A small green candlestick fits the Elliott wave count. Downwards movement is finding support about the lower edge of the green base channel on the hourly chart.

Summary: Momentum may not show a strong increase for another day or so. The trend remains up, and the short term target at 1,251 may be a few days away.

Click on charts to enlarge

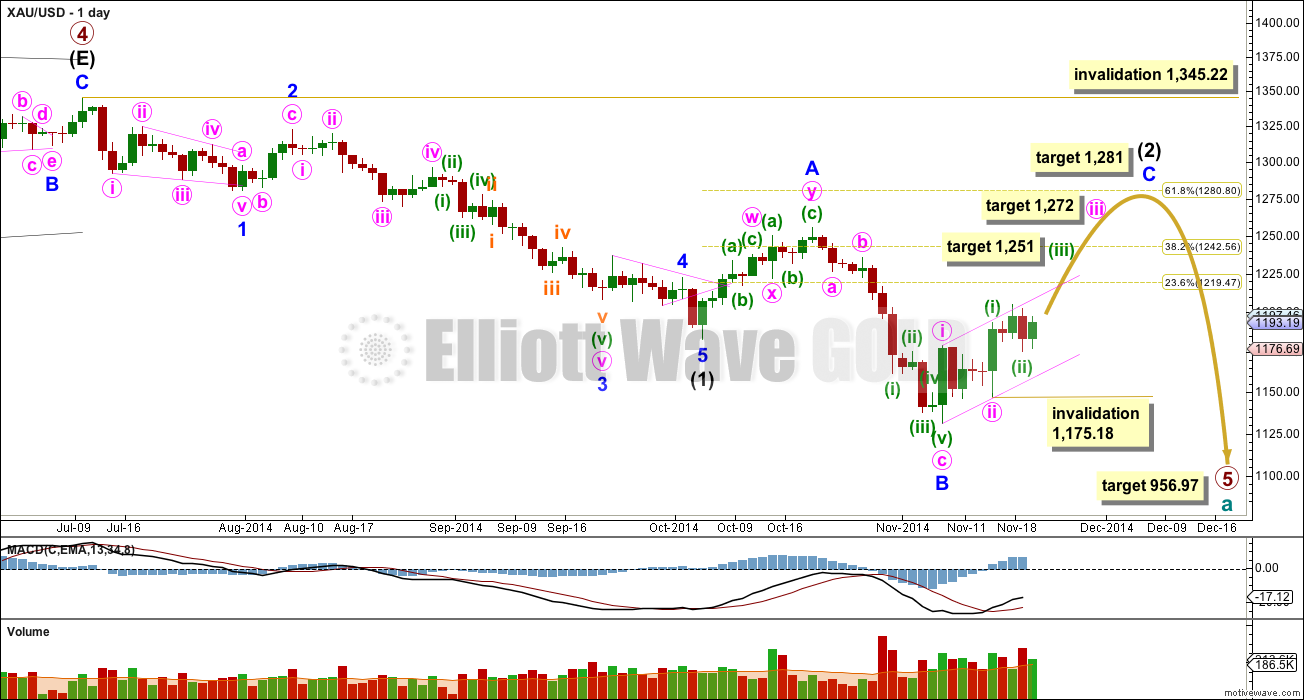

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Within minor wave C minute wave iii would reach 2.618 the length of minute wave i at 1,272. Within minute wave iii minuette wave (iii) would reach 1.618 the length of minuette wave (i) at 1,251.

Intermediate wave (1) lasted a Fibonacci 13 weeks. So far intermediate wave (2) is ending its sixth week. I will expect it may continue for another two weeks at least to total a Fibonacci eight, and be 0.618 the duration of intermediate wave (1). However, it may be a little longer in duration than this.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

Draw a base channel about minor wave C: draw the first trend line from the start of minute wave i to the end of minute wave ii, then place a parallel copy on the end of minute wave i. Copy this pink channel over carefully to hourly charts. Minute wave iii should have the power to break above the upper edge of this channel. Along the way up downwards corrections should find support and not break below the lower edge of this channel. Base channels almost always work like this (note, almost always is not the same as always).

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

So far within minute wave iii minuette waves (i) and (ii) are complete. The middle of a third wave has begun.

Within the middle of this third wave I expect now that its first wave is incomplete because we are not seeing a clear strong increase in upwards momentum and new highs yet. Within minuette wave (iii) I expect that subminuette wave i is incomplete.

Within subminuette wave i micro waves 1 and 2 are complete. Within micro wave 3 sub micro waves (1) and (2) are complete. I have checked the subdivisions of sub micro waves carefully on the five minute chart and I think sub micro wave (1) ended with a truncated fifth wave, which then sees sub micro wave (2) as a perfect zigzag.

I am leaving the invalidation point at 1,175.18 to allow for the possibility that micro wave 2 may continue further sideways as a double combination. It may not move beyond the start of micro wave 1 below 1,175.18.

Downwards movement is finding support close to the lower edge of the green base channel drawn about minuette waves (i) and (ii). This may continue to work while subminuette wave i completes. When subminuette wave i is over then subminuette wave ii may not move beyond its start below 1,175.18. The invalidation point will remain at this point for this reason.

Once subminuette waves i and ii are over then I will expect to see a strong increase in upwards momentum as the middle of this third wave passes. It may be that upwards momentum begins to pick up when the upper edge of the pink base channel is properly and clearly breached.

This analysis is published about 03:04 p.m. EST.

Seeing the Swiss Referendum as influencing the Gold market is a fundamental approach. Fundamental analysis is mutually exclusive to Elliott wave. From an Elliott wave perspective it is the market which makes the news, not the news which moves the market. The distinction is important. And I know, it is highly unpopular.

I will only publish a wave count which sees strong downwards movement from here if it fits. I can’t publish a wave count with the direction you prefer, that’s not how EW works.

At this stage I am looking for such a wave count, but I cannot see how price could break below 1,146.98 yet, and certainly not below 1,131.09 for some time yet.

If I see such a wave count I will publish it if it fits. If any members have such a wave count let me know and I’ll check it out.

wow, lara, my trust in your analysis is 100 times fold with this clarification,

whenever mostly this type of major events come, and if i am confused with counts than i will be stay of that time, i think this is the best polyci ,

Could it be possible that all this choppiness is due to political interfence with the Swiss Referedum that looks like now will not pass? Looks like we are at a ceiling with the 50 day moving average providing very strong resistance? Please consider another alternate wave count supporting downward movement from here as I would like the members to be informed of another wave count moving us strongly down even if the probability is low as many are trading based on your analysis and it would be disappointing if we saw a reversal that we did not consider. I believe we are topping and will be seeing some strong movement down as early as next week based on the false breakout. Have you seen this interfence before? If so, what’s your experience in an alternate wave count that would support a trend change down. Thanks.

Please read the FAQ.

A chart would be much better. Disquis allows you to upload .jpg or .png

How to post a chart? Can a link be pasted here?

Just underneath the box in which you type your comment, in the grey bar below, is a small button. Click on that to upload an image.

Count looks good Lara, I see we hit 3 circle, then down to 4 circle then up to i then down to ii and now heading back up.

No monkeys no mess up, just someone a little confused.

Hi Richard, we do not hit 3 circle. Before we hit 3 circle we need hit ( 3), (4) and (5). The target for 3 circle is much higher.

Richard, your sarcastic comments help nobody on this site. I believe I was the first one to mention int 2 was probably not over. Two days later the main count was changed to exactly that. I know what I’m doing rest assured. I only made the comment because the drop was fast and furious which nearly invalidated the main count.

Chaostick_jr

The drop at 12:00 was within Lara’s instructions as, downward movement is finding support about the lower edge of the green base channel around 1185 to 1190 and trending up. The drop stopped at 1192. That is where my bother and I both loaded up on miners and sold it all 30 minutes before close then I loaded up at close when price dropped.

“Nearly” doesn’t count in invalidation, Lara has several times said it has to be 1 cent over or there is no invalidation and I have etched that into my brain to help me stay calm. By the way the invalidation point was 1175.18 and the lowest was 1186.92 at 4 am so Lara’s masterpiece projection game plan was working as planned despite the fact that the drops are stressful. Lara I appreciate everything you do. I was the first person to subscribe to you and no other Elliott Wave forecaster compares to you. I am thankful for your reports every day.

Chapstick,

You obviously know EW (and probably other analysis techniques) very well and I would appreciate hearing your perspective.

Maybe consider posting your own brief analysis (like Lara’s summary) in the comment section of Lara’s analysis every night. Not a critique of Lara, but your own independent analysis.

Everyone has an opinion, ultimately market action the next day will pass judgement.

Hi Lara, is it possible count, from the low at 1131, 5 waves up us follow:

Wave 1 at 1178,60

Wave 2 at 1146,80

Wave 3 at 1193,48

Wave 4 at 1183,34

Wave 5 at 1204,57

and wave A to 1175, wave B to 1207,50 and wave C in developping?

Waves 1 and 3 are equal and wave 5 is 38,2% of waves 1 and 3.

Thanks

Now a monkey wrench into the overall count with a big drop in last hour…does not appear to be a third wave up

This:

Maybe but I’m still long and did not touch my position. Quite the 1-2 deep punches if all is well if you know what I’m sayin’.

Yeah, those deep second wave corrections always induce a bout of nerves in me too. But… another way to look at them is opportunity, and the deeper they go the lower the risk.

“the deeper they go the lower the risk”. . .

How so??

Please expand on that for me.

The lower the risk of [ ]

Thanks for helpin’ a new person on EW,

The deeper the correction, the closer wave 2 gets to the start of wave 1. Because 2 cannot move beyond the start of 1 (and so that is why I put an invalidation point there) that would be a logical place to put a stop. The closer 2 gets to 1 the closer price gets to the theoretical stop, and so the lower the risk.

When I trade EURUSD or NZDUSD I like deep second wave corrections; you can take a few losses when you get it wrong because the loss is such a small % of equity. But if you get it right… its a third wave and boom, profit. Nice. Then the trick is to get out before the third wave ends as close to the top as you can.

Well said and hilarious, Lara.

I am calm. I have faith in you.

Enjoy your weekend. Is it surfing all year round?

I’d love to live by the ocean. Could go there and swim or meditate after thinking about gold investments all day long.

Yes, I surf all year round. I have a good wetsuit for winter. But the Pacific Ocean is doing a remarkably good impersonation of a lake these days, has been flat for months now! I have to keep up with the yoga and hiking so that I’m ready to surf when the waves come. It does make me antsy, not surfing.

Congrate LARA Gold breached 1200!!! Wave count can proceed as you outlined. Bravo!!!

Gold is battling 1200. Target of 1281 at Fib 61.8 seems too high estimation. in bear market or bull market corrections usually up to 38% or 50%. Target of 1250 seems reasonable. Just my humble opinion.(IMHO)