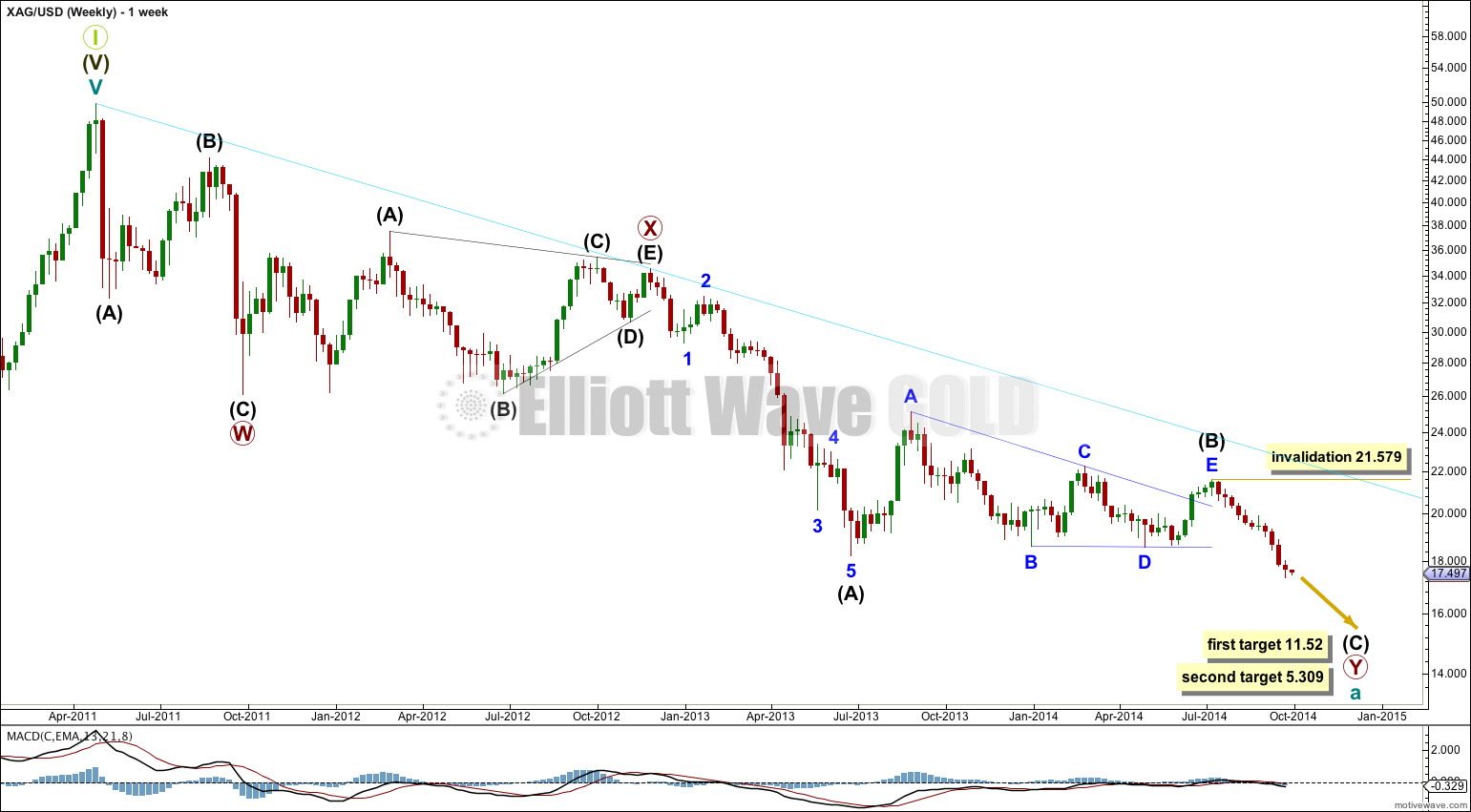

Downwards movement continued as expected for Silver. I do not think minor wave 1 is over yet though; we should see a final fifth wave down to complete it. Thereafter, I would expect an upwards correction for minor wave 2.

Click on charts to enlarge.

Downwards movement subdivides so far as an incomplete double zigzag. This cannot be an impulse if the movement which I have labeled primary wave X is correct as a triangle because a triangle may not be the sole structure in a second wave position.

The first zigzag in the double is labeled primary wave W. The double is joined by a “three”, a triangle, in the opposite direction labeled primary wave X.

The second zigzag for primary wave Y is moving price lower to deepen the correction, and so this structure has a typical double zigzag look in that it has a clear slope against the main trend.

Within primary wave Y the triangle for intermediate wave (B) is now a complete barrier triangle. Movements following triangles, and particularly barrier triangles, have a tendency to be relatively short and brief (more common), or sometimes they are a very long extension. The higher target has a higher probability for this reason.

Within primary wave Y at 11.52 intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 5.309 intermediate wave (C) would reach equality in length with intermediate wave (A).

Within primary wave Y intermediate wave (A) lasted 30 weeks and intermediate wave (B) lasted exactly a Fibonacci 54 weeks. I would expect intermediate wave (C) to end in a total 21 or 34 weeks. So far it has lasted 12 weeks and may yet continue towards the target for a further 9 or 22 weeks, if it exhibits a Fibonacci duration. However, please note, Silver does not reliably exhibit Fibonacci durations nor do its waves reliably exhibit Fibonacci ratios to each other in terms of duration.

Current sideways movement looks very much like a triangle. A triangle may not be the sole corrective structure for a second wave. Therefore, I do not think this is minor wave 2 and so minor wave 1 must be incomplete. This triangle looks like a typical fourth wave.

Minute wave iii is 0.29 short of 4.236 the length of minute wave i.

Ratios within minute wave iii are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is 0.14 short of 1.618 the length of minuette wave (iii).

When minute wave iv is complete then I would be able to calculate a target down for you for minute wave v. I cannot do that yet as I do not know where minute wave v begins. I would expect it is very likely to be only equal in length with minute wave i which was only 0.523.

Minute wave iv may not move into minute wave i price territory above 20.585.

When minor wave 1 is a completed five wave impulse then minor wave 2 should begin. Minor wave 2 should move price higher, it should be choppy and overlapping. It should last at least two weeks and probably longer.

Lara, current daily wave analysis does not allow minute iv to move ABOVE 20.585. Can you estimate where minute iv may actually end?

“Minute wave iv may not move into minute wave i price territory above 20.585”

Maybe about 17.819.

I’m adjusting my wave count for the end of this movement for Silver a little. I will post a chart later today. I expect now that minute wave iii actually ended at 16.672. Draw a Fibonacci retracement along its length. Look for the 0.236 Fibonacci ratio to be reached.

Thank you.