Price whipsawed to breach the invalidation points on both hourly wave counts. The situation is still unclear.

Summary: In the short term I expect to see some more upwards movement. It may end about 1,308 or it may continue higher. If we see a new high above 1,331.29 then I would expect price to continue higher to 1,355.

This analysis is published about 6:25 p.m. EST. Click on charts to enlarge.

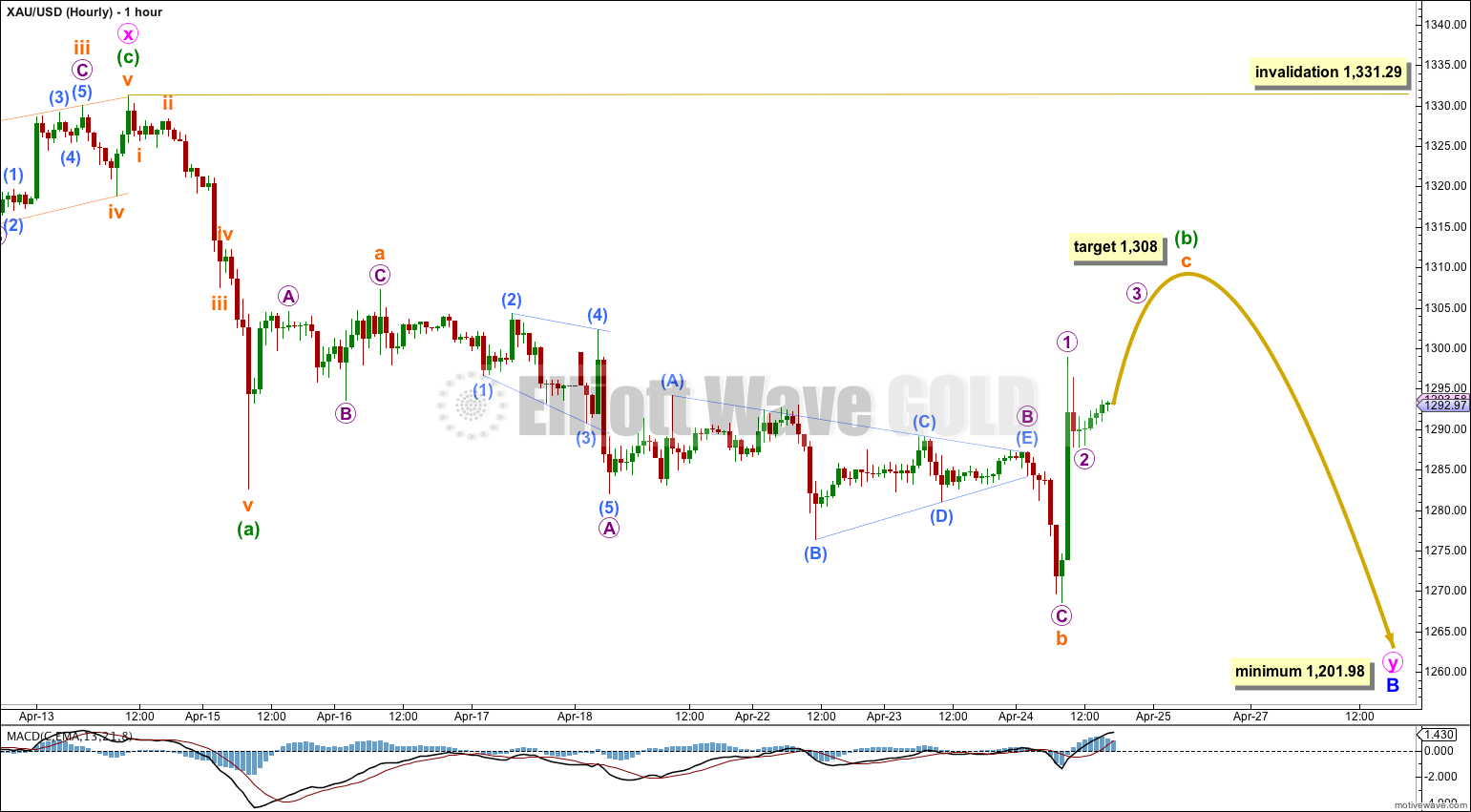

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure fits best as an incomplete double zigzag. Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Within minor wave B minute wave w lasted 11 days and minute wave x lasted 9 days. So far minute wave y has lasted 8 days and it still has a long way down to go. It looks like it will be longer lasting than minute wave w. It may last a total Fibonacci 13 or 21 days.

Minute wave x is still most likely complete as a single zigzag. Minute wave y has most likely begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below.

Downwards movement during Thursday’s session fits nicely as the end of a three wave zigzag downwards. This is followed by upwards movement which should complete a five and end at least slightly above 1,307.19.

Within minute wave y recent movement, which is very choppy and overlapping, may have been minuette wave (b) within it. This does not look like a smaller degree second wave.

Minuette wave (b) is an almost complete expanded flat correction. Within it subminuette wave a subdivides clearly as a three, and subminuette wave b downwards is also clearly a three with a triangle in the middle. At 1,308 subminuette wave c would reach 1.618 the length of subminuette wave a.

Minuette wave (b) may not move beyond the start of minuette wave (a) above 1,331.29. This invalidation point will not change as minuette wave (b) cannot move higher.

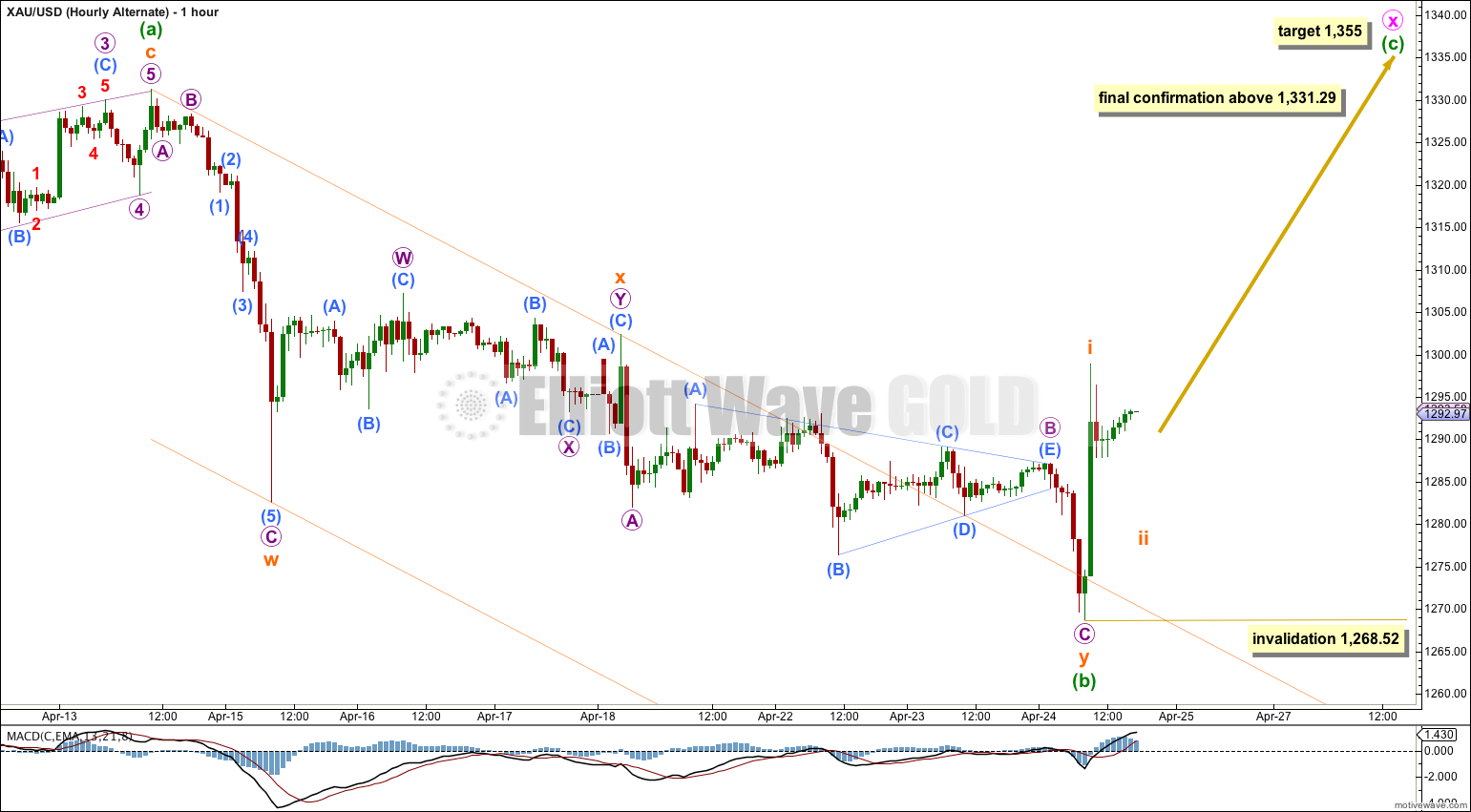

Alternate Wave Count.

Alternatively, minute wave x may still be an incomplete expanded flat correction.

Minor wave B downwards is still seen here as a double zigzag: zigzag – X – zigzag. The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough, so this structure would be able to take price down to 1,201.98 or below.

This alternate still has a lower probability than the main wave count because if minute wave x continues higher for a few days it would be substantially longer in duration than minute wave w. This would be unusual for an X wave within a double zigzag, and reduces the probability of this wave count.

There is no upper invalidation point because there is no minimum or maximum requirement for an X wave. However, X waves within double zigzags are normally shallow as this one would be. The only requirement is that an X wave be a corrective structure.

Within the possible flat correction minuette wave (b) is now a 117% correction of minute wave (a), which indicates an expanded flat. At 1,355 minuette wave (c) would reach 1.618 the length of minuette wave (a).

If price reached up to 1,380.82 or above then I would relabel minor wave B in its entirety as a flat correction.

Minuette wave (c) must subdivide as a five wave structure. Within minuette wave (c) subminuette wave ii may not move beyond the start of subminuette wave i below 1,268.52.

Hi Lara. I truly appreciate your dogged enthusiasm in analysing gold, especially with the whipsaw yesterday. Just one small query on the wave count for the Main Count. Could the point labelled Micro 1 at Subminuette c of Minuette B be Micro 3 instead (Micro 1 and Micro 2 are hidden in the long upward candlestick and can be discerned with the 1-minute chart)? If it is Micro 1 then there isn’t much room for the other 4 waves to reach the target of 1308. The sideways movement today would be Micro 4 and will lead to your target of 1308 at the end of Micro 5. Micro 1, which is Subminuette 1 in the Alternate Wave Count, fits the count very well though.

On a side note, silver has dropped to just below 19 yesterday. Would that actually be the termination of Minute C? Appreciate an update on silver soon. Thanks.

I think the next day’s analysis has answered your question.

No, I would not labeled micro wave 3 as over at the high of micro wave 1. First waves often look exactly like that; they can be very steep sharp movements.

We have a further increase in upwards momentum, MACD is indicating that the third wave is not over.

And micro wave 4 has not yet begun.

As for Silver, yes I would expect that now minute wave C is over. I will not be updating Silver until next week.

Thanks Lara for the clarification. I was all along under the impression that Wave 1 could not rise so substantially in price as compared to Wave 3. That’s a good learning point for me, thanks to your vast experience.

I will be eagerly awaiting your silver update next week. Generally, am I right to say that Minute C has just ended when price dropped below 19.00. It is now undergoing Wave D which would end roughly about the same time when gold reaches Minute X. Both will then make a final plunge to end their respective Minor Bs. In this way, the two metals will then move in tandem.

Yes, that is what I expect and that is how I would label the triangle in Silver.