End of week analysis expected to see one or two days overall of downwards movement towards a target at 1,267. Price did begin the new trading week with downwards movement, but only reaching to 1,277.57 in the first hour. Thereafter, upwards movement has breached the channel on the hourly chart.

Summary: There is now a clear five down on the hourly chart so I have more confidence that the downwards trend has resumed. I expect to see an increase in downwards momentum this week to a target at 1,242. We may see some sideways movement before a third wave down begins, or it may have just begun. Either way by the end of this week we should have new lows below 1,273.43.

This analysis is published about 05:01 p.m. EST. Click on charts to enlarge.

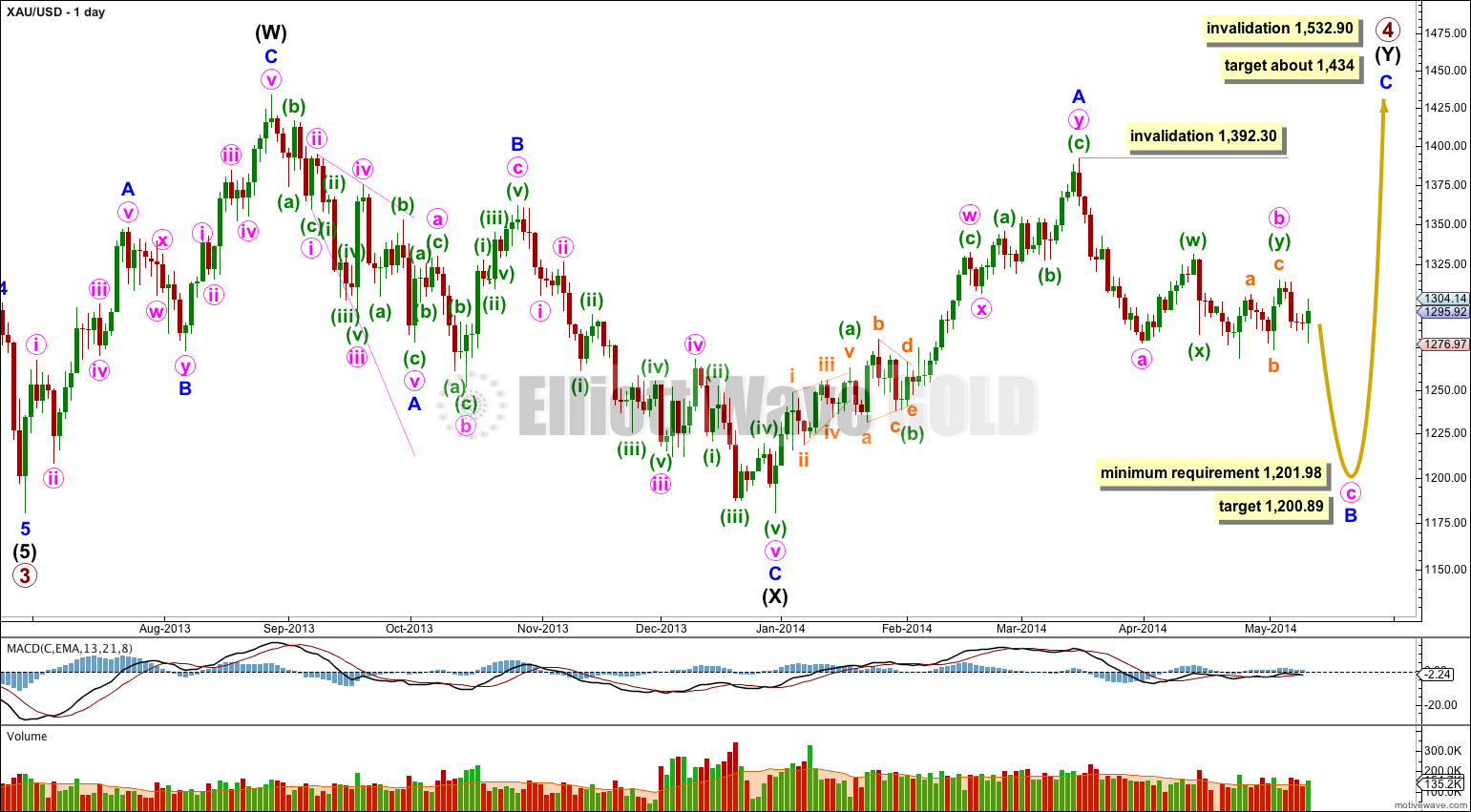

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure may be either a single zigzag (as labeled here) or a double zigzag (relabel A-B-C to W-X-Y). When minute wave b is finally confirmed as complete then I will have two hourly wave counts for the two possibilities of the next downwards wave: either an impulse for a C wave or a zigzag for a Y wave.

If minor wave B is a single zigzag then within it minute wave b may not move beyond the start of minute wave a above 1,392.30. Minute wave c would reach equality in length with minute wave a at 1,200.89.

If minor wave B is a double zigzag, relabeled minute w-x-y, then within it there is no invalidation point for minute wave x. But X waves within double zigzags are usually relatively brief and shallow, as they very rarely make new price extremes beyond the start of the first zigzag in the double.

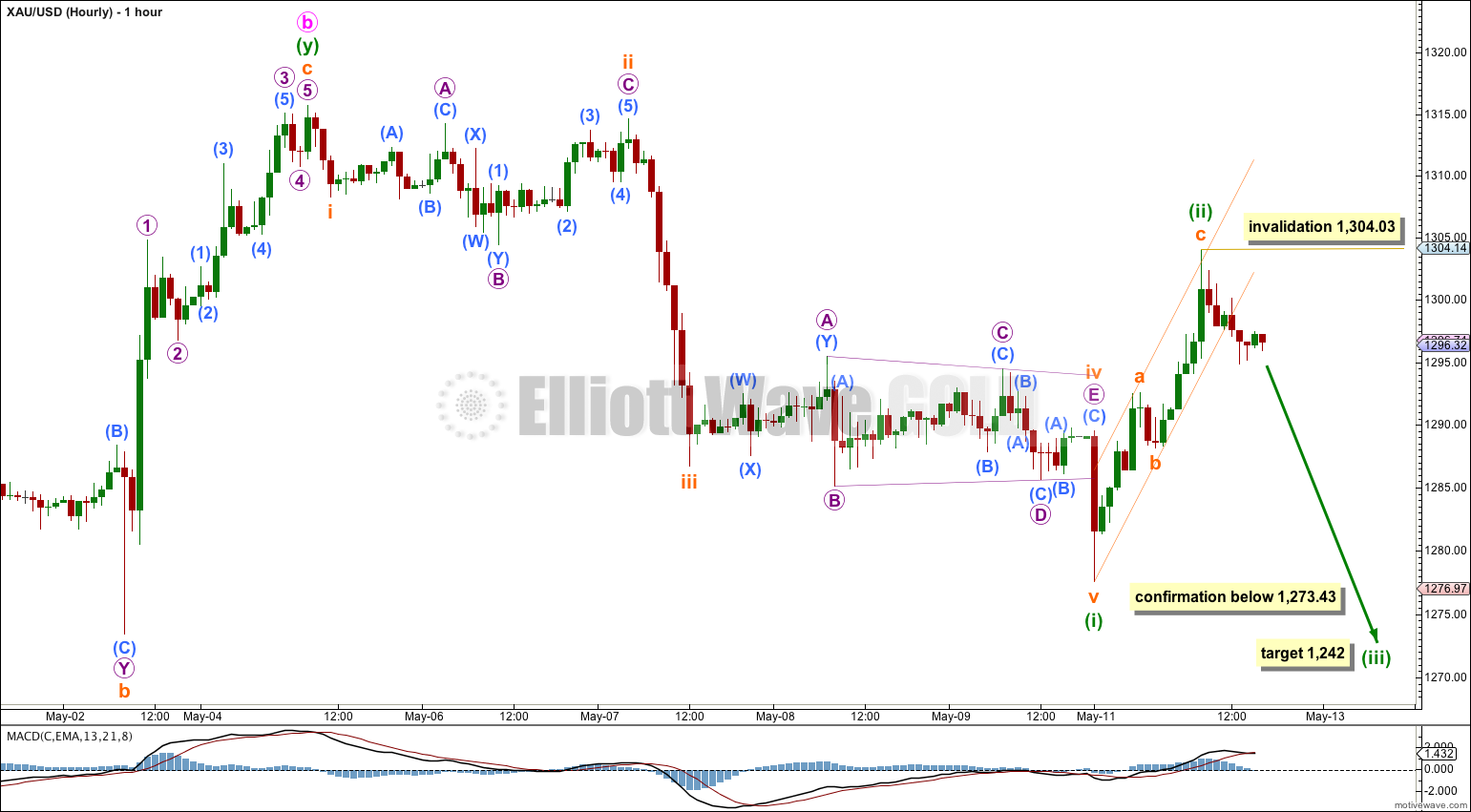

Main Wave Count.

Downwards movement to begin the session completed minuette wave (i) earlier and shorter than expected.

Ratios within minuette wave (i) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.02 short of 1.618 the length of subminuette wave i.

I have relabeled subminuette wave iv as a contracting triangle. It does not have a typical look, but it does not look too atypical either. The trend lines are not converging as strongly as they normally do for contracting triangles. But the subdivisions fit nicely and it fits the within the five down perfectly.

Minuette wave (ii) subdivides nicely as a zigzag which is just over 0.618 the length of minuette wave (i). Because this structure can be seen as complete and it is a typically deep second wave correction I expect it is reasonably likely to be over here. Zigzag corrections can be sharp and brief.

However, my concern today for this wave count is the brevity of this zigzag for minuette wave (ii). I would not be surprised if it continued further sideways for another two or even three days before minuette wave (iii) begins. For this reason I would consider the alternate below.

If the next move down is a clear five on the hourly chart (a first wave within minuette wave (iii) ) then this wave count would be confirmed.

If the next move down is a clear three on the hourly chart then the alternate below would be correct.

If minuette wave (iii) has begun then at 1,242 it would reach 1.618 the length of minuette wave (i).

Within minuette wave (iii) no second wave correction may move beyond the start of its first wave above 1,304.03.

On balance I would have to judge this main wave count as having only a slightly higher probability than the alternate below.

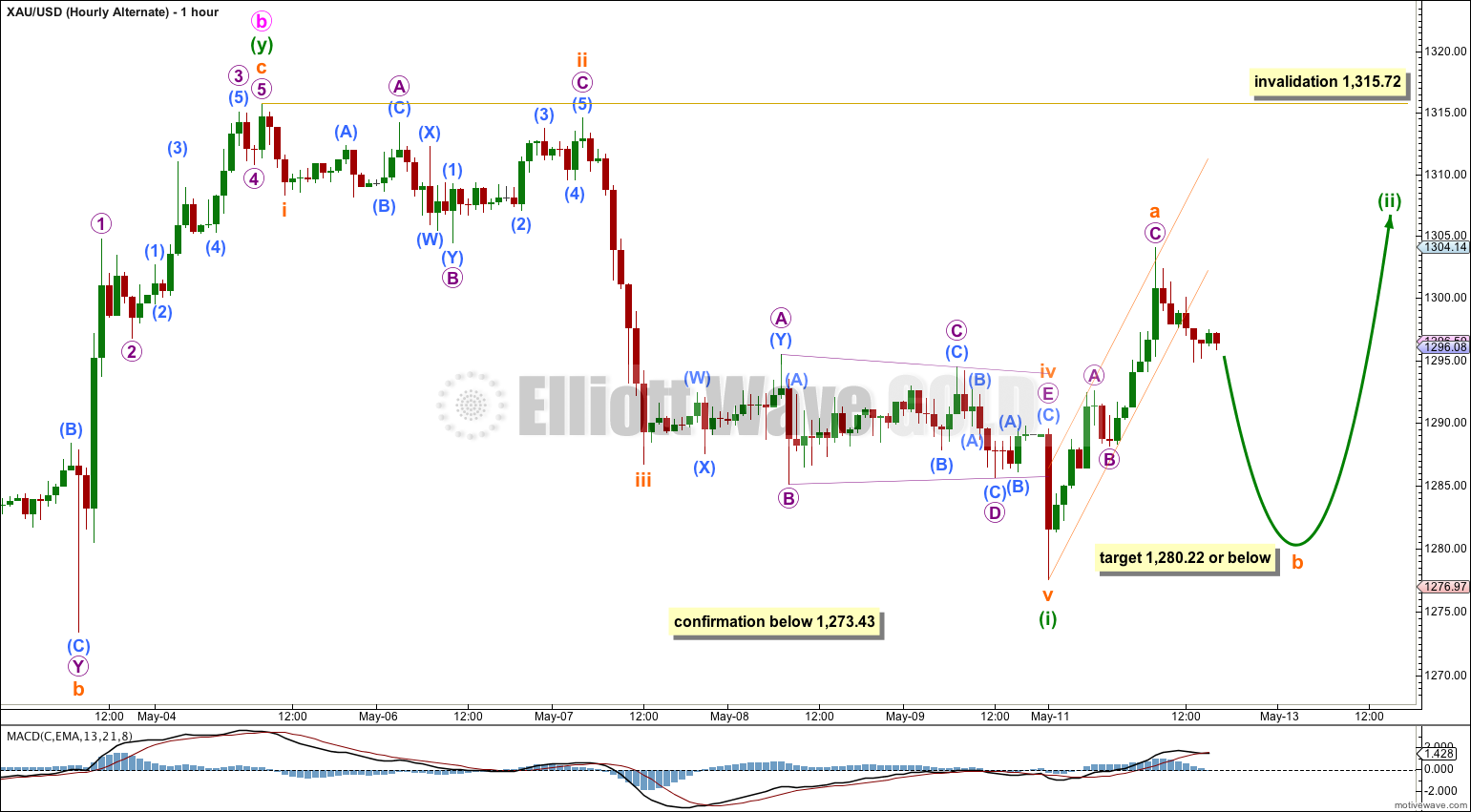

Alternate Hourly Wave Count.

By simply moving the degree of labeling within minuette wave (ii) down one degree it is possible that it is incomplete, that only subminuette wave a (or w) of a flat (or multiple) is completed.

If minuette wave (ii) continues sideways as a flat correction then within it subminuette wave b must reach down to 1,280.22 or below. Subminuette wave b may move beyond the start of subminuette wave a below 1,277.57 if minuette wave (ii) is an expanded flat.

If minuette wave (ii) is a multiple (double zigzag or double combination) then there is no minimum requirement for subminuette wave x within it, and subminuette wave x needs only to be a three wave structure.

If minuette wave (ii) continues further sideways and higher it would be better in proportion to minuette wave (i).

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,315.72.

If we see a clear five down on the hourly chart from here then this alternate would be discarded in favour of the main wave count.

Hi Lara-

Any thoughts of a ‘b wave’ triangle that just completed at $1304? I’m not sure if the subdivisions would fit, but it has a good look on the daily with the exception of the short ‘e wave’. However, this could be fixed with a slightly higher high above $1304 as a WXY.

The subdivisions just don’t work.

If a triangle ended there then wave D downwards of the triangle would be the movement on the hourly chart which I have labeled minuette wave (i). A triangle would have to see that movement as a three. But it looks pretty strongly like a five.

There are other problems too, earlier on in the sideways movement, where a triangle just simply does not fit.

And the E wave would be remarkably brief too, giving it an odd look.

I know it looks like a traditional technical analysis contracting triangle, but it doesn’t fit as an Elliott wave contracting triangle.

Hi Lara

I had trouble seeing wave 3 in Micro wave A of subminuette wave a? I could not see that it was the longest?

I was looking at that on the five minute chart.

It continued lower and turned into a five anyway.