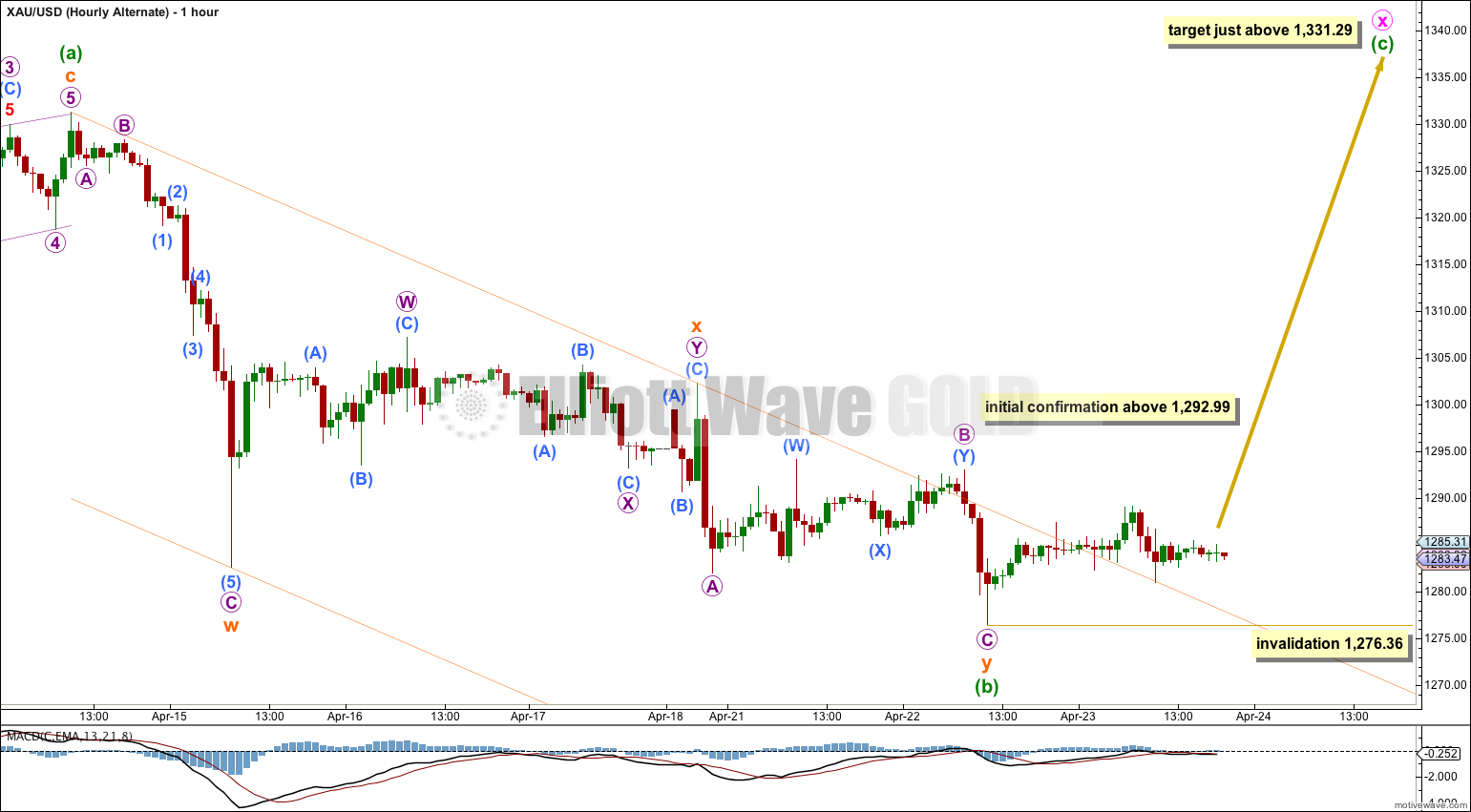

Alternate Wave Count.

Alternatively, minute wave x may be an incomplete regular flat correction.

Minor wave B downwards is still seen here as a double zigzag: zigzag – X – zigzag. The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough, so this structure would be able to take price down to 1,201.98 or below.

This alternate has a lower probability than the main wave count because if minute wave x continues higher for a few days it would be much longer in duration than minute wave w. This would be unusual for an X wave within a double zigzag, and reduces the probability of this wave count.

There is no upper invalidation point because there is no minimum or maximum requirement for an X wave, the only requirement is that it is a corrective structure. However, X waves within double zigzags are normally shallow as this one would be.

Within the possible flat correction minuette wave (b) is a 102% correction of minute wave (a), which indicates a regular flat. Regular flats normally have C waves which are close to equality in length with their A waves. Because this would not be long enough to take price up to 1,380.82 I am no longer considering the possibility that minor wave B in its entirety may be a flat correction. A double zigzag is much more likely at this stage.

If minute wave x is incomplete then within it minuette wave (c) must subdivide as a five wave structure. Minuette wave (c) is very likely to move price at least slightly above 1,331.29 to avoid a truncation and a rare running flat.

If price moves above 1,292.99 within the next day or so then this alternate wave count would be confirmed.

The next day’s analysis is now published. My thoughts are all in there.

Gold crashed to 1270, and then within an hour jumped to 1296. Was that a trend change to go higher? thoughts?

Wow-crazy market. Gold drops below 1276, then moves up past 1292–both lower and upper targets met. Can’t wait to see analysis of this!

My guess is minuette b will be moved to the low this AM and now be part of expanded flat. Minuette c underway to complete x.

Sounds right but wouldn’t minuette b move lower by (1.382 X minuette a)?

If it is Minuette c, this must be Subminuette i of Minuette c, if Subminuette ii return 80-90%, this would very good profit also.

Chapstick_jr

Would you email me at goldjackass@yahoo.com? I have a couple questions I would like to ask.

Thanks