Both hourly Elliott wave counts were invalidated by downwards movement. The Elliott wave count at the daily chart level remains almost the same.

And I have confidence in my labelling of intermediate wave (1) as over and intermediate wave (2) as incomplete.

Summary: Minute wave i was over and this downwards movement is minute wave ii. It is most likely to end about the 0.618 Fibonacci ratio of minute wave i at 1,159. When it is finally done a third wave up should begin.

Click on charts to enlarge

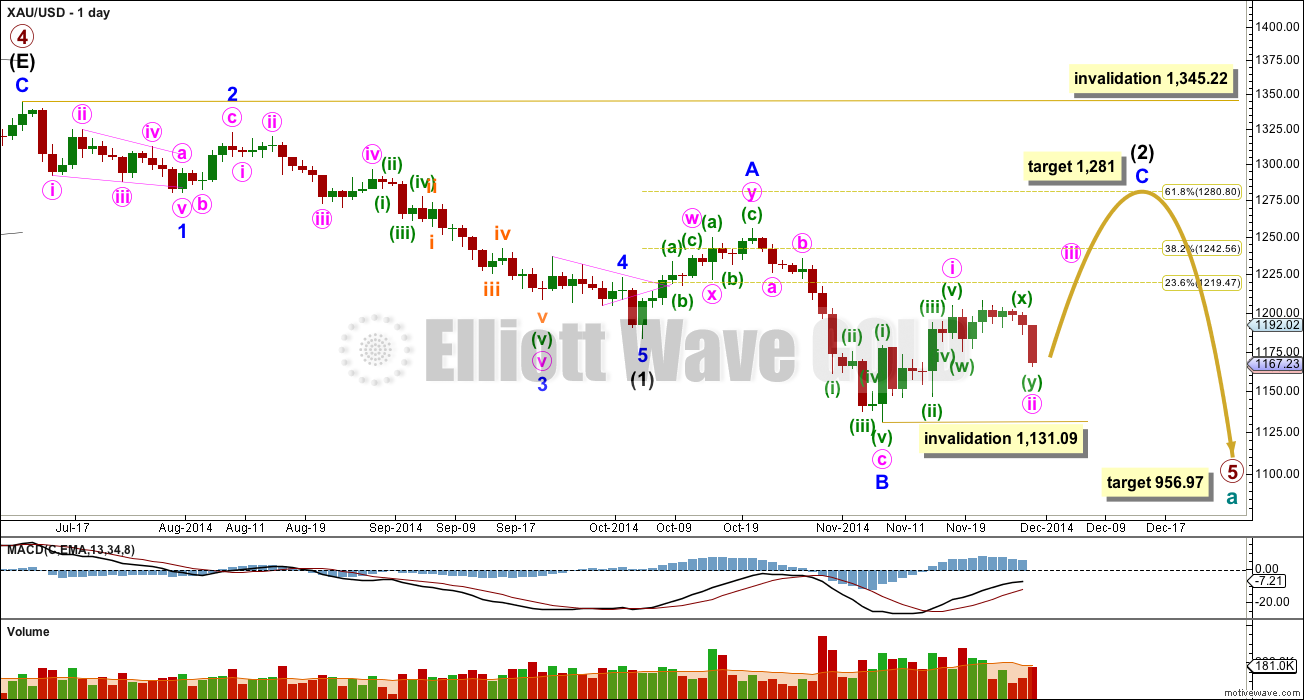

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. At this stage it does not look like intermediate wave (2) will be able to complete in just one more week to total a Fibonacci eight, and so it may continue now for another six weeks to total a Fibonacci 13 and be equal in duration with intermediate wave (1). Alternatively, intermediate wave (2) may not exhibit a Fibonacci ratio.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

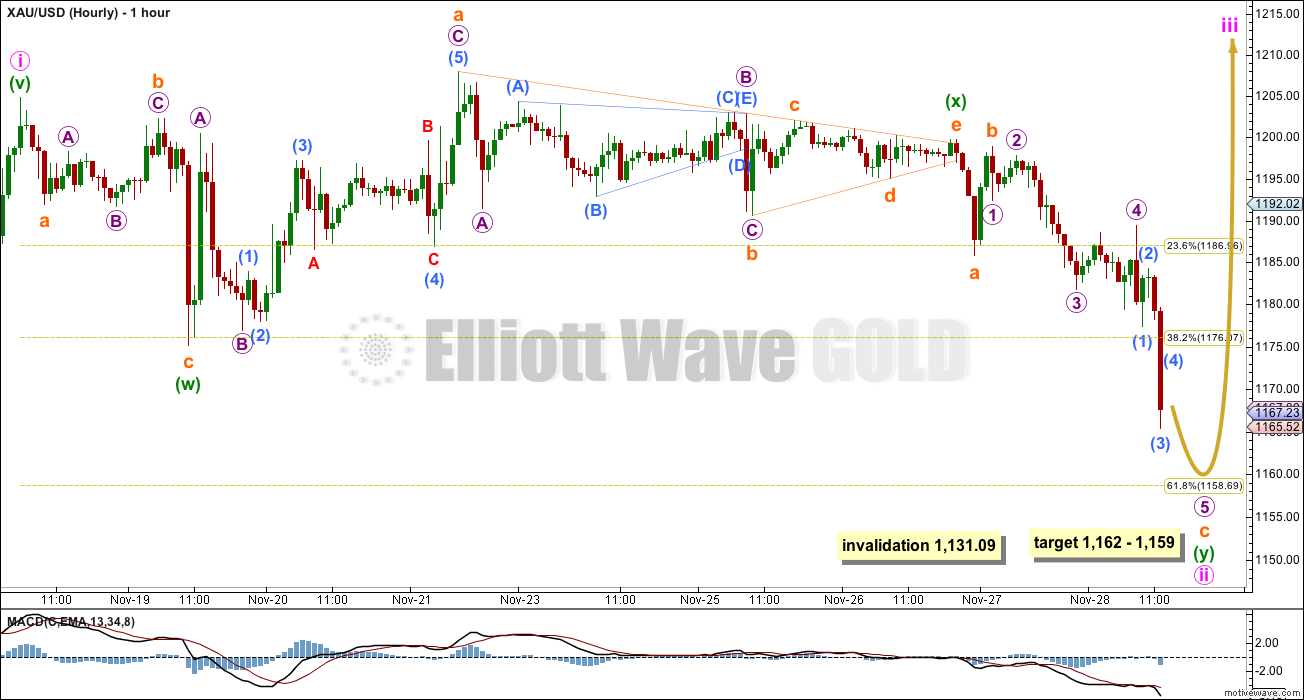

Minute wave i was not unfolding as a leading contracting diagonal, and was already over earlier as an impulse.

Minute wave ii to follow it is unfolding as a double zigzag. The first structure in the double is a complete zigzag labelled minuette wave (w) which only managed to reach down to the 0.382 Fibonacci ratio of minute wave i. The second zigzag in the double is very close to completion, labelled minuette wave (y). Minuette wave (x) to join the two zigzags is a regular contracting triangle.

Within minuette wave (y) zigzag subminuette wave c would reach 2.618 the length of subminuette wave a at 1,162. This is very close to the 0.618 Fibonacci ratio of minute wave ii at 1,159 and so gives us a target zone of 3.

Minute wave ii may not move below the start of minute wave i below 1,131.09.

When minute wave ii is a completed correction then minute wave iii upwards should begin, must move beyond the end of minute wave i, and should show a strong increase in upwards momentum.

Minute wave i lasted seven days. Minute wave ii so far has lasted eight days. It is extremely likely that minute wave ii will end within the next 24 hours as this would give the wave count the right look in terms of proportion on the daily and hourly charts.

At the daily chart level it is extremely likely that minor wave C will move at least slightly above the end of minor wave A at 1,255.40 to avoid a truncation and a very rare running flat. It is not possible to see a five wave structure complete for minor wave C, and even if one could try to fit such a wave count in minor wave C would be enormously truncated, such a wave count would be ridiculous. I am confident that if my labelling of intermediate wave (1) is correct then minor wave C must move up further to complete intermediate wave (2).

This analysis is published about 03:17 p.m. EST.

Wow, I am seriously impressed! Now we have confirmation that you are 100% on track. Would have never guessed that with gold trading in the 1140s just a few hours ago.

Thanks. But you must admit my target at 1,162 – 1,159 was useless.

Still, I do hope members managed to catch this third wave. When second waves get very deep they get close to the start of the first wave. Because thats where the invalidation point is thats a logical place to put a stop, and so the closer it gets the closer the stop and the lower the risk. I hope you’ve all managed this one with its surprising depth, as this third wave is unfolding nicely.

There may be something to EW after all!!! Let’s hope gold can play its part!!

Great work Lara… I was beginning to doubt there for a minute

Current trading gold is hitting 1282. From chart point of view the back teat is at 1285. IF today gold closes higher than last closes it will be a huge bullish enguling candlestick reversal bullish pattern. Bravo hope it the current main wave count holds.

Thanks Lara!!!!!

Hi Lara,

when we get to 1280 will be too easy to congratulate with you for your analysis.

I want congratulate with you now !!

BRAVISSIMA!!!!!!

Thank you very much.

But my target for that end to downwards movement was useless, it was 16.12 too high.

At the daily chart level though this wave count looks good. And now with the alternate invalidated we have a little clarity and confidence.

take care all …elliot wave has proven to be useless TA

i dont even think it traded at 1159…gapped right thru it…

Lara, I really appreciate your posting this update Friday as since Wednesday Gold got beat up and missed my chance in the NYSE to exit at top of Minute wave i and the trip down in Minute wave ii was painful holding bullish gold products. Now I feel better. Thank you for the good news. Like usual your forecast is anticipated and appreciated.

I do hope I’m right Richard. See the alternate published after this.

I do think its most likely int (2) is incomplete, and expanded flats are VERY common. They almost always fool you and make you think their B waves are the start of a new trend. I’ve learned that one lesson the hard way.

But… the alternate is technically possible.

In my experience to date Gold has really very typical looking waves, the subdivisions are almost always clear on the daily chart, its fives look like threes and vice versa.

But… almost always is not the same as always.

If we see a new low below 1,131.09 expect Gold to plummet down hard.

Hello Lara…

Yes, expanded flats are very common and really tricky by so strong B wave, but i still do have several points, why it looks to me strange at least:

1. B wave broke below $1180 rather hard (4%), which is multimonth triple bottom support. Such a strong support should be broken by 3rd or 5th wave not by any B wave. Move $1132-$1207 still looks like only false breakout above previous important support.

2. B wave should usually has correction behaviour, with low volume. But this move $1255-$1132 has easily visible 5waves on daily chart with high volume in second part. Also this ‘B wave’ was strongest by RSI after year and half.

3. Silver is showing completely different idea. When the chart is so deep below $18,5 it’s hard to even think about any (2)nd wave. However because major low is coming, there could be important rare difference like in summer 2011.

4. Yesterday biggest lost in Silver in a year and almost 9% lost of GDX it’s really hard to imagine gold will somehow recover again above $1200. Both other charts has extremely strong correlation with gold and usually are more agressive and faster (in time) than gold.

5. If the gold market is stil within (2)nd wave, then we are running out of time and targets. According to oneyear-triangle top, [A] wave time ($1795($1754)-$1180) the end of three years downtrend should be rather close in time. (3) rd wave in your count would have to go to minimally $990, but where whould go last (5)th, which is usually very strong in metals?? Also again 🙂 silver should go precisely somewhere to $11,5-$11,8 (long term trendline and 0,618 of $34,4-$18,2 minus $21,5) which is only 3,5 dollars away.

Lara, thanks for the update. What would happen if we invalidate 1131.09 in the main wave count?

See the alternate published right after this analysis.

Many thanks Lara. Although the probability is 10%, I do think this is very likely if the Swiss vote does not pass. Time will tell. I really appreciate your responsiveness for your member’s questions and concerns. Very cool…

Is it possible that minute wave (4) and (5) at $1159-$1162 range will complete in one day trading on Monday??????

Technically possible, but exceptionally unlikely.

It looks now like int (2) will last longer. I covered this in text under the daily chart.

Thx Lara, just got done posting that (minute ii still ongoing because of triangle) on yesterday’s comment section although with slightly different labeling.

Chapstick_jr

Interesting comment. You know your Elliott Wave. Thank you for sharing and for the good news about gold. I kept my miners ETF. Looking forward to some upward movement in gold next week. Enjoy the weekend, I will now.

Richard,

The consensus is that the Swiss vote is not going to pass. If this happens, expect gold to tank and fall much further. Maybe have some protective stops in place just in case…

it better 🙂