Upwards movement fits the main wave count and invalidated the alternate hourly wave count.

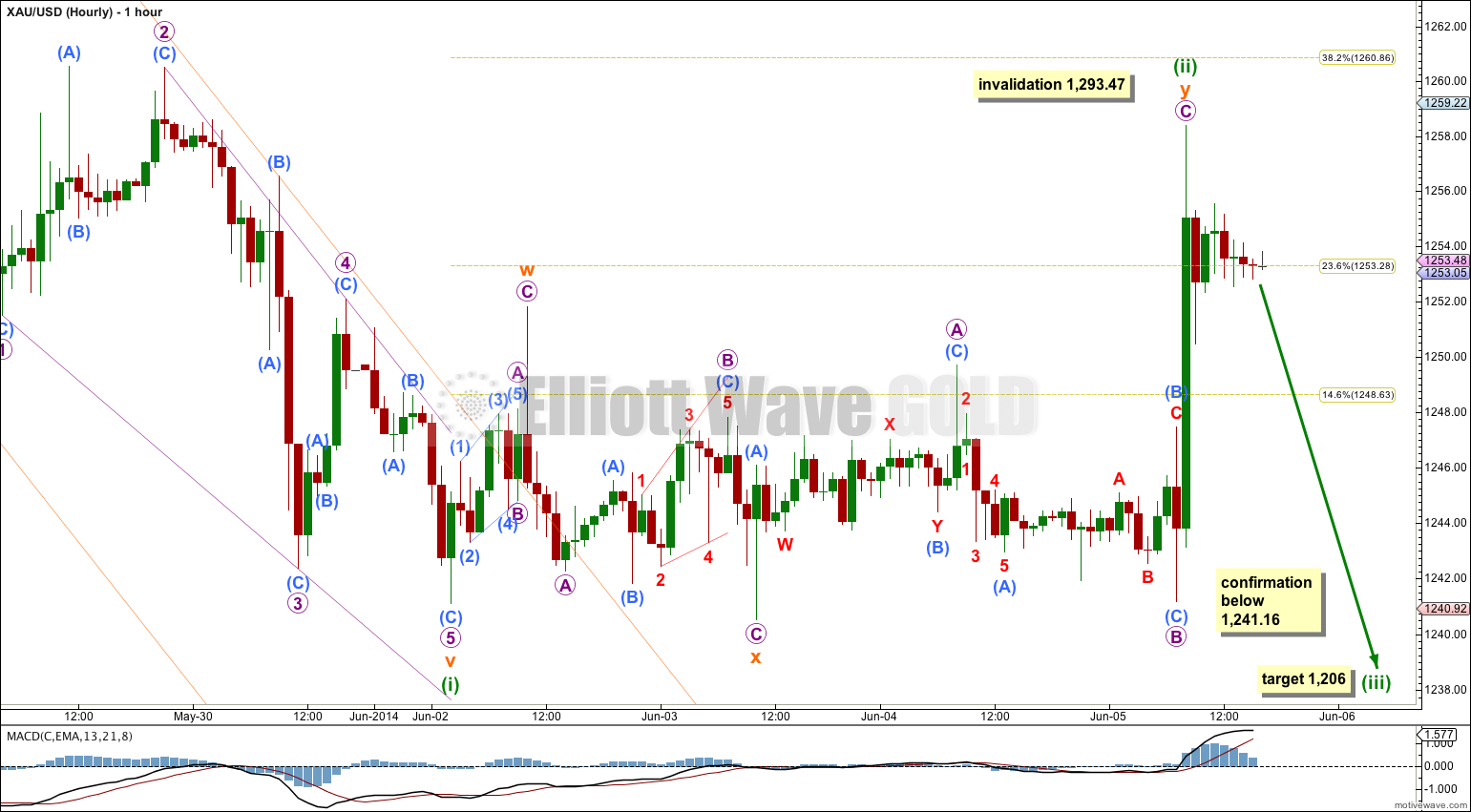

Summary: A third wave down may begin from here. The target is 1,206. Movement below 1,241.16 would confirm the third wave has begun; only below that point will I have any confidence in the target.

This analysis is published about 05:02 p.m. EST. Click on charts to enlarge.

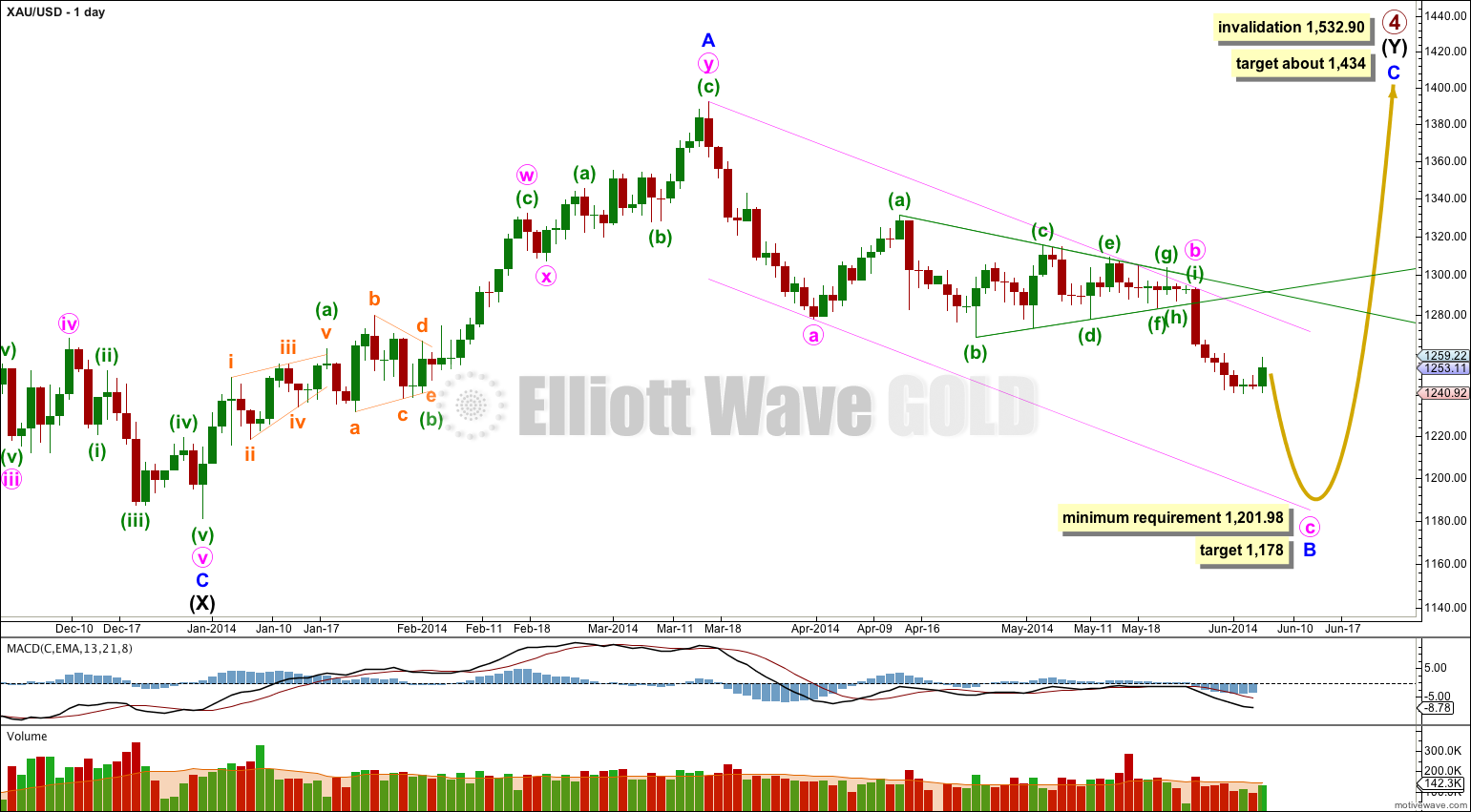

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

If downwards movement does not reach 1,201.98 or below then intermediate wave (Y) may not be a flat correction and may be a contracting triangle. I will keep this alternate possibility in mind as this next wave down unfolds. If it looks like a triangle may be forming I will again chart that possibility for you.

It remains possible that primary wave 4 in its entirety is a huge contracting triangle. This alternate idea is published at the end of this analysis daily.

Overall a double combination for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is incomplete. It may be a single zigzag as labeled here, or it may be a double zigzag as per the alternate below. If it is a single zigzag then minute wave c is unfolding as a five wave impulse. Within the impulse minuette wave (ii) may not move beyond the start of minuette wave (i) at 1,293.47. At 1,178 minute wave c would reach equality in length with minute wave a.

I have drawn a channel about minor wave B downwards: draw the first trend line from the start of minute wave a to the end of minute wave b, then place a parallel copy upon the end of minute wave a. I will expect downward movement to find support at the lower end of this channel due to this being the most common place for minute wave c to end.

Within minor wave B downwards I have extended the triangle trend lines for minute wave b outwards. They cross over slightly beyond today’s candlestick. We may see a trend change today or tomorrow. This may be where the second wave correction ends and a third wave down begins.

Minuette wave (ii) is now most likely complete as a double combination. This has the best fit for this piece of movement. I have considered the possibility of a flat correction for minuette wave (ii) and it does not have as good a fit.

Within the combination subminuette wave w is a zigzag, subminuette wave x is a zigzag, and subminuette wave y is a flat correction.

The correction looks most likely to be over now. The structure is complete.

At 1,206 minuette wave (iii) would reach equality in length with minuette wave (i). I will use this ratio to calculate the target because minuette wave (ii) is relatively shallow and this target fits with the target calculated one degree higher.

Movement below 1,241.16 would confirm that minuette wave (ii) is over. At that stage downwards movement could not be a second wave correction within micro wave C and so micro wave C must be over, which also means subminuette wave y would also have to be over.

If this wave count is correct then the only way minuette wave (ii) could continue further would be as a very rare triple combination. The rarity of triples means the probability that the correction is over when a second structure is complete is very high.

While price remains above 1,241.16 there is no confidence in a resumption of the downwards trend. We must accept the possibility that micro wave C could yet move higher.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,293.47.

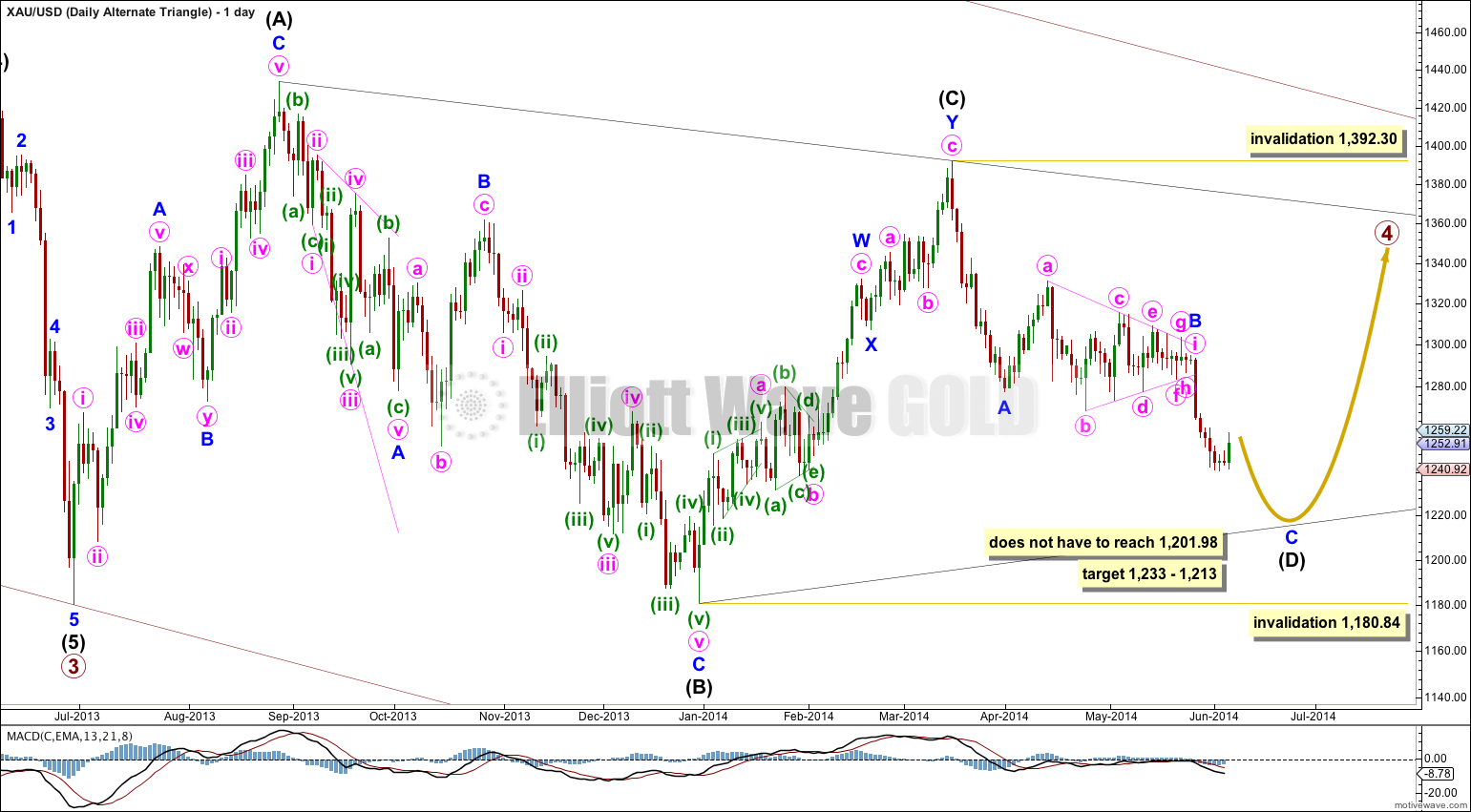

Daily – Triangle.

It remains possible that primary wave 4 in its entirety is a huge regular contracting triangle.

So far one of the five subwaves of the triangle subdivides into a double zigzag. All the other four subwaves must then be simple corrections, and three of them must be single zigzags. The fourth may be another type of simple A-B-C correction, and most commonly it would also be a zigzag.

Intermediate wave (D) would most likely be incomplete for the triangle to have a typical look. Intermediate wave (D) may end between 1,233 and 1,213, 75% to 85% the length of intermediate wave (C), which in my experience is a typical wave length for a triangle subwave.

Intermediate wave (D) may not move beyond the end of intermediate wave (B) for a contracting triangle. For a barrier triangle intermediate wave (D) may end about the same level as intermediate wave (B) as long as the B-D trend line remains essentially flat. In practice this means that intermediate wave (D) may end very slightly below the end of intermediate wave (B). This lower invalidation point is not black and white. This is the only Elliott wave rule which is not black and white.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) for either a contracting or barrier triangle.

Since price has moved sideways since today’s high, I think it increases the likelihood of a test of $1268-$1273 possibly as early as tomorrow AM with NFP day. This looks nothing like a third wave and by moving higher, it puts minuette ii more in proportion with minuette i time wise. Would you agree Lara?

Lara–you have advised many times that “overall a double combination for primary wave 4 should take up time and move price sideways”. Even with your caution I never expected sideways movement to last so long. In your experience is this sideways movement extraordinary long?

Primary wave 2 lasted 53 weeks. In order for the wave count to have the right look at the weekly chart level primary wave 4 should be reasonably even with primary wave 2 in duration.

So far primary wave 4 is 49 weeks in duration.

If it lasted another six weeks it would be a Fibonacci 55.

Primary degree waves should last from a few months to a couple of years in duration.

Looking at the graph of h s flag pennant formation enchanted me. If the 1268 target will not be closing in 1256 upper?