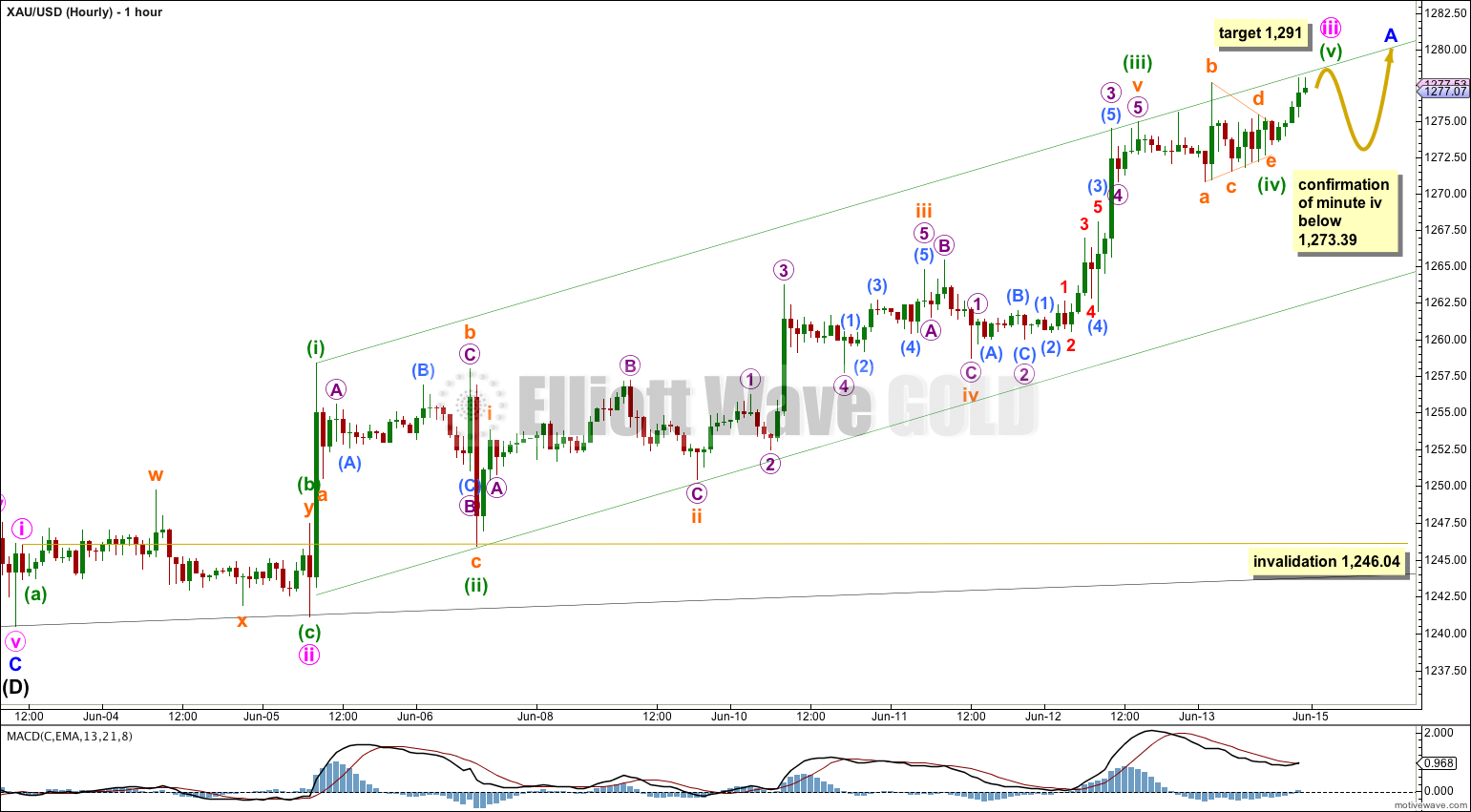

The short term expectation was for a correction to end about 1,263.79 and last about 24 hours. The correction did unfold, but it moved only sideways as a small fourth wave triangle that lasted 20 hours, ending as a very shallow fourth wave at 1,273.39.

Summary: I am more confident today the trend at intermediate degree is up. The short term target for Monday is 1,291. About this point we may see another fourth wave correction, and thereafter more upwards movement.

Click on charts to enlarge.

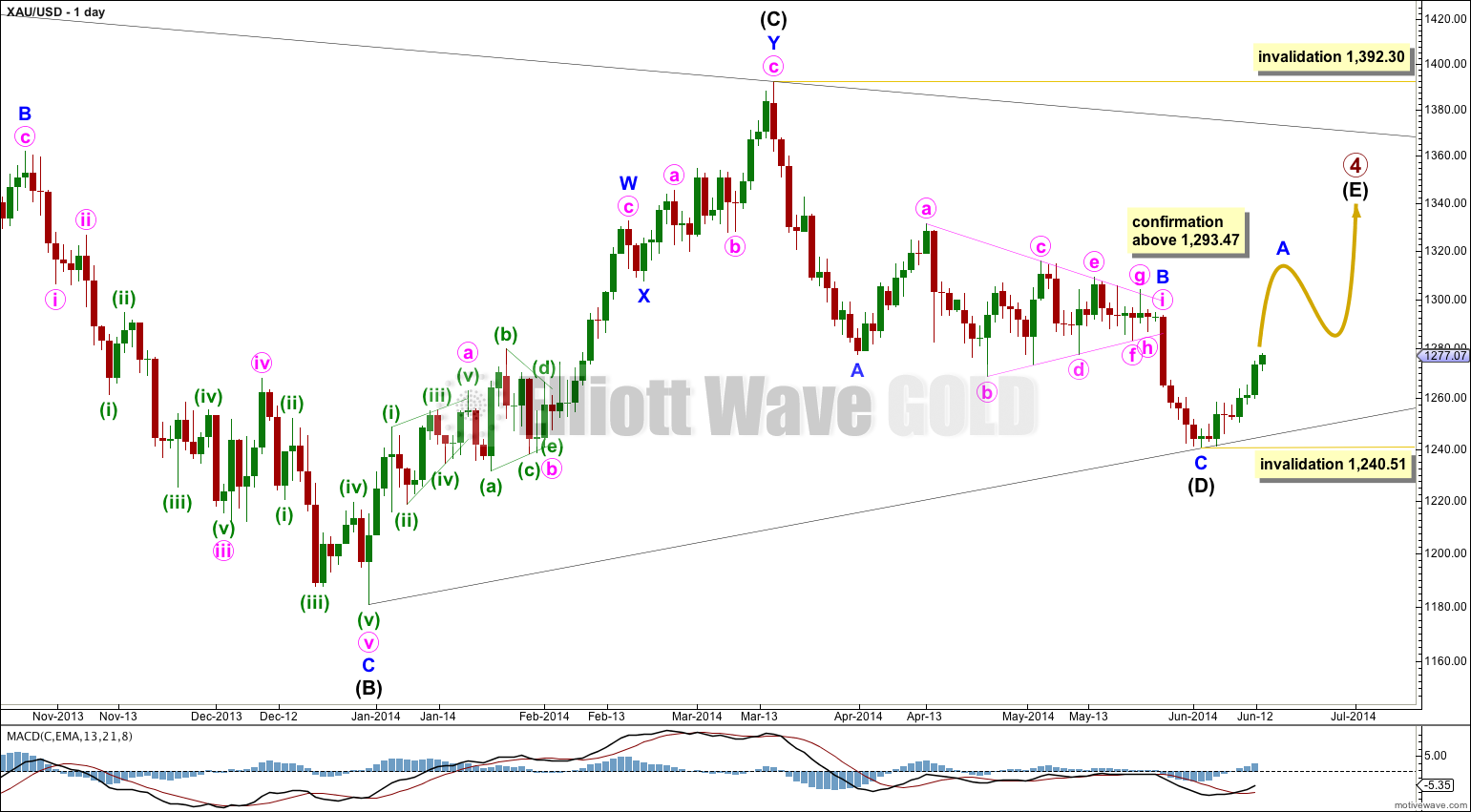

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to be time consuming and fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

Minuette wave (iv) subdivides perfectly as a running contracting triangle. There is perfect alternation between the deep zigzag of minuette wave (ii) and the very shallow triangle of minuette wave (iv).

At 1,291 minuette wave (v) would reach equality in length with minuette wave (i). This would be the most likely ratio for minute wave (v).

When minuette wave (v) completes the impulse of minute wave iii then I would expect a correction for minute wave iv which should show up on the daily chart as a red candlestick or doji. Minute wave ii lasted 43 hours so I would expect minute wave iv to be about the same duration. I would also expect it to be very shallow, and probably to end about 1,273.39, the end of the fourth wave of one lesser degree.

Draw a channel about minute wave iii using Elliott’s first technique: draw the first trend line from the highs of minuette waves (i) to (iii), then place a parallel copy upon the low of minuette wave (ii). Minuette wave (v) may end at the upper end of the channel or it may overshoot the upper trend line as sometimes fifth waves for Gold can be strong. However, price is at the end of Friday touching the upper trend line and this may be an indication that upwards movement could end there. If price turns lower on Monday and moves below 1,273.39 then minute wave iii is over and minute wave iv has already arrived. Minute wave iv should last at least one day and probably two or three days.

While price remains above 1,273.39 on Monday then I would expect more upwards movement towards the target.

Minute wave iv may not move into minute wave i price territory below 1,246.04.

Alternate Wave Count.

The upper edge of the pink channel about minor wave B is now breached by a daily candlestick above it and so I will now discard this wave count. The probability of this wave count is now too low to consider it very seriously.

It would be fully invalidated by price movement above 1,293.47.

This analysis is published about 01:47 a.m. EST.

Hello Lara,

I am very novice at EW analysis. Appreciate your opinion on this count of mine.

Thank you very much.

I am sorry, that wave count is invalid. The second wave is labeled a triangle; second waves cannot be triangles. The fourth wave overlaps into first wave price territory.

Lara,

Would you please give estimate in trading days to reach intermediate E and primary 4.

I am very confident of this wave count. At this late stage it is the only one that has the right look.

I will give time estimates in todays analysis.