The triangle ended but the thrust out of it was down, not up. The hourly Elliott wave count was invalidated but the Elliott wave count at the daily chart remains valid.

Summary: Overall the trend remains up. In the short term a new high above 1,193.99 would provide confidence in the short term target at 1,226. Alternatively, a new low below 1,185.79 would indicate more downwards movement to 1,176.14 but not below 1,175.18.

Click on charts to enlarge

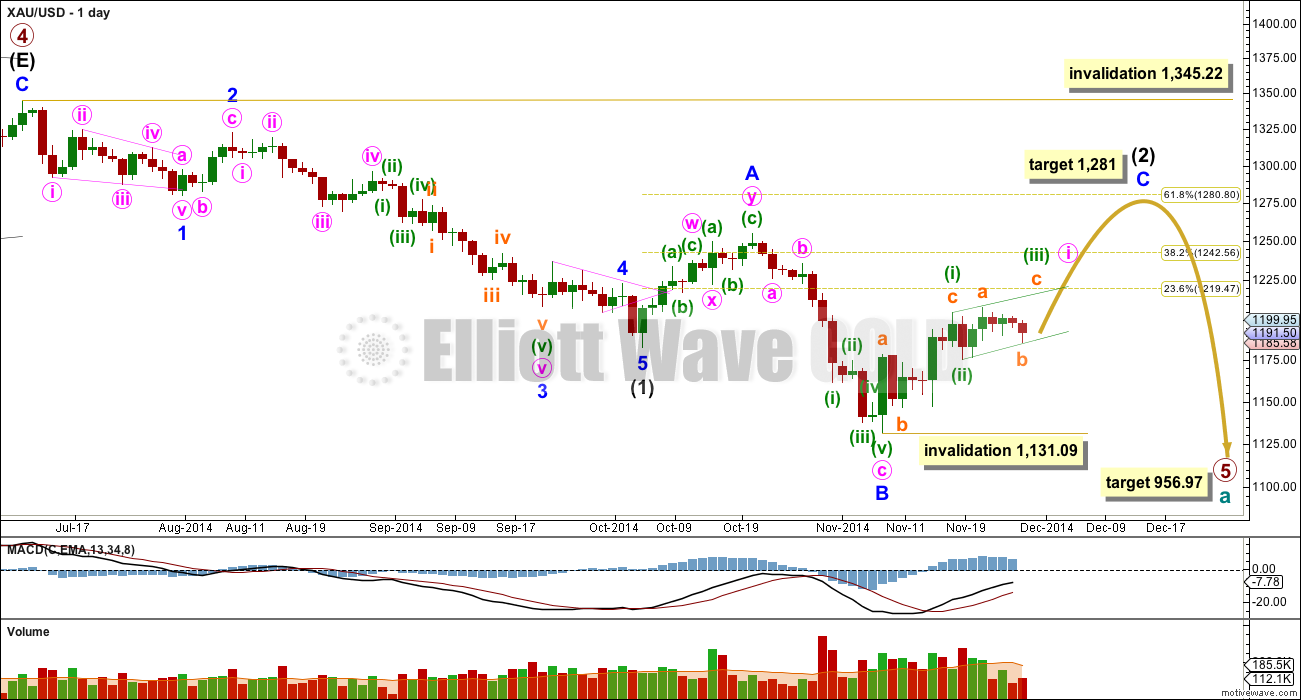

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. So far intermediate wave (2) has just begun its seventh week. I will expect it may continue for another two weeks at least to total a Fibonacci eight, and be 0.618 the duration of intermediate wave (1). Alternatively, intermediate wave (2) may last a total Fibonacci 13 weeks equalling the duration of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

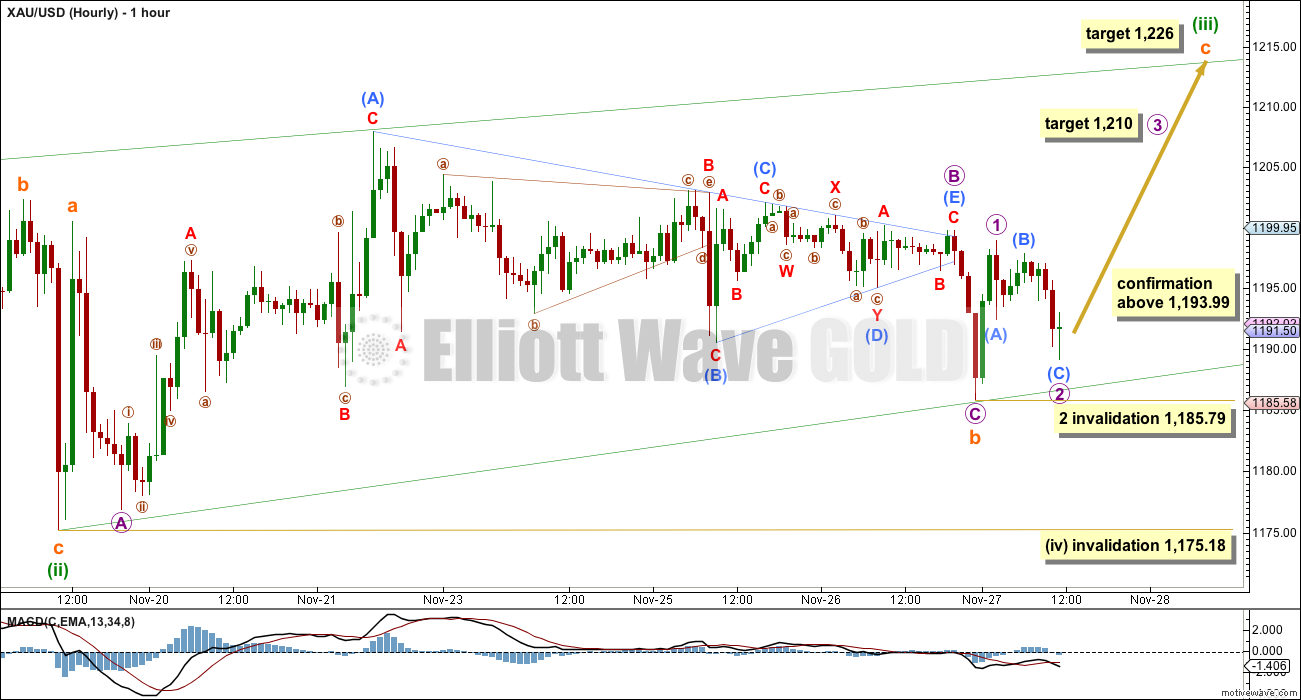

Main Hourly Wave Count

The short sharp thrust out of the triangle was expected to be upwards, but this is not what happened. The triangle completed and the sharp thrust out of it was downwards. My mistake was incorrectly identifying where the triangle began, and allowing for a very rare nine wave triangle to be unfolding.

This illustrates the difficulty with triangles; they are very hard to identify correctly.

There is a triangle in there but it is one degree lower. This is supported by MACD hovering about the zero line while the triangle unfolds.

Minuette wave (iii) upwards must move beyond the end of minuette wave (i) above 1,204.77. Within minuette wave (iii) at 1,226 subminuette wave c would reach 1.618 the length of subminuette wave a. This target must be recalculated if subminuette wave b continues lower, which is an outside possibility.

Within leading diagonals the first, third and fifth waves most commonly subdivide into zigzags. Sometimes they may be impulses. Diagonals are the only structure where you will see a third wave labelled as anything other than an impulse for this reason. Within all diagonals the second and fourth waves must subdivide as zigzags, and are most commonly between 0.66 to 0.81 the length of the prior wave.

For this diagonal minuette wave (ii) is only 0.4 the length of minuette wave (i), which slightly reduces the probability of this structure. However, there is a perfect example of a leading contracting diagonal on the daily chart, minor wave 1 within intermediate wave (1). Within that leading contracting diagonal its second wave was just 0.42 of its first wave, and its fourth wave was 0.66 of its third wave. The common length is just that, common. It is a guideline and not a rule. The structure is more important.

Within minuette wave (iii) subminuette wave b is a regular flat correction. Micro wave B is a 97% correction of micro wave A at its end, but micro wave C has failed to move below the end of micro wave A, and is truncated. This truncation does not mean this structure is a rare running flat, because although part of micro wave B moves beyond the start of micro wave A, it is the end of micro wave B which determines what type of flat correction is unfolding and the end does not move beyond the start of micro wave A. The truncation of micro wave C does reduce the probability that this structure is complete though, and so if the first invalidation point at 1,185.79 is breached I would expect that this may be micro wave C continuing lower. If that happens I would use the alternate below.

Movement above 1,193.99 would invalidate the alternate below and provide confidence in this main wave count and the targets.

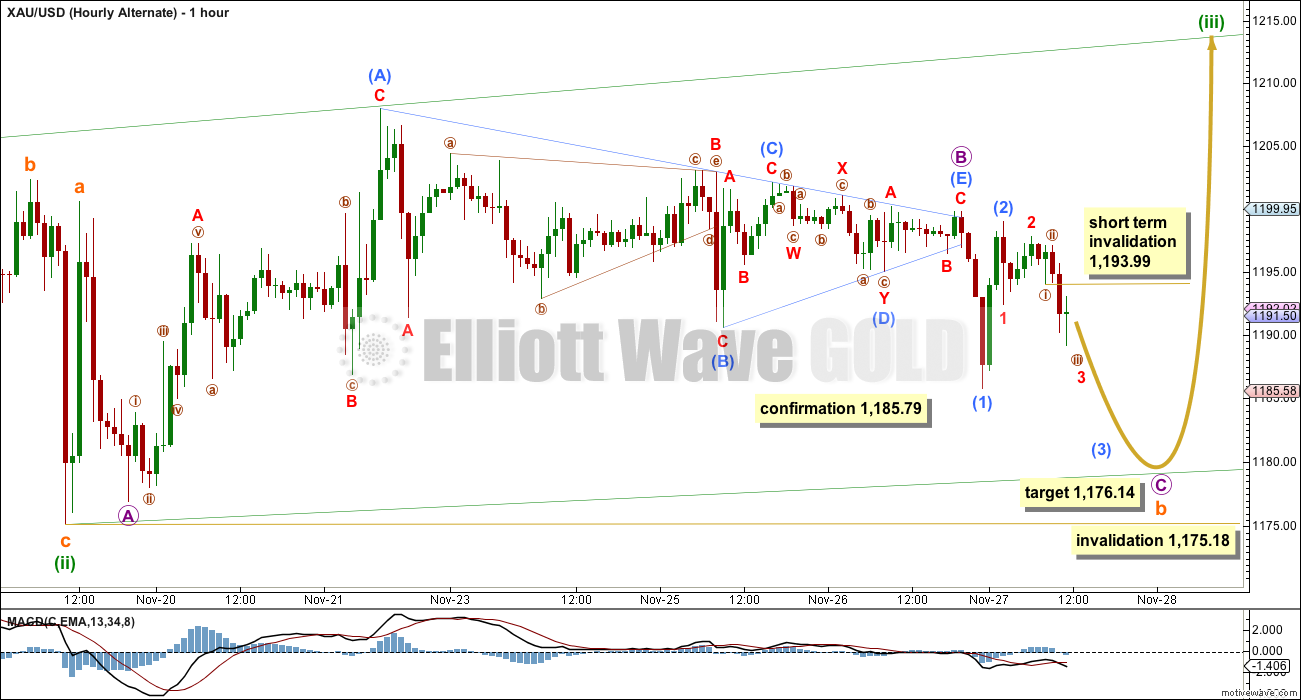

Alternate Hourly Wave Count

Only if price invalidates the main hourly wave count with a new low below 1,185.79 would I use this alternate.

Although the main wave count sees a reasonable truncation if subminuette wave b is complete, I still think it is more likely. If we see subminuette wave b as incomplete then within it micro wave C requires a reasonable amount of downwards movement to complete as a five wave structure, and I am not sure that it can do that within the space left. Within the zigzag of minuette wave (iii) subminuette wave b may not move below the start of subminuette wave a below 1,175.18.

If micro wave C does continue further then it must subdivide as a five wave structure. Within the middle of this five wave impulse minuscule wave 3 is incomplete. Within minuscule wave 3 nano wave 4 may not move into nano wave 1 price territory above 1,193.99.

This alternate wave count requires more downwards movement before subminuette wave b is complete. At 1,176.14 micro wave C would reach equality with micro wave A, and would move below the end of micro wave A avoiding a truncation. Once that is done minuette wave (iii) needs to move above the end of minuette wave (i) at 1,204.77.

The larger structure of a leading contracting diagonal is exactly the same.

This analysis is published about 02:57 p.m. EST.

Intermediate wave 2 is not finished, i think you’re all panicking for nothing. This drop is likely x of a wxy combo. Expanded flat up for w (finished). Now an expanded flat down for x (little bit down left to go) and y back up to complete int. 2 (predictably a zig zag.)

agreed about Int 2 not being done and everyone is panicing way too soon. However, I think you’re labeling is off. We still need 5 waves up to complete minor C. Minute i completed at $1204. Minute ii still in progress as an expanded flat with a target of $1150ish. That obvious triangle is key and the breakout downward suggests this is a corrective move down (a-b-c).

Yes, this is plausible. However, wouldn’t that mean that intermediate 1 ended at 1131?

Do you all think biggest drop in Silver in one year at least and daily drop -8,66% in GDX is nothing? Ok, different charts, but with something around 0,9 correlation coefficient couldn’t be ignored.

Lara, is there any merit to the idea of gold being in wave 3 of intermediate 3? You once marked minor A as intermediate 2. Is that still possible?

then Minor B would have to be seen as a 5 which she’s tried to see it as that a few times and it just doesn’t work out. It would also mean Int 2 lasted 11 days which seems short compared to Int 1. However a breach of $1131 and your count is most likely correct.

Yes. It is possible, but unlikely. I’ve just published an alternate with this exact wave count.

I think Lara is sleeping as she is in New Zealand.

I think it is 7am NZD time.

I got up just after 7am. Yeah, while you were all in discussion I was fast asleep 🙂

For what it’s worth, I think we will test the previous lows and if we invalidate 1131, we will be heading sharply lower to mid 900s to end primary wave 5. Trend is down now. Lara, we need an update quick! Thanks!

Help! Please answer before 1:00 pm EST NYSE close.

Gold just invalidated below 1,175.18 at 12:10 pm EST, Gold just dropped to 1,174.00. We need a new hourly wave count.

Does anyone know if the general trend would still be up because the main wave count is not invalidated below 1,131.09?????

it looks like gold is gonna start heading south hard….Im praying for a bit of a retracement to get out

Like I mentioned before, I wanted to see a new wave count if we breached 1175.18, which we just did. This is not good for Gold. Lara, please publish a new wave count for all of us. With the Swiss vote 2 days away, we could be heading much lower if the vote is no and it appears it will be. Protect yourself if you are bullish on Gold.

Lara says in video “subminuette wave b could get “really close” to this point” 1,176.14 but it must not move below 1,175.18 by even 1 cent or invalidation. She doesn’t say 1,176.14 is an absolute minimum or minimum.

“At 1,176.14 micro wave C would reach equality with micro wave A, and would move below the end of micro wave A avoiding a truncation. Once that is done minuette wave (iii) needs to move above the end of minuette wave (i) at 1,204.77.”

It has already come .94 away from the target at 9:46 am, which might be considered “really close”.

Gold’s next moves are unknown. Whether it will go down to exactly 1,176.14 is unknown. She did say “really close” and didn’t say minimum.

NYSE closes early today at 1:00 PM. It would be a relief if gold makes clear moves to hit the 1176.14 and come back up or

Gold just invalidated below 1,175.18 at 12:10 pm EST, Gold just dropped to 1,174.00

We need a new wave count.

Just get out

GDX and Silver broke down below low from 19th November. It doesn’t look good for bulls. Now it looks much more probable like (5) wave already started with target around $990-$1010 met in several weeks. Invalidation point is $1199, but until is Gold above $1174 there is still rather small possibility of one more rallye to $1222 at least.

Almost 🙂

We may have started the Minuette(iii) from the recent low at 1175.50.

Lara’s targets were precise so far.

Gold does not look that strong as bring in an impulse wave in wave iii. Gold needs to close today minimum above 1185 COMEX’s opening.

9:00 am EST I think gold is heading down right now to 1,176.14 and it needs to avoid a truncation (an EW rule). But must not move below 1,175.18 even 1 cent (“This lower invalidation point should hold” Lara). Once that is done minuette wave (iii) needs to move above the end of minuette wave (i) at 1,204.77.

What changes if that to happen?

Move above 1193.99 as an overlap will confirm it is in Wave (iii). Above number 1175.50 was on Feb. Futures.

As a minimum today’s close shall be above the bottom green rail. That will be a huge reversal (a green candle) from candlesticks pattern.

Hi Lara, regarding tha chart that I posted yesterday, B wave is not 90% of A wave ( it is only 83% ), so could be X wave instead a B wave and now with another minimum down 1181, could be end Y wave……is it correct?

Thanks

….Y wave seems finished….

First invalidation point at 1,185.79 is breached now as gold just dropped to 1,185.10 now at 20:03 Nov 27 EST. We now switch to the Alternate Hourly Wave Count.

The daily chart also applies to the alternate so the end target high for micro wave C of intermediate wave (2) still remains at 1,281, thankfully.

Wave (ii) C is to last in duration 8 weeks which is end of next week. Gold does wonders no doubt but it is too optimistic to get to the target 1281 in 5 days of trading unless the duration extends. Am I correct?

One Lara’s point should meet next week is C should at least extend slightly beyond A 1251.

papudi your week count is incorrect.

See 4th paragraph under the day chart.

Another two weeks at least or in another seven weeks to end this micro wave C of intermediate wave (2) rally to 1,281.

What would happen if we drop below 1175.18 and which would then invalidate the main wave count? Would you publish an alternate wave based on this possibility. Thanks!

Lets focus on Gold going up instead of down.

I just want to make sure we are prepared if the Swiss Referendum is not passed. If we don’t cover ourselves appropriately, we will all lose a lot of money. Based on all the research I’ve been doing, it appears it will not pass. If this is true, then Gold will move sharply down like a thief in the night. I would like us all to be informed if we drop below the invalidation point and what the new wave count would be if this occurs, which I personally think will happen. Sorry to be a pessimist, but better to be prepared than not.

If another probability existed Lara would of posted it. I have seen days with 3 alternates. You are asking for something that doesn’t exist.

Gold Would Get Boost From Surprise ‘Yes’ Swiss Vote; ‘No’ Vote Already Factored Into Prices By Allen Sykora of Kitco News

Wednesday November 26, 2014 11:05 AM

http://www.kitco.com/news/2014-11-26/Gold-Would-Get-Boost-From-Surprise-Yes-Swiss-Vote-No-Vote-Already-Factored-Into-Prices.html

Hello Richard, JAK.

I think daily alternate does exist and has interesting probability as I posted yesterday. Strong resistance around 38,2% for GDX, Gold and Silver could mean it’s not (2) wave, but (4) wave already, which could be completed or has one more push up to 50% retracement. Swiss vote is important, but more important will be market reaction after tight NO for example.

If the low would be set after five waves movement, then gold should go back to resistance 1190-1195, where the trend for next week(s) will be decided.

Chart looks good. Lara, thoughts ?

If it drops below that invalidation point I will give up on elliott wave as being credible analysis . No offense to Lara as she seems to have a strong grip on it but its been hardly ever right since I joined and only seems to come together in hindsight…….

Agreed, however it’s very predictive on typical primary wave counts and intermieadte wave counts, but this is why I wanted a probability analysis in a “what if” scenario that would provide us another alternative, if we do invalidate various smaller minor wave counts (which we just did today). This would help us all be more informed of other probabilities, even if the prevent is low. We all new the trend was down until the Swiss vote showed some legs and Gold popped up significantly and a new unforeseen wave count then appeared from the original EW analysis. Now that the Swiss vote might be a no go, we are seeing Gold react to this information, hence we had difficulties breaking out above 1200. Once the political interference is gone, we will resume back to the original wave count before the false breakout caused by politics. Time will tell.

Great report again!! In today’s trading from candlesticks chart pattern analysis in hour chart doji developed.This indicates reversal of the current downward trend. Combinations of small red bodies and a Doji after a small white body another white (green) candle that may morphed in to a powerful three rising method pattern. A Doji is considered powerful reversal indicator.

Thanks.