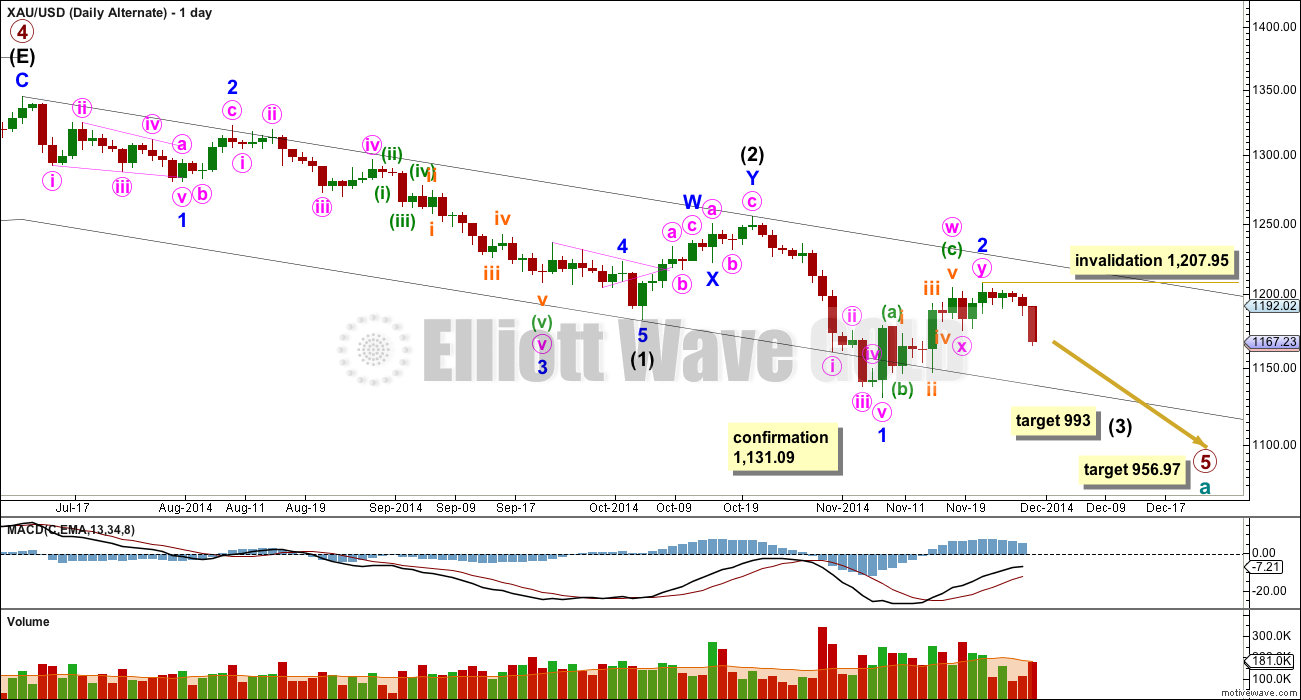

Because some members are concerned (with good reason) that the main Elliott wave count may be wrong and that Gold may plummet lower next week invalidating it, I have considered what if this happens. What would that wave count look like? Below is my alternate for this scenario.

Summary: A new low below 1,131.09 would be required to confirm this alternate. Prior to that I consider it to have a very low probability, less than 10%. If it is confirmed then it expects a strong increase in downward momentum as a third wave within a third wave moves lower to a target at 993.

Click on charts to enlarge

This wave count is identical to the main wave count right up to the end of intermediate wave (1). Thereafter, it moves the degree of labelling within intermediate wave (2) up one degree to see it as a complete double zigzag. This would see intermediate wave (2) as rather brief at only 11 days, and more shallow than second waves usually are at only 45% of intermediate wave (1). This is entirely possible, just a little unusual.

Thereafter, intermediate wave (3) could have begun. At 993 it would reach 1.618 the length of intermediate wave (1). Intermediate wave (3) should show a clear strong increase in downwards momentum, should break below the black base channel about intermediate waves (1) and (2), and then stay below it.

Within intermediate wave (3) so far minor waves 1 and now probably 2 should be over. Minor wave 1 does not fit well as an impulse, and its downwards movement fits better as a zigzag. However, it is possible to label it as an impulse and I have checked the subdivisions carefully on the hourly chart.

Minor wave 2 is another double zigzag, lasting 10 days and exactly 0.618 of minor wave 1. This would normally be perfect for a second wave correction, but in this instance a second wave within a third wave one degree higher may be expected to be a bit more brief and shallow than this. The strong downwards pull of an intermediate degree third wave should force second wave corrections to be more brief and shallow. However, it does remain within the base channel of intermediate waves (1) and (2) so this is possible. Sometimes early on within strong third waves their second waves can be time consuming and deep, before momentum builds.

Within minor wave 3 no second wave correction may move beyond the start of its first wave above 1,207.95. If this price point is passed next week this wave count would be invalidated and I would have increased confidence in the targets for the main wave count.

If 1,131.09 is breached next week then this is the wave count I would use. It fits kind of okay, but it has too many problems for it to be considered as a main wave count.

Expecting the Swiss referendum to move the Gold market is a fundamental analysis approach. Elliott wave analysis is mutually exclusive to fundamental analysis. The Elliott wave principle states that it is social mood which is expressed by market movement. It is social mood (which is expressed in market movement) which decides the result of the Swiss referendum, not the Swiss referendum which determines market movement. The difference is important, and I know it is a very unpopular way to view markets at this time.

Overall, I consider this alternate to have a lower probability than the main count because:

1. Intermediate wave (2) is relatively shallow, and more shallow than minor wave 2 one degree lower. It should be the other way around.

2. Minor wave 1 does not subdivide as well as an impulse as it does as a zigzag. Within it minute wave i looks like a three on the daily chart, and it should be a five.

3. Minor wave 2 is too long in duration, and is almost as long as intermediate wave (2).

Members should do their own due diligence, and use their own preferred technical analysis tools in conjunction with my Elliott wave analysis. If your own technical analysis strongly favours one or the other direction then you may consider the corresponding wave count as more likely.

This analysis is published about 04:59 p.m. EST.

I really have no opinion, except to say that the effect of this vote is probably anticipated by the market already.

As I’ve already stated it is my view (consistent with EW) that it is the market which makes the news not the other way around. This is very unpopular though.

Above Lara states: Within minor wave 3 no second wave correction may move beyond the start of its first wave above 1,207.95.

Anyone can locate the start of first wave 1207,95? I can not pin point on the chart. I know the ending of wave i.

Its the high I have labelled minor (blue) wave 2, on 21st November, 2014. I’m using an FXCM data feed. Your data may be slightly different.

Hi Lara, from the max of 1207,95 the downwards movement does not seem to has started as impulsive…. Why do you consider this alternate count? Have you got a hourly count accetable?

Thanks

Why did I consider it? More than one member suggested Gold had to go down.

I consider it has a low probability. Especially now Silver has made a new low and invalidated its alternate (and its main wave count too which I now need to update).

Lara, maybe an update on silver and GDX would help clarify. GDX and GDXJ back test of previous support turned resistance resulted in strong reversal down. This seems to support this gold alternate…more down ahead?

Chart courtesy of Jordan Roy-Byrne.

Chart courtesy of Bruce Wayne

Done. Except the wave count for Silver was useless and now needs updating already. Ugh.

Got this from alpari:

“This Sunday 30 November could be the most significant day for gold in decades, as Swiss National Bank (SNB) asks Switzerland’s general public whether it should increase gold reserves.

A ’yes’ vote would mean that over the next five years SNB would have to buy at least 1500 tonnes of gold, costing approximately $56.3 billion, to meet the minimum 20% asset-value threshold outlined in the referendum. It would also have to repatriate all the Swiss gold held abroad. As a result, some analysts believe prices could climb by 10-15%.

The latest polls show that support for the ‘yes’ vote is waning however, with only 38% of voters currently in favour. This is down from a month ago, though polls also show that 15% of the public remain undecided.”

What do you think about this? Would this really impact the market so much?

Kindly

Ursula

Since markets generally react most strongly to surprises rather than expected outcomes that might already be factored into prices, observers say gold is more likely to rise sharply on a “yes” vote than fall sharply on a “no” vote. Given that the market seems unprepared for a “yes” vote – psychologically and in terms of positioning – the knee-jerk upside reaction could be quite powerful.” Is the main wave count suggesting a surprise “yes” vote?

Lara- I just reviewed past posts and found that from Nov 5th to Nov 14th the wave count was today’s alternate wave. Nov 14th Summary ” Minor wave 2 is now most likely over. A new low below 1,180.37

would provide confidence. The target for minor wave 3 to end is at

1,004.”

Today gold finally closed below 1180.37. Should this be valid or some thing else has changed??

One thing is sure gold is going down. But need to nail it when???

Appreciate your help.

Lara

Hi.

If your unfavoured (is that a word ?) alternate wave count prevails, what should one perhaps expect after the end of intermediate wave 3 ? Would there still be an ascent to around the 1280 levels (and by when at latest), which should your favoured count prevail would be coming before likely the end of January right ?

Regards

Matt A

Lara- Thanks for alternate count. Pending Monday’s action today’s gold action has broken the upward bearish wedge with force. Based on chart pattern it appears this alternate count is the one may prevail. First sign will be once gold closes bellow the bottom rail on your daily chart just below the wave ii. Dollar is strong and about to break out to new high. Monetarily some thing real bearish must have happened to otherwise fine wave count so far. Yet Monday surprise ?????

forget monday…..vote will be in for the swiss thingy at 7am EST Sunday….the open sunday night should be scary 😀