Upwards movement was expected for Monday. A new high was made and thereafter price has moved sideways. The Elliott wave structure is incomplete.

I am changing the alternate wave count today. Both wave counts expect the same direction next.

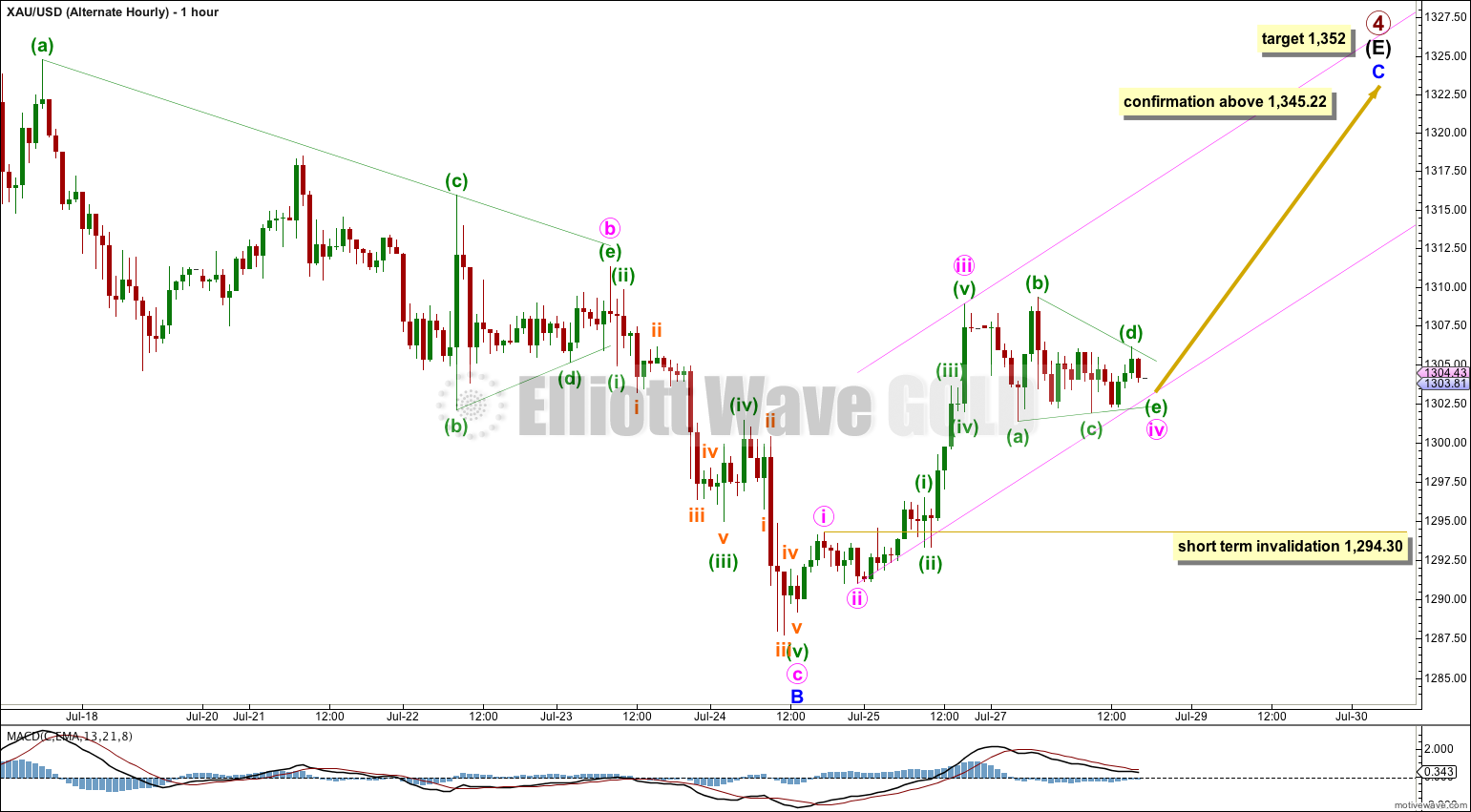

Summary: I am confident that upwards movement should resume soon (within a very few hours of publication). The target is at 1,340 for the main wave count (60% probability). If price moves above 1,345.22 then the target is at 1,352 for the alternate wave count (40% probability).

Click on charts to enlarge.

Main Wave Count.

The main wave count sees primary wave 4 a complete regular contracting triangle lasting 54 weeks. Primary wave 2 was a deep 68% running flat correction. Primary wave 4 shows alternation in depth at only 27% and some alternation in structure.

Primary wave 3 is just 12.54 short of 1.618 the length of primary wave 1. At 956.97 primary wave 5 would reach equality in length with primary wave 1. This is the most common ratio for a fifth wave so this target has a good probability.

Primary wave 1 was remarkably brief at only three weeks duration. I would expect primary wave 5 to last longer, maybe five, eight or thirteen weeks.

Within the start of primary wave 5 minor wave 1 is a completed five wave impulse. Minor wave 2 is unfolding as an expanded flat correction. Minor wave 2 may not move beyond the start of minor wave 1 above 1,345.22.

When minor wave 2 is a complete structure then the next movement should be a strong third wave down for minor wave 3.

At this stage I would judge this main wave count to have about a 60% probability. Movement to a new low below 1,287.75 at this stage would invalidate the alternate wave count below and so increase the probability of this main wave count.

A full daily candlestick below the (B)-(D) trend line would further increase the probability of this main wave count to over 90%. I would have full confidence in it with a new low below 1,240.51.

No matter how this upwards movement for minute wave c is labeled the structure is incomplete. At this stage it looks like a fourth wave triangle is almost complete.

For the triangle to remain valid subminuette wave e may not move beyond the end of subminuette wave c below 1,301.89. If this price point is breached in the next few hours then minuette wave (iv) is not a triangle and would be most likely a combination. Minuette wave (iv) may not move into minuette wave (i) price territory below 1,294.30.

If the triangle remains valid then we have a very high probability that the next movement will be upwards. A new high above 1,309.33 could not be subminuette wave d moving higher and so at that point the triangle must be over and the fifth wave up must be underway.

At 1,340 minute wave c would reach 1.618 the length of minute wave a. This is a typical ratio for a C wave within an expanded flat correction.

When the triangle for minuette wave (iv) is complete then I can add to the target calculation at a second wave degree. The target may widen to a small zone or change tomorrow.

When the triangle for minuette wave (iv) is complete redraw the channel using Elliott’s second technique: the first trend line from the ends of minuette waves (ii) to (iv), then a parallel copy on the end of minuette wave (iii). I would expect minuette wave (v) to end midway or at the upper edge of the channel. When the channel is breached by subsequent downwards movement that shall be earliest indication that minor wave 2 is over and minor wave 3 has begun.

Minute wave a lasted two days. Minute wave b lasted four and a half days. I would expect minute wave c to last four to five days in total so it may end in another two to three days.

Alternate Daily Wave Count.

It is still possible that intermediate wave (E) is an incomplete zigzag and so the triangle of primary wave 4 is incomplete.

I have adjusted this alternate today. The previous wave count no longer had the right look at all, and so is discarded.

I have checked the subdivisions within minor waves A and B and this wave count has a good fit. It has a reasonable probability and would judge it to be about 40% at this stage. My only problem with it, and the reason for it still being an alternate, is the lack of proportion between minute waves ii and iv within minor wave A: minute wave ii is a brief zigzag lasting only one day and minute wave iv is a triangle lasting 10 days. Although triangles are more long lasting than zigzags, so some disproportion would be expected, this lack of proportion is high and reduces the probability of this wave count. The main wave count does not have this problem and has a higher probability.

Minor wave B downwards so far looks like a very clear three wave structure on the daily chart. It subdivides perfectly as a zigzag on the hourly chart.

At 1,352 minor wave C would reach 0.618 the length of minor wave A.

Within minor wave C no second wave correction may move beyond the start of its first wave below 1,287.75.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) above 1,392.30.

The subdivisions within most recent upwards movement are seen in exactly the same way for this alternate as for the main wave count, so the only divergence between the two today is in the targets and invalidation points.

I have a lot of confidence that we shall see upwards movement from Gold once this small triangle is complete. If we see movement above 1,345.22 this alternate would be confirmed.

For this alternate wave count it is extremely likely that minor wave C would make at least a slight new high above the end of minor wave A at 1,345.22 to avoid a truncation.

This analysis is published about 06:30 p.m. EST.

Thanks. I think what I’ll be doing is looking for more alternates which go against the main wave count, to see “what if?”. This will cover what Steve is requesting, which on reflection I think is right. If it has a very low probability I’ll cover it quickly. Finally, yesterday’s video was rather long. What time length do you think I should be sticking to? Once we get three wave counts, it gets really big! How does it fit into your day?

My vote… Under 10 minutes is great, which is generally what they have been. If you need to go a little over on occasion, that’s OK too.

No, I’m not going to accept a wave count with such a hugely truncated C wave. The probability is ridiculously low.

Thats great, and I hope this downwards move did not see your profits all go south with it!

Hello,

it seems, that we reached the end of wave c (and wave 2) today at 1312. That means we had a running flat. I expected at least 1320 so I was long today. So I think Steve is right, we should consider more alternatives.

But that means, that wave 3 downwards startet today with the first impuls. But I will wait for Laras analysis before opening a short position.

Jan

If its a running flat then its a hugely truncated c wave.

I would never accept a wave count with a running flat like that. The probability is minuscule.

Glad to see someone agrees with me!

Hello,

it seems that we saw a running flat and wave c (and wave 2) has ended today at a little bit higher than 1312. And I expected at least 1320. So I lost some money today. Therefore I agree with Steve and we should consider more alternatives.

But wave 2 has ended means, that wave 3 downwards started today. So I think about shorting now. But I will wait till next analysis from Lara.

greetings, Jan

Today’s price action was yet another example of why we should be considering more alternatives. Even though do a splendid job Lara in what you do produce, you still only provide a couple of possibilities rather than several. I’ve seen enough proof that there are in fact many possible interpretations to be taken from Elliott Wave. But Elliott Wave can still be of value. By considering more of the possibilities, you can help traders to be aware of what might come next and prepare themselves. What is helpful to the trader are the price projections which you produce. In gold, these price levels are usually accurate and are useful to a trader even if the wave count interpretations turn out to be wrong (e.g. if you want to trade the beginning of an impulse, but it turns out to be a correction, it is still a safe entry point). But to be able to take advantage of that, the trader has to be informed of the possibility in the first place. I don’t intend this even as a criticism, rather it is an observation and a request to be more inclusive. I know you want to be able to give a trader some firm opinion in order to be decisive, but this is of limited value if you cannot be right about wave counts more than 50% of the time.

Theres only so many possibilities any one human can see at any one time.

My mistake yesterday was to forget that thrusts out of triangles are often very brief and short. If I had remembered that then I would have expected this downwards movement to follow it. I will not be making that mistake again!

And finally, the invalidation points are provided for traders to calculate risk. Movement within the range described by the invalidation points is ALWAYS possible. I must leave it up to members to use their own money management techniques, adjust leverage as necessary, and calculate risk as necessary. This kind of advice is not the type I can legally offer. I can only offer analysis.

While I take your point that “there’s only so many possibilities any one human can see”, 1) I think you can see more than two at a time and it would be helpful let us know of more than two of them if and when they occur to you and 2) I am not asking you to provide definitive advice on price levels, just to provide observations about what is likely for each scenario (which you already do). This goes for both invalidation levels and target levels. It is always up to the trader to decide which course of action he/she takes, based on such knowledge.

I understand your frustration. I am also disappointed with my analysis of yesterday.

In this instance though the mistake was not that an alternate was not considered, the mistake was I forgot fifth wave behaviour following triangles.

Some members want as many alternates as I can provide. Other members… well, they’ll cancel their membership if I provide alternates. They seem to think that an alternate which may expect something different means the analysis is useless because I’m “covering all bases”.

In short, I cannot please everyone all the time, so I will please myself. I’ll provide alternates which I can see only if I think they have a reasonable probability.

I have provided an alternate today. Mostly in response to your suggestion. And that’s okay. However, I think it has a horrible probability. I would have not done otherwise.

First, everyone makes mistakes. Actually, your mistake on the 28th was labelling 1287 to 1294 as minute wave 1 instead of one of its sub-waves. By doing so, you didn’t see the possibility of the deep 2nd wave correction which we are now in (as it placed us in wave 4 during the triangle). It was clear to me at the time that this was in error, because as a minute wave, it was so brief compared to other minute waves. I should have pointed this out at the time. That was my mistake.

Second, I do not see how you can justify yourself on this basis. You are essentially saying that you are willing to let traders remain blind to the fact that they are blind to the facts.

The member who would leave you on this basis is surely a member who wants to remain blind to the facts. You are going to lose their membership anyway over time because they will blow out all their trading capital in due course. The members you want to keep are the ones who are aware that Elliott Wave isn’t perfect, but are willing and able to work within those limitations.

Trading is a game to some, an extra source of money to others and to people like myself, a livelihood. Losing money to me is no joke. If trading were of any importance to a member, he/she would want to know whether or not they are in full possession of the facts and want to be in possession of those facts (to be informed of those alternates) in order to make choices (in association with other information, such as support and resistance levels and time).

That is a service of which I believe you are worthy and which your members deserve.

Steve

I agree with Lara’s response to you so far in this progression of your request.

Most Elliott Wave forecasters provide a fraction of the valuable information that Lara does. Many other EW forecasters don’t have any guts and don’t want to make any mistakes so they give as little information as possible and then point out the a couple of targets and a vague “either this or that” thus wishy washy so the reading can’t make a decision from the forecast. It is obvious that Lara’s updates are superior and more detailed than the competition. I agree with Lara’s statement that many readers may leave if she overloads them with too many scenarios. I spend enough time understanding what she provides. It she provided all possibilities it would be way too confusing and time consuming and unnecessary. Being this is your livelyhood and mine as well I use the cautious investing approach and watch my investment closely and cut my losses quickly. Lara has provided the caution lately about certain wave are difficult to forecast and dangerous to trade and I accept that. In my lifetime I wouldn’t be able to produce even one of her reports so I accept the rare mistake graciously.

I don’t want a twenty page report every day. I prefer Lara using her best judgement and providing a Summary.

I also know she is the best Elliott Wave forecaster I ever read and that is a lot.

Lara keep doing what you do as it is already terrific.

You’re right, my mistake was also not considering the brevity of a minute degree wave.

I have taken your criticisms on board in a constructive manner (I hope) and I will continue to attempt to publish more alternate ideas as I can see them, if they are valid.

I am not however willing to let traders be blind to any truth, I am trying to balance the demands from many different members and trying to the best analysis I am capable of. And as you noted, I make mistakes.

I do want to learn from mistakes though, because thats what will make me better.

And finally, yes. Many members will be using this only as a sideline to try and make a little money. It is the professional traders like yourself who understand the concept of risk, can manage it, and who don’t expect perfection. That is exactly the type of member who stays longer and benefits more from my analysis. And that is exactly the type of member I want, and so I take your comments very seriously.

Thank you Lara, you deserve credit for taking on board my comments so constructively. I really value what you do and while I make these requests for changes, you should know that I am already grateful to be able to read your report at the end of each trading day.

Lara, you have proven time and time again that you are able to accurately provide the one, two, or occasionally more analysis with the highest probabilities. No need to second guess yourself. We rely on your expertise to narrow it down. Too many options will likely only put the average “non Elliott Wave expert” trader into decision paralysis. You are doing great. Thanks,

The ideal would be that we know all the probable options, but which ones Lara thinks are the most likely. The two are not mutually exclusive. Would you prefer to remain in the dark regarding other alternates which remain likely? I doubt it. We all know Lara is doing a good job already, this is not about that. It is about going from good to great. An unbiased appraisal of her work would reveal that her main alternates are both wrong at least 50% of the time. But as we know Lara is doing a good job, that’s probably what we can expect from Elliott Wave. If we acknowledge this, then we traders have to also acknowledge that we need to make decisions for ourselves on each and every trade based not just on Elliott Wave, but also on a few other factors in addition (price, time and our gut feel). We know that we traders do not get it right ourselves more than 50% of the time. But we hope it is worth it for the times when we sometimes do get it right. Right or wrong, we have to live with the imperfection of the experience. The same goes for Elliott Wave analysis.

For what its worth, Steve has a very good point. He’s right and I’ll be looking for more alternates in future to publish.

Yeah, sometimes I do that. Sometimes I don’t.

I did get it wrong on Friday though. I think now I know what I got wrong and I’ll learn from that.

Minute ii of c, if either count is correct, stopped right at 61.8%. Much lower and I’m nervous.

Yeah, I’m nervous too about this wave count this morning.

The one thing that sees me keep to it though is the downwards wave labeled minute wave b (on the main wave count). It is so strongly a three wave structure, theres a triangle in there.

Which means that following a three down we should see a five up.

I think we have a very deep second wave correction unfolding at the moment. They do tend to induce nervousness, they convince us the trend is in their direction, but they do it right before a strong third wave takes off in the opposite direct.

If 1,287.75 is not breached then I’ll hold to a third wave up beginning in a few hours.

Yes I’d keep the main wave count as is and I’m long GLD. I actually think a deep 2nd wave correction fits nicely into the bigger picture. If $1298 holds, minute iii should now reach $1338ish leaving the door open for a shallow wave iv and a wave v reaching $1352. I’m convinced gold wants to touch the upper declining trendline on the weekly before P5 begins so $1352-$1360 makes conete sense.

if it hasn’t already begun?

Am I right in understanding that minor wave 2 could potentially already be over at 1312.3? Thanks.

No, I don’t think so. That would see minute wave c hugely truncated. That has such a very low probability, it should not be considered.

A rare running flat has a truncated C wave, but the truncation is normally only small. Not that big. That looks very wrong.

Hello Lara, thanks for very accurate analysis Thursday and Friday night and a truly incredible written and video analysis Monday night.

It is very clear. I bought some of my favourite gold and silver miners ETF this morning and luckily I kept it overnight and once breakout is confirmed above 1,309.33 this morning then I’ll be buying more in the morning especially with only 2 to 3 days to the peak at 1,340 this week.

Wow from dreadfully slow now it will be fast and furious to profiting in my miners and with a strong third wave down from the peak that you mention, then I’ll look first and them jump into 3 x Bear inverse ETF for awhile on the way down. Of course I will play safe.

Thanks again.