The downwards target for this correction to end was almost met, with downwards movement just 0.83 short of the target. Thereafter, price has turned up a little.

I have a new and better alternate Elliott wave count for you today.

Summary: The main wave count has a close to even probability with the alternate. We must use confirmation / invalidation points to work with these two wave counts today. Movement above 1,312.28 will confirm the main wave count, and the target for upwards movement is 1,332. Movement below 1,291.83 would confirm the alternate wave count. The downwards wave would be expected to be $33 to $37 in total length.

Click on charts to enlarge.

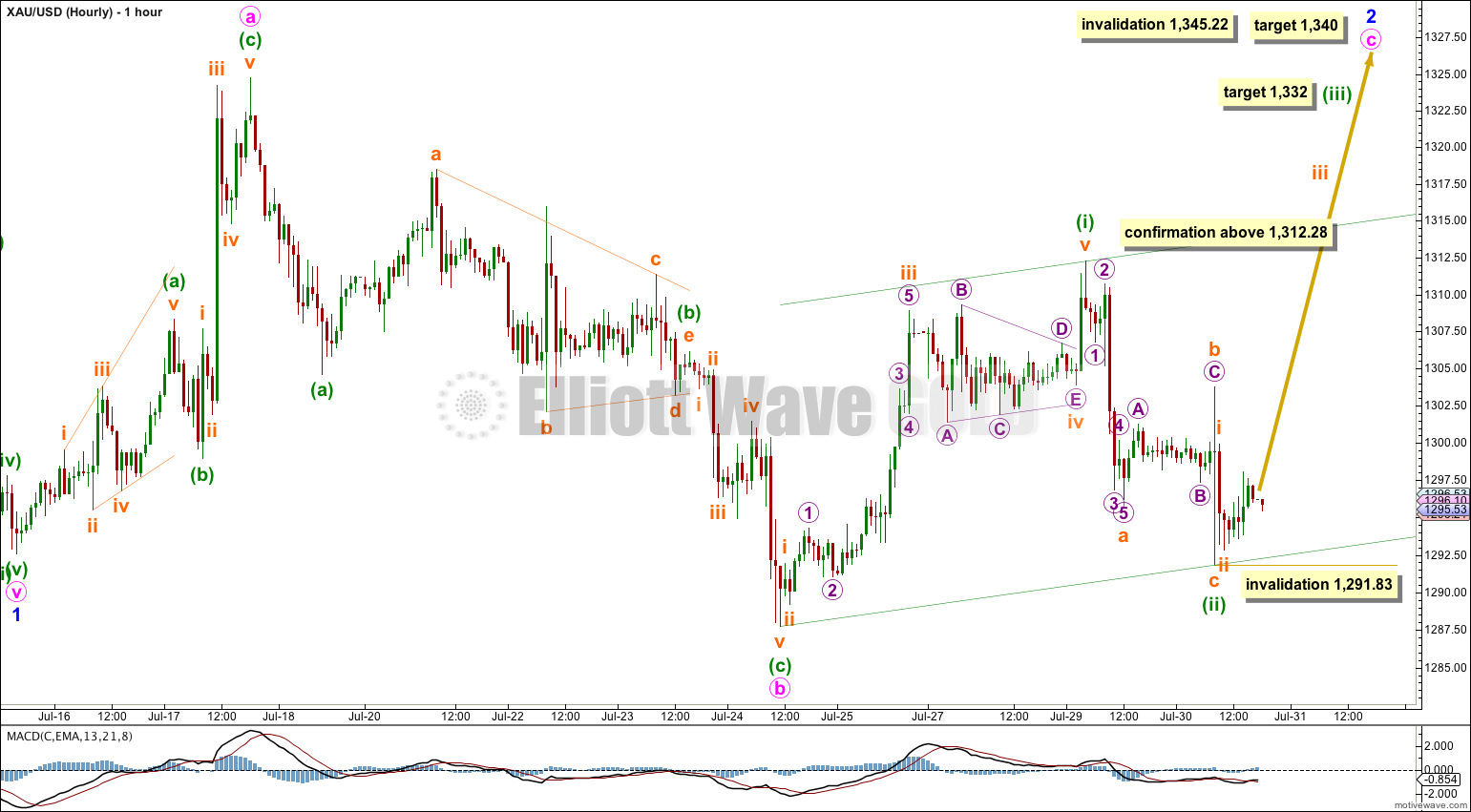

Main Wave Count.

The main wave count sees primary wave 4 a complete regular contracting triangle lasting 54 weeks. Primary wave 2 was a deep 68% running flat correction. Primary wave 4 shows alternation in depth at only 27% and some alternation in structure.

Primary wave 3 is just 12.54 short of 1.618 the length of primary wave 1. At 956.97 primary wave 5 would reach equality in length with primary wave 1. This is the most common ratio for a fifth wave so this target has a good probability.

Primary wave 1 was remarkably brief at only three weeks duration. I would expect primary wave 5 to last longer, maybe five, eight or thirteen weeks.

Within the start of primary wave 5 minor wave 1 is a completed five wave impulse. Minor wave 2 is unfolding as an expanded flat correction. Minor wave 2 may not move beyond the start of minor wave 1 above 1,345.22.

Minute wave c is extremely likely to at least make a new high beyond the end of minute wave a above 1,324.73 to avoid a truncation and a very rare running flat.

When minor wave 2 is a complete structure then the next movement should be a strong third wave down for minor wave 3. At this stage minor wave 2 is incomplete.

Minute wave a lasted two days, and minute wave b lasted four days. Minute wave c so far has lasted four days and looks like it will be more time consuming than initially expected, to last longer than minute waves a or b. It may end in a total Fibonacci eight days, which is in another four days time. However, at this stage it is starting to look more time consuming than it should be to have a good proportion and the “right look”. I would judge this main wave count to have a reduced probability today, close to even with the new alternate below.

The only advantage this main wave count has over the alternate is proportions within minor wave A: the proportions between minute waves ii and iv are much closer than the alternate.

Eventually a full daily candlestick below the (B)-(D) trend line would increase the probability of this main wave count to over 90%. I would have full confidence in it with a new low below 1,240.51.

Within minute wave c minuette waves (i) and now (ii) are most likely complete.

At 1,332 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Draw a base channel about minuette waves (i) and (ii): draw the first trend line from the start of minuette wave (i) to the end of minuette wave (ii), then place a parallel copy on the end of minuette wave (i). I would expect minuette wave (iii) to have the power to break above this channel. Along the way up any downwards corrections should find support at the lower edge of the channel.

Any breach of the channel to the downside at this point (not an intra-hour overshoot, but a full hourly candlestick below the lower trend line) would put doubt on this wave count.

Subminuette wave ii, if it continues further, may not move beyond the start of subminuette wave i below 1,291.83.

If 1,291.83 is breached the alternate wave count will be used.

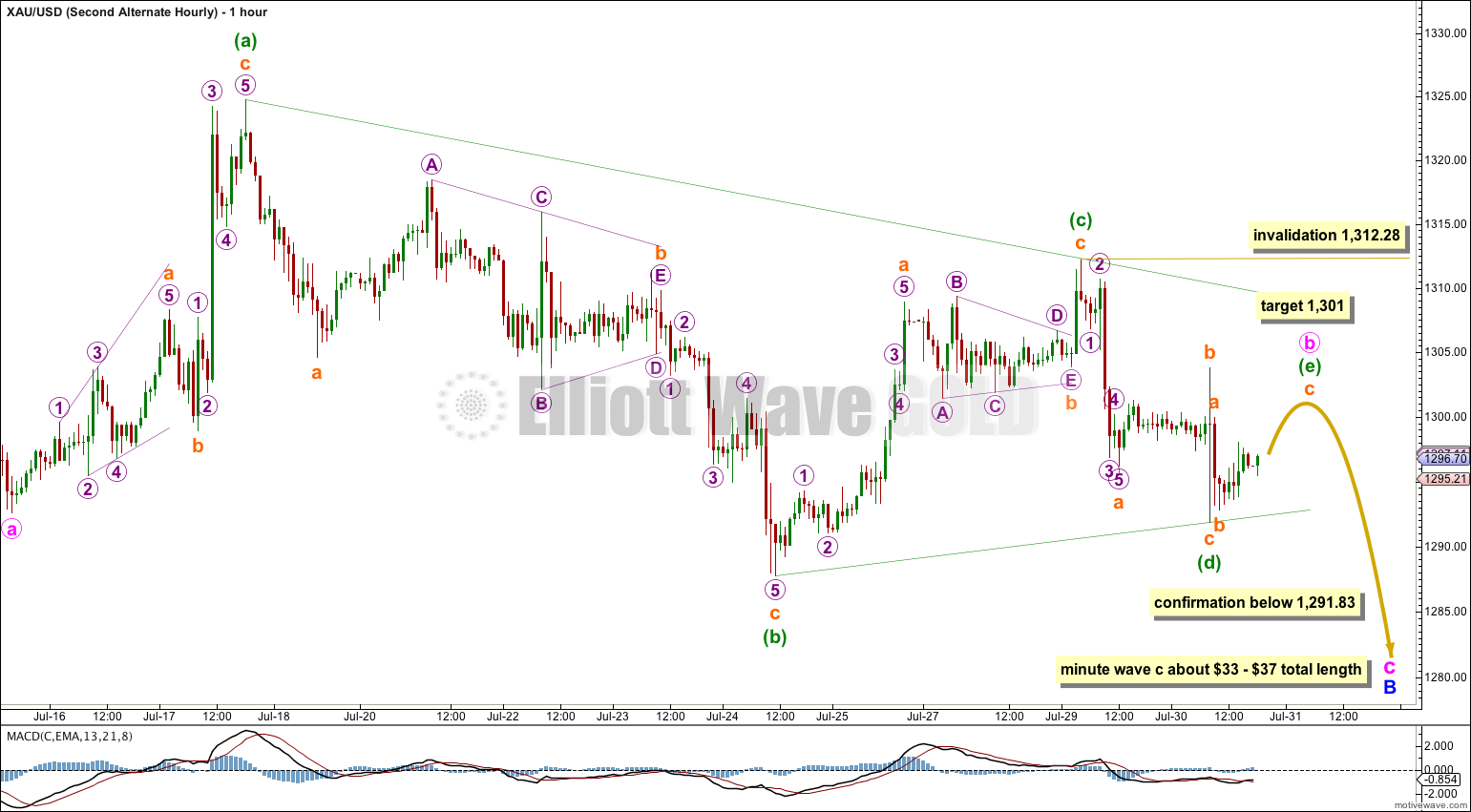

Alternate Daily Wave Count.

It is still possible that intermediate wave (E) is an incomplete zigzag and so the triangle of primary wave 4 is incomplete.

My only problem with this wave count, and the reason for it being an alternate, is the lack of proportion between minute waves ii and iv within minor wave A: minute wave ii is a brief zigzag lasting only one day and minute wave iv is a triangle lasting 10 days. Although triangles are more long lasting than zigzags, so some disproportion would be expected, this lack of proportion is high.

Minor wave B downwards may be incomplete, and sideways movement for the last eleven days looks very much like a running contracting triangle. (Another triangle!) On the hourly chart for this movement MACD hovers about the zero line which supports this wave count.

When the triangle for minute wave b is complete then the downwards movement for minute wave c should be a sharp brief thrust and may last only one to three days. The breakout should be downwards. Minute wave c may be about equal in length with the widest part of the triangle at $37, to about 0.618 the length of minute wave a at $33.

If it gets down that low minor wave B should find very strong support at the lower (B)-(D) black trend line. A breach of this trend line would see this wave count discarded.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) above 1,392.30.

All the subwaves of this triangle so far subdivide perfectly as zigzags. I have resolved the problem of the zigzag within minuette wave (c) and seen subminuette wave b as a triangle in that position.

The final subwave of subminuette wave (e) may subdivide as a single zigzag, double zigzag, or a triangle itself. So far it looks like it may be a simple zigzag. It is most likely to fall comfortably short of the (a)-(c) trend line. At 1,301 subminuette wave c would reach equality in length with subminuette wave a.

Subminuette wave (e) may not move beyond the end of subminuette wave (a) above 1,312.28.

When the triangle is complete then a subsequent break below 1,291.83 would confirm sideways movement is over and the breakout downwards has arrived.

Second Alternate Daily Wave Count.

This alternate wave count remains valid. If the main wave count is confirmed with a new high above 1,312.28 then this alternate will be again considered alongside the main wave count.

This alternate indicates that the target for the main wave count at 1,340 may be too low. Upwards movement could move higher to a second target at 1,352.

This analysis is published about 06:43 p.m. EST.

Hi Lara, On my chart, the 1.618 the length of wave (i) shows 1,327.29 where you said is 1,332. Please re-confirm.

I’m sorry, which wave count are you referring to?

I’m assuming its one of the wave counts which is now invalidated? So this question is now not relevant?

..

Might be easier to see it on spot gold chart below…

Lara, i think there may be a sequential problem on the hourly. The single green candle stick that stems from end to end and includes orange “b” on top and orange “c”/green “d” on the bottom is inaccurate. This single green stick was a whip saw move that actually moved “down” first and then “up”. your count is reversed. Check it out on a five minute chart.

You’re right.

I’m updating the first alternate hourly chart. It makes a difference there to the target calculation.

Thanks for pointing this out to me!