Price continued lower as expected, a little. The target of this third wave to end was 85.88. It has likely ended at 90.43, $4.55 short of the target.

Summary: In the short term I expect a final fifth wave down to complete minor wave 1. The target is 84.65 which may be met in about 3 – 4 weeks time. The mid – long term target remains at 74.53. This target may be months away.

Click on charts to enlarge.

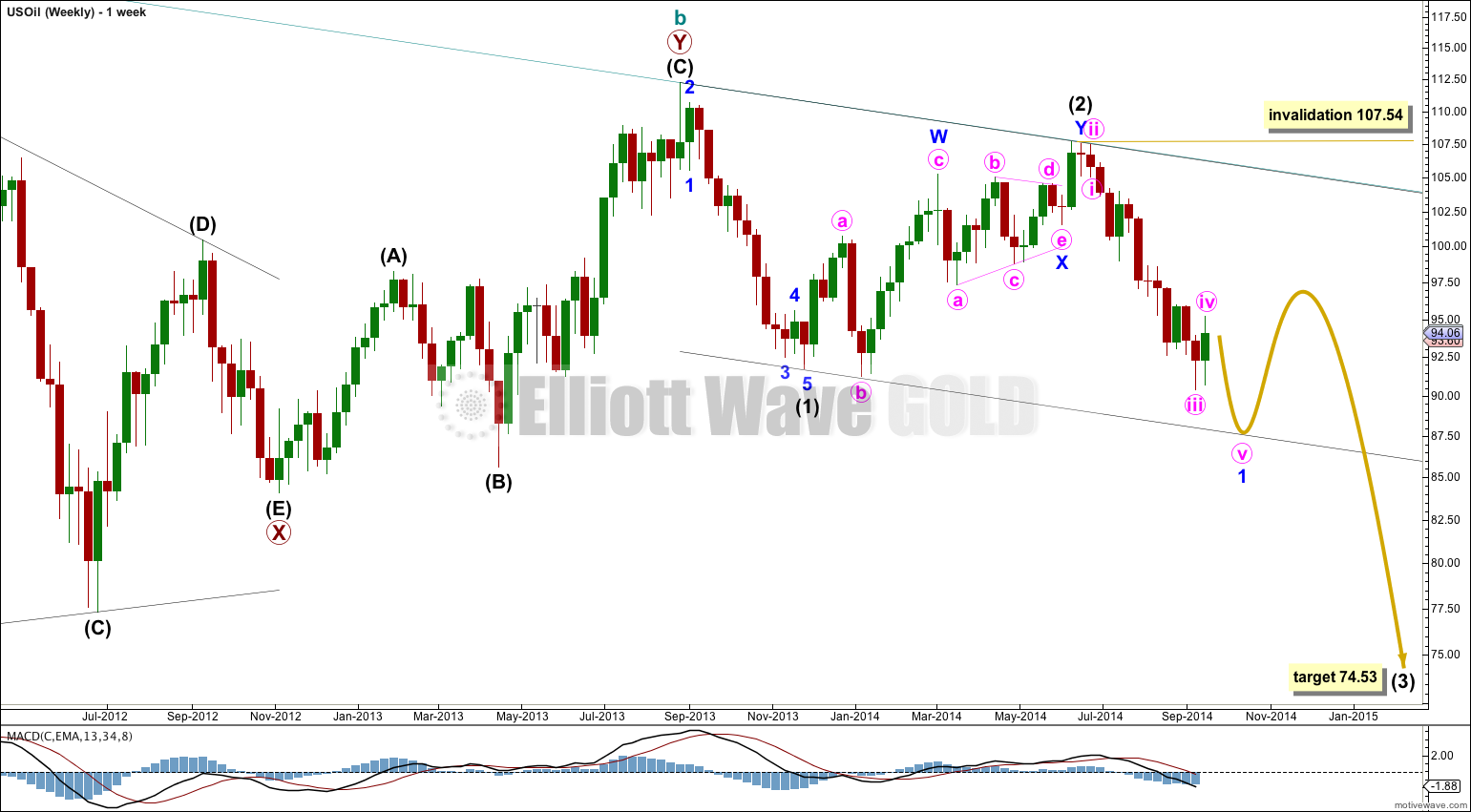

This wave count sees US Oil as still in the early stages of a third wave down at intermediate degree.

The target for intermediate wave (3) remains at 74.53 where it would reach 1.618 the length of intermediate wave (1). Intermediate wave (1) lasted a Fibonacci 13 weeks and intermediate wave (2) lasted 28 weeks. So far within intermediate wave (3) minor wave 1 has lasted 14 weeks and it is still incomplete. It looks like intermediate wave (3) will be much longer in duration than intermediate wave (1) and maybe intermediate wave (2) as well. If intermediate wave (3) exhibits a Fibonacci duration it may be either or 34 or 55 weeks. That would see it end in another 20 or 41 weeks. However, this is a very rough guideline only. Intermediate wave (1) may not exhibit a Fibonacci ratio in terms of duration to intermediate wave (1) as these relationships in terms of duration are not reliable for US Oil.

I have drawn a base channel about intermediate waves (1) and (2). Minor wave 1 downwards may end when price finds support at the lower edge of this channel.

Minor wave 2 may not move beyond the start of minor wave 1, and because this is a second wave correction within a third wave at intermediate degree minor wave 2 may be more brief and shallow than second waves are normally. I would not expect minor wave 2 to breach the upper edge of this base channel because second waves of lower degrees do not normally breach base channels drawn about first and second waves one or more degrees higher.

Minor wave 2 may not move beyond the start of minor wave 1 above 107.54.

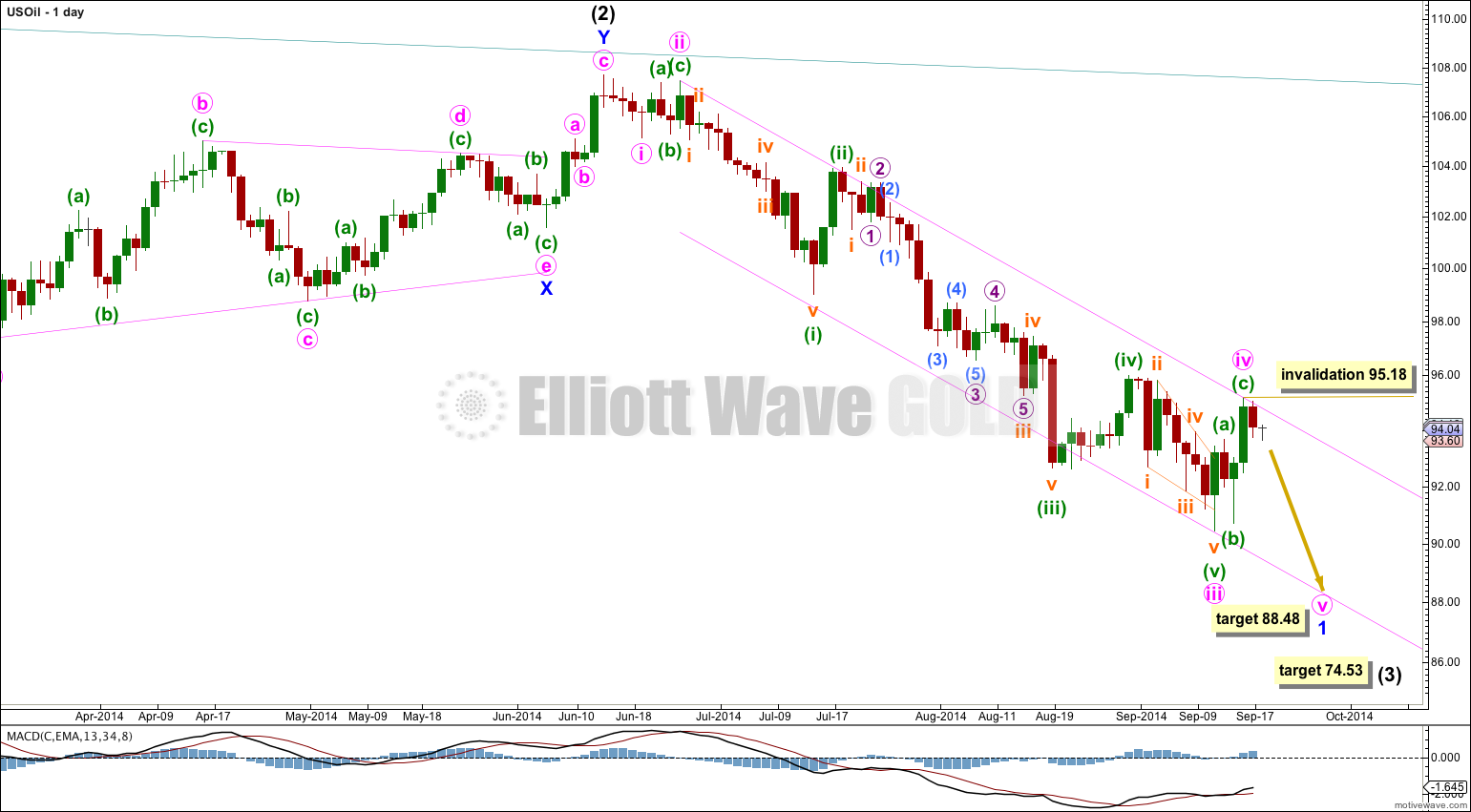

The structure of minor wave 1 is most likely still incomplete.

Within minor wave 1 so far minute wave iii is just 0.52 short of 6.854 the length of minute wave i. We may not see a Fibonacci ratio between minute wave v and either of iii or i, so the target for minor wave 1 down is now best calculated at minuette degree within minute wave v. But that cannot be done until close to the end of this movement.

At 88.48 minute wave v would reach 0.618 the length of minute wave iii. This target may be met within 3 – 4 weeks.

This wave count expects that minute wave iv is over. If it is over here there is perfect alternation between minute waves ii and iv: minute wave ii is a deep 92% expanded flat correction and minute wave iv is a very shallow 28% zigzag. Minute wave ii lasted 4 days and minute wave iv lasted 3 days, and this close proportion gives the wave count the right look.

I have drawn a best fit channel about minor wave 1. I would expect minute wave v to find support at the lower edge. Along the way down upwards corrections should find resistance at the upper edge. If price breaches the upper edge of the channel before minute wave v downwards is complete then this wave count would reduce in probability.

Within minute wave v no second wave correction may move beyond the start of its first wave above 95.18.

If this wave count is breached by upwards movement it is possible that minute wave iv is continuing further as a double zigzag. Alternatively, my wave count within minor wave 1 is wrong and upwards movement could be the start of minor wave 2.

There are too many problems with the alternate I had in last analysis so I will not publish it at this stage because the probability of it is so low. It too would expect downwards movement at this stage, so there is no divergence.

Lara,

Is target 84.65 or 88.48? Would you please clarify? Maybe I miss something.

“The target is 84.65 which may be met in about 3 – 4 weeks time”

“At 88.48 minute wave v would reach 0.618 the length of minute wave iii. This target may be met within 3 – 4 weeks”

Sorry Davey, you’re right. My bad.

The target on the chart should be 84.65.