Yesterday’s Elliott wave analysis expected sideways movement to end within a few hours and be followed by a resumption of the upwards trend. This is exactly what happened. And upwards movement has created a green doji for Tuesday’s session.

Summary: Upwards movement should continue for at least one more day, but probably two or three days. The target remains at 1,346 calculated now at two wave degrees. It is extremely likely we shall see a new high above 1,345.22 within five trading days.

Click on charts to enlarge.

Primary wave 4 is an incomplete regular contracting triangle. Primary wave 2 was a deep 68% running flat correction. Primary wave 4 is showing alternation in depth and some alternation in structure.

Within the triangle of primary wave 4 intermediate wave (E) is unfolding as a zigzag: minor wave A is a five wave impulse and minor wave B downwards is a zigzag. Minor wave C must subdivide as a five wave structure.

At 1,346 minor wave C would move slightly above the end of minor wave A at 1,345.22 and avoid a truncation. At 1,346 minor wave C would reach 0.618 the length of minor wave A. At 1,346 intermediate wave (E) would fall short of the (A)-(C) trend line.

Within minor wave C no second wave correction may move beyond its start below 1,280.35.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) above 1,392.30.

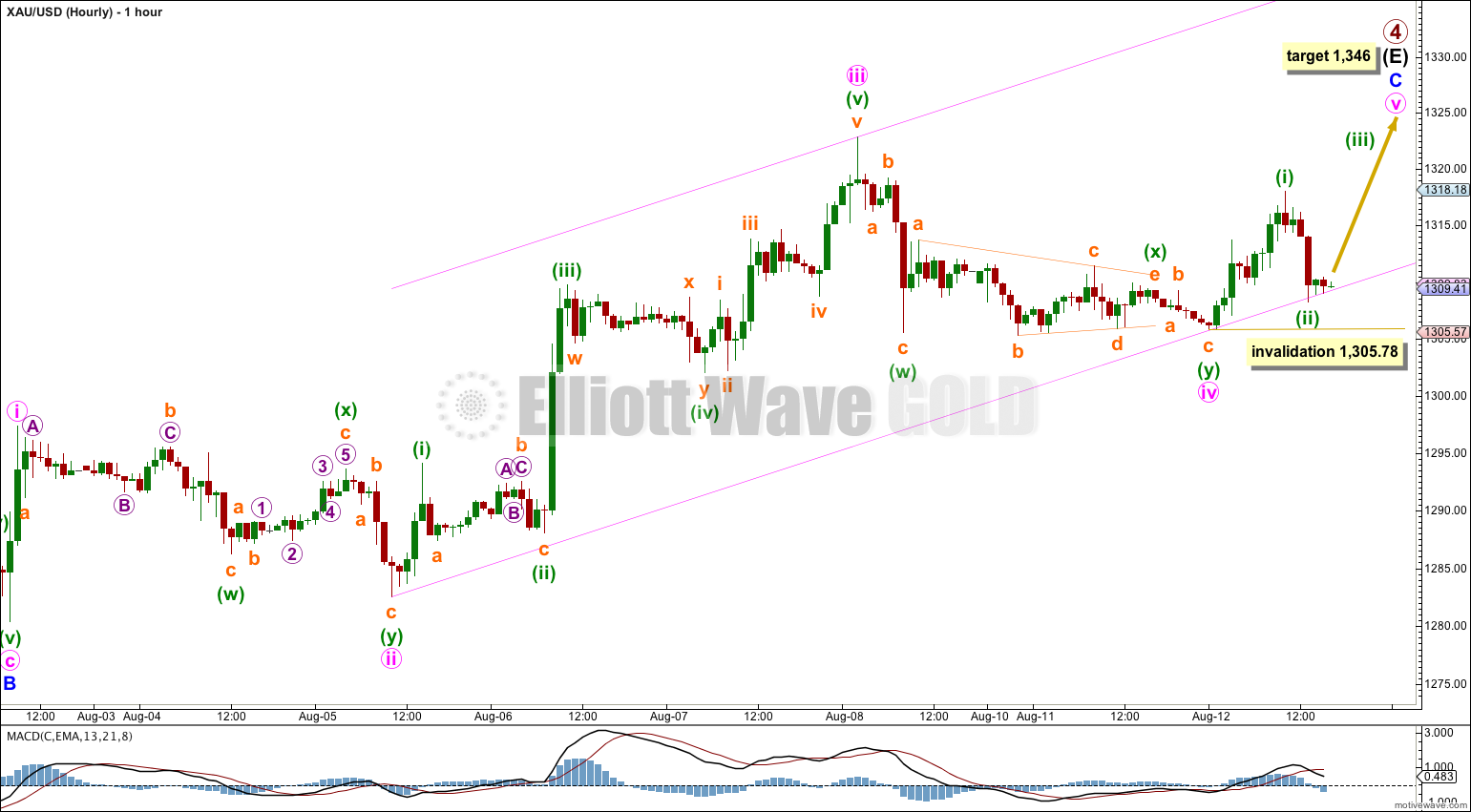

Main Hourly Wave Count.

Minute wave iv is now most likely complete as a double combination: zigzag – X – flat. Minute wave iv is a shallow 42% combination and minute wave ii is a deep 87% double zigzag, so there is still perfect alternation between these two waves.

Minute wave iv was not perfectly contained in the channel drawn on yesterday’s hourly chart using Elliott’s first technique. When fourth waves breach the channel we redraw the channel using Elliott’s second technique: draw the first trend line from the ends of minute waves ii to iv, then place a parallel copy on the end of minute wave iii. Along the way up to the target downwards corrections should find support at the lower edge of the channel. Minute wave v may end midway within the channel, or it may end at the upper edge.

At 1,346 minute wave v would reach equality in length with minute wave iii. This target is now calculated at two wave degrees and has a higher probability.

Within minute wave v no second wave correction may move beyond the start of its first wave below 1,305.78.

Minute wave iii lasted three days. If minute wave v also lasts three days it will end in another two.

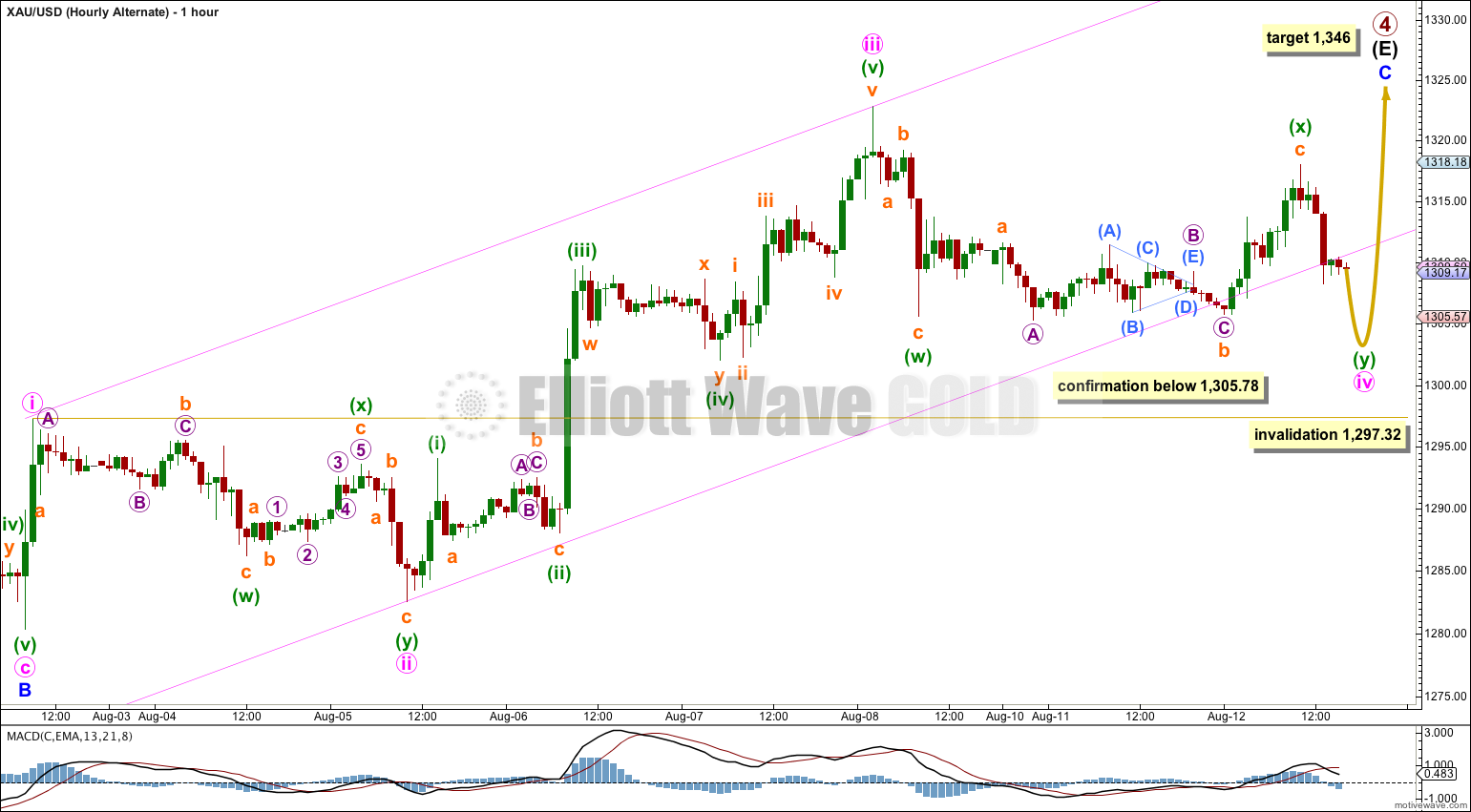

Alternate Hourly Wave Count.

This alternate wave count has a very low probability, maybe as low as 5%. I would only use it if the main hourly wave count is invalidated with a new low below 1,305.78.

If minute wave iv is not over it may be continuing as a double combination: zigzag – X – flat correction for minuette wave (y).

Minuette wave (y) would have to subdivide into a flat correction for this wave count to make sense. If minuette wave (y) subdivided as a zigzag then minute wave iv would be a zigzag and have no structural alternation with minute wave ii.

This wave count would expect choppy sideways movement for another day to complete minute wave iv. Minute wave iv may not move into minute wave i price territory below 1,297.32.

The channel here is drawn using Elliott’s first technique: the first trend line is drawn from the ends of minute waves i to iii, then a parallel copy is placed on the end of minute wave ii. Minute wave iv is not perfectly contained within this channel. If this wave count proves to be correct then the channel must be redrawn when minute wave iv is over using Elliott’s second technique.

This analysis is published about 05:03 p.m. EST.

Hi Lara,

I am thinking along the same lines as Jan in terms of a target for minor wave E. However, in this case, it calls for moving your wave counts down one level, so that your minute waves become minuette waves. This outcome would show further upward movement, but could expect a second wave correction once 1328 is broken.

Steve

Certainly possible, and I like this idea better than trying to see this current movement a second wave. But the target for minor wave C to end would then be much higher and it would overshoot the A-C trend line of the big triangle. That is possible, but much less likely than an undershoot.

After the invalidation on 15th August (assuming the low of 1st August holds), can we say that the above wave count remains possible, except with a truncated minuette 5th? Meaning we could be in minute wave 2 down. Is this the only way to consider that the intermediate E wave as still being in play and we aren’t in intermediate wave 5 down?

very often your alternate is the ONE!

Yep.

It could be a big fourth wave triangle…. in wave c down at the moment. It could move just sideways for another day or so before breaking out upwards.

Hello Lara,

the target of 1346 seems for me a little bit too short for wave e. I would expect an overshooting wave e. Is it possible that your minute wave 3 is only minute wave 1? What is to be said against ma chart?

greetings, Jan

and this is the chart:

Wave i would look like a three wave movement, within it minuette waves (ii) and (iv) are too far out of proportion. Gold does not normally do that.

Also, 1,346 would be a very likely target. Look at triangles on the daily chart. The final wave most often falls short of the A-C trend line. Theres another triangle within intermediate wave (C) that does exactly that. None of the triangles on the daily chart have A-C trend lines overshot.