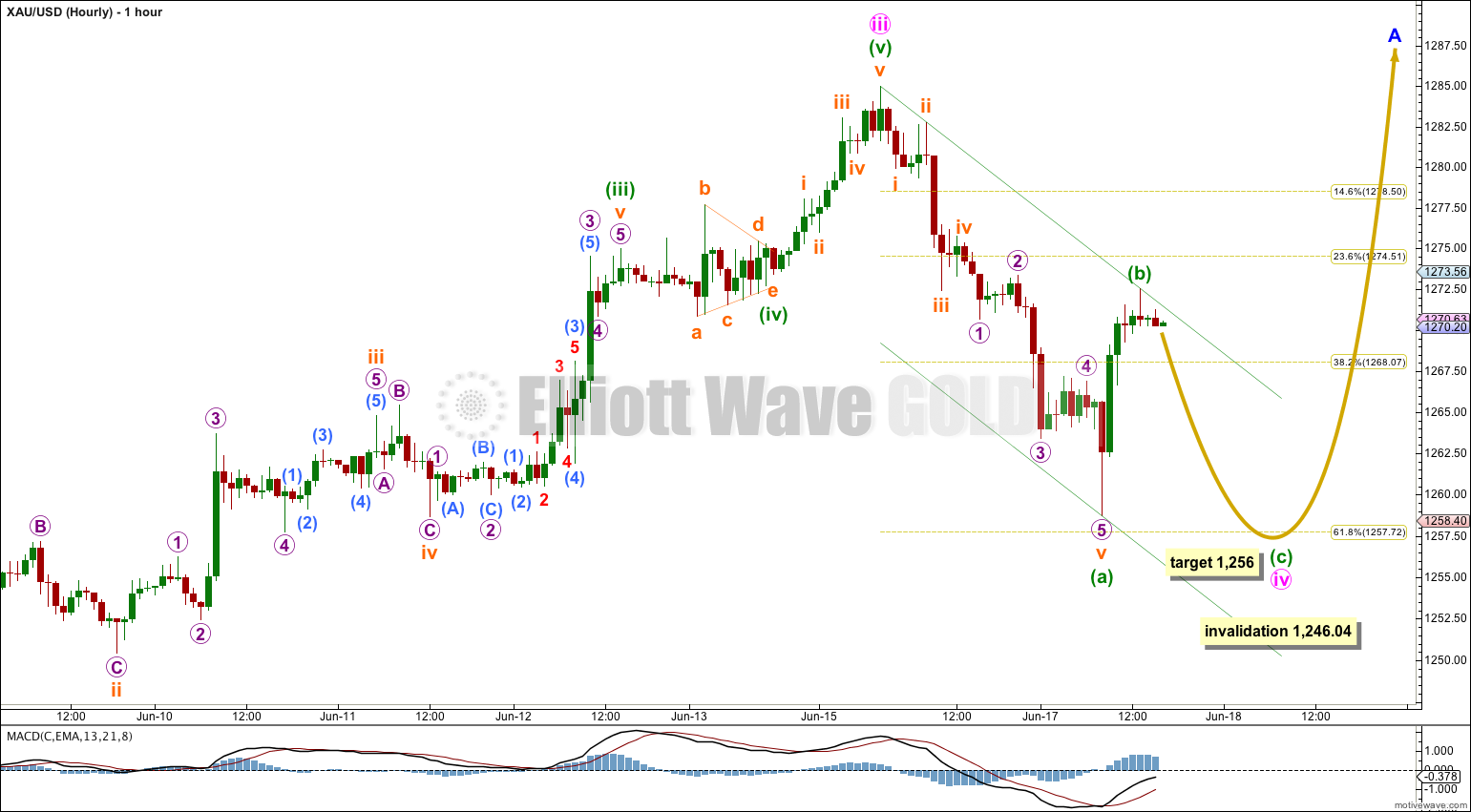

Yesterday’s Elliott wave analysis expected downwards movement for gold towards a target at 1,268.07. Price has moved lower as expected, but the correction is deeper than anticipated.

Summary: The correction is incomplete. It may take price lower again with another half day of downwards movement. The target is 1,256. Thereafter, the upwards trend should resume.

Click on charts to enlarge.

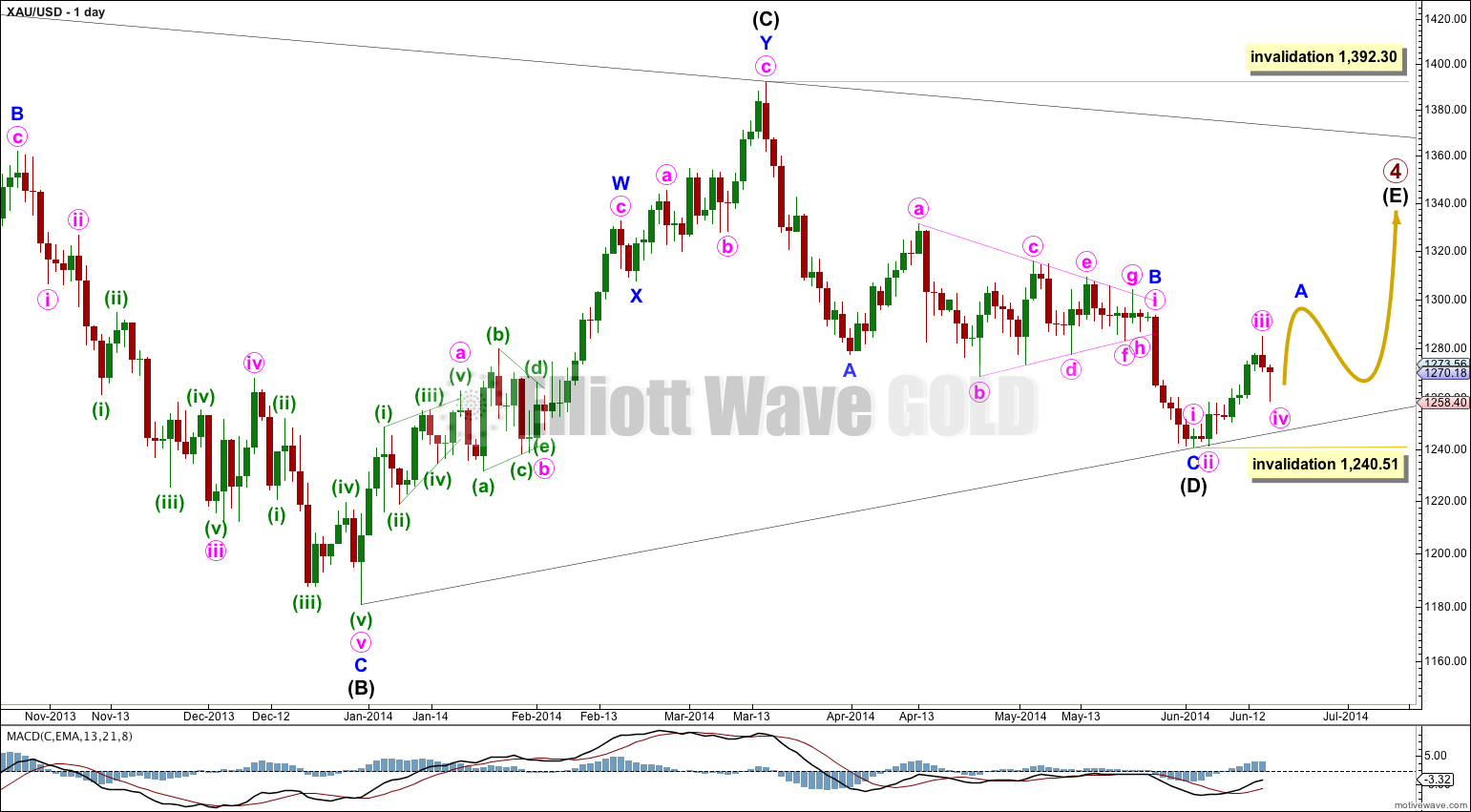

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to be time consuming and fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days, intermediate wave (B) lasted 88 days, intermediate wave (C) lasted 53 days and intermediate wave (D) lasted 56 days. Intermediate wave (E) may last a total of about 43 to 56 days. So far it has only lasted 10 days.

So far within minute wave iv there is a completed five wave impulse downwards. This cannot be the entire correction because it may not subdivide as a five and must be a three. The correction must continue until it is a completed three.

Ratios within minuette wave (a) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is just 0.05 short of 1.618 the length of subminuette wave i.

Ratios within subminuette wave v extension are: micro wave 3 has no Fibonacci ratio to micro wave 1, and micro wave 5 is 0.62 longer than 1.618 the length of micro wave 1.

Minuette wave (b) may not be complete. It may yet move price higher. If it does it may not move beyond the start of minuette wave (a) at 1,284.99. If it moves higher the channel about minute wave iv will need to be redrawn.

Minuette wave (c) is very likely to at least make a new low below the end of minuette wave (a) at 1,258.71 to avoid a truncation.

At 1,256 minuette wave (c) would reach 0.618 the length of minuette wave (a) and just below the 0.618 Fibonacci ratio at 1,257.72. If minuette wave (b) moves higher this target must move correspondingly higher also. I would expect at this stage for minute wave iv to end midway within the channel.

With minute wave iv now a deep correction there is still some alternation in depth with minute wave ii. Minute wave ii was a very deep 0.88 of minute wave i. So far minute wave iv is about 0.618 minute wave iii.

Minute wave iv may not move into minute wave i price territory below 1,246.04.

Minute wave ii lasted 43 hours in total. So far minute wave iv has lasted 37 hours in total. If it is over within the next 24 hours these two corrections will be reasonably in proportion to each other.

When minute wave iv is complete then the upwards trend should resume. When I know where minute wave iv ends and minute wave v begins then I can calculate a target for the next wave up to end. I cannot do that today.

This analysis is published about 04:33 p.m. EST.

To be honest, I’d rather not try to make a time estimate on how long this will last until minor waves A and B within it are complete. But members keep asking for an estimate.

The best I can do is to look at how long the other waves have lasted and expect this one to be around about the same.

You’re right, the final wave is likely to be briefer. But it does not have to be. Sometimes these final waves are more long lasting; the last one (see minor wave B within intermediate (D) ) turned into a very long lasting triangle within a triangle, making the whole structure a nine wave triangle.

There’s so much variation at this stage possible. Time estimates are vague only at this stage.

Finally, there are no rules governing it at all in terms of duration. None whatsoever. It just has to have the “right look” which is pretty vague, and is judgement based on experience.

In terms of length/size, intermediate wave (E) seems like it should be the shortest of all waves (A, B, C, D, E) because it is nearest the apex of the triangle. Why then should it have a similar duration as, let’s say, intermediate waves (A), (C) or (D)? You estimate (E) to last as long as these other waves. Instinctively I would tend to think that wave (E) is the shortest wave in both length/size and duration. What are the rules governing this? Thanks.