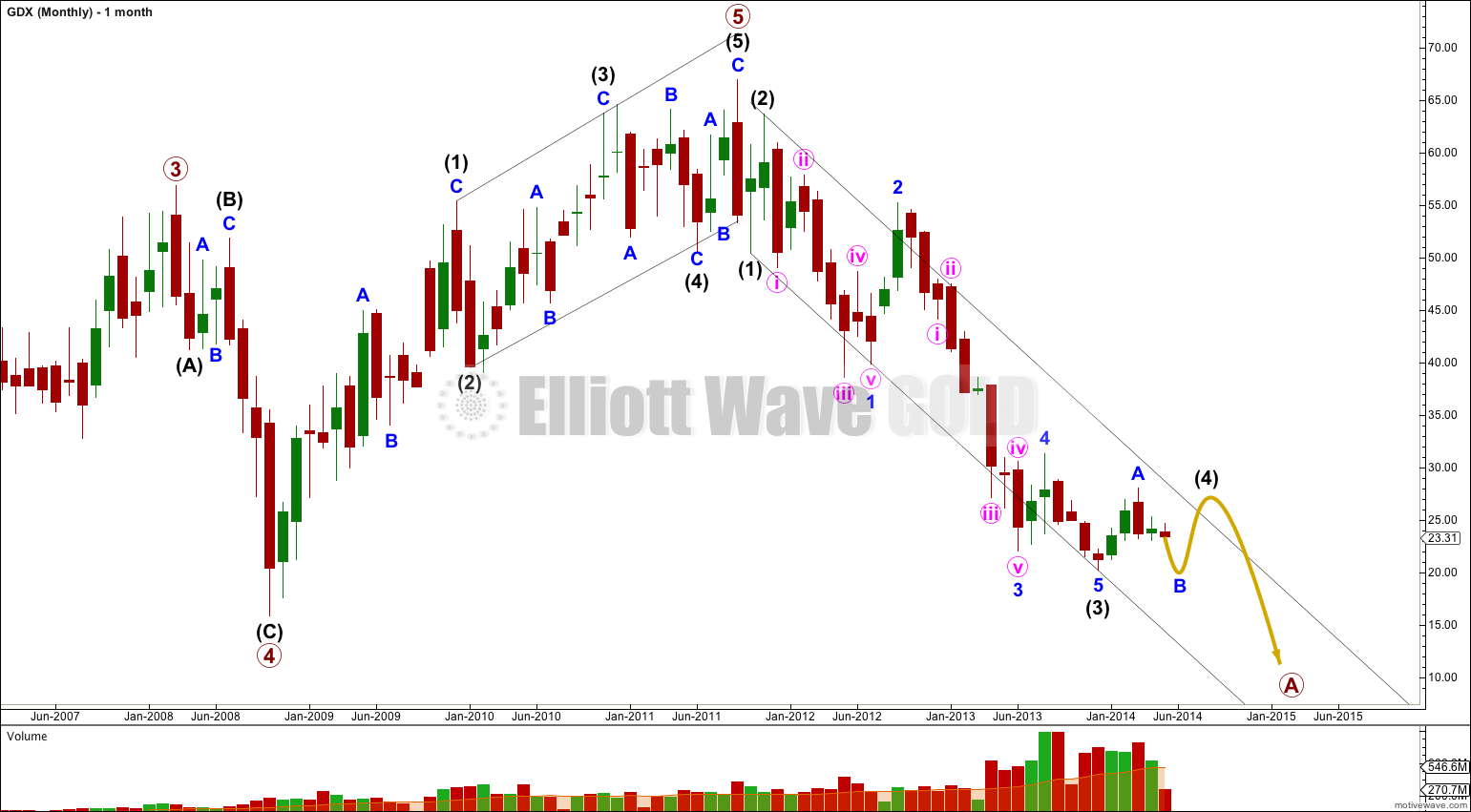

The structure of the daily chart for GDX looks remarkably similar to Gold. This wave count supports the current wave count for Gold.

Click charts to enlarge.

The clearest piece of movement is the downwards movement from the high. This looks most like a first, second and third wave. This may be the start of a larger correction.

Intermediate wave (3) is $1.06 longer than 2.618 the length of intermediate wave (1).

Within intermediate wave (3) there are no Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within minor wave 1 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $2.19 longer than 0.618 the length of minute wave i.

Ratios within minor wave 3 of intermediate wave (3) are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is $0.63 longer than 0.382 the length of minute wave iii.

Draw a parallel channel about this downwards movement. Draw the first trend line from the lows of intermediate waves (1) to (3), then place a parallel copy upon the high of intermediate wave (2). I would expect intermediate wave (4) to find resistance at the upper edge of the channel, and it may end there.

Intermediate wave (4) should last one to a few months. It may end about the terminus of the fourth wave of one lesser degree at $31.35.

At this stage I expect intermediate wave (4) is incomplete. I have moved the degree of labeling for the first wave up labeled now minor wave A down one degree; I expect this is just minor wave A and not intermediate wave (4) in its entirety.

I have done this because the most recent movement suggests a contracting triangle is unfolding. If intermediate wave (5) has begun this triangle would be in a second wave position, and that does not make sense.

At this stage I would expect that minuette wave (e) is incomplete and price should move a little higher to end it. Minuette wave (e) may not move beyond the end of minuette wave (c) at 24.67. If price moves above this point then my wave count is wrong, and I would expect some more upwards movement.

The triangle would be confirmed as complete when price moves below 23.04. Minuette wave (d) may not move beyond the end of minuette wave (b), and so at that stage downwards movement could not be a continuation of minuette wave (d) and the triangle would have to be over.

If intermediate wave (4) is unfolding as a flat correction then within it minor wave B downwards must reach a minimum 90% length of minor wave A at 21.145.

No. This is not part of my data feed, and I’m not adding another market to analyse and publish to my workload. Please see the FAQ.

Hi Lara, is it possible to make a GDXJ Section? thank you so much!

Hi Lara,

Looks like minor B did not reach your target for a flat at 21.145 and that minor B may be complete as a double zig-zag? If yes, is your target for minor C and Intermediate 4 still about 31.35 or is there a possibility of a lower target around 26 to complete a bigger triangle for Intermediate 4? Thanks,

I will try to get GDX updated this weekend, and that will answer your question.

Looks good. Really appreciate the GDX updates!

Thank you, Lara, for this GDX update. Interesting indeed.