Movement above 1,298.93 indicated the alternate wave count was correct and at that stage it expected more upwards movement. I had expected price to move lower and show an increase in downwards momentum for Wednesday’s session. This is not what happened.

Summary: A second wave correction is either over here or extremely close to completion. The next movement should be a strong third wave down. The target is 1,247. The channel on the hourly chart should be used for confirmation of a trend change to the downside.

This analysis is published about 05:03 p.m. EST. Click on charts to enlarge.

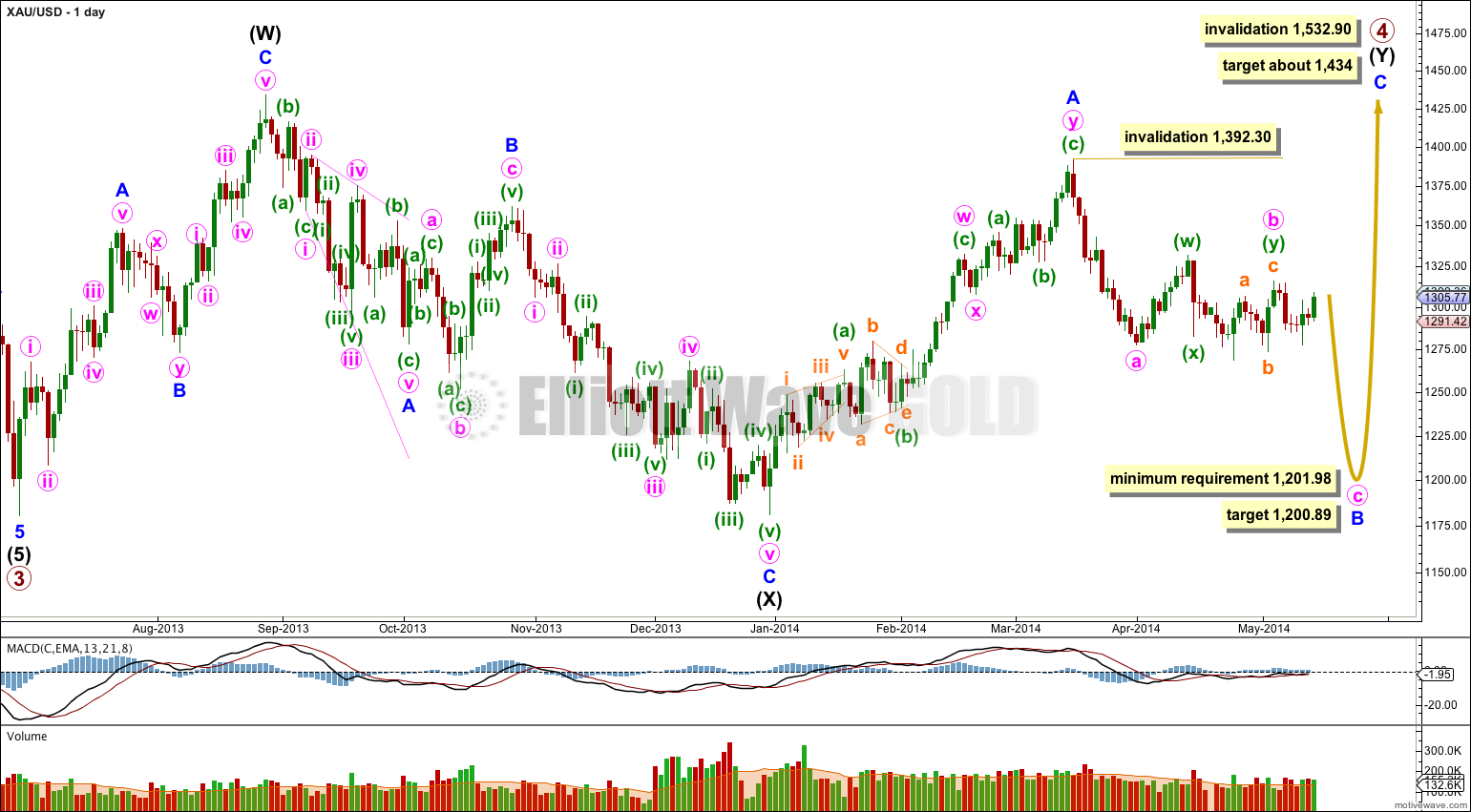

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure may be either a single zigzag (as labeled here) or a double zigzag (relabel A-B-C to W-X-Y). While this next wave unfolds I will have to consider two structural possibilities; it may be an impulse for a C wave, or it may be a zigzag for a Y wave.

If minor wave B is a single zigzag then within it minute wave b may not move beyond the start of minute wave a above 1,392.30. Minute wave c would reach equality in length with minute wave a at 1,200.89.

If minor wave B is a double zigzag, relabeled minute w-x-y, then within it there is no invalidation point for minute wave x. But X waves within double zigzags are usually relatively brief and shallow, as they very rarely make new price extremes beyond the start of the first zigzag in the double.

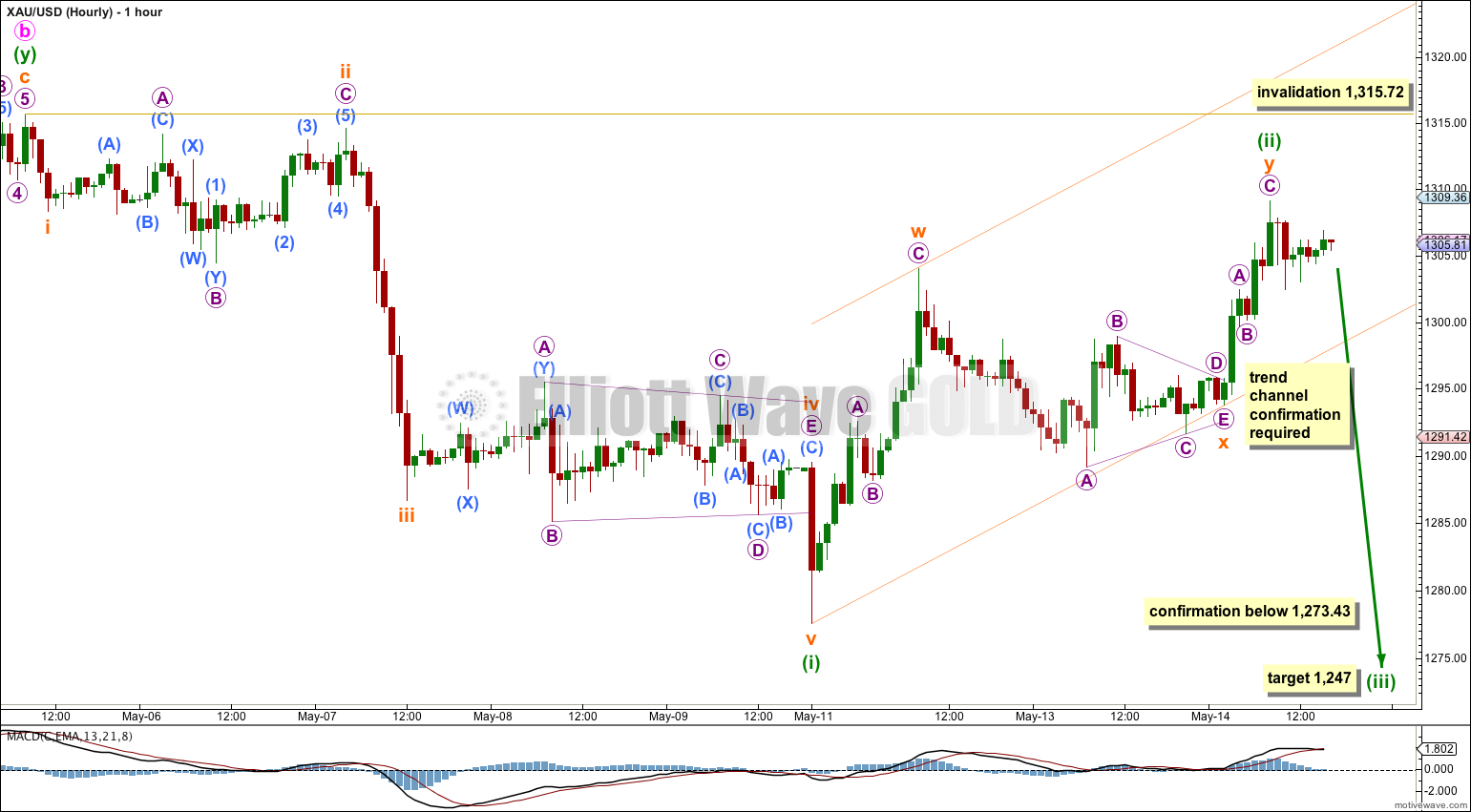

Upwards movement confirmed this wave count which was yesterday’s alternate. Minuette wave (ii) has continued to move higher as a double zigzag.

Minuette wave (i) lasted 103 hours and so far minuette wave (ii) has lasted 60 hours. Minuette wave (ii) managed to complete sooner than this alternate had expected. The wave count still has the “right look” and these waves are still nicely in proportion.

Within the second zigzag of the double, subminuette wave y, the structure fits best on the five minute chart as a zigzag which is complete.

I have drawn a best fit about this upwards correction. I would want to see a clear breach of this channel before having any confidence in the target. A breach would be one or two full candlesticks fully below the lower edge of the channel and not touching the lower trend line. Downwards movement should be clear, not sluggish and sideways.

At 1,247 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Minuette wave (iii) should show a strong increase in downwards momentum.

If minuette wave (ii) continues any higher it may not move beyond the start of minuette wave (i) above 1,315.72.

HI Lara, what do you think of silver? Silver seems to rise.

It’s doing exactly as the wave count expected.

Why silver has a different trend from gold?