I had expected a little downwards movement, likely to 1,141.95. We did see a little downwards movement but it failed to reach 1,141.95 before turning up. This narrows down the structural options for minor wave 2.

Summary: I expect one more green candlestick for Wednesday’s session to end about 1,179 – 1,182. Thereafter, it is likely that the next move should be a strong third wave within a third wave down.

Click on charts to enlarge.

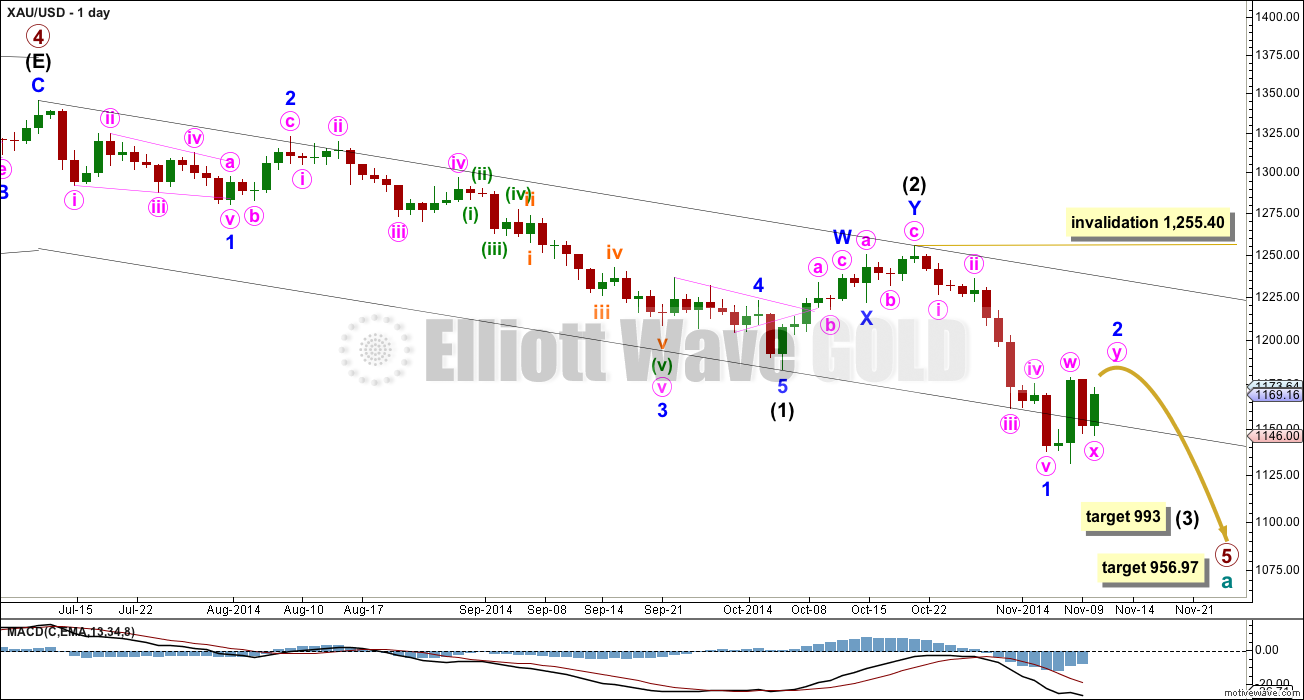

Main Wave Count

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. Intermediate wave (2) is a relatively shallow 45% double zigzag correction.

Intermediate wave (1) lasted a Fibonacci 13 weeks. I would expect intermediate wave (3) to be extended in both price and duration. If it lasts a Fibonacci 21 weeks it would be 1.618 the duration of intermediate wave (1). So far intermediate wave (3) is in its third week.

Intermediate wave (3) may only subdivide as an impulse, and at 993 it would reach 1.618 the length of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (3) must move far enough below the end of intermediate wave (1) to allow room for upwards movement for intermediate wave (4) which may not move into intermediate wave (1) price territory.

Minor wave 2 may not move beyond the start of minor wave 1 above 1,255.40.

Because this is a second wave correction within a third wave one degree higher it may be more quick and shallow than second waves normally are. At this stage I expect minor wave 2 to only reach up to about the 0.382 Fibonacci ratio at 1,182.75.

If minor wave 2 exhibits a Fibonacci duration it may end in one more day, totalling a Fibonacci five days. If it does not end in one more day the next expectation would be for a further three days to total a Fibonacci eight.

The black channel is a base channel about intermediate waves (1) and (2): draw the first trend line from the start of intermediate wave (1) to the end of intermediate wave (2), then place a parallel copy on the end of intermediate wave (1). Intermediate wave (3) has breached the lower edge of the base channel which is expected.

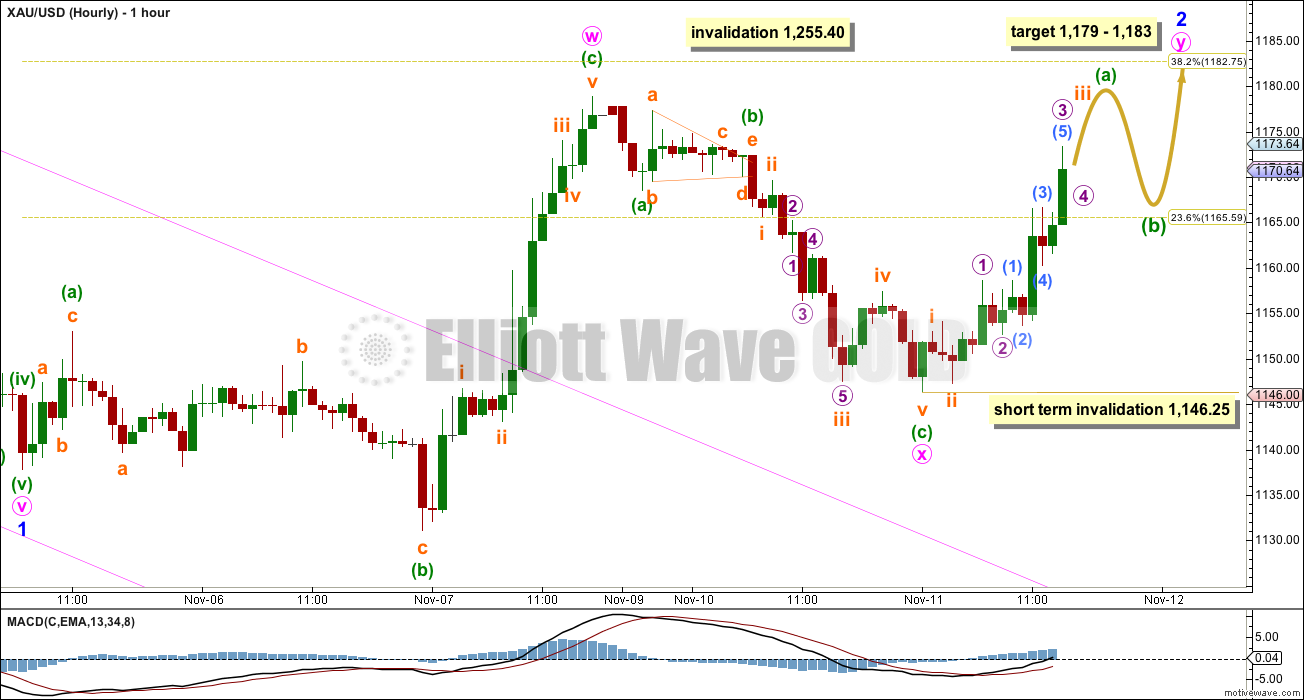

Main Hourly Wave Count

Downwards movement did not reach 1,141.95 and so minor wave 2 cannot be a flat correction because the B wave within it would be less than 90% the length of its A wave.

This leaves two structural options for minor wave 2 and so I have two hourly wave counts for it for you today.

Minor wave 2 may be a double combination. Only because combinations are slightly more common than double flats is this main hourly wave count slightly more likely than the first alternate below.

If minor wave 2 is a double combination then the first structure within it was an expanded flat labelled minute wave w. The double is joined by a “three”, a zigzag in the opposite direction labelled minute wave x. The second structure in the double may be a zigzag or a triangle, with a zigzag much more likely.

Within a zigzag minuette wave (a) must subdivide as a five. It looks like an almost complete impulse. Within a zigzag minuette wave (b) may not move below the start of minuette wave (a) below 1,146.25.

The purpose of double combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends close to the same level as the first. I would expect minor wave 2 to end about 1,179 at the end of minute wave w, to 1,183 about the 0.382 Fibonacci ratio of minor wave 1.

This first hourly wave count could see minor wave 2 end in just one more day / session, lasting a Fibonacci five days.

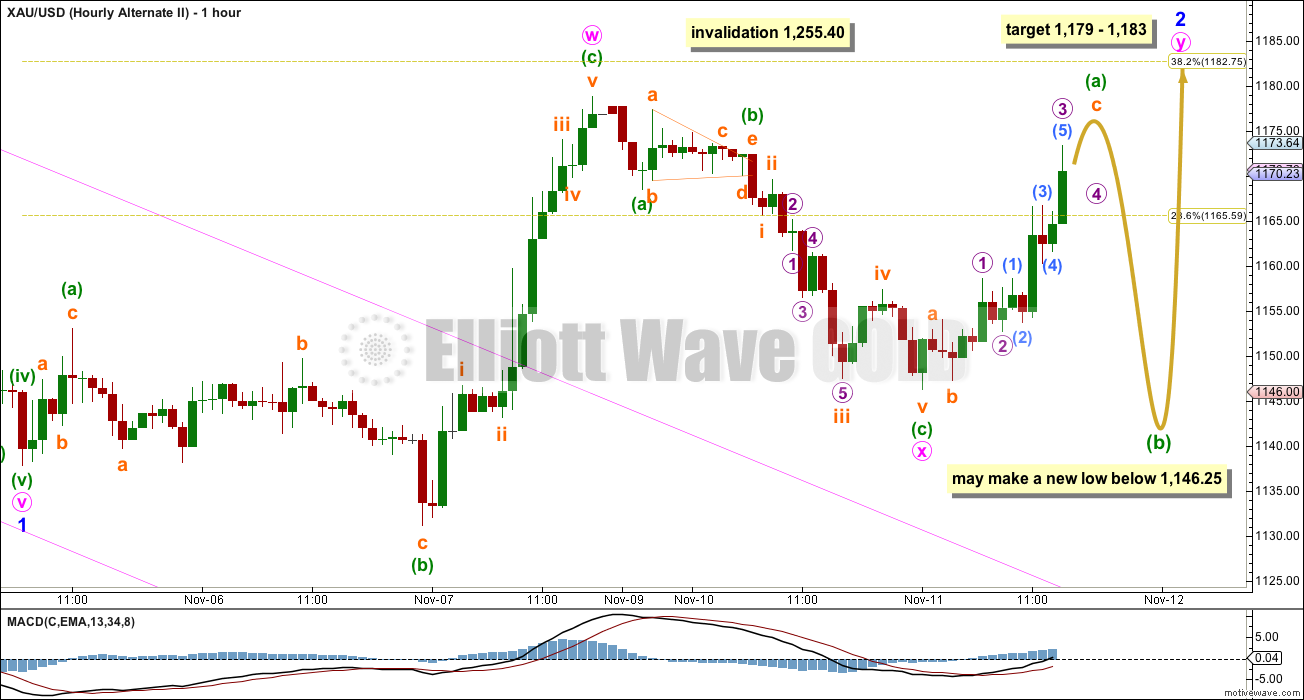

First Alternate Hourly Wave Count

Minor wave 2 may be a double flat correction. The first structure in the double is an expanded flat labelled minute wave w. The double is joined by a “three”, a zigzag in the opposite direction labelled minute wave x. The second structure may be another flat correction to complete a double flat.

The purpose of double flats is the same as double combinations. So I would expect the second structure in the double flat to end close to the same level as the first, which is close to the 0.382 Fibonacci ratio.

The only difference between this second wave count and the first is the structure expected for this second corrective structure; the first wave count expects a zigzag most likely and this second wave count expects a flat correction.

Within a flat correction minuette wave (b) must reach back down to a minimum 90% length of minuette wave (a). Minuette wave (b) may make a new low below the start of minuette wave (a) as in an expanded flat, below 1,146.25.

This second hourly wave count would probably not see minor wave 2 end in just one more day, and looks like this structure would require longer than that to complete. This wave count may see minor wave 2 continue for another four days to total a Fibonacci eight.

Unfortunately, there is no lower invalidation point for this first alternate wave count. Only careful attention to structure will tell when minor wave 2 is over.

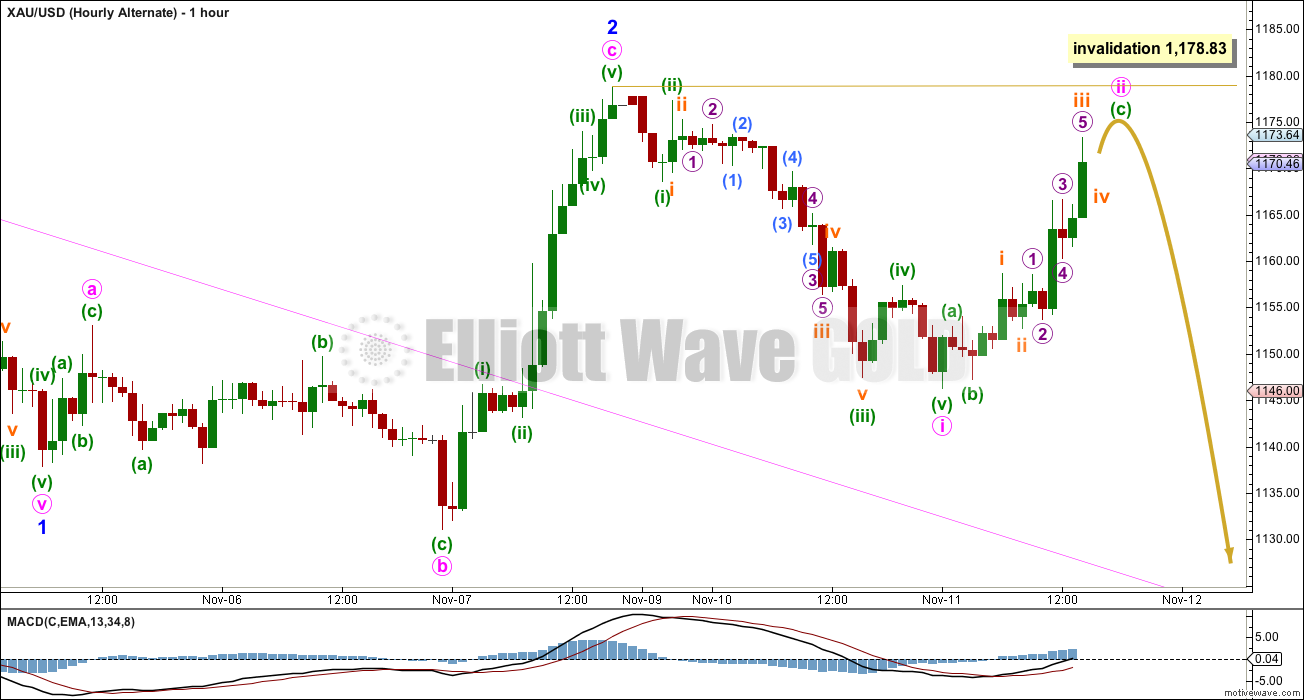

Second Alternate Hourly Wave Count

This second alternate wave count has a greatly reduced probability today. If the middle of a big third wave has begun then I would not expect to see such a deep time consuming correction for minute wave ii. I expect this alternate wave count to be invalidated within the next 24 hours. Minute wave ii may not move beyond the start of minute wave i above 1,178.83.

If this wave count is correct (and it is technically possible so it must be considered) then a very strong downwards movement is imminent. This alternate expects a big red candlestick for Wednesday’s session.

Minute wave iii must subdivide as an impulse. Only careful attention to structure (and momentum as a guide) will tell if the first or this second alternate hourly wave count is correct.

I would judge this second alternate to have a less than 5% probability today.

This analysis is published about 03:35 p.m. EST.

Sorry for the delay in replying to your comment Chris.

I’m seeing a triangle unfold, but its not a fourth wave.

Triangles also appear within corrections as B waves, X waves or Y waves. Or a smaller part of a larger correction.

They’re horribly tricky structures, and the EW rules are black and white (with the exception of D for a barrier triangle).

The bigger picture is always important. If you want to see this triangle as a fourth wave it has to fit at the daily chart level. I’m struggling to see that… if you can then please post a chart.

Are we perhaps nearing the end of a triangle, with a final thrust to the 1179-1183 zone coming in the next few hours? Thanks.

Yes. I’m seeing what you’re seeing.

Hi Lara, could we have finished wave 5 down and have started a 3-wave A,B,C retracement?

Yes, that’s one of the alternates.

Lara, I know very little about elliott waves but have been watching the forth wave triangle area for awhile and I have thought they would bounce where the triangle turned into a falling wedge and that is where it turned. I thought the next move would be to the top trend line of the triangle. My question is. Is it possible for the movement after the third wave to be a forth wave and were in the process of an ending diagonal for the fifth wave?