More sideways movement fits the new main Elliott wave count very well, with some adjustment. The larger Elliott wave structure remains the same, and the target changes by $2.

Summary: When sideways movement is complete I expect a short sharp upwards thrust to about 1,220. Thereafter, I expect some downwards movement for one to three days for a fourth wave correction. Overall the trend at minute and minor degrees is up. I see a rising wedge, a leading contracting diagonal, unfolding upwards which is incomplete.

Click on charts to enlarge

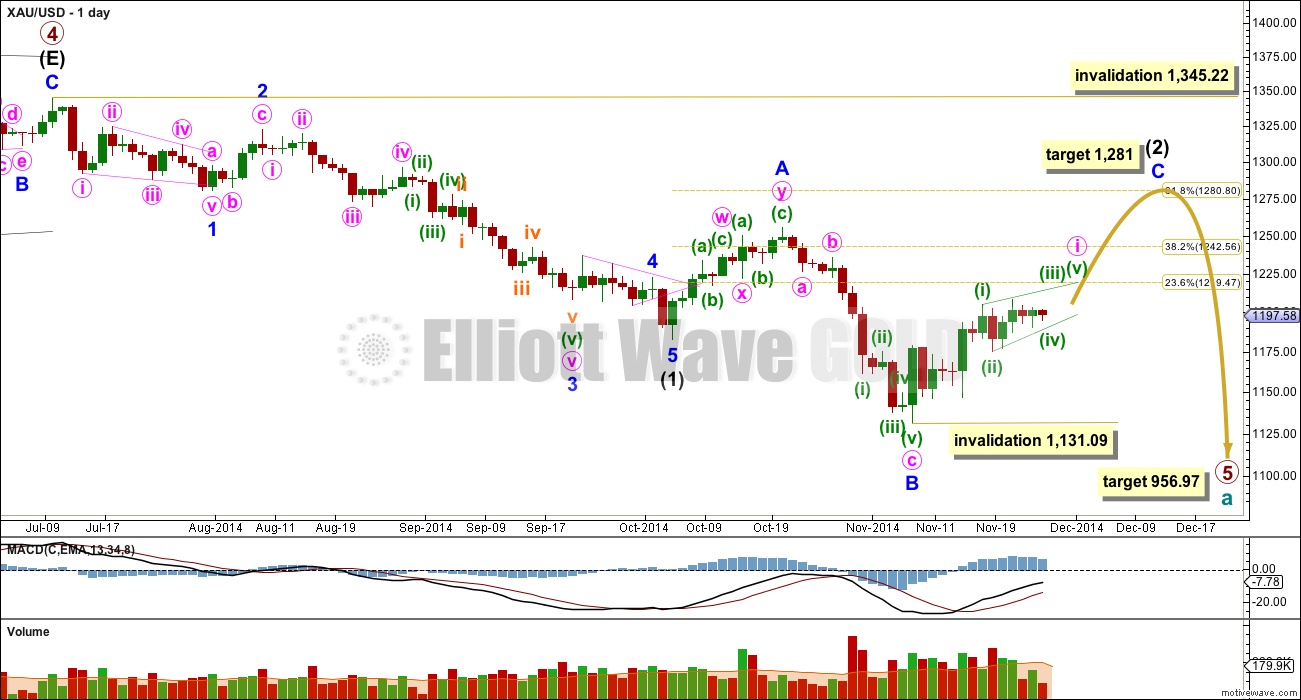

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. So far intermediate wave (2) has just begun its seventh week. I will expect it may continue for another two weeks at least to total a Fibonacci eight, and be 0.618 the duration of intermediate wave (1). Alternatively, intermediate wave (2) may last a total Fibonacci 13 weeks equalling the duration of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

I am discarding yesterday’s alternate hourly wave count and presenting only this one to you for two main reasons:

1. Yesterday’s alternate hourly wave count expected to see a strong increase in upwards momentum as the middle of a third wave took off. This is again not what has happened.

Yesterday’s alternate remains technically possible, but there has to come a point where I accept the probability is so low and discard it. It remains an outside possibility that upwards movement could be very strong from here, but I do not think this will happen.

2. It looks very much like a triangle is unfolding at the moment, and is almost complete. A triangle may not be the sole corrective structure in a second wave, so this cannot be the entirety of a second wave correction just before the middle of a third wave.

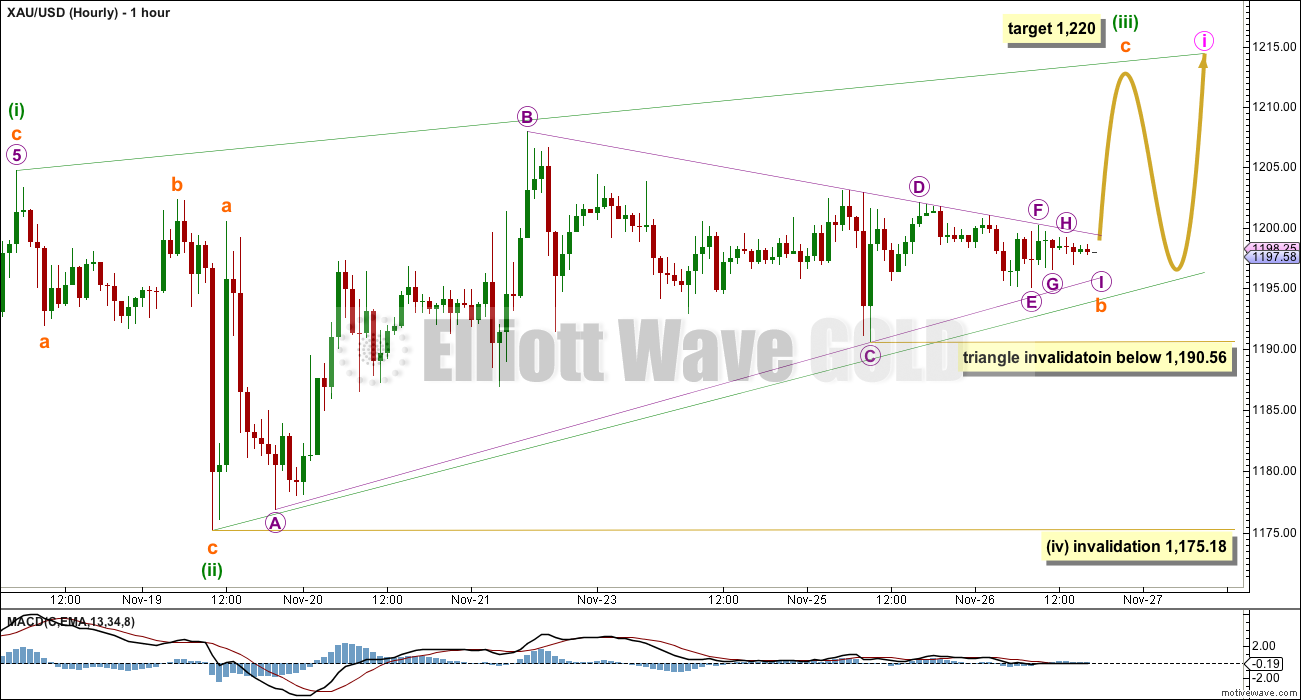

What is much more likely and fits all subdivisions is that minute wave i is completing as a leading contracting diagonal. Contracting diagonals are more common than expanding diagonals.

Minuette wave (i) is a complete zigzag. Minuette wave (ii) is also a complete zigzag, but it is just 0.40 the length of minuette wave (i) which is shorter than normal for a second (and fourth) wave within a diagonal of between 0.66 to 0.81.

Minuette wave (iii) is an incomplete zigzag. Minuette wave (iii) must move beyond the end of minute wave (i) above 1,197.96. At 1,220 subminuette wave c would reach equality in length with subminuette wave a.

It looks very much like this current sideways movement is completing a long nine wave triangle for subminuette wave b. The overall triangle structure looks right and the triangle wave ends fit the rules for a running contracting triangle perfectly, so I will not be overly concerned with how each triangle sub wave subdivides. Within the triangle micro wave E may not move beyond the end of micro wave C below 1,190.56.

I expect the triangle to come to an end within the next 24 hours (sooner rather than later), and when it is done I expect a short sharp upwards thrust towards the target.

When we know how long minuette wave (iii) is then we can know for sure if the diagonal is contracting or expanding. This will tell us if minuette wave (iv) should be shorter or longer than the length of minuette wave (ii).

Minuette wave (iv) should overlap back into minuette wave (i) price territory, but it may not move beyond the end of minuette wave (ii) below 1,175.18.

Minuette wave (v) upwards is most likely to unfold as a zigzag and must move beyond the end of minuette wave (iii), because the fifth wave of a leading diagonal may not be truncated.

In a continuation of choppy overlapping movement, this wave count expects a short sharp upwards thrust in the short term and to move in an upwards direction mid term.

This analysis is published about 05:43 p.m. EST.

Its a word made up by R. N. Elliott (I think, or maybe Frost and Prechter) to name a specific degree of Elliott wave.

So it’s not surprising you have not come across it before.

Hello all,

this is my chart…….with invalidation point at 1199,56

At 11:30 ( GMT-5) closes Europe…. Asia is sleeping …..and USA Thanksgiving.

The gold will be alone…… and could be a good time to go to 1160

Well done.

Within your second wave correction, your A wave subdivides as a three. This indicates a flat correction must be unfolding (or a combination). Within a flat the B wave must be a minimum 90% correction of the A wave at its end. Have you checked that the end of your triangle for wave B is a minimum 90% of A? (it looks like it is, but you’ll need to check).

Nice work.

Thank Lara, but the B wave is only 83% of A wave….

my crude TA 😀 😀

Hello all,

Yes, it’s very tricky and strange action during Thanksgiving, but it’s probably related to fundamental things like sunday’s swiss gold referendum and tomorrow’s gold first notice day at COMEX which is extremely vulnerable during last year (paper contracts are usually 10th times or even more higher than physical resources just four days before first notice day). Maybe COMEX and USA are not leaders of gold market anymore.

But back to the waves. I have for at least one week an alternate count, which also respects other tools like RSI, MACD, trendline etc. and there is really strong resistance at $1200. For me chart has followed different schema in recent days when the strong 38,2% retracement of 4th wave from 1345 couldn’t be broken by several attempts. There could by combination of zigzag and triangle, but also anything else, Lara is much better in this microwaves than me… But same ideas was followed also by GDX and almost by silver (missed 38,2% fibo by just 18 cents). Also i have one more problem with continuing 2nd wave, when breakout of strong multimonth $1180 support by B wave looked improbable together with silver in extremely low levels deep below support $18,5. Of course, there is still possibility PMs somehow recover and gold will touch $1222-$1228 soon with silver at $16,9, but price action from last 10 hours supports something else, yet.

And pictures of course…

Today COMEX is closed for the holiday. But If one looks at the Gold’s price during COMEX trading over last week there has not been a breach of the invalidation price. Invalidation happens out side of COMEX trading hour when gold is extremely illiquid.

The overall theme is wave (2) C at least needs to get to the price point of A?? Is it true?

I would not say out of comex trading hours is gold market illiquid, paper market is in this time usually noticeably less volatile but not extremely illiquid. And physical market ratio is at COMEX extremely low if you compare it wih other exchanges. Many times any important low or high was set during Shanghai or London trading hours.

I do not know how much gold is traded on Shanghai. Hong Kong is lot less than London and COMEX. COMEX daily average is 160K contracts.

Besides Shanghai is physical exchange not a future. COMEX still sets world gold price. That why I reco PM fix and COMEX price.

Thank you

Yes. Comex is still the most important exchange for gold price. Tracking PM fix is also very good idea. But the problem is impact of COMEX is getting lower because of just paper game there. Some excellent comparision is here:

https://www.bullionstar.com/blog/koos-jansen/precious-metals-markets-china-vs-us/

What I wanted to say is gold market is worldwide complicated game and anything is possible even on Thanksgiving. Without EW it is a big mess for sure.

Lara is expert on EW analysis. These tiny movements are very difficult to evaluate. My suggestion to Lara is to evaluate big picture EW using London PM fix data also on side. This suggestion is based on what I have experienced with Sir Alf Field’s analysis over a long time.

For 13 years starting from 2000 to 2013 Sir Alf Field did EW analysis of gold using London PM fix only and he was very successful.

Time to time he would use COMEX prices and compare with PM fix analysis.

It will be interesting to see what EW analysis of PM Fix would reveal.

Yes Gold current count is invalidated yet again and Lara no doubt will come up with a new count.

Thanks for hard and fine work.

Alf Field analyzed only during a bull cycle wave. In 2011, his EW analysis stated a continuing bull run to $5000+ WITH NO INTERVENING CORRECTION to exceed 10%. In fact, the correction has been 41% so far.

Yes I agree after 2013 he went silent. His last post indicated that correction would jump to next degree higher to 36%.He NEVER said “WITH NO INTERVENING CORRECTION”. He wrote as price moves higher expect corrections will be on higher degree of order.He does this on side. Remind you 1979 gold corrected to 50% from $200 to $100. Rest is history. He has retired

Thanks.

I am 100% certain that Alf Field published a forecast and chart in 2011 near the peak gold price showing that gold would not fall more than 10% at any time in its inexorable price march towards the moon. I saw it on my trading forum and I think it might have been in jsmineset as well. He retired thereafter.

Let’s not fool ourselves. Gold is acting irrational due to political interference with the Swiss Referendum vote on 11/30. Expect to see wild swings in Gold until an outcome is determined. Currently the outcome is projected not to pass, which means Gold will take a nose dive and a new wave count will present itself, similar to the unexpected move up that got us here in the first place. Start to position yourself for a sharp move down to new lows and not up.

Hi. I’m not english and I don’t understand word ‘minuette’. What different word.

Happy Thanksgiving to the US! What a mess this gold count is. I think we all need to step back, have a few drinks, and forget about gold for awhile!

Chapstick, i am not saying Lara has done anything wrong. Just wondering what’s going to happen with this unexpected move.

I did do something wrong actually. My triangle was wrong.

Triangles are horribly tricky things like that.

Gold recently completed a nine wave triangle at the daily chart level. This fooled me into trying to see another one…

The hardest thing about triangles is identifying what direction price enters them, or another way of saying it, what the starting point is. Once you have that right everything else falls into place. If you have that wrong…. then your expected thrust out of the triangle will be in the wrong direction.

1175.18 next invalidation point.

anyone know what’s next for gold? it has breached the invalidation point.

Jerry, thank you for noticing we have a problem. Lara said, “Within the triangle micro wave E may not move beyond the end of micro wave C below 1,190.56.

I expect the triangle to come to an end within the next 24 hours (sooner rather than later), and when it is done I expect a short sharp upwards thrust towards the target.”

Instead of an expected upwards trust we had a downward trust out of the triangle at 21:03 at 1,197.26, which then invalidated the triangle at 23:15 by going below the 1,190.56 invalidation point and dropping to 1,186 and then headed up. The NYSE is closed Thursday. I really hope that gold continues moving higher so at Friday open it is somewhere above 1,200 and close to the target of 1,220 so I can cash out before the minuette wave (iv) drop or if it drops it is fast and back up in minuette wave (v) above 1,200 heading up at Friday open, please.

very good plan

This forecast is now invalid. Lara will make a new forecast. Meanwhile we watch gold and pray for the best or cross our fingers or do something else for good luck.

Triangle got invalidated.

Lara,

Maybe I am missing something. Are you saying wave (iv) could move down to 1175 .18 then wave (v) could move to 1281? Wave (v) has the potential of moving over 100 dollars?

Fourth wave correction, minuette wave (iv) should not go below 1,175.18. Minuette wave (v) upwards must move beyond the end of minuette wave (iii) above about

1,220 for a new high. …

Micro wave C of intermediate wave (2) most likely just below 1,281 in at least two weeks to another 7 weeks.

No. This is only the first wave within minor wave C. I don’t have a target for the end of minute wave i yet because I don’t know for sure if the diagonal is expanding or contracting and where the third and fourth waves within it end (because they’re yet to unfold).

Minute wave i will end well below 1,281. That target is still weeks away.